The subject chosen for this conference touches upon a topic that has again become core to central banking. ‘Again’ because the Bank of England became a central bank in the early nineteenth century with what we would now call a macroprudential mandate (Allen, Reference Allen2015). This mandate was not responsibility for price stability, because the restoration of convertibility of Bank of England notes into gold in 1821 after the Napoleonic Wars had taken care of that. The Bank’s task was to avoid financial crises and, when crises did threaten, to limit the systemic impact of any bank failure. Many other central banks also saw their job in such terms. For instance, Rotemberg (Reference Rotemberg2014) has pointed out that the goal of Federal Reserve monetary policy from the 1920s was to limit speculative lending. In a seminal speech at LSE in 1928, Dennis Robertson pointed out the Fed’s error in trying to use interest rates to moderate speculative lending. His proposal that monetary policy should be guided by the Principle of Price Stabilisation (“the sole and sufficient objective of [central] banking policy is the stabilisation of the price level”) proved to be prescient [Turner Reference Turner2017]).

The word ‘macroprudential’ itself seems to have been coined in 1979 by a Bank of England official, the late David Holland. It surfaces in Basel Committee documents at about this time (Green, Reference Green2011) and was prominent in policy discussions at the Bank for International Settlements (BIS) from the early 1980s.

1.1 Introduction

Many see macroprudential policies as essentially having a microeconomic focus, usually to deal with a market failure that an individual bank or other financial firm will not, on its own, address. People often think of such policies as leaving the economy-wide interest rate unchanged. These policies can curb a coordination failure between private firms. They can raise the relative price or availability of credit to those sectors in which the build-up of financial vulnerabilities is most worrisome. By contrast, monetary policy has a macroeconomic focus. If financial stability risks are judged to be high, and inflation risks appear because the interest rate is too low, the central bank can curb new borrowing by simply raising rates.

This stylised dichotomy has an important germ of truth. Financial system vulnerabilities are often most acute in certain sectors. For many central bankers, one of the main lessons of the 2007/2008 financial crisis was the need to develop macroprudential policies to address specific aggregate risk exposures – for example, from overvalued asset prices – that even well-managed firms together create (Galati and Moessner, Reference Galati and Moessner2014; Hoogduin, Reference Hoogduin2014; Kohn, Reference Kohn2014; Tucker, Reference Tucker2014a). Echoing Chuck Prince’s remark about leaving the dance floor while the music was still playing, Paul Tucker (Reference Tucker2014a) observed that macroprudential policies ‘can act as a coordinating device for intermediaries to exit the dance floor together, helping to dampen the pro-cyclical dynamic’. Finally, governance and accountability considerations have led many central banks to establish clear and separate primary objectives for monetary policy and macroprudential policies.

But such a dichotomy is of course a simplification. Any plausible assessment of macroprudential policy choices also requires macroeconomic analysis. One obvious reason is that the imposition of any binding regulatory constraint will affect macroeconomic variables. Normally such measures reduce spending and increase saving, with consequences for real income, interest rates and the exchange rate.Footnote 1 Economic models seek to work out the macroeconomic reactions induced by a tighter regulatory constraint.

Another reason – which is frequently overlooked – is that domestic macroeconomic policies cannot directly influence all relevant macroeconomic variables. In particular, many macroeconomic variables are mainly determined in world markets and thus largely beyond the reach of national policymakers. Prudential regulations (not monetary policy) may need to address what is essentially a macroeconomic problem, and not just a sector-specific problem.Footnote 2

Two examples of such global variables that are of particular relevance to central banks are the interest rate yield curve and the exchange rate. Central banks can set the short-term interest rate in their own currencies, but long-term rates are dominated by developments in global markets. How banks and other financial intermediaries react to this discrepancy – the central bank controlling one end of the yield curve in its own currency with global markets heavily constraining the other end – can have far-reaching implications for financial stability. Movements in the exchange rate can be relevant for financial stability because they have wealth effects and affect risk-taking, both by banks and in capital markets. This risk-taking channel of the exchange rate creates major policy dilemmas for central banks.

I begin my remarks by drawing an analogy with the Bernanke–Blinder (BB) closed economy model of the bank lending channel.Footnote 3 This paper replaced the standard goods-market equilibrium IS curve by a CC (that is, commodities and credit) curve. This extension was designed to allow for the impact on aggregate demand of changes in the willingness of banks to lend. In this model, a financial boom caused by the greater willingness of banks to lend – and not by monetary policy which is unchanged – drives up the real interest rate on bonds. This model can then be extended to an open-economy world by using the simple Mundell–Fleming relationship between the domestic interest rate and the exchange rate.

Note that, in the IS-LM world of the BB model, the monetary policy assumption is defined in terms of the quantity of money, and the interest rate is endogenous. The attraction of this model is that the interest rate responds to changes in risk-taking by domestic banks. The more ‘modern’ convention of defining monetary policy in terms of the policy rate implicitly assumes – at least in its basic versions – that there is no direct reaction of interest rates to financial shocks. This is especially so in models which have a macroeconomic Taylor rule and which assume that the long-term rate (a market rate that in reality does react to financial shocks) is just the average expected short-term interest rate. As Boivin et al. (Reference Boivin, Kiley, Mishkin, Friedman and Woodford2010) have pointed out, many Dynamic Stochastic General Equilibrium (DSGE) models have fallen into this trap. Often in such models the path of expected short-term rates depends only on Taylor-rule-type macroeconomic variables (output gap, inflation rate, etc.) – with financial shocks having no direct effect.

A tightening of macroprudential policy can be thought of as reversing the bank lending channel: it curbs bank lending and drives down the interest rate on bonds (Section 1.2). In an open economy, higher market interest rates attract capital inflows and the exchange rate appreciates. Currency appreciation may actually lead to further financial risk taking. A central bank faced with an overvalued exchange rate and excessive or too-unstable capital inflows may therefore prefer to tighten macroprudential policies rather than increase its policy interest rate (Section 1.3). Section 1.4 discusses some recent policy dilemmas in light of exchange rate developments. A particular form of macroprudential policy would be for the central bank to use its own balance sheet to impose Quantitative Tightening on banks (Section 1.5). The conclusion is that a flexible exchange rate cannot insulate a country from the ‘world’ long-term interest rate or from liquidity conditions in global markets. Capital flow or prudential measures may be needed to address the consequences of a macroeconomic variable that is beyond their reach (Section 1.6), and more than just a sectoral problem.

