Book contents

- Frontmatter

- Contents

- Frontmatter

- Preface

- Introduction: Back to the future of socialism

- 1 The Crosland agenda

- 2 New Labour, Crosland and the crisis

- 3 Finance and the new capitalism

- 4 Growth not cuts

- 5 Growth by active government

- 6 Fraternity, cooperation, trade unionism

- 7 But what sort of socialist state?

- 8 A new internationalism

- 9 Britain in Europe

- 10 Refounding Labour

- 11 Faster, sustainable growth

- 12 A fairer, more equal society

- 13 A future for Labour

- Notes

- Index

12 - A fairer, more equal society

Published online by Cambridge University Press: 15 April 2023

- Frontmatter

- Contents

- Frontmatter

- Preface

- Introduction: Back to the future of socialism

- 1 The Crosland agenda

- 2 New Labour, Crosland and the crisis

- 3 Finance and the new capitalism

- 4 Growth not cuts

- 5 Growth by active government

- 6 Fraternity, cooperation, trade unionism

- 7 But what sort of socialist state?

- 8 A new internationalism

- 9 Britain in Europe

- 10 Refounding Labour

- 11 Faster, sustainable growth

- 12 A fairer, more equal society

- 13 A future for Labour

- Notes

- Index

Summary

Seventy years after Labour created the welfare state based on the Beveridge report, a fresh and complementary set of social priorities is needed, both to reduce the acute inequalities that are undermining social cohesion and to match social policy to the current and future requirements of contemporary society.

However, this is not only about creating a fairer society, it is also about building a more successful economy.

Taxation

Tony Crosland’s focus was on promoting greater equality by taxing wealth more, and taxing income from work less. He specifically ruled out any further major redistribution of earned income by direct taxation, because the top rate of tax on earnings then stood at 83 per cent. Instead he envisaged using the proceeds from higher death duties to lighten the income tax load on earnings.

Crosland saw the distribution of wealth, especially inherited wealth, as flagrantly unfair and the primary cause of inequality in Britain, for two reasons.

First, because inherited wealth distorts the distribution of investment income in favour of those who are already well off – since capital gains, dividends and interest payments go disproportionately to people who own assets like company shares or property or who can afford to lend. To tackle that particular problem he called for a tax on capital gains, which Harold Wilson’s Labour government introduced in 1965. By 2007 individuals were charged capital gains tax at their highest marginal income tax rate. That changed when Alastair Darling’s October 2007 budget announced a single rate of capital gains tax of 18 per cent from April 2008. Since June 2010 capital gains tax has been charged at either 18 per cent or 28 per cent depending on the individual’s total taxable income, way below the 45 per cent top rate of income tax in 2014. By adjusting their affairs to receive rewards as capital gains instead of as income, some highly rewarded people can pay less tax.

Second, and much more important to Crosland, inherited wealth perpetuates privilege from one generation to the next. It does so by providing access to the best possible education, to contact networks and to career ladders, meaning that most of the best jobs stay in the hands of a favoured few – witness the composition of David Cameron’s Conservative Cabinets (mostly millionaires, many Old Etonians), the top ranks of the judiciary, Britain’s business boardrooms, our military and diplomatic services and the senior civil service.

- Type

- Chapter

- Information

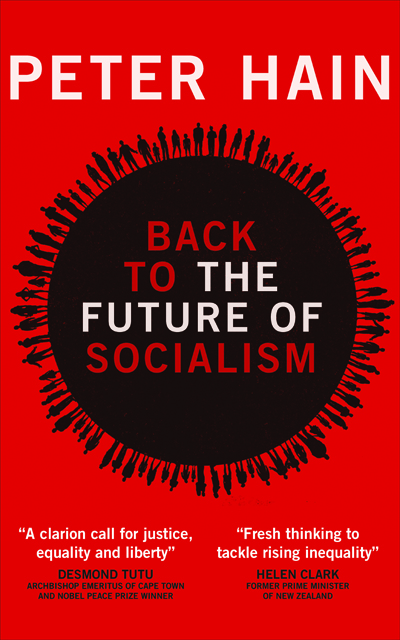

- Back to the Future of Socialism , pp. 279 - 306Publisher: Bristol University PressPrint publication year: 2015