No CrossRef data available.

Article contents

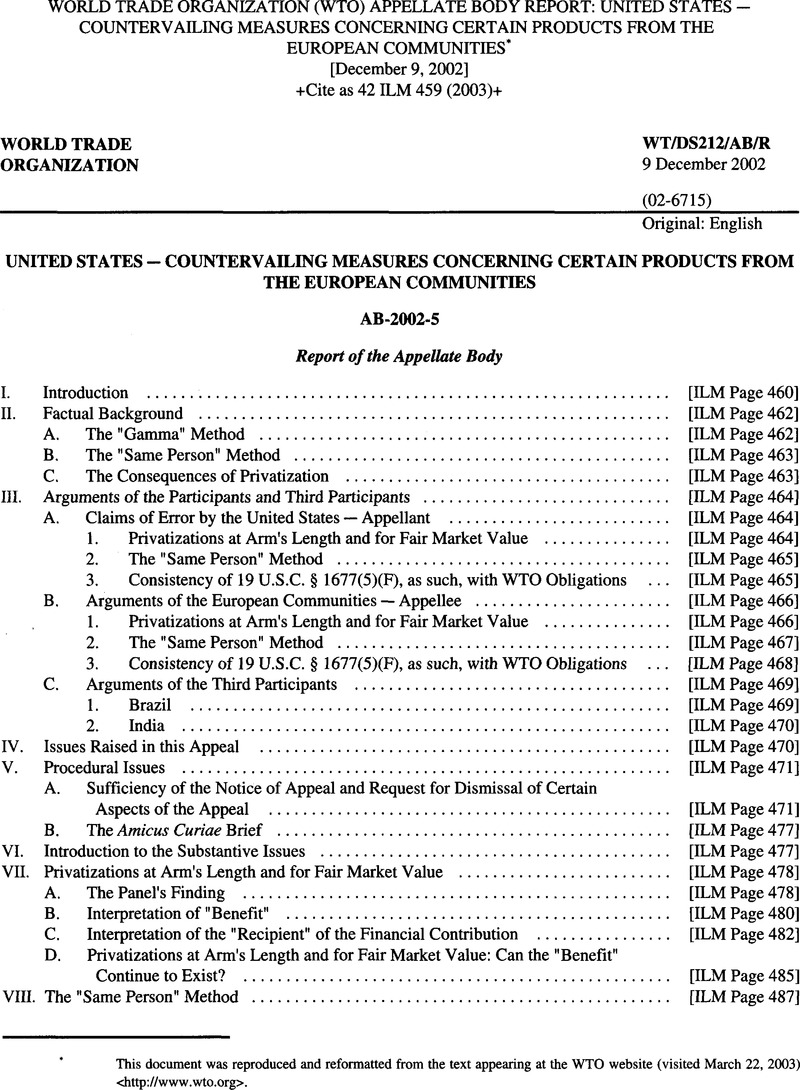

World Trade Organization (WTO) Appellate Body Report: United States -Countervailing Measures Concerning Certain Products European Communities

Published online by Cambridge University Press: 27 February 2017

Abstract

- Type

- Judicial and Similar Proceedings

- Information

- Copyright

- Copyright © American Society of International Law 2003

References

* This document was reproduced and reformatted from the text appearing at the WTO website (visited March 22, 2003) <http://www.wto.org.>

1 WT/DS212/R, 31 July 2002.

2 The Panel adopted the following numbering system, which we will also use, to facilitate identification of the various administrative determinations at issue: Stainless Sheet and Strip in Coils from France 64 Fed. Reg. 30774 (USDOC, 29 June 1999) (Case No. 1); Certain Cut-to-Length Carbon Quality Steel from France 64 Fed. Reg. 73277 (USDOC, 29 Dec. 1999) (Case No. 2); Certain Stainless Steel Wire Rod from Italy 63 Fed. Reg. 40474 (USDOC, 29 July 1998) (Case No. 3); Stainless Steel Plate in Coils from Italy 64 Fed. Reg. 15508 (USDOC, 31 March 1999) (Case No. 4); Stainless Steel Sheet and Strip in Coils from Italy 64 Fed. Reg. 30624 (8 June 1999) (Case No. 5); Certain Cut-to-Length Carbon-Quality Steel Plate from Italy 64 Fed. Reg. 73244 (USDOC, 29 December 1999) (Case No. 6); Cut-to-Length Carbon Steel Plate from Sweden 62 Fed. Reg. 16551 (USDOC, 7 April 1997) (Case No. 7); Cut-to-Length Carbon Steel Plate from United Kingdom 65 Fed. Reg. 18309 (USDOC, 7 April 2000) (Case No. 8); Certain Corrosion-Resistant Carbon Steel Flat Products from France 65 Fed. Reg. 18063 (USDOC, 7 April 2000) (Case No. 9); Cut-to-Length Carbon Steel Plate from Germany 65 Fed. Reg. 47407 (USDOC, 2 August 2000) (Case No. 10); Cut-to-Length Carbon Steel Plate from Spain 65 Fed. Reg. 18307 (USDOC, 7 April 2000) (Case No. 11); and Grain-Oriented Electrical Steel from Italy 66 Fed. Reg. 2885 (USDOC, 12 January 2001) (Case No. 12). Case Nos. 1-6 correspond to original investigations, Case Nos. 7 and 12 to administrative reviews, and Case Nos. 8-11 to sunset review

3 Section 771(5)(F) of the United States Tariff Act of 1930, as amended, which, for purposes of the United States Code, is codified at 19 U.S.C. § 1677(5)(F), attached as Exhibit EC-4 to the European Communities’ first submission to the Panel.

