A person's life consists of a collection of events, the last of which could also change the meaning of the whole, not because it counts more than the previous ones but because once they are included in a life, events are arranged in an order that is not chronological but, rather, corresponds to an inner architecture.

Italo Calvino, Mr Palomar.

1. Introduction

The country has been through a difficult referendum campaign, with a surprising result, a change of Prime Minister and heightened concerns of an immediate economic slowdown, which may have been militated against by the swift change of government, the delay in the triggering of Article 50 and easing in monetary conditions. In the Introduction to the articles for this Review, I suggest that the referendum result will allow the UK to re-consider its democratic institutions and the question facing us is “whether the post-referendum climate will prove to be sufficiently fertile to grow such institutions”. It is actually rather too early to consider any change in the fiscal stance, given the lack of data on the overall economic outlook, and particularly as the exchange rate has provided a considerable impetus to the economy. The way we decide to tackle the fiscal policy framework, which seems to have been shelved after the referendum, may be the start. So in the run-up to the Autumn Statement we may wish to address or frame the questions that need to be answered by a new fiscal framework and the collective shock of the prospective exit from the European Union.

2. What is the shock?

Apart from some immediate volatility in asset prices and some survey data suggesting some retrenchment by firms following the referendum result, there is still relatively little hard data, even towards the end of October, on the impact of the decision to leave the European Union in June. The most obvious response has been a large depreciation of sterling by 15 per cent in effective terms, of a magnitude seen both in 1992 and in 2008. Traditionally the exchange rate has acted as a convenient shock absorber for economic news in the UK. In this case, the downward jump in the exchange rate may reflect a lower equilibrium exchange rate as exit from the EU may imply some diversification away from high-value financial services and a negative terms of trade shock as there are increased overall costs of trade in both goods and services sectors. To the extent that the exchange rate has undershot its long-term level, the depreciation in the real exchange rate will also provide a domestic incentive to move resources into the traded sector and provide a possible boost to output.

Figure 1 illustrates the familar pattern of the exchange rate jumping.Footnote 1 The line EER corresponds to an equilibrium exchange rate for every given level of the domestic price level. We can think of equilibrium as an exchange rate that allows a level of international asset accumulation consistent with the choices of optimising households for consumption and of firms for profit maximisation. As we move along the abscissa the exchange rate depreciates, and so we note that the equilibrium exchange tends to fall as the price level rises. The MM curve depicts equilibrium in the home money market along with interest rate parity where the demand for real money balances falls in the domestic interest rate, which itself increases when the exchange rate is expected to depreciate. The original equilibrium is at A but following a jump in money supply or a fall in the risk-adjusted return on domestic assets the money market curve shifts out to MM∗ and the exchange rate jumps from A to B. At B it is now below its long-run equilibrium which might be at C if the equilibrium exchange rate relationship has not shifted but may indeed be at a lower long-run level such as D if the equilibrium relationship implies a lower exchange rate for every price level, such as EER∗. Such an equilibrium may be consistent with a decisive move away from the provision of financial services. Either way the exchange rate moves further than the equilibrium and provides a boost to output.

Figure 1. The exchange rate jump

The success of the exchange rate as a switching device depends on the supply elasticity of the traded sector. If traded supply can quickly be produced at this lower exchange rate then we can expect a boost to output. Indeed under these circumstances it would also be precisely the wrong thing to increase demand by running expansionary fiscal policy because such a response would tend to signal a switch of resources back to the non-traded sector. But if there is limited capacity in the traded sector the depreciation may then quickly pass through into higher prices. Indeed it is quite possible that the depreciation in 1992 did not lead to higher prices quickly because there was spare capacity and growing demand in mainland Europe as the recovery maintained its momentum at that time.

But if the fall in the exchange rate is seen as an increased or heightened level of risk attached to sterling assets, perhaps because following the referendum there will be a reduction in trade with the rest of the world and this will tend to reduce overall risk sharing for UK production, then there may be a clearer role for the state in engineering safer institutional mechanisms. The literature on risk and exchange rates does not give clear predictions (see, for example, Reference Obstfeld, Rogoff, Helpman and SadkaObstfeld and Rogoff, 2003) and in one well known model, an increase in monetary volatility leads to an increase in the demand for domestic assets and an exchange rate appreciation. Certainly, after the referendum result we did see some elements of a safe haven effect with the 10 term premium on UK bonds falling some 10–20bp in the aftermath of the referendum. But once we start to consider the mitigation of risk, at this point public debt management may have a role to play and I will return to this point shortly.

