1. Introduction

Financial inclusion, or the extent to which people have access to useful and affordable financial products that meet their financial needs, is a cornerstone of economic development (Demirgüç-Kunt et al. Reference Demirgüç-Kunt, Klapper, Singer and Ansar2022). Access to financial products at banks and other brick-and-mortar institutions, as well as digital-only services – such as with a mobile money or other fintech provider – can allow individuals to formally save, borrow, make payments, and manage financial emergencies. While formal financial services can benefit households, adults need to understand the risks and costs of these services to use them effectively. Fraud, over-indebtedness, and misunderstandings about account terms and fee structures pose serious risks to users that lack proper knowledge and financial education (Garz et al. Reference Garz, Giné, Karlan, Mazer, Sanford and Zinman2021).

Using data from the Global Findex 2021 survey for 79 middle- and low-income (“developing”) countries, we present descriptive statistics on unbanked adults (who do not have an account at a formal financial institution, including mobile money services) and on adults with an inactive account (who did not make a deposit, withdrawal, or digital payment in the past year). We also present new data on financial capability and discuss the role improved financial capability could play in motivating and enabling adults to use financial services safely and to their benefit. These findings are supported by results from multivariate regressions.

Our paper makes three contributions. First, we contribute to the literature by quantifying the number of unbanked around the world and identifying who the unbanked are in terms of individual characteristics such as gender, income, educational attainment, age, and employment status. Understanding the demographic and income characteristics of the unbanked in a specific economy can help focus research and educational outreach to the populations most likely to benefit from interventions. It can also inform product design and policies to ensure that available financial services reflect the abilities and needs of the target audience.

Second, we document and examine the reasons the unbanked give for not having an account. In addition, for a subsample of 25 Sub-Saharan African countries, we examine why unbanked adults do not have a mobile money account. Understanding why people do not have an account could help in designing targeted financial education policies focused on expanding access to formal financial services.

Third, we document the reasons adults who have an account give for not using their account. As with the unbanked, understanding why people with an account choose not to use their account can help target financial education on the benefits of formal financial services.

Our findings can be summarized as follows. The Global Findex 2021 data on who the unbanked and underbanked account holders are, combined with insights into the barriers they face, point to the role financial education can play in building financial aptitude as a key strategy for increasing financial inclusion. In particular, we document that 1.4 billion adults –or 24 percent of adults – worldwide remain without a financial account, making them unbanked. Seven countries are home to more than half of the world’s unbanked population. We also show that unbanked adults are significantly more likely to belong to typically underserved groups, such as women, poor adults, less-educated adults, and young adults. The data on self-reported reasons for not having an account show that a lack of financial abilities seems to constitute an important barrier.

Furthermore, in two case studies we examine how adults with an account use it. We consider India, which, at 35 percent, has the world’s highest rate of inactive accounts – seven times the average for developing countries excluding India – and we ask adults with inactive accounts why they do not use them. We also examine whether adults in Sub-Saharan Africa can use their mobile money account without help from an agent, friend, or family member. These data point to an opportunity for financial education to build stronger financial capability in order to improve efficient and effective use of accounts.

This paper is organized as follows. In section 2, we review the literature on the importance of financial inclusion for development and the link between financial literacy and education and the use of financial services. In section 3, we describe the Global Findex 2021 database. In section 4, we explore what the Global Findex 2021 data reveal about where and who the unbanked are. In section 5, we investigate the self-reported barriers to account ownership. In section 6, we explore the reasons why account owners do not use their accounts using a country case study on the barriers behind the inactivity rates in India. We further explore whether mobile money account owners in Sub-Saharan Africa are able to use their mobile money accounts without help. Section 7 concludes.

2. Literature review

2.1. Why financial inclusion matters for development

The use of financial services is associated with numerous positive outcomes, including greater savings (Breza et al. Reference Breza, Kanz and Klapper2020; Blumenstock et al. Reference Blumenstock, Callen and Ghani2018); crime reduction (Wright et al. Reference Wright, Tekin, Topalli, McClellan, Dickson and Rosenfeld2017); more efficient wage payments (Dusza Reference Dusza2016); decreased fraud and administrative inefficiencies (Muralidharan et al. Reference Muralidharan, Niehaus and Sukhtankar2016); greater female workforce participation (Field et al. Reference Field, Pande, Rigol, Schaner and Moore2021); and increased crop yields for farmers (Lasse et al. Reference Lasse, Giné, Goldberg and Yang2016). Additionally, the use of formal financial services has important implications for the ability of account holders to weather negative economic shocks, both through facilitating greater savings (Pomeranz and Kast Reference Pomeranz and Kast2022) and allowing for people to more easily share money and risk with others (Riley Reference Riley2018; Jack and Suri Reference Jack and Suri2014).

