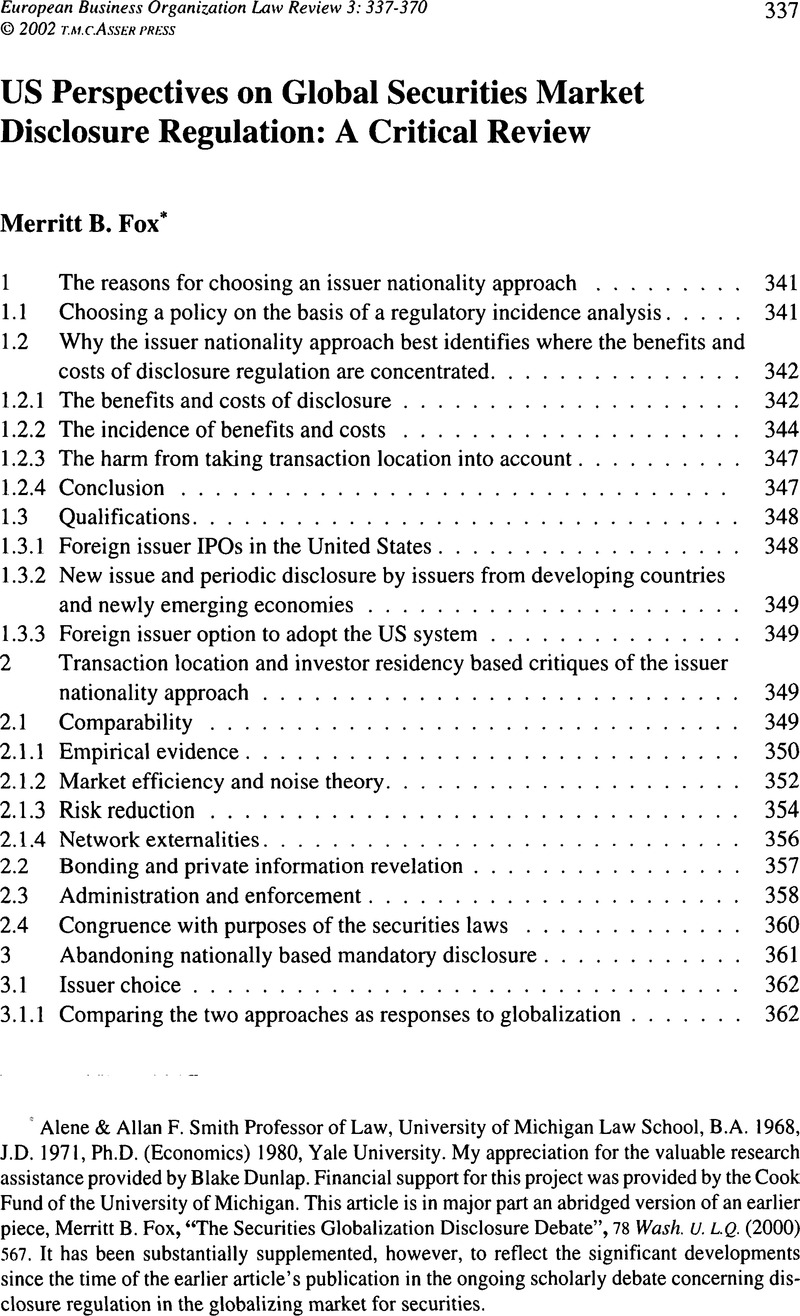

Article contents

US Perspectives on Global Securities Market Disclosure Regulation: A Critical Review

