INTRODUCTION

In 2015, Natalie Jaresko was hailed as the “woman who’s trying to save Ukraine.”Footnote 1 As the first woman to head the country’s finance ministry, Jaresko inherited an economy that had been devastated by an undeclared war with Russia. When she took on the responsibility of trying to protect her country from financial collapse, she joined a small but growing group of elite women who have served as finance ministers.

Finance ministers are among the most powerful and important political figures in their states. In addition to responding to economic crises, they are charged with drafting the budget, handling the government’s economic policy, and negotiating debt relief (Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019; Bäck and Lindvall Reference Bäck and Lindvall2020; Hallerberg and Wehner Reference Hallerberg and Wehner2020). Yet, despite both the importance of the position and significant interest in women’s presence in the executive branch broadly (Alexander and Jalalzai Reference Alexander and Jalalzai2020; Annesley, Beckwith, and Franceschet Reference Annesley, Beckwith and Franceschet2019; Arriola and Johnson Reference Arriola and Johnson2014; Baturo and Gray Reference Baturo and Gray2018; Bauer and Tremblay Reference Bauer and Tremblay2011; Jalalzai Reference Jalalzai2015; Kerevel Reference Kerevel2019; Reyes-Housholder Reference Reyes-Housholder2016; Thomas Reference Thomas2018), we know very little about women finance ministers (though see Armstrong et al. Reference Armstrong, Barnes, O’Brien and Taylor-Robinson2022; Claveria and Lavezzolo Reference Claveria and LavezzoloForthcoming).

We provide the first study of women’s ascension to, and survival in, the Ministry of Finance. We draw on an underexplored explanation for women’s inclusion: the glass cliff phenomenon. Existing work on corporate boards suggests that “women are particularly likely to be placed in positions of leadership in circumstances of general financial downturn” (Ryan and Haslam Reference Ryan and Haslam2005, 87) and that women leaders sometimes seek out high-risk positions to advance their careers (Glass and Cook Reference Glass and Cook2020). A growing body of scholarship also suggests that crisis influences women’s access to political power (Davidson-Schmich, Jalalzai, and Och Reference Davidson-Schmich, Jalalzai and Och2023; O’Brien and Piscopo Reference O’Brien and Piscopo2023; Reyes-Housholder, Suárez-Cao, and Le Foulon Reference Reyes-Housholder, Suárez-Cao and Le Foulon2023; Tripp Reference Tripp2023). Linking this scholarship on gender and crises to work on sociotropic economic voting—which shows that incumbents are punished when the economy is performing poorly (Duch and Stevenson Reference Duch and Stevenson2010; Fiorina Reference Fiorina1981)—we posit that countries may be more likely to deviate from the male-dominated status quo during challenging economic times.

We hypothesize that women are more likely to first come to power as finance ministers during financial crises. We test this expectation with novel data on women’s appointments to finance ministries worldwide over 45 years. The results from our Cox proportional hazards models suggest that women like Natalie Jaresko are more likely to first enter the finance ministry when countries are experiencing a banking crisis—the “nadir of any country’s economic climate” (Crespo-Tenorio, Jensen, and Rosas Reference Crespo-Tenorio, Jensen and Rosas2014, 1050). This relationship also holds for currency and inflation crises and remains even when accounting for the political and economic conditions that might otherwise explain both crisis onset and women’s access to power.

Having established that women are more likely to “shatter the glass ceiling” when countries are faced with financial crises, we then conduct an exploratory analysis of women’s and men’s tenures in the post. Our examination of the career durations of almost 3,000 finance ministers shows that in noncrisis conditions there is no difference in women’s and men’s tenures in office. Banking crises, however, appear to shorten men’s—but not women’s—time in the post.

Together, our findings shed light on the gendered political opportunity structures that shape women’s access to executive branch politics. Though women have been underrepresented in key pipeline positions for the finance ministry (e.g., politicians and economists [Alexiadou, Spaniel, and Gunaydin Reference Alexiadou, Spaniel and Gunaydin2021, 398]), for decades there have been qualified, ambitious women who are willing and able to take on this post. Yet, women have historically been denied these opportunities. Crises, while posing risks, also create circumstances that can be seized upon by women who are otherwise excluded from the portfolio. Our work is thus consistent with—and contributes to—scholarship acknowledging that political turmoil provides actors with opportunities to reconfigure existing structures of political power (Arana Araya, Hughes, and Pérez‐Liñán Reference Arana Araya, Hughes and Pérez‐Liñán2021; Hughes and Tripp Reference Hughes and Tripp2015; O’Brien and Piscopo Reference O’Brien and Piscopo2023; Thomas Reference Thomas2018; Tripp Reference Tripp2019). That is, we identify an important condition that shapes selectors’ incentives to appoint women and set the stage for future research examining women’s behavior during glass cliff conditions (Glass and Cook Reference Glass and Cook2020; Thomas and Bodet Reference Thomas and Bodet2013).

THE IMPORTANCE OF WOMEN’S ACCESS TO THE FINANCE MINISTRY

Cabinet ministers are among the most important political figures. In most states, power lies with the executive branch, which shapes the policy agenda, drafts legislation, and interfaces with the bureaucracy (Annesley, Engeli, and Gains Reference Annesley, Engeli and Gains2015; Atchison Reference Atchison2015; Atchison and Down Reference Atchison and Down2009; Lu and Breuning Reference Lu and Breuning2014). Cabinet ministers are thus both key policy actors and highly visible politicians who embody notions about who “should” lead the country (Franceschet, Annesley, and Beckwith Reference Franceschet, Annesley and Beckwith2017).

Gender and politics scholars, in particular, recognize the power held by the executive. As women make inroads in this historically male-dominated branch, a growing body of research aims to explain women’s access to ministerial posts (Annesley, Beckwith, and Franceschet Reference Annesley, Beckwith and Franceschet2019; Armstrong et al. Reference Armstrong, Barnes, O’Brien and Taylor-Robinson2022; Arriola and Johnson Reference Arriola and Johnson2014; Barnes and O’Brien Reference Barnes and O’Brien2018; Bego Reference Bego2014; Bauer and Tremblay Reference Bauer and Tremblay2011; Jacob, Scherpereel, and Adams Reference Jacob, Scherpereel and Adams2014; Reyes-Housholder Reference Reyes-Housholder2016). Yet, it is not simply whether women are present in the executive branch that matters, but also where they are placed (Escobar-Lemmon and Taylor-Robinson Reference Escobar-Lemmon and Taylor-Robinson2016). Cabinet portfolios vary tremendously in their importance. A small number of high-prestige, inner cabinet posts offer greater access to the chief executive, heightened media attention, and a clearer pathway to higher office (Druckman and Warwick Reference Druckman and Warwick2005; Krook and O’Brien Reference Krook and O’Brien2012).

Among these inner cabinet portfolios, the finance ministry is often the most important. Indeed, its power is typically second only to that of the head of government (Druckman and Roberts Reference Druckman and Roberts2008; Druckman and Warwick Reference Druckman and Warwick2005). The finance ministry develops and oversees economic policies (Moessinger Reference Moessinger2014), with tasks ranging from enacting budgetary objectives and steering the fiscal agenda to negotiating debt relief and attracting foreign investments. Finance ministers are also highly visible, as they are charged with communicating economic policy to elites and citizens alike (Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019).

