Introduction

Population ageing and decreasing aggregate labour force participation rates (LFPR) are worldwide challenges (Aaronson et al Reference Aaronson, Cajner, Fallick, Galbis-Reig, Smith and Wascher2014a; Aaronson et al Reference Aaronson, Fallick, Figura, Pingle and Wascher2006) with huge economic and social consequences (Aaronson et al Reference Aaronson, Hu, Seifoddini and Sullivan2014b; Bloom et al Reference Bloom, Canning and Fink2010; Jones Reference Jones2023; Maestas et al Reference Maestas, Mullen and Powell2023). In response, some forms of parametric reform like increases in the retirement age are certainly required to restore financial sustainability of pension systems. Nevertheless, such reforms have not been fully successful in all countries. Economic growth of an economy, its labour market situation, and job creation potentials are critical factors for reform success. Countries with high rates of youth unemployment in Latin America, the Middle East, and North Africa are already struggling with these problems; however, Iran is an interesting case study, to investigate the matter, for several reasons.

First, based on ILO statistics for 2019, older workers in Iran have very high exit rates from the labour market and retire earlier compared to other countries. While over the past decade, on average, the LFPR of middle-aged Iranians, 25 to 45 years old, has been above 0.7 of their global counterparts, it is declining rapidly at older ages so that for workers between 55 and 64 years, the LFPR reached half the global average. This implies that in addition to factors that may have pushed Iranian workers of all ages towards inactivity, including low growth of GDP and high unemployment due to sanctions, there are specific causes that pull older workers out of work. We hypothesise that the higher exit rate of old-aged Iranian workers is the consequence of generous pension programmes that encourage the cessation of work as an institution.

Second, while many developed countries have implemented reforms to improve the financial sustainability of their pension funds through lengthening working lives (OECD 2013 and 2019), generous policies rewarding retirement seems to be persistent in Iran. Exit from the labour force could be attributed generally to the strategic behaviour of workers, firms, and the government (Ebbinghaus Reference Ebbinghaus, Ebbinghaus and Manow2004, Reference Ebbinghaus2006). For workers, retirement benefits are a form of deferred compensation; they prefer to receive them earlier. Firms also support early retirement because it allows them to replace, at no cost, their low-productive old-age workers with youth familiar with new production technologies. They may lobby governments to lower the statutory retirement age. For example, a law to facilitate modernisation was enacted in Iran in 2003, allowing companies in the industrial and manufacturing sectors to retire employees with 25 years of service, 5 years earlier than the statutory retirement age.Footnote 1 Workers welcomed this law too, as they would get a full pension. The 2020 report of Iran’s Social Security Organization (ISSO) shows that 3.2% of all pensioners had availed themselves of this opportunity. This indicates that not only workers and firms but also governments may support early labour force exits. In terrible macroeconomic situations with record unemployment, early retirement could be a policy to provide jobs for young workers. The 2007 law on civil servants’ early retirement is another example, whereby the government could retire its workers having 25 and 20 years of service for men and women, respectively.

This has left the ISSO in financial difficulty, with an unfunded pension plan for about 52% of the total Iranian labour force. While the ISSO covered 4.2 million pensioners and 14.5 million insured contributors in 2020, according to the ILO’s (2016) demographic projections for 2050, the total number of contributors is estimated to meet 20.7 million, and pensioners are likely to reach 14.3 million (ILO 2016, 18). As a result of demographic changes, the current ratio of 4.1 contributors per pensioner in 2022 is predicted to decline dramatically to 1.45 in 2050, threatening the long-term financial sustainability of the social security scheme. On top of the long-term consequences of population ageing, the ISSO will encounter financial difficulty in the short term due to the generosity of the benefit formula and eligibility conditions. The ISSO’s benefit expenditure will soon outweigh its revenues (ILO 2016, 39), and benefits will be unaffordable without government subsidies (ILO 2016, 21).

Third, the ISSO’s insistence on generous policies implies that pension funds are prone to experience financial bankruptcy even in societies with open demographic windows. Iran, with only 7.37% of the population aged over 65 years, is still young and has the potential to reap the demographic dividend through an increase in the labour force. Fourth, this is while there are limited available resources for investment and job creation in Iran. The lump-sum labour fallacy may in fact be true for Iran as an economy under severe economic sanctions (Khandan Reference Khandan2024). These all make Iran a fascinating country for studying unsustainable pension schemes in developing countries with young populations. The literature is primarily focused on retirement reforms in developed-aged population nations, while studies on pension policies in developing countries are relatively rare. This study is one of the few that empirically evaluates the consequences of generous pension policies in a young populated developing country and, hence, would have practical implications for establishing a sustainable pension plan in developing countries.

We use a unique individual dataset incorporating the pre- and post-retirement profiles of 267, 000 newly-retiredFootnote 2 ISSO employees in 2016 and 2018. Then, a counterfactual scenario of 2018’s new retirees is constructed for 2016. This diversifies our 2016 sample to include both non-retirees and retirees, making it suitable to analyse retirement decisions. In line with the literature, the implicit tax on work continuation is computed for the whole sample and, finally, to find the drivers of retirement age, the Heckman two-step model is applied to control the sample selection bias. The findings show that the ISSO’s generous policies encourage early retirement and reforms are necessary to maintain ISSO’s sustainability.

The paper is structured as follows. “Literature review” section reviews the related studies on early retirement and summarises their findings in estimating the implicit tax on work continuation and explaining the determinants of early retirement. “The ISSO’s pension policies” section introduces the ISSO and describes its policies. It also explains our method for estimating the implicit tax. “Data and methodology” and “Econometric results” sections, respectively, present the estimation methodology and variables of interest. “Conclusion” section is also given.

Literature review//

A trend towards earlier labour market exit can be observed worldwide, which is generally the result of the strategic action of workers, firms, and the government. Generous pension systems disincentivise individuals to continue working and ‘pull’ them out of the labour force. Firms also ‘pushing’ old workers out of the labour market can externalise restructuring costs on to state and public pension plans. This study restricts itself to protection-oriented factors that pull workers out of the labour market.

Incentives for retirement can be investigated by the analysis of long-term choices between work and leisure in life cycle models. Lazear (Reference Lazear, Ashenfelter and Layard1986), while highlighting deficiencies in these models as time and leisure values depend on the worker’s age, argues that the decision to retire is not solely a function of pension or wage amount but also of age-earning profile. A steeper earnings path rewards work in later years relatively more and, thus, induces people to retire later. In this regard, Gruber and Wise (Reference Gruber, Wise, Gruber and Wise1999) focused on the pattern of benefit accruals to quantify pension plan provisions’ incentive effects. Considering the present value of entitled pension benefits as a person’s pension wealth, the retirement decision depends on how this wealth will change with continued work. They considered the ratio of the pension wealth increase, by one year more of work with respect to net wage, as an implicit tax if negative or an implicit subsidy if positive. These calculations enabled them to compare the incentive effect of pension provisions between countries. Their ‘analysis revealed a strong correspondence across countries between social security program incentives to retire early and the proportion of older persons that have left the labour force. The weight of evidence suggested that this relationship was largely causal’ (Gruber and Wise Reference Gruber, Wise, Gruber and Wise2004, 2). Then, using micro-data, Gruber and Wise (Reference Gruber, Wise, Gruber and Wise2004) studied the effect of the implicit tax to work, both in a single-year accrual form and an option value approach considering the entire future path of accruals. Their findings from cross-country analysis shows that the effect of implicit tax as an incentive measure is significantly negative as expected.

Generally, several points must be considered when assessing the effect of the implicit tax. An additional year of work means forgoing the benefits for a later time, receiving them for one less year. Furthermore, increasing age with additional work years raises the odds of dying before collecting any benefits. Moreover, retirees no longer pay any contribution and are even exempted from taxes in some countries, as in Iran. These all make the implicit tax on work continuation negative and provide enough incentive for retirement. On the other hand, postponing retirement would be rewarded usually in pension systems with an actuarial adjustment factor or a higher accrual rate. Additional years of work may also be optimal with the expectation of higher future wages. Since benefits are calculated based on working years’ incomes, this may increase pension benefits and accrual wealth. And finally, if pensions are not yet fully vested, individuals are also incentivised to work to be entitled to a minimum or full pension.

