INTRODUCTION

The first half of this special issue has focused on unpacking the supply side of China's outgoing capital. Next, in this article and that by Wong, we shift focus to examine recipients’ reaction to Chinese capital. With public protests erupting from Sri Lanka to Pakistan, and to other pivotal anchors of China's Belt and Road Initiative (BRI), economic partners seem somewhat unassured by China's promise of “win–win” cooperation.

As Ye notes in this issue, the fact that the BRI was articulated as a grand strategy with “all-out” execution may have invoked geopolitical concerns and undercut China's claim of mutual economic benefits, contributing in part to China's neo-imperialist image. While this logic may explain suspicion about BRI's motives among policy elites, it cannot account fully for public backlash on the ground, where an average person's encounter with Chinese capital occurs on much more direct, tangible terms. In addition, the backlash against Chinese expansion is neither new nor unique to Xi's BRI. Prior to the launch of the BRI, the impact of Chinese investments on developing economies was already subject to much scrutiny and debate without being tied expressly to foreign policy objectives (African Development Bank 2012; Bader Reference Bader2015).Footnote 1 Politicians were already winning elections by leveraging public opposition against Chinese investments.

What drives this public discontent on the ground? In this article, we examine the “reputation deficit” faced by Chinese firms in Zambia. To do so, we document both the public perception and the actual impacts of Chinese investments, and assess the extent to which these align. We measure both perception and reality comparatively, benchmarking the reputation and actual performance of Chinese investors to those of non-Chinese multinational corporations operating in Zambia. Benchmarking is helpful in that, when Chinese investors are scrutinized for their effect on the host country, the scrutiny is often made—explicitly or implicitly—in comparison with “traditional” multinational corporations (e.g. see Baah and Jauch Reference Baah, Jauch, Baah and Jauch2009). For this reason, Zambia makes a particularly attractive case for our analysis. Zambia is home to investors from diverse nationalities in the same sector: mining.Footnote 2 This heterogeneity in investor origin within one sector allows us to compare Chinese investors to investors from other countries on measures such as employment generation, corporate social responsibility, and reaction to market uncertainty, while holding sector-specific factors constant.

To evaluate public perceptions, we employ an original survey conducted among 800 households in Zambia's Lukasa and Copperbelt provinces. To assess actual impacts and on-the-ground practices of Chinese investment, we rely on reports of corporate practices by formal sector workers, who comprise a substantial portion of the respondents in our household survey, as well as interview records and official statistics obtained from Zambian authorities. Juxtaposing perception and reality is an important element of our research design, while prior studies have tended to focus on one or the other.

This juxtaposition confirms a “reputation deficit” for Chinese investments in Zambia, which manifests in two layers: First, there is a reputation gap between Chinese and other foreign investors. That is, the Zambian public is overall less favorable toward investment from China than toward foreign investment in general and that from other countries. However, the source of this reputation deficit does not seem to point to Chinese investors’ performance shortfall in terms of employment generation or development outcomes. Compared with their Western counterparts, Chinese investors generate local employment at a rate on par with other foreign investors, according to both perception and reality. In the mining sector specifically, Chinese firms exhibit no worse labor or environmental standards compared with their Western counterparts. This mismatch constitutes the second layer of the reputation deficit: Chinese investors make substantive contributions to local development comparable with those of their Western counterparts, yet they have a poorer reputation.

Our household survey among Zambians reveals that the primary driver of the reputation deficit is a lack of localization among Chinese firms, which we define as adaptation to the language, culture, and context of Zambia. Specifically, our household survey indicates that managers at Chinese firms are less likely to speak a Zambian language than managers at other foreign firms, and they are also less likely to provide benefits (particularly leave) that aligns with Zambian culture. The reputation deficit is particularly severe among Zambians who perceive Chinese managers as difficult to communicate with and, relatedly, those who perceive Chinese firms as less likely to employ Zambian managers. Thus, specific, on-the-ground corporate practices, and a lack of localization in particular, have likely contributed to China's reputation deficit in Zambia. Interviews and official statistics also corroborate these findings.

Our study speaks to several threads of the burgeoning literature on the impact of China's growing economic presence in developing countries. First, we document the empirical link between public perceptions of Chinese investment and factual indicators of the impact of Chinese investment. In addition to assessing gaps in the perceived developmental impacts of Chinese compared with other foreign investors, we examine to what extent these perceived gaps stem from actual differences in investor practices. That Chinese investment suffers from a lack of public support is not news. Few studies, however, have been able to assess this negative reception empirically and analyze its causes. Our study takes a first step towards filling this gap via empirical research in a country with significant Chinese foreign investment.

Second, we contribute to the nascent repertoire of empirical data on public opinion about China's economic presence in developing economies. Systematic collection of such data has been rare.Footnote 3 Existing public opinion surveys tend to focus on the population's general attitude toward China and not Chinese investment more specifically.Footnote 4 Disaggregating Chinese foreign direct investment (FDI) to examine perceptions of specific economic and social impacts is even more rare. This study is one of the first to use an original household survey in a developing country to capture the public's perception of specific dimensions of China's investment in that country.

Finally, in conversation with the rest of this special issue, our study highlights a previously underexplored mechanism—localization (or the lack thereof)—through which public backlash can build against Chinese investment, and which, in itself, has little to do with whether Chinese investment is state-led. In this issue, Ye posits that a state-directed model invites suspicion about both the geopolitical motives of the investment and about whether such investment, carried out in substantial parts by state-owned enterprises (SOEs) ultimately serving China's policy agenda, can generate developmental benefits for local communities. By comparing firms’ performances in Zambia during the global financial crisis, we find that China's investment model actually provides a more stable source of capital and employment for recipients in the midst of a global crisis thanks to the Chinese government's financial backstopping. This is a direct benefit of China's state-driven model, not a liability. However, in the absence of adequate localization, developmental benefits alone are not enough to overcome the reputation deficit faced by Chinese investors on the ground.

The rest of the article is organized as follows. First, we briefly review the existing literature on the impact of Chinese investment on developing economies and hypothesize the possible causes for the reputation deficit. Next, we present the landscape of public attitudes toward foreign direct investment in Zambia, highlighting both the high level of overall support for China's economic engagement in Zambia and the presence of a reputation deficit: support for China's FDI lags behind support for FDI generally and FDI from other countries. Following that, we use factual data and interview evidence to identify any performance gap between Chinese firms and other multinational firms along three dimensions: (1) firms’ sectoral focus and employment generation; (2) how well Chinese and other foreign firms sustained employment during the global financial crisis; and (3) the labor conditions and environmental practices at Chinese and foreign firms. When we find no evidence of a performance gap along these dimensions, we turn to an analysis of localization to explain the reputation deficit, and find evidence that a lack of localization among Chinese firms likely explains at least some of the deficit. We conclude by discussing the implications and limitations of our study.

