1. Key Definitions and Interpretations

This paper will rely on the definitions as outlined below, with certain other terms being clarified as they occur where appropriate. Technical machine learning (ML) concepts and definitions are not widely used in this paper, with an actuarial and business perspective being favoured.

1.1. Artificial Intelligence (AI)

This paper relies mostly on the Organisation for Economic Co-operation and Development (OECD) (2019) definition of Artificial Intelligence (AI):

“‘Artificial intelligence system’ (AI system) means a machine-based system that is designed to operate with varying levels of autonomy and that can, for explicit or implicit objectives, generate output such as predictions, recommendations, or decisions influencing physical or virtual environments”.

We focus our discussion on the statistical learning, ML, deep learning, and, at a high level, large language models (LLMs) as defined below.

Statistical learning: statistical learning involves using statistical methods (including Bayesian and optimisation methods) to perform ML. It typically covers regression tasks rather than the more comprehensive field of ML, which may include areas like computer vision (cf. Hastie et al., Reference Hastie, Tibshirani and Friedman2017). Whilst statistical learning also encompasses linear models (e.g. Generalised Linear Model (GLMs)) under this definition, they could potentially be placed in a lower-risk class based on their transparency, and many of the traditional risk management strategies can be applied.

ML: this paper takes ML to refer to the process of passing data through an algorithm that seeks to minimise the difference between its output and a target in order to learn (also referred to as supervised learning). The algorithm in question typically has a randomised form initially, but as it sees more and more data, the training algorithm learns parameters which enable the model to perform increasingly better. ML also includes unsupervised learning, where an algorithm seeks to cluster the data, and reinforcement learning, where an algorithm seeks to optimise a specific future goal over time based on user environment feedback. Algorithms such as support vector machines, decision trees, ensemble models like random forests, and boosting algorithms like gradient boosting machines are included but not limited under this definition of ML (see also Brown, Reference Brown2021).

Deep learning: deep learning refers to training neural networks with at least two hidden layers to produce outputs based on training data. Deep learning is a subset of ML in our context (LeCun et al., Reference LeCun, Bengio and Hinton2015).

LLMsFootnote 1 : LLMs are a class of AI models trained on large amounts of text data to “learn” a topic and its language structure to mimic human text. They are usually transformer models comprising billions of parameters, making them a black box, and are often built on an existing, foundational model (Goyal et al., Reference Goyal, Vasrshney and Rozsa2023). They are a class of generative models, meaning they can produce an entirely new output based on input. They have been successfully used to develop sophisticated chatbots, such as OpenAI’s ChatGPT and Google’s Bard (Bowman, Reference Bowman2023).

Similar to the OECD definition and our interpretation above, the European Union’s AI Act (European Council, 2021) offers more specificity in their definition of AI that lists specific approaches included under AI. The Institute and Faculty of Actuaries (IFoA) has taken a broad approach to defining AI, with the IFoA (2023a) defining AI as “an umbrella term for a range of technologies and approaches that includes the use of data science and machine learning models to solve complex tasks”.

The Financial Reporting Council (FRC) (2023b) also takes a broad definition of AI but offers more specificity than the IFoA definition:

“Techniques that allow computers to learn from data without being explicitly programmed or reprogrammed. It involves algorithms that can adapt and improve over time, learning from experiences (in the form of data inputs) to predict outcomes or make decisions. AI/ML algorithms identify patterns and relationships within data, which can then be used to predict future data or inform decision making processes”.

Note that the AI landscape is continually changing, and what is considered AI may evolve.

1.2. Other Definitions and Interpretations

Discrimination: In this paper, discrimination is defined as the unfair or prejudiced treatment of persons belonging to a specific group, particularly concerning protected personal characteristics, for example, race and gender (see section 1.1 for further discussion) (Equality Act, 2010).

Big data: This paper considers big data to be growing amounts of voluminous, diverse sets of data, encompassing the volume of information, the scope of the data being collected, and the speed at which it is collected or created (Thouvenin et al., Reference Thouvenin, Suter, George and Weber2019; Segal, Reference Segal2022).

Regulation: We note that UK’s approach to AI regulation is pro-innovation and principles-based, with additional industry-specific regulations being under development. Additionally, there are efforts underway to develop global AI standards, for example, through the Digital Regulation Cooperation Forum (DRCF) (see DRCF, 2022) and the International Organisation for Standardisation (see Levene, Reference Levene2023).

This paper is also shared with regulatory and industry bodies for discussion, and comments from initial discussions with the Centre for Data Ethics and Innovation (CDEI), FRC, and the Prudential Regulation Authority (PRA) in the UK have been considered.

2. Introduction

The current AI landscape is changing at a rapid pace, as shown by the recent boom in AI releases for public use (e.g. self-driving e-hailing services, ChatGPT, and Microsoft Copilot) and as seen in the application of actuarial work (Richman, Reference Richman2018; Kessler, Reference Kessler2020; Cheung et al., Reference Cheung, Kang and Goldfarb2022; Shaw, Reference Shaw2023; see also Chamberlain & Vander Linden (Reference Chamberlain and Vander Linden2023) for potential future use cases).

During the technology boom and the age of social media, there has been a growing concern regarding data usage and protection, with recent regulation (e.g. the EU General Data Protection Regulation (GDPR)) aiming to address the issue, and recent news coverage is increasing public awareness regarding AI, for example, “‘Godfather of AI’ Issues New Warning Over Potential Risks to Society” (AFP, 2023), with the IFoA releasing a risk alert on the use of AI by actuaries in September 2023 (IFoA, 2023a) and a data science thematic review (IFoA, 2023a). Additionally, the rapid release of various AI tools has made more consumers aware of AI and its potential uses. However, due to the rapid boom of AI, regulation is still, in some respects, playing catch-up. The UK government has taken a principles-based pro-innovation approach to AI regulation (Department for Science, Innovation and Technology, 2023),Footnote 2 and they are embracing initiatives such as the AI safety summit to help promote the responsible adoption of AI. Footnote 3

Regulators and professional bodies are still in the process of developing and releasing regulation and guidance per industry (see also Roberts et al. (Reference Roberts, Ziosi, Osborne, Saouma, Belias, Buchser, Casovan, Kerry, Meltzer, Mohit, Ouimette, Renda, Stix, Teather, Woolhouse and Zeng2023) for a comparative framework of regulatory AI policy). Currently, there appears to be minimal specific regulation on how to appropriately apply AI safely in an actuarial context. However, the UK’s Science, Innovation, and Technology Committee (2023a) has also released an interim reportFootnote 4 on the governance of AI which may help guide the development of regulation.

In the context of these trends, we explore some of the risks related to AI from an actuarial perspective based on research from a transregional industry focus group. The group considered potential issues and challenges of using AI, primarily as it relates to the use of AI for modelling and analytics, in the context of the following themesFootnote 5 :

-

Bias, fairness, and discrimination

-

Individualisation of risk assessment

-

Public interest

-

Interpretability and explainability

-

Transparency, reproducibility, and replicability

-

Validation and governance

-

Lack of relevant skills

Even though the majority of these themes are familiar to actuaries, the use of AI in the context of actuarial work and increased societal awareness of AI is increasing the complexity and magnitude of these themes. The focus is on the ethical and professional challenges regarding the development and use of AI within an actuarial context, but given the rapid development and topical nature of AI in general, certain wider uses and types of AI have been included to a smaller extent.

Whilst some regulation and actuarial guidance on dealing with these topics exist, it can be difficult to consolidate the guidance available and even more challenging to implement it practically in the context of AI. In some cases, there may also be different interpretations depending on the jurisdiction or industry the actuary is working in.

As such, this paper, based on the group’s research, identifies the critical issues faced within actuarial work, evidence example problematic elements of each theme within the context of AI, and presents references to specific regulations, guidance, best practices, and example practical recommendations on how to navigate the use of AI as actuaries. We include example considerations for the appropriate use of AI within traditional and, in some cases, non-traditional actuarial fields.