4 The USDOC analyzed the sales conditions of the privatizations in two of the underlying sunset reviews (Case Nos. 8 and 10) and three of the original investigations (Case Nos. 1, 2, and 4), concluding that those five privatizations took place at arm's length and for fair market value. (See Panel Report, paras. 2.2, 2.39, and 2.45; Remand Redetermination in Acciai Speciali Terni S.p.A. v. United States No. 99-06-00364, slip op. 02-10 (Court of International Trade, 1 February 2002), available at <http://www.ia.ita.doc.gov/remands/02- 10.htm> Remand Redetermination in GTS Indus. SA. v. United States No. 00-03-00118, slip op. 02-02 (Court of International Trade, 4 January 2002), (available at http.7</www.ia.ita.doc.gov/remands/02-2.htm;> and Remand Redetermination in Allegheny Ludlum Corp. v.United States No. 99-09-00566, slip op. 02-01 (Court of International Trade, 4 January 2002), available at <http://www.ia.ita.doc.gov/remands/02-l.htm.))> The USDOC has made no admissions as to the conditions of sale surrounding the other privatizations at issue.

5 Panel Report, para. 2.3.

6 Panel Report, para. 2.3.

7 Ibid., para. 8.1.

8 Ibid., para. 8.2.

9 Ibid., para. 8.3.

10 WT/DS212/7, attached as Annex I to this Report.

11 Request, para. 6.

12 Letter dated 12 September 2002, from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Presiding Member of the Division hearing this appeal, pp. 2-3.

13 Letter dated 12 September 2002, from the Director of the Appellate Body Secretariat to the Senior Legal Advisor, Permanent Mission of the United States to the WTO.

14 Panel Report, paras. 8. l(a)-8. l(d) and 8.2.

15 See Attachment to letter dated 13 September 2002 from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Director of the Appellate Body Secretariat.

16 Letter dated 4 October 2002, from H.E. Mr. Eduardo P6rez Motta, Ambassador, Permanent Mission of Mexico to the WTO, to the Director of the Appellate Body Secretariat.

17 Submission attached to letter dated 19 September 2002, from Andrew G. Sharkey III, American Iron and Steel Institute President & CEO, to the Presiding Member of the Division hearing this appeal.

18 Letter dated 27 September 2002, from the Minister-Counsellor, Permanent Delegation of the European Communities to the WTO, to the Presiding Member of the Division hearing this appeal, p. 1.

19 Ibid., p. 2.

20 Letter dated 27 September 2002, from the Director of the Appellate Body Secretariat to the Minister-Counsellor, Permanent Delegation of the European Communities to the WTO.

21 Ibid.

22 We note that the Panel refers to the administrative practice challenged in this dispute as the “same person methodology.” Article 14 of the SCM Agreement refers to the procedures used by investigating authorities to calculate the benefit as “method[s]”, so we will use the term “method” rather than “methodology.“

23 Both participants agree that “it is a normal and accepted practice… for the importing Member to presume that a non-recurring subsidy will provide a benefit over a period of time, which is normally presumed to be the average useful life of assets in the relevant industry”, (Panel Report, para. 7.75) a practice found permissible by the Appellate Body in US —Lead and Bismuth II para. 62, so long as the presumption remained rebuttable.

24 United States’ first submission to the panel, para. 5, attached to the Panel Report in US —Lead and Bismuth II Attachment 2.1, p. 164.

25 United States’ first submission to the panel, paras. 6 and 44-45, attached to the Panel Report in US — Lead and Bismuth II Attachment 2.1, pp. 164 and 172.

26 United States’ first submission to the panel, para. 44, attached to the Panel Report in US —Lead and Bismuth II Attachment 2.1, p. 172. See also ibid., para. 43, attached to the Panel Report in US —Lead and Bismuth II Attachment 2.1, p. 171, which states: the US countervailing duty statute contains “the irrebuttable presumption that nonrecurring subsidies benefit merchandise produced by the recipient over time,” without requiring any re-evaluation of those subsidies based on the use or effect of those subsidies or subsequent events in the marketplace. (Quoting Certain Steel Products from Austria 58 Fed. Reg. 37217, 37263 (USDOC, 9 July 1993) (General Issues Appendix)).

27 United States’ first submission to the panel, para. 10, attached to the Panel Report in US —Lead and Bismuth II Attachment 2.1, p. 165.

28 United States’ first submission to the panel, para. 53, attached to the Panel Report in US —Lead and Bismuth II Attachment 2.1, p. 174.

29 Appellate Body Report, US —Lead and Bismuth II para. 62.

30 Ibid., paras. 67-68 and 74.

31 As noted above, in paragraph 13, the gamma method was found by the Appellate Body to be inconsistent with the United States' obligations under the SCM Agreement because the method does not permit the investigating authority to re-examine its original benefit determination “given the changes in ownership leading to the creation of the privatized firms. (Appellate Body Report, US —Lead and Bismuth II para. 62) Before the decision of the Appellate Body in US —Lead and Bismuth II the gamma method had similarly been rejected by a United States appellate court as inconsistent with the USDOC's governing statute (in particular, with Section 1677(5)(F)). (See Delverde Sri v. United States 202 F.3d 1360 (Fed. Or. 2000) (“Delverde III“))

32 United States’ response to questioning at the oral hearing.

33 Ibid. The USDOC will, however, proceed to examine, in such an event, whether any new subsidy had been bestowed upon the post- privatization entity's new owners as a result of the change in ownership (e.g., by assessing whether the sale was for fair market value and at arm's length). (Ibid.)