IMPACT OF CHINESE INVESTMENT ON DEVELOPING ECONOMIES: A REPUTATION DEFICIT?

Existing research evaluating the impact of Chinese investment has yielded mixed findings. A number of studies observe that Chinese investments in developing countries improve local residents’ access to basic infrastructure (Alden and Alves Reference Alden and Alves2008; Cissé Reference Cissé2012; Schiere and Rugamba Reference Schiere and Rugamba2011; Urban et al. Reference Urban, Nordensvärd, Khatri and Wang2012), speed up the industrialization of local manufacturing (Bräutigam Reference Bräutigam, Alden, Large and de Oliveira2008), and generate employment for local communities (Kubny and Voss Reference Kubny and Voss2010; Wang et al. Reference Wang, Mao and Gou2014). Wang et al. (Reference Wang, Mao and Gou2014), for example, show that from 2007 to 2010, the share of non-Chinese workers among Chinese firms in Africa grew from 47 per cent to 71 per cent. Whalley and Weisbrod (Reference Whalley and Weisbrod2012) find that Chinese investments’ contribution to Sub-Saharan African growth was pronounced throughout the financial crisis. Kubny and Voss (Reference Kubny and Voss2010) find that the labor-intensive manufacturing investments in Cambodia and Vietnam created large numbers of employment opportunities.

Others, however, point out that the developmental benefits of Chinese investments are limited for the host economies due to the substandard labor and environmental practices of Chinese firms. Chinese investors in developing countries prefer using Chinese employees over hiring local workers, particularly for managerial positions (CCICED 2011). A case study of Egypt, Algeria, Tunisia, and Morocco finds that Chinese investments tend to generate jobs for low-skilled youth, but do little to alleviate unemployment pressure in knowledge-intensive sectors (African Development Bank 2012). In South Africa, a survey of 16 Chinese firms also found that they employ relatively unskilled laborers (Huang and Peiqiang Reference Huang and Peiqiang2013). Baah and Jauch (Reference Baah, Jauch, Baah and Jauch2009) found that Chinese companies operating in several African countries tended to pay lower wages than local and other foreign firms, and often broke contracts. The World Bank, the IMF, and European governments have voiced concerns that Chinese banks apply lower ethical and environmental standards in their loans than their Western counterparts (Sautman and Hairong Reference Sautman and Hairong2009; van Dijk Reference van Dijk2009, 23).

Meanwhile, China's rising economic presence around the world has generated significant public backlash. Public protests have erupted repeatedly in Mongolia, Myanmar, Vietnam, the Philippines, Sri Lanka, and other parts of the subcontinent against China's mining investments and infrastructure projects. In Africa, public discontent about China in Zambia, Zimbabwe, South Africa, and Sierra Leone, to name just a few instances, has allowed politicians to build explicit anti-China electoral platforms. In Latin America, the public has rallied against China's mining developments in Peru, oil exploration in Ecuador, and dam construction in Bolivia. Conflicts with local communities, kidnapping of Chinese workers, and hostage-holding of Chinese managers are commonplace where Chinese firms operate.

What is the source of this public backlash in spite of China's repeated claim of win–win cooperation with its economic partners? As Ye and others note in the first half of the volume, China's state-directed model of capital export invites suspicion about its geopolitical motives, especially when observers cannot perceive the highly decentralized implementation process and economic actors responding largely to commercial incentives in that process. While this reasoning helps to account for mistrust about the BRI among policy elites, it is less useful for explaining discontent about Chinese capital among the public. An average member of the public in recipient developing countries likely cannot perceive the significance of the state-driven nature of China's investment in the same way that academic or policy analysts do. Nor would geopolitical concerns be the first thing that comes to mind when a Chinese power plant breaks ground in town. Indeed, when we interviewed the Zambian public, almost no one was aware that many Chinese firms in the country were state owned, let alone able to ponder the implications of a state-driven model of capita export.

This study focuses on identifying the drivers of China's reputation deficit at the ground level. We hypothesize several possible factors contributing to discontent. One possibility is that Chinese firms, in actuality, fare poorly at generating developmental benefits for host economies; the review of existing studies above offers mixed evidence for this hypothesis. When Chinese investors fail to deliver concrete benefits to local communities, especially compared with other providers of foreign capital, it would be no surprise that the public reacts negatively to China's economic presence.

Another possibility is that the public's misinformation and misperception about China's developmental impact contribute to China's reputation deficit. In a survey of the Canadian public, Li et al. (Reference Li, Kuang and Zhang2019) find that individuals vastly overestimate the amount of China's investment in Canada. When this misinformation is corrected, the study finds, the public's concerns about Chinese investment also lessen. Compared with their counterparts in developed economies, the public's access to factual information is scarcer in developing countries. In this low-information environment, the public's opinion about Chinese investment may be disproportionately influenced by other factors, such as elite cues or one's tangible, interpersonal interactions with Chinese workers and managers, instead of knowledge about China's developmental impact on the country on the whole.

Third, it is possible that Chinese firms are positive for Zambia's overall development, but are not perceived as positive for their employees. For instance, if the public values the quality of jobs more than quantity, and Chinese investment creates largely low-paying jobs with problematic labor standards and inattentiveness to worker safety, then public support for Chinese investment could be low as a result. Similarly, if Chinese capital drives growth and employment at the expense of the local environment, public support would also diminish.

Finally, we hypothesize that the reputation deficit could be driven by a lack of localization among Chinese firms operating in Zambia. Practices such as providing leave for employees to attend culturally important ceremonies and ensuring managers speak the local language may drive negative perceptions, even when the recognition of economic benefits is high. In this article, we treat these possibilities as empirical hypotheses to be evaluated.

PUBLIC PERCEPTION OF CHINESE INVESTMENT IN ZAMBIA

To assess public perceptions of Chinese investment, we conducted an original survey of Zambian households between March 6, 2013 and April 7, 2013. We randomly sampled 800 households in two provinces of Zambia with significant exposure to foreign direct investment from China and from other countries: the Copperbelt, the hub of the mining industry; and Lusaka, the center of all other industries in Zambia. Our enumerators were students at the University of Zambia who were fluent in the predominant languages in which the survey was conducted: Nyanja in Lusaka province and Bemba in Copperbelt province. The survey was translated and back-translated from English into Nyanja and Bemba. The survey questions were read aloud to the respondents, who answered verbally. Additional information on our sampling frame, methods, and survey implementation is provided in the Appendix.