As it is inclusive, implicit tax is at the centre of protection-oriented studies on retirement and their policy recommendations. Duval (Reference Duval2004) estimated the implicit tax on five years of additional work for OECD countries and found it increasing with age; 5% at age 55 years and 30% at ages 60 and 65 years, on average across OECD countries. According to Duval (Reference Duval2004), the implicit taxes in OECD countries rose during the 1970s and 1980s, stabilising from the early 1990s. In a panel data econometric analysis, he found that ‘On average, a 10% points decline in the implicit tax rate reduces the fall in participation rates between two consecutive (five-year) age groups of older workers by about 1.5% points’ (Duval Reference Duval2004, 35). Butrica et al (Reference Butrica, Johnson, Smith and Steuerle2006) estimated the implicit tax rate for a typical man in the United States increasing with age from 14% at age 55 years to nearly 50% at age 70 years. De Preter et al (Reference De Preter, Van Looy and Mortelmans2013) found that ‘financial incentives such as a high implicit tax on continued work and high expenditures on early exit schemes make retirement attractive, whereas the institutional push context is of lesser importance’ (De Preter et al Reference De Preter, Van Looy and Mortelmans2013, 6). They estimated the implicit tax on continued work for the 55–60 age group from 5.44% in the Netherlands to 101.9% in Greece. Their panel data results show that a high implicit tax makes retirement (odds ratios) 1.05 times more likely. Manoli and Weber (Reference Manoli and Weber2016) used administrative data on the census of private sector employees in Austria and non-parametric procedures to estimate labour supply elasticities. Their estimated labour supply elasticities concerning implicit tax rates range from 0.05 to 0.13, 0.08 to 0.21, and 0.16 to 0.38 at monthly, quarterly, and annual frequencies. De Breij et al’s (Reference De Breij, Huisman and Deeg2019) study of 14 OECD countries shows that a higher implicit tax on continued work was associated with a higher risk of early work exit in both men and women but only for lower-educated workers.

Other studies evaluated the impact of pension reforms on the incentives of the labour force to work. The old-age labour supply has been estimated by Colombino et al (Reference Colombino, Hernaes, Locatelli and Strom2011) in response to the impact of flexible pension take-up with actuarial adjustment in Norway. They illustrate that the reform will decrease the number of retirees. Using the Dutch Income Panel 1989–2000, Euvals et al (Reference Euvals, Van Vurren and Wolthoff2010) assessed the 1990s pension reform that made early retirement less rewarding and confirmed that it has successfully encouraged workers to delay retirement. They found that lower implicit taxes’ wealth and substitution effects are significant. Coile (Reference Coile2018) found that in the United States, the implicit tax on work after the age of 65 years dropped by about 15% points due to social security reforms and a shift from DB (defined benefits) to DC (defined contribution). He addressed this as suggestive evidence that the evolution of retirement incentives had contributed to the rise of older workers’ employment rates. Börsch-Supan et al (Reference Börsch-Supan, Rausch and Goll2020) calculated the implicit tax on work from 1980 to 2015 before and after sequential reforms in Germany. Based on their calculation, with the introduction of the actuarial deductions, implicit taxes that were higher during the early retirement window than the preceding claiming ages are declined, for example, by more than 25% points for the age 60 years to the age group 55 years. They indicated that the increase in both men’s and women’s employment rates coincided with a reduction in the early retirement incentives. Börsch-Supan and Coile (Reference Börsch-Supan, Coile, Börsch-Supan and Coile2020) explored how financial incentives to work at older ages have evolved since 1980, across after pension reforms a dozen developed countries. They observed that the average implicit tax, in investigated countries, had reduced substantially from 35% for men and 50% for women in the late 1980s to around 20 and 15%, respectively, in 2015. Examining the effect of these changes in implicit tax on old-age employment, their regression results revealed a negative relationship in half the countries under study and a strong negative effect of implicit tax on the age 60–64 years employment rate for pooled-data regression. Soosaar et al (Reference Soosaar, Puur and Leppik2021) show that raising the statutory age of retirement in Estonia has increased the normal retirement age from 58 to 61.5 years and the early retirement age from 56 to 59.5 years during 2001 to 2011. Giesecke (Reference Giesecke2018), Goda et al (Reference Goda, Shoven and Slavov2018), Cosic and Johnson (Reference Cosic, Johnson, Czaja, Sharit and James2020), and many other studies have also confirmed the effect of implicit tax on work on retirement behaviour.

The central emphasis on implicit tax is because it incorporates many factors that are expected to be influential; nonetheless, other features of pension provisions and their effects on retirement behaviour are also studied in the literature. Lazear (Reference Lazear, Ashenfelter and Layard1986), in a theoretical model, tries to explain individuals’ retirement decision based on the type of pension. DC pensions would not alter individuals’ retirement decisions because the market permanently restricts the sum of wage and pension entitlements that workers can obtain. For DB pensions, on the other hand, the trade-off between pre- and post-retirement wages is not explicit because workers can increase their pension by working for another year. His theoretical model shows that there would be a form of cross-subsidisation for pensions that do not vest immediately; it lengthens the tenure of retired individuals but shortens the tenure of labour market leavers. Xu and Wang (Reference Xu and Wang2018) confirm the point that DB pension systems discourage people from working after the normal retirement age, while individual accounts could offer much more incentive to work longer. They also show that higher returns on DC systems, higher wage growth rates, lower discount rates, and lower pension indexation encourage people to work longer.

Another critical point highlighted in the literature is the various alternative pathways that ‘firms and workers have thus often used … as a bridge to other pre-retirement programs’ (Ebbinghaus Reference Ebbinghaus2006, 136). Health impairments and unemployment are also known in the literature as major individual push factors towards inactivity (Benavides et al Reference Benavides, Duran, Gimeno, Vanroelen and Martínez2015; Hanel Reference Hanel2012; Knardahl et al Reference Knardahl, Johannessen, Sterud, Härmä, Rugulies, Seitsamo and Borg2017; Milligan and Schirle Reference Milligan and Schirle2019; Morrill and Westall Reference Morrill and Westall2019). Neglect of these vital push factors and alternative pathways may lead to an incomplete picture of early retirement and, therefore, they should at least be controlled. The age is another factor that is influential on retirement and must be controlled (Lund and Villadsen Reference Lund and Villadsen2005). Gruber and Wise (Reference Gruber, Wise, Gruber and Wise2004) incorporating particular age dummy indicators studied the effect of age on retirement in a linear and non-linear model. A non-linear relationship is reasonable because, as it was highlighted in Lazear (Reference Lazear, Ashenfelter and Layard1986)’s theoretical model, preferences for leisure and the value of time may change with age.

The ISSO’s pension policies

The ISSO, administering the most extensive pension plan in Iran, is a non-governmental public fund providing varieties of short (maternity, sickness, employment injury and funeral grant) and long-term (old-age, partial and total permanent disability, and survivorship) benefits alongside health and unemployment insurance. Despite Iran’s current low dependency ratioFootnote 3 of 9.5%, showing that ageing although certain and severeFootnote 4 would be a challenge for the future, experts predict a ‘difficult financial situation [for] benefits administered by the ISSO … [mainly because] the benefit formula and eligibility conditions are generous’ (ILO 2016, 39).

