8.1 Introduction

The importance of the role of the mineral sector in Brazil’s economy is beyond doubt. The mining sector accounted for 21 percent of Brazil’s total exports in the first quarter of 2017 (PortalBrasil, 2017). In 2015, metallic minerals accounted for 76 percent of total sales of Brazil’s mineral output (DNPM, 2016a). The country’s balance of trade has been positive owing to the contribution of mineral exports over the past years, which attests to the positive role of the mining industry in national economic growth (Brazilian Mining Institute (IBRAM), 2015a).

While the mining sector is economically strategic to the country, mining output has an unbalancing effect on the economy, since it is concentrated both geographically and in the hands of few producers. This characteristic may be considered contradictory by those who attempt to describe and analyze Brazil’s mining activities, not only because of the country’s size, but also because of its geological diversity.

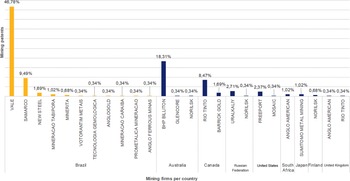

The “concentrated” pattern warrants the Vale S.A. case study. In 2015, the company and its subsidiaries ranked either first or second among the leading production companies in Brazil’s mining sector for various minerals (Figure 8.1). Vale is outstandingly not only a producer but also the operator of a large and sophisticated logistical system of railways and ports, which strongly distinguishes it from its competitors. Besides, it is Brazil’s leading iron ore producer and exporter and the country thus features in the global ranking of iron ore mining companies.

Figure 8.1 Leading producing companies in Brazil (2015)

Characteristics of Brazil’s mining sector will be outlined in the following sections, with emphasis on its competitive dynamics, strategic challenges, technological needs and institutional innovation-promoting arrangements. The chapter aims to describe patterns and distinctive features of Brazil’s mining sector’s technological agenda and proximity to or distance from global sector-specific innovative trends. To that end, answers will be provided to the following research questions:

– In which technological areas is the patent system being used by the mining sector in Brazil?

– How intensively do the mining equipment, technology and services firms (METS) use the patent system?

– How does Brazil’s mining sector import technology? What role do the mining firms and METS play in this process?

Methodologically, two approaches were taken in reviewing innovation in Brazil’s mining sector. First, patents and technology import contracts for metallic minerals, involving mining companies and METS in Brazil, were analyzed. The analysis covered the 2000 to 2015 period and both resident and nonresident stakeholders. Second, a case study was conducted of Vale S.A., Brazil’s largest mining company, with emphasis on its strategies to mitigate challenges and meet technological needs. This qualitative research exercise has sought to highlight and give examples of real-life experience.

8.2 Overview of Brazil’s Mining Sector

From colonial times, the history of Brazil’s development has always been linked to mining. As from the sixteenth century, the pioneers’ search for precious metals and gems, especially gold, silver and diamonds, was a major means of opening up the country’s territories to settlement, leading to the formation of villages and cities that bore witness to the discovery of new metallic mineral deposits, especially iron and manganese. The main regions thus explored were São Paulo, Minas Gerais, Goiás and Mato Grosso. Only a small amount of iron was produced artisanally in Brazil until the nineteenth century in some steelworks (known as Catalan forges) established in Minas Gerais to reduce iron ore directly and to produce iron and steel. Mineral-extracting tools were rudimentary and nonresistant, usually made of cast iron. Veins were worked manually, with pointers and, when necessary, home-made blasting powders were used. The ore was transported in wheelbarrows and, over longer distances, by animal-drawn wagons (Center for Management and Strategic Studies (CGEE), 2002). The most sophisticated mines were the Minas Gerais gold mines, in which techniques brought by English (probably from Cornwall) and German miners, trained in their home countries, were used (CGEE, 2002).

The country’s industrialization began early in the twentieth century and was driven by aluminum, copper, lead, iron, manganese and tungsten metallurgy. The major mining enterprises were managed by foreigners during that period, owing primarily to the war effort, with scheelite being mined in the north-east by United States Vachang engineers and manganese at Lafaiete, in Minas Gerais, by the United States Steel Company (CGEE, 2002).

As shown in Table 8.1, Brazil is now one of the world’s largest mineral producers, playing a major competitive role internationally. Its mineral resources are considerable, both in abundance and diversity, and it produces 72 minerals, of which 23 are metallic, 45 are nonmetallic and four are energy minerals (IBRAM, 2015a). Most minerals in Brazil are produced in open-pit mines, as there are few underground mines. Few operations are conducted on a scale higher than 400 t/d (CGEE, 2002).