Published online by Cambridge University Press: 17 February 2009

Abstract

- Type

- Articles

- Information

- Copyright

- Copyright © T.M.C. Asser Press and the Authors 2002

References

1 International Finance Corporation, Emerging Stock Markets Factbook 1998 at 23.

2 See, e.g. Baumol, William J. & Malkiel, Burton G., “Redundant Regulation of Foreign Security Trading and U.S. Competitiveness”, in: Kenneth Lehn & Robert Kamphuis Jr., Modernizing U.S. Securities Regulation (Pittsburgh: Center for Research on Contracts and the Structure of Enterprise 1992) 35–51Google Scholar; Black, Bernard S., “The Legal And Institutional Preconditions for Strong Securities Markets”, 48 UCLA L. Rev. (2001) 781Google Scholar; Richard Cameron, Blake, “Advising Clients on Using the Internet to Make Offers of Securities in Offshore Offerings”, 55 Bus. Lawyer (1999) 177Google Scholar; Carney, William J., “Jurisdictional Choice in Securities Regulation”, 41 Va. J. Int'l L. (2001) 717Google Scholar; Choi, Stephen J., “Assessing Regulatory Responses to Securities Market Globalization”, 2 Theoretical Inquiries L. (2001) 613Google Scholar [hereinafter “Regulatory Responses”]; Choi, Stephen J., “Promoting Issuer Choice in Securities Regulation”, 41 Va. J. Int'l L. (2001) 815Google Scholar [hereinafter “Promoting Issuer Choice”]; Choi, Stephen J. & Guzman, Andrew T., “Portable Reciprocity: Rethinking the International Reach of Securities Regulation”, 71 S. Calif. L. Rev. (1998) 903Google Scholar; Coffee, John C. Jr., “The Future as History: The Prospects for Global Convergence in Corporate Governance and Its Implications”, 93 Northwestern L. Rev. (1999) 641Google Scholar; Cox, James D., “Premises for Reforming the Regulation of Securities Offerings: An Essay”, 63-SUM Law & Contemp. Probs. (2000) 11 [hereinafter “Premises”]Google Scholar; Cox, James D., “Regulatory Duopoly in U.S. Securities Markets”, 99 Colum. L. Rev. (1999) 1200 [hereinafter “Regulatory Duopoly”]CrossRefGoogle Scholar; Fanto, James A., “The Absence of Cross-Cultural Communication: SEC Mandatory Disclosure and Foreign Corporate Governance”, 17 AW. J. Intl. L & Bus. (1996) 119Google Scholar; Edwards, Franklin R., “Listing Foreign Securities on U.S. Exchanges”, 5 J. Applied Corp. Fin. (1993) 28CrossRefGoogle Scholar; Oren, Fürst, “A Theoretical Analysis of the Investor Protection Regulations Argument for Global Listing of Stocks”, unpublished paper on file with the author (1998)Google Scholar; Uri, Geiger, “The Case for the Harmonization of Securities Disclosure Rules in the Global Market”, Colum. Bus. L. Rev. (1997) 241Google Scholar; Greene, Edward F. & Quinn, Linda C., Building on the International Convergence of the Global Markets: A Model for Securities Law Reform, PLI Order No. BO-0162 (December 10-11, 2001)Google Scholar; Greene, Edward F. et al. , “Hegemony or Deference: U.S. Disclosure Requirements in the International Capital Markets”, 50 Bus. Law. (1995) 413Google Scholar; Harder, Troy L., “Searching for a Level Playing Field: The Internationalization of U.S. Securities Disclosure Rules”, 24 Hous. J. Int'l L. (2002) 345Google Scholar; J. William, Hicks, “Protection of Individual Investors Under U.S. Securities Laws: The Impact of International Regulatory Competition”, 1 Global Legal Stud. J. (1994) 431Google Scholar; Jackson, Howell E., “Centralization, Competition, And Privatization in Financial Regulation”, 2 Theoretical Inquiries L. (2001) 649Google Scholar; Jackson, Howell E. & Pan, Eric J., “Regulatory Competition in International Securities Markets: Evidence From Europe in 1999 – Part I”, 56 Bus. Law. (2001) 653Google Scholar; Karmel, Roberta S., “Changing Concepts of Extraterritoriality”, 1/30/98 NYU 3, (col. 1)Google Scholar; Kitch, Edmund W., “Proposals for Reform of Securities Regulation: An Overview”, 41 Va. J. Int'l L. (2001) 629Google Scholar; Licht, Amir N., “International Diversity in Securities Regulation: Roadblocks on the Way to Convergence”, 20 Cardozo L. Rev. (1998) 227 [hereinafter “International Diversity”]Google Scholar; Licht, Amir N., “Games Commissions Play: 2x2 Games of International Securities Regulation”, 24 Yale Int'l. L. (1999) 61 [hereinafter “Games”]Google Scholar; Palmiter, Alan R., “Toward Disclosure Choice in Securities Offerings”, Colum. Bus. L. Rev. (1999) 1Google Scholar; Frank, Partnoy, “Multinational Regulatory Competition And Single-Stock Futures”, 21 Nw. J. Int'l L. & Bus. (2001) 641Google Scholar; Edward, Rock, “Securities Regulation As Lobster Trap: A Credible Commitment Theory of Mandatory Disclosure”, 23 Cardozo L. Rev. (2002) 675Google Scholar; Roberta, Romano, “Empowering Investors: A Market Approach to Securities Regulation”, 107 Yale L.J. (1998) 2359Google Scholar; Roberta, Romano, “The Need for Competition in International Securities Regulation”, 2 Theoretical Inquiries L. (2001) 387 [hereinafter “Need for Competition”]Google Scholar; Scott, Hal S., “Internationalization of Primary Public Securities Markets”, 63-SUM Law & Contemp. Probs. (2000) 71CrossRefGoogle Scholar; Scott, Hal S., “Internationalization of Primary Public Securities Markets”, 63-SUM Law & Contemp. Probs. (2000) 71CrossRefGoogle Scholar; Steinberg, Marc I. & Michaels, Lee E., “Disclosure in Global Securities Offerings: Analysis of Jurisdic-tional Approaches, Commonality and Reciprocity”, 20 Mich. J. Int'l. L. (1999) 207Google Scholar; Trachtman, Joel P., “Regulatory Competition and Regulatory Jurisdiction in International Securities Regulation”, in: Regulatory Competition and Economic Integration: Comparative Perspectives (Esty, Daniel C. & Damien, Gardin [eds.]) (Oxford: OUP 2001) 289–310.Google Scholar

3 See Fox, Merritt B., “Securities Disclosure in a Globalizing Market: Who Should Regulate Whom”, 95 Mich. L. Rev. (1997) 2498 [hereinafter “Disclosure in a Globalizing Market”]CrossRefGoogle Scholar; Fox, Merritt B., “The Political Economy of Statutory Reach: U.S. Disclosure Rules in a Globalizing Market for Securities”, 97 Mich. L. Rev. (1998) 696 [hereinafter “Political Economy”]CrossRefGoogle Scholar; Fox, Merritt B., “Retaining Mandatory Securities Disclosure: Why Issuer Choice is Not Investor Empowerment”, 85 Vir. L Rev. (1999) 1335 [hereinafter “Retaining Mandatory Disclosure”]CrossRefGoogle Scholar; Fox, Merritt B., “The Securities Globalization Disclosure Debate”, 78 Wash. U. L.Q. (2000) 567 [hereinafter “Disclosure Debate”]Google Scholar; Fox, Merritt B., “The Issuer Choice Debate”, 2 Theoretical Inquiries L. (2001) 563 [hereinafter “Issuer Choice Debate”].Google Scholar

4 While many participants in the debate take positions that weave together two or more of these approaches, the categorization set below forms a useful way to describe their positions and examine their underlying premises.

5 See supra n. 3. For other adherents of this approach, see Greene et al., supra n. 2; Baumol & Malkiel, supra n. 2. In subsequent writings, Edward Greene has placed more emphasis on the desirability of international uniformity, which he sees as being accomplished through harmonization of the rules of the existing national regimes. Greene & Quinn, supra n. 2.

