Introduction

Tax evasion is considered one of the biggest problems for development in the world (Tax Justice Network 2007). Its high cost to society has forced researchers and tax professionals to rethink ways to improve tax enforcement policies. Using several studies, the Tax Justice Network (2007) estimates that less-developed countries evade close to USD 200 billion in taxes each year through personal offshore practices, corporate profit transfers, and informality. This fiscal loss is so high that it doubles the budget established within the United Nations Millennium Development Goals to halve world poverty in a decade. The lack of these large resources has gradually restricted public spending on social programs such as health and education services, so it has not been possible to improve income distribution either.

According to Murphy and Christensen Reference Murphy and Christensen2013), tax evasion can be understood as a form of organized crime that includes several parties, such as taxpayers, lawyers, banks, and multinational entities. These parties interact with one another through a complex economic, financial, and institutional network to avoid tax obligations and increase profits. In this process, accountants are key agents because of their legal liability in a firm’s tax reporting and the privileged information they have on accounting rules, permissible deductions, and exempt revenues to fulfill tax obligations and reduce tax burdens.

This role is more visible when a single accountant is able to work for several firms, each of which may implement compensation mechanisms to prompt efficient tax decisions and mitigate the risk of detection for wrongdoing. To date, there is a lot of empirical evidence about accountant’s incentives for tax avoidance (e.g., Armstrong, Blouin, and Larcker Reference Armstrong, Blouin and Larcker2012; Gaertner Reference Gaertner2014; Powers, Robinson, and Stomberg Reference Powers, Robinson and Stomberg2016). However, there are few theoretical studies that focus on accountants’ behavior inside firms, and these lack any empirical causal test of tax enforcement policies (Crocker and Slemrod Reference Crocker and Slemrod2005; Chen and Chu Reference Chen and Chu2005; Desai, Dyck, and Zingales Reference Desai, Dyck and Zingales2007; Biswas, Marchese, and Privileggi Reference Biswas, Marchese and Privileggi2013).

The aim of this article is to analyze accountants’ role and involvement in a firm’s income tax evasion through a randomized field experiment carried out in Ecuador’s tax system at the beginning of 2016. Through the collaboration of the tax authority, five different electronic deterrent notifications were sent to the tax mailboxes of accountants and taxpayers prior to the reporting deadline. The universe of the experiment was composed exclusively of microenterprises. The first three notifications focused only on accountants. These included a placebo, a notification with penalty message (years of imprisonment in case of tax evasion), and a notification with accountants’ private information (the number of firms the accountant keeps accounts for). The fourth notification focused on both accountants and taxpayers, displayed accountants’ private information, and stressed the reciprocal awareness of both parties (i.e., each one knew the other was notified). The fifth notification focused only on taxpayers and displayed a penalty message. These treatments allow evaluation of the effect of accountant notifications on a firm’s tax reporting and the conditions under which this effect happens.

For the most part, the results show that simultaneous notification of both accountants and taxpayers was the sole treatment that significantly increased firms’ declared income tax. This was even more effective at improving firms’ declared tax than notification of accountants only. This suggests a possible interaction between accountants and taxpayers, when both are notified, which increases the risk of detection, results in better tax compliance, and improves tax reporting.

Furthermore, it was shown that penalty notification of accountants, rather than taxpayers only, was the most significant treatment in increasing firms’ declared revenue. However, this effect did not transfer to declared tax because a cost-overreporting mechanism was found that canceled any effective tax increase. A possible reason for this could be the standard message that the tax authority provided in notifications, which mitigates the risk perceived by taxpayers.

Interestingly, simultaneous notification of both parties was more effective for firms whose revenues and costs are higher, when interaction terms are included. These notifications were also more effective for firms whose accountants work for several companies and for firms whose accountants are young, but these effects have lower statistical significance.

This study provides initial insight into the effect of deterrent policies addressed to accountants. Here, the relevant factors for properly designing tax enforcement policies are not only risk perception (i.e., perception of the tax authority as a threatening agent that can deter, audit, and punish) but also the roles of both taxpayers and accountants in tax compliance. To date there is no evaluation concerning how a deterrent policy could affect the accountants’ behavior and hence the firms’ tax reporting. In providing such an evaluation, this study makes a unique contribution to tax research literature, as most field studies focus on taxpayers instead of other economic agents that interact with them.

In addition, this study provides initial empirical evidence to microeconomic theories on the interaction between an accountant and a firm owner in tax reporting. Although Crocker and Slemrod (Reference Crocker and Slemrod2005), Chen and Chu (Reference Chen and Chu2005), and Biswas, Marchese, and Privileggi (Reference Biswas, Marchese and Privileggi2013) provide guidelines relating to accountant’s participation in tax evasion through an agency problem and contract theory, so far there is no empirical testing of them. Lastly, this study contributes to the increasing but limited literature on tax compliance through randomized field experiments (Hasseldine et al. Reference Hasseldine, Hite, James and Toumi2007; Iyer, Reckers, and Sanders Reference Iyer, Reckers and Sanders2010; Kleven et al. Reference Kleven, Knudsen, Thustrup Kreiner, Pedersen and Saez2011; Ariel Reference Ariel2012; Pomeranz Reference Pomeranz2013; Harju, Kosonen, and Ropponen Reference Harju, Kosonen and Ropponen2014; Kosonen and Ropponen Reference Kosonen and Ropponen2015; Carrillo, Pomeranz, and Singhal Reference Carrillo, Pomeranz and Singhal2017).

Furthermore, this study provides guidelines for the design of tax controls and monitoring process, taking into account the systemic risk of tax obligations. These guidelines are especially important for tax authorities in Latin America as this region collects few taxes and faces serious tax compliance problems (Naciones Unidas 2020), and because fiscal resources are one of the region’s main determinants of social expenditure policy (Martín-Mayoral and Sastre Reference Martín-Mayoral and Fernández Sastre2017). In the case of Ecuador, the most recent estimation of the income tax evasion gap reaches 63.5% in 2008, making it one of the highest of Latin American countries (Jiménez, Gómez Sabaini, and Podestá Reference Jiménez, Gómez Sabaini and Podestá2010)

Literature review

This literature review first introduces the microeconomic theory on firms’ tax evasion with an emphasis in agency models. Second, it presents empirical evidence found in previous experiments regarding the effect of deterrent and nondeterrent policies. This part places special focus on randomized field experiments on firms’ tax fulfillment.