Table 8.1 Brazilian ore production (2015)

| Mineral | Tons | World Rank | World Share |

|---|---|---|---|

| Niobium | 84,189 | 1 | 92.29% |

| Iron | 275,589,840 | 3 | 17.52% |

| Bauxite (raw ore) | 37,057,000 | 3 | 12.77% |

| Manganese | 1,226,458 | 5 | 6.74% |

| Tin | 18,824 | 6 | 5.87% |

| Nickel | 89,302 | 9 | 4.24% |

| Gold* | 83,127 | 12 | 2.69% |

| Copper | 359,463 | 14 | 1.86% |

* Gold output in kg

Since 2005, growing world demand for minerals, in particular iron, bauxite, manganese and niobium ores, has boosted the value of Brazilian Mineral Production (PMB),Footnote 1 which has risen sharply in less than a decade.Footnote 2 In 2000, PMB values amounted to less than 10 billion USD, but rose to 53 billion USD in 2011. That “commodities boom” period gave way, however, to a major international foreign-market ore price crisis, triggered by falling growth rates in large global economies, especially China. The fall in the PMB (from 44 billion USD in 2013 to 24 billion USD in 2016) was due to a downturn in the international prices of Brazil’s primary mineral commodities, namely gold, copper, nickel, zinc, bauxite and, in particular, iron ore which is the flagship of Brazilian exports. That decline was not reflected in the volume of ore produced, which demonstrated the impact of external factors on the mining industry. These fluctuations were not trivial: prices rose by 392.46 percent between 2002 (34.77 USD) and 2011 (136.46 USD), according to World Bank data, but had fallen to 39.78 USD by the end of 2015.

Despite these foreign market fluctuations, the characteristics of Brazil’s mining sector contributed to its competitiveness on the international mineral market. Generally, despite falling mineral commodity prices in relation to output (PMB), the mineral industry still added value to its product. The logistical structure is, moreover, integrated into the international market. Brazil’s iron ore has remained competitive for these reasons (Ministry of Mines and Energy (MME), 2016).

There are sharp contrasts in mining in Brazil. High-technology mining companies operate in some regions alongside artisanal enterprises that use rudimentary and improvised mining techniques. In addition, the country’s mineral capacity is under-explored: less than 30 percent of the national territory has been mapped geologically on a scale appropriate for the activity.Footnote 3 Brazil’s mining sector therefore still holds great potential for investment in exploration and mineral production technologies.

8.2.1 The Role of Metallic Minerals in the Brazilian Mineral Economy

Brazil has metallic mineral reserves in 17 of the country’s 27 federal units.

Metallic minerals accounted for 76 percent of the total value of Brazil’s marketed mineral output in 2015. Eight minerals – aluminum, copper, tin, iron, manganese, niobium, nickel and gold – accounted for 98.5 percent of that value, at 17.3 billion USD. Iron ore, produced mainly in the states of Minas Gerais and Pará, was the main metallic ore marketed in 2015, accounting for 61.7 percent of the total for that class of mineral (DNPM, 2016b). Niobium, another strategic mineral considered rare worldwide, abounds in Brazil, and its known niobium reserves, totaling some 842 million tons, are found in the states of Minas Gerais (75 percent), Amazonas (21 percent) and Goiás (3 percent), constituting 98 percent of world reserves. In 2015, Brazil ranked first in niobium production, with 92.29 percent of the world total, followed by Canada and Australia (World Mining Data, 2017).

8.2.2 Mineral Industries and Foreign TradeFootnote 4

The mining sector achieved an 11.5 billion USD surplus in the first quarter of 2017, accounting for 21 percent of all of Brazil’s foreign market sales (PortalBrasil, 2017). This performance was owing to sales of iron ore, which accounted for 44 percent of mineral-sector exports and 9.3 percent of all Brazilian exports. Gold and niobium, too, performed well at 1.4 billion USD and 766.8 million USD, respectively, in that period. Imports grew concurrently by 53 percent, totaling 3.9 billion USD, as imports of metallurgical coal and potassium had risen in volume and in value.

The mining sector has contributed greatly to Brazilian exports in recent decades. Metallic minerals rank among the first four exported goods. The main countries that purchased ores from Brazil in 2015 were China, Japan, Netherlands, the United States of America and Canada, in that order. China is the largest customer for Brazil’s minerals, in particular iron. In 2015, some 31.93 percent of the main metallic substances exported by Brazil were bound for the Chinese market (DNPM, 2016a).

Brazil has imported metal commodities from Chile, Peru, Argentina, the Russian Federation and China. In 2015, some 43.58 percent of metallic substances imported into Brazil, in particular copper, originated in Chile (DNPM, 2016a).

8.2.3 Trends and New Policies for Brazil’s Mining Sector

Innovation is important to effective exploitation of natural resources, but issues concerning the actual impact of innovation on the sector and the factors that stimulate innovation in individual countries remain controversial (Reference FigueiredoFigueiredo et al., 2016).