34 Panel Report, para. 7.84.

35 Panel Report, paras. 7.104-7.105. Such evidence would include, as in the cases here, changes in ownership occurring after the provision of the relevant financial contribution.

36 Ibid., para. 7.114.

37 Panel Report, paras. 7.86, 7.98, 8.1(a), and 8.1(b).

38 Ibid., paras. 7.114-7.116 and 8.1(c).

39 Ibid., para. 7.90.

40 Ibid., paras. 7.81 and 8.1(b).

41 Ibid.,paia. 8.1(d).

42 Panel Report, para. 8.1(d). The Statement of Administrative Action (“SAA“) was submitted by the President to the United States Congress with the Uruguay Round Agreements Act, the proposed statutory scheme enacting the WTO Agreements into United States domestic law. The SAA “represents an authoritative expression by the Administration concerning its views regarding the interpretation and application of the Uruguay Round agreements.” (H.R. Rep. No. 103-316(1), at 656 (1994)) Congress further adopted the SAA: … as an authoritative expression by the United States concerning the interpretation and application of the Uruguay Round Agreements and this Act in any judicial proceeding in which a question arises concerning such interpretation or application. (19U.S.C. §3512(d))

43 Panel Report, para. 8.l(d).

44 United States’ appellant's submission, para. 60.

45 Ibid., para. 56.

46 United States’ appellant's submission, paras. 58-59.

47 Ibid., para.

48 65Ibid., para. 66, quoting Panel Report, para. 7.50.

49 United States’ appellant's submission, para. 65, quoting Panel Report, para. 7.50.

50 United States’ appellant's submission, para. 66.

51 Ibid., para. 76.

52 Ibid.

53 Ibid para. 46.

54 Ibid., para. 49.

55 United States’ appellant's submission, para. 50.

56 Ibid., para. 49.

57 Ibid., para. 4.

58 Ibid., para. 6.

59 United States’ appellant's submission, para. 107, quoting Panel Report, paras. 7.120-7.121.

60 The Panel uses the term “systematically” to describe a result that would follow “automatically”, namely, occurring always as a necessary consequence. (European Communities’ response to questioning at the oral hearing)

61 United States’ appellant's submission, para. 108, quoting Panel Report, paras. 7.132,7.140, and 8.1(d).

62 United States’ appellant's submission, para. 109.

63 Ibid., para. 110.

64 Ibid., para. 112.

65 United States’ appellant's submission, paras. 115-117.

66 Delverde III, supra footnote 31.

67 United States’ appellant's submission, para. 117.

68 Ibid., paras. 118-121.

69 Ibid., para. 122.

70 Ibid., para. 113.

71 European Communities’ appellee's submission, para. 38.

72 Ibid, paia. 47.

73 Ibid., paras. 23 and 28.

74 European Communities’ appellee's submission, para. 27.

75 Ibid., para. 63.

76 Ibid., para. 52.

77 Ibid., para. 68, quoting Appellate Body Report, Canada —Aircraft para. 157.

78 European Communities’ appellee's submission, para. 70.

79 Ibid., paras. 76-78.

80 Ibid., para. 57, quoting Appellate Body Report, Canada —Aircraft para. 153.

81 European Communities’ appellee's submission., paras. 57-59.

82 Ibid para. 69.

83 Ibid., para. 65, quoting Certain Steel Products from Austria 58 Fed. Reg. 37217, 37262 (USDOC, 9 July 1993) (General Issues Appendix).

84 European Communities’ appellee's submission, para. 72.

85 Ibid., para. 32.

86 Ibid.

87 European Communities’ appellee's submission, para. 7, referring to Appellate Body Report, US —Lead and Bismuth II paras. 56-58.

88 European Communities’ appellee's submission, para. 86.

89 Ibid., para. 106.

90 Ibid para. 108.

91 European Communities’ appellee's submission, para. 109.

92 See supra footnote 42.

93 European Communities’ appellee's submission, paras. 111-119.

94 Ibid., paras. 110-111,118, and 120.

95 Ibid., para. 125.

96 Ibid., paras. 126-127.

97 European Communities’ appellee's submission, paras. 102-104.

98 Ibid., para. 102.

99 Ibid paras. 102-103.

100 Pursuant to Rule 24(2) of the Working Procedures, Mexico did not file a written submission, but it did make a statement and respond to questioning at the oral hearing.

101 Brazil's third participant's submission, para. 23.

102 Ibid., para. 29.

103 Brazil's third participant's submission, para. 52.

104 See supra footnote 42.

105 Brazil's third participant's submission, para. 34.

106 Ibid.

107 Ibid. para. 36.

108 Ibid., para. 39.

109 Ibid.

110 Ibid., paras. 41-43.

111 Brazil's third participant's submission, para. 38.

112 Ibid., p.5.

113 Ibid., quoting Panel Report, para. 7.54.

114 Brazil's third participant's submission, p. 5 and footnote 9.

115 Ibid., p. 5.

116 As to the term “systematically”, see supra footnote 60.

117 Panel Report, para. 8.l(d).

118 Ibid.

119 WT/DS212/7, attached as Annex I to this Report.

120 Request, para. 1.

121 Ibid. .,para.4.

122 Ibid., para.5.

123 Ibid para. 6.

124 Letter dated 12 September 2002 from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Presiding Member of the Division hearing this appeal, p. 2.

