12 - Income Distribution in Pre-War Japan

Published online by Cambridge University Press: 16 August 2023

Summary

Increasing income inequality is one of the most serious problems in the contemporary world, and Japan is no exception. In this context, it is only natural that Thomas Piketty’s Capital in the Twenty-First Century has attracted great interest from general audiences as well as from academia. His book is impressive because it is based on extensive research and a rich long-term data set for the major developed countries. This data set includes the research by Moriguchi and Saez, who studied long-term change in the top income share in Japan. As these authors pointed out, there is a great deal of literature on the long-term development of income distribution patterns in Japan. In this chapter, I begin by surveying this literature, focusing on research into the pre-war period; this is unique, in that studies based on individual-level data exist for this period and, moreover, there is scope to extend these studies. Then, using the new data set, I explore the relationship between income and assets at the individual level in Japan during the pre-war period.

This chapter is organized as follows. The first two sections survey the literature, with the former looking at the functional income distribution and the latter focusing on the individual income distribution. The third section relates the individual distribution of income to the distribution of assets. The final section gives my concluding remarks.

THE FUNCTIONAL DISTRIBUTION OF INCOME

The functional distribution of income in Japan has been studied since the pre-war period, but the systematic estimation of long-term economic statistics in the 1970s substantially improved income distribution estimates. The most important work on this issue is that by Minami and Ono, who estimated the functional distribution of income in the private non-agricultural sector by industry, focusing on the manufacturing and mining industries (“M industry”) and the service sector (“S industry”).

Figure 12.1 shows the change in the capital share (capital income/total income) from 1906 to 1940, using data from Minami and Ono (1978a). While there was a procyclical fluctuation, a clear upward trend can be observed in the capital share, which rose from 0.39 in 1906 to 0.54 in 1940.

- Type

- Chapter

- Information

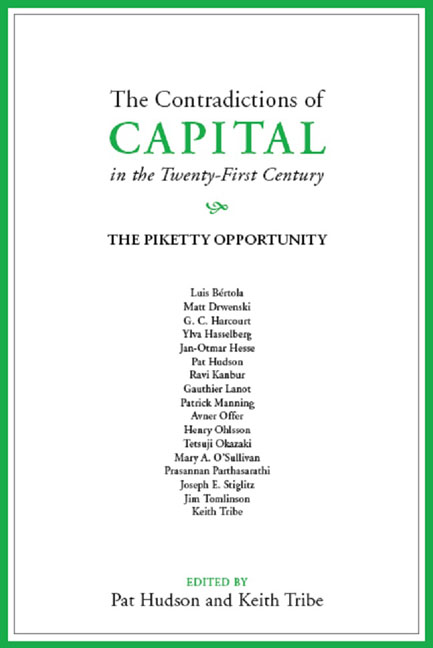

- The Contradictions of Capital in the Twenty-First CenturyThe Piketty Opportunity, pp. 223 - 236Publisher: Agenda PublishingPrint publication year: 2016