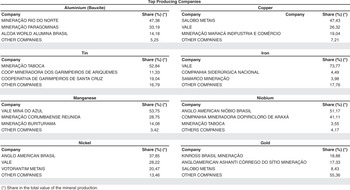

The Innovation Survey (PINTEC) conducted by the Brazilian Institute of Geography and Statistics (IBGE) on the sector’s primary ways and means of acquiring technology, shows that Brazil’s extractive industry has innovated primarily by acquiring machinery and equipment and secondarily by training personnel, which may be deemed complementary.Footnote 5 The survey sample consisted of 47,693 innovation-implementing companies, 1,138 of which were in the extractive sector.

Figure 8.2 shows part of PINTEC’s findings, highlighting the scale of innovative activities conducted by extractive companies from 2012 to 2014. Machinery and equipment acquisition and training accounted for 55 percent of the extractive companies’ innovative activities. These findings spotlighted the importance of reviewing the technology transfer role of METS in Brazil’s mining sector. The mineral sector innovation rate (42 percent) had doubled in comparison with the average for the previous five innovation surveys (21 percent). This increase was mirrored by activities such as machinery and equipment acquisition and research and development (R&D), both of which had doubled in value since earlier research (Lins, 2017, in Reference OliveiraOliveira, 2018).

Figure 8.2 Innovative activities developed by extractive companies and degree of importance.

With regard to the sector’s commitment to the promotion of innovation, companies, government representatives and trade associations have discussed the challenges faced by Brazil’s mining sector. During the 17th Brazilian Mining Congress (Belo Horizonte, Minas Gerais, September 2017), those groups highlighted two major drivers of innovation, namely higher productivity and operational efficiency and the social license to operate, with emphasis on environmental sustainability and relations with local communities (Table 8.2).

Table 8.2 Mining sector challenges and technological demands

| Unlocking productivity and operational efficiency | Social license to operate |

|---|---|

| Digitalization and the Internet of Things in mining | Mining tailings dams |

| The fully connected mine | Mining waste management |

| Autonomous vehicles for the mining industry | Water resources |

| Blasting strategies for increased mill productivity | Climate change |

| Safety and health in mining | Mining and communities |

In raising productivity and operational efficiency, the sector has tended to focus on technologies conducive to greater automation of activities, in particular those that are occupational safety hazards, and to lower operating costs. Digital and satellite connectivity technologies are other factors of investment in innovation through which companies seek process-efficiency gains.

Brazil’s mineral industry has increasingly integrated the social license to operate agenda into its investments, with emphasis on improvements that can enhance sustainable behavior, not only environmentally, but also in relation to communities in the vicinity of operations.

Priority has been given to dam management in particular, by including it not only in the sector’s agenda, but also in the agendas of local governments and the legislature. This resulted from the Bento Rodrigues accident, which occurred when the Samarco Fundão Dam burst in Minas Gerais in November 2015. It shows the extent to which the mining sector reacts to events rather than adopt a more proactive stance conducive to a structuring and long-term approach by anticipating innovative solutions for potential future problems.

Furthermore, Brazil’s mineral sector faces challenges inherent in the national scenario. It was not by coincidence that the Ministry of Mines and Energy (MME) published the 2030 National Mining Plan – Geology, Mining and Mineral Transformation (MME, 2011), in May 2011 as guidance for medium and long-term policies for progress in mining activities. The challenges mapped cover matters such as infrastructure and logistics, sustainability, occupational safety and health, and micro and small local businesses.

Moreover, the Brazilian Government made changes to the mineral sector’s rules in Provisional Presidential Decree No. 790 on June 25, 2017 (MP 790). Brazil’s current Mining Code was established in 1960 and updated in 1996, but has been superseded by current market demands. The federal government wishes to implement new rules to make the sector more competitive and to attract more investors by increasing transparency and legal security.

Highlights of the new rules include: (a) an increase in the sector’s royalty rates (CFEM); (b) establishment of the National Mining Agency (ANM) to replace the current DNPM in regulating and overseeing the sector; (c) a higher ceiling for fines; (d) inclusion of rehabilitation of degraded environmental areas and mine decommissioning plans in miners’ responsibilities; and (e) extension of the mineral prospection and exploration period. Conceptually, MP 790 broadens the scope of the federal government’s competences and of regulated activities. The regulation now covers the entire life cycle of the mining activity, from prospection and extraction to ore marketing and mine decommissioning. The new rules seek to boost the sector’s dynamics and, consequently, its modernization and to intensify the country’s mineral production through new investments and thus new technology.Footnote 6

The propensity to incorporate innovative activities has been rising gradually in Brazil’s mineral sector and its representatives have displayed higher levels of commitment. The sector’s revamping has included a legislative overhaul, highlighting the diversity of forces that have driven Brazil’s mining companies to rethink their forms of action.

8.2.4 Institutional Collaboration for Innovation

Some of the behavioral characteristics of Brazil’s mining companies when acquiring technological capabilities and technologies will be considered in this section. These dynamics are very important if it is borne in mind that the innovation environment can be improved by institutional collaboration and linkages rather than isolationist behavior and aversion to sharing content and experience.

