No CrossRef data available.

Article contents

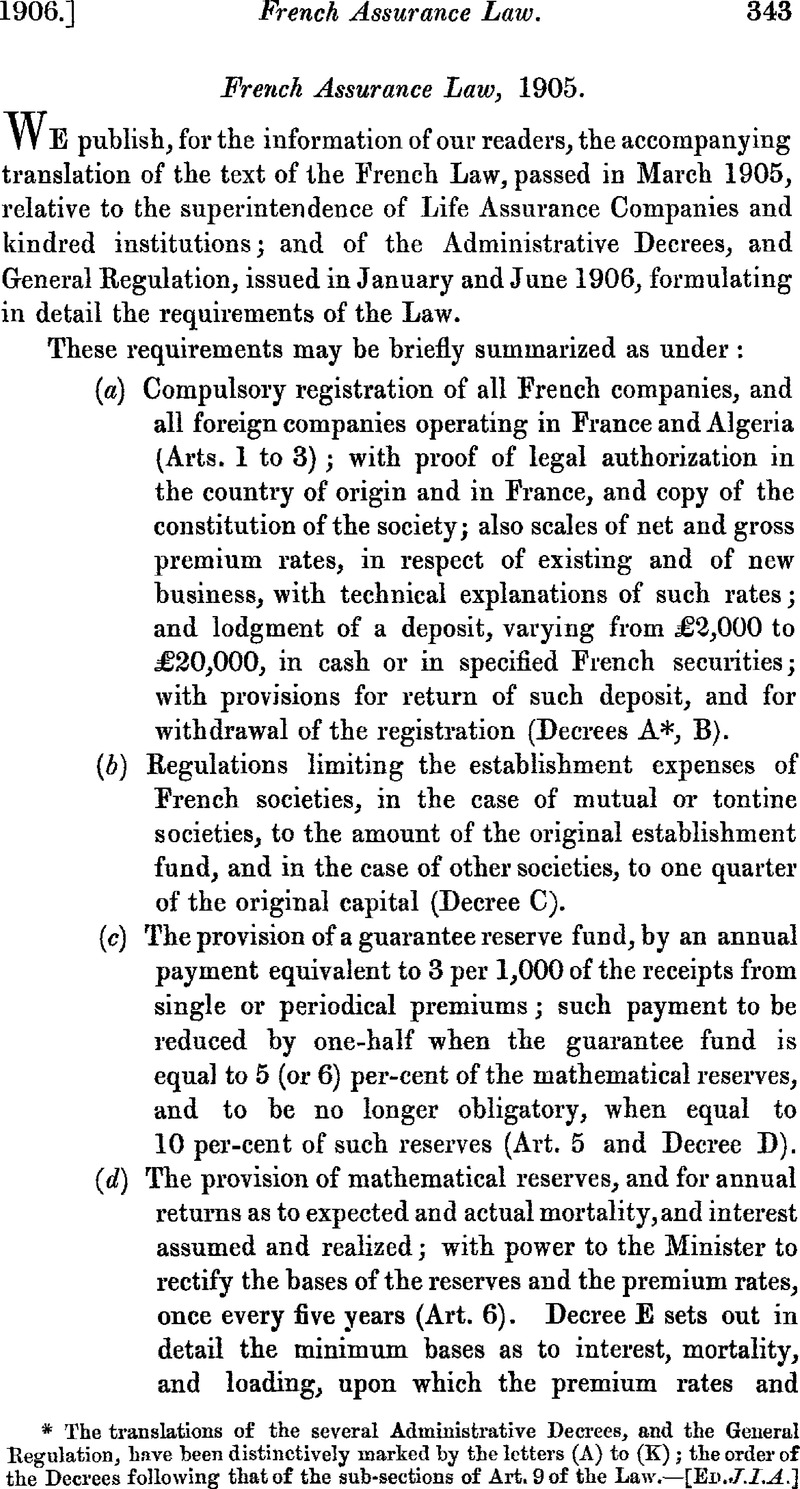

French Assurance Law, 1905

Published online by Cambridge University Press: 18 August 2016

Abstract

- Type

- Other

- Information

- Copyright

- Copyright © Institute and Faculty of Actuaries 1906

References

page 343 note * The translations or the several Administrative Decrees, and the General Regulation, Lave been distinctively marked by the letters (A) to (K); the order of the Decrees following that of the sub-sections of Art. 9 of the Law.—[ED.J.I.A.]

page 344 note * See Note on p. 358 [ED. J.I.A.]

page 349 note * “Entreprises de gestion d'assurances sur la vie.” We understand that the societies referred to are those which, in consideration of a specified remuneration, undertake the management of French mutual assurance societies and kindred institutions.

page 349 note † This Decree, published on 17 March 1905, is not included with those here translated.—[ED. J.I.A.]

page 353 note * This General Regulation, published on 12 May 1906, is not included with those here translated.—[ED. J.I.A.]

page 358 note * We understand from Mr. H. Bearman, F.I.A. (who has kindly perused the proofs of this translation) that the usual practice of the French companies is to value by the use of primes d'inventaire, which include the provision for expenses of management; and that the single premium by which the sum assured is valued is deduced from these valuation premiums, so that A'x=(πx+X)(1+ax), where A' is the single premium employed in the valuation, X is the provision for expenses of management, and p and a are the usual net values of the premium and annuity. The reserve for an ordinary whole-life policy, aftern completed years' duration, is thus equal to (π x+n +X)(1+ax+n )−(π x +X)= (π x+n − π x ); an expression equivalent to the normal net reserve value. In the case, however, where the premiums are fully paid up, or where the period over which they are payable is less than the whole duration of the policy (as in limited premium cases), the reserve made is no longer equivalent to the normal net reserve; but an additional provision is made (as it were automatically) by the formula, in respect of the expenses of management arisin g after the cessation of premiums.—[ED. J.I.A.]