Theoretical approach

The theoretical analysis of tax evasion has its origin in the model proposed by Allingham and Sandmo (Reference Allingham and Sandmo1972), also known as the AS model. This model proposes that an individual will evade income tax when the expected return per unit of income is higher than the expected cost of hiding it. In this case, tax evasion is more likely to occur when: (i) the probability of getting caught decreases, (ii) the penalty decreases, (iii) the tax rate increases, (iv) the risk aversion decreases, or (v) income is higher (Cowell Reference Cowell, Henry and Slemrod2004).Footnote 1

The AS model has laid the basis for several theoretical analyzes on tax evasion, with further implications for labor supply, optimal taxation, uncertainty, informal markets, imperfect information, interaction with the tax authority, design mechanisms, moral issues, and social dynamics.Footnote 2 A topic that has gained interest in recent years is the behavior of firms when it comes to tax evasion.

Most theory on firms’ tax evasion has adopted an individual approach of the AS model considering endogenous income. For the most part, the main research interest in this area has been the separability between production and tax evasion decisions. Additionally, academics have been also interested in the industrial transactional framework and how it might influence the firms’ behavior through third-party information (e.g., Kopczuk and Slemrod Reference Kopczuk and Slemrod2006; Gordon and Li Reference Gordon and Li2009; Kleven, Kreiner, and Saez Reference Kleven, Thustrup Kreiner and Saez2016).

The individual approach of the AS model has a disadvantage in looking at a firm’s tax evasion problem. It does not look at how the accountant/tax manager/CFO and the owner or shareholders participate and interact when it comes to the decision-making process of a company. On one side, company owners have a vested interest in increasing profits by means of tax evasion, while on the other side, accountants have the legal (and illegal) know-how to make it possible. Slemrod (Reference Slemrod2004) considers that the compensation mechanisms between these two parties, either by formal or informal means, are key to understanding the effects of tax deterrent policies, especially in large companies.

This theoretical limitation has led to rethinking firms’ tax evasion as an agency problem, where the roles of company owners and accountants differ accordingly. This formulation involves a compensation mechanism through a contractual relationship that mitigates the risk assumed by accountants when evading taxes on behalf of firms. In other words, this mechanism encourages accountants to make efficient tax decisions that can decrease a firm’s tax payment. Chen and Chu (Reference Chen and Chu2005), Crocker and Slemrod (Reference Crocker and Slemrod2005), and Biswas, Marchese, and Privileggi (Reference Biswas, Marchese and Privileggi2013) are main references on this point.

Chen and Chu (Reference Chen and Chu2005) argue that tax evasion is essentially determined by the trade-off between the expected return, the risk of being caught, and a company’s management control. They analyze tax evasion through income underreporting, assuming there is an incomplete contractual relationship between a company owner and a risk-averse tax manager. When both parties are legally liable for tax fulfillment, they find that tax evasion generates a loss of internal control and inefficiency at a company. The reason for this result is simple: contract incompleteness does not fully mitigate the risk taken by tax managers given that their compensation may be less than it would have been without evasion. This fact discourages managers from giving their best effort and generates agency costs for their firm.

Crocker and Slemrod (Reference Crocker and Slemrod2005) developed a model with a similar theoretical approach. They examine the optimal contractual relationship that should occur between company owners and tax managers (i.e., accountants) when both are risk-neutral, assuming that the latter possess privileged information on permissible legal deductions that might be overreported to reduce corporate income tax (in principle this information is unknown for owners, that is, there is information asymmetry). Thus, the authors find that tax penalties on tax managers are more effective in reducing evasion than those on shareholders if both parties are legally liable for tax fulfillment. This result is essentially due to the information asymmetry embedded in tax reporting and the possibility that accountants can be also penalized when firms are caught by the tax authority. These aspects could weaken the compensation managers should receive for reducing risk and exacerbate the conflict between the two parties when penalties on accountants increase.

Another interesting contribution in firms’ tax evasion through agency models is made by Biswas, Marchese, and Privileggi (Reference Biswas, Marchese and Privileggi2013), who assume that tax managers can carry out self-protective actions to underreport a firm’s income without increasing the risk of being caught. Here, the probability of being caught is endogenous and adversely depends on the tax manager’s effort. Under these considerations, the authors show that not only tax evasion but also the tax manager’s efforts may decrease when liability is gradually shifted from the principal to the agent. This is more likely to occur in situations where there are high tax penalties and high-risk levels of aversion. Evidently, highly risk-averse tax managers with greater liability properly report taxes to avoid penalties, however, if their compensation decreases after the liability shifts, the likelihood of properly reporting taxes will also decrease because the compensation includes an ex ante premium that lessens the risk of being caught.

Empirical evidence

The most relevant empirical evidence on the effects of tax enforcement policies has been found through randomized field experiments. In recent years, the use of these techniques has intensified gradually thanks to tax authorities and their interest in improving their process.Footnote 3 The process generally involves sending either physical or electronic letters to a segment of high-risk taxpayers prior to the fulfillment of tax obligations. The information given is generally focused on deterrent issues (e.g., audit threats, penalty reminders), taxpayer assistance (e.g., service reminders, contact information), public services (e.g., public financing, redistributive issues), and social norms (e.g., morality, social stigma). In summary, results indicate that deterrent notifications usually cause an upsurge in fulfillment of tax obligations. A large compilation of randomized field experiments on tax compliance and their main results can be found in Hallsworth (Reference Hallsworth2014). Additionally, Pomeranz and Vila-Belda (Reference Pomeranz and Vila-Belda2019) make a brief review of some evaluations of corporate income tax that use experimental research designs.

In the context of firms, randomized field experiments have mainly focused on deterrent notifications about income tax, value-added tax, and some subnational taxes. Most of these notifications are sent via email and focus on penalty and deadline reminders. Here, there are three key findings for firms’ tax evasion.

