Article contents

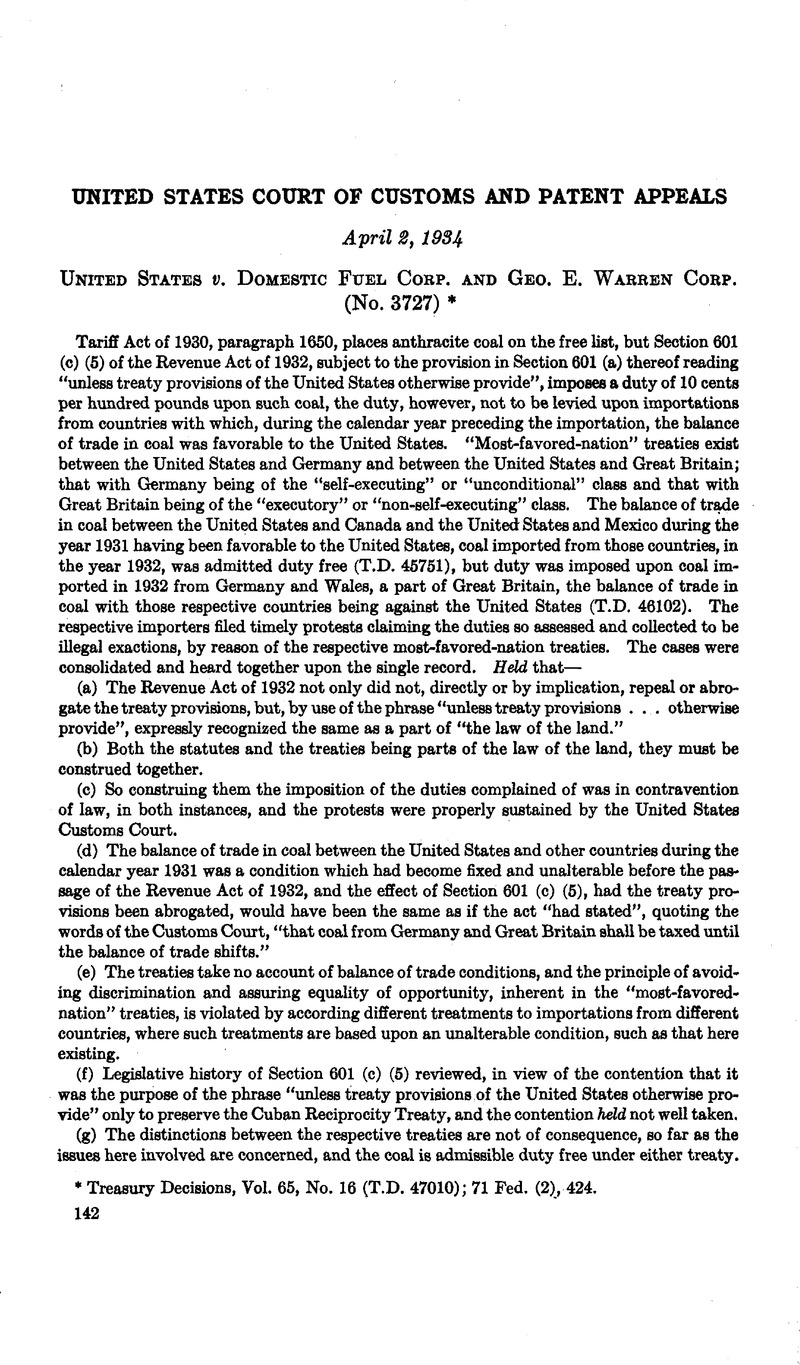

United States v. Domestic Fuel Corp. and Geo. E. Warren Corp.*

Published online by Cambridge University Press: 12 April 2017

Abstract

- Type

- Judicial Decisions Involving Questions of International Law

- Information

- Copyright

- Copyright © American Society of International Law 1936

Footnotes

Treasury Decisions, Voi. 65, No. 16 (T.D. 47010); 71 Fed. (2), 424.