The cross-age comparison of Iran and the world LFPRs in Figure 1 raises the hypothesis that ISSO’s generous policies have driven older workers’ motivation to retire before the statutory retirement age. Iran generally has lower LFPRs that represent some structural drivers, for example, low growth of GDP and high unemployment due to sanctions, gender discrimination, and cultural barriers for females to participate in economic activities. However, the central message of Figure 1 is the widening gap in LFPR between Iran and the rest of the world as the workforce’s age increases. The LFPR ratio, Iran to the World, is above 0.7 for the 25–44 age cohort and dramatically decreases to 0.5 for older workforces aged over 60 years. This contrast reflects the role of ISSO’s generous pension policies that would be introduced in the following parts.

Figure 1. The average 2010–2019 LFPR of Iran and the World by age cohorts. Source: ILO modelled estimates, Nov 2020.

Retirement age

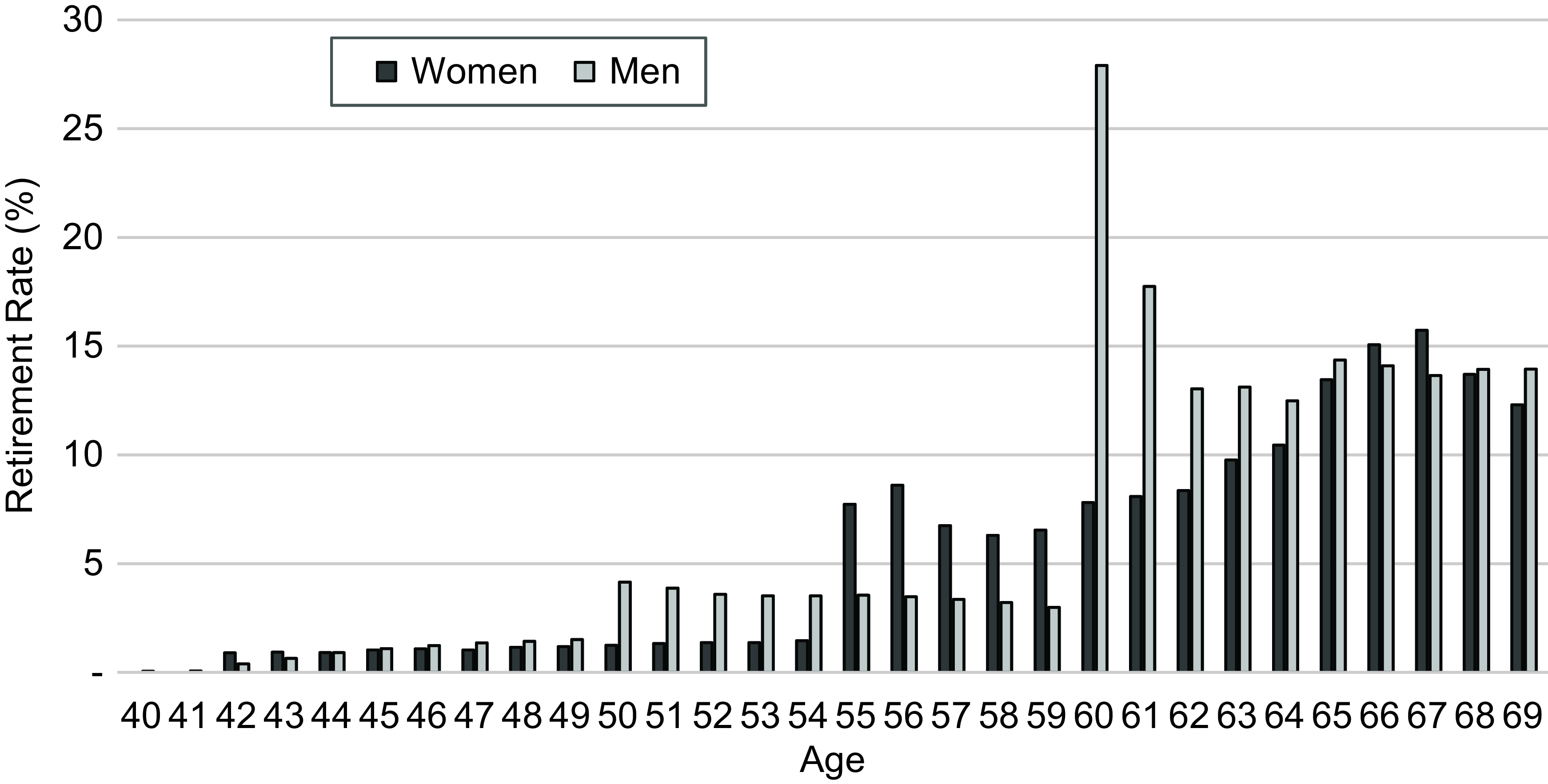

As a general rule, henceforth ret_rule1, ISSO’s contributors with 35 years of service are allowed to be retired at any age without restriction. In addition, there are other rules that make retirement more accessible. Figure 2 illustrates the retirement rates of ISSO’s contributors by gender at different ages. The noticeable point is the jumps at the ages 55 years for women and 60 years for men which reflect two of the lowest statutory retirement ages in the world that permit Iranian female and male workers to retire at ages 55 and 60 years, respectively. We named this rule as ret_rule2, hereafter. The third rule, ret_rule3, allows females and males with 30 years of contribution record to retire, respectively, at ages 45 and 50 years. This rule is manifest in Figure 2 with a rather smaller jump in retirement rates for men. The fourth rule brings retirement for women even earlier. Based on ret_rule4, women aged 42 with 20 years of contribution record have the option to retire with the minimum pension. It explains the tiny jump in female retirement rates at age 42 years in Figure 2. Nevertheless, the rules are always more lenient for hazardous jobs. The leverage of 1.5 applying to the years of service in hazardous jobsFootnote 5 based on the article 76 of the Iran Social Security Law (ISSL) pulls some of these workers to retire even earlier.

Figure 2. The retirement rate of ISSO’s contributors by age. Source: ILO (2016, 35).

Intuitively, the trend of retirement rates depicted in Figure 2 can explain Figure 1’s accelerating decline in LFPR for older labourers, implying that low statutory retirement age can institutionalise and cause early exit from the labour force.

Retirement pension

In all aforementioned cases, retirees receive a DB pension equal to 3.33% of their reference wage, the average earnings of the last two years of work, per year of service. Full-career workers with 30 years of service or less in case of hazardous jobs are entitled to a pension replacement rate of 100%. Considering the retirees’ tax exemption, the net replacement of pensions increases to more generous higher rates, making retirement even more rewarding.

Eligibility rules

Two other points influential on retirement decision are, first, the minimum years of contribution to be entitled to a pension and, second, the minimum pension itself. In Iran, under the ‘TAEEN-TAKLIF Law’, henceforth ret_rule5, the minimum number of years of contribution to be eligible for a pension is 10 for men and women of age 60 and 55 years, respectively. In case of lower years of service, workers at the time of retirement are allowed to purchase the lack of credit. Retirees will receive a fraction of their working reference wage, in proportion to their years of service, while a minimum pension equal to the minimum wage is guaranteed only to those with at least 20 years of contribution, according to Article 111 of ISSL.

Contribution rates

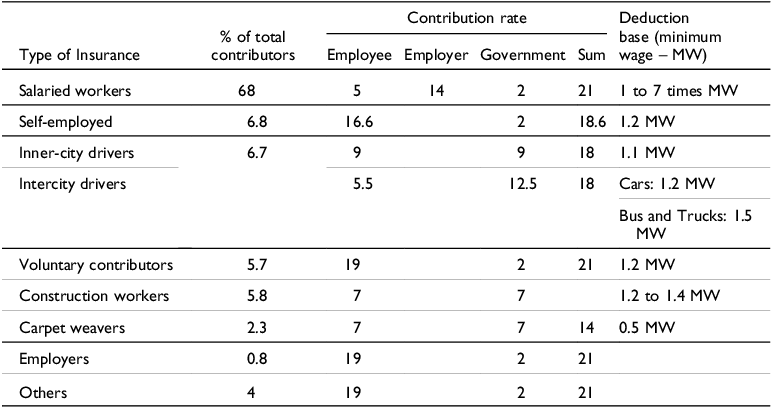

The contribution to ISSO consists of three parts, respectively, paid by employees, employers, and the government. For salaried employees which constitute about 68% of contributors, the total contribution rate for long-term benefitsFootnote 6 is 21%; 5, 14, and 2% paid respectively by employee, employer, and the government. The self-employed, constituting 6.8% of contributors, pay a contribution of 16.6% on average.Footnote 7 There are several other classes of contributors with no employer, depicted in Table 1, where the employee, alone or mutually with the government, pays the whole contribution. In some cases, especially for low-income workers, the government pays higher shares as a subsidy. The higher the paid contribution, the higher the motivation to exit from work. However, subsidising the contribution rates is likely to encourage work continuation and, thus, the impact of the contribution rate on the retirement decisions of low-income workers is not clear.