The first one relates to the importance of paper trails and third-party information for improving tax reporting. For example, Kleven et al. (Reference Kleven, Knudsen, Thustrup Kreiner, Pedersen and Saez2011) elaborated a tax enforcement field experiment in Denmark that randomly audited and sent letters to taxpayers threatening audit. The authors found that these interventions had significant effects on self-reported income (i.e., income reported by taxpayers themselves), but no effects on third-party reported income (i.e., income reported by other taxpayers). This result occurs because third-party information increases the monitoring perception and the risk of being caught, so tax evasion for third-party-reported income is extremely small prior to any tax enforcement intervention.

Secondly, there is a kind of tax evasion substitution between the declared revenue and the declared cost in tax return. Carrillo, Pomeranz, and Singhal (Reference Carrillo, Pomeranz and Singhal2017) supported this idea through a randomized field experiment in Ecuador with electronic notifications. These notifications communicated to firms any difference in income between their tax reporting and third-party reporting with an additional penalty reminder. As a result, authors found that declared revenue by the notified firms increased, removing the differences in income previously detected by tax authority. However, declared costs also increase at a similar rate, generating an inappreciable impact on income tax. In other words, tax evasion through revenue underreporting was replaced by tax evasion through cost overreporting.

The third main finding relates to the spillover effect of the economic productive network. Pomeranz (Reference Pomeranz2013) designed an audit preannouncement experiment that targeted small firms in the Chilean tax system. The study shows that declared added-value tax increased not only for the notified firms but also for their trading partners. This propagation happens in a backward manner within the productive network (i.e., from supplier to supplier); either suppliers overstate their sales (and consequently their tax payments) or they collude with the firm subject to intervention to match its transactions.

Despite this valuable evidence, to date there has been no empirical research to explain how tax enforcement policies could affect accountants’ behavior and their participation in firms’ tax reporting. Furthermore, agency models of firms’ tax evasion lack field testing.Footnote 4 There is only limited empirical evidence on accountants’ compensation incentives for tax evasion through cross-sectional correlation analysis (e.g., Armstrong, Blouin, and Larcker Reference Armstrong, Blouin and Larcker2012; Gaertner Reference Gaertner2014; Powers, Robinson, and Stomberg Reference Powers, Robinson and Stomberg2016).

Evaluation design, data, and empirical specification

Empirical setting

According to the Ecuadorian tax authority, the country’s tax revenue made up approximately 14% of GDP in 2015, excluding social security contributions and sectional taxes. Direct taxes represent approximately 36% of the tax burden, and indirect taxes, 60%. Within direct taxes, corporate income tax is the most important form of revenue. About nine out of every ten dollars from direct tax collection come from companies’ profits while the remainder is obtained from personal income tax and other taxes.

Ecuador’s tax evasion gap for corporate income tax ammounted to 63.5% in 2008 (Jiménez, Gómez Sabaini, and Podestá Reference Jiménez, Gómez Sabaini and Podestá2010), representing 6% of that year’s GDP. Meanwhile, coporate tax expenditure (e.g., employment and investment stimuli) in 2015 represented approximately 1.5% of that year’s GDP.

The reporting of corporate income tax is done annually through the F101 form. Through it, firms are required to declare their revenues, expenditures, and pretax profits for their economic activities. In order to determine the tax base, 15% of workers profit participation is deducted together with several exemptions and deductions.Footnote 5 Consequently, income tax is determined by two flat rates, 22% for regular profits and 12% for profits that will be reinvested.

Corporate tax returns are filed electronically every April according to a reporting deadline and correspond to the economic activity of the previous year. A tax box is available for this purpose, through which taxpayers also receive communications about outstanding and deterrent tax issues.

Experiment design

In order to see how accountants and taxpayers participate and interact in firms’ tax evasion practices, a randomized field experiment was conducted, in collaboration with Ecuador’s tax authority, on corporate income tax reporting of fiscal year 2015. The design of this experiment had five different treatments, T1–T5. Each treatment involved sending one tax deterrent notification to either accountants, their taxpayers, or both prior to the reporting deadline, as follows:

-

T1. Accountant placebo notification

This notification was sent only to accountants. It reminds them of the deadline of income tax reporting. This information was also included for all treatments below.

-

T2. Accountant penalty notification.

This notification was sent only to accountants. It reminds them of the penalties in case of tax evasion, mainly years of imprisonment.

-

T3. Accountant risk notification

This notification was sent only to accountants. It shows the number of firms the accountant keeps accounts for and reminds them of good practices for tax reporting.

-

T4. Accountant-Taxpayer (parallel) risk notification

This notification was sent to both accountants and taxpayers. It simultaneously notifies accountants and taxpayers with the same message of treatment T3. Additionally, it informs accountants that their taxpayers were notified, and vice versa, it informs taxpayers that their accountants were notified. In this treatment, at least one taxpayer per accountant is randomly notified.

-

T5. Taxpayer penalty notification.

This notification was sent only to taxpayers. It reminds them of possible penalties in case of tax evasion. It is similar to treatment T2, but instead of notifying accountants, it is taxpayers who are notified. In this treatment, at least one taxpayer per accountant is randomly notified.

The content of each notification is shown with more detail in the online appendix: Notifications of Field Experiment.Footnote 6 All notifications were sent electronically on March 10, 2016 (one month before the deadlines for corporate income tax reporting of fiscal year 2015), via the tax mailbox system. They were sent to different and mutually exclusive groups that were selected randomly from a high-risk treatment-viable universe defined by the Ecuadorian tax authority. (This universe and the corresponding groups are described in the section below.) A copy of the notification was automatically sent also to their email address.

As can be seen, T1, T2, and T3 notifications focus on accountants; T5 focuses on taxpayers; and T4 focus on both. The placebo notification T1 was included in order to isolate the true effect of deterrent notifications from the risk perception generated by a normal deadline reminder without any dissuasive content. The accountant penalty and risk notifications, T2 and T3, were a requirement of the tax authority and were structured following the traditional deterrent notifications used for years over issues like accountancy, monitoring, and assistance.