Reference FigueiredoFigueiredo et al. (2017) has stressed the importance of collaboration among companies in building their technological capabilities. Research has confirmed that, between 2003 and 2014, much of Brazilian miners’ innovative technological capabilities were accumulated in partnerships with universities and local research institutes, consultants and agents along the production chain (suppliers and clients).

Institutional collaboration in the mineral sector has sound historical foundations in Brazil. The sectoral innovation system was formed through a long process of technological and scientific skills building and accumulation, involving feedback and interaction among companies, research institutions and universities. It is not by chance that undergraduate and postgraduate courses in mining engineering, materials engineering and metallurgy have flourished and are well established at the Federal University of Minas Gerais (UFMG) (Reference Suzigan and AlbuquerqueSuzigan and Albuquerque, 2008).

Brazil’s mining companies and academic community (universities and research centers) collaborate considerably under cooperation agreements and formal partnerships. This has been achieved incrementally, as some confidentiality and intellectual property issues are yet to be resolved in order to smooth out such relations. Vale S.A. exemplifies the way in which such obstacles can be overcome. It has broadened its portfolio of academic partners since 2010, by issuing calls for proposals for partnership with governmental science promotion agencies, and has thus gained access to a broad spectrum of research groups that were previously unknown to the company (Reference Mello and SepulvedaMello and Sepulveda, 2017).

METS are equally crucial innovation stakeholders in the mining sector, as noted in studies abroad (Reference FrancisFrancis, 2015). Mining is a catalyst of technical progress and the capital goods industry has emerged to provide solutions that meet the mining companies’ technological demands (Reference Furtado and UriasFurtado and Urias, 2013).

This has held true for Brazil, too. Throughout its history, as noted at the beginning of this chapter, the technological development of Brazil’s mining corporations has drawn both on the direct participation of foreign producers and on various engineering services. New mining technologies have frequently been brought into Brazil by outside companies and the foreign technicians who came to work in the mines brought what was best known in their home countries (CGEE, 2002).

Furthermore, it was common practice to send Brazilian professionals abroad to complement their studies, and machine and equipment manufacturers sometimes promoted visits to open mines worldwide as a means of observing products and more efficient production processes (Reference Bertasso and CunhaBertasso and Cunha, 2013). In addition, returning Brazilian technicians, having worked in foreign companies and absorbed their practices, actually disseminated new technologies.

Even though a significant part of Brazil’s technological base is imported, domestic machinery, equipment and engineering services were used to modernize much of its mining industry. It is noteworthy that, since the 2000s, the machine and equipment sector has mirrored the concentration and internationalization of the mining sector. This shows that the companies are interdependent. As mining companies became stronger and more complex, thus demanding more comprehensive technological solutions from suppliers, the latter began to build alliances with the mining companies in order to develop new products jointly. This association took the form of knowledge and competency transfers. Machine and equipment suppliers provided training for mineral sector workers and monitored and maintained (preventively and remedially) the machines and equipment supplied (Reference Bertasso and CunhaBertasso and Cunha, 2013). However, in comparison with other countries such as Australia, South Africa, Chile and the United States of America, the trend in Brazil is still nascent, owing to the dearth of examples, which are confined to the major mining companies (Reference FigueiredoFigueiredo et al., 2017).

Brazilian miners seem to be more willing to interact with external players. Brazil’s mining companies have been driven to search for solutions outside their own gates in order to acquire different experience and skill sets.

8.3 Use of the Patent System and Technology Transfer in Brazil’s Mining Sector

This section will consider the main two mechanisms used by mining companies and METS in Brazil to build their technological capabilities, namely technology development and technology acquisition from abroad. It will identify the main technological innovation areas and stakeholders in Brazil’s mining sector and the ways in which companies have been importing new technologies. Both analyses have drawn on a sample of patent and technology import contracts involving resident and nonresident mining companies and METS.Footnote 7

8.3.1 Technology Protection

A sample of 130 resident and nonresident mining companies and METS that filed patents at INPI from 2000 to 2015 was analyzed. As Table 8.3 shows, these companies filed 7,933 patents and utility models, including 4,273 for mining technologies filed by 21 mining firms and 83 METS.

Table 8.3 Patents applications: 2000–15

| Mining firms | METS | TOTAL | |||||

|---|---|---|---|---|---|---|---|

| RES | NRES | Total | RES | NRES | Total | ||

| Number of applicants | 15 | 10 | 25 | 35 | 70 | 105 | 130 |

| Total patents filed | 234 | 131 | 365 | 106 | 7,462 | 7,568 | 7,933 |

| No. of applicants (only mining patents) | 11 | 10 | 21 | 22 | 61 | 83 | 104 |

| No. of patents (only mining patents) | 182 | 113 | 295 | 73 | 3,905 | 3,978 | 4,273 |

Notes: RES = Resident; NRES = Nonresident.

