No CrossRef data available.

Article contents

The Taxation of the Annuity Fund and Some Practical Points Arising Therefrom

Published online by Cambridge University Press: 18 August 2016

Extract

The subject of annuities is one which has rarely been discussed by this Institute and the two classic papers of modern times on the subject (Oakley, J.I.A. Vol. XLIII, p. 281 and Elderton and Oakley, J.I.A. Vol. LV, p. 211) deal very largely with the mortality aspect of the problem. Income Tax is also a subject which has received but scant attention in our literature, the most modern paper in the Journal being that by Faulks written in 1903 (J.I.A. Vol. xxxvIII, p. 297); a later paper was read in Edinburgh in 1922 (Barnett, T.F.A. Vol. IX, p. 65) but even this is quite out of date as regards annuities because the Finance Act of 1923, following the recommendations of the Colwyn Committee, introduced important new factors into the taxation of the annuity fund. Recknell's paper in J.S.S. (Vol. 11, p. 93) suffers from the same disadvantage, having been written in 1921.

- Type

- Research Article

- Information

- Copyright

- Copyright © Institute and Faculty of Actuaries 1937

References

page 447 note * It is rather interesting to note that while under Schedule 5 of the Assurance Companies Act of 1909 offices must return their immediate annuity business in the fullest possible detail, they need only make a bare statement of the total amount of deferred annuities in force and the corresponding annual premiums.

page 453 note * The basis of assessment under Case I of Schedule D is the profit for the office year ending in the preceding fiscal year.

page 455 note * In Type C the actual balance of tax on interest is £5000 (i.e. tax on £30,000) but only £4000 (i.e. tax on £16,000) can be used at once; the balance of tax on £4000 can only be used against subsequent liability for tax on profits.

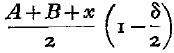

page 469 note * If x is the profit applicable to the annuity fund it is strictly more correct to work with a mean annuity fund of  solving the equation for x but this refinement is not worth the trouble. The profit in the example given is £10,624 by this method.

solving the equation for x but this refinement is not worth the trouble. The profit in the example given is £10,624 by this method.