However, we recognise that further regulation and guidance are required, given the pace of change and the complexity of some of the issues we raise. With the current rate of change, it may be challenging for guidelines and regulation to keep up with technological advancements and new techniques, which could necessitate dynamic guidelines. We acknowledge that there may be regulation or guidance currently in development or in existence that might not be included here that could potentially address some of the challenges outlined here.

Our research aimed to focus on key themes and findings observed by group members during our research (February–June 2023, with additional high-level LLM-focussed research in November and December 2023 as per Appendix B) and is not intended to form an exhaustive list. We recognise that new developments and regulations may also need to be considered. The paper incorporates transregional themes, but in the context of regulation and professional standards, the focus centres mainly around UK (and in some cases European) regulation. Other themes or regulations may be relevant, dependent on the jurisdiction of concern. The examples shown should be viewed as indicative and are not exhaustive.

2.1. Modelling

Utilising synthetic driver telematics data from So et al. (Reference So, Boucher and Valdez2021), we consider and analyse a motor insurance problem using ML which are further discussed in the following sections of the paper:

-

Section 3.1: Proxy discrimination, for example, by identifying whether a subset of features can indirectly be a proxy for a protected feature.

-

Section 3.1: Fairness, for example, by using the fairlearn library (Bird et al., Reference Bird, Dudik, Horn, Lutz, Milan, Sameki, Wallach and Walker2020) to assess the fairness of model predictions.

-

Section 3.2: Individualisation of risk premiums, for example, by evaluating risk premiums across various levels of aggregation.

-

Section 4.1: Explainability techniques, for example, by demonstrating global and local explainability metrics and demonstrating how the output could be explained.

The examples and results are discussed at a high level in relevant sections. A detailed breakdown of the modelling is available on request at info@actuartech.com.

Note that these examples are for illustrative purposes only and the results should not be construed as insurance advice and should not be used for decision-making purposes.

3. Ethical Themes

3.1. Bias, Fairness, and Discrimination

In this paper, we consider the broader notion of bias which is partiality that may result in unethical discrimination against customers with specific protected characteristics, especially when pricing insurance products.

An example of bias includes racial bias, where a system (either the design, input, interpretation, outcomes, etc.) is inherently skewed along racial lines (Casualty Actuarial Society (CAS), 2021a, 2021b; see Fannin (Reference Fannin2022) for a discussion on race in insurance). Introducing fairness criteria and their validation has been seen as a mitigating step, but this requires defining fairness and quantifying discrimination. This also includes identifying where discrimination materialises within the pricing context: data, modelling, interpretation, application, or a combination of aspects.

Discrimination can be considered direct or indirect, with the former being the use of a prohibited characteristic as a rating factor. The latter, in the case of insurance, can be seen as the conflux of (i) the implicit ability to infer protected characteristics from other (legitimately used) policyholder features, that is, proxy discrimination and (ii) a systematic disadvantage resulting in a group that is protected by a non-discrimination provision (Tobler, Reference Tobler2008).

Although insurance practices have not drastically changed and most biases are not new, evolving social contexts and advanced modelling techniques have impacted the conception and execution of insurance fairness and require practitioners to keep up with what is socially, ethically, and legally acceptable. What is perceived as insurance fairness is therefore a dynamic concept dependent on cultural, historical, technical, and technological contexts.

Additionally, the Bank of England (2022) and the UK’s Equality and Human Rights Commission (EHRC) (2023) have raised concerns regarding discriminatory decisions associated with the use of AI, particularly within the context of consumer protection (see Regulation later in this section). The EHRC (2023) notes that government should ensure that regulators are able to address equality adequately within new policies regarding AI.

3.1.1. What empirical evidence is there that this may be an issue?

In addition to those listed above, there have been traditional actuarial examples (see Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022a) where the correlation between smoking and gender was intentionally exploited in the pricing of a health insurance product. The direct discrimination could be reduced through, for example, the removal of sensitive attributes from data. However, residual effects from variables that may have been removed are still cause for concern, such as smoking status. ML models may pick up on proxy features and effectively recreate a feature from other provided features, resulting in proxy discrimination, for example, when certain features such as height are used as a proxy for gender, that could result in unfair discrimination and cause a disparate impact (see Prince & Schwarcz (Reference Prince and Schwarcz2020) for a discussion on proxy discrimination in the age of AI and big data).

Another example of discrimination includes using postcodes as a proxy for ethnicity (CAS, 2021a, 2021b; Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022a, Reference Lindholm, Richman, Tsanakas and Wüthrich2022b; Rakow & Mitchell, Reference Rakow and Mitchell2022; see also Citizens Advice’s (2023) report on discriminatory pricing and the so-called ethnicity penalty). The problem is magnified in advanced ML and AI techniques such as deep neural networks, which might have hundreds of inputs and thousands or even millions of model weights (parameters), which could cause unintentional proxy discrimination.

Whilst there could be a technically sound way of dealing with the issue of bias and discrimination through Discrimination-free Insurance Pricing (Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022a; cf. Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2023), the challenge of appropriately defining what is fair or unfair remains.

Furthermore, some actuarial and insurance bodies abroad have released reports and guidance on the challenges related to bias and fairness for AI in insurance, for example, the report on AI and big data in Canada (Insurance Institute, 2021), and the Australian guidance on issues in AI, which notes the need to tackle bias and fairness (Actuaries Institute and Australian Human Rights Commission, 2022).

3.1.1.1. Modelled example 1

To test the notion of proxy discrimination, we trained an XGBoost model, a popular implementation of a gradient boosting model, whereby classification or regression decision tree models (Breiman et al., Reference Breiman, Friedman, Olshen and Stone1984) are iteratively trained to improve on the performance of its predecessor (Chen & Guestrin, Reference Chen and Guestrin2016), in the context of motor insurance, to try to classify gender based on traditional policyholder characteristics (e.g. age, marital status, car use, credit score, years without a claim) and telematics data (brake intensity, acceleration, turn intensity, times the vehicle is driven).

Hypothesis: if we can train an accurate classifier for the protected feature, it may imply that other features are acting as proxies for the protected feature. However, to determine if proxies exist and to mitigate the effects of proxies, or ensure fairness towards a protected class, the protected feature is still required in order to test where the proxy in respect of a particular feature exists (Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022b).Footnote 6

After training our model, we use the permutation feature importance technique to determine which features are more likely to predict a policyholder’s gender (see Figure 1). Permutation feature importance is a model-agnostic measure of the relative importance of features in a model that is comparable across different families of models (Breiman, Reference Breiman2001; Fisher et al., Reference Fisher, Rudin and Dominici2018).

Figure 1. Permutation feature importance of driver characteristics when predicting gender (higher values indicate greater predictive power).

For reference, in this example, on unseen data, the model achieves an area under curve (AUC) of 92%, which can be interpreted as a measure of excellent accuracy of the model prediction. The above results indicate that certain driving habits may be linked to gender (marital status, age of insured, claim-free years, credit score, brake intensity, actual mileage for the year, time spent in PM rush hour, percentage of time spent driving throughout the year, time spent in AM rush hour, and the average number of days spent driving per week). More traditional insurance characteristics like marital status, age, credit score, and years without a claim also serve as potential proxies.

As with traditional approaches, results may also be linked to sample bias, which is not investigated further here.

We constructed partial dependence plots (PDPs) (Friedman, Reference Friedman2001) to observe the interaction between the most important identified features and gender classification. A PDP aims to find a particular feature’s average marginal effect on predictions. The individual marginal effect is commonly referred to as individual conditional expectation (ICE) (Goldstein et al., Reference Goldstein, Kapelner, Bleich and Pitkin2015).