Women’s access to the finance ministry may thus be meaningful for both substantive and symbolic reasons. Existing work on gender and cabinets shows that men and women ministers have divergent policy priorities (Bashevkin Reference Bashevkin2014; Nwankwor Reference Nwankwor2019), and women’s presence in cabinets is associated with distinct policy outcomes (Atchison Reference Atchison2015; Atchison and Down Reference Atchison and Down2009; Reference Atchison and Down2019; Mavisakalyan Reference Mavisakalyan2014). Research on finance ministers likewise acknowledges the importance of the political, educational, and occupational backgrounds of appointees (Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019; Davidsson and Bäck Reference Davidsson and Bäck2019; Hallerberg and Wehner Reference Hallerberg and Wehner2020), even positing that individual characteristics influence attitudes toward fiscal and monetary policy (Jochimsen and Thomasius Reference Jochimsen and Thomasius2014; Moessinger Reference Moessinger2014). Although evidence is mixed, a growing body of research from behavioral economics and management indicates that firms and banks with more women in positions of power experience less volatility and more financial resilience, perhaps owing to women’s higher levels of risk aversion and lower tendencies to engage in opportunistic behavior (Deller, Conroy, and Watson Reference Deller, Conroy and Watson2017; Sahay et al. Reference Sahay, Cihak, N’Diaye, Barajas, Kyobe, Mitra, Mooi and Yousefi2017; Sahay and Cihak Reference Sahay and Cihak2018). Together, these studies suggest that women’s appointment to the finance ministry could affect policy outputs.

Even in the absence of policy effects, the ascension of a woman to this post can send powerful signals about women’s place in politics and society. A growing body of research on gender and symbolic representation suggests that women’s presence in the executive branch affects citizens’ political attitudes and behaviors (Alexander and Jalalzai Reference Alexander and Jalalzai2020; Barnes and Jones Reference Barnes, Jones and Schwindt-Bayer2018; Kerevel and Atkeson Reference Kerevel and Atkeson2015; Liu and Banaszak Reference Liu and Banaszak2017; O’Brien Reference O’Brien2019; Reyes-Housholder Reference Reyes-Housholder2016; Schwindt-Bayer and Reyes-Housholder Reference Schwindt-Bayer and Reyes-Housholder2017). An examination of survey data from 58 countries across the globe, for instance, finds that women’s presence in finance, foreign affairs, and defense posts is associated with higher levels of satisfaction with, and confidence in, government (Barnes and Taylor-Robinson Reference Barnes, Taylor-Robinson, Alexander, Bolzendahl and Jalalzai2018). More generally, granting a woman influence over economic policy represents a major departure from traditionally gendered appointment patterns, wherein women ministers are typically relegated to low- or medium-prestige portfolios with feminine issue domains (Bego Reference Bego2014; Jacob, Scherpereel, and Adams Reference Jacob, Scherpereel and Adams2014). Existing work suggests that women’s ascension to historically male-dominated executive branch posts is associated with enhanced beliefs about women’s ability to govern (Alexander and Jalalzai Reference Alexander and Jalalzai2020). Appointing a woman to the finance ministry is thus likely indicative of, and may even contribute to, a growing acceptance of women leaders and belief in women’s capacity to govern.Footnote 2

EXPLAINING WOMEN’S ASCENSION TO FINANCE MINISTRIES

When are heads of government willing to break with the male-dominated status quo and nominate a woman to the finance ministry? Existing work on women’s appointment to high-prestige cabinet posts—including finance, foreign affairs, and defense ministries—often focuses on the broader feminization of politics, especially women’s presence in parliaments and cabinets (Armstrong et al. Reference Barnes and Holman2022; Barnes and O’Brien Reference Barnes and O’Brien2018; Escobar‐Lemmon and Taylor‐Robinson Reference Escobar‐Lemmon and Taylor‐Robinson2005; Krook and O’Brien Reference Krook and O’Brien2022).Footnote 3 Other factors that shape women’s access to these male-dominated, high-prestige portfolios include differences in men’s and women’s career paths once in government (Kroeber and Hüffelmann Reference Kroeber and Hüffelmann2022), changes in the remit of the position (Barnes and O’Brien Reference Barnes and O’Brien2018), and shifting norms over time (Escobar‐Lemmon and Taylor‐Robinson Reference Escobar‐Lemmon and Taylor‐Robinson2005; O’Brien Reference O’Brien2015).

Though women’s access to power is undoubtedly shaped by these broader trends, few studies to date focus on the finance ministry and no work asks whether economic conditions affect women’s access to this portfolio. Yet, the broader economic environment affects the attractiveness of the portfolio across space and time. During moments of economic stability, this position can be one of the most desirable and rewarding government posts. Not only does it afford power and prestige, but it also creates attractive career opportunities upon leaving office (Baturo and Gray Reference Baturo and Gray2018; Claveria and Verge Reference Claveria and Verge2015). During financial crises, however, the finance ministry is one of the most difficult positions to occupy. It requires making, and defending, unpopular policy decisions and is associated with significant professional risk (Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019; Alexiadou, Spaniel, and Gunaydin Reference Alexiadou, Spaniel and Gunaydin2021).

This variation in the desirability of the post can, in turn, help us understand when women are first granted access to the finance portfolio. In the business world, research suggests that women are more likely to be selected for leadership posts when there is a high risk of organizational and leadership failure, a phenomenon that Ryan and Haslam (Reference Ryan and Haslam2005) describe as the “glass cliff.” Among Fortune 500 companies, for example, women are more likely than men to be promoted as CEOs of struggling firms (Cook and Glass Reference Cook and Glass2014a) and to take on high-risk leadership positions (Glass and Cook Reference Glass and Cook2016) (though see Bechtoldt, Bannier, and Rock [Reference Bechtoldt, Bannier and Rock2019]; Cook and Glass [Reference Cook and Glass2014b]). Women leaders thus “pay a significant risk tax in order to achieve upward mobility in their organizations” (Glass and Cook Reference Glass and Cook2020, 637).

A growing body of work applies the glass cliff metaphor to the political realm. Though some scholars rightfully worry that the “glass cliff” minimizes women’s agency and “suggests that women are unaware of their own precarious position, and/or that they are not strategic actors, easily pushed over a cliff by others” (Thomas Reference Thomas2018, 399), others find it to be a useful framework for explaining selectors’ incentives during difficult times. Ryan, Haslam, and Kulich (Reference Ryan, Haslam and Kulich2010) show that women are preferentially selected to contest hard-to-win parliamentary seats in the United Kingdom. An analysis of Canadian federal elections found a glass cliff for women in three of the four parties studied (Thomas and Bodet Reference Thomas and Bodet2013), women in the United States are more likely to be exposed to harder-to-win contests for seats in the House of Representatives (Robinson et al. Reference Robinson, Kulich, Aelenei and Iacoviello2021), and far-right parties across Europe recruit more women candidates when they are struggling electorally (Weeks et al. Reference Weeks, Meguid, Kittilson and Coffé2023).

Studies of women party leaders likewise draw on the glass cliff metaphor (O’Brien Reference O’Brien2015; O’Neill, Pruysers and Stewart Reference O’Neill, Pruysers and Stewart2021). This research suggests that women are most likely to hold the post when it is least desirable, such as when parties are scandal-ridden (Beckwith Reference Beckwith2015; Valdini Reference Valdini2019) or in crisis (O’Neill, Pruysers, and Stewart Reference O’Neill, Pruysers and Stewart2021), as well as in minor or opposition parties (O’Neill and Stewart Reference O’Neill and Stewart2009; O’Brien Reference O’Brien2015) and those that have lost vote share (O’Brien Reference O’Brien2015). More generally, crises and conflicts can be catalysts for increases in women’s descriptive representation (Hughes Reference Hughes2009; Tripp Reference Tripp2015; Reference Tripp2023). Inspired by this growing body of cross-disciplinary research, we posit that a similar logic exists for finance ministers. Women should be more likely to first occupy the finance ministry during financial crises.

Crisis and Leadership Change

Poor economic performance is bad news for governments in general and finance ministers in particular. Domestic economic problems consistently contribute to government failure. Numerous studies document economic voting, showing that during periods of economic downturn, democratic leaders are more likely to be voted out of office (Duch and Stevenson Reference Duch and Stevenson2010; Fiorina Reference Fiorina1981; Hibbs Reference Hibbs, Weingast and Whittman2006). Classic rational choice theories suggest that voters should focus on egotropic (i.e., “pocketbook”) assessments of their own personal economic situation and make prospective voting decisions. However, empirical research consistently finds stronger support for retrospective models of voting that reflect sociotropic evaluations intended to punish or reward incumbents for economic performance (Kinder and Kiewiet Reference Kinder and Kiewiet1979; Lewis-Beck and Paldam Reference Lewis-Beck and Paldam2000). That is, voters focus on recent outcomes in the national economy (Hibbs Reference Hibbs, Weingast and Whittman2006), with unexpected shocks weighing more heavily in their evaluations (Duch and Stevenson Reference Duch and Stevenson2010). Unsurprisingly, a growing literature on economic voting during the Great Recession shows that the depth of the crisis is linked to electoral losses for incumbents (Hernández and Kriesi Reference Hernández and Kriesi2016; LeDuc and Pammett Reference LeDuc and Pammett2013).

