This article analyzes the accounting system employed by the Fengshengtai Company (Fengshengtai hao 丰盛泰号). Fengshengtai was a Chinese salt merchant operating in Qing dynasty (1644–1911) Henan Province. Its one hundred surviving account books have recently become available to scholars. These documents are well preserved and span nearly three decades, from 1854 to 1881 (the Xianfeng reign to the Guangxu reign). The collection is currently being transcribed into searchable text to accompany copies of the original documents. When this is completed, the Guangdong People's Publishing House (Guangdong renmin chubanshe; 广东人民出版社) will publish the Fengshengtai collection in its entirety. The material will interest not only historians of accounting but also scholars of Chinese business, salt, and economic history more broadly. The publication of these sources makes them especially valuable to international scholars and makes a study of Fengshengtai's accounting all the more timely.

Our study focuses on Fengshengtai's accounting treatment of sales and purchases of salt. In doing so, it investigates the extent to which Fengshengtai employed double-entry bookkeeping (DEB). This framing of the problem is fraught: it risks imposing a teleology based on western European history onto what was, after all, a very different commercial tradition. Nevertheless, there are good historical reasons to retain the notion of DEB when discussing Chinese accounting. In Chinese accountants’ own words, we find the same understanding of “balance,” that is, the notion that each entry requires an equal, matching entry. This is evident in a highly intriguing late-Qing bookkeeping primer found in Shanxi Province. The primer—entitled Necessary Knowledge for Trade (Jiaoyi Xuzhi; 交易须知) (hereafter, Necessary Knowledge)—offers instruction on how to conduct business and contains several chapters on accounting. The primer unequivocally emphasizes the importance of matching and balancing. In explaining how to keep the books, it states,

When recording sales of grain or goods, record them in the same manner of purchases. After they are recorded, [the books] should counterbalance each other and clear with one other . . . as regards every transaction, the entry in the cash flowing account must match perfectly and be mutually posted and mutually corresponding with an entry in one of the other accounts without a single error. Verily, this is the essence of bookkeeping!Footnote 1

This means that income and outgo must be recorded to allow for clear daily tallies. In addition, every single entry in one book must match an entry in another book. The characters “相投相对” (xiantou xiangdui) specifically mean “mutually posted and mutually corresponding”; that is, the corresponding entries must balance.

Moreover, as Chinese accountants became more aware of Western accounting, they explicitly claimed that the matching and balancing principle in Western DEB was identical to the principles underlying traditional Chinese accounting. Li Mengbai, a traditional Chinese accountant active in Yunnan business, made this claim most eloquently:

Its [i.e., “heaven and earth” or “four-foot” Chinese accounting] principles are the same in their essentials as Western double-entry bookkeeping. The difference is that double-entry is unique in being divided vertically between debits and credits, and recording entries such that debits always equal credits and vice versa. Meanwhile, Chinese-style heaven-and-earth accounting records entries into a flowing account representing cash income and outgo or purchases and sales of goods which are also entered into the client ledgers with income matched to lai entries and outgo matched to qu entries. This is identical to having matching debits and credits.Footnote 2

Here Li is explicitly conveying the idea that dualled entries in traditional Chinese accounting are based on a balancing principle that is “identical” to the logic underlying matching debits and credits in Western accounting. He directly states that for every transaction, two balancing entries must be recorded in two of three accounts: “cash flowing accounts,” “sale and purchases of goods flowing accounts,” and “client accounts.” This is precisely the model that we elucidate and provide new evidence for below in sections three and four. We also portray this model visually in Figure 3. In short, both Chinese and Western accounting recognized the need for mutually balancing entries. But whereas Western balancing occurred in a single ledger, Chinese balancing consisted of entries across multiple account books.Footnote 3

The passages above validate the concept of Chinese double-entry bookkeeping (CDEB) as an analytical category—though they do not establish whether or not such a system actually existed. But this raises a second problem: How exactly do we define CDEB? The secondary literature employs a variety of incompatible definitions and much of the literature lacks any definitions at all.Footnote 4 For many scholars, CDEB is defined narrowly as a system of bookkeeping in which each transaction is recorded twiceFootnote 5—what Alan Sangster refers to as “dual entry” as opposed to true “double-entry” bookkeeping.Footnote 6 For other scholars, DEB entails a system of dual entries that produces self-checking accounts, such as contemporary financial statements.Footnote 7

Weipeng Yuan and Richard H. Macve endorse the latter definition, but with an important innovation. Rather than conceive of CDEB as a binary, they propose a spectrum of four accounting “stages” that correspond to the historical development of DEB in Europe. This framework avoids the need to arbitrarily define CDEB and speak of it in binary terms. Instead, we can state the “stage” of CDEB that actual Chinese firms attained. For Yuan and Macve, anything Stage 3 (iii)—consisting of accounts capable of automatically producing financial statements and commensurate with “four-foot accounting” (on which more below)—would constitute true CDEB.Footnote 8 Note that Macve and Yuan's framework is not an empirical, historical fact; rather, it is a classification system. Moreover, their schema is capable of classifying both Chinese and Western bookkeeping. It is thus the sine qua non of any comparison between Chinese and Western bookkeeping methods.

We find conclusive evidence of Sangster's “dual entries.” This places the level of CDEB in the Fengshengtai accounts no lower than Stage 2 (ii). We find no direct evidence demonstrating Stage 3 (iii), which is what Yuan and Macve's framework demands for true CDEB. But absence of evidence is not proof of absence. Moreover, the evidence we do have pertaining to Fengshengtai's accounting treatment of sales and purchases suggests the very real possibility of Stage 3 (iii) CDEB.

These findings contribute to a rich and lively literature on the history of Chinese accounting. Early scholars, including such luminaries as Werner Sombart and Max Weber, credited Europe's adoption of DEB with the onset of capitalism and the Industrial Revolution. They blamed China's relative decline on its lack of the same.Footnote 9 Neither Sombart nor Weber were historians, and their theories surrounding accounting have been vigorously challenged.Footnote 10 Indeed, subsequent research has cast doubt on the supposed tension between traditional accounting and capitalist dynamism. Some argue that DEB was less prevalent in early modern Europe than previously supposed, perhaps negating much of its causal importance in bringing about industrialization.Footnote 11 However, this point is still contested. Jacob Soll's seminal work on the history of accounting places its development in the late 1200s. Moreover, he has shown widespread dissemination of DEB in early modern Europe, including adoption by Renaissance Italian states in the fourteenth century and knowledge of DEB in Renaissance Italy and among the sixteenth-century Dutch—the two quintessential examples of preindustrial capitalism.Footnote 12 The stakes of this debate are evident not only in the academy, but in the accounting profession itself. Several prominent Chinese accountants in the 1930s insisted on the urgent need to update China's “backward” methods of accounting.Footnote 13 Others disagreed and argued that traditional Chinese accounting possessed all the merits of Western-style accounting.Footnote 14