1.2 A Regulatory Constraint: Impact on Income and Interest Rates

Can the imposition or tightening of a macroprudential constraint have any sustained impact if the policy interest rate is held constant? The plausible microeconomic logic for saying ‘no’ is that interest rates determine intertemporal consumption choices. This logic of course ignores liquidity constraints – and macroprudential policies could work by tightening liquidity constraints. Consider the example of restrictions on mortgage lending, a common macroprudential tool in many countries. Faced with the requirement to make a larger down payment, a household will have to save for a bit longer to buy a house. All that the macroprudential constraint will have achieved, this argument runs, is to delay the house purchase.

But such reasoning works only at the level of the individual. It is fallacious at the aggregate level, because it ignores the impact of regulatory intervention on real GDP, on market interest rates and on asset prices. The imposition or tightening of a binding regulatory constraint that actually lowers borrowing is likely to raise domestic saving. Indeed, the logic of most macroprudential measures is exactly this: to get banks to tighten lending standards so that households or firms in effect increase savings. Normally, regulatory tightening will also lower asset prices – for instance, house prices may fall and this would change household balance sheets, with impacts on spending and output. Lower house prices could help financial stability: as house prices fall, new borrowers become ‘safer’ bets because their equity stake is now a larger proportion of a lower house price – it also reduces what they can borrow on the back of housing collateral.

The shift in aggregate demand induced by a restrictive macroprudential measure will, in simple closed economy models, reduce income and lead to lower interest rates. The credit channel in the BB model provides a simple framework to begin the analysis. Consider a credit expansion that might call for a macroprudential response. Their famous 1988 paper focused on the economy’s response to a financial shock. They analysed what would happen if banks became more willing to extend credit (because of ‘a decrease in the perceived riskiness of loans’, they suggested).Footnote 4 In their IS-LM type model, banks choose between loans and bonds (assuming reserves are constant). The beauty of the Bernanke–Blinder model is that it has a market-determined interest rate (the interest rate on bonds) that responds to changes in banks’ willingness to alter the composition of their assets between loans and bonds. Macroprudential policies can be seen as acting directly on banks’ willingness to lend while holding monetary policy unchanged.

Figure 1.1 reproduces their figure. With monetary policy non-accommodating (i.e. a given LM curve corresponding to a fixed money supply), an outward shift in the credit supply function shifts the ‘commodities and credit’ (CC). Both real GDP (Y) and the real interest rate on bonds (i) rise – moving along a given LM curve. To repeat a point made earlier: in this framework, the interest rate is not a simple function of a policy rate under the control of the central bank, a point of some importance for the discussion of the term premium in the ‘world’ long-term interest rate in Section 1.6.

The Bernanke–Blinder model takes both the price level and inflation as given. In practice, however, the response of monetary policy would depend on inflation prospects. If the rise in output takes Y above full employment, the central bank might tighten monetary policy (leftward shift of the LM curve), reinforcing the rise in the interest rate on bonds. Or with high unemployment, it may welcome the more expansionary attitude of banks and loosen monetary policy (rightward shift of the LM curve) to prevent the interest rate on bonds from rising.

Macroprudential policies have the advantage of giving central banks additional instruments to curb bank lending directly. They can change the regulatory risk weights on loans, for instance. The aim would be to affect the behaviour of banks in ways that are akin to changes in the perceived riskiness of loans which Bernanke and Blinder analysed. Hence a tightening of macroprudential policy can be represented as a downward shift in the credit supply function which would shift the CC curve inwards (Figure 1.1). The interest rate on bank loans rises while that on bonds falls.Footnote 5 The policy alternative to the macroprudential measure would have been to tighten monetary policy. Figure 1.1 shows a leftward shift in the LM curve that produces exactly the same decline in real GDP from Yo to Y′. But the two policies have the opposite impact on the interest rate on bonds – tightening macroprudential policies lowers this interest rate, while tightening monetary policy increases it.Footnote 6

Such simple macroeconomic models need to be complemented by analyses of balance sheet variables of households. A lower interest rate on bonds in this model, for instance, has a correspondence in a higher market value of bonds. As other asset prices rise, the net worth of borrowers improves and they can borrow more (the balance sheet channel to monetary policy). Changes in the value of marketable collateral held by potential borrowers can have a sizeable effect on their ability to borrow.

Analysing balance sheet effects is not simple. One shortcoming of many financial stability analyses is that the asset side tends to be neglected. Much of the literature has an almost exclusive focus on the liability side of borrowers’ balance sheets. ‘The balance sheet channel of monetary policy,’ wrote Bernanke and Gertler (Reference Bernanke and Gertler1995), ‘arises because shifts in Fed policy affects … the financial positions of borrowers, both directly and indirectly.’