6 See Fox, , “Political Economy”Google Scholar, supra n. 3 at 705-717. Professor Roberta Karmel has correctly noted that international uniformity through harmonization has also become an important element of the overall US approach, although only with regard to the SEC's treatment of foreign issuers, not domestic ones. Karmel, supra n. 2, at 485. She goes on to argue that the increasing ease with which US investors can trade on foreign exchanges makes the investor residency element of the current US approach (what Karmel calls “national treatment”) increasingly impractical. Ibid., at 488. She concludes that more emphasis on harmonization is the most practical way for the SEC to live with this situation and thus allow a limited issuer nationality approach to foster global integration of capital markets.

7 Some critics of the issuer nationality approach question the meaningfulness of the concept of an economic center of gravity in a world in which multinational companies have production facilities located around the world. See Kitch, supra n. 2, at 651. Critics have also questioned its workability as legal concept, suggesting that my assumption that it is not manipulable by well advised corporate managers is “heroic”. Jackson, supra n. 2, at 657 (18). Most of the world's issuers, even ones labeled “multinational”, still, however, have a distinct nationality of this sort in some country (particularly if the EC is for these purposes treated as a single country). In 1990, profits from foreign operations of US corporations amounted to only about one-sixth of all corporate profits, see NIPA Table 6.16C, 72 Surv. Current Bus. No. 12 (1992) at 14Google Scholar. In 1989, overseas assets of even US corporations designated as “multinational” were only about one-fifth of their total assets, see Lowe, J. & Mataloni, R. Jr., “U.S. Direct Investment Abroad: 1989 Benchmark Survey Results”, 71 Surv. Current Bus. No. 10 (1991) at 29 (data from Table 1)Google Scholar. I will briefly consider exceptions to this generalization – truly multinational companies such as Daimler-Chrysler and BP Amoco – in Part 4 infra.

8 I have discussed this point in more detail elsewhere. See Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2544-2550. See also Marcel, Kahan, “Securities Laws and the Social Cost of ‘Inaccurate’ Stock Prices”, 41 Duke L.J. (1992) 977Google Scholar; Mahoney, Paul G., “Mandatory Disclosure as a Solution to Agency Problems”, 62 U. Chic. L. Rev. (1995) 1047.CrossRefGoogle Scholar

9 See Fox, , “Retaining Issuer Disclosure”Google Scholar, supra n. 3, at 1358-1363.

10 See Fox, Merritt B., Required Disclosure and Corporate Governance, in: Hopt, Klaus J. et al. (eds.), Comparative Corporate Governance: The State of the Art and Emerging Research (Oxford: Clarendon 1998) 701–718Google Scholar. In the United States, we are so accustomed to a high level of issuer disclosure that we tend not to appreciate its importance with respect to these devices. A comparison with Russia is revealing. The dearth of disclosure there renders the fiduciary duties nominally imposed on management almost useless. See Bernard, Black & Reinier, Kraakman, “A Self-Enforcing Model of Corporate Law”, 109 Harv. L. Rev. (1996) 1911Google Scholar. It also makes relatively meaningless disinterested shareholder approval of transactions in which management is interested. See Fox, Merritt B. & Heller, Michael A., “Corporate Governance Lessons from Russian Fiascos”, 75 N.Y.U. L.Rev. (2000) 1720.Google Scholar

11 The market for corporate control is a well-recognized device for limiting the agency costs of management where ownership is separated from control, as in the typical publicly held corporation. More information and the resulting increase in price accuracy improve the control market's effectiveness in performing this role. A potential acquirer, in deciding whether it is worth paying what it would need to pay to acquire a target that the acquirer feels is mismanaged, must make an assessment of what the target would be worth in the acquirer's hands. This assessment is inherently risky and acquirer management is likely to be risk averse. Greater disclosure, however, reduces the riskiness of this assessment. Hence, with greater disclosure, a smaller apparent deviation between incumbent management decision-making and what would maximize share value is needed to impel a potential acquirer into action. Also, when share price is inaccurately high, even a potential acquirer that believes for sure that it can run the target better than can incumbent management may find the target not worth paying for. The increase in share price accuracy that results from greater disclosure reduces the chance that a socially worthwhile takeover will be thwarted in this fashion.

12 See Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2548-2550.

13 If a country's issuers represent only a small portion of all equities available to investors in the world, investors would share in none of these gains. The country would be analogous to a single small firm in a perfectly competitive industry. Such a firm's level of production has no effect on price. Following this analogy, what the country produces is investment opportunities – dollars of future expected cash flow – just like the firm produces products. A disclosure improvement's positive effects on managerial motivation and choice of real investment projects will increase the number of dollars of future expected cash flow that the country has to sell. This benefits the entrepreneurs, who are selling the cash flow, and labor, who gain from the overall increase in the country's economic efficiency. See Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2561-2569. Because the country is like a small firm, however, the increase in the amount supplied is not great enough to lower the price at which a dollar of future expected cash flow is sold. Thus there is no benefit to investors, the “buyers” of these dollars of expected future cash flow.

If a country's issuers represent a substantial portion of all equities available to investors in the world, as is the case with the United States, investors will share in some of these gains. A disclosure improvement's increase in the number of dollars of future expected cash flow that the country has to offer would be great enough to lower the price at which a dollar of future expected cash flow is sold, at least slightly. Thus investors — the buyers of these dollars of expected cash flow — would gain from the improvement. This is equally true of foreign investors as US investors, however, and foreign investors own almost two-thirds of all the shares of publicly traded issuers in the world. Ibid., at 2525 n. 51. And it is equally true of disclosure improvements of US issuers whose shares are primarily sold to, or traded among, only foreign investors as it is of US issuers with primarily US shareholders. For more detailed discussions of these points, see, ibid., at 2552-2580, and Fox, “Political Economy”, supra n. 3, at 732-739.