Table 1. The composition of contribution rates for ISSO’s contributors

Source: Iran Social Security Law.

Implicit tax on work continuation

To quantify the pension provisions’ incentive effects, we shall focus on the pattern of benefit accruals and the change in pension wealth with work continuation. Following Börsch-Suspan (Reference Börsch-Suspan2000) and Gruber and Wise (Reference Gruber, Wise, Gruber and Wise1999) in calculation, the pension wealth of a worker aged S eligible for retirement is equal to equation 1:

where PW(S) stands for pension wealth in case of retirement at the current age, S. It is the sum of discounted received pensions PEN(S)

t

throughout retirement; a defined pension based on years of experience at the age of retirement, S. Annual pensions are discounted by the time preference discount factor

![]() $\sigma $

and the term

$\sigma $

and the term

![]() $\alpha {\left( S\right)_t}$

which is the probability of survival at age t given survival until age S. A particular worker, however, may decide not to retire and work for an additional year which, in this case, will change pension wealth in several ways:

$\alpha {\left( S\right)_t}$

which is the probability of survival at age t given survival until age S. A particular worker, however, may decide not to retire and work for an additional year which, in this case, will change pension wealth in several ways:

-

1. The pension will increase due to the wage accrual of one more year of service.

-

2. The pension would be received when one year older with a lower probability of survival during retirement.

-

3. Social security contributions will need to be paid for another year.

Equation 2 illustrates the pension wealth of a worker aged S in the case of working for an additional year with retirement at age S+1:

where c is the contribution rate and W(S) represents the worker’s wage as the contribution base. The pension accrual (

![]() $PW\left( {S + 1} \right) - PW\left( S\right))$

is the difference between the pension wealth of retiring today and the pension wealth of retiring next year. In equation 3, the implicit tax on continued work is defined as the percentage change in pension wealth multiplied by negative one. A positive implicit tax means that work continuation is not economical, and the workers would lose as their pension wealth decreases. On the other hand, a negative implicit tax represents a work subsidy that makes work continuation valuable. The negative implicit tax happens when workers can increase their pension wealth by continuing to work:

$PW\left( {S + 1} \right) - PW\left( S\right))$

is the difference between the pension wealth of retiring today and the pension wealth of retiring next year. In equation 3, the implicit tax on continued work is defined as the percentage change in pension wealth multiplied by negative one. A positive implicit tax means that work continuation is not economical, and the workers would lose as their pension wealth decreases. On the other hand, a negative implicit tax represents a work subsidy that makes work continuation valuable. The negative implicit tax happens when workers can increase their pension wealth by continuing to work:

The implicit tax on work continuation summarises all the essential points related to individuals’ incentives for retirement. To calculate the implicit tax for the case of Iran, some necessary assumptions are made as follows: first, it is assumed that pensions are indexed completely to inflation and, hence, the PEN(S) represents the real guaranteed pensions. We also assume that no real growth occurs in wages. In fact, it represents the current situation of Iran’s economy, which has experienced zero real GDP growth on average over the last decade due to sanctions. Therefore, the pension PEN(S+1) increases only by the accrual of one more year of service, as the defined pension formula shows in equation 4. The reference wage, the average wage of the last two years of work, is fixed because of no real growth in wages. The accrual rate in Iran is 3.33% which applies with the maximum of 35 years of service:

We also assume the time preference discount factor

![]() $\sigma = 0.95$

. The probability of survival at age t given survival age S,

$\sigma = 0.95$

. The probability of survival at age t given survival age S,

![]() $\alpha {\left( S\right)_t}$

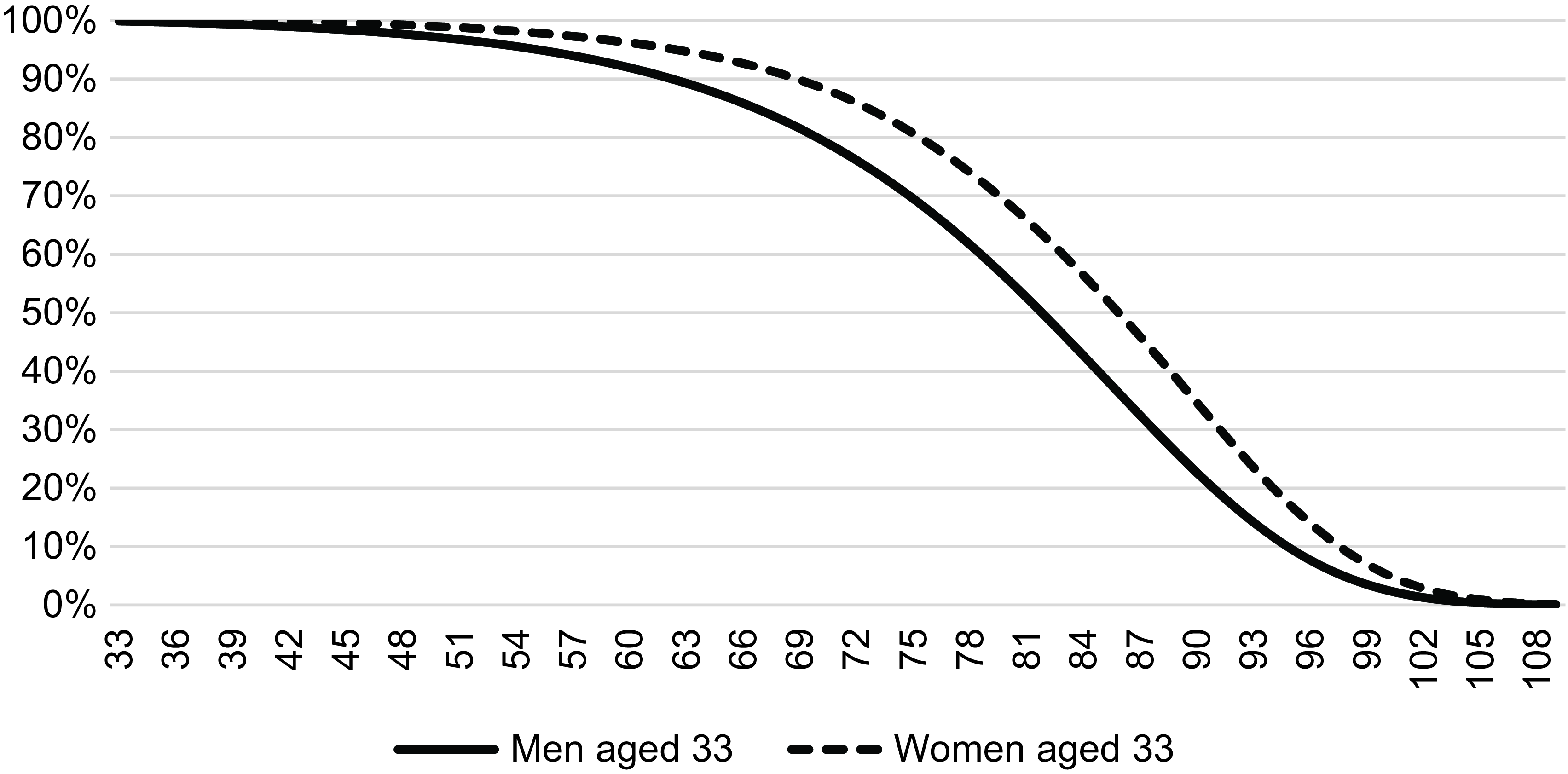

, is calculated based on the actuarial life table of the insured population of ISSO estimated by Eghbalzadeh and Hassanzadeh (Reference Eghbalzadeh and Hassanzadeh2018). As an example, Figure 3 illustrates the probability of survival at age t given survival until age S = 33 for men and women.