125 Ibid.

126 Article 16.4 of the DSU provides as follows: Within 60 days after the date of circulation of a panel report to the Members, the report shall be adopted at a DSB meeting unless a party to the dispute formally notifies the DSB of its decision to appeal or the DSB decides by consensus not to adopt the report. If a party has notified its decision to appeal, the report by the panel shall not be considered for adoption by the DSB until after completion of the appeal. This adoption procedure is without prejudice to the right of Members to express their views on a panel report, (footnote omitted)

127 Article 17.5 of the DSU provides as follows: As a general rule, the proceedings shall not exceed 60 days from the date a party to the dispute formally notifies its decision to appeal to the date the Appellate Body circulates its report. In fixing its timetable the Appellate Body shall take into account the provisions of paragraph 9 of Article 4, if relevant. When the Appellate Body considers that it cannot provide its report within 60 days, it shall inform the DSB in writing of the reasons for the delay together with an estimate of the period within which it will submit its report. In no case shall the proceedings exceed 90 days.

128 Letter dated 12 September 2002 from the Director of the Appellate Body Secretariat, to the Senior Legal Advisor, Permanent Mission of the United States to the WTO.

129 Letter dated 13 September 2002, from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Director of the Appellate Body Secretariat.

130 Attachment to letter dated 13 September 2002, from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Director of the Appellate Body Secretariat.

131 European Communities’ appellee's submission, para. 17.

132 Ibid., para. 19. India concurs with the European Communities that the United States’ Notice of Appeal is inadequate, arguing that it is “too brief that the [appellee] and the third parties could not make out as to what legal issues were in appeal.” (India's third participant's submission, p. 2.) India, however, does not expressly seek the dismissal of certain issues argued by the United States in its appellant's submission.

133 Appellate Body Report, US —Shrimp para. 97.

134 Ibid.

135 Appellate Body Report, US —Shrimp, para. 95.

136 Ibid., para. 92.

137 Ibid., para. 96.

138 Ibid., para. 97.

139 Appellate Body Report, EC —Bananas III para. 152.

140 Ibid.

141 Letter dated 12 September 2002 from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Presiding Member of the Division hearing this appeal, p. 2.

142 The United States’ comparison to the lack of notice provided to a cross-appellee is not appropriate because the Working Procedures do not impose any notification requirements under such circumstances.

143 Appellate Body Report, US —Shrimp para. 97.

144 European Communities’ appellee's submission, paras. 13 and 16; European Communities’ statement at the oral hearing as well as responses to questioning at the hearing.

145 Panel Report, paras. 8.1(a)-8.1(c).

146 European Communities’ appellee's submission, para. 17.

147 European Communities’ appellee's submission, para. 17.

148 United States’ response to questioning at the oral hearing.

149 See supra, para. 57.

150 United States’ response to questioning at the oral hearing.

151 American Iron and Steel Institute.

152 United States’ and European Communities’ responses to questioning at the oral hearing. The third participants disagreed.

153 United States’ responses to questioning at the oral hearing.

154 European Communities’ responses to questioning at the oral hearing.

155 These are set out in more detail in paras. 1-17 of this Report and in paras. 2.1-2.61 of the Panel Report.

156 Article VI:3 of the GATT 1994.

157 Article 10 of the SCM Agreement.

158 Article VI of the GATT 1994.

159 Article VI:3 of the GATT 1994.

160 Article 1.1 of the SCM Agreement.

161 Article 1.1 (b) of the SCM Agreement.

162 Ibid.

163 Article 14of the SCM Agreement. Although the term “recipient” appears in Article 14 and not in Article 1 of the SCM Agreement we recognized in Canada —Aircraft that the ordinary meaning of Article 1.1 (b), in conjunction with the structure of Article 1.1 and the context provided by the reference to “benefit to the recipient” in Article 14, reveal that “the word ‘benefit', as used in Article 1.1 is concerned with the ‘benefit to the recipient'”. (Appellate Body Report, Canada —Aircraft para. 155 (original emphasis))

164 Article 19.1 of the SCM Agreement.

165 Article 19.4 of the SCM Agreement.

166 Article 21.1 of the SCM Agreement.

167 Article 14 of the SCM Agreement.

168 Article 32.5 of the SCM Agreement.

169 Article XVI:4 of the WTO Agreement.

170 Panel Report, footnote 313 to para. 7.40.

171 Ibid., para. 7.62.

172 See supra para. 2 and footnote 4.

173 Panel Report, para. 7.75.

174 Appellate Body Report, US —Lead and Bismuth II para.

175 Panel Report, para. 7.40.

176 Ibid., para. 7.62.

177 We observe, in particular, that the Panel has not examined whether a “benefit”, within the meaning of the SCM Agreement would be extinguished following a change in ownership under circumstances different from those in the 12 cases under consideration. (Ibid.) Hence, our analysis will be circumscribed to determine whether, in the light of the circumstances of this case, the findings and conclusions of the Panel are in conformity with the SCM Agreement.