14 In portfolio theory terms, issuer disclosure reduces firm specific (”unsystematic”) risk. Firm specific risk can be completely eliminated by sufficient diversification. See Barbara, Banoff, “Regulatory Subsidies, Efficient Markets, and Shelf Registration: An Analysis of Rule 415”, 70 Va. L. Rev. (1984) 135.Google Scholar

Professor Hal Scott concludes that my proposition concerning the irrelevance of investor protection is “extreme” and “entirely unconvincing”. Scott, supra n. 2, at 75. He bases this conclusion on several arguments. First, he argues that there is no way for an investor to know that he is missing information. This argument, however, ignores the capacity of the market to make an unbiased guess as to the significance of the absence of an issuer statement about any particular matter. See infra, Sec. 2.1.3 and Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2533-2539. Second, he argues that in any event the price of a security in a primary offering is not set by the market. Scott, supra n. 2, at 76. I agree, which is why I would not apply my issuer nationality approach to foreign issuer IPOs, only to non-initial offerings where the security being offered already trades in an efficient market somewhere in the world. See infra, Sec. 1.3. Thus the price of any offering to which I would apply the issuer nationality approach is established in the securities market. Third, Scott argues that my proposition ignores the problem that rules can also require over-disclosure and that investors are hurt by such requirements. Ibid. The very legitimate concern over the costs of over-disclosure is not what I, at least, mean by “investor protection”, however, which I define as protecting investors from making damaging securities choices due to poor information. My incidence analysis shows that under the issuer nationality approach, the incidence of these costs would be on entrepreneurs and labor in the regulatory country, not on investors abroad. Finally, Scott argues that the “lack of disclosure would still result in imperfect allocation of capital”, ibid, at 78. I agree, but my incidence analysis shows that the issuer's home country government is the best government to decide on the optimal level of disclosure given the tradeoff between the costs of disclosure and its benefits such as improved allocation.

15 To the extent that globalization has not yet proceeded far enough to fully result in a single global risk adjusted expected rate of return on capital, the remaining market segmentation simply reinforces the point that the gains from a country's issuers disclosing at their optimal levels will be concentrated at home. A country whose issuers disclose at the optimal level of disclosure will have capital utilizing enterprises that produce higher returns net of costs of disclosure. If the single rate assumption is correct, the gains from getting the disclosure level right will primarily be enjoyed by the less mobile claimants on these returns, domestic entrepreneurs and labor, not by the suppliers of capital, who, wherever in the world they live, will at best enjoy a slight increase in the overall global expected return on capital. See supra n. 13. If the assumption is incorrect, the reason would be that each country's investors still have a degree of bias against issuers from other countries. In that event, US investors, for example, might share disproportionately in the gains from moving the US issuer disclosure level toward its optimal level. The bias of foreign investors against US issuers would mean that the increase in the number of expected dollars of future cash flow resulting from the change in required disclosure would be offered to a somewhat restricted market and push the price for them down more for US investors than for other investors. To the extent that a US issuer has US shareholders, the fact that US investors will share disproportionately in the gains from optimal disclosure simply creates an additional US interest in the level of the issuer's disclosure. As for US issuers whose shares are sold to and traded among only foreign investors, entrepreneurs and labor in the United States would, just as if there were a single global expected rate of return on capital, enjoy most of the gains from optimal disclosure. See Fox, , “Securities Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2561-2569. Thus, the United States interest in the disclosure behavior of this second set of issuers would be as strong as it is shown to be under the assumption in the text.

16 Professor Hal Scott, in support of a proposal for a modified harmonization approach, argues that different standards for issuers of different nationalities are inappropriate when the issuer of one country – Deutsche Telecom in his example – offers securities abroad because “the concern is with allocation among issuers of different countries”. Scott, supra n. 2, at 73. He does not, however, attempt to rebut the reasons set out above as to why, in his example, Germany's choice of disclosure level will in fact affect the allocation of capital to issuers of other countries.

17 See Fox, , “Retaining Mandatory Disclosure”Google Scholar, supra n. 3.

18 See Fox, “Political Economy”, supra n. 3, at 745-754 for a more detailed discussion of these points.

19 See Fox, “Political Economy”, supra n. 3, at 754-757 for a more detailed discussion of these points. See also Greene & Quinn, supra n. 2, at 17.

20 See 1.3.3. infra.

21 See Fox, “Political Economy”, supra n. 3, at 742-743 for a more detailed discussion of the points in the subsection.

22 Ibid. For similar reasons, Professor Choi would not extend his issuer choice proposal to such issuers. Choi, , “Promoting Issuer Choice”Google Scholar, supra n. 2, at 34-35.

23 See Fox, “Political Economy”, supra n. 3, at 756.

24 Cox, “Regulatory Duopoly”, supra n. 2, at 1202.

25 Ibid.

26 Ibid., at 1211.

27 See 1.2 supra.

28 See Fox, “Political Economy, supra n. 3, at 757-760. Professor Scott questions this proposition by stating “in major markets, including Germany and Japan, securities markets currently play an important enough role that those countries care about how they allocate capital”. Scott, supra n. 2, at 72. This statement, while true, does not respond to the point that determining the optimal level of disclsoure in the United States and in each of these other countries involves finding the point at which the marginal cost of more disclosure just equals the marginal benefit. Securities markets may be gaining in importance in these other countries, but they still have relatively greater importance in the United States. This greater relative importance of securities markets in the United States means that the benefits from more disclosure in the United States are greater, which in turn means that a more costly higher level of requried disclosure is optimal in the United States than in other countries.

29 Cox, “Regulatory Duopoly”, supra n. 2, at 1217-1223.

30 See Fürst, supra n. 2.

31 Cox, “Regulatory Duopoly”, supra n. 2, at 1234.

32 According to the efficient market hypothesis, the price at which an issuer's shares trade will be unbiased whether there is a great deal of information available about the issuer or very little. By “unbiased”, I mean that the price is on average equal to the share's actual value, i.e., what the future income stream accruing to the holder of the share – its dividends and other distributions – turns out to be, discounted to present value. Speculators – the persons whose actions in the market set prices – assess what this future income stream will be based not only on what information is available about the issuer but also on what is not. The empirical literature testing the efficient market hypothesis suggests that the inferences that speculators draw from issuer disclosures are in fact unbiased. Since there is no reason to believe that their inferences from issuer absences of comment are any more likely to be biased than their inferences from issuer disclosures, this literature suggests as well that the inferences they draw from issuer absences of comment are also unbiased. I discuss these points in considerably more detail elsewhere. See Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2533-2539.