The last two notifications were included to evaluate the extent to which notifications to accountants improve tax fulfillment more than those to taxpayers. The parallel risk notification T4, unlike T3, simultaneously notifies accountants and taxpayers with reciprocal awareness about the notification. This allows evaluation of whether sending a deterrent notification to both the firm’s accountant and taxpayer (where each knows the other was also notified) is more effective than sending a deterrent notification to the firm’s accountant. On the other hand, the taxpayer penalty notification T5, unlike T2, contacts taxpayers rather than their accountants. This notification in turn allows evaluation of whether a deterrent notification of accountants is more effective than a deterrent notification of taxpayers.

Data

The universe of the experiment was composed by all the firms whose accountants exclusively work for microenterprises (firms with annual revenues less than $100,000) and carry out the accounting of two or more taxpayers in the tax system (between firms and personal small businesses). This restriction was imposed by Ecuadorian tax authority for two reasons. First, medium- and high-income sectors are continuously monitored by semi-intensive and intensive tax enforcement policies. In this sense, there is working openness and data accessibility only for low-income firms. Second, accountants who work for more than one taxpayer are considered risky by the tax authority.Footnote 7

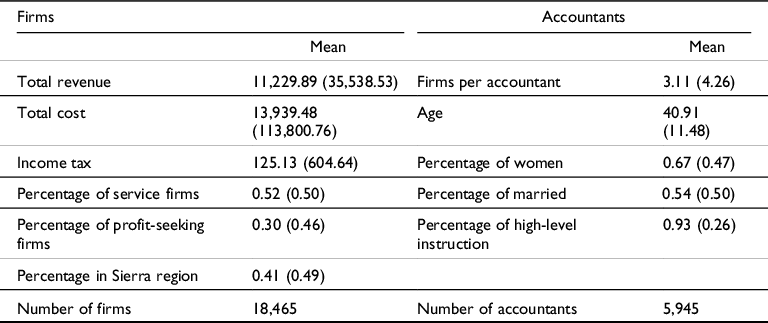

A two-period panel of firms was available for the evaluation: fiscal year 2014 (the pretreatment period or baseline), when no treatment was developed, and fiscal year 2015 (posttreatment period), for which tax deterrent notifications had already been sent. Some statistics of the universe in the pretreatment period are shown in Table 1 for firms and accountants. In total, there were 18,465 firms and 5,945 accountants for fiscal year 2014. This universe represents nearly 20% of all corporate taxpayers in the country.

Table 1. Baseline summary statistics, fiscal year 2014.

Note: This table shows the mean and the standard deviation in parentheses for some variables in the pretreatment period (fiscal year 2014). In the case of qualitative variables, only statistics for most relevant categories are shown.

At the firm level, most are part of the service sector (52%); they are profit-seeking firms (30%) and do their business in the highland region (41%).Footnote 8 At the accountant level, accountants are on average forty years old and work for approximately three firms. Most of them are women (67%), married (54%), and they possess a high level of formal instruction (93%).

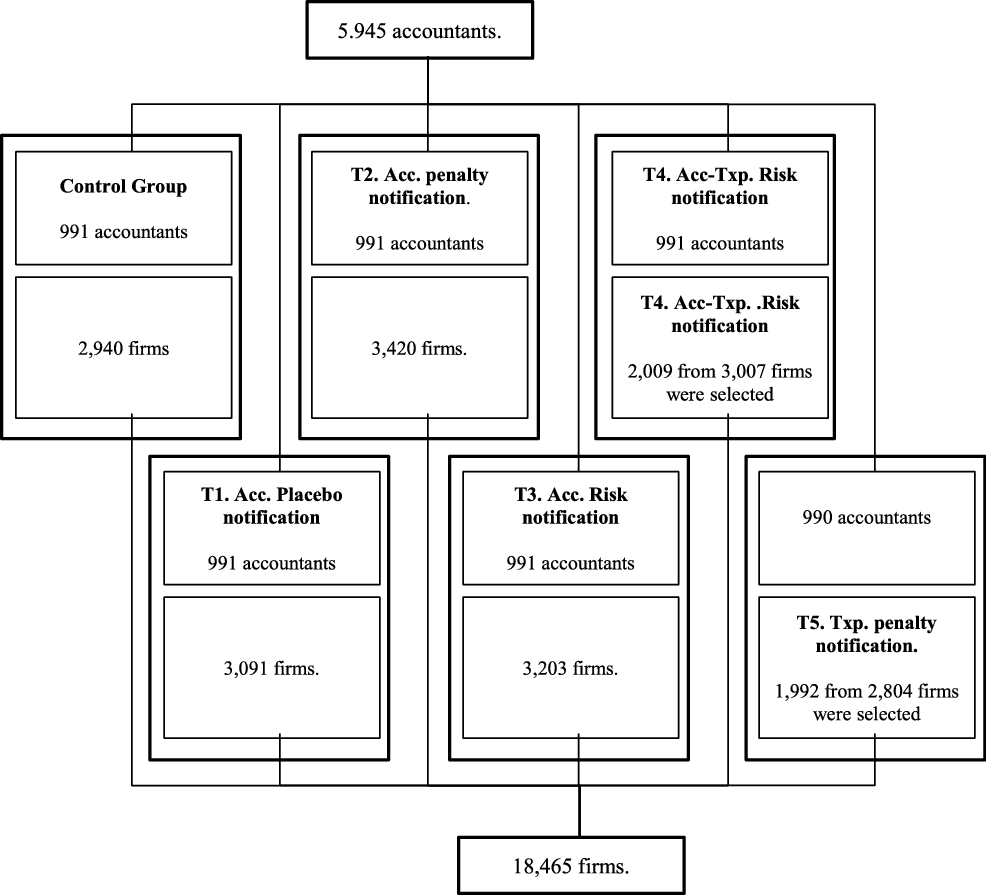

The universe was split randomly into six equal-sized groups at the accountant level, according to the tax deterrent notifications described above. One group did not receive treatment and was used as a control group (i.e., counterfactual), while the other five groups were treated with the notifications from T1 to T5 (i.e., treatment groups). Figure 1 details the experiment design at the baseline.

Figure 1. Experiment design.