178 For an explanation of the “same person” method, see paragraph 14 of this Report. At the oral hearing, the United States argued that the “same person” method, as such, was not at issue before the Panel. The European Communities recalled that “the practice” of the USDOC was included in its request for the establishment of the Panel (WT/DS212/4) and noted that the Panel accordingly found, in paragraph 7.90 of the Panel Report, that “the same person methodology is itself inconsistent with the SCM Agreement”. We note that the United States has not claimed before us that the Panel, in so finding, exceeded its mandate. We also note that the United States claimed, in clarifying its Notice of Appeal, that “the Panel erred in finding that … the so-called ‘same person methodology’ is inconsistent with the SCM Agreement.” (Attachment to letter dated 13 September 2002, from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Director of the Appellate Body Secretariat, p.2)

179 The 12 cases are listed in footnote 2 to this Report. Case No. 12, Grain-Oriented Electrical Steel from Italy 66 Fed. Reg. 2885 (USDOC, 12 January 2001) (“GOESfrom Italy“), attached as Exhibit EC-7 to the European Communities’ first submission to the Panel, is an administrative review and the only underlying administrative determination in which the USDOC applied the “same person“ method in the first instance. The method has been applied by the USDOC in certain other countervailing duty determinations upon remand from the United States Court of International Trade (that is, where the Court has ordered the USDOC to reconduct those determinations). The United States claimed before the Panel, however, with apparently no rebuttal from the European Communities, that the determinations upon remand, which had applied the “same person” method, were not challenged by the European Communities. (Panel Report, footnote 81 to para. 2.55 (quoting United States’ first submission to the Panel, para. 85)) Thus, in the course of making the twelve initial determinations (that is, not subsequent to a United States court appeal) in dispute, USDOC applied the “same person“ method only once, namely, during the administrative review identified as Case No. 12.

180 Panel Report, para. 8.1(d). This finding is also at the core of the Panel's conclusions in para. 8.1(a)-8.1(c).

181 United States’ appellant's submission, para. 46.

182 “[F]or fair market value (or otherwise).” Ibid., paras. 2 and 6. See also United States’ second submission to the Panel, para. 10; United States’ response to questioning at the oral hearing.

183 United States’ appellant's submission, para. 50.

184 Ibid., para. 56.

185 Ibid., para. 65.

186 United States’ appellant's submission, para. 6.

187 Appellate Body Report, Canada —Aircraft para. 153.

188 European Communities’ appellee's submission, paras. 57-59.

189 Ibid., paras. 23 and 28.

190 Ibid., para. 38.

191 Ibid.,para.47.

192 Ibid., para. 63.

193 Appellate Body Report, US — Lead and Bismuth II para. 18.

194 Ibid para. 73.

195 Ibid, paia. 74.

196 Panel Report, para. 7.82. Compare Panel Report, US — Lead and Bismuth II para. 6.81: Assuming “financial contributions” bestowed directly on BSC could be deemed to have been bestowed indirectly on UES and BSplc/BSES, this fact alone would not mean that pre-1985/86, untied, non-recurring “financial contributions” bestowed on BSC necessarily confer any “benefit” on UES or BSplc/BSES. This would only be the case if those “financial contributions” were found to have been bestowed indirectly (i.e., through the relevant change-in-ownership transactions) on UES and BSplc/BSES respectively on terms more favourable than UES and BSplc/BSES respectively could have obtained in the market. We consider that such a finding would only be possible if fair market value was not paid for all productive assets etc. acquired by UES and BSplc/BSES respectively from BSC. Since fair market value was paid for all such productive assets etc., we do not consider that any untied, non-recurring “financial contribution” bestowed indirectly on UES and BSplc/BSES could be deemed to confer a “benefit” on those entities, (footnote omitted; underlining added)

197 “[A] change in the shareholders of a subsidy recipient does not remove the new equipment, extract knowledge from the workers, or increase the previously lowered debt load.” United States’ appellant's submission, para. 49.

198 See supra footnote 182.

199 United States’ appellant's submission, para. 18. If the two enterprises are found to be different legal persons, the USDOC will continue to examine the terms of the sale to determine whether the purchaser(s) of the privatized entity received a new subsidy as a result. (United States’ responses to questioning at the oral hearing)

200 Panel Report, para. 7.72.

201 Ibid., para. 7.77.

202 Ibid., para. 7.81.

203 Appellate Body Report, Canada —Aircraft para. 157.

204 United States’ appellant's submission, para. 44.

205 Ibid, para. 50.

206 Ibid., para.. 46.

207 The United States assumes that ownership is held by means of shares.

208 United States’ appellant's submission, para. 49.

209 See United States’ first submission to the Panel, paras. 56-61.

210 Panel Report, para. 7.80.

211 Ibid.

212 Ibid.

213 In US —Lead and Bismuth II para. 56, we stated: It is true, as the United States emphasizes, that footnote 36 to Article 10 of the SCM Agreement and Article VI:3 of the GATT 1994 both refer to subsidies bestowed or granted directly or indirectly “upon the manufacture, production or export of any merchandise”. In our view, however, it does not necessarily follow from this wording that the “benefit” referred to in Article 1.1 (b) of the SCM Agreement is a benefit to productive operations (original emphasis)

214 United States’ appellant's submission, para. 41.

215 United States’ response to questioning at the oral hearing, discussing Certain Steel Products from Austria 58 Fed. Reg. 37217, 37264 (USDOC, 9 July 1993) (General Issues Appendix).