Since the early 1980s, scholarship on historical Chinese accounting has taken an empirical bent, seeking to determine the precise nature of traditional Chinese bookkeeping methods and situating these methods in the context of Chinese business.Footnote 15 Robert Gardella's seminal study of Ruifuxiang, a dry goods trader in Beijing, analyzed the bookkeeping system's ability to track profits and investment. He went on to outline the basic principles behind traditional Chinese accounting, namely, the “four-pillar balancing method” (sizhujiesaunfa; 四柱结算法), the “three-legged account” (sanjiaozhang; 三脚账), and the “dragon gate account” (longmenzhang; 龙门账). The first was a way of balancing accounts to determine profit, the second was a system of partial dualled entry, and the third was a system of fully dualled entry. In Gardella's words, the three-legged account adopted the “double-entry recording principle,” while the dragon gate account constituted “an indigenous double-entry accounting system.”Footnote 16 Pak Aeuyung, Lei Fu, and Zhixiang Liu came to similar conclusions in their study of accounts used by Zigong salt merchants.Footnote 17 They found evidence of partial double-entry accounting in the “three-legged accounts,” in which credit transactions were recorded twice while cash transactions were recorded only once. They also claimed complete double-entry accounting in the “dragon gate” or “six-pillar accounts” deployed by larger enterprises.Footnote 18 Maxwell Aiken and Wei Lu believe that double-entry accounting emerged in China in the late Ming and early Qing. They argue that with the advent of the “four-foot account” (sijiao zhang; 四脚账) Chinese accounting began to use CDEB and to produce financial statements tracking net assets and profit and loss. Nevertheless, Aiken and Lu hedge considerably in their conclusions, conceding that even in the most advanced form of Chinese accounting, posting between different accounts was unsystematic.Footnote 19 In short, the consensus holds that Chinese accounts developed, first, partial dualled entry in the form of “three-legged accounting” and then fully dualled entry and perhaps even CDEB in the form of “four-foot accounting.”

Keith Hoskin and Richard Macve challenge this consensus. They point out that the standard by which previous scholars have defined CDEB is lower than that of Western DEB. Specifically, historians of Chinese accounting have mistakenly viewed DEB as referring to more basic accounting functions.Footnote 20 They caution that any discussion of CDEB must take care to define CDEB—and to do so such that it is more than simply reciprocal entries for a given transaction. Recent work by Yuan, Macve, and Debin Ma appears to bear out Hoskin and Macve's warning; it also offers the most exhaustive analysis of historical account books to date. The authors analyze the voluminous records of the Tongtaisheng Company (统泰升号), a grocer-cum–merchant banker in Qing-era Zhili Province.Footnote 21 They take a lukewarm view of the previous scholarship, writing, “In this accounting debate . . . with a few limited exceptions, most studies which have made those claims for a CDEB have presented no systematic evidence based on careful demonstration from original Chinese account records—and none of the evidence presented is sufficient to demonstrate the emergence of CDEB.” Yuan, Macve, and Ma take a highly nuanced position. They find no evidence of a “fully-closed system” as developed in Italy between the thirteenth and fourteenth centuries.Footnote 22 They find partially doubled accounts, meaning Tongtaisheng credit transactions are entered in both the “flowing account” and the “credit account” (we explain these terms in the section on taxonomy below). This implies a system consistent with what the earlier literature terms “three-legged accounting.” However, they find no evidence of the fully doubled entries necessary for four-foot accounting and are skeptical that such a system was present in traditional Chinese accounting.Footnote 23

Our work builds on this scholarship in several important ways. First, it analyzes the treatment of revenue and purchasing with specific reference to how a single transaction flowed through different account books. It does so following Yuan, Macve, and Ma's methodology, providing direct, pictorial demonstrations with heavy annotation where needed. Our analysis provides hard evidence of doubled entries for all sales and purchases, not merely for credit transactions, as has been the case in previous studies.Footnote 24 This constitutes empirical proof for comprehensively “dualled entry” accounting used by at least one major firm. It also amounts to circumstantial evidence for four-foot accounting and thus a system of true CDEB. We return to this problem in our conclusion.

Finally, it is worth pointing out several key questions that are beyond the scope of this study but that this article raises as critical challenges for future research. The first is the question of chronology. There is an old debate as to when China's complex, traditional accounting systems developed and whether they emerged indigenously or from contact with Western systems of accounting. Our intuition is that borrowing from Western accounting in the early Qing was minimal. This is because of the continuities between Ming-era account books and Qing-era Shanxi merchant accounts.Footnote 25 We suspect that Western and Chinese accounts represent, instead, an intriguing case of convergent evolution, akin to wings on butterflies and birds or the independent development of writing systems.Footnote 26 However, to address this question properly would require a comparative study of Ming, Qing, and Republican-era accounting (by which point we know that Chinese businessmen were learning Western DEB) and thus lies beyond the scope of this article.Footnote 27 A related question is the extent to which the observed accounts in the Fengshengtai collection change over time. There is no discernible pattern; we see mostly the same kinds of flowing accounts, client accounts, and an occasional miscellaneous account throughout the period that the collection covers. However, account books from the Xianfeng reign are scarce. Those from the Tongzhi reign are more common, and accounts from the Guangxu reign are far more common than either Xianfeng or Tongzhi documents. This matches the general pattern of Qing-era “popular sources,” in which the availability of sources grows exponentially over time. Unfortunately, this makes changes in the nature of account books more difficult to identify, simply because the sample size for earlier years is so small.

The rest of this article is divided into five sections. First, we take a step back from the account books to introduce Fengshengtai, situating the business within the wider context of late imperial salt markets and relaying what details we know about the firm itself. We then go on to briefly present our taxonomy for analyzing Chinese bookkeeping. In this section, we deal more in categories of account books than in specific examples from the primary sources. The third section delves into the Fengshengtai accounts themselves. We provide detailed examples of the four kinds of accounts on which we base our analysis. This section serves, incidentally, as a primer on how to read the Fengshengtai accounts; as such, it may prove useful to scholars interested in using Fengshengtai sources for purposes other than accounting history. After introducing our sources, section four takes us to the heart of our analysis. In this section, we show how different accounts were related to each other and how the same transaction always resulted in two distinct entries across multiple account books. The final section is a conclusion, in which we assess what our analysis reveals about the level of CDEB that obtained at Fengshengtai. Our conclusion is careful to distinguish between the level of double-entry bookkeeping that our analysis demonstrates and the level that it merely implies.

The World of Fengshengtai: Salt and Commerce in Late-Qing Henan Province

The salt trade in China dates from at least 1000 BCE, when, according to the archaeological record, salt production commenced in Zhongba, in present-day Chongqing.Footnote 28 Salt is one of the two commodities in the first-century BCE classic text Discourses on Salt and Iron, from the early Han dynasty. In these debates, the Grand Councilor argued that the state required control of salt and iron to raise revenues in support of its military campaigns against the Xiongnu barbarians. The Confucian literati argued that state meddling was harmful to the people.Footnote 29 The discourses showcase the importance of salt to Chinese imperial political economy and presaged what would become a millennia-long tradition of state involvement in the Chinese salt trade.

