Book contents

- Frontmatter

- Contents

- Preface

- Acknowledgments

- 1 INTRODUCTION

- 2 INTERNATIONAL MONETARY EQUILIBRIUM AND THE PROPERTIES OF THE GOLD STANDARD

- 3 THE INTERNATIONAL MONETARY SYSTEM BETWEEN THE WORLD WARS

- 4 THE MONETARY SYSTEM IN ECONOMIC ANALYSIS: THE CRITIQUE OF THE GOLD STANDARD

- 5 THE GREAT DEPRESSION: OVERTURNING THE STATE OF THE ART

- 6 PROVIDING FOR A NEW MONETARY ORDER

- 7 THE BRETTON WOODS AGREEMENTS

- 8 BRETTON WOODS AND AFTER

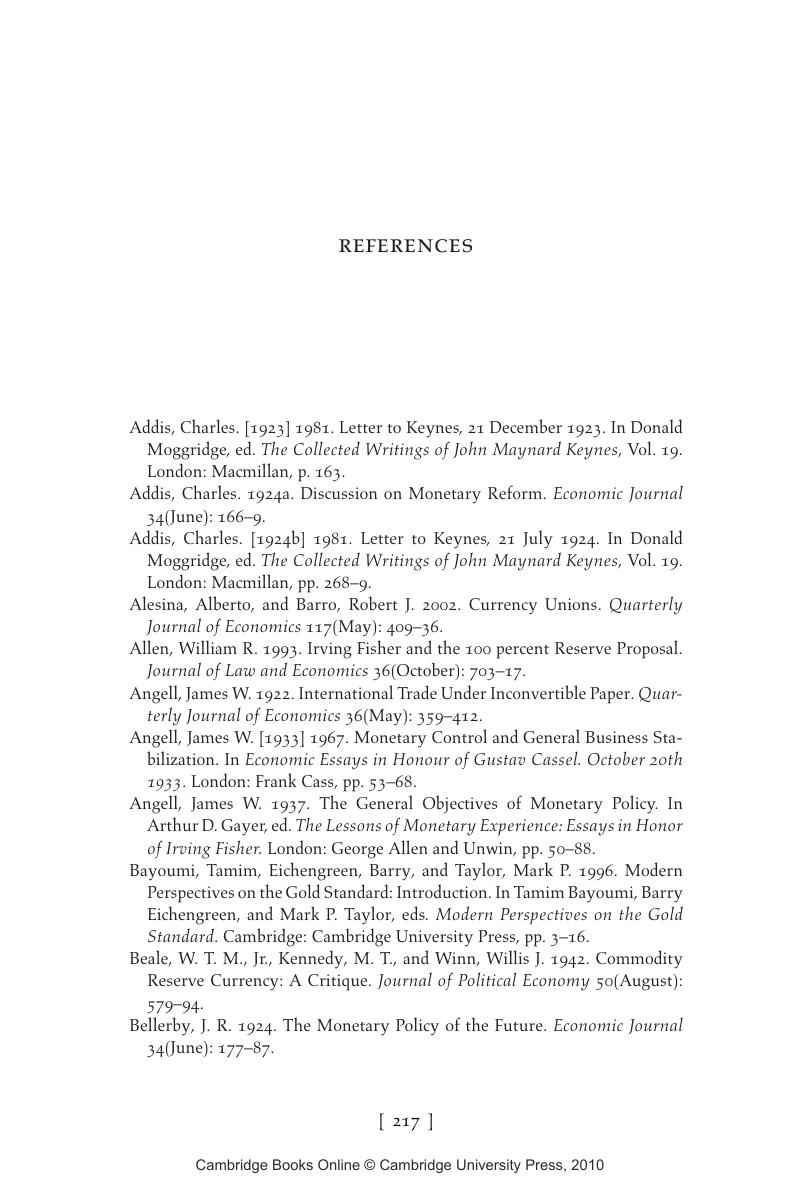

- References

- Author Index

- Subject Index

- References

References

Published online by Cambridge University Press: 18 December 2009

- Frontmatter

- Contents

- Preface

- Acknowledgments

- 1 INTRODUCTION

- 2 INTERNATIONAL MONETARY EQUILIBRIUM AND THE PROPERTIES OF THE GOLD STANDARD

- 3 THE INTERNATIONAL MONETARY SYSTEM BETWEEN THE WORLD WARS

- 4 THE MONETARY SYSTEM IN ECONOMIC ANALYSIS: THE CRITIQUE OF THE GOLD STANDARD

- 5 THE GREAT DEPRESSION: OVERTURNING THE STATE OF THE ART

- 6 PROVIDING FOR A NEW MONETARY ORDER

- 7 THE BRETTON WOODS AGREEMENTS

- 8 BRETTON WOODS AND AFTER

- References

- Author Index

- Subject Index

- References

Summary

- Type

- Chapter

- Information

- Monetary Theory and Bretton WoodsThe Construction of an International Monetary Order, pp. 217 - 240Publisher: Cambridge University PressPrint publication year: 2006