Book contents

- Frontmatter

- Contents

- List of figures

- List of tables

- Preface to the third edition

- 1 Introduction

- 2 Univariate linear stochastic models: basic concepts

- 3 Univariate linear stochastic models: testing for unit roots and alternative trend specifications

- 4 Univariate linear stochastic models: further topics

- 5 Univariate non-linear stochastic models: martingales, random walks and modelling volatility

- 6 Univariate non-linear stochastic models: further models and testing procedures

- 7 Modelling return distributions

- 8 Regression techniques for non-integrated financial time series

- 9 Regression techniques for integrated financial time series

- 10 Further topics in the analysis of integrated financial time series

- Data appendix

- References

- Index

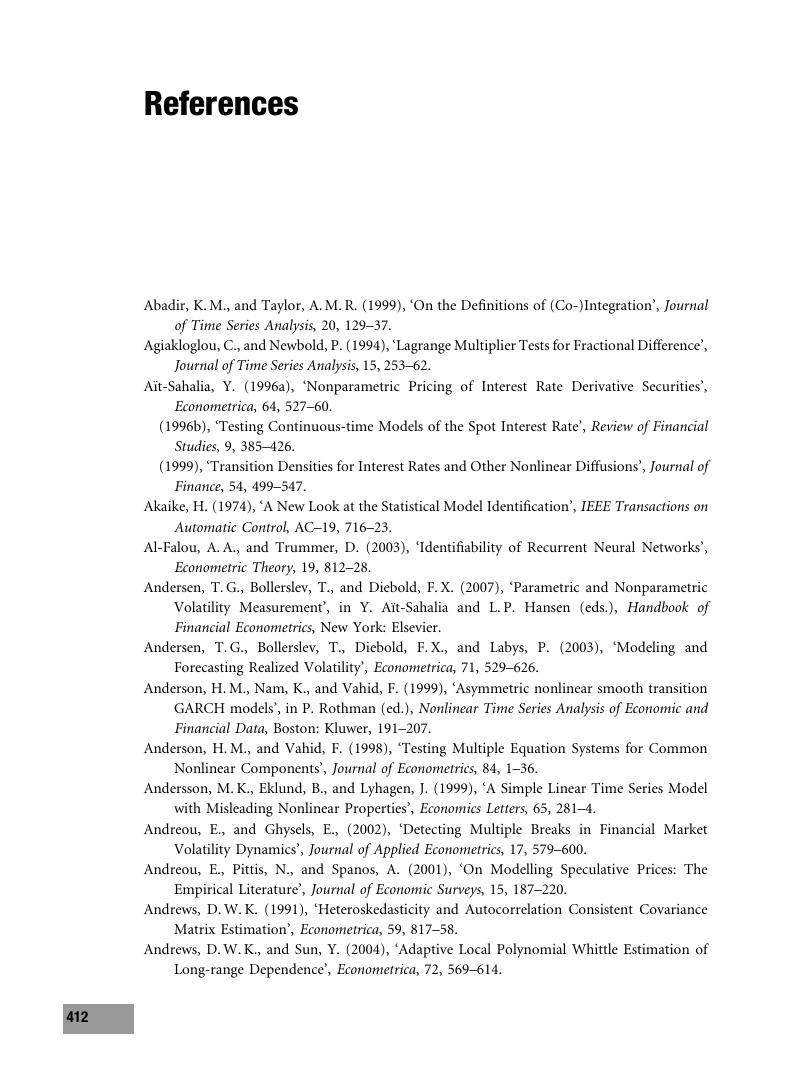

- References

References

Published online by Cambridge University Press: 05 June 2012

- Frontmatter

- Contents

- List of figures

- List of tables

- Preface to the third edition

- 1 Introduction

- 2 Univariate linear stochastic models: basic concepts

- 3 Univariate linear stochastic models: testing for unit roots and alternative trend specifications

- 4 Univariate linear stochastic models: further topics

- 5 Univariate non-linear stochastic models: martingales, random walks and modelling volatility

- 6 Univariate non-linear stochastic models: further models and testing procedures

- 7 Modelling return distributions

- 8 Regression techniques for non-integrated financial time series

- 9 Regression techniques for integrated financial time series

- 10 Further topics in the analysis of integrated financial time series

- Data appendix

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- The Econometric Modelling of Financial Time Series , pp. 412 - 445Publisher: Cambridge University PressPrint publication year: 2008