216 Certain Steel Products from Austria 58 Fed. Reg. 37217, 37264 (USDOC, 9 July 1993) (General Issues Appendix).

217 See supra footnote 182.

218 Ibid., para. 49.

219 Appellate Body Report, Canada —Aircraft para. 157.

220 United States’ appellant's submission, para 49.

221 See supra footnote 182.

222 Panel Report, para. 7.60. The Panel noted that the USDOC agrees with this characterization of private investors. (Ibid para. 7.61

223 Ibid., para. 7.60.

224 Appellate Body Report, Canada —Aircraft para. 157.

225 United States’ appellant's submission, para. 49.

226 “The basic principle underlying USDOC's methodology is that… a subsidy benefits the production of merchandise and [USDOC] does not envision ever re-visiting the original determination of the existence of a subsidy benefit.” (United States’ first submission to the panel, para. 9, attached to the Panel Report in US —Lead and Bismuth II Attachment 2.1, p. 165) This similarity is seen also in the examples used by the United States in its appellant's submission. In one instance (United States’ appellant's submission, paras. 47- 48), an “uncle” forms for his “nephew” a company (“Nephew, Inc.“) and provides that company with a “subsidy” in the form of a newly-constructed apartment building. The consequence of this new building is the depressing of rents in the local real estate market. The United States argues that the new apartment building continues to depress rents in the town even after the transfer of “Nephew, Inc.” for fair market value. The “only” way to negate the effects of “uncle's subsidy”, according to the United States, would be to return rents in town to their previous levels. From the United States’ perspective, therefore, the “benefit” persists so long as the distortions of the financial contribution are detectable in the market, and a transfer in ownership, at fair market price or otherwise, would be immaterial to the determination of whether a “benefit” continues to exist.

227 Panel Report, para. 7.80.

228 Ibid.

229 See supra para. 82.

230 Panel Report, para. 7.54.

231 United States’ appellant's submission, para. 55.

232 Ibid., paras. 56, 65-67.

233 Ibid., para. 58.

234 See supra footnote 182.

235 Appellate Body Report, Canada —Aircraft para. 154.

236 We use the term “firm” in this Report to include corporate associations, partnerships, limited liability partnerships, unincorporated entities, and other forms of business organization.

237 We use the term “owner” in this Report to include shareholders, members, proprietors, partners, and all other holders of an equity interest in the relevant business organization.

238 Appellate Body Report, US — Lead and Bismuth II paras. 56 and 58.

239 United States’ appellant's submission, para. 64.

240 Appellate Body Report, Canada —Aircraft para. 154.

241 United States’ appellant's submission, para. 60.

242 Panel Report, para. 7.51.

243 Article l.l(a)(l) of the SCM Agreement provides: (a)(1)there is a financial contribution by a government or any public body within the territory of a Member (referred to in this Agreement as “government“), i.e. where: (i)a government practice involves a direct transfer of funds (e.g. grants, loans, and equity infusion), potential direct transfers of funds or liabilities (e.g. loan guarantees); (ii)government revenue that is otherwise due is foregone or not collected (e.g. fiscal incentives such as tax credits); (iii)a government provides goods or services other than general infrastructure, or purchases goods; (iv) a government makes payments to a funding mechanism, or entrusts or directs a private body to carry out one or more of the type of functions illustrated in (i) to (iii) above which would normally be vested in the government and the practice, in no real sense, differs from practices normally followed by governments;… (footnote omitted)

244 United States’ appellant's submission, para. 58.

245 Article VI:3 of the GATT 1994 provides: No countervailing duty shall be levied on any product of the territory of any contracting party imported into the territory of another contracting party in excess of an amount equal to the estimated bounty or subsidy determined to have been granted, directly or indirectly on the manufacture, production or export of such product in the country of origin or exportation, including any special subsidy to the transportation of a particular product. The term “countervailing duty” shall be understood to mean a special duty levied for the purpose of offsetting any bounty or subsidy bestowed, directly, or indirectly, upon the manufacture, production or export of any merchandise, (emphasis added, footnote omitted)

246 Footnote 36 to Article 10 of the SCM Agreement provides: The term “countervailing duty” shall be understood to mean a special duty levied for the purpose of offsetting any subsidy bestowed directly or indirectly upon the manufacture, production or export of any merchandise, as provided for in paragraph 3 of Article VI of GATT 1994. (emphasis added)

247 United States’ appellant's submission, footnote 77 to para. 76.

248 United States’ appellant's submission, footnote 77 to para. 76.

249 Footnote 36 to Article 10 of the SCM Agreement.

250 Panel Report, para. 7.54.

251 See supra paras. 84-85.

252 Panel Report, para. 7.40.

253 Ibid., para. 7.62.

254 Panel Report, para. 7.62.

255 Ibid., para. 7.54.

256 Ibid.

257 Panel Report, para. 7.82.

258 Ibid, para. 8.1(d).

259 Panel Report, para. 7.76.

260 Ibid.

261 Panel Report, para. 7.82.

262 Ibid., para. 8.1 (d).

263 See Appellate Body Report, US — Lead and Bismuth II.

264 United States’ response to questioning at oral hearing.

265 Ibid. See also supra,footnote 179.

266 See supra footnote 179.

267 United States’ response to questioning at the oral hearing.

268 Ibid.

269 Ibid.

270 Ibid.

271 Panel Report, paras. 8.1(a) and 8.1(b). In this respect, we note that the United States proposes to reconduct the determinations made in the course of original investigations (Case Nos. 1-6) and the administrative review (Case No. 7) on the basis of the “same person“ method. ﹛Ibid., para. 7.90)