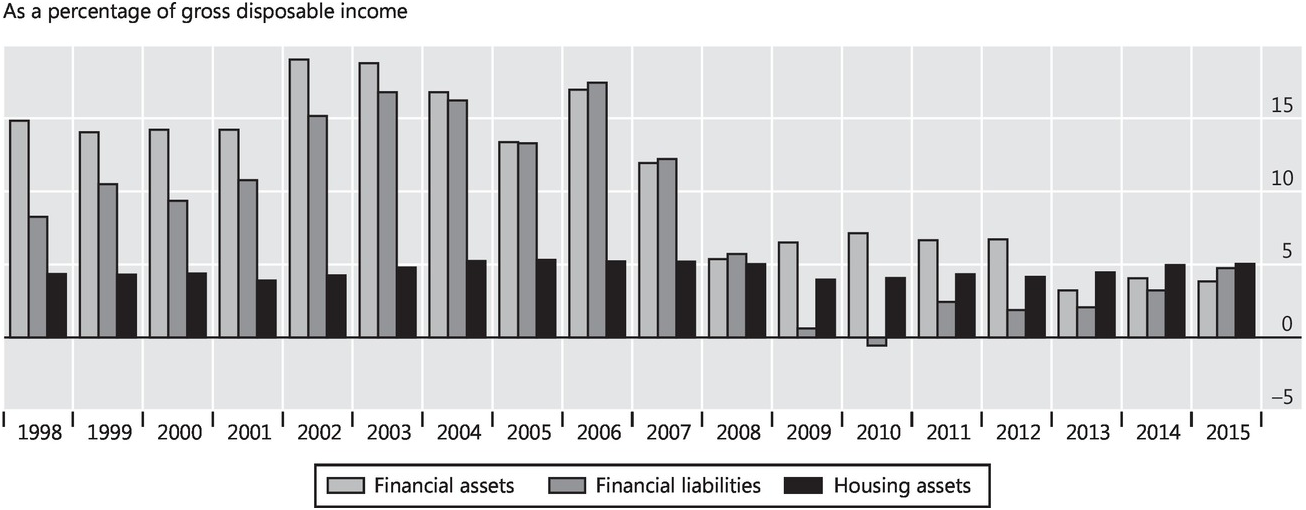

The most obvious implication of considering both sides of a balance sheet is that increased financial debts of borrowers are financial assets for the lenders. Changes in stocks of assets – not just debt – can have macroeconomic consequences. Writing about a UK house price boom in the early 2000s, Stephen Nickell, then a member of the Bank of England’s Monetary Policy Committee, noted a remarkable correspondence between the substantial accumulation of household financial debts (mostly mortgages) and the accumulation of household financial assets. Developments up to 2007 confirmed his observation (Figure 1.2). There is a ‘systemic connection’ between debt and assets, Nickell argued, whenever a household takes out a mortgage to buy a house from a seller who has no mortgage and who either inherits a new house or moves into rented property. The seller adds to his stock of financial assets just when the borrower adds to his financial liabilities. What is striking about Figure 1.2 is the stability of households’ net acquisition of housing assets through all the ups and downs in the property market. Yet large variations in the rate of house price increases seem to generate swings in the acquisition of both financial debts and financial assets that are many times larger than changes in investment in houses. Since the crisis, however, financial debts and assets have been more stable. More work is needed to understand how swings in financial assets could aggravate financial accelerator effects.

Figure 1.2 The accumulation of household debt and assets in the United Kingdom.

1.3 A Regulatory Constraint: Impact on the Exchange Rate

The Bernanke–Blinder closed economy model can be extended to an open economy analysed using simple Mundell–Fleming mechanisms linking interest rates and the exchange rate. Consider first the impact of the domestic shock that BB considered. A rise in the interest rate on bonds coming from an outward shift of the CC curve – that is, as banks become more willing to lend – will attract foreign as well as domestic buyers of the bonds. One consequence is that the market interest rate rises by less than in a closed economy; and the resultant capital inflows induce a currency appreciation.Footnote 7 Currency appreciation may lead to yet further increases in domestic bank lending. The appreciation of their currency makes households (especially those with foreign currency debts, common in emerging market economies [EMEs]) feel better off, and may encourage them to reduce savings.Footnote 8

Such exchange rate impacts add an important dimension to the policy debate on the response to a domestic shock. Regulatory tightening leads to currency depreciation, but monetary tightening leads to currency appreciation. This important difference is not lost on policymakers grappling with what they see as overvalued currencies.

Figure 1.3 illustrates some elements of this issue. It represents an initial situation such that the level of income and the exchange rate generate a trade balance of zero. The consumption and production of tradable goods are exactly equal so that the trade account is in balance. If banks become more adventurous, and lend more, the CC curve shifts outward, the exchange rate rises and the output of tradables falls. The demand for non-tradables is stimulated and a trade deficit emerges.

In practice, of course, the exchange rate can also be driven up by an external shock, adding new policy dilemmas. Consider the case of a rise in the world price of the export goods. This is important for developing economies dependent on primary commodities. (A boom in external markets has a similar effect on countries with more diversified export structures.) The trade-related effect of such a shock is an improvement in the terms of trade, which allows the country to balance its currency account with a lower output of tradable goods. The ray B in the figure swivels anti-clockwise. But there may also be a financial aspect that is particularly relevant for capital flows. This is that the higher real value of expected future exports in effect gives the country increased collateral, making foreigners more willing to lend. A decline in the country’s risk premium moves the FF schedule leftwards, capital inflows rise and the exchange rate appreciates. This is of course the short-run effect. In the long run, foreign debts gradually increase as the strong exchange rate erodes the country’s capacity to produce tradable goods.

Such slow-moving balance sheet effects, not of course included in the Mundell–Fleming framework, can ultimately have major implications for financial stability. Bruno and Shin (Reference Bruno, Shim and Shin2015) have termed this phenomenon the risk-taking channel of currency appreciation. Hofmann et al. (Reference Hofmann, Shim and Shin2016) have shown how currency appreciation in EMEs is indeed associated with a decline in the country’s risk premium (i.e. lower sovereign credit default swap spreads): capital inflows tend to increase and the yields on local currency government bonds fall.

Faced with strong capital inflows, many central banks intervene on a large scale in the foreign exchange market. But buying foreign exchange increases central bank liabilities, usually with the banking system. Bank reserves rise and monetary policy becomes more expansionary (i.e. the LM shifts to the right), tending to drive down the interest rate on bonds. Historically, central banks have found it difficult to fully insulate domestic bank credit from very large and persistent purchases of foreign exchange without resorting to quantitative measures such as reserve requirements. Marcio Garcia (Reference Garcia2011) has shown, also using the Bernanke–Blinder model, that selling bonds in order to restore the original interest rate still leaves banks with larger liabilities. Hence banks in this model expand loans in response to sterilised intervention. In any event, even greater holdings of government bonds – not just reserves – make banks’ balance sheets more liquid. Gadanecz et al. (Reference Gadanecz, Mehrotra and Mohanty2014) find evidence that increased bank holdings of government bonds in EMEs has led to an expansion in bank credit to the private sector. Macroprudential policies with an exchange rate dimension (such as limiting foreign currency borrowing, increasing reserve requirements, capital account management policies, etc.) can support (and perhaps provide reliance on) forex intervention because they limit credit expansion and put downward pressure on the exchange rate (Pereira da Silva and Harris Reference Pereira da Silva and Harris2012).