In Figure 2, a higher predicted probability indicates the feature is a stronger predictor for females as an indicator of one implies a gender of female, based on our modelling. This tells us that lower claim-free years (<30) could be indicative of the female gender, whereas more claim-free years are more indicative of males, in this example. Note however that sparse data points at larger claim-free years may be a contributing factor to this as a proxy.

Figure 2. PDP of claim-free years.

When considering the most important telematics feature, we note from Figure 3 that brake intensity could be linked to gender, where more intense braking may suggest a female, thereby acting as a proxy for gender. In summary, this indicates that, with a protected feature excluded from the model, a ML model may still have sufficient information in the form of proxies to inadvertently characterise policyholders based on protected features.

Figure 3. PDP with 75 ICE samples showing brake intensity over a 6-mile period, as a percentile (0% indicates the lowest percentile and 100% indicates the highest percentile of brake intensity).

3.1.1.2. Modelled example 2

We will demonstrate fairness in a technical sense by comparing outcomes across protected classes. To do this, we start with a fairness-unaware (i.e. trained to maximise accuracy without any allowance fairness measures – “typical” modelling) Gradient Boosted Machine, using Microsoft’s open source LightGBM (Ke et al., Reference Ke, Meng, Finley, Wang, Chen, Ma, Ye and Liu2017) implementation, which aims to predict whether a claim occurs. We aim to achieve equalised odds, that is, equal true and false predictions within an accuracy threshold, and see whether it performs equally well across classes, particularly those related to protected features (Hardt et al., Reference Hardt, Price and Srebro2016). We apply two mitigation techniques to improve fairness,Footnote 7 namely, threshold optimisation and grid search.Footnote 8 Note that we deliberately exclude a policyholder’s gender as a factor in our model. Also note that the reason we can adjust how our model is trained to avoid additional discrimination is because it can broadly be viewed as a calibration issue, that is, our model needs to be recalibrated, or calibrated in a certain way, to produce a desired outcome. This however means providing it with some knowledge of protected classes to learn to avoid discriminating between members of the class.

First, we analyse the false positive and false negative rates on the fairness-unaware model.

Table 1 above suggests the fairness-unaware model produces a higher false negative rate for males than females on the testing set (meaning the model is more likely to misclassify a male as having claimed than a female when exposed to unseen data). It also produces a higher false positive rate for females than males (implying the model tends to misclassify females as having not claimed more than males).

Table 1. Model Performance for the Fairness-Unaware Model

Since predicting claim occurrence (true negatives) contribute to the policyholder’s risk premium, false negatives could adversely impact their risk premium if they are unfairly attributed as likely to claim. From the perspective of treating policyholders fairly, we aim to minimise disparity in false negatives across protected classes. It should be noted that, in this example, random chance and noise may contribute to the reported equalised odds.

Further, using the fairlearn libraryFootnote 9 (Bird et al., Reference Bird, Dudik, Horn, Lutz, Milan, Sameki, Wallach and Walker2020), we apply post-processing based on the threshold optimisation approach (Hardt et al., Reference Hardt, Price and Srebro2016). This algorithm finds a suitable threshold for the scores (class probabilities) produced by the fairness-unaware model by optimising the accuracy rate under the constraint that the false negative rate difference (on training data) is zero. Since our goal is to optimise balanced accuracy (the average of the sensitivity and specificity of the model (Kuhn et al., Reference Kuhn, Vaughan and Hvitfeldt2023)), we resample the training data to have the same number of positive and negative examples.

There are however limitations to this approach:

-

There may be a substantial accuracy trade-off compared to the fairness-unaware model.

-

Access to the sensitive feature is required to train the “fairness-unaware” model in the first instance.

An alternative to threshold optimisation is to perform a grid search, where multiple models are trained using different trade-off points between performance and fairness. In our example, performance is measured using the balanced accuracy, and fairness is measured using the equalised odds difference. The grid search technique can provide the practitioner with a choice of models that suits their accuracy and fairness thresholds. In our example, all models trained are LightGBM with differing hyperparameters (i.e. the parameters controlling the depth, number of leaves, etc. of the LightGBM model).

Figure 4 below shows the trade-off between balanced accuracy and equalised odds difference. The fairness-unaware model performed best but had a relatively high equalised odds difference (i.e. could be perceived as relatively unfair). However, by performing a grid search, we identified a marginally less accurate model but one that is algorithmically fairer (see Dolata et al. (Reference Dolata, Feuerriegel and Schwabe2021) for a discussion on algorithmic fairness). In comparison, the model identified when applying the threshold optimisation technique was the fairest but at the expense of its accuracy.

Figure 4. Trade-off between relative balanced accuracy (higher accuracy indicates better model performance) and relative equalised odds difference (lower values indicate less discrepancy in results between male and females).

In summary, the threshold-optimised model significantly reduced the disparity in model performance between males and females. However, the overall error rate and AUC for the threshold-optimised model were worse than the fairness-unaware model. With the grid search algorithm, we trained multiple LightGBM models that balance the trade-off between the balanced accuracy and the equalised odds fairness metric. The identified model appears algorithmically fairer with minimal impact on accuracy.

Further actions could involve engaging with relevant stakeholders, to conclude as to which model balances the performance–fairness trade-off as required by stakeholders, noting the potential trade-offs between accuracy and fairness.

3.1.2. What regulation and professional guidance may be relevant?

Below we have included some regulation and professional guidance that could be relevant in the context of this issue.

3.1.2.1. Regulation and legislation

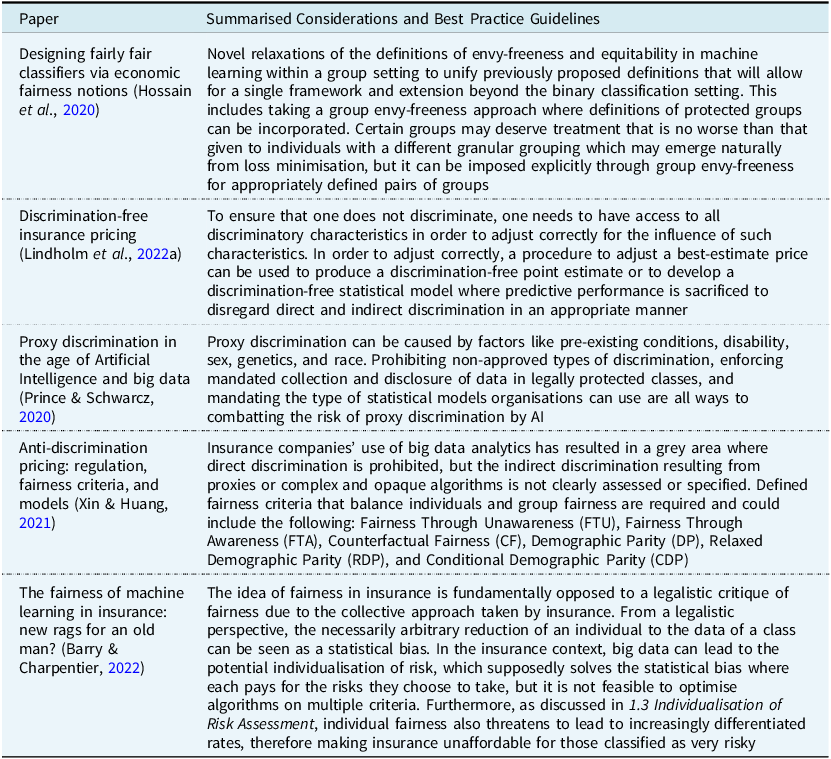

Table 2 below outlines some regulation regarding bias, fairness, and discrimination which may be relevant. Note that further regulation may apply within certain jurisdictions regarding the treatment of policyholders, such as the Insurance Act (2015) in the UK or Colorado’s (2021) SB21–169, in the US, which restricts the insurers’ use of external consumer data concerning protecting consumers from unfair discrimination.