The late imperial regulatory framework for salt dates back to the eleventh century, when the Song dynasty instituted a state-managed distribution system. Under this system, salt-producing regions of the empire were divided into “certificate territories” (yindi; 引地) that corresponded to specific “sales territories” (yin'an; 引岸, or xiaodi; 销地). In order to participate in the salt trade, merchants purchased certificates giving them statutory permission to purchase salt produced in a given certificate territory and to market the salt in the corresponding sales territories. For most of the Qing dynasty, the certificate system remained a relatively hands-off licensing regime. Prices at salt yards and retail shops alike were set by the market. The state's laissez-faire attitude toward pricing changed, however, in the nineteenth century. The Qing state experimented with a series of different regulatory regimes, any of which could be implemented in a given locale at a given time. As a result, it is difficult to generalize about the Qing salt industry. Historians are most familiar with regulatory changes in Sichuan, thanks to the scholarly attention paid to the Zigong merchants. Regional politics weighed heavily on Sichuanese salt. In the 1850s, the powerful governor of the Liangjiang provinces, Zeng Guofan (1811–1872), successfully lobbied the state to restrict Sichuanese salt exports in favor of salt from his own, downriver provinces. Nevertheless, high levels of smuggling—by some estimates, up to one-third of salt marketed in Huguang was illicit—limited the ability of the state to curb market forces.Footnote 30

To understand the Fengshengtai books, it is necessary to give some background on the specific salt market in which the firm operated. For our purposes, the most important salt market was in northwestern Henan Province near the city of Luoyang. This is the market where the Fengshengtai Company was active. During the Qing, salt in the Luoyang market and its environs hailed from salt pools in Hai prefecture (Haizhou; 解州) and other prefectures near the city of Yuncheng (运城), in Shanxi Province.Footnote 31 (Today, Hai is a mere township-level entity under the authority of Yuncheng municipality.) This salt was known interchangeably as either “Lu salt” (lu yan; 潞盐) or “river east salt” (hedong yan; 河东盐). The names refer to Yuncheng, whose ancient name (still used today as an abbreviation) is “Lu,” while “river east” references Yuncheng's location on the east bank of the Yellow River. This is important because Shanxi salt merchants had operated in this region since the Ming dynasty's “kaizhong” system (1368–1644), and thus their bookkeeping practices would likely have been among the most advanced in China.Footnote 32

It is also important to understand the regulatory regime governing Lu salt, since this would impact whether prices recorded in the account books were fixed or market prices. This regulatory regime underwent several changes during the Qing dynasty. In the early nineteenth century, the government permitted a free market in Lu salt. This period of laissez-faire ended in 1820, when the Jiaqing emperor implemented guandu minxiao (官督民销), or “official supervision and popular marketing.”Footnote 33 Under this policy, the Board of Revenue (hubu; 户部) issued salt certificates to merchants in return for a deposit. The licenses bestowed exclusive rights to transport a given amount of salt from certificate territories to sales territories, while also imposing responsibility on the merchants for a given amount of tax (essentially the cost of the certificate). Upon arrival at the sales territory, the salt could trade freely, albeit within the geographical ambit of the sales territory.Footnote 34

As part of this regulatory regime, the Qing state confined shipments to statutory trade routes along which it permitted Lu salt to travel from the salt yard to markets in Henan. This made it easier to police smuggling and thereby ensure that unlicensed merchants were not shipping salt (or that licensed merchants did not exceed their quota). Salt would enter Henan from Yuncheng by way of the Moujin (茅津) crossing on the northern banks of the Yellow River. After crossing the Yellow River, it would arrive in Huixing Market (Huixing Zhen; 会兴镇), in northern Henan. Thus, Huixing served as the transshipment hub for Lu salt destined for all points in Henan.Footnote 35 Once in Huixing, the salt was permitted to trade freely within the sales territory.

By no later than the Qianlong reign (1735–1796), the salt merchants most active in this salt trade hailed from Shanxi Province. They were thus a part of the Ming and Qing dynasties’ celebrated “Shanxi merchant” network.Footnote 36 After the Taiping rebellion broke out in 1850, Shanxi merchants became even more prominent in the Henan salt trade.Footnote 37 They were particularly dominant in Huixing Market, where they constructed their own Temple to Lord Guan (Guandimiao; 关帝庙), also known as a “Shanxi native place association” (Shanxi huiguan; 山西会馆).Footnote 38

Fengshengtai was a Shanxi merchant firm whose founders hailed from Gaoping County in southern Shanxi, roughly three hundred kilometers away from Yuncheng. This is in many ways a typical salt merchant story.Footnote 39 Fengshengtai itself was a joint-stock company. As was common amongst Shanxi merchant firms, its investors consisted largely of investment trusts (tanghao; 堂号) along with wealthy individuals. Fengshengtai operated a large branch network throughout Henan and even farther south. In the key entrepôt of Huixing Market, it conducted purchasing operations and managed a complex logistics network to ship salt purchased in Huixing to its target markets. Fengshengtai's sales branches were located in the environs east of Luoyang, where most of its marketing took place. In addition to trading salt, Fengshengtai operated cloth-trading branches as far afield as Zhoukou in southeastern Henan and even in the Jiangnan region, in southern China.

The scale of Fengshengtai's salt business was considerable. Sales in the fifth year of the Tongzhi reign (1866) amounted to volumes of 125,000 jin (斤) worth revenues of 5.625 million copper cash or 4,136 taels of silver at market prices. One jin weighed 596.816 grams, with substantial regional variations, making for sales of approximately eighty tons of salt. Business results fluctuated considerably. The period that the documents cover includes the Great North China Famine, or Dingwu Qihuang (丁戊奇荒). The famine was caused by a protracted drought that lasted from 1876 to 1879 and spanned north China from Shandong Province in the east to Gansu Province in the west. Estimates of the death toll range from nine million to thirteen million lives, with Henan and Shanxi being the most affected.Footnote 40 The disaster caused a sharp business downturn, and Fengshengtai's salt sales slumped to 55,000 jin. This reflects a severe decline in population around Luoyang. The Luoyang Municipal Old District Gazetteer records a Qing-era account that reads, “From the first to the fourth reign year of the Guangxu Emperor [1875 to 1879], Luoyang experienced terrible drought for four years in a row. The Yi and Luo Rivers did not flow. The five grains were not harvested. Eight or nine out of every ten persons starved to death. It was a calamity unseen in three hundred years.”Footnote 41 Fengshengtai's target market would have fallen by over half, from approximately 32,000 people to 13,500.Footnote 42 It is not clear that the firm ever entirely recovered. In Guangxu 8 (1882), annual sales totaled 66,433 jin of salt worth 3.452 million copper cash. At these levels, Fengshengtai was still a large trading firm but diminished from prefamine heights. Thus, throughout the entire period for which we have Fengshengtai account books, we can interpret these books as at least potentially representative of larger, and presumably more sophisticated, salt trading firms.

Taxonomy of Chinese Account Books

This section describes our taxonomy of traditional Chinese account books. We divide the majority of traditional Chinese account books into three major functional categories: operational accounts, general clearing accounts, and capital accounts. The Fengshengtai records contain account books almost exclusively of the first category. Nevertheless, we believe an overview of our general-case taxonomy is useful as this informs our view of how different Fengshengtai accounts are related.Footnote 43 We subdivide our functional categories as follows:Footnote 44

Operational accounts

An operational account is any account that directly records transactions of the firm. This includes everything from sales and purchases to wages and personal expenses of family members paid for out of the firm's pocket. We can further subdivide operational accounts into four subcategories:

1. “Flowing accounts” (liushuizhang; 流水账). These include any account book that is organized by date. In the case of Fengshengtai, they include “cash flowing accounts” (yinqian liushuizhang; 银钱流水账) recording all cash income and outgo, “salt sales flowing accounts” (maiyan liushuizhang; 卖盐流水账), and “purchase accounts” (zhihuozhang; 置货账).

