Book contents

- Corporate Groups and Shadow Business Practices

- Corporate Groups and Shadow Business Practices

- Copyright page

- Dedication

- Contents

- Foreword

- Preface

- Part I Setting the Scene

- Part II The Emergence of Group Complexity

- Part III Decomposing Corporate Groups

- Part IV Deficiencies of Formal Approaches to Group Transparency in EU Law

- Part V Systems Approach as a More Comprehensive Concept toward Group Transparency

- Part VI Results

- Bibliography

- Index

- References

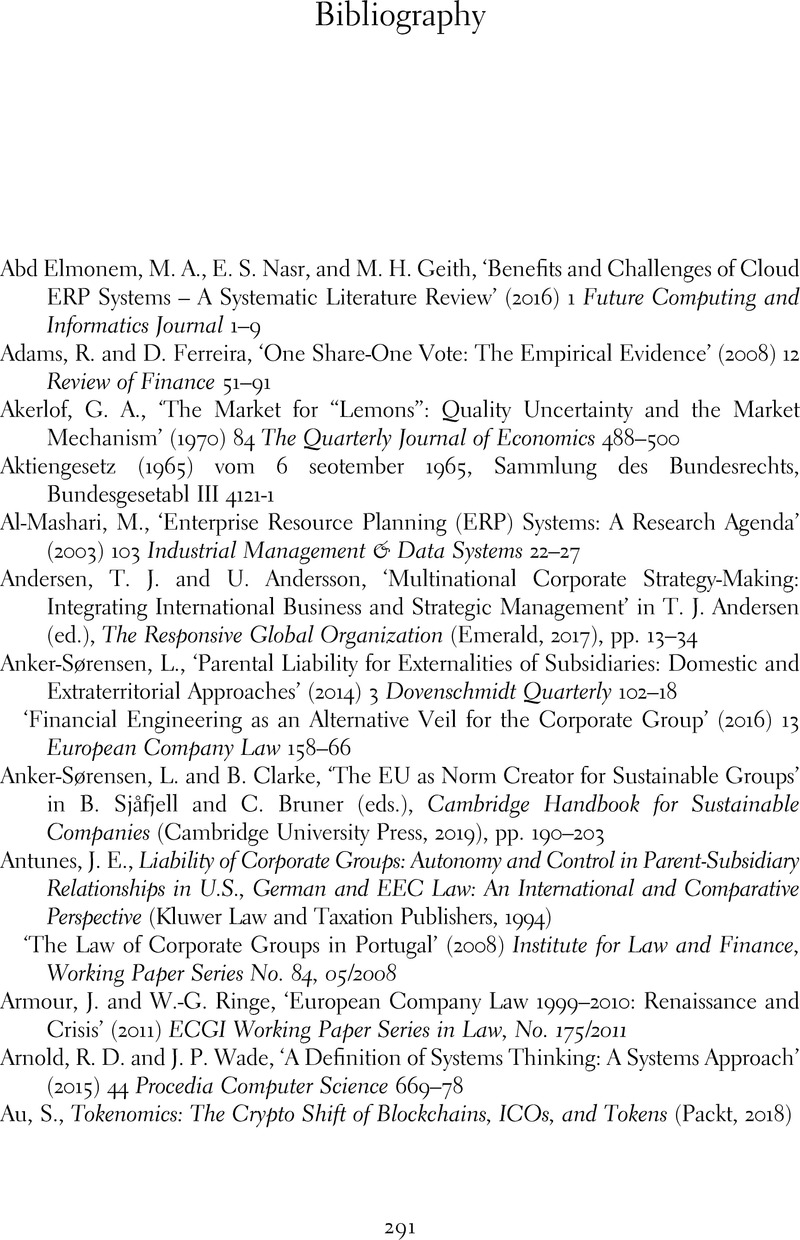

Bibliography

Published online by Cambridge University Press: 04 May 2022

- Corporate Groups and Shadow Business Practices

- Corporate Groups and Shadow Business Practices

- Copyright page

- Dedication

- Contents

- Foreword

- Preface

- Part I Setting the Scene

- Part II The Emergence of Group Complexity

- Part III Decomposing Corporate Groups

- Part IV Deficiencies of Formal Approaches to Group Transparency in EU Law

- Part V Systems Approach as a More Comprehensive Concept toward Group Transparency

- Part VI Results

- Bibliography

- Index

- References

Summary

- Type

- Chapter

- Information

- Corporate Groups and Shadow Business Practices , pp. 291 - 316Publisher: Cambridge University PressPrint publication year: 2022