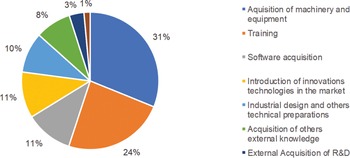

As shown in Figure 8.3, nonresident METS predominate in applications for patents in Brazil’s mining sector. They account for nearly all of the mining patents filed from 2000 to 2015.

Figure 8.3 Mining patents, by type of applicant (2000–15).

METS are more likely to file patents for mining and metallurgy technologies, while mining firms focus on refining and transport technologies, as can be seen from Figure 8.4.

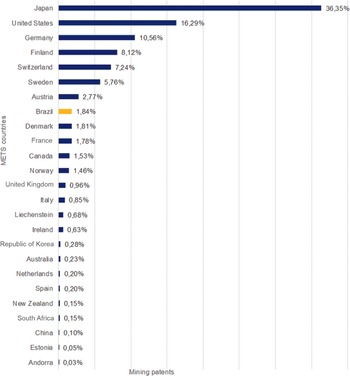

It can be seen that most of the METS applicants were from Japan, as they accounted for 36 percent of the 3,978 patents filed in the period under review, followed by North American and German METS. Although Brazilian METS hardly feature in these results, they seemed more concerned to protect technology in Brazil than Canadian or Australian METS, for instance (Figure 8.5).

Figure 8.5 Mining patents filed by METS, by country of origin (2000–15).

The major two METS applicants were Nippon Steel and Mitsubishi, from Japan. They focused on metallurgy and mining technologies. The leading applicants among resident METS were Terex Cifali and Ciber, both of which deal with transport and processing technologies (Figure 8.6).

Figure 8.7 shows applicant mining firms. There is a wide gap between Vale S.A. and the other mining firms. While Vale filed 46.8 percent of patents from 2000 to 2015, the remaining firms filed 53.2 percent of patents altogether. This confirms the aforementioned concentrated nature of Brazil’s mining sector.

Vale has filed for patents mainly in transport and refining technologies. Transport is crucial to Vale’s patenting strategy because of its logistics business and demand for railway technologies. In addition, Vale has protected technologies in seven of the eight mining technology areas present in the WIPO Mining Database, and has not applied for patents in blasting technology only. Here, too, Vale’s representativeness warrants a more detailed analysis, which will be provided in the Section 8.4.

The Anglo-Australian Broken Hill Proprietary Company Limited (BHP Billiton) was the leading applicant among non-resident mining firms, followed by a Rio Tinto Canadian subsidiary. BHP Billiton applied for patent protection mainly in refining technologies. The company did not seek to patent transport, environment, automation and blasting technologies in Brazil. Here, too, this mining firm’s patenting strategy focused on refining technologies in Brazil’s mining sector, in the same way as its Brazilian competitor, Vale S.A.

According to Reference FigueiredoFigueiredo et al (2017), Brazil’s mining sector’s technological capabilities are greatest in mineral processing (refining), which is warranted by the need to maximize productivity and minimize costs. Companies are consequently more concerned about being competitive in those areas and, therefore, protecting such technology.

Of the 255 Brazilian patent applications relating to mining technologies, including both resident mining firms and METS, only 11 patents were filed jointly with academic institutions (see Table 8.4)

Table 8.4 Coapplications and foreign inventors, by mining technology

| Resident firms | Coapplications with universities | Foreign inventors | |||

|---|---|---|---|---|---|

| Nippon Steel | METS | N/A | 0 | Metallurgy | 1 |

| Samarco Mineracao | Mining firm | Exploration | 1 | Processing | 1 |

| Vale S.A. | Mining firm | Environmental | 2 | Environmental | 1 |

| Exploration | 3 | Exploration | 3 | ||

| Mining | 1 | Mining | 3 | ||

| Processing | 2 | Refining | 3 | ||

| Anglogold Ashanti Brasil | Mining firm | Environmental | 1 | N/A | 0 |

| Mineração Caraiba | Mining firm | Metallurgy | 1 | N/A | 0 |

| TOTAL | 11 | TOTAL | 12 | ||

8.3.2 Technology Transfer

Two systems for innovation are known: the so-called open and closed innovation systems. While in a closed innovation system all the R&D is done within the firm, in an open innovation system external cooperation among different entities is promoted to accelerate internal innovation and expand the markets for external use of innovation (Reference Chesbrough, Vanhaverbeke and WestChesbrough et. al., 2006). The Brazilian economy seems increasingly oriented toward the open innovation system.

As an example of that, some nonresident METS that used the patent system in Brazil had been contracted by resident mining firms to provide technological service or technological know-how. The sample of 18,252 import contracts registered in INPI’s database showed that 707 concerned mining companies and METS. As Table 8.5 shows, 26 mining firms and 14 resident METS were recorded as technology contractors. Only two METS contracts did not involve a parent company and its resident subsidiary. Resident METS (the subsidiaries) assumably acted as intermediaries between non-resident METS and resident mining firms in order to operationalize technology transfers.