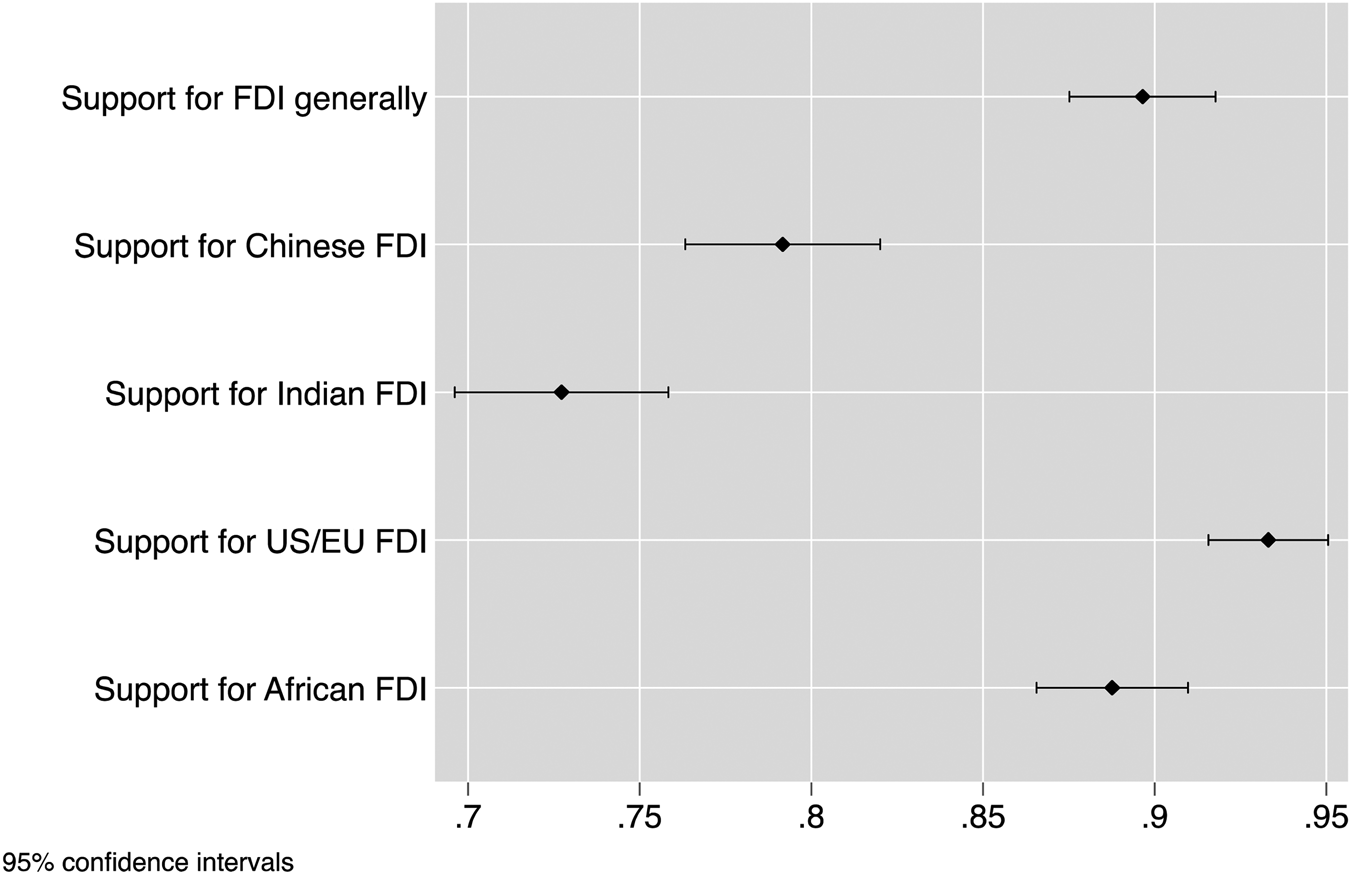

Figures 1a and 1b compare the percentages of respondents in support of investment from China vs. other countries. The first thing to note is that the public overall possesses a high level of support for Chinese investment: 79 percent of all respondents support investment from China. This is somewhat surprising given that public backlash against Chinese investment has been widely reported in the media and that, just under two years before this survey was fielded, presidential candidate Michael Sata was elected to office on a strong anti-Chinese platform. Members of Sata's party, the Patriotic Front (PF), constitute 37 percent of our survey sample, yet 78 percent of PF members in the survey sample support Chinese FDI, statistically undistinguishable from the 80 percent of non-PF members that do.

Figure 1a Percentage of respondents supporting FDI vs. FDI from China

Figure 1b Percentage of respondents supporting FDI from China vs. other countries

However, a gap does exist between the levels of support for Chinese investment and FDI in general (Figure 1a). Further, Zambians are less supportive of Chinese investment than they are of investment from the United States, Europe, and other African countries (Figure 1b). These statistics point to the first layer of the reputation deficit we note in the Introduction to this article.

REALITY CHECK: COMPARING THE DEVELOPMENTAL IMPACTS OF CHINESE AND OTHER FOREIGN INVESTORS

What causes the reputation deficit? The previous section outlined several hypotheses that we will now examine. We begin by doing a reality check and comparing the developmental impacts of Chinese and other foreign investors along three dimensions: firms’ sectoral focus and employment generation; how Chinese and other foreign firms weathered the global financial crisis; and the labor conditions and environmental practices at Chinese and foreign firms.

China's sectoral focus and employment generation in Zambia

FDI has played a significant role in Zambia's economy since the 1990s,Footnote 5 and a significant driver of FDI is the country's mining sector. The sector accounts for roughly 70 percent of exports and is operated mainly by multinational corporations. According to data provided by the Zambian Development Agency,Footnote 6 China, India, Britain, South Africa, and the United States were the top five foreign investors during the period 2006–2012, measured by pledged project counts (Table 1). China tops the list with 260 approved projects. Measured by investment amount (not shown), the set of frontrunners is slightly different with the inclusion of Canada and Ireland,Footnote 7 but China still ranks first with US$5.7 billion. This accounts for more than 20 percent of all foreign investment in Zambia during this period. In this time frame, China also accounts for the most pledged employment for the local population. Pledged employment per million dollars of investment (not shown), a crude measure for the efficiency at which jobs are generated, is slightly lower for China (around 39.7 persons/US$ million) compared with the United States, South Africa, and Britain, but the figure is higher than that for Indian and other foreign investors.

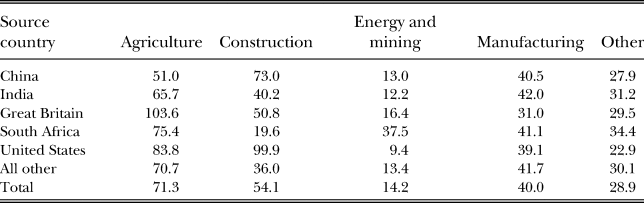

Table 1 FDI flows into Zambia: Summary and pledged employment per US$ million, 2006–2012.