33 See, e.g, Fisher, Black, “Noise”, 41 J.Fin. (1986) 529.Google Scholar

34 Cox, “Regulatory Duopoly”, supra n. 2 at 1234, 1246-1247.

35 The points that follow in the text summarize a more extensive discussion of mine concerning why noise theory does not undermine the argument that the issuer's home country has the greatest interest in its disclosure level, see Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2536-2537 n. 76, and 2555 n. 103.

36 Ibid.

37 Ibid.

38 Moreover, even if one does consider it unfair that naive speculators lose money in this fashion, there is no sound theoretical reason to believe a priori that increased disclosure is any more likely to alleviate the unfairness than to exacerbate it. This is because one of the effects of increased disclosure will be to reduce the riskiness for smart money speculators to engage in the trading activities that move wealth to themselves from the naive traders. Ibid.

39 Scott, supra n. 2, at 77. Scott states that if one is “picking stocks” (by which he presumably means trying to identify underpriced stocks) and assembling a portfolio of such stocks that is on the frontier of the possible tradeoff between risk and return, one needs to know as much as possible about each such identified stock's covariance with each other such identified stock. And knowing as much as possible about each of these covariances requires current information about the issuers involved, not just the historical figure. This exercise is worked through in Fox, , Finance and Industrial Performance in a Dynamic EconomyGoogle Scholar, supra n. 11, 36-43. Scott's statements are correct, but they are not relevant to the ordinary investor who follows the financial economist's standard advice: “don't stock pick, be fully diversified”. This good advice is based on the abundant evidence supporting the proposition that the ordinary investor cannot beat the market on an expected basis. Being fully diversified means holding the market portfolio (e.g., through holding shares of an index fund) or some random sample thereof. The investor following this advice needs no information to do so and enjoys no reduction in his overall portfolio risk from greater disclosure by the issuers of the stocks in his portfolio. Thus Scott is only correct that risk reduction is a good justification for mandatory disclosure if one concludes, contrary to the suggestion in the text infra, that a high level required disclosure, despite its very substantial costs, is preferable to better education as way of protecting investors who currently do not follow this advice.

40 Whatever level of disclosure is imposed on the issuer, each additional investment opportunity available to US investors that a share value maximizing firm finds worth selling into a market with unbiased pricing represents an increase in demand for savings. It therefore marginally raises the overall market expected rate of return available to every such investor. Also, each additional investment opportunity has a future return generated by a probability distribution with somewhat different variance-covariance characteristics than any existing opportunity and therefore permits investors to compose portfolios with more favorable tradeoffs between risk and return than otherwise would have been available. For a more formal elaboration of these points, Fox, , “Disclosure in a Globalizing Market”Google Scholar, supra n. 3, at 2542-2544.

41 Coffee, supra n. 2, at 694.

42 Frank, Easterbrook & Daniel, Fischel, “Mandatory Disclosure and The Protection of Investors”, 70 Va. L Rev. (1984) 669, 685–687.Google Scholar

43 At year-end 1994, the “G7” countries – United States, Canada, the United Kingdom, France, Italy, Japan, and Germany together accounted for 75 percent of the world's total market capitalization of nearly US $ 15.2 trillion. International Finance Corporation, Emerging Stock Markets Factbook 1995 (1995) at 15.Google Scholar

44 One way to test this proposition is to compare, for foreign issuers listed on a US exchange, the response of their share prices when they originally announce their earnings prepared on the basis of home country conventions, with the response of their share prices when they subsequently announce these earnings reconciled with US GAAP. Gary Meek performed such a test and found that the price response to the first announcement suggests it has considerable information value, while there was not a statistically significant price response to the second announcement. Meek, Gary K., “U.S. Securities Market Responses to Alternate Earnings Disclosures of Non-U.S. Multinational Corporations”, 58 The Accounting Review (04 1983) 394.Google Scholar

45 Coffee, supra n. 2, at 694.

46 This response to the comparability argument in favor of the transaction location approach over the issuer nationality approach depends on the primary market in which an issuer's shares are traded being efficient. I limit my proposal for adoption of the issuer nationality approach to issuers that meet this condition. Sec. 1.3.3 supra. For the same reason, Professor Choi imposes a similar limitation on his issuer choice proposal. Choi, , “Promoting Issuer Choice”Google Scholar, supra n. 2, at 824-25.

47 1.2.3 supra.

48 Ibid.

49 Coffee, supra n. 2, at 691-692; Rock, supra n. 2.

50 See 1.3.3 infra.

51 Fürst, supra n. 2, at 1.

52 Cox, “Regulatory Duopoly”, supra n. 2, at 1239-1242.

53 Karmel, supra n. 2, at 3.

54 Cox, “Regulatory Duopoly”, supra n. 2, at 1240.

55 The confusion between the issuer nationality approach and the issuer choice approach is suggested by his statement: “Greater extraterritorial breadth is recognized with respect to power of a state over its citizens abroad, but this is not the relationship we find with the Dutch corporation purporting to invoke US disclosure standards in its French offering.” Ibid. It should be noted that in this statement, Cox appears to agree with my position that there is no international law problem with the United States enforcing its regime against a disclosure violation by a US issuer making an offering in France, which is all that the issuer nationality approach calls for.

56 Fox, “Political Economy”, supra n. 3, at 727. Ironically, it is the transaction location approach that, when applied to the secondary trading in the United States of foreign issuer shares, can create problems under international law. These problems arise where neither the issuer nor anyone contractually related to it offered, sold, or promoted the trading of its shares in the United States, but organized trading in the issuer's shares nevertheless develops in the United States. In that situation, the issuer has undertaken no conduct occurring within the United States. The nationality principle obviously does not work either. And the substantial effects principle is only of debatable help. See ibid., at 724-727.

