Book contents

- Frontmatter

- Contents

- List of Figures

- List of Tables

- Acronyms

- Preface

- 1 Introduction

- 2 Fundamental concepts and techniques

- 3 Modern portfolio theory

- 4 Market efficiency

- Chapter 5 Capital structure and dividends

- 6 Valuing levered projects

- 7 Option pricing in discrete time

- 8 Option pricing in continuous time

- 9 Real options analysis

- 10 Selected option applications

- 11 Hedging

- 12 Agency problems and governance

- Solutions to exercises

- Glossary

- References

- Index

- References

References

Published online by Cambridge University Press: 05 February 2013

- Frontmatter

- Contents

- List of Figures

- List of Tables

- Acronyms

- Preface

- 1 Introduction

- 2 Fundamental concepts and techniques

- 3 Modern portfolio theory

- 4 Market efficiency

- Chapter 5 Capital structure and dividends

- 6 Valuing levered projects

- 7 Option pricing in discrete time

- 8 Option pricing in continuous time

- 9 Real options analysis

- 10 Selected option applications

- 11 Hedging

- 12 Agency problems and governance

- Solutions to exercises

- Glossary

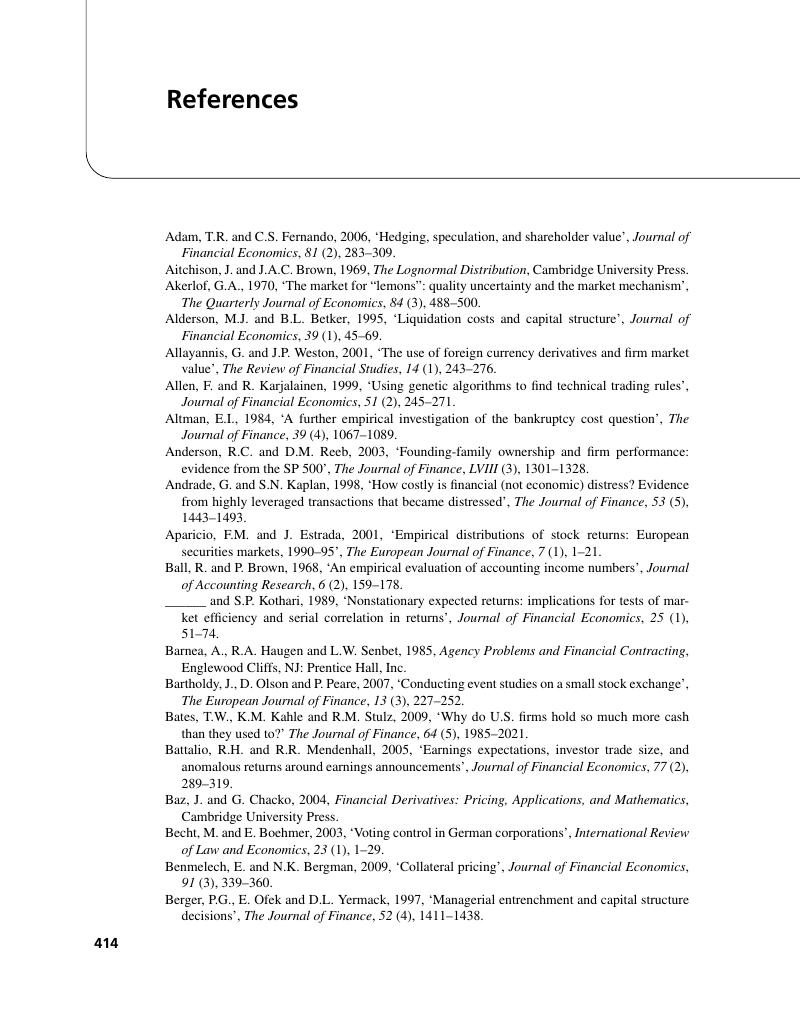

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- FinanceA Quantitative Introduction, pp. 414 - 424Publisher: Cambridge University PressPrint publication year: 2013