Digital financial services, such as mobile money, have been shown to protect users from some of the consequences of unexpected income drops by allowing users to easily receive payments from geographically dispersed social networks (Jack and Suri Reference Jack and Suri2014) and improving risk-sharing within communities (Riley Reference Riley2018). Mobile money is also associated with an increased likelihood that users will access formal health services when sick or injured (Haseeb and Cowan Reference Haseeb and Cowan2021). Digital payments make the practice of sending and receiving remittance payments more efficient, resulting in greater payment values and consequently, greater consumption in rural communities (Lee et al. Reference Lee, Morduch, Ravindran, Shonchoy and Zaman2021; Munyegera and Matsumoto Reference Munyegera and Matsumoto2016).

The use of formal financial services also has implications for gender equality. Account ownership is associated with greater financial independence and empowerment for women, allowing them increased decision-making power within their households and greater needs-specific spending (Ashraf et al. Reference Ashraf, Karlan and Yin2010). Female account ownership is also associated with increased spending on nutritious food (Aker et al. Reference Aker, Boumnijel, McClelland and Tierney2016; Prina Reference Prina2015), increased savings that can be used in financial emergencies (Pomeranz and Kast Reference Pomeranz and Kast2022), and even changing social norms regarding female employment (Field et al. Reference Field, Pande, Rigol, Schaner and Moore2021). The use of digital financial services has also been found to positively impact female development outcomes, lowering rates of poverty and increased consumption for women (Suri and Jack Reference Suri and Jack2016), reducing reliance on high-risk income sources like transactional sex (Jones and Gong Reference Jones and Gong2021), and reducing both travel and wait times to receive benefits like school subsidies for their children (Gelb et al. Reference Gelb, Mukherjee, Navis, Akter and Naima2019).

2.2. Financial literacy, education, and use of financial services

Previous studies have examined the relationship between greater financial literacy and financial education and use of financial services. Multiple studies have found that people with more years of general education are more likely to save and invest, leading to higher financial market participation and lower probabilities of bankruptcy (e.g., Cole et al. Reference Cole, Paulson and Shastry2014). Furthermore, a recent meta-analysis of the evidence highlights the effectiveness of financial education on financial knowledge and behavior (Kaiser et al. Reference Kaiser, Lusardi, Menkhoff and Urban2022). Surveys measuring levels of financial literacy have also shown relationships with usage of financial services and savings and borrowing (Klapper and Lusardi Reference Klapper and Lusardi2020; OECD 2020).

It could also be possible that account usage and the experience with using an account can improve financial literacy. Cross-country analysis finds higher financial literacy to be associated with greater financial inclusion as measured by account ownership, debit card ownership, using an account to save, and using a debit card in past year at the country level (Grohmann et al. Reference Grohmann, Klühs and Menkhoff2018). For instance, “learning by doing” financial literacy training conducted while opening an account was associated with more frequent and savvy account usage (Lee et al. Reference Lee, Morduch, Ravindran, Shonchoy and Zaman2021; Breza, et al. Reference Breza, Kanz and Klapper2020). Presenting customers with simplified key facts about financial products likewise was associated with better product selection (Giné et al. Reference Giné, Cuellar, Mazer and Cuellar2017). In fact, the use of digital payment tools and platforms was found to be associated with higher digital literacy, at all levels of financial literacy (Lo Prete Reference Prete2022). Additionally, easily available real-time information on account balances can increase user trust and account usage (Bachas et al. Reference Bachas, Gertler, Higgins and Seira2021).

3. Data

This paper uses data from the World Bank Global Findex (Demirgüç-Kunt et al. Reference Demirgüç-Kunt, Klapper, Singer and Ansar2022) to document current trends in account ownership and usage and identify ongoing barriers to financial inclusion.Footnote 1 The Global Findex is the world’s most comprehensive database on financial inclusion and the only data source collected directly from users of financial services that allows for global and regional cross-country analysis to provide a rigorous and multidimensional picture of how adults save, borrow, make payments, and manage financial risks. The data can be used to also identify gaps in access to and usage of financial services by specific groups. Since 2011, the database has triennially collected indicators on access to and use of formal and informal financial services and digital payments, and behaviors that enable financial resilience.