Financial crises are especially associated with executive turnover (Chwieroth and Walter Reference Chwieroth and Walter2017; Reference Chwieroth and Walter2020; Crespo-Tenorio, Jensen, and Rosas Reference Crespo-Tenorio, Jensen and Rosas2014). In the aftermath of recent crises, elections across Europe (e.g., Cyprus, Ireland, Iceland, Greece, Italy, Spain, and Portugal) offer explicit examples of retrospective voting aimed at removing incumbent governments (see Talving 2018 for a review). Governing parties are punished irrespective of variation in the institutional features that typically affect the clarity of responsibility (Chwieroth and Walter Reference Chwieroth and Walter2017; Crespo-Tenorio, Jensen, and Rosas Reference Crespo-Tenorio, Jensen and Rosas2014). Even in authoritarian regimes, Pepinsky (Reference Pepinsky2012) finds a relationship between “sinners”—those affected by conditions believed to increase the chance of a financial crisis—and political turnover.

Heads of government, in turn, respond to economic conditions when selecting their (finance) ministers. Existing work by Alexiadou (Reference Alexiadou2015; Reference Alexiadou and Thompson2018), Alexiadou and Gunaydin (Reference Alexiadou and Gunaydin2019), Davidsson and Bäck (Reference Davidsson and Bäck2019), and Hallerberg and Wehner (Reference Hallerberg and Wehner2020) shows that chief executives select ministers with different educational and occupational backgrounds depending on the health of the economy, in part because ministers’ characteristics can send powerful signals to domestic and international audiences (Alexiadou, Spaniel, and Gunaydin Reference Alexiadou, Spaniel and Gunaydin2021). Importantly, during financial crises, governments are “pressured to enact economic reforms that directly affect and often hurt important constituencies and stakeholders” (Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019, 849; see also Alexiadou, Spaniel, and Gunaydin Reference Alexiadou, Spaniel and Gunaydin2021). It is the ministers of finance, who are “called to draft policy and communicate it with other cabinet members, party backbenchers, affected interest groups and stakeholders of their ministerial departments, and, of course, the public” (Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019, 849). Thus, chief executives need to recruit finance ministers who can not only make economic policy, but can also be the representatives of these difficult policy decisions to the public, media, and other politicians.

Financial Crises and Women’s Initial Appointment to Power

During challenging economic times, women may be especially desirable as finance ministers. In their work focusing on the corporate sector, Morgenroth et al. (Reference Morgenroth, Kirby, Ryan and Sudkämper2020) identify three explanations for the glass cliff phenomenon. First, though we normally associate men—and masculine traits—with leadership, this association sometimes reverses in times of crisis. Second, when faced with crisis conditions, organizations select leaders from underrepresented groups to signal change. Third, women are appointed to precarious leadership positions because these posts are less desirable and have a high risk of leadership failure. These factors are not mutually exclusive and together lead to the emergence of the glass cliff (Morgenroth et al. Reference Morgenroth, Kirby, Ryan and Sudkämper2020; Ryan et al. Reference Ryan, Haslam, Morgenroth, Rink, Stoker and Peters2016). Importantly, these three factors are also likely applicable to ministerial appointments during times of financial crisis.

With respect to gender stereotypes, beliefs about the policy priorities and leadership traits of men and women have historically aided men’s access to the finance ministry. Men are associated with the economy (Bauer Reference Bauer2020a; Holman Reference Holman2015), and traits attributed to men are linked with successful financial management—e.g., aggressiveness, objectiveness, and forcefulness (Holman, Merolla, and Zechmeister Reference Holman, Merolla and Zechmeister2022; Schein Reference Schein1975). Men are also seen as more risk-acceptant than women (Eckel and Grossman Reference Eckel and Grossman2002)—despite mixed empirical evidence with respect to financial management (Sahay et al. Reference Sahay, Cihak, N’Diaye, Barajas, Kyobe, Mitra, Mooi and Yousefi2017).

In good times, these stereotypes may help men’s (and hamper women’s) access to the finance ministry. During crises, stereotypically feminine characteristics can be seen as important traits for leaders (Ryan et al. Reference Ryan, Haslam, Morgenroth, Rink, Stoker and Peters2016). Women are stereotyped as creative, understanding, helpful, aware of others’ feelings, and intuitive (Ryan et al. Reference Ryan, Haslam, Hersby and Bongiorno2011; Schein Reference Schein1975). Women are often assumed to be better managers during organizational decline because “they are seen to be good people managers” (Ryan et al. Reference Ryan, Haslam, Hersby and Bongiorno2011, 470) and are viewed as “tend[ing] to cope with failure more pragmatically than men” (Ryan, Haslam, and Postmes Reference Ryan, Haslam and Postmes2007, 190). Research from political science finds that women are seen as better at compromise and consensus building (Schneider et al. Reference Schneider, Holman, Diekman and McAndrew2016) and stereotyped as more honest and cautious (Barnes and Beaulieu Reference Barnes and Beaulieu2019). Importantly, women are stereotyped as more risk-averse than men (Eckel and Grossman Reference Eckel and Grossman2002) and women managers are seen as “hav[ing] more skills to balance risk” (Ryan, Haslam, and Postmes Reference Ryan, Haslam and Postmes2007, 190). Given that financial crises have been shown to diminish trust in the political system (Roth Reference Roth2022), feminine stereotypes about competence, trustworthiness, and risk aversion may make women more appealing ministerial candidates in these moments.

Beyond the role of stereotypes, when faced with public criticism, organizations often wish to communicate that they are taking a new approach. Appointing a leader who is different from those who came before her can help accomplish this aim. Kulich et al. (Reference Kulich, Lorenzi-Cioldi, Iacoviello, Faniko and Ryan2015), for example, find that the preference for women executive directors following a poor performance stems from beliefs about the woman’s ability to signal change. Reinwald, Zaia, and Kunze (Reference Reinwald, Zaia and Kunze2022) show that crises lead to an increase in women’s presence in top management posts, and press releases from firms in crisis are more likely to frame women’s appointments as change-related. Following the 2008 financial crisis, Iceland adopted corporate gender quotas to bring about change. The bill’s sponsor pointed to the “need for a new approach and a new thinking in the management of finance companies” (Axelsdóttir and Einarsdóttir Reference Axelsdóttir and Einarsdóttir2017, 52). Two of the country’s three largest banks also appointed women directors during this tumultuous period. Given that their gender confers “outsider” status, women may serve as signals of a new approach to the handling of the crisis—offering a visible break from the past (McKay Reference McKay2004; O’Brien Reference O’Brien2015; Wiliarty Reference Wiliarty2008) and indicating change and renewal (Murray Reference Murray2010).

Finally, women are sometimes appointed to precarious leadership positions because these posts are less desirable (Ryan et al. Reference Ryan, Haslam, Morgenroth, Rink, Stoker and Peters2016). Beckwith (Reference Beckwith2015), for example, argues that the withdrawal of male candidates has allowed women to become party leaders in times of crisis. A similar dynamic may emerge for the finance portfolio. Serving as finance minister during financial crises can be akin to committing political suicide. As Greek finance minister Giorgos Papakonstantinou noted, the 2008 economic crisis “eras[ed] political careers that had been painstakingly built over decades” (quoted in Alexiadou and Gunaydin Reference Alexiadou and Gunaydin2019, 850).