Table 2. Available Regulation and Legislation Regarding Bias, Fairness, and Discrimination

In addition, global standards currently under development such as ISO/IEC FDIS 42001Footnote 10 (ISO and IEC, Reference Levene2023) may apply, which focusses on how to manage AI systems, including governance and trust. Key themes in ISO/IEC 42001 includes fairness, transparency, explainability, accountability, reliability, privacy, and security (Levene, Reference Levene2023).

3.1.2.2. Actuarial professional guidance

Although there is regulation that aims to prevent direct discrimination based on protected factors, there appears to be less specific regulation on indirect discrimination, for example, proxy discrimination, and how to address this issue within the context of AI. Additionally, it might be challenging to introduce specific regulation or principles, especially for proxy modelling. It is often hard to distinguish between real and causal risk, for example, where smoking status is used as a “proxy” for gender in health insurance. Smoking might per se increase the risk of a claim and could be relevant and appropriate. However, when also used as a proxy to differentiate implicitly for gender, one could argue that it is not fairly applied. Table 3 below summarises some of the professional guidelines available.

Table 3. Available Actuarial Professional Guidance Regarding Bias, Fairness, and Discrimination

Analysing outcomes and assessing the fairness of outcomes could be a valuable starting point, but it is useful to continuously operate with some conception of ethics and fairness, with attention being paid to the fairness of the process and the specific use case. Particular attention may need to be paid to the ethical use of data, including whether the use of behavioural data, especially that linked to individual choice, is appropriate and ethical to use.

Appendix A provides further best practice examples.

3.1.3. Exploring how to navigate the topic: recommendations and best practice examples

There are various techniques established in the academic community and in industry that can help guide practitioners on how to address bias and discrimination in the context of AI in insurance. Techniques discussed include:

-

Discrimination free insurance pricing (Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022a)

-

Treatment of proxy discrimination (Prince & Schwarcz, Reference Prince and Schwarcz2020; Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022a; Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2022b)

-

Designing fair classifiers using specific fairness notions (Bird et al., Reference Bird, Dudik, Horn, Lutz, Milan, Sameki, Wallach and Walker2020; Hossain et al., Reference Hossain, Mladenovic and Shah2020; Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2023)

-

Developing and implementing fairness criteria and post-processing (Bird et al., Reference Bird, Dudik, Horn, Lutz, Milan, Sameki, Wallach and Walker2020; Xin & Huang, Reference Xin and Huang2021; Lindholm et al., Reference Lindholm, Richman, Tsanakas and Wüthrich2023)

In addition, the OECD (Reference Kachra, Hilliard, Gulley and Wilson2023) offers a catalogue of tools and metrics for trustworthy AI, with fairness as one of the key objectives. Proprietary tools are being made available within AI suites to help address the issue (e.g. DataRobot’s bias and fairness tool), but open source tools seem to be more popular due to the ability to tailor it to infrastructure or use case where needed.

Based on established techniques in the literature, recommendations for managing bias, fairness, and discrimination include:

-

Following a well-defined and documented process and frequent validations to avoid bias in data and results (see the report by Society of Actuaries for foundational principles and an example model development framework (Smith et al., Reference Smith, Pirchalski and Golbin2022):

-

1. Define and document what factors are relevant for anti-discrimination (e.g. gender, social status, and origin).

-

2. Derive analytical methods that could be used to identify possible bias in data and the modelling in the context of stakeholder requirements.

-

3. Implement and document the agreed methods and explain, and demonstrate how bias could be measured, reduced, and monitored during this process.

-

4. Define and perform frequent checks, to ensure limitation of bias over time.

-

-

Taking an “Ethics by Design” approach where ethical principles are included and addressed throughout the developmental process (Brey & Dainow, Reference Brey and Dainow2020; European Commission, 2021)

-

Developing a fairness assessment methodology, for example, a fairness tree (MAS et al., 2022; Smith et al., Reference Smith, Pirchalski and Golbin2022)

-

Using counterfactuals to test how the model performs if input differs marginally, for example, by only changing the status of a protected class, and ensuring the model’s output does not vary if the status of a protected class changes, all else remaining equal (Mothilal et al., Reference Mothilal, Sharma and Tan2020; Molnar Reference Molnar2022)

Note that whilst we only consider one notion of bias as defined earlier in this section, other notions of bias, for example, statistical bias and related statistical phenomena such as Simpson’s Paradox, need to be taken into account and appropriately addressed to mitigate out-of-sample error and to limit the potential of models picking up incorrect patterns from training data but which do not translate to unseen data (Chen et al., Reference Chen, Bengtsson and Ho2009; Stanley & Mickel, Reference Stanley and Mickel2014).

Open questions include:

-

Whose responsibility is it to define fairness – the actuary, the profession, society, or policy makers?

-

○ If it is the actuary’s responsibility to define fairness, how does the actuary assess fairness in the modelling process, for example, considering the target market, what is the level of cross-subsidy, level of aggregation, etc.?

-

-

When the actuary presents results, is there a potential risk of misrepresentation of results if the uncertainties and potential unfairness of the process and results are not emphasised, and to what extent does the actuary need to emphasise potential uncertainties and impacts?

3.2. Individualisation of Risk Assessment

Traditionally insurers rely on risk pooling to calculate risk and hence premiums and reserves, but there are examples where AI (ML in particular) produces more granular or individualised risk assessment. Still, the insurer may achieve diversification if they secure a large enough portfolio of risks. Hence, even having individualised the estimation of the expected claims cost on a very granular level does not jeopardise the diversification effect of randomness.

Actuaries have a unique role in their areas and have critical responsibilities for the management and understanding of the risk both the company is exposed to and that it continues as a sustainable entity. Traditional insurance and risk pooling allow for the transfer of risk from individuals to insurers to reinsurers, protecting the individual and the public in times of need. On average, everybody benefits. Through AI and data science with large datasets, individual risk assessment might become possible which could result in a trade-off between pricing on an individual basis and maximising commercial interests.

Actuaries need to consider different impacts on the calculation of premiums, which AI can support, but also keep in mind that sometimes a cohort of the public that can least afford insurance are the ones that are in the most need of insurance, and individualised risk ratings could result in more expensive insurance, rather than the purpose of pooling risk and making it affordable for those that need it most. Actuaries can be crucial here to ensure stakeholder needs and commercial profitability are balanced ethically, calculating premiums fairly and ensuring that the premiums will not lead to insolvency. Whilst the actuary may not have the ability to dictate if their organisation chooses to individualise or not, there are vital considerations and practices the actuary could employ if their company chooses to individualise more (see Modelled example 3).

The potential for the individualisation of risk assessment introduces two key challenges:

-

The breakdown of risk pooling, that is, potentially losing certainty as to how a portfolio will perform or requiring a new approach to assessing a portfolio (not included in the discussion below).

-

Potential of exclusion through individualisation: do actuaries really want to differentiate and potentially “discriminate” socially disadvantaged groups of people, and if actuaries are no longer transferring risk but charging for the specific/actual risk of insuring an individual, is it fair (see section 3.1 and the discussion below)?

3.2.1. What empirical evidence is there that this may be an issue?

Granular behavioural data may be used to produce an individualised risk assessment, leading to potentially highly differentiated rates that can make insurance unaffordable for those classified as high risk. This concern has been raised by the Bank of England (2022), and customer concerns regarding this pricing model have been reported in a survey by the Pew Research Center (2016) with the majority of concerns relating to how long the data will be retained. In addition, if a customer is denied insurance, will it change their behaviour, and if not, is it in the public’s interest for the insurer to still provide cover and absorb the risk (see section 3.3)?

