Book contents

- Frontmatter

- Contents

- Acknowledgements

- Introduction: Highlighting Migrant Humanity

- Chapter 1 Ngezinyawo - Migrant Journeys

- Chapter 2 Slavery, Indenture and Migrant Labour: Maritime Immigration from Mozambique to the Cape, c.1780–1880

- Chapter 3 Walking 2 000 Kilometres to Work and Back: The Wandering Bassuto by Carl Richter

- Chapter 4 A Century of Migrancy from Mpondoland

- Chapter 5 The Migrant Kings of Zululand

- Chapter 6 The Art of Those Left Behind: Women, Beadwork and Bodies

- Chapter 7 The Illusion of Safety: Migrant Labour and Occupational Disease on South Africa's Gold Mines

- Chapter 8 ‘The Chinese Experiment’: Images from the Expansion of South Africas ‘Labour Empire’

- Chapter 9 ‘Stray Boys’: The Kruger National Park and Migrant Labour

- Chapter 10 Surviving Drought: Migrancy and the Homestead Economy

- Chapter 11 Migrants from Zebediela and Shifting Identities on the Rand, 1930s–1970s

- Chapter 12 Verwoerd's Oxen: Performing Labour Migrancy in Southern Africa

- Chapter 13 ‘Give My Regards to Everyone at Home Including Those I No Longer Remember’: The Journey of Tito Zungu's Envelopes

- Chapter 14 Sophie and the City: Womanhood, Labour and Migrancy

- Chapter 15 Bungityala

- Chapter 16 Migrants: Vanguard of the Worker's Struggles?

- Chapter 17 Debt or Savings? Of Migrants, Mines and Money

- Chapter 18 Post-Apartheid Migrancy and the Life of a Pondo Mineworker

- Notes on Contributors

- List of Figures and Tables

- Index

Chapter 17 - Debt or Savings? Of Migrants, Mines and Money

Published online by Cambridge University Press: 04 July 2018

- Frontmatter

- Contents

- Acknowledgements

- Introduction: Highlighting Migrant Humanity

- Chapter 1 Ngezinyawo - Migrant Journeys

- Chapter 2 Slavery, Indenture and Migrant Labour: Maritime Immigration from Mozambique to the Cape, c.1780–1880

- Chapter 3 Walking 2 000 Kilometres to Work and Back: The Wandering Bassuto by Carl Richter

- Chapter 4 A Century of Migrancy from Mpondoland

- Chapter 5 The Migrant Kings of Zululand

- Chapter 6 The Art of Those Left Behind: Women, Beadwork and Bodies

- Chapter 7 The Illusion of Safety: Migrant Labour and Occupational Disease on South Africa's Gold Mines

- Chapter 8 ‘The Chinese Experiment’: Images from the Expansion of South Africas ‘Labour Empire’

- Chapter 9 ‘Stray Boys’: The Kruger National Park and Migrant Labour

- Chapter 10 Surviving Drought: Migrancy and the Homestead Economy

- Chapter 11 Migrants from Zebediela and Shifting Identities on the Rand, 1930s–1970s

- Chapter 12 Verwoerd's Oxen: Performing Labour Migrancy in Southern Africa

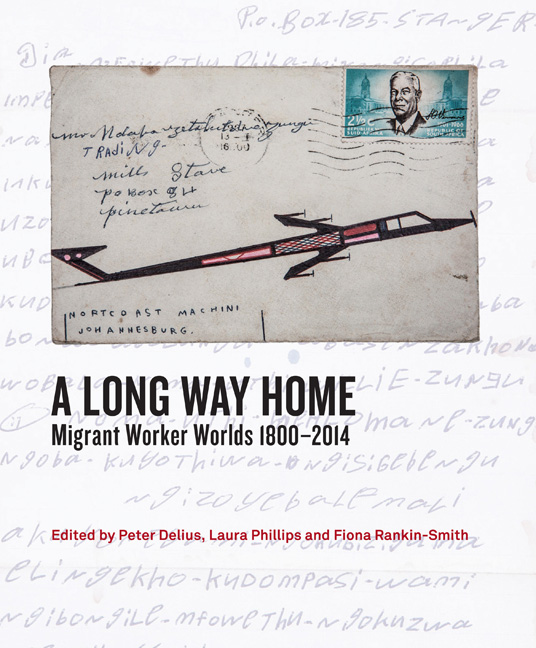

- Chapter 13 ‘Give My Regards to Everyone at Home Including Those I No Longer Remember’: The Journey of Tito Zungu's Envelopes

- Chapter 14 Sophie and the City: Womanhood, Labour and Migrancy

- Chapter 15 Bungityala

- Chapter 16 Migrants: Vanguard of the Worker's Struggles?

- Chapter 17 Debt or Savings? Of Migrants, Mines and Money

- Chapter 18 Post-Apartheid Migrancy and the Life of a Pondo Mineworker

- Notes on Contributors

- List of Figures and Tables

- Index

Summary

South Africa found itself on the front pages of the world's press in 2012 when police shot and killed 34 platinum miners during a strike by rock-drillers at the Marikana mine. It soon emerged that one factor underlying the episode, which had long been of concern to the African National Congress (ANC) government, was an ‘epidemic’ of indebtedness. Speaking of credit providers’ ‘outright preying on the vulnerabilities of low income and working people’, the minister of Trade and Industry undertook to implement more controls in order to check such activities: proof that the stringent efforts already made since South Africa's democratic transition to regulate and control the lending of money at interest had proved inadequate. What has become clear in the wake of the killings is that the Marikana episode was at least partly about a deeper economic disenfranchisement. The experience of debt is profoundly connected to the domain of wage labour and migrancy, as miners struggle to sustain new economic expectations and insecurities on already overstretched pay packets. Although the extending of access to formal credit facilities, denied to black South Africans under apartheid, has played a central role in including them financially, it brings with it, particularly for lower-wage workers, a very ‘precarious’ kind of ‘liberation’.

Making this doubly burdensome for such miners is the fact that waged workers in the 2000s must support a wider range of kinsmen than previously and that many, rather than being permanent employees, are subcontracted on lower wages. Mineworkers, formerly benefiting from greater levels of security and unionisation than other areas of wage labour, are now finding their livelihoods increasingly precarious and overstretched. Added to these features are creditors’ techniques for collecting repayments (often of borderline legality). Deductions are made in two ways. Banks, furniture and appliance retailers and microlenders often use (and abuse) the practice of ‘garnishee’ or emoluments attachment orders, while informal moneylenders (mashonisas) keep borrowers’ ATM (automated teller machine) cards and use these to withdraw funds with interest (typically 50 per cent per month) at month end when they are paid. This means that many mineworkers simply have nothing left to live on.

- Type

- Chapter

- Information

- A Long Way HomeMigrant Worker Worlds 1800–2014, pp. 241 - 253Publisher: Wits University PressPrint publication year: 2014