Breaking down investments by sector (Table 2), we find that the majority of Chinese investment (66 percent), measured by the amount of investment, is in energy and mining. With the exception of South Africa, this percentage is higher for most other major investors. Over 90 percent of American investments and 75 percent of Indian investments are directed to energy and mining. Chinese investors are no more focused on the natural resource sector than other foreign investors. Almost 30 percent of Chinese investments are in manufacturing, compared with only 16 percent of Indian investments and less than 2 percent of American investments. The only country that directs more investments to manufacturing is South Africa (34 percent). Manufacturing is widely regarded as a primary source of employment. The perception that Chinese investors plunder resources without generating jobs for the population appears to be exaggerated in Zambia, a country that is known predominantly for its copper reserves.

Table 2 Investments in Zambia by sector (as a percentage of total invested)

Note: Rows sum to 100 and indicate sectoral composition of investment for each source country, and overall.

Table 3 presents the level of employment generation by foreign investor by sector. Among all jobs Chinese investors have pledged to generate, the largest number is in manufacturing. Chinese investors are also particularly efficient at generating employment in the construction industry. For every million dollars of investments in construction, 73 local employment opportunities are pledged, significantly higher than the levels pledged by British and Indian investors.Footnote 8

Table 3 Employment per US$ million invested, by sector

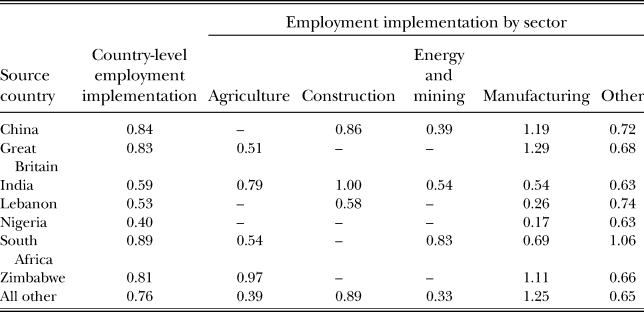

The employment data presented so far are pledged values at the time of investment application. A notable concern is whether implementation rates match pledged levels. Bräutigam and Xiaoyang (Reference Bräutigam and Xiaoyang2009), for example, find that in spite of the presence of intergovernmental memoranda of agreement (MOUs), a large number of Chinese investment projects in African agriculture fail to materialize. To mitigate this concern, we analyze inspection records from the research department of the Zambian Development Agency (ZDA). The records pertain to companies that obtained licenses between 2007 and 2009. Albeit based on this small sample, Table 4 demonstrates that Chinese firms on average exhibit one of the highest employment implementation rates (84 percent) among all foreign investors in Zambia. British and Zimbabwean investors registered similar rates of implementation above 80 percent, whereas Indian investors implemented 59 percent of the pledged employment during this period. Chinese firms achieve a lower rate of employment implementation in the mining sector (39 percent), but the rates are high for manufacturing (120 percent) and construction (85 percent). These numbers suggest that Chinese investors contributed more manufacturing jobs to Zambia than originally had been pledged.

Table 4 Implemented employment as a fraction of pledged employment, by source country and sector

Note: Values are implemented employment divided by pledged employment. “–” indicates no projects in cell.

One may suspect the possibility of data falsification by the ZDA's monitoring personnel. Chinese firms have been known to bribe bureaucrats both in and outside China. However, one would expect that Chinese firms in the mining industry, which are larger, fewer, and possess considerably more bargaining power and ability for collective action than firms in manufacturing, would be more successful at engaging in bribery to falsify statistics.Footnote 9 Yet Chinese mining firms have recorded the poorest implementation records among all sectors.

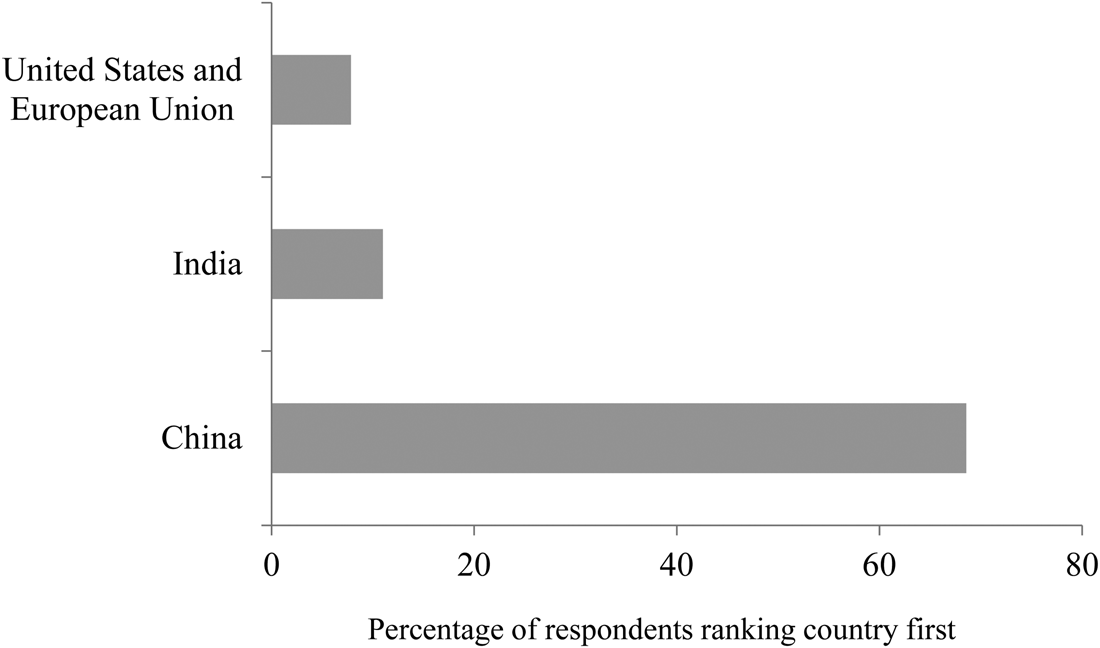

In addition to official records, the Zambian public overwhelmingly perceive Chinese investors to be the foremost job creators in Zambia, despite a lack of public support for Chinese investment in general. Based on our survey data, Figure 2 depicts respondents’ ranking of foreign investors based on perceived job creation in Zambia. Nearly 70 percent of respondents ranked the Chinese as first for job creation. When asked to list the top three job creators in Zambia, over 90 percent include Chinese investors in their selection. This suggests that the public's misinformation surrounding job creation is likely not a contributing factor to China's reputation deficit in Zambia. The majority of Zambians recognize that Chinese investors bring employment opportunities to the country.