$\alpha {\left( S\right)_t}$

, is calculated based on the actuarial life table of the insured population of ISSO estimated by Eghbalzadeh and Hassanzadeh (Reference Eghbalzadeh and Hassanzadeh2018). As an example, Figure 3 illustrates the probability of survival at age t given survival until age S = 33 for men and women.

Figure 3. The probability of survival at age t given survival until age S = 33 for ISSOs’ insured.

Using data on the entitled pension, years of experience, the average wage of the last two years of work and stated assumptions about time preference discount rate and the zero real wage growth; the pension wealth at retirement or its change after an additional year of work is computed for every individual in our sample. The estimated implicit tax rates are illustrated in Figure 4 for men and women of different ages. The minimum implicit tax is −2.61, and the maximum is 14.90%. The implicit tax on work continuation increases by age because older workers have a shorter perspective for survival and pensions receipt. The implicit tax is also higher for men than women because of men’s shorter expected life.

Figure 4. Implicit tax on work continuation for men and women of different ages.

Data and methodology

Data

Our primary research questions are to know if Iran’s generous social security policies are the drivers of labour force inactivity. To address this question, we utilised the individual data of newly retired individuals from ISSO for the years 2016 and 2018. It is important to note that ISSO does not publicly release the individual data of pensioners and contributors. They only publish annual reports that provide a general overview of contributors and pensioners, including statistics on age, years of service, and gender distributions. This dataset is exceptional as it encompasses the entire population of retired persons, approximately 115,000 and 152,000 in the respective years. The dataset includes key characteristics of the retirees, such as gender, retirement age, years of experience, wage profiles during the final pre-retirement years, contribution rates, job types (whether hazardous or not), and the defined pension received upon retirement.

To address the effects of pension policies on retirement decision, it is crucial to incorporate both retirees and eligible non-retirees, simultaneously. However, our dataset includes solely the individuals who have chosen to retire in 2016 and 2018 and does not cover their retirement-eligible counterparts who intend to keep working. Applying the retirement rules outlined in part 3 and general statistics from ISSO’s 2016 contributors report, the ISSO had 759,000 eligible contributors within its portfolio in 2016. As reported in Figure 5, this population can be categorised into three distinct groups based on their retirement timing:

-

• The first group, comprising 19% of the population, consists of early birds who exited the labour market swiftly. These contributors retired shortly after the observed year, specifically in the subsequent year, which is 2017.

-

• The second group, accounting for 20% of the eligible population, made the decision to retire in 2018.

-

• The third group, comprising 61% of the eligible population, consists of latecomers to retirement. These individuals remained non-retired until 2018.

From this population, it is important to note that we only have access to the profiles of individuals in the second group specifically for the year 2018, after they have already retired. So, our strategy to cope with this data limitation is to consider a counterfactual scenario by bringing 2018’s pensioners’ profiles two years backward into 2016 when they were still working. This way, we can create a pool of retired and eligible non-retired individuals contributing in 2016.