57 American Law Institute, Restatement (Third) of Foreign Relations Law of the United States (1987) § 402(2)Google Scholar (hereinafter Restatement). This basis involves “determining jurisdiction by reference to the nationality or national character of the person committing the offense”. “The Harvard Research on International Law: Jurisdiction to Prescribe”, 29 Am.J.Int.L, Supp. 1 (1935) 435, 445Google Scholar. It is described by commentators as “universally accepted”. Ibid. Cox suggests that this does not constitute adequate authority because I do not “consider well recognized limits on a nation's jurisdiction to enforce its prescriptions”, Cox, “Regulatory Duopoly”, supra n. 2, at 1239 n. 126, but he ultimately makes nothing of this distinction, citing the same section of the Restatement as I do and even making reference to the nationality principle as one of “the five bases for claiming jurisdiction under international law”. Ibid., at 1240-1241 n. 130.

58 Fox, “Political Economy”, supra n. 2, at 735-736.

59 Cox is silent about exactly what he thinks the “terrific” political issues might be.

60 The only French group who could possibly be injured by extending US disclosure requirements to US issuers whose shares are offered in the French market are persons who profit from the volume of securities transactions effected in France. With the issuer nationality approach, US issuers will no longer have an incentive to evade US disclosure rules by offering and promoting the trade of their shares abroad. Thus the proposed switch in approach would diminish the volume of US issuer share transactions located in other countries. But this injury is not a legitimate basis for other countries to protest the proposed extension of the US requirements. Between countries, volume is a 0-sum game. It should be won or lost based on the cost and quality of the transactional services available in each country, not on the ability of one country to offer a way to evade regulations of another country aimed at behavior that primarily affects the welfare of residents of the country whose regulations are being evaded.

61 See Blake, supra n. 2; Fox, “Political Economy”, supra n. 3, at 780-782.

62 Cox, “Premises”, supra n. 2, at 29-30.

63 Ibid.

64 Sec. 1.2.2 supra.

65 Cox instead focuses almost entirely on problems with issuer choice – ones that do not apply to issuer nationality – when he provides the reasoning behind his purposes critique of any move away from the transaction location approach. Cox, “Premises”, supra n. 2, at 30-32. His only remark relating to issuer nationality is the incorrect statement that it “focuses exclusively on the impact of mandatory disclosure on issuers”. Cox, “Premises”, supra, at 29. In fact, as the incidence analysis in the text shows, my proposal for the issuer nationality approach focuses not on the artificial person of the corporate issuer but on the real persons ultimately most affected by an issuer's level of disclosure. These turn out to be entrepreneurs and suppliers of the factors of production that are less globally mobile than capital. On an expected basis, investors are only affected by the issuer disclosing closer to its optimal level of disclosure to the minuscule extent that doing so enhances the overall global expected return on capital. See nn. 13 and 15 infra.

66 Sec. 1.2 supra.

67 Recent, fully elaborated proposals for full scale issuer choice have been made by Professors Choi and Guzman and Professor Romano. See Choi & Guzman, supra n. 2; Romano, supra n. 2. Professor Palmiter has recommended that issuers be able to opt out of the federal mandatory disclosure system, but only for the offering of securities, not for periodic disclosure. Palmiter, supra n. 2, at 86-101. Palmiter's primary concern does not appear to be transnational securities transactions, however. Ibid. These recent proposals have less elaborated historical antecedents. See Grundfest, Joseph A., “Internationalization of the World's Securities Markets: Causes and Regulatory Consequences”, in: International Competitiveness in Financial Services (Kosters, Marvin H. & Meltzer, Allan H. [eds.]) (Kluwer 1991) 349Google Scholar; Nicholas, Demmo, “U.S. Securities Regulation: The Need For Modification to Keep Pace with Globalization”, 17 U. Pa. J. Int'l Econ. L. (1996) 691, 720.Google Scholar

68 See, e.g., Geiger, supra n. 2; Steinberg & Michaels, supra n. 2, at 261-265 (the world's countries, by self selection, would be divided into three groups - developed market, semi-developed market and emerging market - and each group would work out a uniform disclosure rules for its countries' issuers that would permit sale and trading of their securities anywhere within the group). IOSCO, a worldwide organization of countries that provides a forum for meetings of the securities regulators of member states, initially undertook a straddle in which it urged countries either to adopt uniform rules (international uniformity) or reciprocity (essentially the issuer nationality approach). International Equity Offers, Report of the Technical Committee of IOSCO, as cited in: Steinberg & Michaels, supra n. 2, at 241. IOSCO, in cooperation with IASC, is seeking to develop a recommended set of international accounting standards and has developed a set of non-financial disclosure standards that could be used in a single uniform disclosure document for cross border offerings, and thus has tilted toward international uniformity as the preferred result. See IOSCO, International Equity Offers, Report of the Technical Committee (Sept. 1989)Google Scholar, available from IOSCO at <www.iosco.org> cited in: Michel, Hurley, “International and Debt and Equity Markets”, 8 Emory Int'l. L. Rev. (1994) 701, 733Google Scholar; Steinberg & Michaels, supra n. 2, at 241,243-246; and Karmel, Roberta S., “The IOSCO Venice Conference”, NYU 3 (Oct. 19, 1989)Google Scholar, Karmel, supra n. 2, at 488.

69 Advocates of some kind of harmonization include Greene & Quinn, supra n. 2, and Karmel, supra n. 2. See nn. 4 and 5 supra for further discussion of their approaches. See Fox, “Political Economy”, supra n. 3, at 705-717.