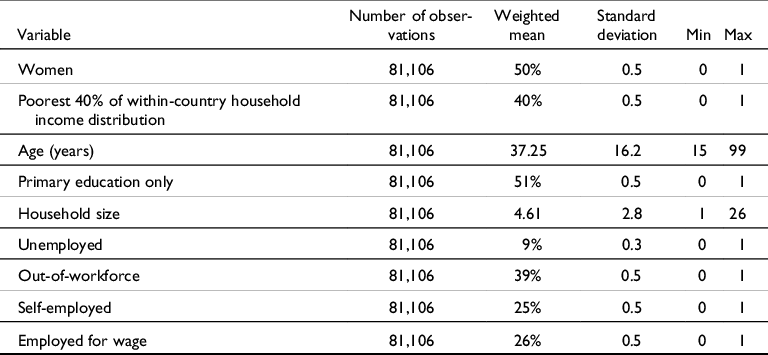

The 2021 edition is based on nationally representative surveys of 128,000 adults in 123 countries, including both high-income and developing countries. Fewer than 4 percent of the unbanked live in high-income countries. Thus, in our empirical analysis we focus on developing countries.Footnote 2 Table 1 presents the summary statistics of the individual characteristics for the 79 developing countries used in our multivariate regression analysis. In our sample, 50 percent of adults are women and the average age of adults is 37.25 years. Just over half of adults in the sample (51 percent) have primary education only. The average household size is 4.61. In terms of employment status, 26 percent of adults are employed for a wage, 25 percent are self-employed, 9 percent are unemployed, and 39 percent are out of the labor force.

4. Who are the unbanked?

Our measure of financial inclusion is ownership of an account – that can be used to store money and send or receive payments – at a regulated financial institution, including mobile money service providers. Looking at all countries covered in the database, the Global Findex 2021 data find that globally, 76 percent of adults surveyed had a financial account in 2021 – a 50 percent increase from 2011, when only 51 percent of the global adult population had an account.Footnote 3 Yet, about 1.4 billion adults – or 24 percent of adults – worldwide remain without a financial account (Figure 1) or are unbanked. The share of unbanked as a percent of the population varies significantly across countries (Table A.1). While there are, on average, virtually no unbanked in high-income countries (4 percent on average), the share increases to 29 percent in developing countries, ranging from 2 percent in Mongolia to a staggering 94 percent in South Sudan. Differences across countries are driven by polices, regulations, and economic development (Allen et al. Reference Allen, Demirguç-Kunt, Klapper and Martinez Peria2016) but are beyond the scope of this paper.

Figure 1. Adults with no account, 2021.

Source: Global Findex Database (2021).

Note: Data are not displayed for economies in which the share of adults without an account is 5 percent or less, or for economies in which no data were available.

Though financial inclusion has increased across developing countries, those increases have not happened evenly across all countries. Nor have they always occurred equitably, such that underserved adults have been able to benefit from increases in financial access. Here, we examine the data revealing who the unbanked are.

4.1. An outsized share of unbanked adults live in a few countries

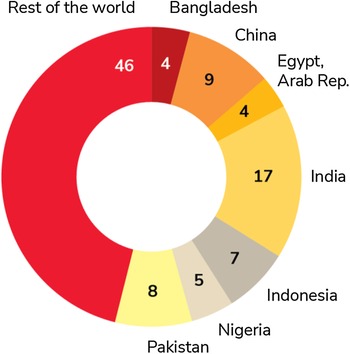

Seven countries are home to more than half of the world’s unbanked population, equaling 740 million people. The countries are Bangladesh, China, Egypt, India, Indonesia, Nigeria, and Pakistan. This concentration is partly a function of the large populations in these countries. For example, in China and India, about 80 percent of adults have a bank account. Yet the sheer magnitude of their populations leaves many millions of their people without bank accounts – 130 million and 230 million, respectively (Figure 2). Pakistan, for its part, has 115 million unbanked adults and Indonesia has 100 million. Unfortunately, we observe little progress over time, the top five countries with the largest share of the world’s unbanked were the same in 2017 and 2021.

Figure 2. Global distribution of adults with no account (%), 2021.