3.2.1.1. Modelled example 3

To illustrate how risk premiums could vary as risk pools get smaller and approach an individual level, we divided the data into the following risk pools (note, gender is excluded). N indicates the number of risk pools:

-

A. Traditional insurance rating factors such as age of the policyholder, age of vehicle insured, years without claims, marital status, and the use of the car (N = 207)

-

B. Factors included in A as well as credit score, estimated annual miles driven, and region (N = 2,085)

-

C. Factors included in B as well as telematics data such as percentage of time spent driving throughout the year, brake intensity, accelerations, actual total miles driven, percentage of time spent driving on particular days of the week, percentage of time spent driving in AM or PM rush hour, percentage of time spent driving continuously over different stretches (in hours), and right- and left-turn intensity (N = 100,000, data is at an individual level)

Using each group, we model claim frequency and claim severity separately and multiply the results to calculate the risk premium. We utilise the duration (measured in days) as an exposure metric and use it to standardise the claim frequency. For example, if a policyholder has their policy for half a year and incurs one claim, it will be recorded as two claims when standardised and viewed over a full year of exposure. In Risk Pool C, after benchmarking a Poisson GLM (see De Jong & Heller, Reference De Jong and Heller2013), decision tree, random forest (Breiman, Reference Breiman2001), LightGBM, XGBoost, and a multi-layer perception (MLP, a vanilla feed-forward neural network (Hastie et al., Reference Hastie, Tibshirani and Friedman2017), we deduced that the MLP better balanced accuracy and avoided overfitting relative to other models benchmarked. The MLP had the following architecture for the separate claim severity and claim frequency models:

-

Claim severity

-

○ All groups: three hidden layers (32, 16, number of features in Group X)

-

○ ReLu (rectified linear unit, i.e. outputs are strictly positive) activation function between layers and as output layer

-

○ Mini-batch gradient descent with the Adam solver – see Kingma and Ba (Reference Kingma and Ba2015)

-

○ Constant learning rate of 0.01

-

○ Early stopping enabled

-

-

Claim frequency

-

○ Group A: two hidden layers (24, number of features in Group A)

-

○ Group B: three hidden layers (32, 16, number of features in Group B)

-

○ Group C: two hidden layers (30, number of features in Group C)

-

○ ReLu activation function between layers and as output layer

-

○ Mini-batch gradient descent with the Adam solver

-

○ Constant learning rate of 0.01

-

○ Early stopping enabled

-

We observed that whilst the tree-based models proved to be highly accurate, they were very sensitive to feature adjustments (i.e. policyholder to policyholder). This may lead to potentially volatile risk premiums (see Figures 7 and 8 in section 4.1). In contrast, additive models, including feed-forward neural networks, present a smoother transition.

The results across each group for the final MLP models that best balanced accuracy and smoothness in results are presented in Table 4.

Table 4. Individual Risk Assessment Models Across Different Levels of Granularity Based on MLP Model (Note that CU Refers to Currency Units)

Table 4 indicates that the model improved in accuracy as the risk pools moved from broader categorisations to individual levels of risk assessments (i.e. from A to C), but in more granular risk assessments, the resulting risk premiums were higher for certain individuals. In the broader risk groupings such as A, the individual’s experience is absorbed by the group’s experience, resulting in lower-average-risk premiums. However, very granular assessment improves the prediction but increases the risk premiums.

When analysing risk premiums predicted at some of the extremes at each of the three groups, the movement in predicted claim amounts as groups become more granular, as shown in Table 5. The significant features per group mentioned here were identified post modelling using one of the explainability techniques discussed in section 4.1: Shapley Additive exPlanations (SHAP) (Lundberg & Lee, Reference Lundberg and Lee2017).

Table 5. Predicted Risk Premiums on a Policyholder Level Across Groups A, B, and C

The more individual the risk assessments, and the smaller the risk pools became, the more accurate the model appeared to be, but it also resulted in increasingly volatile and potentially expensive risk premiums. This is particularly evident when additional features are added (such as credit score), which serve as strong predictors for risk premium on average, and telematics information like acceleration and brake intensity leading to individuals’ risk premiums adjusting substantially from their risk groups where telematics are not used.

3.2.2. What regulation and professional guidance may be relevant?

Below, we have included some regulation and professional guidance that could be relevant in the context of this issue.

3.2.2.1. Regulation and legislation

In Table 6, we have highlighed some regulation and legislation that may be applicable. Further regulation may apply within certain jurisdictions regarding the pricing of risk, such as the Insurance Act in the UK.

Table 6. Available Regulation and Legislation Regarding Individualisation of Risk Assessment

3.2.2.2. Actuarial professional guidance

There appears to be little guidance as to the extent that insurers may price on an individual basis (barring bias and discrimination based on sensitive features discussed in section 3.1) and to what extent individual (especially social) risk should be considered. However, some legislations ensure all lives/risks are accepted, for example, medical aid in South Africa (Republic of South Africa, Department of National Treasury, 2012), medical insurance in the USA (Patient Protection and Affordable Care Act, 2010), and group insurance policies. Table 7 outlines some available professional guidance on the topic.

Table 7. Available Actuarial Professional Guidance Regarding Individualisation of Risk Assessment

It is unclear to what extent insurers can individualise premiums versus relying on more traditional methods of risk pooling. Whilst the conflict between the individual and the majority is not new and it is generally agreed that some equilibrium must be found, where this balancing point lies is debatable. Here, public interest (which we delve into later) comes into play as, depending on what society deems (un)acceptable, the insurer may decide on behalf of society how much collective benefit society (or then the majority of their policyholders) could concede to individuals. Furthermore, high risks may be excluded from insurance due to a high cost or may be denied cover, and premiums may become more volatile (Keller, Reference Keller2018). However, if the market moves towards individualised risk assessments, it may necessitate widespread adoption of this practice to avoid retaining expensive risks at too low a price point. If this is the case, further regulation may be required to manage this practice within the context of consumer protection.

However, risk mitigation techniques can be applied, such as offering specific types of insurance to high-risk individuals. This notion could be applied to providing specialised cover to those identified as very high risk when conducting an individual risk assessment. An example of targeted insurance is diabetes insurance where premium rates are revised annually based on average blood sugar levels over the past 3 months and cannot increase past the premium rate at inception (see, e.g. Royal London, 2023).

3.2.3. Exploring how to navigate the topic: recommendations and best practice examples

Assessing or pricing risk on an individual basis raises various ethical and practical concerns, particularly as it relates to the underlying ideas of insurance, including that of transferring risk. Where voluminous, granular data or modelling techniques are available that can be used to price risk on a more granular level, consider how consumers would be affected if pricing methodology changed.

When considering risk pooling and grouping customers, practitioners could explore where a fair and sensible premium cap would be that could be introduced into the modelling process. Baselining a risk premium using larger risk pools (e.g. under Group A in Modelled example 3) and adjusting based on more granular data (e.g. introducing driver telematics such as in Group C in Modelled example 3) can also prove to be a suitable strategy. To help ensure that there is no model risk leading to an “unfair” outcome from an individualised risk perspective, check that extreme model outcomes could be assessed.

In addition, where big data is concerned, there are examples where insurance companies are advised to ensure they obtain consent from their customers before making individualised offers based on big data analytics using those customers’ data (Thouvenin et al., Reference Thouvenin, Suter, George and Weber2019).Footnote 12

Open questions include:

-

In an example where more data points are available for a certain individual (e.g. results from voluntary genetic testing) or if explainability techniques (e.g. SHAP) show granular results per individual, could their premium be highly individualised, or should risk pooling become more granular? In the case of the latter, when does more granular risk pooling simply become a type of individualisation?

-

Is individualisation unfair in principle – is it not more fair to price based on individual choice of behaviour so that everyone only pays for their own risk, or does individualisation undermine the public interest? Might individualisation even be needed in some cases to provide incentives to help mitigate risks, for example, when pricing for flood risks for certain highly exposed areas, cover will become more expensive so that the space could no longer be used for building unless certain risk mitigating measures are in place?

-

Who is responsible for addressing the issue – the actuary, the profession, society, or policy makers?

