Book contents

- The European Corporation

- The European Corporation

- Copyright page

- Contents

- Figures

- Tables

- Contributors

- Preface

- Acknowledgements

- 1 Introduction

- Part I Anglo-Saxon Countries

- Part II Central European Countries

- Part III Scandinavian Countries

- Part IV Mediterranean Countries

- Part V European Transition Countries

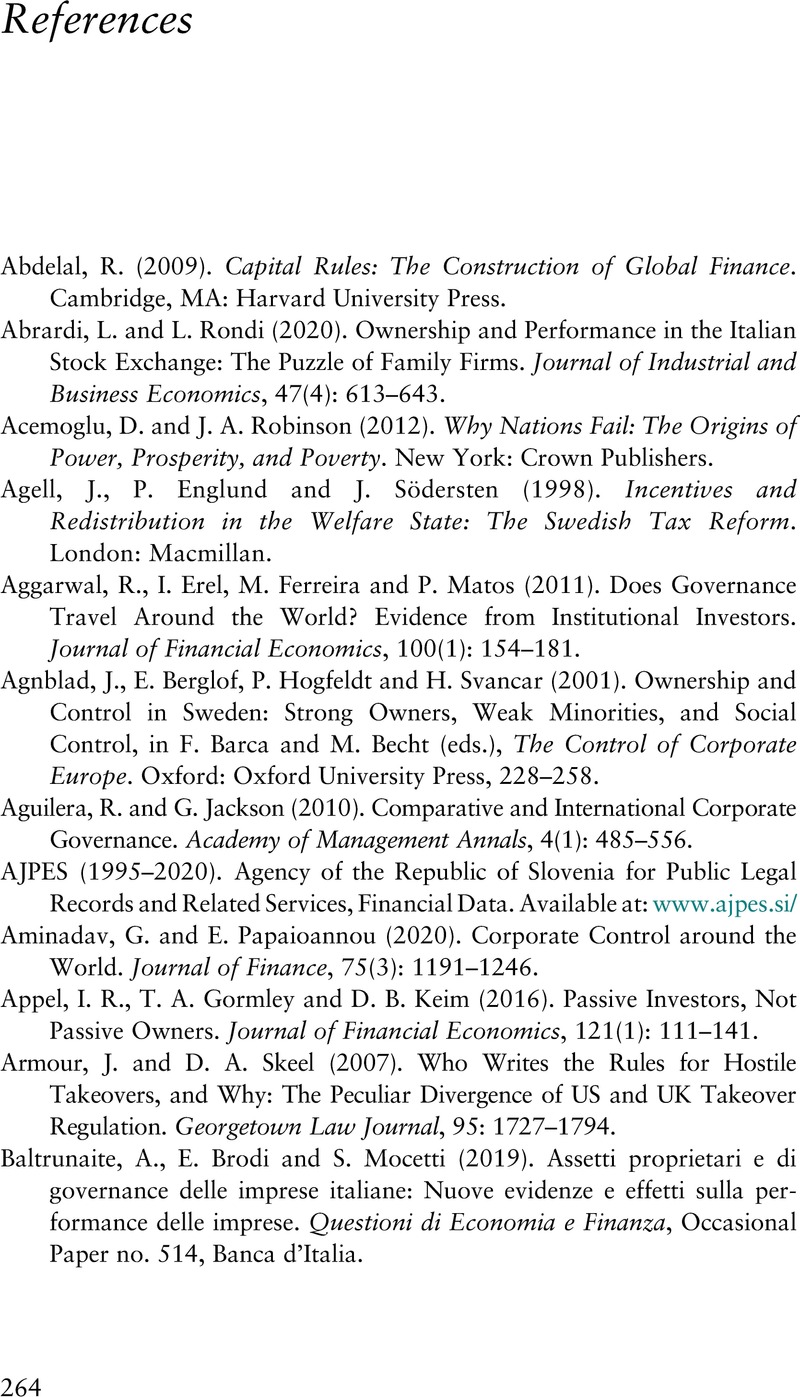

- References

- Index

- References

References

Published online by Cambridge University Press: 01 June 2023

- The European Corporation

- The European Corporation

- Copyright page

- Contents

- Figures

- Tables

- Contributors

- Preface

- Acknowledgements

- 1 Introduction

- Part I Anglo-Saxon Countries

- Part II Central European Countries

- Part III Scandinavian Countries

- Part IV Mediterranean Countries

- Part V European Transition Countries

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- The European CorporationOwnership and Control after 25 Years of Corporate Governance Reforms, pp. 264 - 280Publisher: Cambridge University PressPrint publication year: 2023