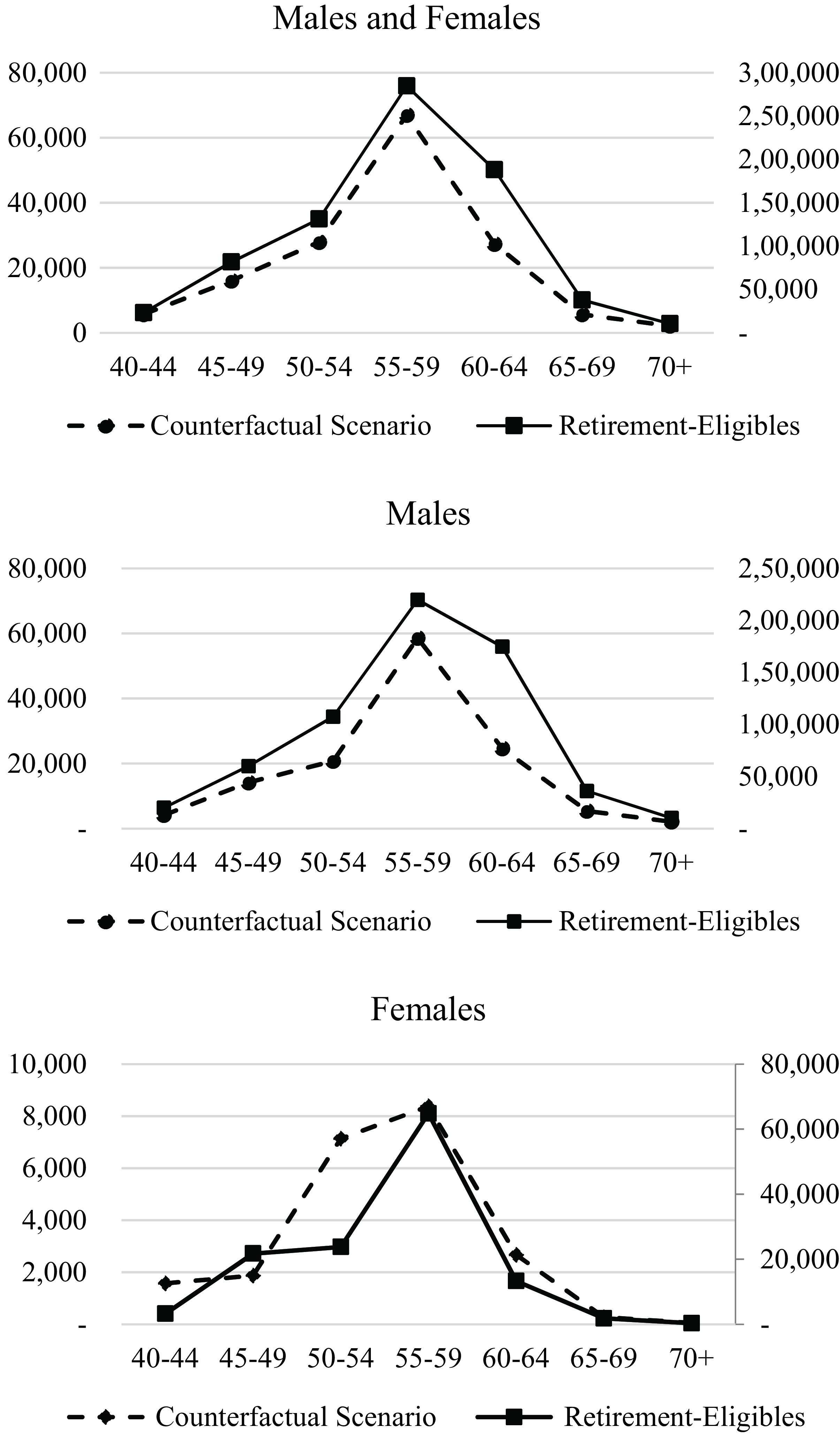

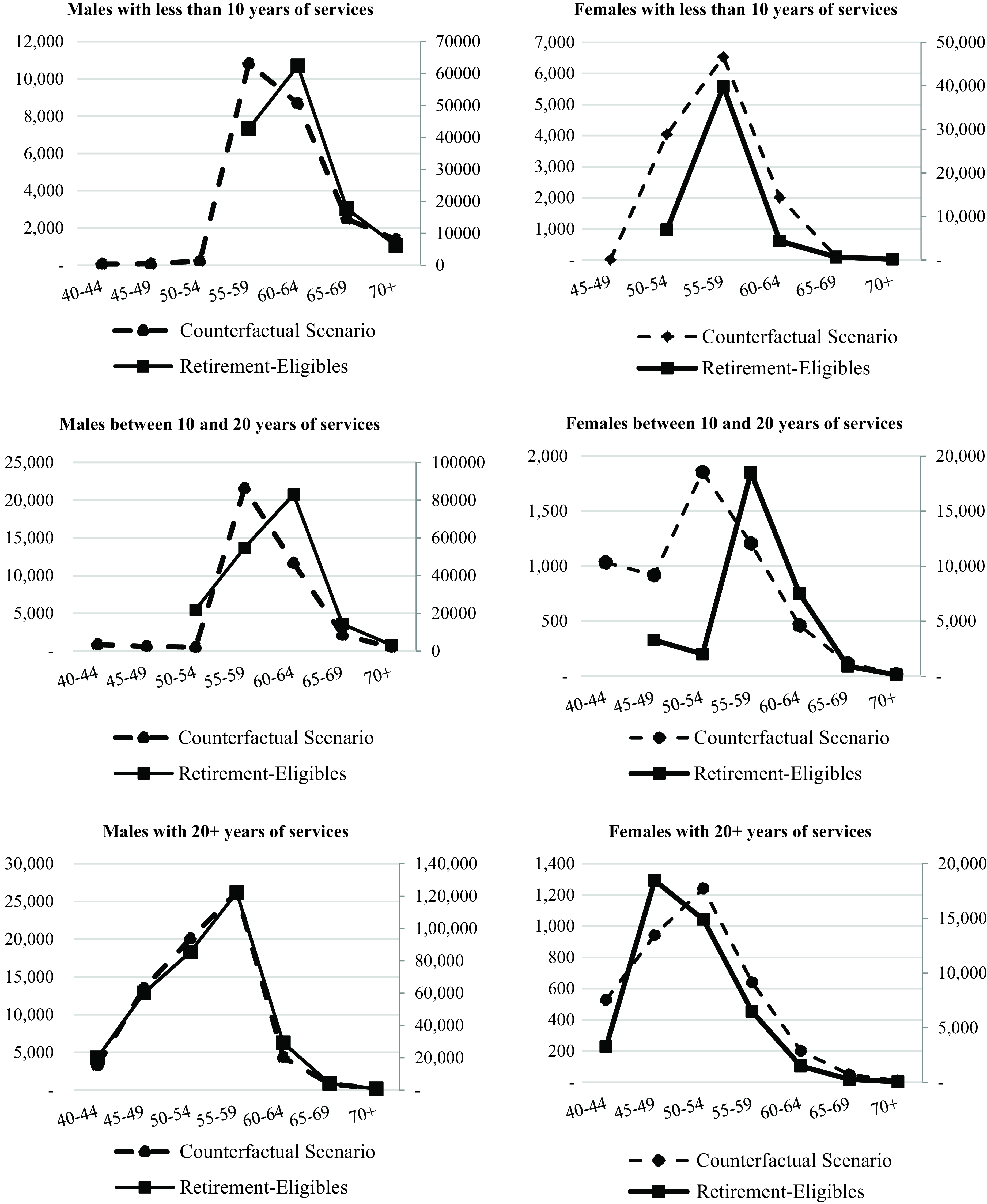

To ensure that the counterfactual data accurately represent the entire eligible population, the following sets of figures compare it with total eligible population we simulated. Figure 6 visualises the age patterns of total eligible non-retirees compared to the counterfactual data (for males, females, and as a total). Figure 7 provides more detailed comparisons based on service years, and Figure 8 offers even more detailed comparisons for males and females based on service years.

Figure 6. The age distributions of retirement-eligible contributors and the counterfactual scenario.

Figure 7. The age distributions of retirement-eligible contributors and the counterfactual scenario based on years of service.

Figure 8. The age distributions of males’ and females’ retirement-eligible contributors and the counterfactual scenario based on years of service.

As depicted in Figures 6–8, the counterfactual data exhibit similar age distributions to the entire retiree eligible population, and this similarity persists when comparing age distributions within subgroups of employees based on their years of service. Additionally, the age-experience patterns remain similar within both the male and female populations.

Methodology

We empirically analyse the association between the ISSO’s pension policies and incentives for early retirement reflected by the retirement age. Equation 5 represents this association where

![]() ${y_i}$

stands for retirement age and

${y_i}$

stands for retirement age and

![]() ${x_i}\;$

incorporates independent variables including different pension policy instruments, and

${x_i}\;$

incorporates independent variables including different pension policy instruments, and

![]() ${\varepsilon _i}$

is a normally distributed error term:

${\varepsilon _i}$

is a normally distributed error term:

However, note that estimation of equation 5 using ordinary least squares estimators will be biased and inconsistent. When we pool the counterfactual data (i.e., individuals who were not retired in 2016) together with retirees in 2016, the dependent variable for the former group does not exist. In fact, for individuals in the counterfactual dataset, we do not have any retirement age since these individuals were working in 2016. So, we face a problem often called incidental truncation (Wooldridge Reference Wooldridge2013). To tackle this problem, we use Heckman’s two-step estimation, including a retirement selection regression and retirement age regression. Equation 6 demonstrates the retirement selection regression that reflects the labour forces’ self-selection towards retirement:

where

![]() ${d_i}$

is a dichotomous variable that takes the value of 1 if the contributor i intends to exit the labour force and takes 0 otherwise,

${d_i}$

is a dichotomous variable that takes the value of 1 if the contributor i intends to exit the labour force and takes 0 otherwise,

![]() ${z_i}$

is a set of factors that influence the retirement decision, and

${z_i}$

is a set of factors that influence the retirement decision, and

![]() ${u_i}$

is the error term that incorporates the unmeasured drivers of retirement decisions. In practice,

${u_i}$

is the error term that incorporates the unmeasured drivers of retirement decisions. In practice,

![]() ${\varepsilon _i}$

and

${\varepsilon _i}$

and

![]() ${u_i}$

are correlated since individuals’ retirement decisions and their retirement ages have roots in some common unmeasured factors. As Heckman (Reference Heckman1979) has shown, in the case of dependence between

${u_i}$

are correlated since individuals’ retirement decisions and their retirement ages have roots in some common unmeasured factors. As Heckman (Reference Heckman1979) has shown, in the case of dependence between

![]() ${\varepsilon _i}$

and

${\varepsilon _i}$

and

![]() ${u_i}$

, the conditional expectation of

${u_i}$

, the conditional expectation of

![]() ${\varepsilon _i}$

will be non-zero, and consequently, the estimated parameters in the selected sample regression will be dependent concurrently on

${\varepsilon _i}$

will be non-zero, and consequently, the estimated parameters in the selected sample regression will be dependent concurrently on

![]() ${x_i}$

and

${x_i}$

and

![]() ${z_i}$

:Footnote

8

${z_i}$

:Footnote

8

Using equation (5) for a non-random sample would ignore the sample selection rule reflected in the final term of equation (7) and leads to biased estimators often arising in the case of omitted variables (Greene Reference Greene2018 and Heckman Reference Heckman1979). According to Heckman (Reference Heckman1979), the omitted term mentioned above should augment the response regression explaining retirement age. With the jointly normal distributed error terms, we have

In this equation,

![]() $\lambda \left( {{z_i}\gamma } \right) = $

$\lambda \left( {{z_i}\gamma } \right) = $

![]() ${{\phi \left( {{z_i}\gamma } \right)} \over {\Phi \left( {{z_i}\gamma } \right)}}$

is the inverse mills ratio where

${{\phi \left( {{z_i}\gamma } \right)} \over {\Phi \left( {{z_i}\gamma } \right)}}$

is the inverse mills ratio where

![]() $\phi \left( {{z_i}\gamma } \right)$

and

$\phi \left( {{z_i}\gamma } \right)$

and

![]() ${\rm{\Phi }}\left( {{z_i}\gamma } \right)$

are, respectively, the probability and cumulative normal distribution functions of

${\rm{\Phi }}\left( {{z_i}\gamma } \right)$

are, respectively, the probability and cumulative normal distribution functions of

![]() ${z_i}\gamma $

. The estimation of equation (8) is based on a two-step process. The first step is a probit regression of retirement decision to estimate

${z_i}\gamma $

. The estimation of equation (8) is based on a two-step process. The first step is a probit regression of retirement decision to estimate

![]() ${z_i}\gamma $

and compute

${z_i}\gamma $

and compute

![]() $\lambda \left( {{z_i}\gamma } \right)$

. The second step is a retirement age regression on its determinants

$\lambda \left( {{z_i}\gamma } \right)$

. The second step is a retirement age regression on its determinants

![]() ${x_i}$

while controlling

${x_i}$

while controlling

![]() $\lambda \left( {{z_i}\gamma } \right)$

.