Figure 2 Zambian Household Survey: Country that respondents rank first in job creation

In brief, both official statistics and the household survey provide evidence for positive impact of Chinese investments on the Zambian economy and employment generation in Zambia. Zambia is best known for its copper mines, but Chinese investments on the whole still generate many employment opportunities beyond the mining sector. This evidence refutes our first two hypotheses regarding China's reputation deficit in Zambia. Neither a failure to deliver employment nor prevailing misinformation among the public about these benefits account for the reputation deficit.

Sustaining employment during the global financial crisis

One important feature of Zambia's heavily copper-dependent economy is its vulnerability to the volatile international commodity markets. The 2008 global financial crisis had a severe impact on Zambia's copper sector, and its economy overall. The world copper price dropped precipitously from $9,000/ton in July 2008 to $2,900/ton by the end of the year. The decline in copper prices reduced Zambia's trade surplus from US$30 million in June 2008 to a deficit of US$70 million in November 2008. The exchange rate, which was heavily influenced by the strength of Zambian copper exports, declined from K3,200 to the dollar in June 2008 to about K5,500 in February 2009 (Green Reference Green2009).

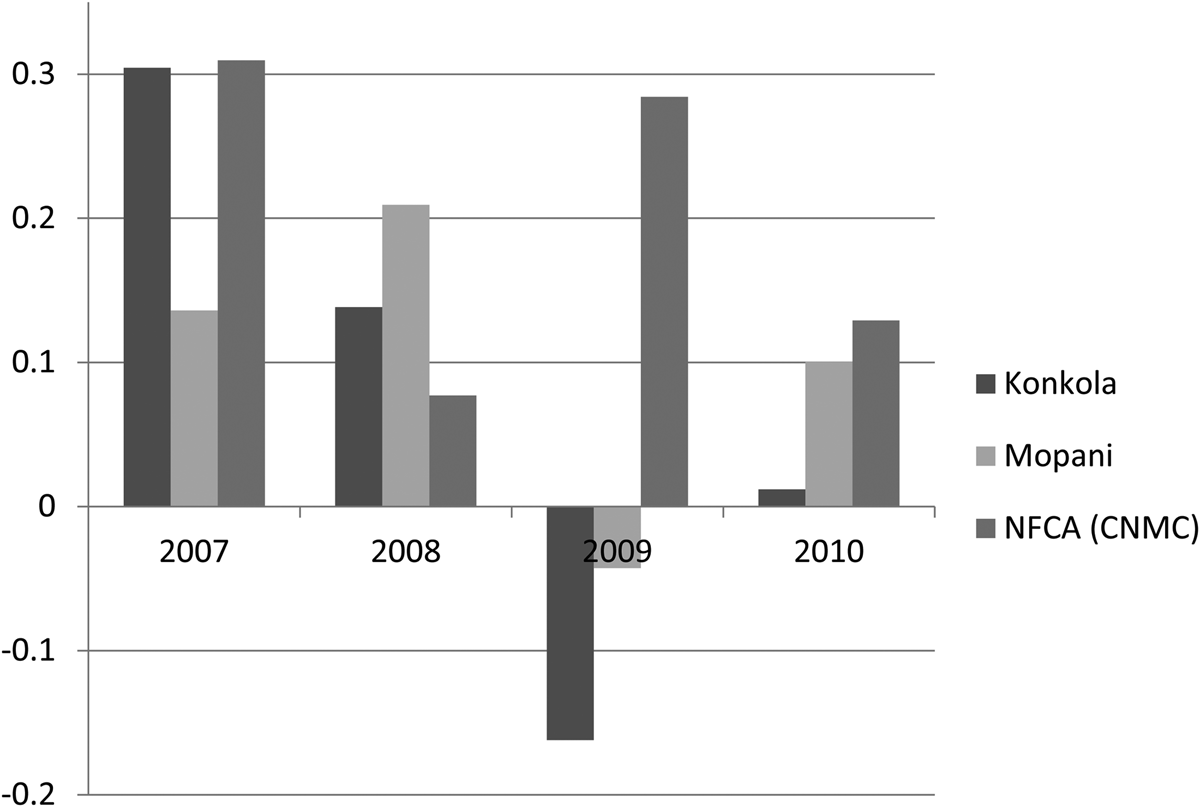

How foreign investors in the mining sector respond to market volatility has a direct impact on employment in the local communities. Zambia's copper mines are operated almost entirely by international investors from India, Canada, Switzerland, China, and South Africa (Table 5). Figure 3, reproduced from ZCCM Investment Holding's strategic plan, reveals how some of the major mining corporations in Zambia weathered the 2008 crisis and its aftermath.Footnote 10 Note that Konkola Copper Mines (KCM) and Mopani Copper Mines (Mopani) both suffered losses following the 2008 crisis, but Nonferrous China Africa (NFCA), operated by China Nonferrous Metal Mining Co. Ltd. (CNMC), has maintained stable and even mildly increasing sales following the crisis. During the crisis CNMC announced, “We will not reduce our investment by one penny; we will not reduce our production by one ton, and we will not lay off one single worker” (Zhongguowang 2010). CNMC not only maintained its operation of the NFCA mines, it also took over Luangshya in 2009. The Luangshya mine, originally under Indian (1997–2000) and Swiss (2003–2009) ownership, was one of the mines that had terminated production entirely during the crisis.

Figure 3 Contrast in mining profits through the recession: Konkola, Mopani, and NFCA (CNMC) (mining profits reported in the ZCCM-IH 2012–2016 Strategic Plan)

Table 5 Major MNCs in the Zambian copper industry

During the crisis, most major foreign investors in mining curtailed production and three stopped operations altogether, resulting in the loss of some 5,000 out of a total of about 30,000 jobs in the mining sector. Green (Reference Green2009) estimates that each of these formal sector jobs in Zambia in turn supported 20 jobs in services, so the employment loss in the mining sector had a serious detrimental impact on Zambia's economy and communities.