3.3. Public Interest

Public interest is defined as the general welfare and interest (stake) of the public. In respect of the insurance industry, what is considered “the public” comprises various groupings, for example, (prospective) policyholders, employees, and shareholders, each with its own interests, with some more influential than others. There are some regulation and guidance on navigating certain issues as they pertain to the public (e.g. data privacy and genetic testing) and acting ethically and with integrity, but this concern is primarily up to the organisation to manage, particularly within their environmental, social, and governance framework.

Whilst the IFoA’s charter notes that “the objects [of the IFoA] shall be, in the public interest”, what this comprises is not explicitly stated (IFoA, 2010). Additionally, this does underpin the sentiment of the Actuaries’ Code (IFoA, 2019) which notes that members should act with integrity and speak up if they believe any action is unethical. In addition, regulation around bias and discrimination (see section 3.1) promotes the public interest, for example, the Equality Act (2010).

Furthermore, big data is sometimes seen as a potential threat to the public interest and various data regulations try to ensure the privacy of the public. The principles of data minimisation and purpose specification as identified in the OECD Fair Information Practices of 1980 (which underlies most Western privacy regulations) are often difficult to account for in big data analyses: at the time of data collection, it might not be clear which data is useful for which purposes, making it hard to strike a balance between minimising data collection and providing room for innovation.

The key question that arises regarding public interest (other than how to define who constitutes the public) is if it is the duty of insurers/actuaries to ensure that everyone can get affordable insurance, and if so, how does the actuary ensure this?

In Tables 8 and 9, we have included some regulation and professional guidance that could be relevant in the context of this issue.

Table 8. Available Regulation and Legislation Regarding Public Interest

Table 9. Available Actuarial Professional Guidance Regarding Public Interest

The insurance industry also needs to consider its own interest as a business, navigating through a market economy and recognising the necessity for regulation to safeguard the public interest. Whilst there is some guidance available to actuaries, these are often in the form of non-mandatory guidelines or not specific enough to help actuaries in practice.

Appendix A provides further best practice examples.

3.3.1. Exploring how to navigate the topic: recommendations and best practice examples

Regulation on the use of AI should be driven by public (national) interest, with care taken as to how to define public interest (with due consideration to target markets, stakeholders, the commercial and economic environment, and society). Here, AI auditing may be required. Additionally, whilst there is no single agreed international model for data protection law at this stage, organisations should still strive to comply with relevant regulations.

Open questions include:

-

To what extent is it (solely) the actuary’s responsibility to care?

-

How much should actuaries care?

-

What are examples of caring in the public’s best interest whilst still playing a role in a commercial institution?

4. Professional Challenges

4.1. Explainability

In the context of traditional actuarial work, models developed have typically been interpretable by design. Traditionally, the models produced are parametric, for example, GLMs, or semi-parametric, for example, Generalised Additive Models. Based on the parametric design, familiarity, and wide use of these models, they are typically considered to be auditable.

More generally, explainability and interpretability are relatively broad concepts that have received various definitions, and several attempts of a comprehensive taxonomy have been launched (Linardatos et al., Reference Linardatos, Papastefanopoulos and Kotsiantis2020; Schwalbe & Finzel, Reference Schwalbe and Finzel2023).

A general distinction is made between three types of models:

-

Intrinsically or inherently interpretable models – also often called white or glass boxes, which are either statistical models (linear discriminant analysis, naïve Bayes, etc. (Hastie et al., Reference Hastie, Tibshirani and Friedman2017)), linear models (linear regression, logistic regression (De Jong & Heller, Reference De Jong and Heller2013)), or additive models (Lasso, ridge, Elastic Net, Bayesian inference models, etc. (Hastie et al., Reference Hastie, Tibshirani and Friedman2017)). These models are sometimes referred to as explainable.

-

Ex-post interpretable models – black boxes that benefit from various explainable techniques, most often with local interpretation. Techniques include SHAP (see discussion in section 4.1.3), local interpretable model-agnostic explanations (LIME) (Ribeiro et al., Reference Ribeiro, Singh and Guestin2016; see also discussion in section 4.1.3), PDPs, ICE, and attention maps.

-

Explainable models – black-box algorithms (XGBoost, neural networks) that are trained to produce an inherently interpretable model, for example, XGBoost-based Explainable Boosting Machine (Lou et al., Reference Lou, Caruana, Gehrke and Hooker2013; see also Caruana, Reference Caruana2020; Microsoft Developer, 2020), neural network-based generalised additive model with structuted interactions (GAMI-Net) (Yang et al., Reference Yang, Zhang and Sudjianto2021), or localGLMnet that produces a GLM (Richman & Wüthrich, Reference Richman and Wüthrich2021).

Interpretability refers to the degree by which a model or system can be easily understood and explained by human users and the degree to which a human can consistently predict the model’s results (Miller, Reference Miller2019). It implies a person can scrutinise the decision-making process without technical background into the model’s inner workings.

Similarly, explainability refers to the degree by which a model or system can be easily understood and explain its decisions, predictions, or actions. These explanations are usually in terms of the input features and their importance in the outcome: both at a global level and locally (Molnar, Reference Molnar2022).

Interpretability is a property of the model or system that makes it understandable, and explainability is the degree to which the decisions, predictions, and actions can be explained. Not all explainable models are necessarily interpretable, as external algorithms can be applied to determine feature importance.

According to Phillips et al. (Reference Phillips, Hahn, Fontana, Yates, Greene, Broniatowski and Przybock2021), where AI systems or models are required to be explainable, such as in various types of traditional actuarial work, they should adhere to four principles:

-

Explanation: a system delivers or contains accompanying evidence or reason(s) for outputs and/or processes.

-

Meaningful: a system provides the intended consumer(s) understandable explanations.

-

Explanation accuracy: an explanation correctly reflects the reason for generating the output and/or accurately reflects the system’s process.

-

Knowledge limits: a system only operates under conditions for which it was designed and when it reaches sufficient confidence in its output.

As computing power increases and, with the availability of big data, interactions become more complex for traditional methods to capture, ML techniques and algorithms are becoming go-to techniques due to their ability to process large amounts of data and features in order to produce an outcome. In contrast to the techniques generally applied to traditional actuarial work, these are not interpretable – although external techniques exist.

When producing explanations for non-interpretable models, the main aspects to consider are:

-

Feature importance to justify outcomes and the inclusion or exclusion of the feature in the model

-

Interactions between features in the model, given any correlations present

-

Fairness and treatment of disparate treatment present

-

Modeller’s judgement on whether the observed relationship between inputs and the model’s outputs is reasonable

Correlations in the feature set produce additional complexities that may lead to incorrect inference of explainability techniques.

It is essential to consider interpretations, explanations, and outcomes in the context of making business sense (do the explanations make actuarial sense or is the model overfitting noise?), compliance with regulation and laws (is the model suggesting outcomes that follow regulation and consumer protection?), and stakeholders impacted by the use of the model (can a particular decision taken be explained to stakeholders, and is it fair?).

4.1.1. What empirical evidence is there that this may be an issue?

In the US, the National Association of Insurance Commissioners (NAIC) CAS Task Force (2020; see also NAIC’s bulletin on the use of AI by insurers, updated on December 2023 (NAIC, 2023a)) notes the following are required for the review and governance of predictive models:

-

Individual feature significance (p-values and confidence intervals)

-

Relations between features and their outputs with explanations

-

Impact of variable interaction on results

Whilst the above criteria are properties of GLMs (particularly p-values), they are not properties of more complex non-linear models, therefore requiring the use of explainability techniques to be used to meet the guidelines above. In addition, regulators may not be willing or legally empowered to broaden the validation approaches (see section 4.3). This presents an issue as measures such as p-value are inferential statistics but do not necessarily indicate the predictive performance of a model (Lo et al., Reference Lo, Chernoff, Zheng and Lo2015).