For men, who may reasonably believe that they will have other, more attractive opportunities to ascend to leadership posts, there are clear reasons to avoid the finance ministry at these moments. Women, in contrast, have incentives to accept a risky appointment if they see it as their best (or only) opportunity for power. Indeed, Glass and Cook (Reference Glass and Cook2020) find that women and people of color in high-status jobs pursue high-risk leadership opportunities in an effort to overcome their simultaneous invisibility and hypervisibility as outsiders. Periods of economic uncertainty may likewise provide opportunities that can be seized by women ministrables. The diminished desirability of the post during financial crises—combined with a preference for feminized leadership traits and desire to signal change—together lead us to posit: women are more likely to be first appointed to the finance ministry in countries experiencing financial crises.

TESTING THE EFFECT OF FINANCIAL CRISES ON WOMEN’S ENTRANCE INTO POWER

We examine the time until the initial appointment of a woman to the finance ministry, identifying the country month in which a woman first ascended to the post. To do so, we use information gathered from the Central Intelligence Agency’s (2018) Directory of Chiefs of State and Cabinet Members of Foreign Governments, the Worldwide Guide to Women in Leadership, and the WhoGov dataset (Nyrup and Bramwell Reference Nyrup and Bramwell2020).Footnote 4 Figure 1 illustrates women’s inclusion in finance ministries across 202 countries from 1972 to 2017. In total, women have held this position in 77 different states. The first woman appointee in our dataset is Dora Reluz in Panama in 1972. Since that time, women have been appointed to the finance portfolio in every region of the world, with most of these appointments occurring after 2000. In most states, only one woman has served in this capacity, though 31 countries had multiple women finance ministers during this period. Finally, in this period 2,976 ministers were appointed in total, 117 (4%) of whom were women. Five of these women held multiple nonconsecutive appointments for a total of 123 women minister terms in office.Footnote 5

Figure 1. Women Finance Ministers Across the Globe, 1972 to 2017

Note: Figure 1 depicts the number of women who hold the finance ministry in each country between 1972 and 2017. The data were gathered from the CIA’s Directory of Chiefs of State and Cabinet Members of Foreign Governments, the Worldwide Guide to Women in Leadership, and WhoGov (Nyrup and Bramwell Reference Nyrup and Bramwell2020).

Measuring the Glass Cliff: Banking Crises and Women’s Entrance into Power

Consistent with the glass cliff phenomenon, we posit that women are most likely to first access the finance ministry during financial crises. For our primary explanatory variable, we use the most frequent financial crisis occurrence studied in the literature: banking crisis. In particular, we adopt the measure developed by Laeven and Valencia (Reference Laeven and Valencia2010; Reference Laeven and Valencia2020), which has been used in the work by Chwieroth and Walter (Reference Chwieroth and Walter2017), Crespo-Tenorio, Jensen, and Rosas (Reference Crespo-Tenorio, Jensen and Rosas2014), and Hallerberg and Wehner (Reference Hallerberg and Wehner2020).Footnote 6 In the Supplementary Table 4, we also examine currency, inflation, and unemployment crises.Footnote 7

Laeven and Valencia (Reference Laeven and Valencia2010, 6) define systemic banking crises as cases in which there were (1) “Significant signs of financial distress in the banking system (as indicated by significant bank runs, losses in the banking system, and bank liquidations)” and (2) “Significant banking policy intervention measures in response to significant losses in the banking system.”Footnote 8 Banking crises generally result from either solvency crises—shocks that abruptly change the value of banks’ assets and liabilities—or liquidity crises—pressure from depositors that starts a run on banks (Crespo-Tenorio, Jensen, and Rosas Reference Crespo-Tenorio, Jensen and Rosas2014). Banking crises are also frequently associated with other crises (Laeven and Valencia Reference Laeven and Valencia2013; Reference Laeven and Valencia2020) and are a highly damaging economic event that can lead to deep recessions and large current account reversals.

Banking crises are the most frequent crisis occurrence studied in the literature (Gandrud and Hallerbeg Reference Gandrud and Hallerbeg2014). Unlike some other crisis types, moreover, banking crises can now also affect a broad set of countries. While “before the 2008 global financial crises, banking crises had predominantly been a low- and middle-income country phenomenon” (Laeven and Valencia Reference Laeven and Valencia2020, 313), the 2008 global financial crisis illustrated that they are an “equal opportunity menace” for countries of any income level (Reinhart and Rogoff Reference Reinhart and Rogoff2013, 4557).Footnote 9 We thus have the potential to observe crises’ effects on women’s representation among a broad set of countries.

Importantly, existing work convincingly demonstrates that banking crises hasten executive turnover (Chwieroth and Walter Reference Chwieroth and Walter2017; Reference Chwieroth and Walter2020). Crespo-Tenorio, Jensen, and Rosas (Reference Crespo-Tenorio, Jensen and Rosas2014) argue that “unlike more nuanced economic outcomes and political events…the implications of banking crises are obvious to even the most uninformed voters” (1050). They find that even in favorable conditions, banking crises significantly increase the likelihood of government termination in democratic states. In more extreme circumstances, they observe a sixfold increase in the risk ratio of termination following a banking crisis. This is to be expected, given that banking crises represent the “most extreme instances of economic disaster” (Crespo-Tenorio, Jensen, and Rosas Reference Crespo-Tenorio, Jensen and Rosas2014, 1051). There is a high fiscal cost of restoring banks to solvency (Honohan and Klingebiel Reference Honohan and Klingebiel2000), and banking crises hamper economic growth (Rosas Reference Rosas2009).

Given the dire consequences of banking crises for chief executives, these are precisely the moments that lend themselves to glass cliff effects in cabinet appointments. That is, we expect that banking crises will lead heads of government to consider appointing a new, and new type of, finance minister. In fact, Hallerberg and Wehner (Reference Hallerberg and Wehner2020)—who use the same operationalization and measurement—show that financial crises affect leaders’ propensity to appoint economists as top-level policymakers. Importantly, we find that banking crises shorten finance ministers’ tenures in office, suggesting that they create opportunities for women’s appointment (see Table 2 and Figure 3).

In total, there are 151 banking crises in our dataset, making them more common than sovereign debt and inflation crises (but less common than currency crises). The precise start date of a banking crisis is difficult to pinpoint. We measure banking crises at the country-month level, identifying crisis onset as the month in which both of Laeven and Valencia’s definitional benchmarks are met. Countries then receive a “1” in each subsequent month until the end of the banking crisis (Laeven and Valencia Reference Laeven and Valencia2010, 10).

Other Factors Shaping Women’s Access to the Finance Ministry

Countries that appoint women as finance ministers may share other characteristics that affect their likelihood of experiencing banking crises.Footnote 10 To begin with, research on the executive branch shows that women’s presence in politics may increase both the supply of, and demand for, women cabinet ministers (Escobar-Lemmon and Taylor-Robinson Reference Escobar-Lemmon and Taylor-Robinson2016; Krook and O’Brien Reference Krook and O’Brien2012).Footnote 11 Governments with more women also experience more stability (Acconcia and Ronza Reference Acconcia and Ronza2021), allowing financial markets to operate with less policy uncertainty. We thus use the QAROT database (Hughes et al. Reference Hughes, Paxton, Clayton and Zetterberg2017) to include the lag of the share of women in parliament. We account for whether the head of government is a woman using data from WhoGov.