Source: Global Findex Database (2021).

4.2. The unbanked include outsized shares of more vulnerable populations, including women, poor, and rural adults

Beyond where the unbanked live, the Global Findex 2021 offers some insights into who they are.

About 740 million women do not have an account, representing 13 percent of all adults globally and 54 percent of the unbanked. Global Findex 2021 data show no relationship between increases in account ownership and declines in the gender gap across developing countries. On the contrary, countries that would seem to have similar economic environments for financial inclusion and equal track records at increasing financial account ownership (or not) show radically different patterns related to gender and account ownership.

India, for example, has achieved significant and equitable growth in account ownership, such that the country has now no discernible gender gap. Yet in other countries with successful increases in overall account ownership, women still represent the majority of the unbanked. For example, Brazil, China, Kenya, and Thailand have relatively high rates (about 80 percent of higher) of account ownership compared with their developing economy peers, and yet a majority of their unbanked are women. Türkiye also has a 74 percent account ownership rate, yet of the 26 percent of adults who are unbanked, 71 percent are women. Women also make up the majority of unbanked adults in countries with account ownership rates below 50 percent, such as Egypt, Guinea, and Pakistan.

Unsurprisingly, low household income also correlates with a lack of account ownership, such that the poorest 40 percent of households worldwide make up nearly half of all the unbanked. As with gender, income level affects the unbanked population averages more in some places than in others. In East Asia and Pacific, for example, 53 percent of unbanked adults overall are in the poorest 40 percent of households, whereas in China specifically (a country with an 89 percent account ownership rate), a higher percentage, 60 percent, of the unbanked live in the poorest 40 percent of households.

The impact of income on account ownership, however, is likely to be influenced by multiple co-existing factors, also linked to income, including gender, formal employment (adults who are unemployed or out of the workforce – another category in which women are over-represented – tend to live in poorer households), rural residence (rural adults are more likely to have lower incomes than urban residents), educational attainment (less-educated adults tend to be poorer), and age (younger adults aged 25 and under and older adults aged 65 and over are both more likely to live in lower-income households than prime working-age adults). Each of these sub-factors is also associated with being unbanked, as discussed below.

Employment status is strongly associated with account status in several countries: Seventy percent of unbanked adults are unemployed or out of the workforce across the Middle East and North Africa; in Egypt specifically, where 73 percent of adults are unbanked, 65 percent are unemployed or out of the workforce.

The unbanked are also more likely to live in rural areas.Footnote 4 In Sub-Saharan Africa, for instance, rural residents represent 62 percent of unbanked adults. In Tanzania, 71 percent of the country’s unbanked live in rural areas; in Uganda and Zambia, 70 percent and 67 percent of the unbanked do.

Low educational attainment, which the Global Findex defines as having a primary education or less, is also associated with unbanked status, in that globally, 64 percent of unbanked adults have low education. That share varies by region and economy. In Sub-Saharan Africa, for example, 74 percent of the unbanked have low education. That share is even higher in Mozambique, where 90 percent of unbanked adults have low education; in Côte d’Ivoire where 83 percent do; and in Tanzania, where 88 percent of the unbanked have low education. In Kenya, where 79 percent of adults have an account, 62 percent of unbanked adults have a primary education or less.

Multivariate regression results with country fixed effects reported in Table 2, columns 1–2, for the sample of developing countries confirm these findings.Footnote 5 They show that unbanked adults in these countries are significantly more likely to belong to typically underserved groups, such as women, poor adults, less-educated adults, and young adults.Footnote 6 They also show that women with less formal education are significantly more likely to be unbanked.

Table 2. Multivariate analysis – Individual characteristics of the unbanked, 2021

Note: All regressions use individual-level data for adults in 79 low- and middle-income countries and are estimated using ordinary least squares with robust standard errors. Summary statistics are shown in Table 1. The dependent variable in columns 1–2 is equal to 1 if the respondent does not have an account at a financial institution or with a mobile money service (and equal to 0 otherwise). The dependent variable in columns 3–4 is equal to 1 if the respondent is unbanked and predicts they would be unable to use an account at a financial institution without help. All regressions include country fixed effects. Omitted variables include males, adults belonging to richest 60 percent of households, adults with secondary education or above, and adults employed for wage. Standard errors in parentheses. *, **, and ***indicate significance at 10%, 5%, and 1%, respectively.