3. The Fiscal Charter

To help bolster fiscal credibility, the then Chancellor George Osborne had implemented two key reforms for the process of setting fiscal policy. First, in 2010 the OBR was established as a ‘fiscal watchdog’, which, inter alia, continues to provide an independent assessment of the long-term sustainability of the public finances and provides forecasts of the economy and the public finances. Second, in the post-election 2015 Summer Budget, Chancellor Osborne announced a new Charter for Budgetary Responsibility.

That fiscal policy framework set two clear objectives for fiscal policy: (i) to achieve sustainable public finances and (ii) to support the effectiveness of monetary policy. The resulting mandate was in two parts. In ‘normal times’, when a headline surplus had been achieved, the Treasury would target a surplus on public sector net borrowing every year. At other times, where there had been a significant negative shock to real GDP growth, which is identified by real-time GDP growth of less than 1 per cent on a rolling 4-quarter on 4-quarter basis, the target for a surplus was to be suspended and a plan for fiscal targets to return to surplus to be presented by the Chancellor and approved by a vote in the House of Commons. This framework needs to be rethought so that it is not pinned down to Parliamentary schedules which are arbitrary in economic terms and concentrates on debt levels rather than deficits.Footnote 2

One key problem that a framework should seek to address is to avoid the perception of fiscal dominance. That is essentially when the expected path for debt is such that it prevents the central bank from being able to move policy rates sufficiently to stabilise inflation. This problem has been widely studied (see Reference Leeper, Leith, Taylor and UhligLeeper and Leith, 2016) and the perception of dominance in a world when it is not possible to know with certainty the path of future debt and where debt has just increased markedly means that some institutional constraints on future paths of debt may act to leave open more room for monetary manoeuvres by enhancing the credibility of fiscal policy. As the literature is very much concerned with the level of public debt rather than plans over the deficits, which recent experience has continually shown are very sensitive to shocks, any new charter ought to focus on plans for reducing debt levels over time or to plotting the path for debt reduction. Indeed, Reference Chadha and NolanChadha and Nolan (2004) show that when there is an expected escalation in debt there is always an upper bound on the feasible path of policy rates. So by announcing some debt limits, this upper bound is less likely to bite.

But the problem is currently perceived to be the obverse. There is an effective lower, rather than upper, bound on policy rates as the neutral rate may well be somewhere below the effective bound of zero. This particular problem implies that rather than a concern over whether policy rates can be prevented from going too high, we need to find sources of demand so that the neutral rate is back within the space in which the monetary policy maker can operate in ‘normal’ times. And to many commentators the natural source of such demand would be a further episode of expansionary fiscal policy. Before going on, let us next look at fiscal policy responses to earlier episodes of fiscal expansion.

4. Fiscal consolidation

In this section, we briefly examine two 20th century episodes of debt stabilisation following WW1 and WW2 and draw a some tentative conclusions for a prospective 21st century debt consolidation (IMF, 2012). The dynamics of public debt to GDP, bt, are captured by the following expression, where it is the interest rate payable on government debt obligations, πt is the rate of change in the GDP deflator, yt is the growth rate of real GDP, and st is the primary surplus as a proportion of GDP and εt is a residual to account for valuation effects and any one-off adjustments. We thus, in principle, can decompose changes in public debt into each of these factors and assess the contributions during the two consolidations.

Figure 2. UK debt to GDP, 2004–16

In the aftermath of WW1 and the Great Slump, 1919–21, public debt to GDP in the UK peaked at 188 per cent of GDP in 1923 and in the aftermath of WW2 public debt to GDP peaked at 262 per cent in 1946. I start the post-WW1 period a year or so after the end of the Great Slump in 1923 and carry on until the start of the US Great Depression in 1930. For the later period, I start the period of analysis in the year after the devaluation of 1949 in 1950 and run the analysis for the rest of the decade. These dates are inevitably arbitrary but in the former case, we are trying to exclude the impact of a deep postwar recession and in the second case trying to examine the economy when it has started to put the war economy more firmly behind it. The broad picture does not change if we move the starting points back or forth a little.