2. Client accounts (fenhuzhang; 分户账). A client account is any account organized by a specific counterparty, either individuals or corporate entities. These include outstanding balances, extensions of credit, and repayments between a firm and its counterparties. The client accounts correspond exactly to what Yuan, Macve, and Ma label “Stage 2” account books.Footnote 45

3. Salaries and disbursement accounts (zhishizhang; 支使账). These are also organized by a counterparty and contain a record of wages paid, certain payments to investors or other related parties, and other expenses.

4. Family expense accounts (jiating kaizhizhang; 家庭开支账). These accounts record the expenses of families or lineages with investments in the firm, which the firm pays for out of its own pocket.

General clearing accounts

General clearing accounts (zongqing zhang; 总清账) are the summary statements of the firm's stocks and flows, compiled based on the rough flowing accounts at regular intervals. Note that we have not found any general clearing accounts in the Fengshengtai records. Nevertheless, a number of other examples of such accounts from Shanxi merchants exist.Footnote 46 The most important subcategories are monthly clearing accounts (yue zongqing; 月总清) and yearly clearing accounts (nian zongqing; 年总清). Monthly clearing accounts were calculated by adding up the daily subtotals of operating accounts. Yearly clearing accounts were calculated by adding up monthly clearing accounts. These accounts use the four-pillar method of summarizing the firm's financial position and calculating profits.

Capital accounts. For Shanxi merchants, the capital account was known as the wanjin zhang (万金账); this translates to something like “comprehensive funds account.” It records all capital transactions, including equity investments, changes in equity, certain debt instruments, dividend payments, and firm liquidation.Footnote 47 There is some debate over how standardized they were and whether they count as “real” account books. But at least some capital accounts included annual or triennial financial statements. For Shanxi merchants, capital accounts were of two types:

1. Four-pillar account method (sizhujiesuanfa; 四柱结算法). These are Chinese financial statements that give summary results of a business's profit, loss, and financial position over a given period. The formula governing these accounts is either: Income – Outgo = Present net assets – Beginning period net assets; or Income – Outgo = Assets – Liabilities. Typical assets in a four-pillar account include receivables, cash in the till, inventories, furniture and fixtures, and advances given to employees. Liabilities generally consist of loans, equity, and payables. Profits were calculated by deducting starting capital from assets net of liabilities.Footnote 48

2. Statement of dividends (fenhongzhang; 分红账). These are statements of dividends paid to shareholders, as well of the shareholding structure of the firm.

For Shanxi merchants, both four-pillar accounts and statements of dividends were often combined into a “comprehensive funds account” (wanjinzhang; 万金账). Some of these accounts contain only an abridged financial statement.Footnote 49 The line between general clearing and capital accounts is therefore fuzzy.

The Fengshengtai Accounts

The Fengshengtai documents are account books taken almost exclusively from the first category—operational accounts—along with several miscellaneous account books. Its operational accounts consist mainly of flowing accounts and client accounts. Apart from these, there are occasional salaries and disbursement accounts as well as family expense accounts. In this article, our focus on the accounting treatment of revenue and purchasing leads us to analyze three distinct kinds of flowing accounts, along with several client accounts. In this section, we introduce the structure and format of these accounts before proceeding in the next section to our analysis of revenue and purchasing treatment. We note that the accounts are written in traditional Chinese, but we transcribe them in simplified characters in keeping with standard written Chinese.

The first type of flowing account that we analyze is a cash flowing account (hereafter, “cash account”). The cash account begins with an entry transferring the previous account's balance to the new account. It then records in chronological order the firm's cash inflows and outflows. Entries recording cash receipts are written at the top of the page, preceded by the character ru (入), meaning “enter.” Entries recording cash payments are indented downward and commence with the character chu (出), or “exit.” Roughly twice a month, balances of cash and silver in hand are summarized with an entry beginning with the character cun (存), meaning “keeping” or “to deposit.” Silver balances are denoted with the characters zuwen yin (足纹银) or abbreviated as simply zu yin (足银), which translates literally to “pure silver”; among Shanxi merchants, it denoted a fineness of 935.374 per mille. This does not mean Fengshengtai received actual specie of such high quality in all of its transactions—this would have been impossible. Rather, zu yin served as the standard of account. Thus, if the firm received physical silver of a lower grade, it would convert the amount into zu yin for the purpose of bookkeeping.