5. Why unbanked adults do not have an account

To understand why the unbanked do not have an account, the Global Findex 2021 survey asked the unbanked directly why they did not have an account. Specifically, globally, unbanked adults are asked why they do not have an account at a financial institution (excluding mobile money).Footnote 7 Moreover, in Sub-Saharan African countries, where mobile money accounts are widespread, the survey also asks the unbanked why they do not have a mobile money account.

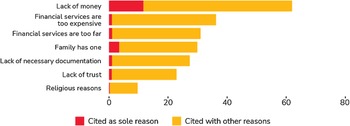

5.1. Reasons for not having a financial institution account

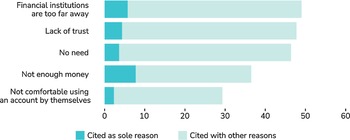

“Lack of money” was, unsurprisingly, the most common answer given by 62 percent of unbanked adults for not having a financial institution account (excluding mobile money). However, only 12 percent said that not having enough money was their only reason for not having an account (Figure 3). Respondents were allowed to offer multiple reasons, and, on average, most gave two. These findings suggest that if, for example, the costs of opening and maintaining an account or a minimum balance requirement were reduced, adults might be able to have an account.

Figure 3. Adults with no account (%) citing a given barrier as a reason for having no account at a bank or similar financial institution, 2021.

Source: Global Findex Database (2021).

Note: Respondents could choose more than one reason.

The second most common answer, given by 36 percent of unbanked adults worldwide, is that financial services are too expensive. High costs have an even larger impact in Latin America and the Caribbean, where 60 percent of unbanked adults say that costs keep them from having an account. This is a region with less bank competition, greater bank concentration, and higher bank overhead cost-to-total assets ratios, which are associated with higher costs for banking services (Gershenson et al. Reference Gershenson, Lambert, Herrera, Ramos, Rousset and Torres2021). In addition, “mystery shopping” exercises have found that customers often receive bad financial advice or misinformation from bank staff (Mazer et al. Reference Mazer, Giné and Martinez2015).

Distance is the next most common barrier, named by 31 percent of unbanked adults. Technology-enabled accounts, such as those offered by bank and mobile money agents, could help reach adults living too far from a bank branch or ATM. However, low levels of financial and digital literacy might make it difficult for potential customers to use these products without the help of an agent or family member, which might increase the risk of financial abuse (Annan, Reference Annan2022a).

An almost equal share of unbanked adults, 30 percent, said that they do not have an account because a family member already has one. This reason is more common among women than men in some countries, including Türkiye, where 39 percent of unbanked women mentioned this reason compared to 25 percent of unbanked men. Adults in Algeria, Bolivia, Nepal, Pakistan, and Tunisia also had a high share of adults saying they did not need an account because a family member had one – all of these countries also have gender gaps in account ownership. Bridging the gender gap in financial literacy might encourage more women to manage their own account (Hasler and Lusardi Reference Hasler and Lusardi2017).

Documentation also hampers account ownership according to the 27 percent of unbanked adults who said they did not have the formal identification or documentation needed to open an account. Greater access to national identification might require governments to simplify the process to apply, as well as educating adults how to apply for identification for themselves and their children. Interestingly, in developing countries, of the 27 percent of unbanked adults who report that identification is a barrier, 70 percent of them report having national identification. Improving access to identification is often not enough to increase account ownership because national identification does not always satisfy additional bank requirements when opening an account, sometimes beyond regulatory know-your-customer requirements. For example, customers often need to show local documentation as well – such as a utility bill with a home address – and this may be difficult to produce.

Distrust of the financial system plays a role for 23 percent of unbanked adults. In Europe and Central Asia and in Latin America and the Caribbean, about a third of unbanked adults cited distrust of the banking system as a reason for not having an account. This appears to both reflect legacies of bank appropriations (such as in the former Soviet Union) and the relatively high banking costs found in Latin American countries (Gershenson, et al., Reference Gershenson, Lambert, Herrera, Ramos, Rousset and Torres2021). This points to the importance of educating and informing consumers on interest rates and how to efficiently use formal financial services in order to build trust, and greater usage, of bank products.

