No CrossRef data available.

Article contents

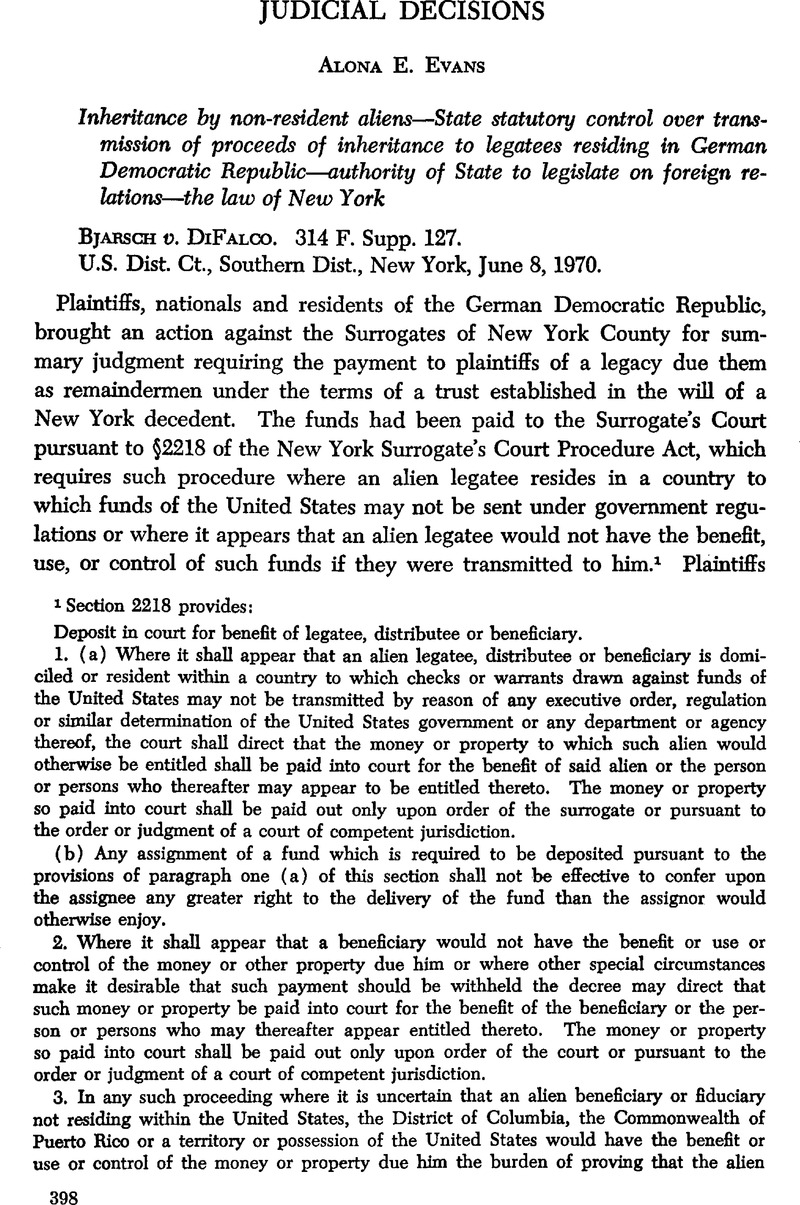

Bjarsch v. DiFalco. 314 F. Supp. 127

Published online by Cambridge University Press: 28 March 2017

Abstract

- Type

- Judicial Decisions

- Information

- Copyright

- Copyright © American Society of International Law 1971

References

1 Section 2218 provides: Deposit in court for benefit of legatee, distributee or beneficiary. 1. (a) Where it shall appear that an alien legatee, distributee or beneficiary is domiciled or resident within a country to which checks or warrants drawn against funds of the United States may not be transmitted by reason of any executive order, regulation or similar determination of the United States government or any department or agency thereof, the court shall direct that the money or property to which such alien would otherwise be entitled shall be paid into court for the benefit of said alien or the person or persons who thereafter may appear to be entitled thereto. The money or property so paid into court shall be paid out only upon order of the surrogate or pursuant to the order or judgment of a court of competent jurisdiction. (b) Any assignment of a fund which is required to be deposited pursuant to the provisions of paragraph one (a) of this section shall not be effective to confer upon the assignee any greater right to the delivery of the fund than the assignor would otherwise enjoy. 2. Where it shall appear that a beneficiary would not have the benefit or use or control of the money or other property due him or where other special circumstances make it desirable that such payment should be withheld the decree may direct that such money or property be paid into court for the benefit of the beneficiary or the person or persons who may thereafter appear entitled thereto. The money or property so paid into court shall be paid out only upon order of the court or pursuant to the order or judgment of a court of competent jurisdiction. 3. In any such proceeding where it is uncertain that an alien beneficiary or fiduciary not residing within the United States, the District of Columbia, the Commonwealth of Puerto Rico or a territory or possession of the United States would have the benefit or use or control of the money or property due him the burden of proving that the alienbeneficiary will receive the benefit or use or control of the money or property due him shall be upon him or the person claiming from, through or under him. 314 F. Supp. 127 at 119. Footnote by court. Other footnotes by court renumbered or omitted.

2 Leikind v. Attorney General of New York, 397 U.S. 148 (1970) (dismissing appeal from In re Estate of Leikind, 22 N.Y.2d 346, 292 N.Y.S.2d 681 (1968) for lack of finality); Goldstein v. Cox, 396 U.S. 471 (1970) (dismissing appeal from Goldstein o. Cox, 299 F. Supp 1389 (S.D.N.Y., 1968), 64 A.J.I.L. 417 (1970) on jurisdictional grounds); Ioannou c. New York, 371 U.S. 30 (1962) (dismissing appeal from In re Marek's Estate, 11 N.Y.2d 740, 226 N.Y.S.2d 444 (1962) for want of substantial Federal question), motion for rehearing denied, 391 U.S. 604 (1968). Cases cited by court, ibid. 132-133.

3 331 U.S. 503 (1947); 42 A.J.I.L. 201 (1948).

4 389 U.S. 429 (1968); 62 A.J.I.L. 971 (1968).

5 Quoting Zschernig «. Miller, 389 U.S. 429 at 433.

6 Cited note 2 above.

7 314 F. Supp. 127, 133-134.

8 Ibid. 130 (footnote by court).