70 Ibid.

71 Romano, supra n. 2, at 2361-2362, Choi & Guzman, supra n. 2, at 907.

72 Romano, supra n. 2 at 2419-2420; Choi & Guzman, supra n. 2, at 922-923.

73 Fox, “Retaining Mandatory Disclosure”, supra n. 3.

74 Romano, supra n. 2, at 2362.

75 Choi & Guzman, supra n. 2, at 916-17.

76 Fox, , “Retaining Mandatory Disclosure”Google Scholar, supra n. 3, at 1342-1410.

77 Choi & Guzman, supra n. 2, at 948-950.

78 Ibid., at 948.

79 See Fox, “Political Economy”, supra n. 3, at 766-797.

80 There is also the distinct possibility that issuer choice will lead to a convergence of disclosure regimes with each jurisdiction competing to attract the maximum its number of issuers by trying to appeal to the broadest possible segment of the market. This would be accomplished by offering a regime that minimizes the average distance between its requirements and the preferences of each of the world's issuers. US issuers would move from being regulated by a standard designed for the average US issuer to being regulated by one designed for the average issuer worldwide. This would reduce, not enhance, US welfare because the only effective choices then available to US issuers would likely have requirements further from these issuers' socially optimal level of disclosure than is the current US mandatory regime. I discuss these points more fully in Fox, , “Retaining Mandatory Disclosure”Google Scholar, supra n. 3, at 1396-1404.

81 Professor Bernard Black is unconvinced that issuer choice poses a serious problem of US issuers choosing a foreign regime with a suboptimal level of required disclosure. Black, supra n. 2, at 843-845. To start, Black is skeptical that many US issuers would make such a choice. He predicts that such a choice would have a negative impact on an issuer's share price because of the loss in comparability with other US issuers and the choice's adverse selection implications. This negative price impact would “swamp the modest accounting cost savings”. Ibid., at 845. Black's analysis misses the point of my concern with issuer choice, however. The primary motivation for the choice of regime with a suboptimally low level of required disclosure is not the savings of accounting costs, but the ability to avoid disclosures of value to competitors, an aspect of the choice that will enhance, not hurt, share price. To the extent the higher US regime accounting costs are justified by their capacity to improve project choice and managerial discipline, their elimination would indeed result in a lower price and thus under my analysis would not be a reason for concern with allowing issuer choice, at least in situations where we expect managers to make share value maximizing choices. The reasons Black cites for why a choice of a suboptimal regime would be deterred by a negative price effect do not appear very important. Comparability, as we have seen, is not a serious problem for share price, Sec. 2.3. And an adverse selection price effect based on a concern that the firm was switching to hide bad news would, in any case where in fact nothing was being hidden, dissipate over time as real results become apparent. Thus such an effect would not be a major deterrent to a switch to a suboptimal foreign regime by an established publicly traded US firm that is run by a share value (rather than immediate share price) maximizing management. It should also be kept in mind that another reason to be concerned with switches to suboptimal regimes under issuer choice is, as Black himself notes, that the managers of established publicly traded issuers are the ones that would effectively make the decision to switch, not the issuer's shareholders, and their self interest in laxer disclosure might dominate their concern about any negative price effects. Ibid. See also Fox, , “Retaining Mandatory Disclosure”Google Scholar, supra n. 3, at 1355-56, 1410-12.

The second reason Black is unconvinced that issuer choice poses a serious problem of US issuers choosing a foreign regime with a suboptimal level of required disclosure is that he dismisses the whole importance of the choice. He terms the debate between advocates of issuer choice and issuer nationality as “misguided” because it focuses on disclosure rules, which “are a small part of the network of institutions that support strong disclosure”. Black, supra n. 2, at 844. This statement both misdescribes the focus of the debate and incorrectly minimizes the importance of effectively enforced rules. More is at stake in the debate than just substantive rules: concern about the enforcement mechanisms that come along with the regime assigned to govern an issuer, whether that assignment is made as a result of the issuer's nationality, as it would be under the issuer nationality approach, or as a result of the issuer's choice, as it would be under issuer choice, is just as great a concern to the debaters as concern about the substantive rules associated with the assigned regime. And I simply cannot agree that differences among regimes in their substantive rules about such things as the disclosure of reserves or of interested transactions are, when effectively enforced, of little importance.

Professor William Carney is also unconvinced that issuer choice poses a serious problem of US issuers choosing a foreign regime with a suboptimal level of required disclosure. He reaches this conclusion even though he acknowledges that an issuer will have negative incentives to disclose because of concerns that the disclosure will be of benefit to competitors, major suppliers and major customers. Carney, supra n. 2, at 735. Carney does not see this as a problem, however, because he says that diversified investors will, because of their investments in these other companies, want the issuer to disclose more and the issuer's share price will suffer if it does not provide what the market wants. Ibid. The problem with Carney's analysis is that in fact there will be no price penalty for failing to provide the extra information. The shares will not be more valuable to hold and hence will not command any higher price in the market if the issuer provides this information of value to these other companies than if it does not. This point is discussed in more detail in Fox, , “Issuer Choice Debate”Google Scholar, supra n. 3, at 585-590.

82 Professor Howell Jackson and Eric Pan have conducted a survey of offering practices in Europe and find little utilization of the EC mutual recognition directive that allows an issuer from one country to conduct a public offering in another country by simply complying with its home country disclosure rules. Instead, an issuer wishing to conduct an international offering typically offers its securities publicly just to its home country investors (in accordance with home country disclosure rules) and simultaneously offers them abroad only to institutional investors. These institutional offerees are provided “international-style offering” disclosure, which is higher in quality than what is required by home country rules. From this, Jackson and Pan conclude that concern that issuer choice would cause downward pressure on the level of issuer disclosure is overblown since issuers appear to be responding to market pressures to provide more than what is required of them. Jackson and Pan, supra n. 2, at 655.

I am not convinced that the survey results properly lead to this conclusion. To start, it is important to note that there is no evidence that issuers provide more than home country disclosure in their periodic disclosure and this is the level of disclosure at which secondary trades across Europe will occur in an issuer's securities. Second, the higher level of disclosure found in the primary international style offerings was not public disclosure, it was made only to the institutional offerees. Third, Jackson and Pan themselves note that the mutual recognition rules for primary offerings directly to retail customers are not as convenient as they first appear, ibid., at 680-81, and that there is considerable evidence that instead the institutional offerees often quickly resell their shares in the public trading markets, thus acting merely as conduits to retail purchasers in a way that without registration would be prohibited under US securities laws. Ibid., at 687-690. These ultimate retail purchasers purchase on the basis of the lower level home country mandated periodic disclosure. Ibid. Thus, viewing the transactions in terms of their economic substance rather than legal form, even primary offering disclosure is at this lower home country level.