Finally, 10 percent of unbanked adults globally cited religion as a barrier. In the Middle East and North Africa, where adults might prefer Sharia-compliant banking services, religion is more frequently cited as a barrier. For example, 24 percent and 19 percent of the unbanked in Iraq and Morocco, respectively, cited religion as a barrier. There are also gender differences in citing religion as a barrier to account ownership. For example, in Morocco, 14 percent of unbanked men compared to 23 percent of unbanked women cite religion as a barrier. Sharia-compliant savings and credit products can help address this barrier (Karlan et al. Reference Karlan, Osman and Shammout2021). However, prices on Sharia-compliant products are typically more expensive (Hussain et al. Reference Hussain, Shahmoradi and Turk2016), stressing the importance that users understand the often more complicated terms and fees.

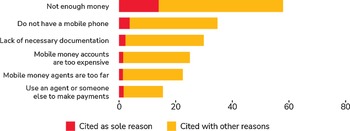

5.2. Lack of access to technology is a leading barrier to using a mobile money account

Account ownership has increased in certain countries due to the adoption of digital technologies, including mobile phones. Since 2014, Sub-Saharan Africa has been the global leader in mobile money account ownership. As of 2021, 33 percent of adults reported having a mobile money account in the region, compared with only 10 percent of adults globally. In this way, mobile money has played a foundational role in driving increased account ownership in Sub-Saharan Africa.

Given such high mobile money adoption in Sub-Saharan Africa, the Global Findex 2021 survey included a dedicated module that asked unbanked adults in that region (i.e., adults with neither a mobile money account nor an account at a traditional financial institution, like a bank) specifically why they did not have a mobile money account. As with the general set of questions about financial institution accounts, respondents could give more than one reason for not having a mobile money account, though most gave fewer than two.

Consistent with the previous answers, nearly 60 percent of unbanked adults in Sub-Saharan Africa said that a lack of money was their reason for not having a mobile money account. Only 14 percent of the unbanked said it was their only reason, however (Figure 4).

Figure 4. Adults with no account (%) citing a given barrier as a reason for not using a mobile money account, 2021.

Source: Global Findex Database (2021).

Note: Respondents could choose more than one reason.

The second most common reason was lack of a mobile phone, given by 35 percent of unbanked adults in Sub-Saharan Africa. There is an important gender component here, as unbanked women in Sub-Saharan Africa were 7 percentage points more likely than unbanked men to cite lack of a mobile phone as a reason for not having a mobile money account. Lack of identification is the third most common barrier, given by 30 percent of unbanked adults. Two other reasons, cited each by about a quarter of the unbanked, are that mobile accounts are too expensive or mobile money agents are too far away. Finally, 16 percent of unbanked adults said they made payments using an agent or someone else, such as a family member or friends, and therefore did not need an account of their own.

5.3. Many unbanked adults could not use an account without help

The data on barriers to account ownership for the unbanked hint at factors that may affect their ability to leverage financial services to their benefit. To dig deeper, the Global Findex 2021 asked unbanked adults whether they would be able to use an account without help, if they opened one.

The responses revealed a significant finding among the unbanked. In developing countries, 64 percent of unbanked adults said they could not use an account at a financial institution without help. In some countries such as Pakistan and South Sudan, the proportion was as high as 80 percent of unbanked adults (Figure 5).

Figure 5. Adults with no account who said they could not use an account at a bank or similar institution without help (%), 2021.

Source: Global Findex Database (2021).

Here, too, there is a gender component. Unbanked women in developing countries are on average 10 percentage points more likely than unbanked men to say they would need help using an account at a financial institution. That rate understates the challenge in certain countries like Nigeria, where women are twice as likely as unbanked men to say they would need help.

The multivariate regression results with country fixed effects in Table 2, columns 3–4, confirm this finding and show that unbanked adults are significantly less likely to be able to use an account if they belong to typically underserved groups, such as women, poor adults, less-educated adults, and adults out of the workforce.

6. Explaining why account owners do not use their accounts

Having an account is only the first step toward achieving the benefits of access to formal financial services. More importantly is how people use their account. There are about 430 million people in developing countries (including 280 million in India), representing about 13 percent of banked adults, who have an account but do not use it – these are the financially inactive consumers, sometimes referred to as the “underbanked.” Inactive account holders at banks and similar financial institutions are concentrated in one country – India – where 35 percent of accounts were inactive in 2021. India’s share of inactive accounts coupled with its large population has the statistical effect of pushing the overall developing economy average of inactive accounts to 13 percent of account holders. Yet, when we examine the inactive account data for India separately from the rest of the world’s developing countries, the average developing economy inactive account rate decreases sharply to 5 percent, making India’s inactive account share about seven times larger than the developing economy average. For this reason, additional data were collected only in India on the reason for account inactivity.