Political institutions also affect both women’s access to office and crisis onset. First, democracy promotes inclusion and representation and is thus a consistent predictor of women’s cabinet representation (Arriola and Johnson Reference Arriola and Johnson2014). Yet, the frequent turnover experienced in democracies can also incentivize leaders to neglect the long-term consequences of their policies in exchange for short-term payoffs, rendering the country more vulnerable to financial instability (Lipscy Reference Lu and Breuning2018). We thus account for democratic regimes using the Unified Democracy Score (Pemstein, Meserve, and Melton Reference Pemstein, Meserve and Melton2010). Second, the system of government (presidential vs. parliamentary) may also be a confounder. In the face of economic instability, independently elected executive and legislative branches hamper elected officials’ ability to make swift and decisive decisions necessary to stave off crisis (Lipscy Reference Lu and Breuning2018). Presidents also often have more control over cabinet appointments than prime ministers, so they can appoint women (or not) depending on their own preferences. We use data from Cheibub, Gandhi, and Vreeland (Reference Cheibub, Gandhi and Vreeland2010) (updated by Bjørnskov and Rode Reference Bjørnskov and Rode2020) to account for presidential versus parliamentary systems. Third, under unified governments, leaders may be more likely to appoint women to the cabinet since they do not have to allocate portfolios to coalition partners (Escobar-Lemmon and Taylor-Robinson Reference Escobar-Lemmon and Taylor-Robinson2016, 831). Yet, unified governments also increase policy risk for financial markets (Bechtel and Füss Reference Bechtel and Füss2008). We include a measure of government type from the Database of Political Institutions.

Finally, economic factors can influence both women’s access and crisis onset. Historically, women’s representation was higher in high-income states. Country wealth is also correlated with economic health. We use a measure of the lagged gross national income per capita to account for wealth and a measure of the lag of gross national income per capita growth to capture economic growth. Inflation, by contrast, increases financial volatility. We thus include the lagged annual percent of inflation in consumer prices (measures taken from The World Bank [2018]). Women are also more likely to hold positions that are less powerful (Jalalzai Reference Jalalzai2013; O’Brien Reference O’Brien2015). The finance minister may have less power in countries with open economies, as domestic policy decisions have less influence on the state’s economy (Frieden Reference Frieden1991). Economic openness also makes countries more vulnerable to shocks in the global economy (Cameron Reference Cameron1978). We thus incorporate lagged measures of economic openness and trade openness.

Start Date

Our analysis includes monthly data on women’s appointment to the finance ministry from 1972 to 2017. We focus on this start date for three reasons. First, it reflects the transformation of the global economy that accompanied the collapse of the Bretton Woods monetary order in 1971. The global monetary regime exerts an important influence on domestic monetary policy choices and economic outcomes (Broz and Frieden Reference Broz and Frieden2001). The collapse of the Bretton Woods monetary order marked the beginning of unregulated global finance, with increased capital flows and amplified financial and monetary volatility, resulting in more severe and more frequent financial crises (Marichal Reference Marichal2009). Focusing on the post-Bretton Woods period allows us to hold the international monetary order constant in our analysis.

Second, this start date marks the beginning of the systematic documentation of banking (and other financial) crises on a global scale. Whereas the “tedious predictability of currency values under the Bretton Woods system lulled most scholars into inattention” (Broz and Frieden Reference Broz and Frieden2001, 317), the system’s collapse increased scholarly interest. Unsurprisingly, the most comprehensive database on banking crises begins cataloging these events in 1970 (Laeven and Valencia Reference Laeven and Valencia2008; Reference Laeven and Valencia2010).

Third, our start date reflects the beginning of the period in which women might be appointed to the finance ministry. As O’Brien (Reference O’Brien2015) notes, few women could realistically aspire to leadership positions in the executive branch before the 1960s. Indeed, no woman was appointed to the finance ministry before the breakdown of the Bretton Woods monetary order.Footnote 12 Extending our analysis backward in time would not net additional appointments.

Modeling Strategy

Our outcome variable is the time between a country’s entry into the process and the occurrence of the first woman minister—that is, the survival time.Footnote 13 Although we have 202 countries in our data, three countries are excluded from our analysis: two countries (East Timor and Lithuania) appointed a woman as their first finance minister upon independence; another country (India) had a woman prime minister who assumed the title before 1971 (see Footnote Footnote 12). We thus have 199 countries in our analyses of women’s initial appointment to the finance ministry.

We fit Cox proportional hazards (PH) models of the length of time to the first woman appointee.Footnote 14 In particular, we model the length of time the finance ministry remains male-dominated as a function of a baseline hazard rate, banking crises, and our control variables that may influence the baseline hazard. We use the Efron method to approximate the exact marginal likelihood of handling ties, although the results are almost identical if we use Breslow’s simpler approximation method (see Supplementary Table B3 and Supplementary Figure B1).

ANALYSIS OF WOMEN’S ENTRANCE INTO FINANCE MINISTRIES

We posit that leaders may be more likely to appoint a woman to the finance portfolio during financial crises. The results from our analysis of women’s appointment to the finance ministry are found in Table 1 and Figure 2. Table 1 presents the estimated hazard rate coefficients from the Cox PH models. We first fit a model that includes the banking crisis as the sole predictor (Model 1). We then incorporate women’s political representation in Model 2, political institutions in Model 3, and economic conditions in Model 4. Model 5 displays the results of the full analysis.

Table 1. Banking Crisis and Women’s Initial Access to the Finance Ministry, 1972–2017

Note: Table 1 presents the estimated hazard rate coefficients from the Cox proportional hazards models of the time until women’s first appointment to the finance ministry (1972–2017). The data are measured monthly. Standard errors (clustered at the country level) are in parentheses. *p<0.10, **p<0.05, ***p<0.01.

Figure 2. Effect of Banking Crisis on Women’s Initial Access to the Finance Ministry

Note: This figure presents marginal effect estimates (along with 95% confidence intervals) from the five models shown in Table 1 of the main text. Marginal effects are shown in the hazard ratio—a ratio of the estimated hazard rate under crisis relative to the baseline no-crisis hazard rate. We can see that the hazard rate of women’s initial access to the finance ministry at least doubles under a banking crisis across all specifications.

Across the five models, a banking crisis is one of the most consistent and reliable predictors of women’s access to the finance portfolio.Footnote 15 The hazard rate for the banking crisis measure is greater than zero, indicating that banking crises shorten women’s time until appointment. This relationship is illustrated in Figure 2, where we plot the hazard ratios (i.e., the relative risk of an appointment of a woman under banking crisis and noncrisis conditions).Footnote 16 When the hazard ratio equals 1, there is no difference between the likelihood of women’s appointments during crisis and noncrisis times. When the hazard ratio is greater than 1, women experience a shorter time until an appointment during crises. The hazard ratio from our fully specified model (Model 5) indicates that women are 3.1 times more likely to be appointed during banking crises.

Beyond the effect of banking crises, democracies and countries with more women in legislatures are also more likely to appoint women to the finance ministry. We find no relationship between women’s ascension to the post and unified governments, inflation, trade openness, or capital openness. Results are inconsistent with respect to the effects of women heads of government, presidential systems, economic growth, and GDP per capita. At the same time, we note that Keele, Stevenson, and Elwert (Reference Keele, Stevenson and Elwert2020, 3) show that “estimated coefficients for control variables are uninterpretable” and advise that “researchers should avoid interpreting these quantities in statistical models.”

Finally, our analysis focuses on banking crises, not only because this is the most frequently used measure of financial crises in previous studies but also because the consequences of banking crises are severe and broadly felt (and thus associated with executive branch turnover). In the Supplementary Table B4, we present results from additional models that examine other crisis types. We find that our results hold for currency and inflation crises, but not for unemployment crises. This suggests that economic downturns do not uniformly increase the likelihood of women’s initial appointment to the finance ministry. Rather, a crisis needs to create an opening for new women to be appointed. In the Supplementary Table B9, we show that unlike banking, currency, and inflation crises, unemployment crises do not predict turnover in the finance ministry. It is thus unsurprising that unemployment does not predict women’s access to power.

The results presented in Table 1 and Figure 2 show strong support for our expectation that women are more likely to first be appointed to the finance ministry in countries faced with financial crises. Of course, because this is a correlational study, we cannot isolate the mechanisms that underpin the glass cliff phenomenon. We can, however, attempt to shed some additional light on women’s appointment to the finance ministry during banking crises. In particular, if women’s appointments send signals to the polity—whether about risk aversion, competence, trustworthiness, or change—then we expect the effect to be strongest where women’s presence in high-prestige, masculine posts remains exceptional. Where women have held these posts, in contrast, their presence erodes stereotypes (both positive and negative) about gender and leadership and women’s presence no longer signals change. Consequently, women’s appointment during crises should be more likely in countries that have never had a woman chief executive. In Supplementary Tables B5 and B6 (Supplementary Figures B2 and B3), we show that our results only hold in countries that have not yet had a woman head of government.