Table 8.5 Research sample (technology import contracts) (2000–15)

| Mining firms | METS | TOTAL | |||||

|---|---|---|---|---|---|---|---|

| RES | NRES | Total | RES | NRES | Total | ||

| Import contracts (No. of contracts) | N/A | N/A | N/A | N/A | 18,252 | 18,252 | 18,252 |

| Import contracts (No. of contracts within Brazil’s mining sector) | N/A | N/A | N/A | N/A | 707 | 707 | 707 |

| Import contracts (No. of contractors) | 26 | n/a | 26 | 14 | n/a | 40 | 40 |

| Import contracts (No. of providers) | N/A | N/A | N/A | N/A | 295 | 295 | 295 |

Table 8.6 shows technology import contracts, by type, by contractor and by supplier. Technical assistance services contracts were the type of contract most used, mainly by resident mining firms. This finding assumably flows naturally from the previously mentioned point on nonresident METS’ key role in providing technical services to Brazil’s mining enterprises (Reference Bertasso and CunhaBertasso and Cunha, 2013; CGEE, 2002).

Table 8.6 Technology import contracts by type, by contractor and by supplier (2000–15)

| Type of contract | Contractor | Supplier | |

|---|---|---|---|

| RES Mining Firms | RES METS | NRES METS | |

| Technical assistance services | 82% | 10% | 92% |

| Know-how agreement | 1.5% | 5.5% | 7% |

| Patent licensing | 0.00% | 1% | 1% |

| Total | 83.5% | 16.5% | 100.00% |

Figure 8.8 shows that Vale S.A. is the leading contractor, accounting for more than half of the INPI-registered technology import contracts. If the parent companies are taken into consideration, then it can be said that four mining groups, namely Vale S.A., Anglo Gold Ashanti, Kinross and Yamana Gold, are represented by their Brazilian subsidiaries in technology-transfer contracts negotiated with nonresident METS, as observed in Table 8.7.

Table 8.7 Mining firm contractors (subsidiaries and parent companies)

| Contractor (Mining firms) | Parent company |

|---|---|

| Salobo Metais S/A | Vale S/A |

| Samarco Mineração S/A | |

| Anglogold Ashanti Córrego Do Sítio Mineração S/A | Anglo Gold Ashanti |

| Mineração Serra Grande S/A | Anglo Gold Ashanti and Kinross |

| Rio Paracatu Mineração S/A | Kinross |

| Jacobina Mineração E Comércio Ltda | Yamana Gold |

| Mineração Maracá Indústria E Comércio S/A | |

| Mineração Caraíba S/A | N/A |

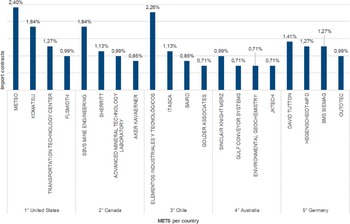

Figure 8.9 shows that the suppliers of most technology import contracts are from North America. Metso’s and Komatsu’s subsidiaries are the major suppliers from the United States of America and, as can be seen from Figure 8.9, they have been contracted by their own subsidiaries, MetsTao Brasil and Komatsu do Brasil, both acting as technology transfer intermediaries. Another two major suppliers are Chile’s Elementos Industriales y Tecnologicos and Canada’s SBVS Mine Engineering.

Figure 8.9 Leading suppliers, by country of provision of the contract (2000–15).

In view of the major role of Vale S.A. in Brazil’s mining sector, this company’s technological strategies will be the subject of a case study in the next section.

8.4 Vale S.A. Case Study

Companhia Vale do Rio Doce (CVRD) was founded in 1942, as a state-owned company (Reference ValeVale, 2012).Footnote 8 In 1974, it took the lead in iron ore exports, which it has not relinquished since. Two decades later, in 1997, CVRD was privatized and, in 2006, it made other giant step by acquiring INCO, a Canadian firm, and thus became the world’s second-largest mining company after the Anglo-Australian BHP Billiton. Vale S.A. is a now a multinational company; it is active on six continents and is one the largest iron ore producing companies in the world, as the world leader in the production of pellets. Vale produces coal, copper, fertilizers, manganese and ferroalloys. Its iron ore production flagship, Carajás deposits, in the state of Pará, is the world’s largest open-pit iron mine and produces the world’s best quality iron ore. On average, the Carajás rocks have a 67 percent iron ore content, which is considered a very high grade.

8.4.1 Science, Technology and Innovation at Vale

Like any big mining company, Vale faces major technology and innovation challenges. Producing hundreds of millions of tons of ore yearly, Vale’s operations involve complex and sophisticated logistics and increasingly advanced energy-intensive prospection, exploration and mineral-processing technologies, while minimizing environmental, health and safety impacts.