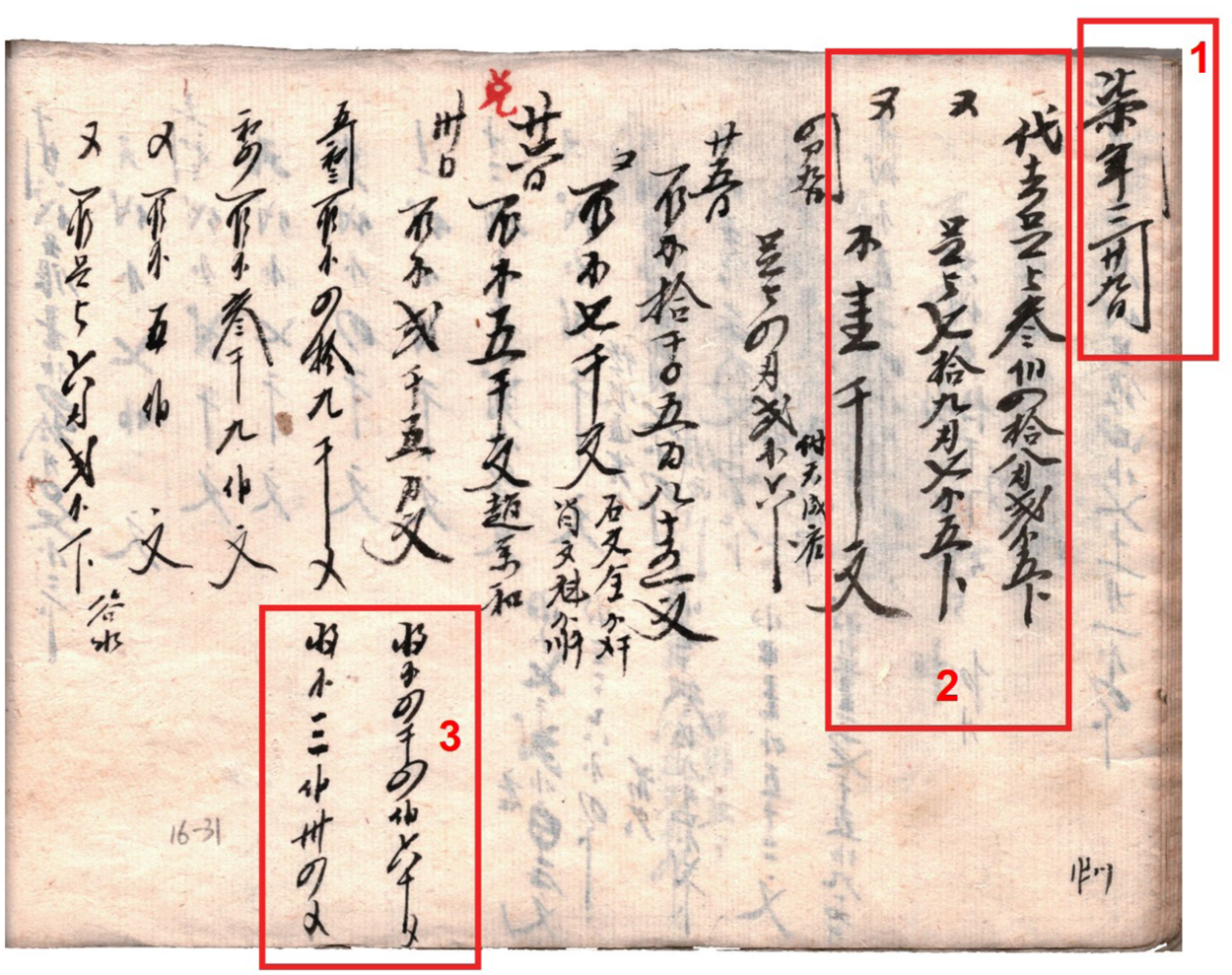

The second kind of Fengshengtai flowing account that we analyze is the “salt sales flowing account” (hereafter, “salt account”). The salt account is dedicated to tracking sales of salt. It is organized in a way that is similar to the cash account, chronologically by transaction. Salt sales can be entered in several ways. In the event of a cash transaction, as in the majority of sales, there would be two entries. First, the outgo of physical salt would be entered at a downward indent, much like cash outflow in the cash account. Entries for the outgo of physical salt begin with the characters chuyan (出盐), or “exit salt,” followed by the physical weight of the salt denominated in jin. The second entry records the receipt of cash for the salt. These entries begin at the top of the page and begin with the characters rulai (入来), or “enter.” Credit sales are recorded differently. Sales on credit commence at the top of the page, beginning with the customer name. This is followed by the characters quyan (取盐), or “drawing salt,” and then the physical amount of salt. These transactions generally contain a note, in Suzhou numerals (Suzhou mazi; 苏州码子), with the market value of the sale. The fact that they are in Suzhou numerals is significant in itself. Suzhou numerals are more convenient to use with an abacus and thus are often used for prices or market values.Footnote 50 In addition, Suzhou numerals are noteworthy because of the ease with which they allow numbers to be paired with not only different denominations—including silver taels and copper cash—but also measures of physical goods such as catties, piculs, or boxes.Footnote 51 Since China lacked a true standardized unit of account until 1933 at the earliest, a shorthand that allowed any number to be denominated in a specific—and distinct—unit was highly useful.Footnote 52 Following this entry, indented downward, are entries denoting any cash received as consideration for the sale. These indented entries start with the character shou (收), meaning “received,” and state the amount of cash received. Some of these transactions do not appear to actually involve trade credit, as consideration for the salt is given in full. In these cases, there is generally something slightly more complicated about the transaction, such as the need to give the customer change or the use of multiple types of currencies to pay for the salt. An annotated example of the salt account is presented in Figure 1.

Figure 1. Salt account, Guangxu 7 (1881). Notes: (1) “Xin zhengyue chu wu ri kai zhang hongxi da ji” (新正月初五日开账鸿禧大吉), meaning “First month of the new year, fifth day. Starting a new account book for great fortune.” This marks the date, in this case 1/5 on the lunar calendar, in the year Guangxu 7 (1881). Shanxi merchants often wished for good fortune or success on the first entry of a new account book or of the new year. (2) These are transactions with a client named Zhu Haiyin (朱海印). The rightmost entry reads “Zhu Haiyin qu yan liushi jin” (朱海印取盐六十斤), meaning “Zhu Haiyin received 60 jin of salt.” This records the physical transfer of salt to the client Zhu Haiyin. The middle entry reads “Shou zuyin er liang ling er fen 17 he qian 3,434” (收足银弍两〇二分17 合钱3,434), meaning, “Received silver of 2.02 taels, at 17 worth cash of 3,434.” This records the receipt of payment from Zhu Haiyin, to the amount of 2.02 taels of silver. The character “zu” (足) is short for “zuwen” (足纹), and translates literally to “pure silver.” In practice, it denoted a regionally specific, high degree of fineness. The entry records the payment value first in silver, and then converts it to copper cash at the market rate of 1,700 copper cash per silver tael. Note that the exchange rate and the copper price of 3,434 are written in business numerals. The final entry reads “zhaoqu qian wu bai wen, liang qing” (找去五佰文, 两清). It means, “Returned change of 500 copper cash. Transactions cleared.” This is so because Zhu Haiyin paid for the salt in silver, while normally copper cash would be used for retail transactions. But the amount of silver he had on hand to pay exceeded the market price, so Fengshengtai gave him 500 copper cash in change. The “transactions cleared” statement is used to note that after giving him his change, neither party owes the other anything. (3) “Chu liu ri” (初六日), this is the date. It means “the sixth.” Note that for this date, and all subsequent dates, there are no accompanying auspicious statements. (4) This is a typical entry in the salt account. The first column on the right records the amount of salt sold, while the next column on the left records the copper cash received. The salt entry reads “chu yan sishisan jin” (出盐四十三斤) or “Outgo of 43 jin of salt.” The second column reads “ru lai da qian erqianlingliushisi wen” (入来打钱弍千〇六十四文), or “Income of 2,064 copper cash.” (Source: Fengshengtai Company Accounts, “maiyanliushui zhang.”)

To summarize, Figure 1 displays three entries—outlined in box 2—for a transaction with client Zhu Haiyin (朱海印). In this case, the sale is a cash sale, but Fengshengtai has received silver from Zhu Haiyin and given him change in copper. These cash exchanges are indented after the entry indicating Zhu Haiyin's receipt of 60 jin of salt. If the sale were made in credit, there would be no need for the second two entries. Box 4 presents a simpler sale, where the customer purchased salt using a cash payment.

The third flowing account that we analyze is a “purchase account.” This is not merely our nomenclature but appears on the account book's front cover. This is one of the most interesting documents in the Fengshengtai collection because material relating to the accounting of purchases are rare. The purchase account is divided into two sections, which we treat as two distinct account books. The top section is a flowing account, recording purchases of salt. We refer to this section alone as the “purchase account.” The bottom half is a client account, which we refer to as the “purchase client account.”

The purchase account is organized by date and records purchases of salt. Amounts are in three distinct units, either copper cash (qianwen; 钱文), silver taels (yinliang; 银两), or jin (斤) of salt. There are three distinct kinds of transactions: dai (代), qu (取), and shou (收). Dai and qu both represent expenses and are written at the top of the account. Qu is seen commonly in Shanxi merchant documents; it translates literally to “draw” (in the sense that one “draws down a deposit” or “draws an advance”). Shanxi merchant client accounts frequently use qu to represent withdrawals of deposits or advances, while Shanxi merchant flowing accounts use qu to denote outlays and/or expenses. The use of the character dai is more unusual. The nuances that determined which purchases used qu and which used dai at present elude us. The shou transactions are more straightforward. These are written at the bottom half of the account and represent income—usually of salt but sometimes of monetary amounts (on which more below). The use of qu and shou bear a surface resemblance to Western DEB debits and credits. It is therefore important to point out that the logic is distinct from Western DEB in that qu do not equal shou. The doubling occurs, rather, by making the same entries in cash flowing, salt flowing, and customer ledgers, as we will demonstrate below.

