No CrossRef data available.

Article contents

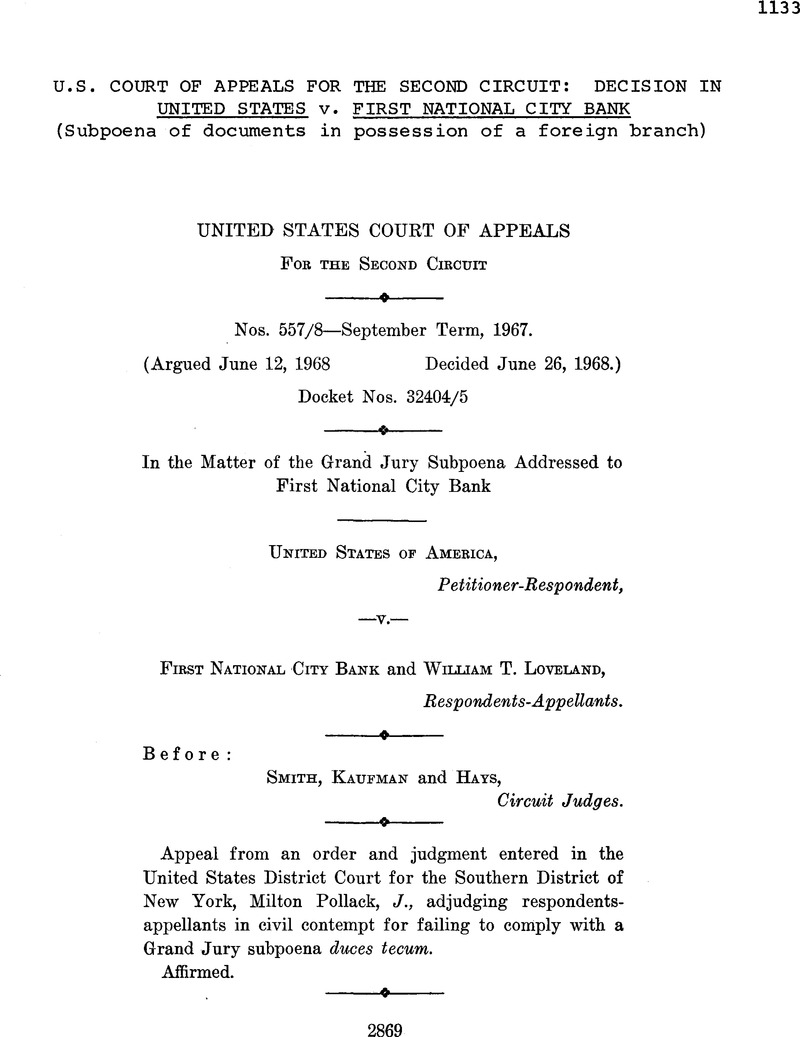

U.S. Court of Appeals for the Second Circuit: Decision in United States v. First National City Bank (subpoena of documents in possession of a foreign branch)

Published online by Cambridge University Press: 04 April 2017

Abstract

- Type

- Judicial and Similar Proceedings

- Information

- Copyright

- Copyright © American Society of International Law 1969

References

1 Citibank is organized under the laws of the United States and has its principal place of business in the Southern District of New York.

2 Citibank does not contend that records located in its Frankfurt branch are not within the possession, custody and control of the head office. See United States v. First National City Bank, 379 U. S. 378, 384 (1965); First National City Bank v. J. B. S., 271 F. 2d 616, 618-19 (2d Cir. 1959), cert, denied, 361 U. S. 948 (1960).

3 Section 890 of the German Code of Civil Procedure provides that:

“If the defendant violates his duty to omit an act or to suffer the commission of an act, the Court of first instance, on application of the plaintiff, must punish him, the defendant, for each violation with a fine or with jail up to six months. . . . “

Although this section is found in the Code of Civil Procedure the penalties it prescribes are considered criminal sanctions.