WOMEN’S AND MEN’S SURVIVAL IN OFFICE

Our primary analysis shows that women are more likely to first access the finance portfolio during banking crises, when there is a high risk of failure. This in turn raises questions about crises and women’s and men’s tenures in the post. If women are more likely to come into office during crises and crises shorten women’s time in the position, this suggests that women finance ministers may be set up for failure. However, if once appointed women remain in the portfolio for as long as (or longer than) men—even in the face of crises—this indicates that some women may be able to capitalize on the gendered opportunities created by this glass cliff. Below, we expand on this rationale and then analyze banking crises’ effects on men’s and women’s tenures in the finance ministry.

Tenure in Times of Crisis

Since banking crises pose a significant risk to government survival (Crespo-Tenorio, Jensen, and Rosas Reference Crespo-Tenorio, Jensen and Rosas2014), we expect that they shorten finance ministers’ time in office. By requesting the finance minister’s resignation, heads of government can demonstrate that they are addressing the missteps of the incumbent minister—pinning blame on them—or simply signal a new direction in response to the crisis. Even if chief executives do not respond by sacking the finance minister, financial crises may cause voters or parliament to lose confidence in the head of government, ultimately expediting cabinet failure. If the incumbent government is ousted because of a crisis, the finance minister is unlikely to keep their job under the next administration.

Though banking crises should on average shorten finance ministers’ time in office, they may differentially affect men’s and women’s tenures in the post. Previous research points to competing expectations on this front. On the one hand, to be judged as equally capable, women must often outperform men (Bauer Reference Bauer2020a; Reference Bauer2020b). A large body of work—ranging from politics to computer programming to academia—shows that women in historically male-dominated positions are held to higher standards than men. Research from business on the “savior effect” further posits that women will be afforded less time (and fewer opportunities) than men to demonstrate their leadership skills. After glass cliff appointments, women may thus be more likely to be replaced by more traditional leaders (i.e., men) brought in to “save” the firm from poor leadership (Cook and Glass Reference Cook and Glass2014a).

In politics, voters are more likely to punish women at the polls when they are implicated in scandals (Barnes and Beaulieu Reference Barnes and Beaulieu2019; Saxton and Barnes Reference Saxton and Barnes2022) and women heading major parties have been found to have considerably shorter terms than their male peers (O’Neill and Stewart Reference O’Neill and Stewart2009). O’Brien (Reference O’Brien2015) shows that across parliamentary democracies, women party leaders who lose seat share are more likely than men to leave the post. Examining politicians’ behavior, Bisbee, Fraccaroli, and Kern (Reference Bisbee, Fraccaroli and Kern2022) document sexism in U.S. congressional hearings for Federal Reserve appointees. The application of different or higher standards may thus make women finance ministers especially vulnerable to removal.

On the other hand, women may be as or more likely to retain their post than men. Because the finance portfolio is historically reserved for men, the women who access this position may have distinct backgrounds, skills, or pathways to power that make them as (or even more) likely to weather the storm as their male counterparts. Previous research on women’s access to legislatures, for instance, shows that the women who come to power are highly qualified (Besley et al. Reference Besley, Folke, Persson and Rickne2017; Fulton Reference Fulton2012). Likewise, the positive stereotypes about women that allow their appointment to the position (e.g., compassionate and risk-averse) may also allow them to remain in the portfolio.

Consistent with this expectation, existing work suggests that, once in office, women hold cabinet positions for as long (or longer) than men (Bäck et al. Reference Bäck, Persson, Vernby, Wockelberg, Dowding and Dumont2009; Berlinski, Dewan, and Dowding Reference Berlinski, Dewan and Dowding2007; Escobar-Lemmon and Taylor-Robinson Reference Escobar-Lemmon and Taylor-Robinson2016).Footnote 17 Even some work on party leaders finds no differences between men’s and women’s tenures in office (Gruber et al. Reference Gruber, Cross, Pruysers and Bale2015; Horiuchi, Laing, and Hart Reference Horiuchi, Laing and Hart2015; O’Brien and Rickne Reference O’Brien and Rickne2016), and Carlin, Carreras, and Love (Reference Carlin, Carreras and Love2020) find no evidence that the public judges women and men presidents differently when it comes to economic conditions. Thus, even if they are held to higher standards, women who are appointed to the finance ministry may have (above) average staying power.

EXPLORING THE EFFECT OF CRISES ON FINANCE MINISTERS’ TENURE IN OFFICE

As before, we use Cox proportional hazards models to examine the effect of gender on finance ministers’ careers. In this case, however, the event of interest is ministers’ transitions out of office and the survival time is the number of months served by each finance minister. In this analysis, we consider all finance ministers who served between 1972 and 2017. As we noted above, across the 202 countries, 2,976 finance ministers—117 of whom are women—held office during this period. When a person serves as finance minister for multiple terms consecutively (including under different prime ministers or presidents), we treat them as a single minister-tenure spell. On the other hand, when a person comes back to the position after one or more other ministers have held the office, we treat their later terms as a separate minister-tenure spell.

This procedure yields 3,257 minister-tenure spells—123 of which feature a woman.Footnote 18 We assume ministers start being “at risk” of leaving office as soon as they are appointed. As 159 of the 3,257 minister tenures (5%) began before 1972, we treat them as having a left-truncated duration. We treat the 202 ministers (6%) who were still in office at the end of the observation period as having a right-censored duration.Footnote 19 In addition to accounting for a banking crisis and the gender of the minister in office, our models include the same set of control variables as our previous analyses.Footnote 20

ANALYSIS OF FINANCE MINISTERS’ TENURE IN OFFICE

Our results are reported in Table 2.Footnote 21 In Model 1, we first demonstrate that banking crises increase the hazard rate for the finance minister. That is, the presence of a banking crisis decreases the time that a minister is likely to serve in office. These results hold when accounting for confounders (Model 5). In addition to banking crises, democracies and inflation are also associated with shorter terms in office, whereas a unified government, economic growth, trade openness, and the presence of greater numbers of women in the legislature lengthen the time in office. These coefficient estimates are consistent with expectations vis-à-vis ministerial turnover, though we again limit our interpretation following Keele, Stevenson, and Elwert (Reference Keele, Stevenson and Elwert2020).

Table 2. Risk of a Finance Minister Leaving Office, 1972–2017

Note: Table 2 presents the estimated hazard rate coefficients from the Cox proportional hazards models of the time until a finance minister leaves office (1972–2017). The data are measured monthly. Standard errors (clustered at the minister-tenure level) are in parentheses *p<0.10, **p<0.05, ***p<0.01.

The results for banking crises are consistent with our broader assumption that they represent watershed moments that create both challenges and opportunities with respect to the finance portfolio. To illustrate this point, Figure 3 plots the hazard ratios for ministers during banking crisis periods relative to the baseline (i.e., noncrisis periods). Recall, hazard ratios greater than 1 indicate a shortened time in office. In the bivariate analysis (Model 1), the hazard rate of leaving office is 1.59 times greater during crisis periods compared with a noncrisis period. Similarly, Model 5 shows that once controlling for potential confounders, the hazard rate of leaving office remains elevated—1.38 times greater during times of crisis. This lends support to our broader expectation that banking crises are likely to result in changes in ministry leadership. Indeed, if crises failed to hasten the departure of the incumbent finance minister, there would not be opportunities for women’s appointments during these pivotal moments.

Figure 3. Effect of Crisis on Tenure

Note: This figure illustrates the effect of banking crisis on minister tenure. It plots the estimated hazard ratios (along with 95% confidence intervals) from Model (1) and Model (5) in Table 2 of the main text. These hazard ratios compare the hazard rate during a banking crisis against the baseline scenario (no crisis).