There is of course a counterweight that could reverse this conclusion. Real currency appreciation reduces real net exports, driving down income (i.e. moving the CC curve towards the origin). Such competitiveness effects, however, take years to build up and may be weak in countries dependent on commodity exports. The initial impact of real currency appreciation (especially in a commodities boom) is often to increase gross fixed capital formation. This would move the CC curve outwards – and reinforce the impact of credit expansion. For many commodity producers, this effect of increased fixed investment seems to dominate at least for a few years the demand-depressing effect on the output of tradables of lower competitiveness. So capital inflows, the supply of credit, fixed investment and the exchange rate can all rise together when the real terms of trade improve.

A scenario where currency appreciation, forex intervention and domestic credit expansion go hand-in-hand is of more than academic interest. Many financial crises in the past have been preceded by periods when credit expansion and currency appreciation feed on each other. Gourinchas and Obstfeld (Reference Gourinchas and Obstfeld2012) report clear evidence that overvalued exchange rates during cyclical booms (with large capital inflows) increase the risk of financial crises. During such periods, policymakers will have to cope with expansionary appreciations. Once there is a ‘sudden stop’ in capital flows, the currency falls as the country is forced to rapidly correct its trade deficit by reducing income to match the (diminished) level of tradables output. The exchange rate often overshoots hurting these with currency mismatches. The three financial channels go into reverse, and may create what seems like a contractionary devaluation.Footnote 9

A tightening of macroprudential policies during boom periods could counter such a dynamic. It would lower the interest rate on bonds and so drive down the exchange rate (e). This in turn increases the output of tradable goods, T. A tightening in bank lending standards reduces the demand for non-tradables. The trade deficit is reduced. It is easy to see that tightening monetary policy calibrated in a way to have the same impact on Y as macroprudential tightening would lead to a larger full employment trade deficit because it would drive up the exchange rate and increase capital inflows.

Because a currency appreciation and sizable capital inflows can increase financial risk-taking, monetary tightening may be undesirable: the financial stability consequences of yet-further increases in the exchange rate can be damaging. This story is of course highly stylised – a starting point of analysis, not a final conclusion. The link between interest rates and the exchange rate is not stable or predictable enough to rely on for policy purposes, and in any case relies also on what is happening to ‘foreign’ short rates. Nothing has been said about the dynamics. The microeconomic impact of a regulatory tightening, which is usually greatest while private sector balance sheets are in the process of adjusting, tends to weaken over time. This may not matter because both financial market conditions and the macroeconomic situation tomorrow will be different from today. A reversal of upward pressure on the currency, for instance, would remove a constraint on raising policy rates so that monetary tightening could then supplement macroprudential tightening.

A deeper analysis would also have to assess the macroeconomic consequences as private agents try to find ways around policy action, be it in monetary policy or in regulatory policy. For instance, if domestic banks are constrained to apply tougher lending standards, borrowers may seek loans from banks abroad, sometimes in foreign currency. This will tend to drive up the exchange rate. This is similar to the consequences of raising the policy rate in local currency, which may induce some to switch to borrowing in foreign currency. Financial stability risks coming from currency mismatches would be aggravated, but – in the short term – borrowing in a depreciating currency will appear to be an attractive trade. In such circumstances, tightening rules on currency mismatches (or on foreign borrowing) might be needed to prevent borrowers from escaping the intent of monetary tightening. Ozkan and Unsal (Chapter 6) argue convincingly that a separate macroprudential instrument is especially needed in economies with sizable foreign borrowing, because domestic monetary policy cannot influence the cost of foreign borrowing.

Several recent papers report simulations with general equilibrium models that tell a similar story as the stylised model. Such models demonstrate that the relative impact on the exchange rate is crucial in deciding between monetary tightening and macroprudential tightening. Using a general-equilibrium model, for instance, Alpanda et al. (Reference Alpanda, Cateau and Meh2014) find that more targeted tools such as loan-to-value (LTV) regulations are more effective in reducing household debt at a lower cost in terms of GDP than raising the policy rate.Footnote 10 The logic is that tightening LTV regulations reduces GDP and inflation. As a central bank following a Taylor rule reduces the policy rate, the real exchange rate falls. This stimulates the demand for tradables. Ozkan and Unsal also use their small open economy general equilibrium model to show that a monetary policy response to a surge in capital outflows (decreasing the policy rate as aggregate demand weakens) can depreciate the currency and motivate more outflows. Mimir et al. (Reference Mimir and Surel2015) develop a model in which banks have both foreign and domestic sources of funding: they analyse how counter-cyclical reserve requirements can affect real exchange rate developments and the volatility of credit spreads.

1.4 The Exchange Rate and Some Recent Policy Dilemmas

The short summary of the discussion in the previous section is that there are three possible financial channels through which currency appreciation or a terms-of-trade gain can lead to an expansion in credit:

increased bank lending as banks see households and firms (especially those with foreign currency debts, common in EMEs) as better risks

a lower country risk premium and stronger capital inflows

monetary expansion in the wake of larger central bank balance sheets

This section considers how relevant such channels may have been in recent policy dilemmas.