4 Dr. Domke testified that if he were representing Boehringer in Germany, he would advise his client not to seek an injunction enforceable under Section 890, see note 3, supra. until the court in the United States had decided whether to enforce the subpoena.

5 In addition, an official of the German Consulate General in New York, introduced a statement from the Bundesbank—the central bank of Germany roughly equivalent to the Federal Reserve Bank—defining the German policy of bank secrecy. This statement was in broad terms, not addressed to the specific facts of the instant litigation, and did not add to or contradict the testimony of either expert witness in any significant way.

6 Dr. Schoch testified that if Citibank were sued by Boehringer, the bank could plead compulsion by an American court as a complete defense to the action. She indicated that performance of the bank’s contract with Boehringer would be excused under German doctrines of impossibility of performance and of requiring only the “good faith” performance of contracts taking into consideration ordinary usage. Similar defenses were said to apply if Citibank were sued in tort. Moreover, Dr. Schoch indicated that Section 25 of Citibank’s written contract with Boehringer—which provides that “The bank is not liable for any losses caused by disturbances of its operations or by domestic or foreign acts of authorities at home or abroad”—would provide another defense to a civil suit since the process of an American court would be considered the act of a “foreign authority.” Cf. First National City Bank v. I. B. S., supra, 271 F. 2d at 619-20 (Panamanian provision dealing with disclosure pursuant to the order of “a competent authority and by means of legal formalities” not limited to proceedings of Panamanian authority). She testified further that Boehringer would have to prove actual damages resulting from the disclosure but could not recover for “loss of face or mental upset.” (And, we note that, in any event, any disclosure by Citibank would be made to the Grand Jury whose proceedings are kept secret.) Finally, Schoch gave her opinion that Citibank would have an action for damages against Boehringer under German law if Boehringer made good its threat to cause itibank to lose business.

7 The subpoena duces tecum, requiring the actual production of documents or other matter, is a procedural device unknown to German law. Instead, a party or witness is apparently required to testify with respect to relevant information; he need not, however, produce actual records.

8 Judge Pollack based his finding of lack of good faith on the fact that Citibank, as noted above, had failed to even make a simple inquiry into the nature or extent of the records available at the Frankfurt branch. In addition, the expert testimony was clear that the bank secrecy doctorine applied only to material entrusted to a bank within the framework of any confidential relationship of bank and customer but not to records that were the bank’s own work product. Citibank failed to produce any documents reflecting its own work product that were within the terms of the subpoena or to indicate that none existed.

9 By the terms of the District Court’s order, Citibank and Loveland were cited for civil contempt, both penalties to cease upon compliance with the subpoena. Also, the punishment could not extend beyond the expiration of the life of the Grand Jury. See Loubriel v. United States, 9 F. 2d 807 (2d Cir. 1926); United States v. Collins, 146 Fed. 553 (D. C. D. Or. 1906). See also Howard v. United States, 182 F. 2d 908, 914 (8th Cir. 1950), vacated as moot, 340 U. S. 898 (1950).

10 The omission of bankers cannot be considered accidental. Bankers are apparently privileged to refuse testimony in a civil proceeding. See Article 383 of the German Code of Civil Procedure.

11 While it may be true that the subpoena duces tecum is unknown to German law, see note 7, supra, the important point is that bank secrecy is no bar to as much disclosure as German law ever requires in a criminal proceeding; it should have no greater impact in a criminal proceeding in this country.

12 The Consulate General of Germany did, however, introduce a document describing the nature of bank secrecy. See note 5, supra.

13 The government stated at oral argument, and Citibank does not contend otherwise, that the bank’s overseas growth rate has increased in the years since the Supreme Court rejected its contention in First National City Bank (Omar), that the Court’s decision would subject the bank to severe economic consequences overseas.

14 See note 6, supra.

15 See note 8, supra.