References

† Treasury Decisions, Vol. 63, No. 24.

1 The paragraph which appears in “Title II—Free List” of the Tariff Act of 1930 reads: “Pak. 1650. Coal, anthracite, semianthracite, bituminous, semibituminous, culm, slack, and shale; coke, compositions used for fuel in which coal or coal dust is the component material of chief value, whether in briquets or other form: Provided, That if any country, dependency, province, or other subdivision of government imposes a duty on any article specified in this paragraph, when imported from the United States, an equal duty shall be imposed upon such article coming into the United States from such country, dependency, province, or other subdivision of government.”

2 Sec. 601. Excise Taxes on Certain Articles.

(a) In addition to any other tax or duty imposed by law, there shall be imposed a tax as provided in subsection (c) on every article imported into the United States unless treaty provisions of the United States otherwise provide.

(b) The tax imposed under subsection (a) shall be levied, assessed, collected, and paid in the same manner as a duty imposed by the Tariff Act of 1930, and shall be treated for the purposes of all provisions of law relating to the customs revenue as a duty imposed by such Act, except that—

(c) There is hereby imposed upon the following articles sold in the United States by the manufacturer or producer, or imported into the United States, a tax at the rates hereinafter set forth, to be paid by the manufacturer, producer, or importer:

(5) Coal of all sizes, grades, and classifications (except culm and duff), coke manufactured therefrom; and coal or coke briquettes, 10 cents per 100 pounds. The tax on the articles described in this paragraph shall apply only with respect to the importation of such articles, and shall not be imposed upon any such article if during the preceding calendar year the exports of the articles described in this paragraph from the United States to the country from which such article is imported have been greater in quantity than the imports into the United States from such country of the articles described in this paragraph.

3 The pertinent portion of T.D. 45751 reads as follows:

“As the total exports of coal, coke, and briquettes described in Section 601 (c) (5) from the United States to Canada exceeded the total imports of the same commodities from that country to the United States during the calendar year 1931, and the total exports of such commodities from the United States to Mexico exceeded the total imports from that country during the same period, no tax shall be collected during the calendar year 1932 on such articles imported into the United States from Canada or Mexico.”

4 Paragraph 6 of T.D. 45991 reads:

“ (6) Revenue act of 193$—Coal.—In view of the provisions in the treaties between the United States, and Great Britain and Germany, respectively, and of the express provision made by the Congress in Section 601 (a) of the revenue act of 1932 for an exception from the application of the taxes thereby imposed in cases where treaty provisions of the United States otherwise provide, held that, so long as coal from Canada or any other country is exempt from the tax prescribed in Section 601 (c) (5) of the revenue act, coal from Great Britain or Germany is entitled to similar treatment when imported into this country. Bureau letter dated November 14, 1932. (110409.)”

5 (T.D. 46102)

Treasury Department, January 9, 1933.

To Collectors of Customs and Others Concerned:

Reference is made to T.D. 45991-6, an abstract of a department ruling of November 14, 1932, that, by reason of the most-favored-nation treaties between the United States and Great Britain and Germany, respectively, and the terms of Section 601 (a) of the Revenue Act of 1932, coal imported from the two countries last named is not subject to the import tax provided for in Section 601 (c) (5) of the Revenue Act, so long as coal from Canada or other countries'is admitted free of such tax.

The department held in T.D. 45751 of June 20, 1932, that coal, coke, and briquets imported from Canada during the year 1932 would not be subject to the import tax, and in a letter of July 26, 1932, the Bureau of Customs advised an inquirer that coke from Great Britain, Belgium, or Germany, imported into the United States during 1932 after the effective date of the revenue act would be subject to the import tax provided for in the said act. In determining the taxable status of the fuels in each of these instances consideration was given only to the balance of trade in such fuels between the United States and each of the other countries.