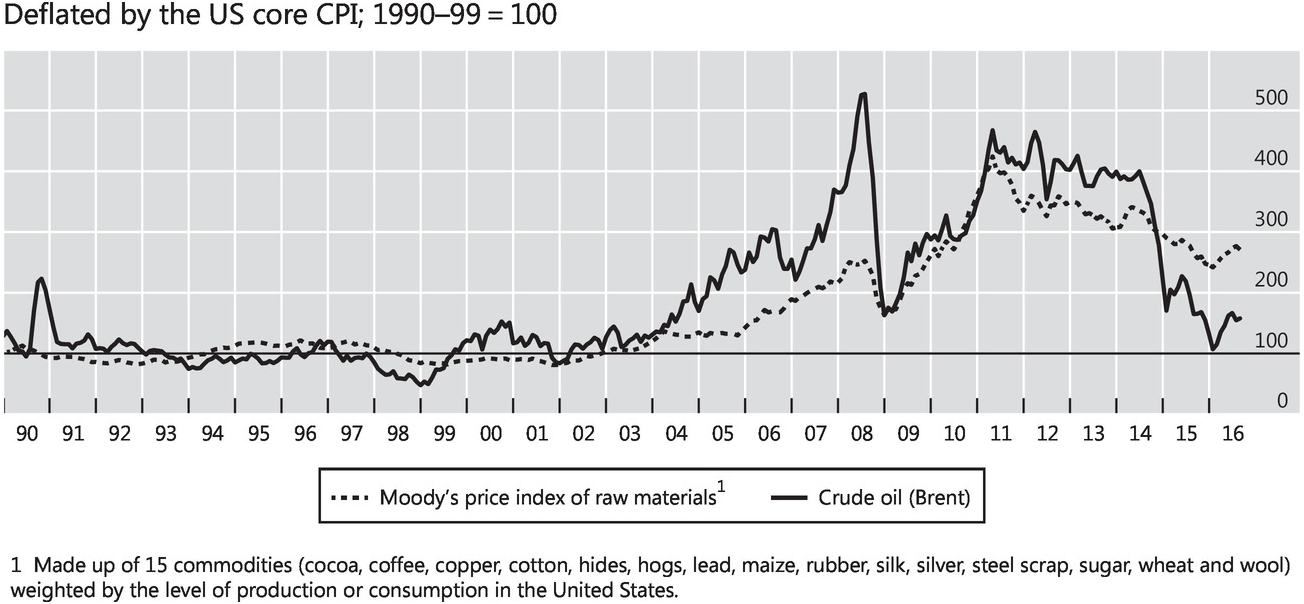

The case of countries dependent on commodities has already been mentioned. Their exchange rate is bound to be driven up by strong rises in the price of their export commodity.Footnote 11 This had been a major force up to 2014, as real commodity prices have risen by a factor of three-to-four over their average level in the 1990s (Figure 1.4). Such price increases stimulate investment in commodity-producing and ancillary sectors. Moreover, the country’s risk premium typically declines; higher export earnings give the country extra collateral. The consequences are sizable currency appreciation and credit expansion, including those through offshore borrowing. But the subsequent dramatic reversal of commodity prices (especially oil) has put the currencies of several commodity exporters under heavy downward pressure. This serves to illustrate how large changes in relative prices increase the risks of currency overvaluation and subsequent reversal.

Figure 1.4 Real commodity prices.

In their model of a small open and commodity exporter economy, González et al. (Reference González, Hamann and Rodríguez2015) show how, in the commodity boom phase, real currency appreciation and credit growth in effect transfer net worth from the tradable to non-tradable sector. The authors argue that a macroprudential rule aimed at controlling total credit would perversely reinforce the misallocation of credit from the tradable to the non-tradable sector. To avoid this, they formulate a macroprudential forex intervention rule as a function of the deviation of the real exchange rate from its long-run target.

Somewhat comparable forces may operate in non-commodity producing countries. Terms-of-trade gains of whatever source have a mechanical effect of stimulating private consumption in most models. A period of currency appreciation may even persuade households that their permanent income has risen. They feel they can borrow more, and then the banks think that local borrowers have become better risks. Borrowers with foreign currency debts (e.g. in an emerging market) see their balance sheets strengthen when the currency appreciates, and banks are willing to lend them more. Large currency appreciations may lower the ‘perceived riskiness of loans’, as Bernanke–Blinder put it. Historically, credit expansions and currency appreciation have indeed gone together, suggesting that they actually reinforce each other. The model developed by Bruno and Shin (Reference Bruno and Shin2014) has currency appreciation making the balance sheets of local borrowers appear even stronger, encouraging banks to lend them even more. The paper by Ozkan and Unsal sheds further light on this issue, by showing that the source of borrowing in an economy – whether it is foreign or domestic – matters for any assessment of alternative policy responses to a financial market shock.

The classic response to a terms-of-trade gain and the greater willingness of banks to lend is for households to invest in houses. What if the stimulus to the demand for houses coming from an appreciated exchange rate dominates the restraint coming from higher interest rates? Paradoxically, investment in the non-tradable sector (notably houses) may actually rise following a tightening of monetary policy. If households can borrow in foreign currency while their income is in local currency (e.g. dollar-denominated mortgages in Latin America, Swiss franc mortgages in central Europe, etc.), the stimulus coming from currency appreciation is even stronger.

A central bank cannot be indifferent as to which component of aggregate demand it affects. Stimulating private consumption or house building will not help future growth as much as business fixed investment. Lower investment in tradables but increased investment in non-tradables makes a country more vulnerable to external shocks. Nor can central banks be indifferent about the nature of capital inflows attracted by higher rates. Raising the domestic short-term rates above levels prevailing in the main international markets may attract increased capital inflows into more shorter-term debt paper. Hence the structure of capital inflows becomes more volatile, potentially accentuating financial stability risks. Central banks with financial stability mandates have to worry about such external dimensions.

Assessing the sustainability threshold for the real exchange rate is very difficult. This is particularly true for economies with undiversified export structures (e.g. commodity exporters) because of long swings in relative prices in world markets. An overvalued exchange rate maintained for a prolonged period typically leads to large external debts, which makes the country’s external position unsustainable.

The conclusion from this analysis is that the combination of overvalued house prices (requiring a higher policy rate) and an overvalued exchange rate (requiring a lower policy rate) presents the central bank with a dilemma. The Governor of the Reserve Bank of New Zealand recently noted that the IMF considered New Zealand house prices to be overvalued by around 25 per cent – and the real effective exchange rate was about 18 per cent above its fifteen-year average (Wheeler, Reference Wheeler2013). The Reserve Bank has noted that it introduced macroprudential measures in October 2013 to counter further rapid house price inflation, given that it was not appropriate to raise interest rates because ‘annual CPI was running at 0.7%, the exchange rate was strong, and there [was] a negative output gap’ (Wheeler, Reference Wheeler2014). By reducing housing market pressures, these macroprudential measures allowed the Reserve Bank ‘to delay the tightening of interest rates, thereby reducing the incentive for any additional capital inflows into the New Zealand dollar.’

The Bank of England faced a similar dilemma in the first half of the 2000s (Figure 1.5). The United Kingdom began the decade with sterling overvalued and house price inflation very strong. The Bank of England’s Monetary Policy Committee in February 2000 agreed that, ‘it would be preferable to have a lower exchange rate and higher interest rates from the point of view of economic conditions and balance more generally.’ The Committee decided to raise Bank rate by 25 basis points and considered, but rejected, forex intervention. With mounting losses and closures in the tradable sector (especially manufacturing), the central bank came under strong pressure from businesses and unions to cut interest rates and lower the exchange rate (Brittan, Reference Brittan2000).