Table 1 shows the fall in overall public debt to GDP in the 1920s and the 1950s. There was a more gradual fall in the 1920s as there was on average a deflation, real income growth was lower and even though the primary surpluses were extraordinarily high by modern standards they could not chip away much at the debt level because the average interest rate on debt was 4.6 per cent on a debt stock that was nearly twice GDP. The remarkable fall in public debt to GDP in the 1950s of nearly over 90 per cent results from an inflation rate that was nearly 5 per cent higher and a real growth rate of over 3 per cent. The primary surplus was just about offsetting the interest rate burden, which while there was considerably more debt the average interest rate paid was significantly lower at just over 3 per cent.

There does not seem to have been any target per se for debt consolidation, simply that a primary surplus seemed to have been targeted to match debt repayments, which meant that nominal income growth would reduce the debt burden over time. What is clear though is that having reached a peak in public debt to GDP relatively soon after each war (or expenditure) episode, there was no clear subsequent attempt to ratchet up levels of debt, even though it seems likely that there was significant need for post-WWII economic development in both the 1920s and 1950s. What seems to have happened were quite different paces – which we might term state dependent – for debt consolidation but there were concerted movements to reduce debt to GDP ratios in both eras.

5. Debt management

The perceived sustainability of the debt position is a key objective of fiscal policy. Reference FetterFetter (1965) described the development of British Monetary Orthodoxy that operated against the backdrop of an enormous and prolonged attempt to stabilise public debt levels in the 19th Century. The well-known key sustainability equation normally requires that r < g, where r is the real interest rate and g is the growth rate of output. Clearly the fall in funding costs (figure 3), to near zero, means that, at least temporarily, public debt constraints may not apply. It may though be misleading to use the temporary costs of funding to demand higher debt levels, which are funding calls on future generations, to drive nearpermanent levels of debt.