We also examine why adults in Sub-Saharan Africa do not use a mobile money account on their own, without help from an agent, family member, or friend. Previous research has shown that adults that transact through their account without the help of a mobile money agent can sidestep illicit extra charges. For example, in Ghana, consumers are overcharged in one out of four mobile money transactions, with female customers more likely to face misconduct (Annan Reference Annan2022b).

6.1. The case of India

As mentioned earlier, in India, 35 percent of account holders report not using their account at a bank or similar financial institution for a single deposit, withdrawal, or digital payment in the past year. One potential contributing reason for India’s share of account inactivity may be the large number of accounts that were opened as part of the Indian government’s Jan Dhan Yojana program, which offered no-minimum balance, no-fee accounts to all adults with an Aadhaar biometric ID. Launched in August 2014, it brought an additional 450 million Indians into the formal banking system, most of them before the collection of the Global Findex 2017 survey data (Indian Ministry of Finance 2022). The launch and trajectory of Jan Dhan Yojana correspond with a significant increase in inactive accounts in India.

India’s account ownership initiative is broadly viewed as a successful example of a government investing in financial access for development purposes. However, the high level of financial inactivity correlated with the program is a reminder that account ownership alone is not enough. Usage is also important.

Although there is no gender gap in account ownership in India, the gender gap in account use is high. Forty-two percent of female account holders in the country are inactive compared to 30 percent of male account holders, a 12-percentage point inactive account gender gap. In contrast, in all developing countries outside of India, women and men are equally likely to have inactive accounts. Moreover, regression results in Table 3, columns 1–2, show adults in India with inactive accounts are significantly more likely to belong to typically underserved groups, such as women, the poor, those less educated, and adults who are self-employed, unemployed, or out of the labor force.

Table 3. Multivariate analysis – Individual characteristics of the underbanked, 2021

Note: All regressions use individual-level data and are estimated using ordinary least squares with robust standard errors. Summary statistics are shown in Table 1. Columns 1–2 include 2,368 Indian adults and the dependent variable is equal to 1 if the Indian respondent has an inactive account, defined as not a single deposit, withdrawal, or digital payment within in the past year. Columns 3–4 include 10,383 adults in 25 Sub-Saharan African countries who use a mobile money account and report needing help using it (e.g., from an agent, family, or friend). All regressions include country fixed effects. Omitted variables include males, adults belonging to richest 60 percent of households, adults with secondary education or above, and adults employed for wage. Standard errors in parentheses. *, **, and ***indicate significance at 10%, 5%, and 1%, respectively.

The Global Findex questionnaire also asked inactive account owners in India why they do not use their account (multiple answers are permitted). The most common reasons given by inactive account holders in India overlap with some of the reasons given by the unbanked for not having an account at all. Namely, that financial institutions are too far away; that inactive account holders lack trust in financial institutions; and that they have no need for an account (Figure 6). Each of these reasons was cited by about half of adults with an inactive account. In addition, nearly 40 percent of inactive account holders said they did not have enough money to use an account, though interestingly, this issue – primary for the unbanked – came in as the fourth most common for inactive account holders. These findings reinforce the importance of other factors for promoting account usage.

Figure 6. Adults in India with an inactive account citing a given barrier as a reason for not using their account (%), 2021.

Source: Global Findex Database (2021).

Note: Respondents could choose more than one reason.

As interesting, however, is that inactive account holders in India specifically cite their comfort level with financial services among their top barriers to account usage (the unbanked did not mention their comfort level and instead were asked separately whether they could use an account by themselves). Specifically, about 30 percent of inactive account holders do not use their account because they do not feel comfortable doing so by themselves. More men with an inactive account (34 percent) than women with an inactive account (26 percent) say they do not feel comfortable using it by themselves, perhaps because men typically make larger or more complex transactions. There was no income or educational attainment gap for inactive account holders who gave this reason.

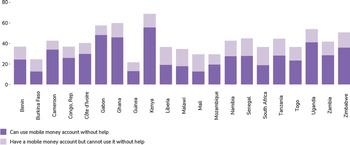

6.2. The case of Sub-Saharan Africa

The Global Findex 2021 survey also asks mobile money account owners in Sub-Saharan Africa if they are able to use their mobile money account without help. Across Sub-Saharan Africa, one in three (31 percent) mobile money account holders cannot use their account without help (Figure 7). In countries such as Liberia, Malawi, and South Africa, this share is much higher, with more than 50 percent of mobile money users needing help using their account.