Given strong domestic demand and continued rises in house prices, however, UK Bank rate did not follow the sharp cuts in the Federal funds rate during 2001. By mid-2001, the United Kingdom had the highest real short-term interest rate in the G7. And UK rates remained 200 basis points or more above US rates until mid-2005. This sustained a substantial appreciation of sterling against the dollar, and the real effective exchange rate remained well above historical levels. What prevented the Bank of England from following US rates was not the risk of failing to meet their inflation target but worries about the apparently inexorable rise in house prices – and the rising household indebtedness associated with it. At that time of course the Bank of England had no macroprudential instrument at its disposal.

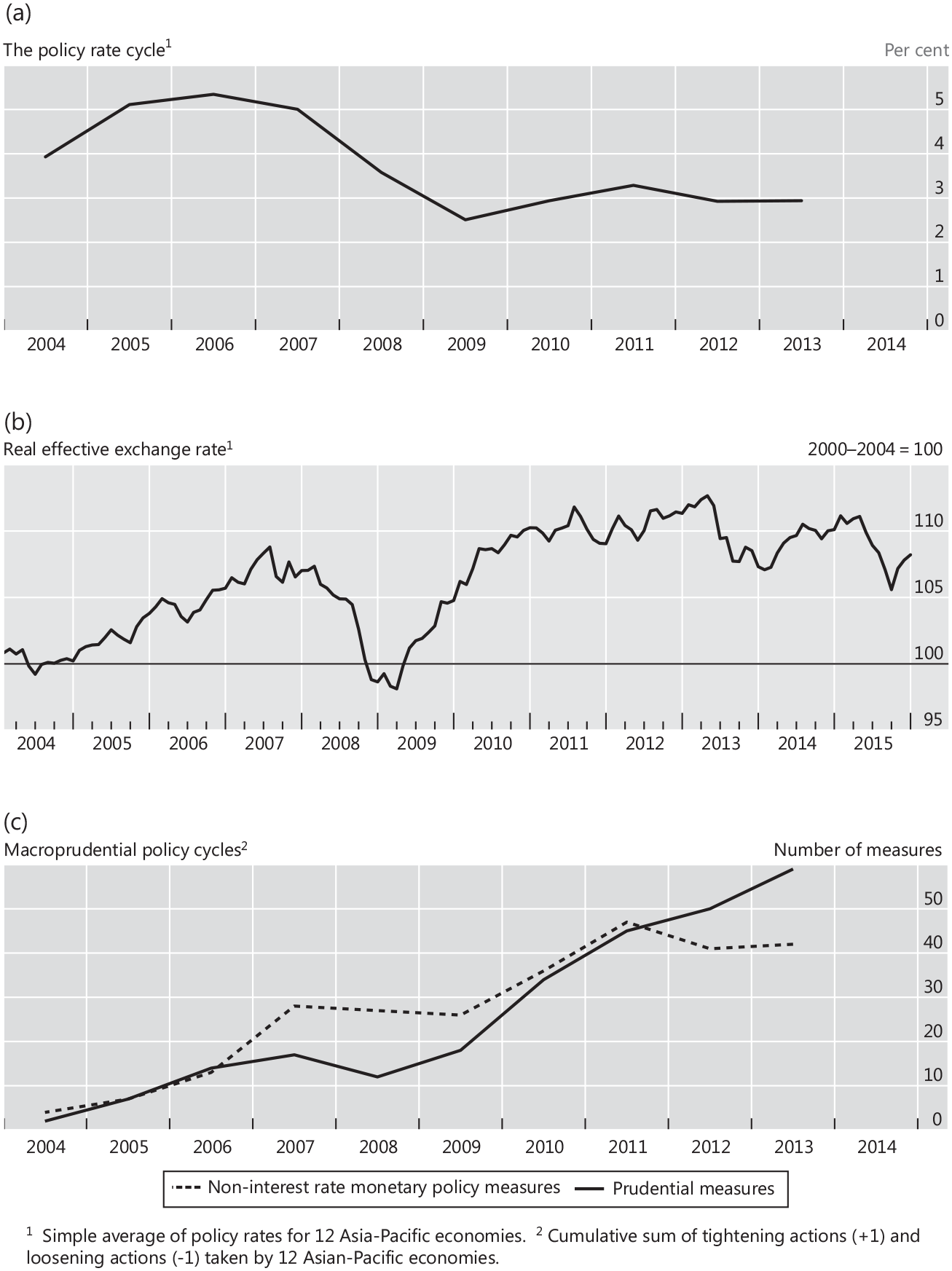

A strong real exchange rate has led central banks (or governments) in many emerging markets to put greater emphasis on macroprudential policies, sometimes raising the policy rate less than appears warranted by domestic conditions. Hofmann and Bogdanova (Reference Hofmann and Bogdanova2012) show that the average real policy rate in the EMEs has been somewhat below that implied by a Taylor rule since 2003, and was well below that level in 2010 and 2011. Figure 1.6 from the Bruno et al. (Reference Bruno, Shim and Shin2015) study covering twelve Asia-Pacific economies shows that strong growth and inflation pressure led to rises in policy rates in the mid-2000s. One consequence, however, was a sharp real exchange rate appreciation. As growth strengthened after 2009 and there was a renewed rise in their exchange rates, much greater reliance was therefore placed on macroprudential measures.Footnote 12

1.5 Macroprudential Policies and the Central Bank’s Balance Sheet

The central bank’s balance sheet can be important in influencing bank lending. Central bank liabilities are usually assets for the private sector, normally the banks. When a central bank’s balance sheet is very large – whether because of forex intervention or the purchase of domestic assets to counter recession – so too is the balance sheet of the commercial banking system. Even in normal times, the central bank throughout history has been the bank for banks (Billi and Vredin, Reference Billi and Vredin2014). Charles Goodhart has argued many times that the central bank could use its own balance sheet to implement macroprudential policy. He argues that the existence of financial frictions, of asymmetric information, of externalities and systemic effects means that the central bank’s ability to buy (or sell) claims on the private sector is their ‘first macroprudential instrument’ (Goodhart, Reference Goodhart2011). Such transactions could be used to provide reassurance during panics. Or they could be used to signal disapproval of riskier paper generated during booms: historically, this has been an important function of central bank discounting practices. In a similar vein, Jean-Pierre Landau (Chapter 2) argues that the use of reserves requirements can give macroprudential policy an important systemic liquidity-oriented dimension. Mervyn King (King, Reference King2016) extends these ideas: he proposes that the central bank be the pawn-broker for all seasons, ready to lend to banks against a pre-agreed set of illiquid and risky assets at a pre-agreed haircut.