Figure 3. Costs of funding UK government liabilities: 2004–16

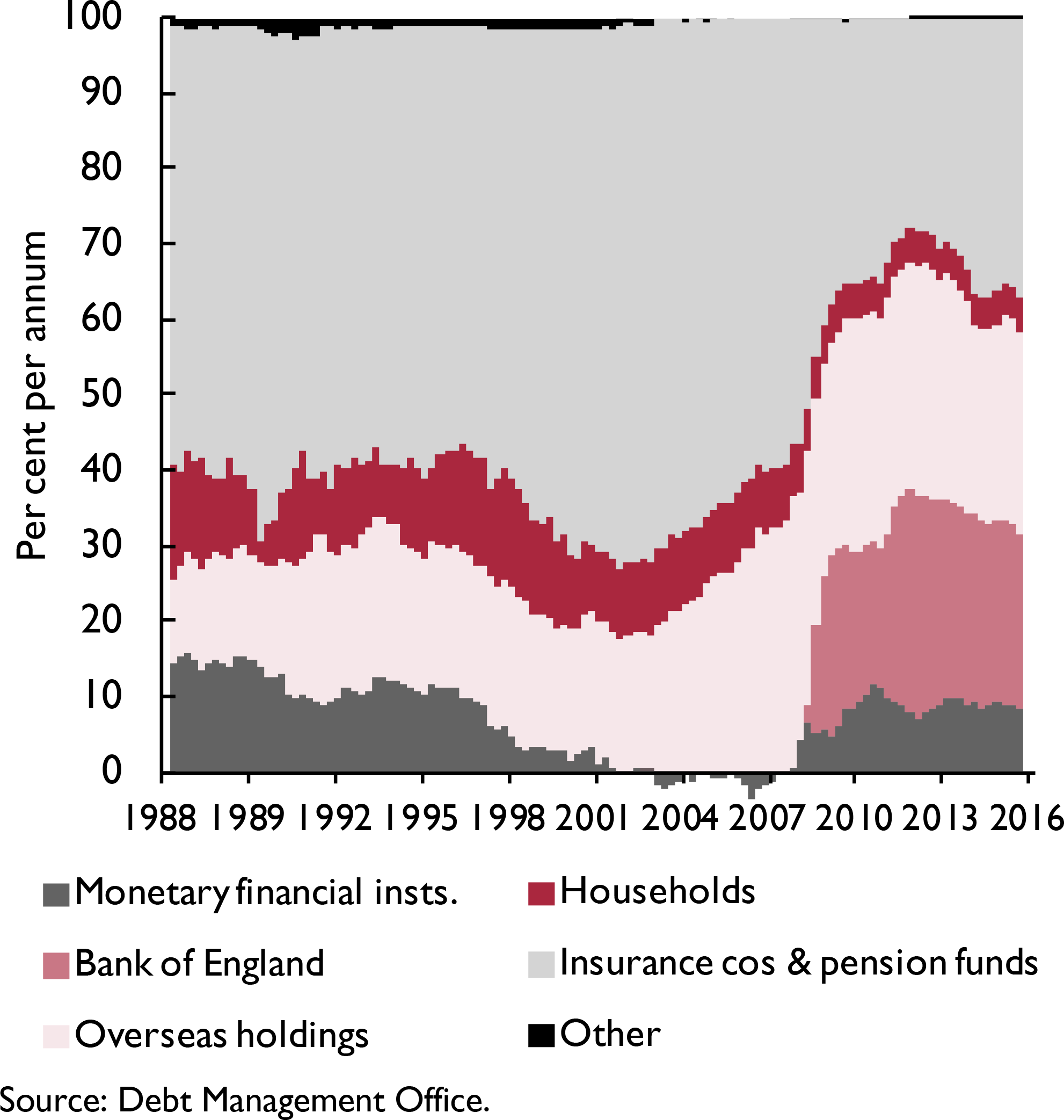

It is also hard to understand what the true demand curve looks like for government bonds, as the market prices are distorted by quantitative easing. Figure 4 shows the extent to which the Bank of England, through its asset purchase facility, holds central government liabilities. Given the objective of this policy has been to increase the prices of conventional debt, we cannot say then that the true costs of debt are quite so low. Most studies think that the asset purchases have pari passu reduced bond rates by some 50–100bp.

Figure 4. Holdings of central government liabilities, per cent of total stock

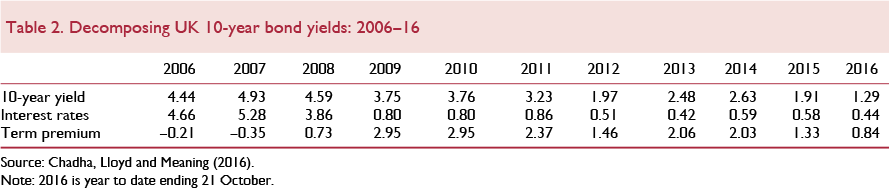

Despite that extra demand from the Bank of England the premia on UK debt are still evelated by pre-crisis standards. NIESR estimates of the term premia, which may include liquidity and credit risk, for 2016 show that they are still near 100bp (Reference Chadha, Lloyd and MeaningChadha et al., 2016). The CDS spread for UK five year tenor is around 30–35bp this year compared to around 20bp for 2015. The question it seems is less that there should be a wholesale abandonment of a debt reduction strategy but some mechanism might be considered that allows some slower rate of consolidation and yet retains the primacy of a sustainable set of fiscal plans. Given that it continues to be hard to identify any start to a sustained fiscal consolidation, as shocks dominate the outcomes, it is important that a strategy for the sustainability of fiscal plans is adopted.

6. Concluding remarks

The projections presented in this Review suggest that the UK economy will undergo something of a slowdown as the risks identified by NIESR from an exit from the European Union start to materialise. The government may be tempted to use fiscal policy to offset the slowdown but caution must be exercised. Public debt levels are already high and risk premia have been far from eradicated. The Bank of England is the largest single holder of UK debt and that starts to erode the distinction between monetary and fiscal policy to the point where it is hard to see much of a difference. We need to think about a fiscal framework that explains ‘misses’ from previously announced plans but promotes a sense of ‘timeless’ fiscal sustainability. The fiscal framework is in need of attention before policy can be asked to allow debt to deviate for long periods from what we may think is normal. If the framework is credible then there will be more latitude for the government to provide a persistent buffer for shocks (Reference Faraglia, Marcet and ScottFaraglia et al., 2008). We may wish to consider addressing the problem of fluctuations in refinancing costs by lengthening the maturity of public debt (Reference BarroBarro, 1997). Even though the average maturity of conventionals is around 16 years at present (excluding the holdings of gilts by the APF) and nearly 25 years for index-linked bonds, there may be some merit in issuing even longer-term bonds and restructuring the maturity of debt to match ever longer-term liabilities faced by financial institutions and perhaps promote longer-term planning horizons by the private sector. Ultimately, rather than a rule for deficits we might need an architecture for managing debt.