83 Choi & Guzman, supra n. 2, at 749.

84 Ibid.

85 See 1.3 supra.

86 Choi & Guzman, supra n. 2, at 749-750; Romano, supra n. 2, at 2362.

87 I am skeptical on both these points. See “Retaining Mandatory Disclosure”, supra n. 3, at 1416-1419. Professor Choi has recently supplemented his arguments that issuer choice is superior to issuer nationality by minimizing the problem of the externalities associated with issuer disclosure. He suggests, for example, that sometimes a firm with good news that it does not want other companies to know about can signal its good news to investors by obtaining certification through association with a high-reputation intermediary. Choi, “Regulatory Responses”, supra n. 2, at 625-626.1 am sure this can happen but I am doubtful as to the importance of the technique relative to the size of the problem. Choi gives no examples and it would seem that the most common reputational intermediaries – underwriters and accountants – primarily signal that there is no hidden bad news rather than that there is hidden good news. Choi also suggests that not all issuer disclosures involve positive externalities from a social point of view because, for example, some disclosures can make price collusion easier. Ibid., at 627. This observation, however, does not obviate the concern that, absent regulation, there will, from a social point of view, be under-provision of the wide range of disclosures that do involve positive externalities. It simply suggests that there is no need to mandate disclosure of those items that, on balance, are socially undesirable to have disclosed.

88 See nn. 5, 6 and 68, supra.

89 The SEC, and some key persons who have been associated with the SEC, have professed interest in disclosure rules being internationally uniform, but want the rules to be as close as possible to the current US rules. Regulation of International Securities Markets – Policy Statement of the U.S. Securities and Exchange Commission, SEC Release 33-6807 (Nov. 14, 1988) (laying out a preference for uniformity in broad terms); Doty, James R., “The Role of the SEC in an Internationalized Marketplace”, 60 Fordham L Rev. (1992) S77, S78, S85, S86Google Scholar; Lome, Simon M., “Current Trends in International Securities Regulation”, 28 Cornell Int'l L.J. (1995) 453Google Scholar. Adherents of this position are, in a sense, “trying to have their cake and eat it too”. They are really seeking to achieve the same goals as are served by the investor residency and transaction location approaches: assuring US resident investors wherever they buy, and investors from anywhere who utilize US markets, that the issuers (whether US or foreign) whose stock they buy provide traditional US level disclosure. At the same time, they seek to eliminate the existing barrier – the difference between US and foreign disclosure standards - that keeps most foreign issuers away from US markets, a barrier that deprives the US securities industry of business and limits or makes more expensive for US investors a variety of foreign investment opportunities. The problem with this position is that foreign countries are unlikely to agree to rules that come close to US standard because the optimal disclosure level for their issuers is lower than the optimal level for US issuers. See 3.2.2 infra; Licht, “Games”, supra n. 2 (discussing models of the bargaining dynamics and competitive factors that would shape whether there would be convergence of disclosure rules); Fox, “Political Economy”, supra n. 3 at 757-765 (describing the unlikelihood of international agreement on uniform rules) and at 766-785 and 799-822 (describing the likelihood that absent a switch to the issuer nationality approach, globalization will lead to a lowering of the traditional US level of required disclosure).

90 See, e.g., Facilitation of Multinational Securities Offerings, Securities Act Release No. 33-6568, 1985 SEC LEXIS 2074 (February 28, 1985)Google Scholar (suggesting agreement among several countries on a single prospectus format and common disclosure standards as one possible approach to facilitating multinational offerings). See also IIIWarren, Manning Gilbert, “Global Harmonization of Securities Laws: The Achievements of the European Communities”, 31 Harv. Int'l L.J. (1990) 185, 187Google Scholar; Fontecchio, John M., “The General Agreement on Trade in Services: Is It the Answer to Creating a Harmonized Global Securities System?”, 20 N.C.J. Int'l Law & Com. Reg. (1994) 115, 123Google Scholar (suggesting that GATS be considered as a means to pull the governments of the world toward a harmonized global securities market).

91 Professors Fanto and Karmel conducted a survey of foreign issuers that had registered their shares with the SEC. Their results provide an example of this kind of problem. Some of the surveyed issuers complained that the SEC staff was unfamiliar with the business, accounting and legal practices in their countries, thereby generating more lawyer involvement and expense. See Fanto, James A. & Karmel, Roberta S., A Report on the Attitudes of Foreign Companies Regarding a U.S. Listing (NYSE Working Paper No. 97-101,1997) 32-35.Google Scholar

92 See Fox, “Political Economy”, supra n. 3, at 758-760; Licht, “International Diversity”, supra n. 2, at 237-253. Steinberg and Michaels' suggestion of three groups of countries, self-identified in terms of market development, each developing its own uniform rules appears to be a compromise between fully accounting for national differences among issuers and having full international uniformity. Steinberg & Michaels, supra n. 2, at 261-265. It is not clear that the tradeoff that they propose is particularly helpful, however. First, national differences in socially optimal disclosure levels differ for many reasons other than level of market development: the United States, Germany and Japan are illustrative of this point. Second, there is no reason to keep an issuer from the emerging country group that only complies with that group's disclosure rules, from trading in the US as long as their principal trading market, wherever it is located, is efficient. See 2.2.2 and 2.3 supra. The primary gains from transnational securities transactions for an emerging country issuer is presumably to access capital from developed countries; an offering by such an issuer into another emerging country would be of little value to the issuer.

93 See 2.1 supra.

94 Kitch, supra n. 2, at 651, and Choi, “Regulatory Responses”, supra n. 2, at 646, have each expressed concern about this phenomenon in terms of the rationale for the issuer nationality approach.

95 I discuss these points in more detail elsewhere. See, Fox, “Political Economy”, supra n. 3, at 747-749, 762-764.

- 2

- Cited by