Book contents

- Frontmatter

- Contents

- Preface

- 1 Introduction

- PART I TOOLS FOR RISK ANALYSIS

- PART II GENERAL INSURANCE

- PART III LIFE INSURANCE AND FINANCIAL RISK

- Appendix A Random variables: Principal tools

- Appendix B Linear algebra and stochastic vectors

- Appendix C Numerical algorithms: A third tool

- References

- Index

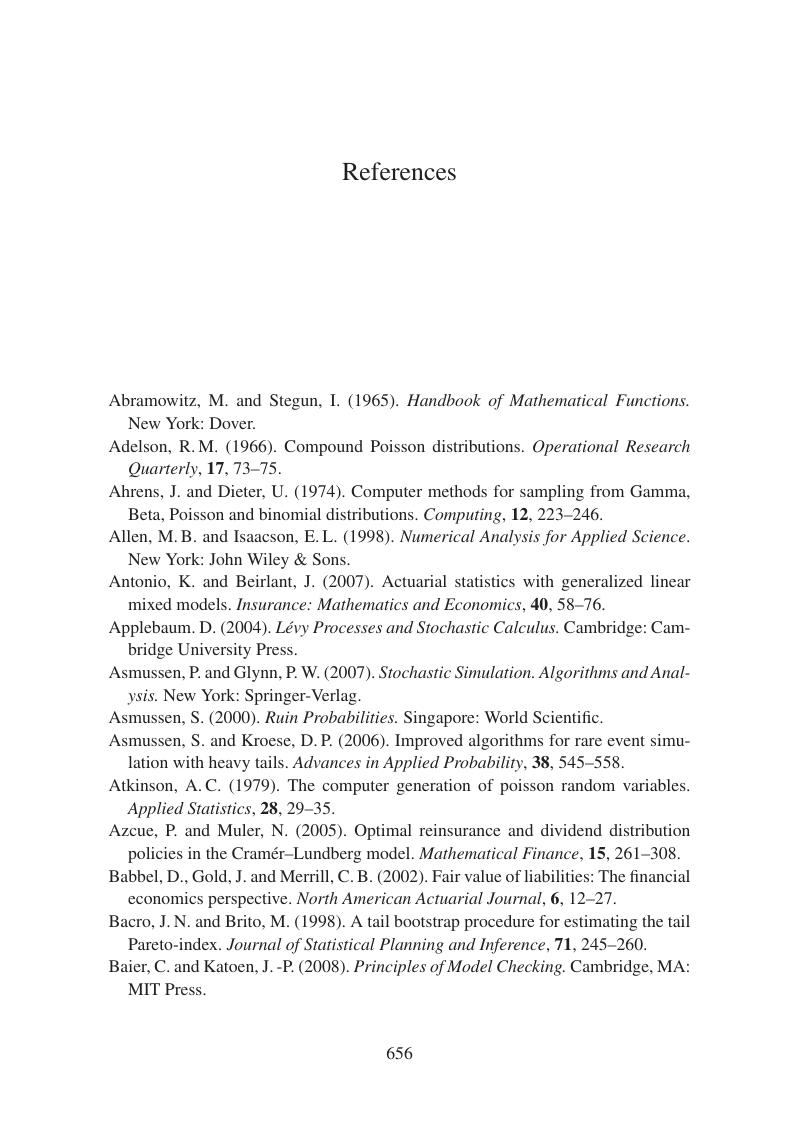

- References

References

Published online by Cambridge University Press: 05 May 2014

- Frontmatter

- Contents

- Preface

- 1 Introduction

- PART I TOOLS FOR RISK ANALYSIS

- PART II GENERAL INSURANCE

- PART III LIFE INSURANCE AND FINANCIAL RISK

- Appendix A Random variables: Principal tools

- Appendix B Linear algebra and stochastic vectors

- Appendix C Numerical algorithms: A third tool

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- Computation and Modelling in Insurance and Finance , pp. 656 - 679Publisher: Cambridge University PressPrint publication year: 2014