Here, the control group consisted of 991 accountants that keep the books of 2,940 firms; the treatment group T1 consisted of 991 accountants that keep the books of 3,091 firms, and so on. It should be recalled that in treatments T1, T2, and T3, all accountants were notified and none of their taxpayers were notified. Only treatments T4 and T5 exchanged the target of notification with taxpayers. Here, treatment group T4 simultaneously notified 991 accountants and 2,009 taxpayers (selected randomly from 3,007 firms). Treatment group T5 only notified 2,804 taxpayers (selected randomly from 3,007 firms) and not their accountants.

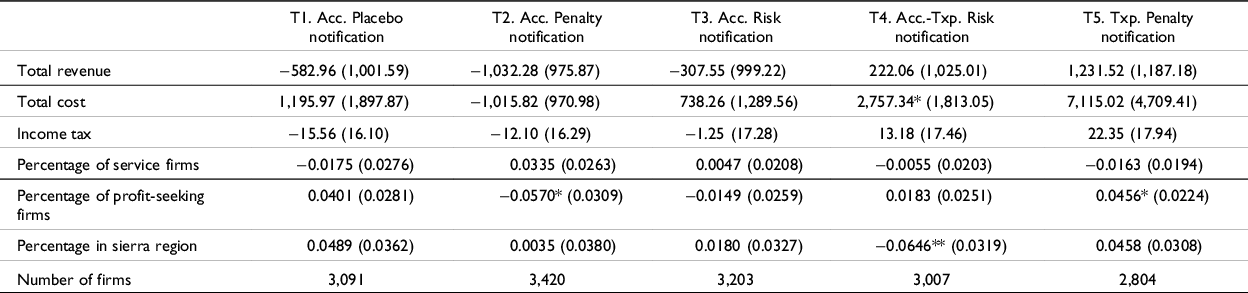

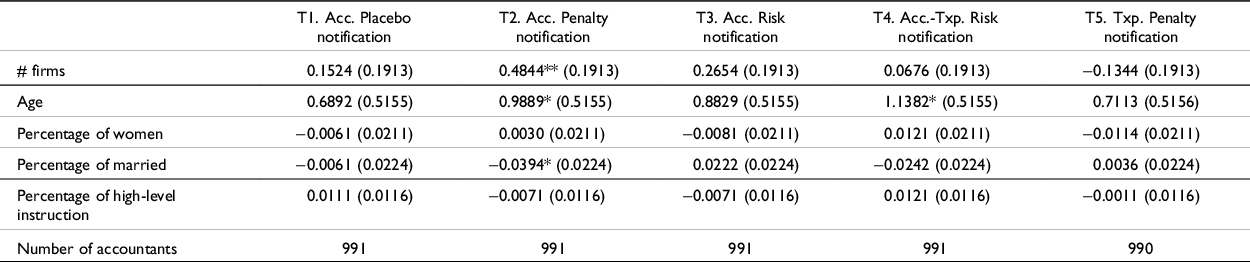

As one would expect, groups must be homogenous prior to intervention. In Tables 2 and 3, almost all mean differences at both the firm and accountant levels between each treatment and control groups are statistically equal to zero for baseline variables.

Table 2. Differences of treatments groups with respect to control groups at the firm level, fiscal year 2014.

Note: Each row shows the regression coefficients of treatments for different dependent variables at the firm level in the pretreatment period. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

Table 3. Differences of treatments groups with respect to control groups at accountant level, fiscal year 2014.

Note: Each row shows the regression coefficients of treatments for different dependent variables at accountant level in the pretreatment period. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

There are very few cases where these differences are significant despite randomization, as happened, for example, at the firm level with the percentage of firms in the highlands region in treatment T4, or at the accountant level with the number of firms for which accountant works in treatment T2.

Information for the posttreatment period (fiscal year 2015) used for impact evaluation was collected until May 31, 2016, that is, around three months after sending notifications and around one month after the reporting deadline. This date was established by the tax authority as the deadline for collecting data. In this period, there were 14,700 firms clustered among 5,131 accountants that filed their tax returns for fiscal year 2015. This is an approximate 20% reduction from the original universe in the pretreatment period.

Validity factors

There are some non-negligible issues concerning the internal and external validity of the experiment that should be considered before analyzing its results. When it comes to external validity, it is important to stress that the randomized control trial universe is a nonrandom segment defined by the Ecuadorian tax authority (firms whose accountants work exclusively for microenterprises and keep the books of two or more taxpayers). Therefore, the empirical results shown cannot be extrapolated or generalized to the whole population of taxpayers. They must be used strictly to explain the behavior of the specified taxpayer segment. Nonetheless, it could be said that the results show an extreme case regarding firms’ responses in the small business sector because the selected firms exhibit a high-risk level for income tax fulfilment according to tax expert criteria.

In terms of internal validity, the randomness of treatments and the incorporation of a placebo intervention in the field design allow for the estimation of a true causal effect of deterrent notifications on income tax reporting. As shown above, the treatments and control groups are statistically balanced as a result of the random selection. With no significant ex ante difference between them, any ex post difference can be attributed to the impact of notifications. Therefore, the identification of causal effects in a firm’s tax reporting is possible by simply comparing groups in the posttreatment period. Moreover, the addition of a placebo allows for the observation of whether these effects are significantly produced by a higher risk perception on deterrent messages or by nondissuasive notifications that could make taxpayers think they are being monitored.

It should also be noted that the country’s tax authority did not intervene in the universe by any enforcement policy after notifications were sent (on March 10, 2016) and before tax information was collected (May 31, 2016). This ensures that the estimated effects are exclusively attributed to the notifications. On the other hand, although external factors such as the negative shock of oil prices and the earthquake that took place in 2016 could have influenced companies’ activities and therefore their tax returns, the randomness of the field experiment guarantees that both the control group and the treatment groups were affected equally by these factors, thus generating no bias on estimations.

Despite these advantages, there is one important issue that potentially threatens the internal validity of results: the attrition due to postponing behavior of firms. As mentioned before, about 20% of the original universe had not filed the tax return prior to May 31, 2016, when data were downloaded for the posttreatment period. Notifications did not require both accountants and taxpayers to provide information about their bookkeeping system. Also, they did not require the fulfillment of any additional tax obligation. Thus, it is reasonable to expect that taxpayers who did not report taxes before the reporting deadline were motivated not to do so by external factors rather than by the experiment itself.