It is mainly in the emerging markets that macroprudential measures have had close links to the central bank’s balance sheet. A particularly important instance is the extensive use of reserve requirements. Heavy and prolonged central bank purchases of foreign exchange had made commercial bank balance sheets in many EMEs too liquid. They therefore raised reserve requirements to counter excess liquidity within the banking system. Differential reserve requirements were also imposed to influence the composition of bank balance sheets (e.g. to combat the dollarisation of local banking systems).

In the advanced economies, by contrast, banks’ balance sheets were found, during the financial crisis, to have been too illiquid. Requiring banks to hold a higher proportion of their own balance sheets in liquid assets – as in Basel III – will have implications for the central bank’s balance sheet. Because of new regulations requiring financial institutions to have more liquid balance sheets than before the recent financial crisis, the central bank may have to leave more ‘liquidity in the financial system on a permanent basis’, to use the words of Joe Gagnon and Brian Sack (Reference Gagnon and Sack2014). Jean-Pierre Landau (2015) makes a persuasive case for liquidity regulation as an effective counter-cyclical tool.

Ben Friedman (Reference Friedman2014) has argued that the central bank’s standard toolkit in normal times is now likely to include its own balance sheet, and not just the policy rate as was the fashion before the crisis.Footnote 13 Could the central bank’s balance sheet, so useful in correcting dysfunctional markets during slumps, be used to temper over-exuberance during booms? Quantification of the monetary and prudential ramifications of the size and nature of the central bank’s balance sheet has been much debated over the years, without any consensus emerging. One lesson of the crisis is that central banks can easily miss latent threats to financial stability if they focus only on short-term interest rates and ignore sizable changes in monetary quantities. A former Deputy Governor of the Bank of England made this crystal clear in a speech before the recent crisis broke (Tucker, Reference Tucker2007). There is also a vigorous debate about how to avoid the trap of a too-active use of central bank balance sheets compromising efficient market functioning.Footnote 14

1.6 The Long-Term Interest Rate

The market-determined interest rate on bonds that is linked to the attitude of banks to lending is central to the Bernanke–Blinder analysis. How macroprudential policies could influence market interest rates is a very useful question. Economists are often tempted to evade this question by assuming that ‘interest rates are determined by monetary policy’. They often fall back on the expectations theory of interest rates, even if this has been falsified by events over the past decade.

We need to think much harder about the determinants of the long-term rate. Many studies have established that, during the past twenty years, long-term interest rates in an increasing number of countries have become more dependent on yields in global bond markets. As capital controls or regulatory limits have been progressively relaxed, international investors now have more influence over the long-term interest rate than the central bank in most economies. Many studies over the years have found that changes in long-term rates of industrial countries are much more correlated across countries than are short-term rates. Obstfeld (Reference Obstfeld2015) finds that a 100 basis point change in the foreign long-term rate leads to a 40 basis point change in the local long-term rate in his sample of emerging markets. A central bank cannot set its own long-term rate even if it has a flexible exchange rate.