In taking up these technological challenges, Vale has established several internal R&D facilities. The first facility, the Mineral Development Center (CDM), was founded in 1965 in order to develop technological improvements to the extraction and processing of itabirito, a low-iron-content ore extracted from Minas Gerais deposits. CDM was instrumental in making the technological change through which Vale became the world’s largest iron ore exporter (Reference Mello and SepulvedaMello and Sepulveda, 2017). At the time, in a technological leap forward, Vale pioneered the use of magnetic separators that raised the productivity of itabirito (Reference ValeVale, 2012). Present-day CDM’s specialists use state-of-the-art equipment to investigate production and processing methods for different types of ores and to ensure mineral project viability. The second facility, the Ferrous Metals Technology Center (CTF) was established in 2008 to focus research on the use of iron ore and coal in steelmaking. Both CDM and CTF are located in the southeastern state of Minas Gerais.

The third facility, the Logistic Engineering Center (CEL), was established in 1997 with three units based in Espirito Santo (southeast), Maranhão (north) and Minas Gerais (southeast), respectively. Its main characteristic is its combination of lectures and practical lessons in providing port and railway technical training to employees and market professionals.

In 2009, Vale Institute of Technology (ITV) was founded under a broader science, technology and innovation (ST&I) strategy designed to take up technological challenges over the long term.Footnote 9 ITV is a major link between Vale and the scientific and technological community (Reference Mello and SepulvedaMello and Sepulveda, 2017). It is a nonprofit research and postgraduate teaching institution with two units, one in Pará and the other in Minas Gerais. We can say that the new R&D configuration has complemented those that already exist, giving the company a longer-term view of its innovation strategy. In this sense, since 2009, Vale has been more in touch with external partners, such as universities and funding agencies, which have gradually shifted the ST&I from a closed toward a more and more open innovation system.

8.4.2 Vale’s Institutional Collaboration to Foster R&D

As mentioned, ITV began to coordinate the company and ST&I community more broadly and methodically in 2009. Since 2010, Vale has entered into major partnerships with Brazilian funding agencies in order to launch calls for proposals to promote R&D projects in states in which Vale operates. State Research Foundations (FAPs) are National Science and Technology System entities attached to state governments.

Through these partnerships, Vale has expanded its portfolio of R&D partners and related research themes. From 2010 to 2018, these partnerships have involved the ST&I community in six Brazilian states, namely Minas Gerais, Pará and São Paulo (in 2010), Espírito Santo and Rio de Janeiro (in 2016) and Maranhão (in 2017).

In addition to State funding agencies, Vale has acted in coordination with federal government agencies, such as the National Council for Scientific and Technological Development (CNPq), which plays a significant role in national science and technology policy formulation (in 2009 and 2011), and the Brazilian Development Bank (BNDES) in 2012. In each agency, Vale shares financial resources with the government, thus improving the purpose and strength of the collaborative model. This was, moreover, a means by which both sides – the company and the public authority – leveraged resources from each other. Vale’s BUs are in contact with a variety of R&D institutions in order to exchange information and practices that will enable both sides to learn from each other and, consequently, devise more innovative solutions to meet technological demands. It is a virtuous circle, from which the company and the ST&I community benefit. Highlights of partnership outcomes include the project on the use of biotechnology to accelerate environmental solutions in the field and the project implemented to automate routine mining activities in order to optimize operational processes (Vale, 2017). In addition to new technologies, other important findings comprise the number of new researchers recruited under research grants. For example, under the partnership with FAPs in Minas Gerais, Pará and São Paulo, 621 research scholarships are active in 30 universities and research institutes (Vale, 2017).

8.4.3 Vale’s Intellectual Property Strategy

Vale’s IP strategy is recent and it has been extensively discussed in Reference OliveiraOliveira (2018). We now summarize and discuss some of her main findings. Before 2009, Vale did not have a structured and coordinated IP process. IP was not treated globally but piecemeal, under a restricted strategy. In fact, IP was a small, almost isolated, area involving administrative and bureaucratic activities rather than those evocative of a consistent IP strategy. During that period, Vale’s patent application practice focused on what might be termed “tooling,” encompassing small incremental technologies involving equipment and tools used in day-to-day activities. The company did not focus on technology per se, but on minor operational improvements. It can be said that documentary and administrative management was geared to protecting developments, but no strategy was in place to evaluate whether inventions were actually being used in operations or whether they could be licensed or made available to third parties. However, even though it lacked a coordinated IP strategy, Vale did acquire new knowledge and technologies from some inventions during that period, as some had been applied in operations and had generated value for the company.