There are periodic, semiregular summaries in which prior transactions are added together and denoted with a gongdai (共代), meaning “total expenses.” These summaries tend to occur after the third month, the fifth month, and the tenth month. These months were almost certainly settlement months, during which the bulk of trade was conducted.Footnote 53 Month ten stands out as particularly important, during which the bulk of salt purchases were contracted, delivered, and settled. This reflects the seasonality of Hedong salt production, which finished for the year around the middle of the tenth month.Footnote 54 These periodic sums are first totaled for silver and copper separately, after which copper is converted to silver at the market rate. The sums are then followed by a net sum, netting out any cash inflow in the account. After this, the average price of salt in terms of silver taels per 100 jin of salt is noted next to the net silver outflows, written in Suzhou numerals. The price fluctuates throughout the year, as is logical since the Henan salt certificate territory was a free market.

In sum, the purchase account tracks net monetary and physical purchases of salt. In Yuan, Macve, and Ma's taxonomy, it consists of a Level 1 document, while Aiken and Lu would classify it as either a primary or secondary account. The purchase summary gives us a self-contained “engineering equation,” in which opening balances plus net inflows equal closing balances.Footnote 55 The equation governing the periodic summaries does not roll forward previous balances but rather consists of dai + qu – shou = gong dai (or costs – income = net costs) for any given period. The price is then calculated by dividing net costs by the net amount of salt purchased. This shows that the monetary receipts recorded in the purchase account are not sales but rather contra accounts being netted out of the total purchase value. This makes sense, particularly as we believe these receipts reflect sales conducted on agency for related parties, rather than on Fengshengtai's own account (and thus are entered as contra accounts in the purchase account, rather than as sales in the salt account). The purchase account may sound complicated when described verbally, but a pictural explanation shows that it is actually quite straightforward.Footnote 56 A sample of the purchase account can be seen in Figure 2.

Figure 2. Purchases flowing account, Guangxu 7 (1881). Notes: (1) Reads “Qi nian san yue nianjiu ri” (七年三月廿九日), indicating the date as Guangxu 7 (1881), 29th day of the third month on the lunar calendar. (2) These are three distinct entries. They read, in order from right to left, “dai zuyin sanbaisishiba liang er qian wu fen” (代足银叁佰四拾八两弍钱五分), “you zuyin qishijiu liang qiqian wufen” (又足银七拾九两七钱五分), “you qian yiqian wen” (又一千文). The “you” character signifies “same as above.” Thus, the entries translate to “Outgo of 348.25 taels of silver,” “Outgo of 79.75 taels of silver,” “Outgo of 1,000 copper cash.” (3) These entries, written on the bottom of the purchases flowing account, represent receipts. They read, from right to left, “shou qian siqiansibailiushi wen” (收钱四千四伯六十文) and “shou qian sanbaisasi wen” (钱三伯卅四文), meaning “Receipts of 4,460 copper cash and “Receipts of 334 copper cash,” respectively. (Source: Fengshengtai Company Records, “zhihuozhang.”)

In addition to the above three flowing accounts, we also review numerous client accounts. Client accounts consist mainly of ledger accounts for customers and other counterparties. These are organized by counterparty name, rather than by date. They record, among other things, credit transactions with counterparties, including trade credit extended to customers, loans advanced to borrowers, advances received from suppliers or affiliates, purchases made on credit, and repayments of the above. In the case of Fengshengtai, client accounts are organized spatially, with outgo from Fengshengtai (i.e., extensions of credit) recorded at the top of the page and income (such as when a customer repaid their obligations to Fengshengtai) recorded at the bottom. Payments from Fengshengtai to a counterparty began with the character qu (取), meaning “draw,” or jie (借), meaning “loan.” The former indicates either extensions of credit from Fengshengtai to a customer or repayments of credit from Fengshengtai to a creditor. The latter indicates a financial loan to a counterparty. Entries recording the receipt of credit from a counterparty—whether a financial loan or trade credit—begin with the character shou (收), or “receive.” Occasionally, a net balance is calculated and recorded. Where Fengshengtai is the creditor, the character qian (欠) is used, meaning “to owe,” since the counterparty owes money to Fengshengtai. Where Fengshengtai is the borrower, the entry for the outstanding balance opens with the character cun (存), or “keeping.”Footnote 57

Sales and Purchase Accounting

The key to understanding the Fengshengtai accounts is that all transactions were recorded twice—but recorded in distinct account books. This includes, but goes beyond, the trivial observation that any system of bookkeeping must record credit transactions twice as a matter of technical necessity. That is, a credit transaction is always recorded at least once as a sale and then again as an entry into the customer's or supplier's ledger in order to keep track of receivables and payables, respectively. But in the case of Fengshengtai, even cash sales were doubled. Cash sales were recorded once in the cash account and once in a specialized salt flowing account. Credit sales were recorded once into the specialized salt flowing account and then again into the client account. The result is a system of dualled entry revenue recognition, distributed across three distinct account books. A summary of the system can be seen in Figure 3. The three accounts—the cash account, the salt account, and the client account—thus formed a kind of tripod on which Fengshengtai's system of dualled entry rested and that allowed it to record to entries for all sales and collections of receivables.

Figure 3. Summary of account relationships in accounting for revenue

The nature of the dual recording is complicated—and was extremely difficult to figure out. The specialized salt account records each individual transaction, while the cash account aggregates several transactions every few days. When transactions are aggregated, this is noted with the character zong (宗), preceded by the number of aggregated transactions. Thus, if the cash account has an entry aggregating two entries in the salt account, the entry will read “ru xianshi er zong” (入现市二宗), or “Income from two current market [i.e., ‘sales’] items.” The er zong, or “two entries,” refer to the number of transactions from the salt account, thus comprising a crude form of cross-referencing.

To demonstrate the relationship between the salt account and the cash account in more detail, we present an example. Figure 4 shows how salt sales recorded in the salt account were again recorded, albeit in a summarized form, in the cash account. An entry in the cash account recorded both the monetary amount of the income and the number of transactions referenced in the salt account.Footnote 58 This suggests that entries in the cash account pertaining to salt sales were themselves copied from the salt account. We also see evidence of this in an occasional lag of one or two days from when an entry is made in the salt account to its entry into the cash account.