Figure 7. Adults in Sub-Saharan Africa with a mobile money account (%), 2021.

Source: Global Findex Database (2021).

Among mobile money account holders, women, the poor, the less educated, the young and those outside the labor market are more likely to need assistance, making them at potentially higher risk of financial abuse from agents or family members.

Gender differences are relevant: female mobile money account holders are 5 percentage points more likely than men to need assistance. In many countries like Ghana, Liberia, Malawi, and Senegal, this share is much higher, at more than 10 percentage points. On the other hand, in countries like Benin, Cameroon, Côte d’Ivoire, and Nigeria, male and female mobile money account holders are equally likely to need help.

Poorer mobile money account holders are 10 percentage points more likely than the rich to need assistance. In some countries, the share is much higher – about 20 percentage points in Burkina Faso, Ghana, and Mali to 30 percentage points in Zambia. In countries like Cameroon, Côte d’Ivoire, and South Africa, poor and rich mobile money account holders are equally likely to need help.

The less-educated mobile money account holders (defined as those with a primary education or less) are 22 percentage points more likely than the more educated to need help. Of mobile money account holders, those outside the labor market are 5 percentage points more likely than those in the labor market to need help. Interestingly, younger mobile money account holders are 8 percentage points more likely than older account holders to need help; even though younger adults might be more familiar with the use of technology, they also use a wider array of digital payment products.

These findings are confirmed in multivariate regressions. As reported in Table 3, columns 3–4, with country-fixed effects, adults in the region who need help using a mobile money account are significantly more likely to belong to underserved groups like women, the poor, those less educated, out of labor force, or self-employed. Younger adults are also significantly more likely than their older counterparts to need assistance.

7. Conclusion: The importance of digital and financial literacy for financial inclusion

This paper summarizes findings from the Global Findex 2021 data on the unbanked and underbanked worldwide and the barriers they face using and benefiting from financial services.

A large share of people, particularly in developing countries, do not have a bank account, and there are many important barriers to accessing an account at a financial institution. One important finding unveiled in this work is that many unbanked adults say they could not use an account without help, and even some adults who have an account say they need help to use it. In other words, it should not be taken for granted that people are comfortable or able to use basic financial services. Promoting financial inclusion should include promoting basic financial education to ensure that people understand how to use financial products such as bank accounts and understand basic financial concepts such as interest rates and inflation.

As the financial industry increasingly offers digital financial services, a new population of financial customers is entering the formal financial system. These consumers may need more and better information in order to fully understand product features and fees. Financial regulators and supervisors can take the lead to help identify information gaps in the marketing and provision of financial services, requiring that financial institutions provide customers with complete and clear information about their products. One possible remediation approach might be to establish clear guidelines for financial institutions about disclosures and transparency, as well as sound enforcement practices to ensure compliance. Behavioral insights can also help financial institutions communicate more effectively with customers, provide clear and complete information about costs, highlight salient details, and ensure that customers understand the benefits and risks of financial products and services.

Though regulators and financial institutions each have important roles to play, consumers can and should be given opportunities to protect themselves through information and education. Public service programs should also inform and educate consumers about the risks of predatory financial practices and what they look like. Financial service providers and regulators should offer this information in plain language and in a format that all users can understand – including consumers with less financial experience and lower education levels.

Investments in digital and financial education are critical to ensure that financially inexperienced users benefit from account ownership and understand how to use financial services in a way that optimizes benefits and avoids risks such as high and hidden fees, over-indebtedness, fraud, and discrimination.

Acknowledgments

We are grateful to Alexandra Norris, Mansi Vipin Panchamia, and Jijun Wang for outstanding research assistance and to Laura Starita for excellent editorial support. We also appreciate the helpful comments received from Annamaria Lusardi and two anonymous referees. The opinions expressed in this paper do not necessarily reflect the views of the World Bank, its executive directors, or the countries they represent.

Appendix 1

Table A.1. Share of unbanked adults, 2021

Source: Global Findex database (2021).

Note: The Global Findex database relies on income classification data from the World Bank Group. This list excludes Venezuela due to the lack of any income classification data for the country.