$\lambda \left( {{z_i}\gamma } \right)$

.

Variables and summary statistics

The vector

![]() ${z_i}$

covers variables that pull people out of work. It includes gender, the most common rules regarding retirement eligibility, working in hazardous jobs, the provincial unemployment rate, and implicit tax that represents an individual’s life cycle decision-making. On the other hand, the variables embedded in

${z_i}$

covers variables that pull people out of work. It includes gender, the most common rules regarding retirement eligibility, working in hazardous jobs, the provincial unemployment rate, and implicit tax that represents an individual’s life cycle decision-making. On the other hand, the variables embedded in

![]() ${x_i}\;$

explain the age of work exit. So,

${x_i}\;$

explain the age of work exit. So,

![]() ${x_i}$

comprises gender, the annual contribution to be paid, the number of exemption years due to serving in hazardous jobs relative to the years of service, and the eligibility for retirement at 10 or 20 years of service with less than the full pension. The implicit tax on work continuation should be included in

${x_i}$

comprises gender, the annual contribution to be paid, the number of exemption years due to serving in hazardous jobs relative to the years of service, and the eligibility for retirement at 10 or 20 years of service with less than the full pension. The implicit tax on work continuation should be included in

![]() ${x_i}$

; however, doing so would lead to the endogeneity problem as it makes

${x_i}$

; however, doing so would lead to the endogeneity problem as it makes

![]() ${x_i}$

and

${x_i}$

and

![]() ${\varepsilon _i}$

correlated. The implicit tax, by definition, is strongly correlated with age. Retirement age is also explicitly associated with age. Thus, as an omitted variable hidden in

${\varepsilon _i}$

correlated. The implicit tax, by definition, is strongly correlated with age. Retirement age is also explicitly associated with age. Thus, as an omitted variable hidden in

![]() ${\varepsilon _i}$

, employees’ age makes

${\varepsilon _i}$

, employees’ age makes

![]() ${x_i}$

and

${x_i}$

and

![]() ${\varepsilon _i}$

associated and results in biased estimators. To deal with the endogeneity problem, we use an instrumental variable. The replacement rate is the most relevant variable to be alternated with implicit tax as it reflects employees’ trade-off between current and future incomes and simultaneously is not correlated with age. Table 2 introduces variables in the selection or response equations. Table 3 is devoted to the summary statistics of the variables.

${\varepsilon _i}$

associated and results in biased estimators. To deal with the endogeneity problem, we use an instrumental variable. The replacement rate is the most relevant variable to be alternated with implicit tax as it reflects employees’ trade-off between current and future incomes and simultaneously is not correlated with age. Table 2 introduces variables in the selection or response equations. Table 3 is devoted to the summary statistics of the variables.

Table 2. The variables’ description

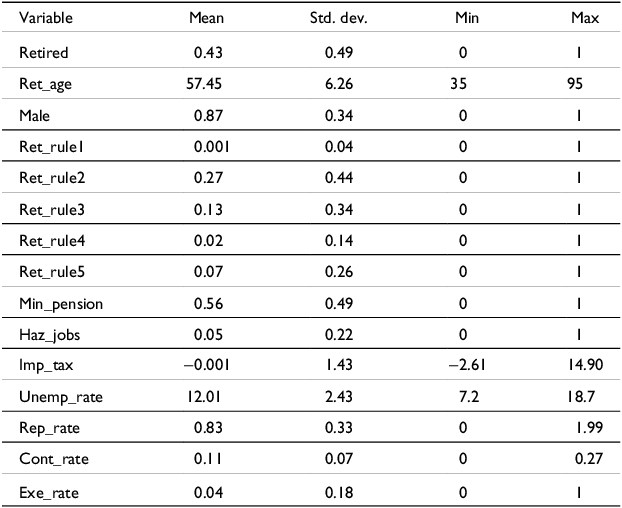

Table 3. The variables’ descriptive statistics

As Table 3 shows, 43% of individuals in the sample were retired with an average retirement age of 57.5 years, while the data on retirement age are truncated for the remaining 57% of the sample. Of the entire sample, 87% were men, and 5% were employed in hazardous jobs with an exemption rate of up to 100% of their length of service. Table 3 illustrates the generosity of ISSO when only 0.1% of contributors have extended their years of service to 35 years, required for ret_rule1. While 27% and 13% of individuals, respectively, are retired according to more lenient requirements of ret_rule2 and ret_rule3. Retirement rules ret_rule4 and ret_rule5 with more permissive requirements are used, respectively, by 2% and 7% of the sample. Of employees in the sample, 56% had the option to legally retire with 20 years of service in exchange for a minimum pension. While sample retirees have been paid on average 83% per cent of their reference wages as a pension, the replacement rate can be much higher for retirees who earn low wages in their final years of service for reasons such as temporary unemployment.

Econometric results

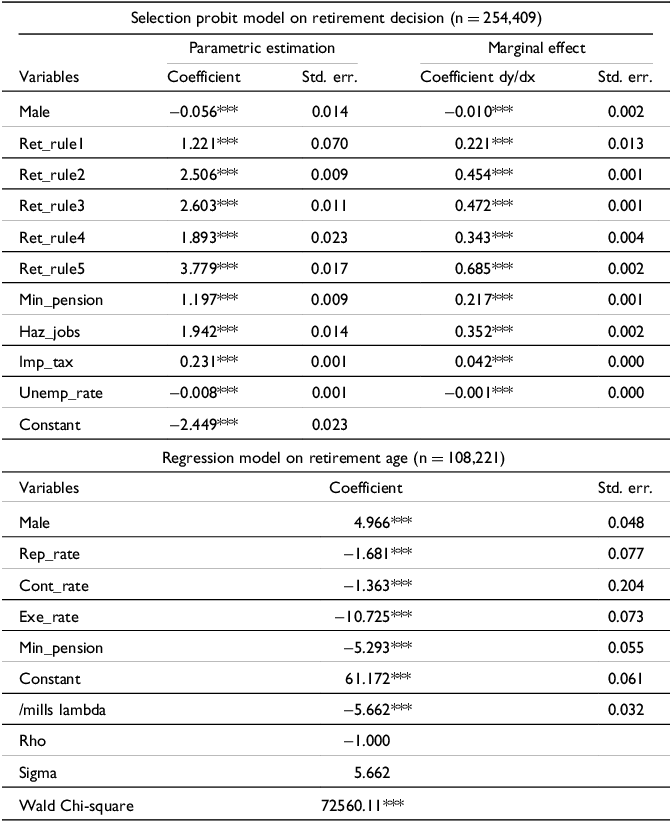

The estimation results of the Heckman two-step selection model are shown in Table 4. The selection probit model of the first step explains the determinants of retirement decision, while the second equation explicates the retirement age. All the variables are statistically significant at 1% with the expected sign. Gender differences are controlled by a binary variable, Male. Based on the results, males’ probability of retiring is 1% less than females. This shows that in a country with a relatively traditional labour market, men in Iran are more likely to continue working as they are economically responsible for their families.