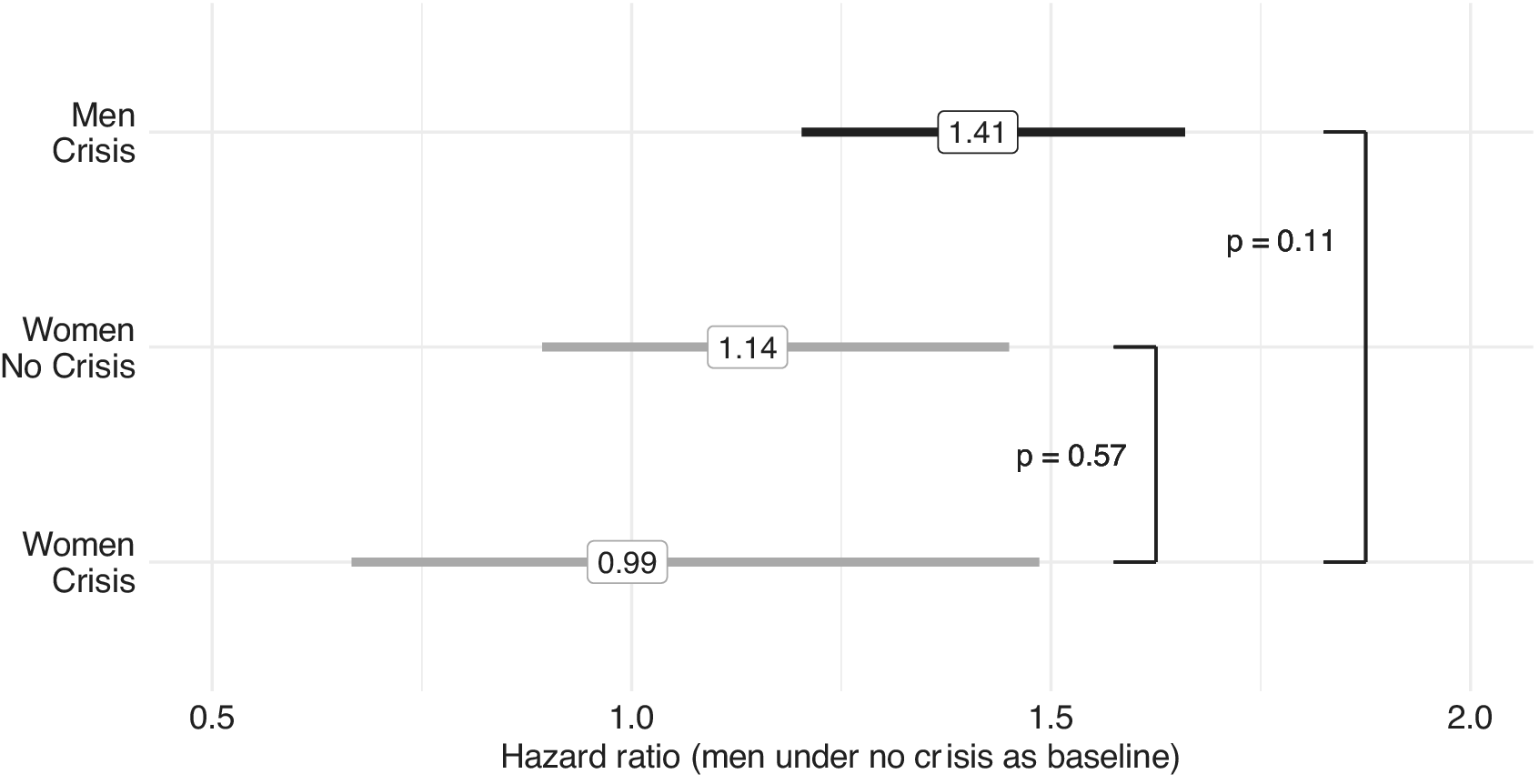

Next, we evaluate the baseline tenure rate for women finance ministers compared with their male counterparts. Model 2 in Table 2 indicates that women ministers do not serve for more or less time than men. This relationship holds even when accounting for the presence of a banking crisis and other control variables that likely influence ministers’ tenure in office (Models 3 and 5). We next ask whether women finance ministers’ durations in office are disproportionately affected by banking crises. Models 4 and 6 include an interaction term between women ministers and the presence of a banking crisis. To interpret the effect of the interaction term, Figure 4 plots the hazard ratios for men during crises, women during crises, and women during noncrisis periods relative to the baseline (i.e., men during noncrisis periods). As before, hazard ratios greater than 1 indicate a shortened time in office.

Figure 4. Effect of Crisis on Tenure by Gender

Note: This figure illustrates the effect of banking crisis on minister tenure by gender. It plots the estimated hazard ratios (along with 95% confidence intervals) from Model (6) in Table 2 of the main text. These hazard ratios compare the hazard rate under different scenarios against the baseline scenario (men under no crisis). For example, the hazard rate of leaving office is 1.41 times greater for men during a banking crisis compared with men during a noncrisis period. Estimates in gray indicate that the hazard ratio is statistically indistinguishable from 1.

The results suggest that the crisis effect is driven by men. That is, men are 1.41 times more likely to exit the post of finance minister (voluntarily or not) during a banking crisis as compared to noncrisis periods. This is not the case for women. Women finance ministers serving during banking crises are no more (or less) likely to leave the position than ministers (both men and women) who hold the post in more normal times. The effects of crisis on the career duration of men versus women appointees also point toward men being more likely than women to exit the post during bad times, though these results fall outside the bounds of conventional significance (p-value=0.11). Thus, our exploratory analysis suggests that the careers of women appointees are not disproportionately harmed by banking crises. If anything, it is men who are more likely to leave the finance ministry during these challenging moments, either because they opt out of the position or are removed from the post.

Supplementary analyses reveal that both currency and inflation crises also shorten ministers’ time in office (Supplementary Table B9). Importantly, and in contrast to the other financial crises we consider, unemployment crises do not shorten finance ministers’ terms in office. This is in line with our finding that unemployment crises do not predict women’s appointments to the finance ministry. If crises do not cause incumbent turnover, they cannot create opportunities for women to gain access to ministerial posts.

Finally, the backgrounds of women who come to power may also provide some insights into their survival as finance ministers. Previous research on women legislators and cabinet ministers shows that women are often better qualified than their male counterparts (Besley et al. Reference Besley, Folke, Persson and Rickne2017; Escobar-Lemmon and Taylor-Robinson Reference Escobar-Lemmon and Taylor-Robinson2016; Fulton Reference Fulton2012). Biographical information for over 2,500 ministers from 191 countries included in our newly compiled data suggests that similar patterns may emerge in the finance ministry.Footnote 22 A simple difference in mean tests shows that women appointees are more likely than men to be technocrats with economic expertise (about 38% of men and 63% of women; diff.=25%; p-value<0.001; Supplementary Table C2).Footnote 23 Women are also more likely than men to have an advanced degree in economics (about 38% of men and 58% of women; diff.=20%; p-value<0.001; Supplementary Table C3), including a Ph.D. (about 19% of men and 31% of women; diff.=12%; p-value<0.01; Supplementary Table C4). Consistent with broader literature, this suggests that women appointees may be as or more qualified as compared to men.

Although preliminary, these data also offer a counterpoint to the narratives that can accompany women’s initial appointment to high-prestige and historically male-dominated positions, which sometimes imply a trade-off between inclusion and competence. In line with existing work, our data suggest that this is simply not the case. Women’s inclusion increases both diversity (Barnes and Holman Reference Barnes and Holman2019; Reference Barnes and Holman2020) and competence (Besley et al. Reference Besley, Folke, Persson and Rickne2017) within political institutions, which is particularly important given that the finance ministry ranks among the most important in the executive branch.