272 Appellate Body Report, US — Lead and Bismuth II para. 62.

273 Panel Report, paras. 2.29-2.30. For Case Nos. 1-6, the United States acknowledged the WTO-inconsistency “to the extent that they were based on the gamma methodology and that the underlying determinations did not fully examine whether the pre- and post-change in ownership entities involved were the same legal persons.” (Ibid., para. 2.29) For Case No. 7, the WTO-inconsistency was admitted by the United States “to the extent that the review was based on the gamma methodology and that, therefore, the underlying determination did not fully examine whether the pre- and post-change in ownership entity was the same legal person.” (Ibid., para. 2.30)

274 Ibid., para. 8.1(c).

275 Ibid., para. 7.116.

276 United States’ appellant's submission, footnote 28 to para. 26.

277 Ibid para. 26.

278 Panel Report, para. 7.77.

279 Ibid., para. 7.90.

280 Panel Report, para. 7.77.

281 See supra footnote 178.

282 Attachment to letter dated 13 September 2002 from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Director of the Appellate Body Secretariat, p. 2.

283 See supra para. 15.

284 Attachment to letter dated 13 September 2002 from the Senior Legal Advisor, Permanent Mission of the United States to the WTO, to the Director of the Appellate Body Secretariat, p. 2.

285 Panel Report, para. 7.78.

286 Article 14 of the SCM Agreement in relevant part, provides that: any method used by the investigating authority to calculate the benefit to the recipient conferred pursuant to paragraph 1 of Article 1 shall be … transparent and adequately explained.

287 Panel Report, para. 7.78.

288 Ibid., para. 7.90.

289 Panel Report, para. 8.1(b).

290 United States’ appellant's submission, paras. 86-90.

291 European Communities’ appellee's submission, paras. 2 and 7.

292 Article VI:3 of the GATT 1994 provides as follows: No countervailing duty shall be levied on any product of the territory of any contracting party imported into the territory of another contracting party in excess of an amount equal to the estimated bounty or subsidy determined to have been granted, directly or indirectly, on the manufacture, production or export of such product in the country of origin or exportation, including any special subsidy to the transportation of a particular product, (emphasis added)

293 Article 10 of the SCM Agreement provides as follows: Members shall take all necessary steps to ensure that the imposition of a countervailing duty on any product of the territory of any Member imported into the territory of another Member is in accordance with the provisions of Article VI of GATT 1994 and the terms of this Agreement. Countervailing duties may only be imposed pursuant to investigations initiated and conducted in accordance with the provisions of this Agreement and the Agreement on Agriculture, (emphasis added, footnotes omitted

294 Appellate Body Report, US — Lead and Bismuth II para. 61.

295 Ibid paras. 68 and 74.

296 United States’ appellant's submission, para. 16.

297 Appellate Body Report, US —Lead and Bismuth II paras. 68 and 74.

298 Ibid., para. 68.

299 Appellate Body Report, US —Lead and Bismuth I para. 68.

300 United States’ first submission to the Panel, para. 37.

301 United States’ appellant's submission, para. 16. We also note, as does the European Communities (in the European Communities' appellee's submission, paras. 24-27 and footnote 23 to para. 26; and also in the European Communities’ response to questioning at the oral hearing), that the creation of a new legal person could not have been the basis for our requirement of a new benefit determination to be conducted by USDOC because the other privatized company at issue in US —Lead and Bismuth II British Steel pic, became a separate legal entity before the privatization took place, rather than establishing a new legal identity as a result of the privatization transaction. (See Appellate Body Report, US —Lead and Bismuth II para. 2) In finding that a benefit could have been extinguished under such circumstances and that the USDOC accordingly should have conducted a new benefit determination, we thus focused necessarily on the change in ownership of the companies at issue, and not on their legal personalities.

302 Appellate Body Report, US —Lead and Bismuth II para. 62.

303 Panel Report, para. 7.78. See also ibid para. 7.77: In the Panel's view, the United States’ same person methodology, as such, prohibits the examination of the conditions of the privatization-transaction when the privatized producer is not a distinct legal person based on criteria relating mainly to the industrial activities of the producers concerned. In applying its methodology the US Department of Commerce does not assess whether the privatized producer has received any benefit from prior financial contributions. This requirement of the “same person” method was confirmed by the United States in its responses to questioning at the oral hearing.

304 United States’ responses to questioning at oral hearing.

305 See supra footnote 182.

306 Appellate Body Report, US — Lead and Bismuth II para. 63.

307 Article 19.1 permits the imposition of a countervailing duty only after the investigating authority has found a subsidy (as defined in Article 1), injury, and a causal link between the two.

308 Article 21.3 of the SCM Agreement provides that: Notwithstanding the provisions of paragraphs 1 and 2, any definitive countervailing duty shall be terminated on a date not later than five years from its imposition (or from the date of the most recent review under paragraph 2 if that review has covered both subsidization and injury, or under this paragraph), unless the authorities determine, in a review initiated before that date on their own initiative or upon a duly substantiated request made by or on behalf of the domestic industry within a reasonable period of time prior to that date, that the expiry of the duty would be likely to lead to continuation or recurrence of subsidization and injury. The duty may remain in force pending the outcome of such a review, (footnote omitted)

309 Panel Report, paras. 7.114-7.116. The Panel found this conclusion consistent with that reached by the United States Court of International Trade when it found that the USDOC's practices in sunset reviews are inconsistent with the United States legislation, as ” [b]y its nature, then, a sunset review is designed to account for changes in law that have a bearing on whether countervailable subsidies will continue or recur.” (Panel Report, footnote 359 to para. 7.114, quoting AG der Dillinger Htittenwerke v. United States Court No. 00-09-00437, slip op. 02-25, at 32 (Court of International Trade, 28 February 2002)) Furthermore, the Panel also noted “that the [United States] Court rejected the [USDOC's] arguments that it was not appropriate to reach the privatization issue in a sunset review or that an interested party participating in a sunset review must have first requested and completed an administrative review.” (Ibid.)