CNMC's behavior was countercyclical, however, expanding as other investors contracted. A CNMC executive shared with us that the rationale for continuing to produce and expand was not entirely economic: “We won't stop production, we need to uphold our responsibilities. Even if we lost money, we would have provided employment to local communities.” The executive also portrayed the Luangshya takeover as a helping gesture to the Zambian people in times of dire need. The mine employed 1,800 workers prior to the economic crisis; CNMC pledged to invest US$400 million and employ 3,000 workers in the following five years (MOFCOM 2009). The executive described CNMC's presence as an integral part of building and improving bilateral China–Zambia relations.Footnote 11

That CNMC is owned and financed by the Chinese state is an important factor in enabling its counter-cyclical behavior. CNMC's presumed role as instrument of the state allowed the firm to access ample financing. According to reports submitted to ZCCM-IH, even though CNMC's NFCA mine officially registered profits during the crisis (US$38.4 million and US$17.4 million in 2009 and 2010, respectively), the shareholders’ equity dropped to negative US$137.4 million by the end of 2010. Negative shareholder equity occurs when the cost of liabilities exceeds the value of assets, suggesting a heavily leveraged position, or reflecting continued posting of substantial losses from prior years.Footnote 12 CNMC's profit margin may not be as sound as it seems on paper, and the operations would likely be unsustainable without heavy lending by China's state banks.

State support gave CNMC higher risk tolerance and a longer time horizon, both of which made them a more stable presence when Zambia's backbone industry faltered during the global financial crisis. This longer time horizon is unmatched by investors from fully liberalized market economies. As Stephen Kaplan, an observer of China's influence in Latin America, notes, “In comparison to the United States, where markets and short-term profits have often ruled the day, China focuses on the longer term … China has aimed to secure long-term access to energy and raw materials through global trade and investment” (Kaplan Reference Kaplan2015). On the one hand, CNMC's takeover of the Luangshya mine can be interpreted as fulfilling policy goals, increasing China's overseas copper reserve and extending a helping hand when the Zambian economy struggles. On the other hand, though, the takeover is a commercial move—albeit bankrolled by the state—to acquire risky assets that are not immediately profitable but possess growth potential.Footnote 13 In a study of Chinese investments across southern Africa, Van der Lugt et al. (Reference Van der Lugt, Hamblin, Burgess and Schickerling2011) echo this observation: the behaviors of China's SOEs and parastatal companies often lead to a blurring of national policy and the profit-seeking strategies of companies.

For recipients, this feature of Chinese capital is a direct, if not counterintuitive, benefit of China's state-run model. Thanks to the Chinese state's financial backstopping, Chinese investors are more risk-tolerant, possess a longer time horizon, and can weather hard times more successfully than their Western counterparts hailing from market economies. The global financial crisis demonstrated that Chinese investors in Zambia can not only generate employment at a level that is on par with other foreign investors, but also maintain and even grow employment at a time other investors shut down due to short-term profit pressure. This further corroborates our finding that Chinese investors’ reputation deficit in Zambia does not stem from a lack of developmental benefits.

Labor standards in Chinese vs. other foreign firms

In addition to skepticism about employment generation, Chinese MNCs have also faced repeated accusations by civil society groups of poor adherence to labor standards in developing countries. Chinese involvement in Zambia in particular were subject to intense scrutiny. In 2011, Human Rights Watch (HRW) released a 122-page report, “You'll Be Fired If You Refuse”: Labor Abuses in Zambia's Chinese State-Owned Copper Mines. The report documents persistent abuses in CNMC mines, including poor health and safety conditions, regular 12-hour and even 18-hour shifts involving arduous labor, and anti-union activities—all in violation of Zambia's national laws and international labor standards (HRW 2011). The report was widely read and created a public relations crisis for CNMC. Labor relations appear to be equally poor in some private Chinese establishments. At Collum coal mine in southern Zambia, Chinese managers fired shots at striking workers in 2010. In 2012, rioting miners killed a Chinese supervisor and injured two others during a wage protest (Bariyo Reference Bariyo2015).

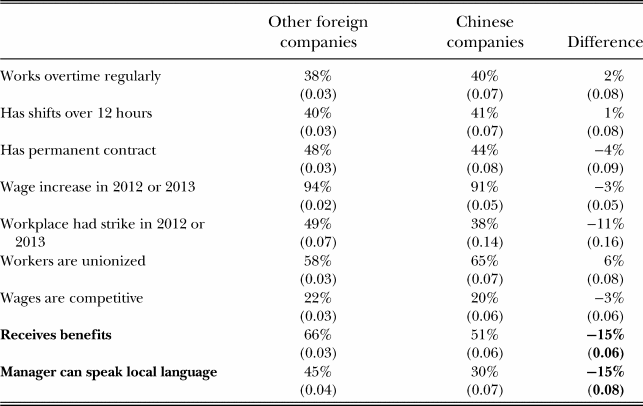

In our household survey, we asked respondents who were employed by foreign firms a range of factual questions about their wages, contractual arrangements, length of shifts, and other indicators of working conditions. As Table 6 demonstrates, the performance of Chinese firms is no worse than other foreign firms, with two exceptions: First, workers employed by a Chinese firm are less likely to receive benefits. Follow-up interviews with both firm managers and the employees indicate that the gap in benefits refers predominantly to the fact that Chinese managers are less likely to grant employees extended leave for culturally important ceremonies, including weddings, funerals, and other familial and community functions. Second, workers employed by a Chinese firm are less likely to have a manager who can speak the local language. As we discuss below, we view these differences in benefits and managerial structure as capturing a localization gap more than differences in labor standards.

Table 6 Are Chinese companies worse companies? Two-sample difference in means tests from Zambian Household Survey

Note: Bold type indicates difference is significant at 5%. Standard errors in parentheses.

On other measures, nearly 40 percent of workers at both Chinese and other foreign firms regularly work overtime and endure shifts longer than 12 hours. Fewer than 50 percent have a permanent contract. Over 90 percent had a pay increase in 2012 and 2013, but only about 20 percent of workers at both Chinese and other foreign firms think the wages they receive are competitive for their line of work. Workers at a Chinese firm are in fact more likely to be unionized and less likely to have had a strike in the last two years. These differences are, however, not statistically significant due to the relatively small sample size.Footnote 14 Granted, the direct comparison shown in Table 6 does not demonstrate that Chinese firms’ labor practices are exemplary; rather, it points out that most other foreign investors are equally at fault, and that differentially problematic labor standards at Chinese firms are not driving the reputation deficit they face, at least not in Zambia.

This point was also raised by Deborah Bräutigam (Reference Bräutigam2011) as she commented on the HRW report in her widely read China in Africa blog:

The [report] leaves a bit of a feeling that the rest of the mining sector is far better run and organized than CNMC's part. No doubt that's generally true, but workers have also complained of ‘serious human rights violations’ at KCM, with wildcat strikes, people being fired, and a general ‘chaotic’ labor situation in the mines in general. The fatality figures also suggest that the Chinese are by no means the only mines with safety problems.Footnote 15

Our findings from the household survey corroborate Bräutigam's observation: Chinese firms’ labor standards may be lacking, but they are hardly alone in the crime. A follow-up visit to the Mines Safety Department (MSD) in Kitwe also confirmed that CNMC was not the lone offender. The interviewed official disclosed that Mopani, a subsidiary of the Swiss-based conglomerate Glencore, had one of the worst safety records among major operators in Zambia today. KCM was also problematic in terms of safety standards, although the corporation tended to shift blame to its extensive network of subcontractors, some of which were private Chinese firms. The CNMC-owned NFCA mines had experienced problems in the past, skimping on safety gear and protocol, but they had shown improvement in recent years.