Figure 4. Salt account (left) vs. Cash account (right), Guangxu 7 (1881). Notes: Entries in the salt sales flowing account are aggregated and doubled in the cash flowing account. The number coding matches the specific entries in the salt sales flowing account with their aggregates in the cash flowing account. The three entries coded #1 in the salt sales flowing account read “Zhaoqu qian wu bai wen” (找去五佰文), “Ru lai daqian erqianlingliushisi wen” (入来打钱弍千〇六十四文), and “Ru lai daqian sibaibashisi wen” (入来大钱四百八十四文). These mean, “Returned change of 500 copper cash,” “Income of 2,064 copper cash,” and “Income of 484 copper cash,” respectively. The entry coded #1 in the cash flowing account reads, “Ru xianshi er zong daqian erqianlingsishiba wen” (入现市二宗大钱弍千〇四十八文), meaning “Income from two current market items of 2,048 copper cash.” Note that it only counts two items, because returning change from a silver transaction does not “count” as an item. This number ties with the entries coded #1 in the salt sales flowing account, as 2064 + 484−500 = 2048. The two entries coded #2 in the salt sales flowing account read, from right to left, reads “Shou zuyin er liang ling er fen” (收足银弍两〇二分), meaning, “Received silver of 2.02 taels” and “Ru lai zuyin yi liang si qian” (入来足银壹两四钱), meaning “Income of 1.4 silver taels,” respectively. The entry coded #2 in the cash flowing account reads, “Ru xianshi er zuyin san liang si qian er fen” (入现市二宗足银叁两四钱弍分), or “Income from two current market items of 3.42 taels of silver.” This ties, as 2.02 + 1.4 = 3.42. (Source: Fengshengtai Company Records, “maiyanliushui zhang” and “yinqianliushui zhang.”)

Salt sales on credit were also recorded twice: once in the salt account, and again in the client account. They are denoted in the salt account by the fact that the amount of salt sold is recorded in jin of salt with the value noted in Suzhou numerals, but without a following line item indicating cash income. There was also a relationship between the cash account and the client accounts. Several types of transactions could occasion an entry dualled on both the cash account and client account. The first is when Fengshengtai gave a loan or an advance to a client. During the Qing dynasty, it was common for commercial firms to engage in lending or to provide credit to customers and related parties. But more importantly, even commercial transactions could be recorded in both the cash account and client account. When receivables were collected, the cash inflow would be recorded on the cash account while the reduction in the outstanding balance was entered into the client account. To demonstrate how the entries in the client account were connected to entries in the salt account and the cash account, we provide Figure 5, comparing the relevant entries in the client account along with corresponding entries in the two flowing accounts.

Figure 5. Client account “Jiao He” vs. Salt account vs. Cash account, Tongzhi 3 (1864).

(Source: Fengshengtai Company Records, “laiwanglaozhang,” “maiyanliushui zhang,” “yinqianliushui zhang.” Credit sale coded as #1, repayment of credit coded as #2.)

The two entries in Figure 5 that are labeled 1 represent sales made on credit to Jiao He. In the salt account, the first of these transactions reads “Jiao He quyan babaisishiyi jin, 30.28 liang” (焦河取盐八佰四十一斤, 30.28 两), meaning, “Jiao He acquired 841 jin of salt, 30.28 taels.” The transaction is recorded first in physical weight of salt, with the total value of 30.28 taels recorded afterward in Suzhou numerals (this works out to a price of 3.60 taels per 100 jin, at the higher end of normal market fluctuations). The second entry reads, “koudaiqi gen he zuyin ba qian si fen” (口袋七根合足银八钱四分), or “seven bags worth 0.84 taels of silver.” In the client account, these transactions are doubled in two entries, also outlined in boxes labeled 1. The client account outlined entries read, “qian zuyin sanshi liang ling er qian ba fen” (欠足银三十两〇二钱八分) and “qian koudai zuyin ba qian si fen” (欠口袋足银八钱四分), meaning “Owes 30.28 taels” and “Owes bags silver 0.84 taels,” respectively. These match the entries in the salt account exactly. The date is also the same in both accounts, with the transactions recorded for the twenty-seventh day of the fifth lunar month in Tongzhi 3.

The entries outlined and coded as 2 in Figure 5, one in the client account the other in the cash account, represent a cash payment from Jiao He to Fengshengtai, clearing his silver obligations incurred from the previous transactions coded as 1. In the cash account, this reads “rushou Jiao He sanshiyi liang yi qian er fen” (入收焦河叁拾壹两一钱弍分), or “Received from Jiao He 31.12 taels.” A matching entry, though made after a brief, two-day delay, reads, “shou zuyin sayi liang yi qian er fen” (收足银卅一两一钱弍分), or “Received 31.12 taels.” These dualled entries also tie to the 1-coded transactions, as 30.28 + 0.84 = 31.12. In short, both the initial credit sale as well as Jiao He's repayment of this credit were recorded twice, with each transaction being recorded in two distinct accounts.

According to our schema, purchases should be recorded with doubled entries, much as sales transactions. Purchase account entries should appear as cash outflows in the cash account or, in the case of credit transactions, as entries into the client accounts. It is quite easy to demonstrate doubled entries with the cash account. Unfortunately, the critical client accounts—which would have been called something like qianwai laozhang (欠外老账), or “venerable account of payables and debt”—have not survived (though there are such accounts for other Qing-era firms). Had they survived, we could then see how “costs of sales” and “profits” were calculated, given that market prices for salt were not fixed. Fortunately, purchases on agency were also often made on credit, and these purchases hit the purchase client accounts of certain Fengshengtai-related parties. Thus, we can still demonstrate dualled entries for a limited number of purchases made on credit.

First, we will give an example of dualled entries for cash purchases. The examples are selected from the first page of the Guangxu 7 purchase account and are compared to their corresponding entries in the Guangxu 7 cash account.

Figure 6 shows how all three purchases entered into the purchase account for Guangxu 7 on the twenty-ninth day of the third month of the lunar calendar are duplicated in the cash account. The entry coded 1 in the purchase account reads, “daiqu zuyin sanbaisishiba liang er qian wu fen” (代去足银叁佰四拾八两弍钱五分), or “Outgo of 348.25 taels.” This corresponds to the entry coded 1 in the cash account, which reads, “chu Huixingzhen dai zuyin sanbaisishiba liang er qian wu fen” (出会兴镇代足银叁佰四拾八两弍钱五分), or “Outgo in Huixing Market of 348.25 taels.” Huixing Market, as discussed in section 3, was the key entrepôt where Fengshengtai sourced its salt. The transactions coded 2 and 3 are also dualled entries for purchases, amounting to 79.75 taels and 1,000 copper cash, respectively. The majority of entries in the purchase account are doubled in the cash account, indicating that Fengshengtai purchased most of its salt with cash.

Figure 6. Purchase account (left) vs. Cash account (right), Guangxu 7 (1881). Notes: Purchase of 348.25 taels outlined in boxes #1. Purchase of 79.75 taels is outlined in boxes #2. Purchase of 1,000 copper cash is outlined in boxes #3. (Source: Fengshengtai Company records, “zhihuozhang” and “yinqianliushui zhang.”)

Credit transactions were duplicated as well, though they did not, of course, hit the cash account until settlement. Instead, purchases done on credit were entered once into the purchase account and once into the client account. The relationship between the purchases flowing account, cash account, and purchases client account thus mirrors the relationship between the salt flowing account, cash account, and client accounts.

Once again, we do not have the client account that would have contained the bulk of purchases on credit. Fortunately, we do have selected summary accounts of Fengshengtai-related parties, many of whom the firm purchased salt from. This is sufficient to demonstrate the accounting relationship between the cash flowing account, customer accounts, and purchases flowing account.