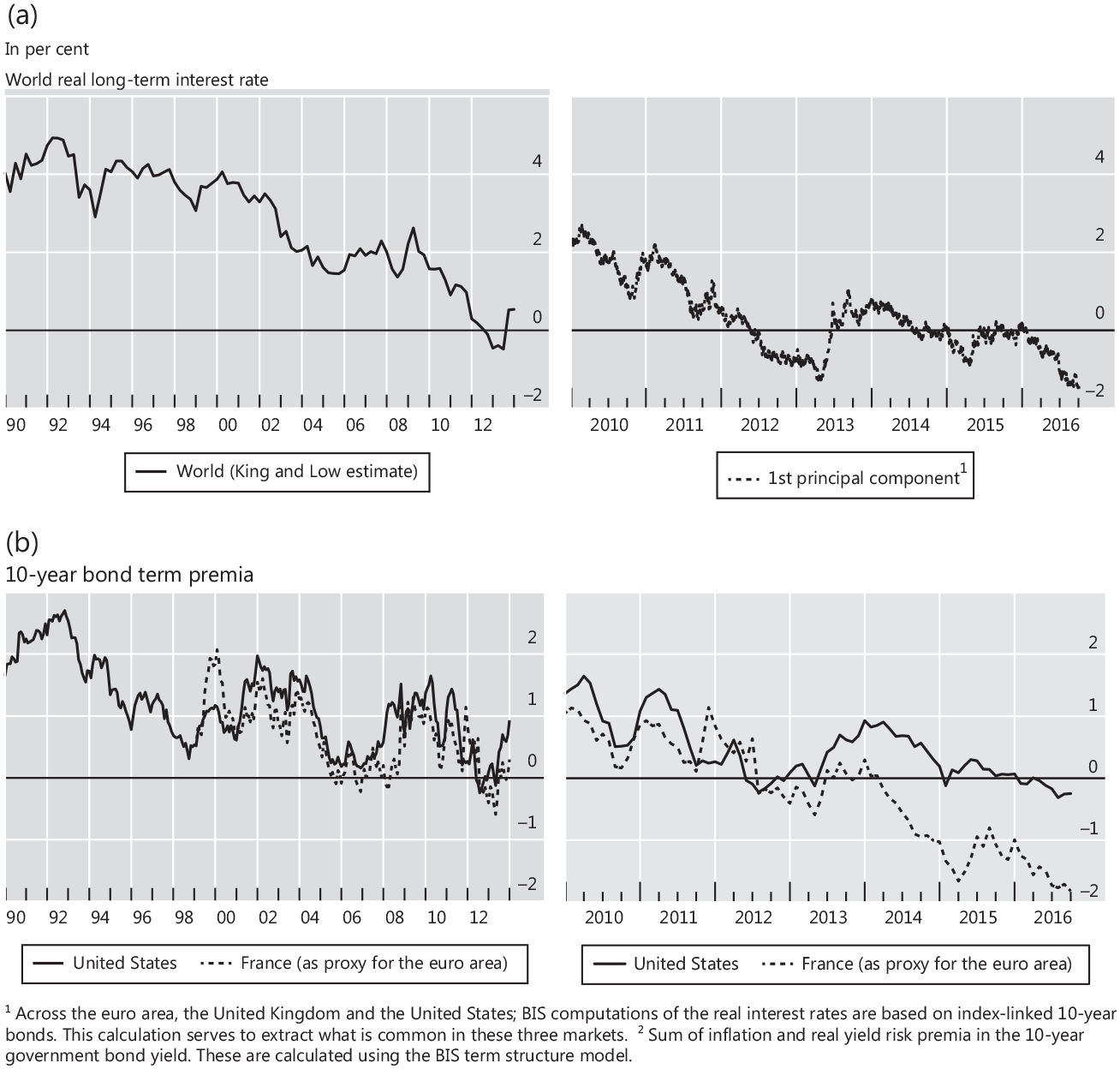

Mervyn King and David Low (Reference King and Low2014) used advanced economy bond market data to construct an estimate of the ‘world’ real long-term interest rate, shown in Figure 1.7, panel A. Movements in the yield on ten-year US Treasuries dominate this ‘world’ interest rate. But it is not true that developments in the United States determine this world rate. US yields themselves respond to global, and not just US, forces. This is because of the extensive use of US dollars in financial contracts between non-US residents that have little or nothing to do with the US economy. US dollar credit to non-bank borrowers outside the United States now exceeds $9 trillion – up from $6 trillion at the start of 2010 (McCauley et al., Reference McCauley, McGuire and Sushko2015). In addition, a much larger portion of credit for the US economy comes from abroad than in the past. Mendoza and Quadrini (Reference Mendoza and Quadrini2010) show that, by the end of 2008, about one-fifth of total net credit liabilities of the US nonfinancial sector was held by agents outside the United States.

Figure 1.7 The long-term interest rate.

The real world long-term interest rate has been falling for more than a decade and is now close to zero. Panel B of the figure, based on calculations from Hördahl et al. (Reference Hördahl, Sobrun and Turner2016), shows that this has been largely driven by a compression of the term premium – the reward for holding long-dated rather than short-dated bonds.Footnote 15 In the early 1990s, the term premium was around 300 basis points. Then from 1994 to 2003 it was around 150 basis points. Global recession, Quantitative Easing, and a flight to ‘safe’ assets such as US Treasuries has made it negative in recent years. The euro area’s term premium (Panel C, Figure 1.7) has fallen below that on US Treasuries. During much of 2014, lower euro area yields seem to pull down US Treasury yields even as prospects of stronger US growth, higher policy rates and the end of new bond purchases by the Federal Reserve should have pushed yields higher. Even the United States cannot escape the ‘world’ interest rate.

Understanding the drivers of the term premium and not using the expectations theory of the interest rate to sweep it under the carpet, is a huge present challenge for economists. It is hard to overstate the importance of this because the long-term interest rate is fundamental for financial stability. It provides, first, the discount rate to value the stream of expected earnings of all long-lived assets. Other things equal, a reduction in the long-term rate would tend to raise house prices, equity prices and so on. Hence the level of long-term rates is central to any analysis of asset prices. Second, it provides the risk-free benchmark for financial intermediaries such as pension funds which hold assets in order to meet future long-term liabilities. When long-term rates fall, the steady-state pension from a given stock of assets declines.Footnote 16 Funds that cannot cut the pensions they pay may build up losses, and UK corporate pensions have indeed reported mounting funding deficits. And, third, it defines the terms of maturity transformation. Flat near-term yield curves encourage banks and others to extend maturity mismatches in a search for yield.

Collateral practices reinforce the importance of the long-term rate. A rise in bond and other asset prices raises the value of the assets held by borrowers, which can be pledged as collateral. Hence liquidity constraints are eased.

Very low long-term real interest rates at the global level may well be suitable for advanced economies where the scope for productivity growth is limited and with a sizable retired population holding a large stock of financial assets. But developing countries – where real income per head is growing more rapidly and marginal investment returns are higher – would, in a closed economy, have a higher long-term rate. To avoid excessive (and perhaps volatile) debt inflows, the domestic authorities may want to restrict non-resident flows into local debt markets, long as well as short. When global macroeconomic variables are so far away from their long-run equilibrium levels, there may be good second-best arguments for such restrictions.Footnote 17

Several observers (for example, BIS, 2009) have made a lucid case for regarding deliberate capital account management – as opposed to a laissez-faire stance – as an essential element of macroprudential policies in EMEs. How to do this whilst maintaining the benefits of international capital mobility – in disciplining governments as well as private firms – is one challenge. In practice, restrictions often can be evaded by moving financial transactions offshore, which could make risks worse by obscuring exposures.

Conclusion

Any analysis of macroprudential policies must take account of the impact on market-determined interest rates, which are not simply determined by monetary policy. The Bernanke–Blinder analysis of the closed economy case is very helpful in showing how macroprudential policies can affect interest rates.

But in an open economy, it is the impact on capital flows and on the exchange rate of alternative policies – in particular, the choice between monetary and macroprudential policy – that will often be decisive. An overvalued exchange rate can increase financial risk-taking through many channels. A central bank contemplating an increase in its policy rate on domestic grounds will have to weigh the financial stability risk of exacerbating exchange rate overvaluation.

Paul Tucker (Reference Tucker2014b) has observed, commenting on Jeremy Stein’s famous phrase about monetary policy getting into all the cracks, that, in an open economy, ’domestic monetary policy does not [his emphasis] penetrate all risk-taking channels and institutions.’ Extremely easy global financial conditions – as today – can push the long-term rate in countries with open capital accounts and a flexible exchange rate far below their domestic long-term equilibrium levels. Global liquidity is in many ways the quantity dual of low real interest rates. Landau (Reference Landau2013) has pointed to several channels of transmission of global liquidity to domestic financial markets. As with convergence forces on long-term rates, such channels apply irrespective of the exchange rate regime because international investors move from one market to another when they see risk-adjusted yield differentials emerge. Domestic macroeconomic policies may not be able to do much about such mechanisms of transmission. Macroprudential policies aimed at domestic credit and at foreign borrowing may on occasion be the best option open to the authorities of small countries.