No CrossRef data available.

Article contents

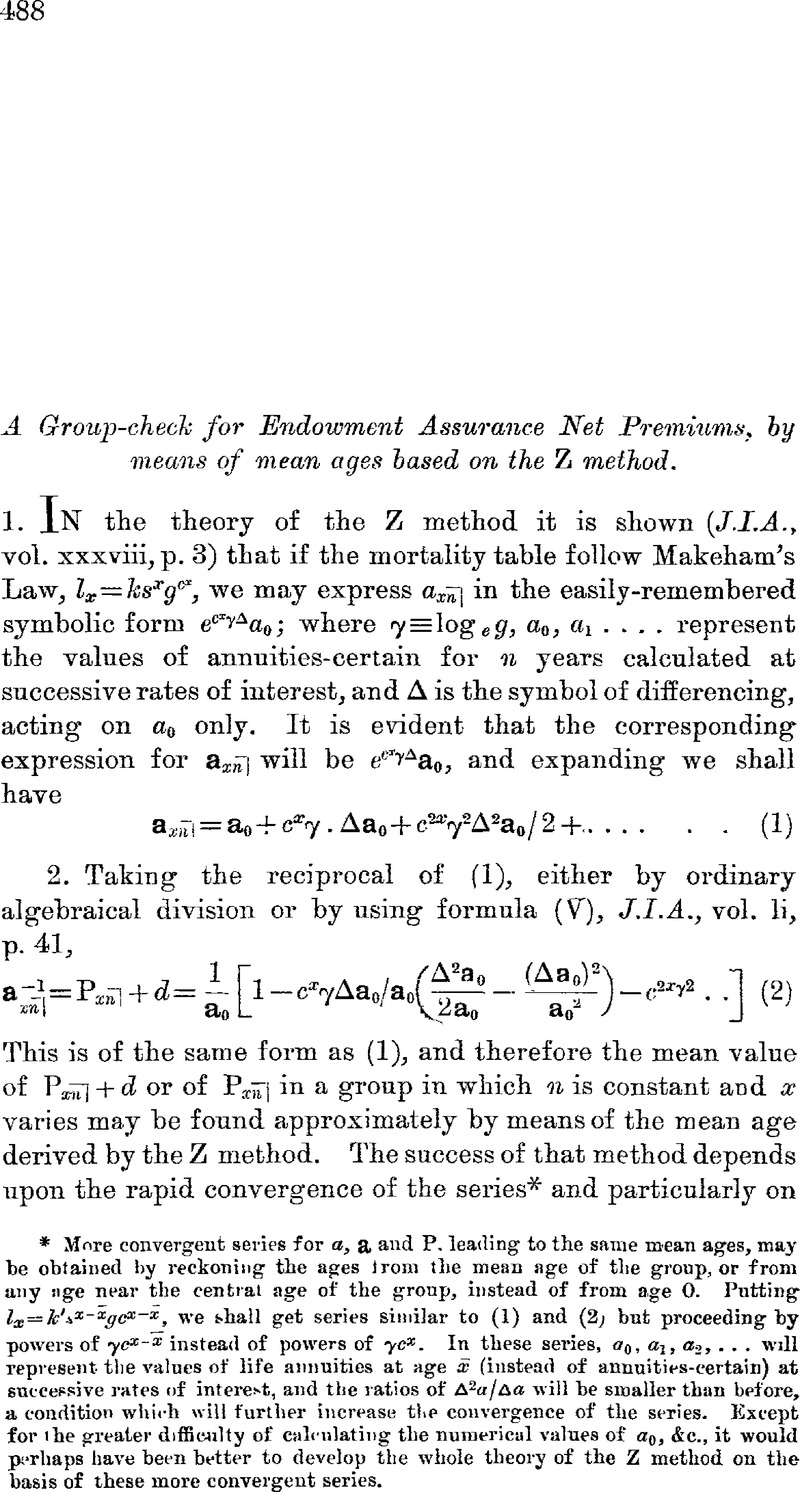

A Group-Check for Endowment Assurance Net Premiums, by means of Mean Ages Based on the Z Method

Published online by Cambridge University Press: 18 August 2016

Abstract

- Type

- Other

- Information

- Copyright

- Copyright © Institute and Faculty of Actuaries 1921

References

page 488 note *

More convergent series for α, a and P. leading to the same mean ages, may be obtained by reckoning the ages from the mean age of the group, or from any age near the central age of the group, instead of from age O. Putting ![]() we shall get series similar to (1) and (2) but proceeding by powers of

we shall get series similar to (1) and (2) but proceeding by powers of ![]() instead of powers of

instead of powers of ![]() In these series, α

0, α

1, α

2, … will represent the values of life annuities at age

In these series, α

0, α

1, α

2, … will represent the values of life annuities at age ![]() (instead of annuities-certain) at successive rates of interest, and the ratios of

(instead of annuities-certain) at successive rates of interest, and the ratios of ![]() will be smaller than before, a condition which will further increase the convergence of the series. Except for the greater difficulty of calculating the numerical values of α

0, &c., it would perhaps have been better to develop the whole theory of the Z method on the basis of these more convergent series.

will be smaller than before, a condition which will further increase the convergence of the series. Except for the greater difficulty of calculating the numerical values of α

0, &c., it would perhaps have been better to develop the whole theory of the Z method on the basis of these more convergent series.

page 490 note * The tests in paragraphs 4 and 5 are rather severe, since equal weights of maturity-ages ranging from 40 to 70 are hardly likely to arise in practice.

A correction has been issued for this article:

Linked content

Please note a has been issued for this article.