According to the tax authority, the attrition happened because many micro-sized businesses temporally closed or went bankrupt due to the slowdown in the economy at the beginning of 2016 (caused by the shock on oil prices and the earthquake), so they fulfilled the tax reporting later, or they suspended or cancelled their tax registration.

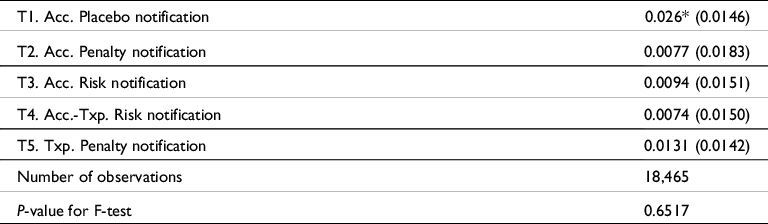

In order to test this fact, a Probit model was estimated for the probability of reporting before May 31, 2016, taking treatments as independent variables and other characteristics as covariables (the detail of these variables is explained in the next section). As seen in Table 4, no notification influenced the firm’s reporting behavior. Only the placebo notification had an effect, but at the 10% significance level.Footnote 9 Furthermore, the p-value for the F-test is very high, so all treatments have no overall significant effect on reporting behavior. It means that the proportion of firms that filed taxes before the posttreatment date were statistically equal between treatments and control groups. Therefore, it can be concluded from these results that notifications did not persuade taxpayers/accountants to report taxes on time, so the attrition problem is negligible in the estimations below.

Table 4. Probit of reporting before May 31, 2016. Marginal effects, fiscal year 2015.

Note: This table shows the marginal effects of reporting in the posttreatment period (fiscal year 2015). All covariable sets were included for both estimations (see the next section). Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

Estimation strategy

The impact estimation of each treatment on declared taxes, revenues, and costs was done through a simple OLS regression model. Here, I used the midpoint relative change of tax reporting variables between fiscal years 2014 and 2015 as outcome variable.Footnote 10 This indicator has the advantage of enclosing the variable’s percentage rate within a bounded interval from −200% to 200%, thus diminishing the variance of estimators. Also, it can be calculated for variables with initial null values, and, among other properties, it is not sensitive to scale and is symmetric and robust to outliers.

Under these considerations, the following lineal model was estimated:

Where Δ% Y ij is the midpoint relative change of tax reporting variables declared by the firm i with the accountant j, between fiscal years 2014 and 2015; T i represents the vector of treatment variables according to treatments described above; X i is the vector of covariables and e ij is the error; α, β, θ are the coefficients of the model.

The treatment variables from T1 to T3 are dummies and indicate whether accountant j was notified. In contrast, the treatment variables T4 and T5 are continuous and represent the proportion of firms that were notified for each accountant j. Because at least one firm is notified randomly in both treatments, these proportions are strictly positive and they approach 1 as more firms are notified. This feature not only makes treatments T4 and T5 comparable to the others but also has the advantage of introducing intensity to these interventions.Footnote 11 It should be noted the variables T1 to T5 are independent and exogenous due to the randomness of the field experiment.

The covariables X i were divided in three sets: firms’ characteristics (economic activity, region, and company type), accountants’ characteristics (age, gender, civil status, and instruction), and time variables (date when tax return must be filed). All these variables were extracted from the tax authority database and were gradually incorporated in the regression model in order to check the robustness of the effect estimation.

In the model (1), the effect of treatments is identified through the set of coefficients β. These coefficients quantify how high the relative change of tax reporting variables in treatments groups compare to the control group. Therefore, their estimation is the mainly interest of this article.

Owing to the experimental design used, it should be noted that observations in the model are independent between firms with different accountants and not among firms that have accountants in common. As such, estimations were corrected by using cluster-robust errors. This correction increases the probability of finding nonsignificant effects due to cluster characteristics (for example, a low cluster size and/or a high intracluster correlation), however, it is consistent with accountant interventions made in the field experiment.