In addition to inadequate labor conditions, Chinese firms have been cited repeatedly for environmental violations. In February 2013, the Chambishi Copper Smelter was suspended for several days over environmental concerns (Lusaka Times 2013). In January 2014, NFCA's Chimbishi South East Ore project was suspended for several months for breaking environmental laws (Bariyo Reference Bariyo2014). Officials in Kitwe again claimed that almost all major mining investors had environmental infractions at one time or another. An on-site visit to Mufulira in 2013 provided first-hand confirmation of the severe air pollution caused by Mopani's copper smelter. The acid air, a result of sulphur dioxide emissions, stung eyes as far as 10 miles outside town.Footnote 16

WHY REPUTATION DEFICIT? A LACK OF LOCAL ADAPTATION

Our research showed no significant performance gap between Chinese firms and multinational firms from other countries. China generates substantial employment opportunities and is widely recognized by the public as Zambia's top job creator. Thanks to the state's financial backing, the mines that are operated by CNMC, a Chinese state-owned enterprise (SOE), was able to withstand the market fluctuations of the global financial crisis and has continued to offer employment. In addition, based on the workforce's self-reporting, Chinese firms are no worse than other MNCs in upholding labor standards in Zambia's mining sector, and environmental violations are common among all foreign investors. Chinese firms do, however, fall short on indicators of localization such as employing Zambian managers, learning the local language, and offering culturally relevant benefits to employees. In this section, we test empirically whether inadequate localization can partly explain the reputation deficit facing Chinese investors.

Using data from our household survey, we employ a probit model to identify the factors shaping public attitudes toward Chinese investment in Zambia (Table 7). We investigate the determinants of two dependent variables: the probability of a respondent expressing support for Chinese investment (Column 1); and the probability of a respondent expressing support of foreign direct investment in Zambia in general but not investment from China (Column 2). Our key independent variables are a range of indicators of Chinese firms’ corporate practices as perceived by the public, such as whether Chinese firms are more or less likely to hire Zambian managers, involve themselves in the local communities, or have managers who are easy to communicate with compared with Western firms. We also include as controls demographic variables such as gender, education, and cosmopolitanism, which are standard controls identified by the international political economy literature to account for individual variations in terms of support for globalization.

Table 7 Zambian Household Survey: Marginal effect of attitudes about Chinese businesses on respondent's support for Chinese FDI

Additional controls (not shown) are age, income, travel frequency, marital status, and sector of employment. Standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1.

The results shown in Table 7 reveal that the two strongest predictors for lack of support for Chinese FDI (as opposed to FDI in general) are the perceived lack of Zambian managers in the workplace and the difficulty in communicating with managers. It is noteworthy that other indicators of corporate practices did not yield significant coefficients, including whether Chinese businesses are perceived to be involved with local communities, to show care, or to bribe disproportionately. This is consistent with our qualitative data collection in Zambia that Chinese firms expended considerable resources on local public works projects such bus stops, schools, and health clinics and hospitals. These projects have likely helped to establish Chinese businesses’ engagement with local communities in the minds of the public. Interestingly, one's belief about whether Chinese businesses are more likely to bribe does not predict one's support for Chinese investment. It is possible that, for an average member of the public, whether a company engages in bribery is not as salient an issue as the company's day-to-day managerial presence and communication.

To account for the alternative hypothesis, that in a low information environment the public may rely disproportionately on elite cues to form opinions about investors, we include on the right-hand side the respondent's party identification. Contrary to what an elite cues mechanism would suggest, we find that being a member of the Patriotic Front, Michael Sata's party that ran an explicit platform to oppose Chinese investment in Zambia, has no significant effect on the respondent's attitude toward Chinese investment.

The findings in Table 7 align with the differences presented in Table 6 and discussed previously. Employees of Chinese firms are less likely to report having a manager who speaks a local language (Table 6). Our interviews reveal that Chinese firms tend to perceive having Chinese managers as key to maintaining their competitive advantage. A CNMC executive lists two reasons why CNMC was able to pull through the global financial crisis and expand while other firms struggled:

First, Chinese firms are managed differently. We employ a larger number of Chinese managers; our managers are paid less. We Chinese are hardworking, dedicated, and willing to sacrifice, so we can accomplish what others cannot in a short period of time. Second, we obtain machinery and inputs from China at a lower cost compared to those used by western MNCs.

Many Chinese managers also experience a genuine difficulty in communicating more than rudimentary work instructions to their Zambian colleagues. From the perspective of the Zambian workforce, however, the “glass ceiling” in Chinese firms represents a lack of upward mobility when in fact, employed as manual labor, they may be just as underpaid and overworked in any other commercial mine.

These findings suggest that, rather than a lack of employment generation, disregard for labor or environmental standards, or lack of involvement with local communities, it is Chinese firms’ lack of localization that contributes to their reputation deficit on the ground. More specifically, two aspects of inadequate localization stand out in the mind of an average member of the Zambian public who has reservations about Chinese investment: difficulty to communicate with Chinese managers; and a relative lack of Zambian managers to begin with (Table 7). These two variables in turn could be indicative of more general Chinese style practices as well as company culture on the shop floor that are not captured by wages or employment. In other words, although Chinese firms may offer the same contracts, wage rates, shift lengths, and union access to their Zambian employees, a relatively low level of localization surrounding benefits, managerial structure, and communication capabilities has contributed to the reputation deficit.

In addition to less localized company practices, interviews reveal another potential reason why Chinese MNCs suffer from a reputation deficit in the eyes of the local public. Chinese firms – especially state-owned enterprises, demonstrate a marked fear of and unwillingness to deal with the local and international media. There is a deep-seated belief that media outlets are only interested in painting a sinister image of Chinese investors because those types of stories sell. One CNMC executive lamented:

We don't talk to any media personnel now, unless they are from reputable outlets in China like Xinhua or CCTV. Otherwise we only consider media requests authorized by the embassy; even then we are reluctant and will not say much … Western media outlets are deceptive. When they come to us, they say they want to hear our side of the story and clear our name, but, regardless how open we are and what they actually observe, they turn around and ‘blacken’ (mo hei) us. So we've now stopped talking to them altogether.