Figure 7 compares an entry in the purchase account to an entry in one of the client accounts. The outlined entry in the purchase account records a payment of 153 taels of silver. There is no matching entry in the cash account, indicating a purchase made on credit. Moreover, the purchase account has a note next to the entry, reading “Xiangshengde” (祥盛德), indicating the seller as Xiangshengde. This is confirmed in the purchase client account, which contains an account for Xiangshengde. Xiangshengde's account reads, “shiyue jiezhu jingcun zuyin yibaiwushisan liang zheng” (十月结住净存足银一百五十三两), or “balance outstanding at month ten, deposits of 153 silver taels.” This does not appear to be a precisely matching entry; the language “jiezhu jingcun,” or “net balance outstanding,” reads like it was transferred, or summed up, from a different client account. Nevertheless, it shows that some client account for Xiangshengde must have recorded the debt of 153 silver taels, thereby matching the entry in the purchase account.

Figure 7. Purchase account, Guangxu 7, 10/20 (left) vs. Client account, “Xiangshengde” (right). (Source: Fengshengtai Company Records, “zhihuozhang.”)

The advantages of this system over single-entry accounting in a single journal are obvious. First, it would allow a clerk handy with an abacus to cross-check balances and ensure accuracy of accounts. This is because income recorded in the cash account would have to equal sales in the specialized flowing accounts minus changes in the client accounts. Second, it would have been useful from a managerial perspective. Fengshengtai would have ready access to a record of its cash position and cash flows, as well as to recent salt sales and trends in salt prices. We also note that this system appears to be somewhat consistent with Yuan, Macve, and Ma's analysis of the Tongtaisheng accounts, at least in years for which Tongtaisheng produced specialized flowing accounts. It is not clear from Yuan, Macve, and Ma's work if Tongtaisheng's specialized flowing account entries were doubled with corresponding entries in the cash accounts (nor was this the focus of their study), but their analysis leaves open the possibility.

Conclusion

In the above section we showed how Fengshengtai accounted for sales and purchases of salt. Here we assess what these findings mean in terms of CDEB. In doing so, we borrow the framework from Yuan and Macve, who classify bookkeeping according to stages of historical development. Stage 1 corresponds to a simple engineering equation in which opening balances plus net inflows equal closing balances. Stage 2 includes doubled entries for credit and financial transactions and a balance sheet comprising financial assets (i.e., cash plus loans and receivables). Stage 3 requires accounts with nonmonetary assets converted into a common numeraire, thus allowing for balance sheets to be produced. Stage 4 is the final stage, in which “full DEB enables production of detailed income statements and balance sheets as part of an integrated and fully cross-referenced system.” Stage 2 and Stage 3 are further broken up into substages denoting different levels of sophistication. Stage 2 (i) requires a common numeraire, while Stage 2 (ii) requires a balance sheet, at least of financial assets and liabilities. Stage 3 (i) calculates income through changes in the balance sheet. Stage 3 (ii) requires doubled entries for credit transactions but “relies on period-end inspections for completing the financial statements.” Finally, in Stage 3 (iii), “if all transactions are also integrated the system can produce analysed ‘income statements’ as well as ‘balance sheets.’ This seems equivalent to the Chinese method(s) that have been labelled sìjiăoshū ([四脚书] = ‘four feet accounts’).”Footnote 59 Stage 3 (iii), or four-foot accounting, marks Yuan and Macve's minimum threshold to qualify as CDEB.

The documents we reviewed in this article place Fengshengtai's bookkeeping at least in Stage 2 (i), which calls for dualled entries of credit transactions. Indeed, Fengshengtai exceeds this threshold since not only credit transactions but all transactions—including both sales and purchases—were doubled. Furthermore, while no Fengshengtai balance sheets have been recovered, we do know that Fengshengtai had numerous shareholders consisting of individuals and tanghao (堂号), often translated as “lineage trust.” This was typical of Chinese firms, and of Shanxi merchant firms in particular.Footnote 60 As such, it is a virtual certainty that the company would have prepared some kind of summary balance sheet. This would place Fengshengtai—not incontrovertibly, but in all likelihood—at the level of Stage 2 (ii) or Stage 3 (i).

More speculatively, there is an open possibility that Fengshengtai reached Yuan and Macve's Stage 3 (iii). This remains speculative, as Stage 3 necessitates final tallies of all assets and liabilities found in general clearing accounts. As noted above, this genre of account book has not survived in the Fengshengtai collection. Nevertheless, we believe our findings imply Stage 3 for several reasons. First, one argument against the existence of CDEB was the lack of evidence for dualled entry of cash transactions, as required by the four-foot method. Now that we have discovered dualled entry of cash transactions in the specialized account, it reopens the possibility that four-foot accounting was used by actual firms. Second, the existence of a specialized salt sales account and salt purchase account suggests a desire to monitor the income and expenditures (cash and credit) of specific business operations. While this desire might simply derive from the need to make superior business decisions, it also suggests a focus on using the accounts to track income and expenditure—that is, to compile financial statements. If the firm's financial statements only tracked cash in hand, the specialized flowing accounts would be superfluous.

In addition, we have circumstantial evidence militating in favor of Stage 3 (iii) in Necessary Knowledge. The primer contains several chapters on accounting. It describes a bookkeeping system in which doubled entries automatically produce financial statements, including assets, liabilities, profits, and dividends to shareholders.Footnote 61 The system it describes is exactly commensurable with the Fengshengtai documents. That is, the textbook insists that sales be recorded twice: in a cash account and specialized flowing account in the case of cash transactions, and in a specialized flowing account and a client account in the case of credit transactions.

One example is Necessary Knowledge's prescribed accounting treatment for buying and selling exchange (i.e., buying and selling silver and copper).Footnote 62 Necessary Knowledge tells merchants involved in this business to maintain a duihuan yinqian zhang (兑换银钱账), or “silver and copper exchange account.” The description of the account is sparse. We transcribe it in full as follows:

兑换银钱账

系买卖银钱。

Exchange of silver and copper account

This is for buying and selling silver and copper.

This account appears to be a flowing account for recording all exchange transactions. Cash transactions would be duplicated in a cash account. Credit transactions would also have gone into the exchange account, to be duplicated in a client account. In sum, the exchange account serves the same function for a financial firm that the salt account serves for Fengshengtai.Footnote 63

We thus find ourselves in the position of a paleontologist with only a few scattered bones, trying to decide what kind of skeleton they fit into. In this analogy, Necessary Knowledge is akin to a sketch of a stegosaurus, drafted by someone who saw one in person. We cannot prove that our bones belonged to a stegosaurus—that is, that the Fengshengtai accounts belonged to a system of integrated bookkeeping as required for Stage 3 (iii). All we can say is that they match parts of the skeleton exactly. Thus, they are evidence, albeit circumstantial, that Fengshengtai employed such a system. The weight of this evidence is a matter of judgment. For our part, we consider the weight of evidence as implying a fully integrated system. This would mean that Fengshengtai also had numerous balance sheet accounts, “general clearing” accounts, and capital accounts that, alas, are lost to the historical record. Other scholars may disagree and prefer to see our inference as little more than conjecture. We leave the question open to the reader, and to future scholarship.