310 Panel Report, para. 8.1 (c).

311 As we observed earlier, supra paras. 65-66, the United States quoted paragraph 8.1(c) in full in the document filed subsequent to its Notice of Appeal. That paragraph includes this finding.

312 See supra para. 139.

313 Panel Report, para. 7.116.

314 Ibid., para. 8.1 (c).

315 Ibid., para. 7.90.

316 In GOES from Italy the USDOC found the pre- and post-privatization firms to be the same legal person. Accordingly, the USDOC, as required under the “same person” method, irrebuttably presumed that the “benefit” from the financial contribution received by the firm when owned by the state, continued to exist. See Issues & Decision Memorandum to GOES from Italy 66 Fed. Reg. 2885 (USDOC, 12 January 2001), at comment 1, attached as Exhibit EC-7 to the European Communities’ first submission to the Panel: [The USDOC] seeks to determine whether the privatized [respondent] is the same person that received the pre-privatization financial contributions and benefits at issue in this review .. . [W]e would only reach [the respondent's] fair-market-value claim in the event that we first find the privatized [respondent] to be a different person from the original recipient… [W]e find that the privatized [respondent] is for all intents and purposes the same person that existed prior to the privatization, and accordingly it received the pre-privatization financial contributions and benefits at issue in this review, (emphasis added)

317 See supra footnote 273.

318 Panel Report, paras. 8.1 (a)-8.1 (b).

319 Ibid., para. 8.1 (c).

320 Appellate Body Report, US —Lead and Bismuth II para. 62.

321 Panel Report, para. 8.l(d).

322 19 U.S.C. § 1677(5)(F), attached as Exhibit EC-4 to the European Communities’ first submission to the Panel.

323 Panel Report, para. 7.138.

324 Ibid., para. 7.139.

325 Panel Report, para. 7.140. We note that the United States contests this interpretation, particularly the Panel's reading of “judicial interpretation” (namely of Delverde III), in its argument under Article 11 of the DSU. However, we found earlier that this issue was not properly raised in the United States’ Notice of Appeal and is not before us. (See supra paras. 71-75)

326 In the words of the United States Court of Appeals for the Federal Circuit: [Section 1677(5)(F)] clearly states that a subsidy cannot be concluded to have been extinguished solely by an arm's length change of ownership. However, it is also clear that Congress did not intend the opposite, that a change in ownership always requires a determination that a past countervailable subsidy continues to be countervailable, regardless whether the change of ownership is accomplished through an arm's length transaction or not. If that had been Congress's intent, the statute would have so stated. Rather, the Change of Ownership provision simply prohibits a. per se rule either way. Delverde III, supra footnote 31, at 1366. The Panel interpreted a “per se” rule as a “systematic” rule. (Panel Report, para. 7.147)

327 Panel Report, para. 8.1 (d).

328 See supra footnote 42.

329 Panel Report, para. 7.156.

330 Article XVI:4 of the WTO Agreement provides: Each Member shall ensure the conformity of its laws, regulations and administrative procedures with its obligations as provided in the annexed Agreements.

331 See supra paras. 126-127.

332 See supra paras. 121-124.

333 See supra para. 126.

334 We are not, by implication, precluding the possibility that a Member could violate its WTO obligations by enacting legislation granting discretion to its authorities to act in violation of its WTO obligation. We make no finding in this respect.

335 Panel Report, para. 7.134; United States’ and European Communities’ responses to questioning at the oral hearing. The fact that the “same person” method is not mandated by Section 1677(5)(F) appears also to be the view of the United States Court of International Trade. In several recent decisions the Court has held the “same person” method inconsistent with Section 1677(5)(F), as interpreted in Delverde III. See Ilva Lamiere E Tubi S.r.L v. United States 196 F. Supp. 2d 1347 (Court of International Trade, 29 March 2002); Acciai Speciali Terni S.pA. v. United States No. 99-06-00364, slip op. 02-10 (Court of International Trade, 1 February 2002); GTS Indus, v. United States 182 F. Supp. 2d 1369 (Court of International Trade, 4 January 2002); Allegheny Ludlum Corp. v. United States 182 F. Supp. 2d 1357 (Court of International Trade, 4 January 2002). We also note one decision of the United States Court of International Trade that has upheld the “same person” method as consistent with Delverde III and therefore a permissible exercise of the USDOC's discretion under the statute. Acciai Speciali Terni S.p.A. v. United States 206 F. Supp. 2d 1344 (Court of International Trade, 4 June 2002). This decision, however, explicitly recognizes that Section 1677(5)(F) does not prevent the USDOC from devising any methodology to determine the post-privatization subsidization of a foreign firm under investigation, provided that a. per se rule is not applied. (Ibid., at 1349-50, 1354-55) These cases were brought to our attention by the participants and third participants.

336 See supra footnote 326.

337 Panel Report, para. 8.1(d).