DISCUSSION AND CONCLUSIONS

Financial crises are fundamentally gendered events whose consequences are felt differently by men and women in the polity (Blanton, Blanton, and Peksen Reference Bodea2019; Hozić and True Reference Hozić, True, Hozić and True2016). Yet, no study to date considers whether these crises also affect women’s access to the executive branch. Using a new global dataset that spans over 45 years, we show that women are more likely to first be appointed to the finance ministry during a banking crisis. These results also hold for currency and inflation crises—which are similarly associated with ministerial turnover—and when accounting for potential confounders. We then evaluate the time until ministers leave office. We demonstrate that banking crises curtail men’s—but not women’s—survival in the post. Together, these results suggest that women can sometimes use crises to access traditionally male-dominated positions.

Our detailed examination of women’s ascension to, and survival in, the finance ministry paves the way for additional research on the relationship between economic conditions and women’s political representation. There is growing interest, for example, in women’s underrepresentation among central bankers, which may be shaped in part by perceptions that women are soft on inflation (Bodea and Kerner Reference Bodea and Kerner2022a; Reference Bodea and Kerner2022b; Bodea et al. Reference Bodea, Ferrara, Kerner and Sattler2022). Future studies should consider how economic conditions influence women’s selection as heads of government, legislators, etc. Moreover, our work finds effects for currency and inflation crises, but not for unemployment crises. Future research should consider whether, why, and when different economic conditions affect women’s access to power across political posts. Importantly, although we find that financial crises create opportunities for women, moving forward we must be attentive to the possibility of backlash effects. Financial crises are associated with anger and dissatisfaction with incumbent governments, which may now result in a shift toward more conservative or populist parties. These parties have traditionally been less supportive of women’s rights and gender equality, which could have broader negative effects on women’s representation.

Our work also suggests the need for future studies of the mechanisms that underpin our findings. With respect to the glass cliff phenomena, it is difficult to determine whether the effects we observe are due to stereotypes about women’s abilities, a desire to communicate newness or change, or men opting out of the position. Though we find some evidence related to women heads of government and the signaling effects of women’s appointments, we are hesitant to draw strong conclusions given the small number of women prime ministers and presidents. Yet, irrespective of the exact mechanism (or combination of mechanisms) that underpins our findings, the results comport with the experiences of women finance ministers. Newspaper coverage stated that Chrystia Freeland was asked “to come to the rescue” when she was appointed the first woman finance minister in Canada “during the worst economic crisis since the Depression.” Reporters at the time argued that Freeland had been “put on the glass cliff” (Munro Reference Marcella2020). When asked if the economic climate in Ukraine helped explain her ascension to the post, Natalie Jaresko likewise responded: “Absolutely. It was being in a crisis that made that possible. I was the first female finance minister, you know? …So, it was crisis, and that crisis was economic, and political, and military.”Footnote 24

Likewise, additional work can consider why women finance ministers are more likely to survive financial crises. Our findings on this front are consistent with scholarship on party leaders (O’Neill, Pruysers, and Stewart Reference O’Neill, Pruysers and Stewart2021) and the private sector (Balkin and Gomez-Mejia Reference Balkin and Gomez-Mejia2002; Cook and Glass Reference Cook and Glass2014b; Kulich, Ryan, and Haslam Reference Kulich, Ryan and Haslam2007; Kulich et al. Reference Kulich, Trojanowski, Ryan, Haslam and Renneboog2011). As in the corporate world, men may be likely to leave the finance minister post when facing poor performance—in this case a banking crisis—either because they are punished for this poor performance or because they opt out. As for women, crises may be an instance in which they benefit from gender stereotypes about leadership and perceived outsider status (Ryan et al. Reference Ryan, Haslam, Morgenroth, Rink, Stoker and Peters2016). Though research on party leaders and the private sector offers useful insights for interpreting our findings, future work should examine which of these factors explain men’s and women’s differential access to, and tenures in, the finance ministry.

One approach for future research would be to interview selectors—that is, heads of government—who could reflect on their ministerial appointments.Footnote 25 Interviews with former ministers could also offer insights into their pathways to power, relationships with the head of government and bureaucrats, and survival in and exit from the post. Focusing on the women who have held this portfolio would also further reinforce the role of women’s agency as it relates to the glass cliff (Thomas Reference Thomas2018; Thomas and Lambert Reference Thomas, Lambert, Thomas and Bittner2017). Another option might be to employ experiments that attempt to disentangle these mechanisms (e.g., Claveria and Lavezzolo Reference Claveria and LavezzoloForthcoming). Survey experiments would focus on the polity—rather than selectors—and would not have the breadth of our cross-national analyses, but they could help us establish whether, where, and for whom glass cliff effects stem from stereotypes, outsider status, and/or the diminished desirability of the post.

Beyond the glass cliff metaphor, our work also lays the foundation for additional research on gender, executive branch politics, and crises. From pandemics and extreme weather events to civil and interstate disputes, politics is increasingly dominated by crises (Davidson-Schmich, Jalalzai, and Och Reference Davidson-Schmich, Jalalzai and Och2023; O’Brien and Piscopo Reference O’Brien and Piscopo2023; Tripp Reference Tripp2023). Faced with these challenges, we must ask whether, when, and why crises yield new political opportunities, alter beliefs about the characteristics of “qualified” politicians, and change the (gendered) expectations placed on political posts. Our findings, for example, suggest that for crises to create opportunities for women, they must first create turnover in the position. While some crises lead to the removal of incumbents (e.g., banking, currency, and inflation crises), others fail to do so (e.g., unemployment crises). In the absence of turnover, we find that women are not more likely to come to power.

We also focus on an especially severe form of crisis. Banking crises are “highly disruptive events that lead to sustained declines in economic activity, financial intermediation, and ultimately in welfare” (Laeven and Valencia Reference Laeven and Valencia2020, 307). These types of financial crises have also been shown to diminish trust in the political system, which may create opportunities for women ministrables to capitalize on feminine stereotypes about trustworthiness and risk aversion. Less severe crises, and/or those that do not erode systemic trust, may have no influence on women’s representation or may even reinforce the male-dominated status quo.

Finally, centering the agency of women politicians, future work should consider the policy ramifications of women’s presence in the finance ministry. Researchers should establish whether women ministers are associated with different policies, including more gender-conscious government budgets. They should focus special attention on the management of financial crises. Crises undermine women’s participation in the formal labor force, educational attainment, and health outcomes (Blanton, Blanton, and Peksen Reference Bodea2019; Hozić and True Reference Hozić, True, Hozić and True2016). They may thus represent an important moment for women’s representation in the portfolio, as women ministers are often more likely to represent women’s policy interests (Armstrong Reference Armstrong2023; Atchison Reference Atchison2015; Atchison and Down Reference Atchison and Down2009; Taylor-Robinson, Pignataro, and Armstrong Reference Taylor-Robinson, Pignataro and Armstrong2023). Yet, our work suggests that women may be appointed to make difficult budget cuts, which can disproportionately affect women citizens. Future studies should examine whether women’s presence in the post guards against heightened social and economic gender disparities in the wake of financial crises.

SUPPLEMENTARY MATERIAL

To view supplementary material for this article, please visit https://doi.org/10.1017/S0003055423000825.

DATA AVAILABILITY STATEMENT

Research documentation and data that support the findings of this study are openly available at the American Political Science Review Dataverse: https://doi.org/10.7910/DVN/IAEUVB.

ACKNOWLEDGMENTS

We thank Michelle Taylor-Robinson and the faculty and students at the University of Maryland, University of Wisconsin, University of California-Berkeley, University of Pittsburgh, Western University, and Texas A&M University for their comments on this research. We thank Sonal Churiwal, Benjamin Leo, Stephen Morkel, Camila Rezende Tavares Pimentel, Aliyyah M. Sadek, and Emma Thyne for their research assistance. We also thank the editors and reviewers at the American Political Science Review for their thoughtful guidance and feedback throughout the editorial process. Earlier drafts of this paper were presented at the 2019 and 2021 meetings of the American Political Science Association.

FUNDING STATEMENT

This research is funded by the National Science Foundation (SES-1851407 and SES-1851457).

CONFLICT OF INTEREST

The authors declare no ethical issues or conflicts of interest in this research.

ETHICAL STANDARDS

The authors affirm this research did not involve human subjects.

Comments

No Comments have been published for this article.