Table 4. The results of the Heckman selection model for retirement age

***, ** and * denote statistical significance at the 0.01, 0.05 and 0.10 levels, respectively.

Retirement rules for pension eligibility are also significant showing that as social norms, they are influential on individuals’ decisions. The results are supported by the literature and studies that find a positive effect for raising the statutory retirement age on older cohorts’ employment (de Grip et al Reference de Grip, Fouarge and Montizaan2013; Rabaté and Rochut Reference Rabaté and Rochut2019; Vermeer et al Reference Vermeer, van Rooij and van Vuuren2019). As mentioned in “The ISSO’s pension policies,” the ISSO’s contributors are permitted to retire if their job profiles fulfil the requirements of 1st to 5th retirement rules, although they always have the chance to keep working in pursuit of more desirable retirement benefits. Regarding the marginal effects, workers permissible to leave work with only 10 years of service according to TAEEN-TAKLIF Law, named as ret_rule5, are more prone to retirement with a 68.5% higher probability. Although these workers receive one-third of the full pension, they prefer to retire because they are of an age with limited life expectancy, and it is not economically profitable to continue working to meet the 20 years of service required for the minimum pension.

Employees eligible to Ret_rule2 also have a 45.4% more chance of retiring. Despite being of the same age as the previous group, they have longer contribution records and their retirement decision depends on how far they are from completing 20 or 30 years of service, the eligibility conditions required for the minimum or the full pension, respectively. The greater their years of service, the more likely they are to claim a pension. Since the binary variables could not capture such a trade-off, we add the implicit tax to the selection model to explain individuals’ lifetime decisions towards retirement. As Table 4 shows, for 1% implicit tax increase, the probability of retirement is 4.2% higher. This is in accordance with the reviewed literature in part 2 and other ‘like’ studies which have found a positive association between implicit tax on work and retirement (De Preter et al Reference De Preter, Van Looy and Mortelmans2013; Kuitto and Helmdag Reference Kuitto and Helmdag2021; Manoli and Weber Reference Manoli and Weber2016; Queiroz Reference Queiroz2008). Since the implicit tax is directly related to age, this result is an alarming message for Iran whose population is on the verge of ageing.

Eligibility to the retirement rule Ret_rule3 increases the probability of work exit by 47.2% points. This group consists of workers at ages of 50 years for men and 45 years for women with at least 30 years of service. They are more likely to leave the job than workers eligible to Ret_rule2 because they are closer to the full pension. The retirement probability for females qualified for Ret_Rule4, that is, women aged 42 with 20 years of service, is 34.3% higher. That is because they are women aged 42 to 54 years who have paid contributions for more than 20 years but still are far from reaching 30 years of experience. A similar argument could be provided for other employees with 20 years of experience entitled to the minimum pension. They are 21.7% more likely to retire.

As mentioned in “The ISSO’s pension policies,” hazardous job holders in Iran have the privilege of paying about two-thirds of other workers as their accrual rate is multiplied by a factor of 1.5. So, all things being equal, they have a higher probability of exit, which is 35.2%. Furthermore, most people while making retirement decisions usually consider income opportunities of informal jobs during their post-retirement period. Adding regional unemployment rates to the selection model to control workers’ prospect of finding a new job after retirement, these results show an inverse association between the provincial unemployment rate and retirement. The probability of retirement decreases by 0.1% for every 1% point increase in the provincial unemployment rate.

The second part of Table 4 reports the results of retirement age regression for a subsample of individuals those who have retired. Following Heckman (1979), the inverse mills ratio that is statistically significant controls the non-selection hazard. The negative coefficient implies that the variables that predict retirement probability inversely affect retirement age. As predicted, men work for 5 years longer than women. The replacement rate is a determinative variable in intertemporal decisions as it compares workers’ pre- and post-retirement income. Paying a higher share of the current wage as a pension makes retirement more rewarding and decreases the retirement age. The results imply that the retirement age falls by 0.17 years or two months in response to a 0.10 increase in the replacement rate. The positive effect of higher replacement rates on retirement is confirmed in the literature (Brown and Fraikin Reference Brown and Fraikin2022; De Preter et al Reference De Preter, Van Looy and Mortelmans2013; Van Soest and Vonkova Reference Van Soest and Vonkova2014).

The contribution rate is the other driver influencing retirement age. As a participation cost of a pension scheme, any rise in the contribution rate can diminish the net benefit of continuing working. However, the results indicate that the contribution rate has a relatively small effect as the retirement age will diminish only by 0.14 years due to a 0.1 rise in contribution rate. The hazardous job exemption rate is another influential factor. The coefficient of −10.7 implies that the retirement age can decline by approximately one year as the exemption rate rises by 0.1. Finally, the retirement age among employees who have guaranteed their minimum pension, those with more than 20 years tenure, is about 5 years less.

Conclusion

Compared to the global average, the outflow rate of old-aged Iranian workers is significantly higher than that of middle-aged, raising the hypothesis that pension generosity pulls older workers into retirement. This study assessed the impact of the ISSO’s generous pension policies on employees’ retirement age. With a unique dataset of 267,000 ISSO new retirees, a counterfactual scenario is designed to simulate the pre-retirement status of around half of our sample. After estimation of implicit tax on work continuation for ISSO contributors, we used the Heckman two-stage model consistent with truncated data to tackle the sample selection bias.

Our findings proved the hypothesis that pension policies implemented by the ISSO encourage early retirement. First, although the statutory retirement age in Iran is one of the lowest in the world, other generous retirement rules determining the age of exit or eligibility conditions make retirement available even earlier. Playing the role of social norms, these rules have influenced employees’ decisions and motivated them to leave work at a younger age. Second, the ISSO pension formula regarding the accrual rate and reference wage does not incentivise workers to increase their tenure. The implicit tax, which summarises all pension formula elements, shows that ISSO’s current accrual rate and reference wage penalise work continuation. The current generous benefit formula, considering the reference wage equal to the average salary in the last two years of tenure, also leads to a very high replacement rate that exceeds 100% t in many cases and rewards work withdrawal. Third, the exemptions for hazardous jobs, although necessary, are very generous and have reduced the retirement age by almost ten years.

The generosity of the social security scheme in Iran can no longer continue as it has led to financial difficulties even now when the population of Iran is relatively young. Undoubtedly, given the trend towards ageing, Iran’s social security programme reforms are necessary to maintain financial sustainability. The policy implications can include a broad range of reforms in retirement age, benefit formula, and exemptions. The ISSO can determine the retirement age in proportion to the evolution of life expectancy. The reforms should also consider critical alterations in the benefit formula, for example, the reduction in the accrual rate and change in the calculation method of the reference salary so that it assumes a more extended period than the last two years. Finally, while the exemption for hazardous jobs is a fair policy, the coefficient of 1.5 multiplied by the years of service in these jobs has to decrease gradually.

Funding statement

This research used no funding.

Competing interests

The author(s) declare no competing interests.

Saeed Malek Sadati is a tenured assistant professor in economics at Ferdowsi University of Mashhad (FUM). His research interests are labour economics, environmental economics, political economy, and socioeconomics. Recently, he has worked mostly on empirical analysis of labour market institutions and reforms, regarding unemployment insurance, pension policies, and wage discrimination. He has conducted several projects on the socioeconomic problems in developing countries, including child labour and school dropout.

Abbas Khandan is a tenured assistant professor in economics at Kharazmi University (KHU). For many years, his main research interests have been labour economics, informal economy, social security, pension and unemployment insurance. He has published several books and articles in these fields and has conducted several projects regarding pension funds financial sustainability and reforms in Iran.

Maliheh Hadadmoghadam holds a Ph.D. in Economics from University of Tehran and is currently an assistant professor in Department of Demography at the same university. Her research interests span population economics, labor economics and human capital, and computational social sciences. She has conducted significant research in these areas thus far.