Other SOEs operating in Zambia adopt a similar stance. As of 2013, the only major Chinese firm in Zambia that had a dedicated PR department was Huawei. When asked why CNMC did not recruit media personnel, the executive cited a lack of suitable talent. Although there may be some truth to the claim of talent shortage, it also appears that a state-owned firm such as CNMC prioritizes its audiences differently than a typical mining MNC. For a Western MNC, good local and international press on corporate social responsibility is important for succeeding in the host environment and for satisfying shareholders and the public at home. For Chinese SOEs, however, the importance of impressing delegations from the Chinese government and getting coverage by Xinhua and CCTV outweighed establishing amenable relations with the local press and international outlets. Although difficult to test empirically, we document the anecdotal possibility that Chinese firms’ lack of press strategy has also contributed to its tarnished image.

CONCLUSION

In this article, we evaluate public reaction to Chinese investment in Zambia and identify a reputation deficit: Chinese investment enjoys less support among the public compared with that of other foreign investors. However, this gap in support for Chinese investment does not stem from an actual gap in the performance of Chinese firms compared with that of Western multinational firms: Chinese investment is widely recognized by the Zambian public as a top contributor to Zambia's employment; this contribution remained stable even during the trough of the financial crisis; and Chinese firms in the formal sector exhibit labor and environmental practices generally comparable to those of Western firms. Instead, Chinese firms’ lack of localization accounts in part for the deficit in public support for Chinese investment.

However, our study does not address why Chinese firms are less localized or examine the extent to which inadequate localization is a common phenomenon across China's multinational firms. These are questions worthy of further research. In the 1970s and 1980s, rapidly globalizing Japanese firms were also observed to practice a lower level of localization compared with their Western counterparts. This disparity was in part attributable to the belief that Japanese management itself was the core competence that gave firms the competitive edge. Chinese managers we interviewed in Zambia offered a similar line of reasoning. In addition to executives at CNMC, another manager we interviewed at a Chinese construction company also noted that the Chinese workforce is considered an important source of productivity.

Nor does our study evaluate the extent to which inadequate localization accounts for the public backlash suffered by Chinese investment outside Zambia. Readers should be cautious about extrapolating our findings about Zambia to other economies where Chinese investors operate. The next article in this volume by Wong, for example, highlights a wholly different mechanism through which China's economic statecraft may elicit public backlash by delving into the case of Australia.

Finally, it should be noted that both the factual and perceptions data presented in this article were from 2013, just before Xi Jinping officially launched China's BRI. These records highlight the significant continuity—and to some extent the surprising endurance—of China's outward investment model from the Go Out phase under Hu Jintao to BRI under Xi Jinping. The state-directed model did not begin with the BRI; the backlash against it also did not begin with the BRI. Today Chinese firms continue to struggle with issues related to localization and corporate practices, not only in developing economies but in developed economies as well, as illustrated by the popular documentary American Factory.

This persistence invites questions about how adaptable China's investment model really is to local feedback and host country reactions. In this issue, Ye outlines a system in which Chinese policymakers show awareness of negative reactions and take steps to mitigate such reactions by depoliticizing rhetoric about the BRI and increasing educational exchanges. More specifically on the issue of workforce localization, the government has called for exporting China's vocational education with the goal of training a skilled local labor force that understands Chinese technical standards and possesses a command of the Chinese language. On the ground, however, it remains to be seen whether such policy initiatives can increase the level of managerial localization at Chinese firms, and whether that can reduce public backlash, given that the proposed training programs are China-centric. They are designed primarily to lower operative costs for Chinese conglomerates and focus more on training workers than managers.

Inadequate localization may not be a direct outcome of China's state-directed investment model, nor is it a unique challenge facing Chinese companies. However, the state can easily shape economic actors’ incentives to address the challenge they encounter on the ground. When it comes to specific corporate practices, what motivates a typical multinational firm's change of behavior is when public reaction translates into a threat to profits. For Chinese firms and SOEs in particular, commercial incentives are embedded within a larger system where the Chinese government's policy directives and financial backstopping can have an outsized impact on a firm's bottom line, both at home and abroad. Chinese firms’ ability to “self-correct” in response to ground-level feedback will therefore likely remain limited as long as they continue to look to the Chinese state as their ultimate principal and to export a China-centric modus operandi overseas.

ACKNOWLEDGMENTS

The authors thank Ronald Kaunda for excellent research management in Zambia.

CONFLICT OF INTEREST

The authors declare no conflicts of interest.

APPENDIX: ZAMBIAN HOUSEHOLD SURVEY: SAMPLING AND SURVEY IMPLEMENTATION

Our study focused on the opinions and experiences of Zambians who had been exposed to industries and businesses involved in FDI, trade, and employing migrant workers. These Zambians principally reside in the Copperbelt, the hub of the mining industry, and in Lusaka, the hub of all other industries in Zambia. There are 370 wards in these two provinces with a total of 815,543 households.

To sample individuals in these provinces, we used a three-stage cluster sampling strategy. First, we randomly selected two constituencies in each province, the Copperbelt and Lusaka. Then we stratified on density of mining industry and randomly selected four wards. We divided the ward into square geographic units and randomly selected one square unit. Then, a team of two enumerators traveled to each unit and complete d15 surveys each over the course of one day. Via a random walk skip pattern, every seventh household within the unit was sampled, although households with only children present were not counted in this skip pattern. Only one adult was sampled per household or residential unit, including in polygamous housing groups, and the enumerators alternately asked for males to females at a rate of three to one. When more than one adult was present of the to-be-sampled gender, the adult who most recently had a birthday was selected. Enumerators were permitted to circle back to households if an adult of the to-be-sampled was meant to return shortly. They were also permitted to find the adult elsewhere, take them aside, then interview them in a private location. If the enumerators walked to the edge of the unit, they were permitted to spin a bottle and resume the random walk pattern in the direction of the open side of the bottle. The lead enumerator kept a map of the walk patterns and sampled households in each ward, which are available upon request. The starting points for the random walk in each unit were as follows:

(1) Chingola District: Nichanga Constituency:

Kabundi Shopping Area

Chiwempala Township

Chikola Township

Town Centre

(2) Kalulushi District: Kalulushi Constituency:

Kalulushi Town Centre

Chibuluma Shopping Area

Chambishi Town Centre

Kamakonde Area

(3) Mufulira District: Mufulira Constituency:

Mufulira Town Centre

Kawama Township

Kantanshi Township

Kamuchanga Township

(4) Lusaka District: Mandevu Constituency (low income):

Chipata Compound

Chaisa Compound

Chilulu Compound

Garden Luangwa

(5) Lusaka District: Chawama Constituency (middle income)

Chawama Police Compound

Kuomboka Compound

Maplot Weluzani

Chawama Eye Clinic Area

(6) Lusaka District: Munali Constituency (high income)

Kalundu

Chadleigh

Handsworth

Chamba Valley