There are a distrust and a perception of greater model risk when using non-interpretable models, likely owing to the unfamiliarity of the models themselves, inability to reconcile their decision-making process, policies requiring that models be of a particular form, and a limited understanding of the tools and techniques to generate explanations (Baeder et al., Reference Baeder, Brinkmann and Xu2021).

4.1.1.1. Modelled example 4

Below we demonstrate global and local methods for explaining model outcomes from Modelled example 3. Global methods look at the overall model and identify features of influence. The approaches used below are model agnostic, meaning the same technique can be used on different models.Footnote 13

4.1.1.1.1. Global explainability

Figure 5 is an example of a permutation feature importance plot (Breiman, Reference Breiman2001; Fisher et al., Reference Fisher, Rudin and Dominici2018) produced from the MLP (neural network) model fitted to Group C in Modelled example 3.

Figure 5. An example of a permutation feature importance, indicating the top ten features identified by order of relevance when predicting claim frequency.

Features with the most influence on model outcomes are assigned a higher relative importance value. Figure 5 also denotes results in an absolute sense, meaning it is not obvious from the feature importance whether total miles driven has a positive or negative effect on the outcome, only that it is an important feature. This is similar to comparing the absolute values of coefficients produced by a GLM (provided features are scaled and therefore comparable).

Feature importance may be misleading if correlation is not accounted for, and different families of models are compared. Therefore, permutation feature importance is a preferred metric for global model explainability.

In conjunction with a feature importance plot, a PDP can be produced which showcases the relative influence a particular feature has on the outcome. These are also model agnostic and explain the average effect features have on the outcome.

Like a feature importance plot, PDPs can be used to sense check results against the practitioner’s business sense.

The PDP shown in Figure 6 can be interpreted as new cars adding approximately CU 220 to the risk premium, whereas older cars add approximately CU 120, all else remaining equal. The net effect is CU 100. PDPs are sometimes visualised centred at zero, depending on context.

Figure 6. An example of a partial dependence plot for a binary feature, showcasing the impact on risk premium of insuring a new car versus an older car.

Similarly, for continuous functions, PDPs may look as follows.

Figure 7 indicates the impact different percentiles of acceleration have on predicted risk premium. The black bars in the x axis indicate where the data most strongly supports the outcome, with results taken outside considered extrapolation as there are fewer data points over its range. At zero acceleration, the higher-risk premium requires further investigation as it does not adhere to the general (and expected) positive relation between risk premium and acceleration.

Figure 7. An example of a partial dependence plot for a continuous feature, indicating the relative effect of acceleration on risk premiums, across its range. All else being equal, it shows the average impact on risk premium of a being in a higher percentile of acceleration.

When assessing model performance based on PDPs, “spikiness” should be avoided. Figure 7 suggests an increase of around CU 80 when moving from the 18th percentile to the 19th percentile in acceleration, before dropping by CU 40 when moving to the 20th percentile. Models producing erratic predictions based on minor adjustments to input parameters are unfavourable and may suggest overfitting on the training set. This is particularly prevalent when fitting tree-based models. Figure 8 below shows preferred behaviour.

Figure 8. A partial dependence plot from a non-tree-based model, indicating a smoother increase in risk premiums as acceleration intensity increases.

4.1.1.1.2. Local explainability

Explainability can also be performed locally, meaning a model’s individual effect can be observed. This means that, for instance, a high-predicted-risk premium can be investigated to determine what features led to the model’s decision. Results can be validated by taking a random sample of results to sense-check results and whether extreme values are sensible and can be explained. Local interpretation is based on the outputs from the model fitted and constitutes a local approximation. Care must be taken when interpreting local feature importance as model error and sampling may create noisy local interpretations.

A popular model-agnostic technique for local model interpretation is SHAP. SHAP produces an account of the impact features have on an individual output by considering the impact of their inclusion (applying techniques found in game theory). Figure 9 below is an example of SHAP output from a policyholder in Group A, as defined in Modelled example 3.

Figure 9. An example of SHAP values at a per-policy level. Positive values correspond to a higher-predicted-risk premium for the individual, ordered by absolute magnitude.

In addition, SHAP values can be used to produce a localised feature importance plot, such as in Figure 10.

Figure 10. An example of a localised feature importance plot, using the absolute magnitudes of Figure 9.

As an alternative to SHAP, LIME fits a simpler, glass-box model as a surrogate that is easier to interpret (see Ribeiro et al., Reference Ribeiro, Singh and Guestin2016). This produces coefficients that indicate what impact features have on a prediction (Ribeiro et al., Reference Ribeiro, Singh and Guestin2016). In this instance, LIME provided a localised linear regression model where fitted coefficients explain model output. Alternative formulations of LIME exist, such as local decision trees and local ridge regression models. The two examples below show the impact observed values have on a localised prediction.

We use a ridge regression LIME with an intercept to produce the following local explanations for a policyholder with a low-predicted-risk premium. The output is based on 10,000 data points sampled.

Per Figure 11, the majority of the top ten features lead to a decrease in risk premiums. The observed values (such as “Insured.age_0–24 ≤0” which is interpreted as being at least 25 years old) result in a low overall predicted risk premium. From the above, a linear formula can be constructed.

Figure 11. An example of LIME outputs. The x axis indicates the coefficient of each feature. Positive values indicate that a particular feature increases predicted risk premium for the individual.

Similarly, the LIME output in Figure 12 below indicates the impact features have when the model predicts a high-risk premium.

Figure 12. An example of LIME outputs when the model predicts a high-risk premium.

The limitation of LIME is that it produces an estimate of a local model based on the original model provided, so explanations must be considered in the context of the original’s accuracy. LIME however produces a more intuitive output than SHAP (for those familiar with linear models), although SHAP is observed to be more popular in practice.

Both SHAP and LIME can be used to explain tabular data (as indicated) as well as image and text recognition models.

4.1.2. What regulation and professional guidance may be relevant?

Below we have included some regulation and professional guidance that could be relevant in the context of this issue.

4.1.2.1. Regulation and legislation

Table 10 below highlisghts some key regulation and legislation in the context. Further regulation and standards may apply within certain jurisdictions, as well as global standards currently under development such as ISO/IEC FDIS 42001 (ISO and IEC, Reference Levene2023), which focusses on how to manage AI systems, including governance and trust. Key themes in ISO/IEC 42001 includes fairness, transparency, explainability, accountability, reliability, privacy, and security (Levene, Reference Levene2023).

Table 10. Available Regulation and Legislation on Interpretability and Explainability

4.1.2.2. Actuarial professional guidance

Guidelines often just note that actuaries should be able to understand models and disclose considerations, conditions, and limitations for how to proceed with model explainability (see ASSA’s (2021) APN 901: General Actuarial Practice, section 2 on Model Governance). Table 11 provides some professional guidelines that may apply.

Table 11. Available Actuarial Professional Guidance on Interpretability and Explainability

Most suggested risk classes of algorithms and/or applications only superficially touch this problem. Through an AI risk tiering approach, there is a potential innovation slowdown for cases where the governance requirements are not gradually but abruptly stricter for just slightly more complex applications (e.g. EU AI Act’s classification of AI risk (European Council, 2021),Footnote 14 where the focus is on items classed as high risk and Canada’s AI and Data Act (Innovation, Science and Economic Development Canada, 2023)).

There is a lack of specific and detailed guidance for actuaries on approaching explainability as an actuary navigating complex models. There is also a lack of consensus on the best interpretability techniques for actuarial ML models to ensure that they balance business and societal aims. The actuarial standards set forth by industry bodies do not appear to offer comprehensive guidelines and methodologies for explaining models nor offer detailed criteria or practical recommendations. Without proper techniques to understand these models and guidance on what is required in terms of explainability, it will remain a serious issue with potentially negative impacts.