Results

Overall effects

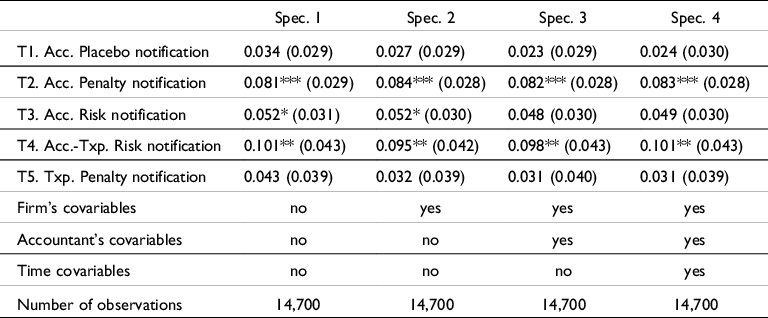

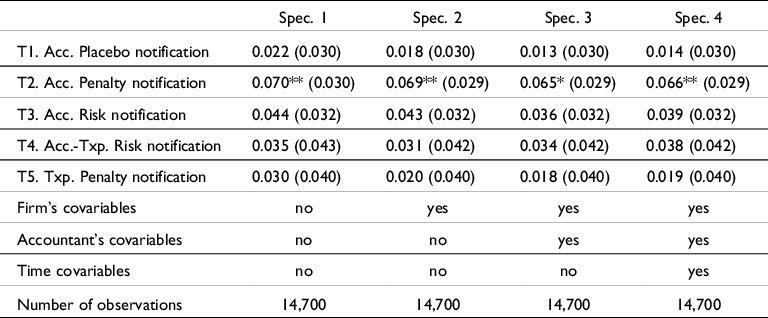

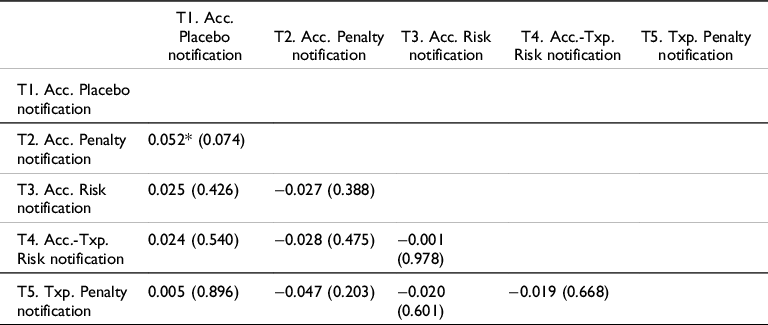

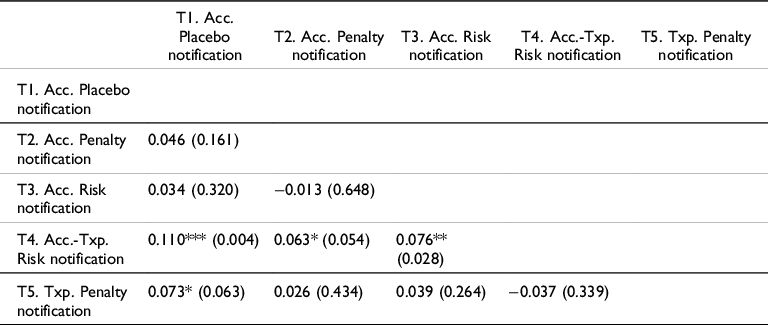

The effects of each treatment on declared total revenue, total cost, and income tax are shown in Tables 5, 6, and 7, respectively. In addition, the differences in effects between any pair of treatments are shown in Tables A1–A3 of the appendix.

Table 5. Impact estimation on declared total revenue, fiscal year 2015.

Note: Each column shows a regression of total revenue relative change on treatments. The specifications 1 to 4 gradually include the covariable sets. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

Table 6. Impact estimation on declared total cost, fiscal year 2015.

Note: Each column shows a regression of total cost relative change on treatments. The specifications spec. 1 to spec. 4 include gradually the covariable sets. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

Table 7. Impact estimation on declared income tax, fiscal year 2015.

Note: Each column shows a regression of income tax relative change on treatments. The specifications spec. 1 to spec. 4 include gradually the covariable sets. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

The more remarkable effects appeared on total revenue in Table 5. Here, the accountant penalty (treatment T2), accountant risk (treatment T3), and parallel risk (treatment T4) notifications had a positive and statistically significant impact. The stronger effect was provided by parallel risk notification (treatment T4), which increased by around 10% with a 5% significance level. The accountant penalty notification (treatment T2) increased revenue by 8.4%, at the 1% significance level (most significant). Finally, the accountant risk notification (treatment T3) increased revenue by approximately 5.2 % with a lower significance level, 10%. The rest of the treatments had a positive effect but were statistically equal to zero.

Interestingly, notifying both accountants and taxpayers (treatment T4) increased more revenues than notifying exclusively accountants with a similar message (treatment T3); however this difference is not significant (see Table A1 of the appendix). This shows a possible interaction between both parties when they are simultaneously contacted by the tax authority in order to reduce the risk perception about notifications. This interaction is intensified not only by reciprocal awareness of the treatment (each party knows that the other was notified), but also by accountants’ private information shown in notifications (number of firms for which they work for). The fact that both know that the tax authority has private information (in this case about the accountant’s business) can increase taxpayers’ risk perception because it could make them aware that the tax authority is strong and capable of obtaining any type of economic information for fiscal purposes.

It is also worth noting the penalty notification had a greater effect on accountants (treatment T2) than on taxpayers (treatment T5); however, as before, this difference is not significant (see Table A1 of the appendix). This result makes sense because accountants are more risk-averse due to their legal liability for firms’ tax reporting and the accounting process they know to reduce the tax payment. This finding is analyzed latter with interaction terms.

Regarding the effects on cost reporting in Table 6, only accountant penalty notifications (treatment T2) had a significant impact. It increased the total cost by approximately 6.5% at the 5% significance level. The rest of the treatments had a positive effect but were statistically equal to zero. This evidence is also observed when the differences between treatments are estimated (see Table A2 of the appendix).

These results are not surprising because firms use cost mechanisms to reduce tax payments. If they increase the declared revenue as a response to tax notification, they could increase the declared cost to eliminate any tax increases.Footnote 12 In the context of the present study, it is likely that an accountant uses this mechanism in lower-risk situations, when deterrent notifications are standard and have been known for a long time by taxpayers without any subsequent tax audit. This seems to happen with the accountant penalty notification (treatment T2), which had a similar format to other tax notifications implemented previously by the Ecuadorian tax authority. For the other treatments, cost overreporting is reduced due to their novelty, either through notifications that included some private information about accountants (treatment T3), through notifications that simultaneously contacted two parties of firms’ social capital (treatment T4), or through notifications that contacted taxpayers with same accountants (treatment T5).

All the patterns above explain the effects on declared income tax. As can be seen in Table 7, the parallel risk notification (treatment T4) is the unique treatment that had a significant positive impact as it increased the declared income tax by approximately 8.3% at the 5% significance level. But not only that, this effect was significantly greater than that obtained by notifying only accountants without knowledge of their taxpayers (treatment T3), as seen in Table A3 of the appendix. As noted before, the interaction between accountants and taxpayers, the reciprocal awareness of both parties, and the accountant’s private information are the main factors in this notification that reduced revenue underreporting and cost overreporting. As a result, a better tax return was generated.

It should be noted that the placebo treatment had no significance in all estimations shown in Tables 5, 6, and 7. That means the results described above are directly related to the deterrent messages, not by the fact that taxpayers might think they are being monitored by tax authority when they are not. This evidence strengthens the reliability of estimations.

In summary, research findings present some interesting conclusions relating to firms’ tax behavior. On the one hand, between all notifications, only parallel-risk notifications (treatment T4) had a statistically significant effect on income tax. As a matter of fact, these notifications produced a greater effect than risk notifications sent exclusively to accountants (treatment T3). This suggests that accountants and taxpayers interact on tax reporting and reach an agreement in order to reduce risk perception effectively.

On the other hand, penalty notifications on accountants (treatment T2) had the most significant effect on declared revenue. These notifications were even more effective at increasing declared revenue than notifications on taxpayers only (treatment T5), but with a nonsignificant difference. Despite that, these notifications did not produce a significant impact on income tax due to a cost-overreporting mechanism that cancelled out the previous effect. This was likely due to electronic sending and the notification’s standard format used by tax authority, which lessen the risk perception of taxpayers.

