Book contents

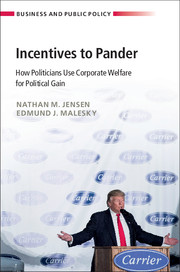

- Incentives to Pander

- Business and Public Policy

- Incentives to Pander

- Copyright page

- Contents

- Acknowledgments

- 1 Introduction

- 2 Theory of the Political Use of Investment Incentives

- 3 Incentives and the Competition for Investment Within Countries and Around the World

- 4 The Economic Case Against Investment Incentives

- 5 Economic or Political Competition?

- 6 Money for Money

- 7 Political Pandering in the United States

- 8 Pandering Upward

- 9 The Distributional Effectsof Investment Incentives

- 10 Potential Policy Solutions to the Pandering Problem

- 11 Final Thoughts

- References

- Index

- References

References

Published online by Cambridge University Press: 23 February 2018

- Incentives to Pander

- Business and Public Policy

- Incentives to Pander

- Copyright page

- Contents

- Acknowledgments

- 1 Introduction

- 2 Theory of the Political Use of Investment Incentives

- 3 Incentives and the Competition for Investment Within Countries and Around the World

- 4 The Economic Case Against Investment Incentives

- 5 Economic or Political Competition?

- 6 Money for Money

- 7 Political Pandering in the United States

- 8 Pandering Upward

- 9 The Distributional Effectsof Investment Incentives

- 10 Potential Policy Solutions to the Pandering Problem

- 11 Final Thoughts

- References

- Index

- References

- Type

- Chapter

- Information

- Incentives to PanderHow Politicians Use Corporate Welfare for Political Gain, pp. 231 - 253Publisher: Cambridge University PressPrint publication year: 2018