In a letter addressed to the President on December 27, 1932, the Attorney General expressed his opinion that the ruling of November 14 above mentioned reversed adversely to the United States the prior rulings of the department mentioned in the preceding paragraph, which he viewed as giving a construction to so much of Section 601 of the Revenue Act of 1932 as relates to the import tax provided for certain kinds of coal, coke, and briquets.

Inasmuch as the department’s ruling of November 14 was made without the concurrence of the Attorney General, that officer holds that it is contrary to the provisions of Section 602 (b) of the Tariff Act of 1930 and inoperative. He states further that in his opinion the question involved in the ruling is one which is bound to become immediately the subject of judicial inquiry, regardless of what opinion he might render with respect to it, and he therefore holds that it is not proper for him to express any opinion as to the effect of treaty provisions on the taxable status of the imported fuels, and that the tax should continue to be assessed in order that this question may be judicially determined on protest and litigation by the importers.

In view of the foregoing opinion of the Attorney General, T.D. 45991-6 is hereby revoked. Collectors of customs shall accordingly proceed with the assessment of the import tax of 10 cents per 100 pounds on all entries covering importations after June 20,1932, of coal of all sizes, grades, and classifications (except culm and duff), coke manufactured therefrom, or coal or coke briquets from countries to which the exports from the United States did not exceed the imports therefrom of such fuels during the calendar year preceding the date of importation. Importers dissatisfied with such assessment of duty may avail themselves of their statutory right of protest, as provided in Section 514 of the Tariff Act. The Attorney General states that his department will offer every facility to the importers to enable them to obtain a speedy judicial decision of the questions involved.

(110409.) Ogden L. Mills,

Secretary of the Treasury.

6 The treaty with Germany (vide 44 Stat. 2132, 2137) was proclaimed October 14, 1925. The portions of same here pertinent are found in Article VII thereof, reading:

. . . . .

“Each of the high contracting parties binds itself unconditionally to impose no higher or other duties or conditions and no prohibition on the importation of any article, the growth, produce, or manufacture, of the territories of the other than are or shall be imposed on the importation of any like article, the growth, produce, or manufacture of any other foreign country.

. . . . .

“Any advantage of whatsoever kind which either high contracting party may extend to any article, the growth, produce, or manufacture of any other foreign country shall simultaneously and unconditionally, without request and without compensation, be extended to the like article the growth, produce, or manufacture of the other high contracting party.

. . . . .

“With respect to the amount and collection of duties on imports and exports of every kind, each of the two high contracting parties binds itself to give to the nationals, vessels and goods of the other the advantage of every favor, privilege or immunity which it shall have accorded to the nationals, vessels and goods of a third State, and regardless of whether such favored State shall have been accorded such treatment gratuitously or in return for reciprocal compensatory treatment. Every such favor, privilege, or immunity which shall hereafter be granted the nationals, vessels or goods of a third State shall simultaneously and unconditionally, without request and without compensation, be extended to the other high contracting party, for the benefit of itself, its nationals and vessels.”

7 The treaty with Great Britain (vide 8 Stat. 228, 7 Fed. Stat. Ann. 525) was proclaimed December 22,1815. The portion of same here pertinent is found in Article II, reading:

“Art. 2. No higher or other duties shall be imposed on the importation into the United States of any articles, the growth, produce, or manufacture, of his Britannick majesty’s territories in Europe, and no higher or other duties shall be imposed on the importation into the territories of his Britannick majesty in Europe of any articles, the growth, produce, or manufacture, of the United States, than are or shall be payable on the like articles being the growth, produce, or manufacture, of any other foreign country; nor shall any higher or other duties or charges be imposed in either of the two countries, on the exportation of any articles to the United States, or to his Britannick majesty’s territories in Europe, respectively, than such as are payable on the exportation of the like articles to any other foreign country; nor shall any prohibition be imposed on the exportation or importation of any articles, the growth, produce, or manufacture, of the United States, or of his Britannick majesty’s territories in Europe, to or from the said territories of his Britannick majesty in Europe, or to or from the said United States, which shall not equally extend to all other nations.”

- 1

- Cited by