Interaction effects

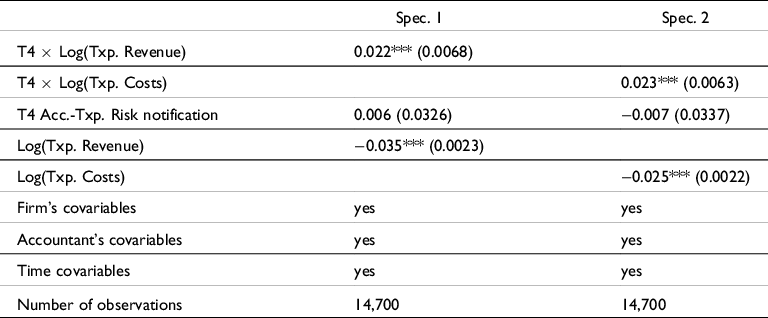

In this section, only the heterogeneity of the parallel risk notification’s impact (treatment T4) is analyzed, by examining the interaction of the treatment with characteristics of both taxpayers and accountants.

Table 8 shows how the effect of parallel risk notification (treatment T4) varies in relation to firm size, according to revenues and cost declared in fiscal year 2014. Here, results show that the higher the revenues and costs, the greater the effect on income tax, with significant interaction terms at the 1% significance level. Considering that the main effect of the treatment is nonsignificant, it could be stated that these results are mainly driven by the size of the firm.

Table 8. Interaction of parallel risk notification (treatment T4) by firm’s variables, fiscal year 2015.

Note: This table only shows estimations for treatment T4. Acc.-Txp. risk notification. Spec. 1 includes the interaction term for firm’s revenues and Spec. 2 includes the interaction term for firm’s costs. All covariable sets were included for both estimations, as well the rest of treatments. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

This evidence is consistent with the microeconomic theory of tax evasion, which supports that tax evasion (as well as risk perception) is greater when taxpayers’ incomes are higher. This means that any dissuasive policy would likely produce more effective tax changes for firms whose revenues and/or costs are higher.

Table 9 displays impact estimations when the number of firms for which accountants work for or their age varies. As shown, the more taxpayers accountants keep books for, and the younger the accountants are, the greater the effect will be on income tax. Despite the expected signs, only the interaction term related to the number of firms is significant at the 10% level. In addition, as occurred before, the main effect of the treatment is nonsignificant.

Table 9. Interaction of parallel risk notification (treatment T4) by accountant’s variables, fiscal year 2015.

Note: This table only shows estimations for treatment T4. Acc.-Txp. risk notification. Spec. 1 includes the interaction term for numbers of firms per accountant and Spec. 2 includes the interaction term for accountant age. All covariable sets were included for both estimations, as well the rest of treatments. Robust standard errors are in parentheses. They were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

These results make sense. It is expected that the effect of notifications on accountants is high when the number of taxpayers for whom they work is important, as their responsibility in complying with tax obligations and their perception of risk increases. By contrast, the inverse effect regarding to accountant’s age may evidence their experience with carrying out legal or illegal practices for reducing tax liability, which would help to mitigate a company’s risk perception.

Conclusions

Tax evasion could be analyzed as a social economic phenomenon through which several parties interact in order to reduce tax payment. Here, accounts are key agents owing to their privileged information on accounting rules and how to apply them, their liability in the fulfillment of tax obligations, the fact that they can work for several firms, and the possible compensation mechanisms to mitigate the risk of being detected.

Accountants have been the empirically invisible party in the design of tax enforcement policies. Although there have been an increasing number of impact evaluations of deterrent policies on firms’ tax behavior, the effect of deterrence actions on accountants and their participation in tax evasion remains unknown beyond the theoretical implications of agency models.

This study provides the first empirical evidence on the causal effect of deterrent notifications on accountants. Through a randomized field experiment conducted in Ecuador’s tax system, it was shown that simultaneous deterrent notifications of both accountants and taxpayers with reciprocal awareness (treatment T4) increase firms’ declared income tax by approximately 8.3% at the 5% significance level. This effect was the only significant one in the experiment; it was even significantly higher than the effect caused by the notifications focused on accountants only (treatment T3). Moreover, it was shown that penalty notifications on accountants (treatment T2) increased firms’ declared revenue by 8.4% at the 1% significance level. This effect was even higher than the effect caused by the penalty notifications focused on taxpayers only (treatment T5), but with a nonsignificant difference. It should be noted that despite the fact that penalty notifications of accountants were more effective in firms’ declared revenue, they did not generate a significant impact on declared income tax.

These results suggest that accountants have an active role in a firm’s tax reporting. One the one hand, there is evidence of interaction between the accountant and taxpayer when both are notified, which increases the perceived risk by firms and stimulates better tax reporting. On the other hand, there is a cost mechanism through which accountants apparently cancel the effect of notifications. Even though firms increase the declared revenue when their accountants are notified, they seem to overreport costs to reduce tax payments.

The systemic relationship between accountants and taxpayers and evasion mechanisms of cost overreporting are innovative clues to understanding accountants’ behavior in a firm’s tax reporting and to design better tax enforcement policies. It is recommended to extend this kind of analysis to other parties that are involved in the social capital of the firm, such as suppliers, owner’s familiars, or shareholders, and evaluate their reaction to tax monitoring.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/lar.2022.90

Appendix. Impact differences between treatments

Table A1. Impact differences on declared total revenue, fiscal year 2015.

Note: This matrix shows the difference between any pair of treatments on total revenue relative change. All covariable sets were included for the estimation. P-values are in parentheses. Robust standard errors were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

Table A2. Impact differences on declared total cost, fiscal year 2015.

Note: This matrix shows the difference between any pair of treatments on total revenue relative change. All covariable sets were included for the estimation. P-values are in parentheses. Robust standard errors were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.

Table A3. Impact differences on declared income tax, fiscal year 2015.

Note: This matrix shows the difference between any pair of treatments on total revenue relative change. All covariable sets were included for the estimation. P-values are in parentheses. Robust standard errors were corrected by accountant cluster.

*p < .1; ** p < .5; ***p < .01.