In acquiring INCO and its highly renowned R&D center in 2006, Vale also acquired a substantial technological hard core, owing to INCO’s mining patents, and Vale’s portfolio increased by approximately 1,500 active processes, brands and patents. In 2010, as Vale INCO, the company began to manage the entire portfolio of Canadian patents, all of which concerned nickel operations. As a result, the IP department was obliged to implement more robust procedures.

In 2009, IP activities began to be more structured and to focus on technology rather than minor improvements.Footnote 10 This change was consistent with the new company’s ST&I position. ITV hired a specialized team, with employees who could effectively address IP issues and formulate an integrated IP strategy for the company. Strategically, Vale files patent applications primarily in Brazil. The company uses the Patent Cooperation Treaty (PCT) system, which gives access to the results of international search reports, in order to decide whether to file patent applications in other countries. Operationally, the IP Management department has structured and centralized the entire technology protection process into technology evaluation, patent search, protection and maintenance and has adopted specific forms and tools in order to coordinate the BUs’ IP activities. Vale considers that it is vital to protect technologies that are integrated into its core business. The strategy under the current model is to protect inventions that are aligned with the company’s business in Brazil and in the world, rather than simply expanding its IP portfolio without any specific focus.

8.4.4 Technology Import Contracts and Technology Transfer at Vale

Despite being part of Vale’s activities from its beginning, the technology transfer are not structured in a specific area. As can be seen from Figure 8.7, Vale registered the highest number of import contracts with INPI between 2000 and 2015, according to the Innovation Survey (PINTEC) results.

As to the other side of the technology transfer coin, Vale does not have a structured process in place to license technology developed in-house or through R&D project partnership with external institutions. In view of the importance of a culture of technology transfer and in-house or external R&D project outcomes as a means of adding value to the business, Vale’s IP Management department is planning to implement such procedures in the company (Reference OliveiraOliveira, 2018).

As Vale is the major stakeholder in Brazil’s mining sector, a trend that may augur a paradigm shift in other Brazilians mining companies, by pushing the entire sector in the same direction or even opening up new development pathways for Brazil’s mining sector.

8.5 Innovation Patterns in Brazil’s Mining Sector: Final Considerations

Despite the size and geological diversity of Brazil, mining activities are concentrated geographically and in the hands of a single company. Minas Gerais and Pará account for more than half of Brazil’s mining output, and Vale S.A. is the predominant producing company. These factors are critically important to any analysis of innovation and technology transfer in the sector, as the same pattern of concentration is mirrored in decisions on the technology agenda of Brazil’s mining sector.

In this last section, we’ll try to answer the questions that were specifically presented before. The sector seems to focus more on protecting technologies that raise productivity and lower costs, such as mining (extraction), metallurgy, processing, refining and transport technologies, rather than on a technological agenda with an emphasis on long-term solutions that will actually change the way of doing things, such as automation and environmental protection. The perceptible underlying rationale gives pride of place to innovation that focuses on short-term matters, such as operational improvements and cost reduction, in setting a technological trajectory (Reference DosiDosi, 1982).

Brazil’s mining sector should invest in prospection for new deposits (greenfield projects) and in mineral extraction technologies in order to take advantage of the country’s geology, size and diversity. In view of the role played by mining firms and METS in the technology protection agenda, it must be stressed that mining firms have not heretofore focused on the protection of exploration and mining technologies. That role has been played by nonresident METS, which have mainly protected mining technologies (extraction), while mining firms have mainly protected refining and transport technologies.

The analyzed data have shown the patterns of concentration of the few companies that are active in the mining sector in Brazil. Nonresident METS, from Japan and North America in particular, accounted for practically all applications filed for mining technology patents. The concentration pattern for mining firms shows that only one resident mining firm, Vale S.A., has patents in seven of the eight mining technology areas considered in this chapter.

We have also observed some historical collaborations among players in Brazil’s mining sector. The analyzed data showed that some mining patents applied for by resident companies from 2000 to 2015 were results of coapplications generated from partnerships with universities, which corroborates that technologies and knowledge required for mining development were in part provided through this type of relationship.

Data analysis of the use of technology import contracts in Brazil’s mining sector as a means of technology transfer has shown that non-resident METS are still the main suppliers of technology and technical assistance services to resident mining firms. Their role has been fundamental to mining technology development in Brazil. This characteristic has been corroborated by some global mining strategy studies, according to which companies, in times of crisis, choose to keep their main operations at the lowest possible cost and to focus on the operating cash flow ratio to ensure long-term profitability. Historically, the sector’s innovative capability tends to be limited to short-term solutions, which in turn contributes to companies being “followers” of existing technologies (EY, 2016). Thus, mining companies became clients of existing technologies rather than investing in long-term, more disruptive research and development to deal with future challenges. This study shows that a shift from short-term to long-term innovation investments is happening in mining firms. Vale, the biggest Brazilian mining company, started to put in place a consistent and long-term-oriented IP strategy which replaced the old uncoordinated investments mostly aimed at small and short-term technology improvements.