Whilst best practice is not yet clearly defined by industry bodies, we have observed organisations utilising various techniques, including SHAP and LIME as discussed. These are often being incorporated into other modelling tools, for example, AWS’ SageMaker Clarify and IBM’s Watson, AI Explainability 360. In addition, we have observed the use of surrogate modelling, whereby a highly interpretable glass-box model is trained to approximate a complex black-box model. For example, a neural network may be used to predict risk premiums, whose predictions are then approximated by a GLM. The GLM is then used by the organisation as their pricing model. This example can be taken further by training an ensemble of models and averaging over their results to form a distilled model, which can then be approximated by a smaller, simplified model (Buciluă et al., Reference Buciluă, Caruana and Niculescu-Mizil2006; Hinton et al., Reference Hinton, Vinyals and Dean2015).

However, if explainability techniques are not well understood by those employing them or well defined for stakeholders, incorrect inferences could be made that can impact business decisions. Techniques may be misleading if not used for correct purposes, for example, using feature importance as a guideline for causal inference (and what-if scenarios). This incorrect use could result in conclusions based on features and target being correlated but not causally related. The isolated use of an explainability techniques could also potentially mis-specify correlations between features, leading to incorrect interpretations.

In addition, there appears to be a lack of educational support for actuaries to underpin the continual advancements made in AI (refer to section 5.1 on the lack of skills).

4.1.3. Exploring how to navigate the topic: recommendations and best practice examples

To ensure that the model fitted is explainable, some model-agnostic tools and techniques can be used. Examples of tools that can be used to assist the developer in explaining the model results include PDPs (Friedman, Reference Friedman2001), SHAP (Lundberg & Lee, Reference Lundberg and Lee2017) values, and LIME (Ribeiro et al., Reference Ribeiro, Singh and Guestin2016). The OECD (Reference Kachra, Hilliard, Gulley and Wilson2023) offers a useful catalogue of tools and metrics for trustworthy AI, with explainability as one of the key objectives.

Open questions include:

-

When considering explainability techniques, consider:

-

○ How understandable are they for the intended audience?

-

○ Do they present a risk of misinterpretation?

-

○ Can they lead to misguidance or a false sense of comfort?

-

-

What is an acceptable trade-off between accuracy and explainability? What is the balance, and who defines it?

-

Should there be a preference for solutions with interpretable algorithms when undertaking ML exercises, for example, linear regression, logistic regression, decision trees, Naïve Bayes classifier, and k-nearest neighbour?

-

How could we utilise new techniques to try and tackle traditional challenges; for example, could SHAP be used to explain Monte Carlo Simulations?

4.2. Transparency

Transparency refers to the disclosure of information to stakeholders to understand the process a system or model followed, with relation to how the model uses data, sources of external data, the workings of the model, and in what context the outcomes will be used. When considering transparency from a model-only perspective, transparency can be considered at three levels, namely, that of the entire model (simulatability), individual components (decomposability), and the training algorithm (algorithmic transparency) (Lipton, Reference Lipton2016).

Due to the competitiveness of insurance markets, customers and the general public have remained largely uninformed about the details of actuarial modelling. Still, there may be a shift in how much detail an insurer discloses due to the requirements of GDPR and other legislation. From a stakeholder perspective, they should be able trust that the process, systems, and models were audited sufficiently and with proper due diligence – whether AI was used or not. Documentation could assist in improving the overall trust in the system.

Additionally, when training a ML model, there are elements of randomness in the process, for example, randomness influencing how to split the data. In addition, the modellers’ choice of hyperparameters, and influence on feature selection (as part of the training process), may lead to scenarios where the underlying training methodology becomes non-transparent.

The EU AI Act’s (European Council, 2021) view of transparency includes:

-

Instructions for use and complete, correct, and clear information which should be accessible to users

-

The identity and contact details of the provider and/or representative

-

The capabilities, characteristics, and limitations of the AI system which contains:

-

○ The intended purpose of the AI system

-

○ The level of accuracy, robustness, and cybersecurity, including:

-

How the system has been tested and validated

-

Any known or foreseeable circumstances which could impact the level of accuracy, robustness, or cybersecurity

-

-

○ Any known or foreseeable potential misuse

-

○ The system’s performance as it relates to the intended groups or persons on which the system will be used

-

○ Appropriate input data specifications and other relevant information regarding the training, validation, and testing datasets

-

-

Human oversight measures

-

Any predetermined changes to the AI system and its performance

-

The expected lifetime of the system and any maintenance and care measures (including software updates)

In this view, transparency enables users to use an AI system appropriately and to interpret an AI system’s output.

Additionally, reproducibility and replicability need to be considered. Reproducibility is important for transparency because it means that an independent reviewer can re-run the model and achieve the same results. This help validates the accuracy and legitimacy of a model, thereby reducing model risk. In a ML context, this can be achieved by setting seeds when generating random samples, aggregating results over many samples, and providing details of the model’s architecture and the system on which the analysis and training were performed. Conversely, replicability means the model and results can broadly be applied to a different set of data and leads to the same conclusions. This can be achieved by documenting the process sufficiently and stating assumptions.

4.2.1. What empirical evidence is there that this may be an issue?

In many use cases, it is not feasible to train an AI from scratch. Instead, practitioners often need to rely on vendor solutions that contain pre-built models (either to be used as is or which can be customised) or on models that are built by other technical resources. There remains however a lack of guidance in how best to validate these AI models and what criteria need to be met before it can be used in actuarial work. Transparency becomes difficult to achieve when off-the-shelf models are closed source and data sources used to train and evaluate the model are difficult to verify.

There are however cases where non-transparency is preferred, such as anomaly detection in the context of fraud detection (cf. Baesens et al., Reference Baesens, Van Vlasselaer and Verbeke2015).

4.2.2. What regulation and professional guidance may be relevant?

Below we have included some regulation and professional guidance that could be relevant in the context of this issue.

4.2.2.1. Regulation and legislation

Table 12 highlights some key regulation that may be applicable. Further regulation and standards may apply within certain jurisdictions, as well as global standards currently under development such as ISO/IEC FDIS 42001 (ISO and IEC, Reference Levene2023) which focusses on how to manage AI systems, including governance and trust. Key themes in ISO/IEC 42001 include fairness, transparency, explainability, accountability, reliability, privacy, and security (Levene, Reference Levene2023).

Table 12. Available Regulation and Legislation on Transparency

4.2.2.2. Actuarial professional guidance

Table 13 highlights the transparency principles available in some professional guidelines.

Table 13. Available Actuarial Professional Guidance on Transparency

There seems to be fewer checks and transparency expected for humans – more may be expected from AI (models) than from humans, which is likely to be based on trusting the years of training, experience, and judgement of industry experts. Accordingly, is it then sufficient for AI to “explain” itself, or to use AI to explain other AI, or is human intervention required for trustworthiness and buy-in? In the case of the former, sentience (and therefore trust in AI) becomes a potential issue.

Richman et al. (Reference Richman, Von Rummell and Wüthrich2019) provide a detailed account of model risk and note that the majority of risk controls related to models require the actuary to “step through the calculations required by a model to produce its predictions (simulatability) or to investigate particular aspects of one part of the model in isolation, say a particular model coefficient (decomposability)”. However, even GLMs that fit on a high number of parameters (50+) lose transparency and become intractable, and deep learning models exacerbate this issue.

4.2.3. Exploring how to navigate the topic: recommendations and best practice examples

It is essential to maintain proper technical documentation which outlines the purpose, development, data, and limitations of AI systems as this not only assists in regulatory compliance but also helps to uphold ethical and professional standards and can also assist in replicability and reproducibility which is often considered key criteria for validation (see section 2.3).

Open questions include:

-

What level of transparency is required for different purposes, for example, is the same level required for commercial versus exploratory purposes?

-

○ If not, how do actuaries determine the appropriate level for different purposes?

-

4.3. Validation and Governance