Introduction

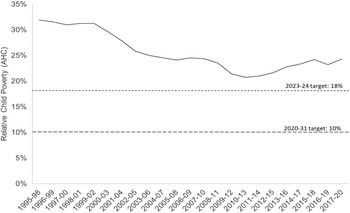

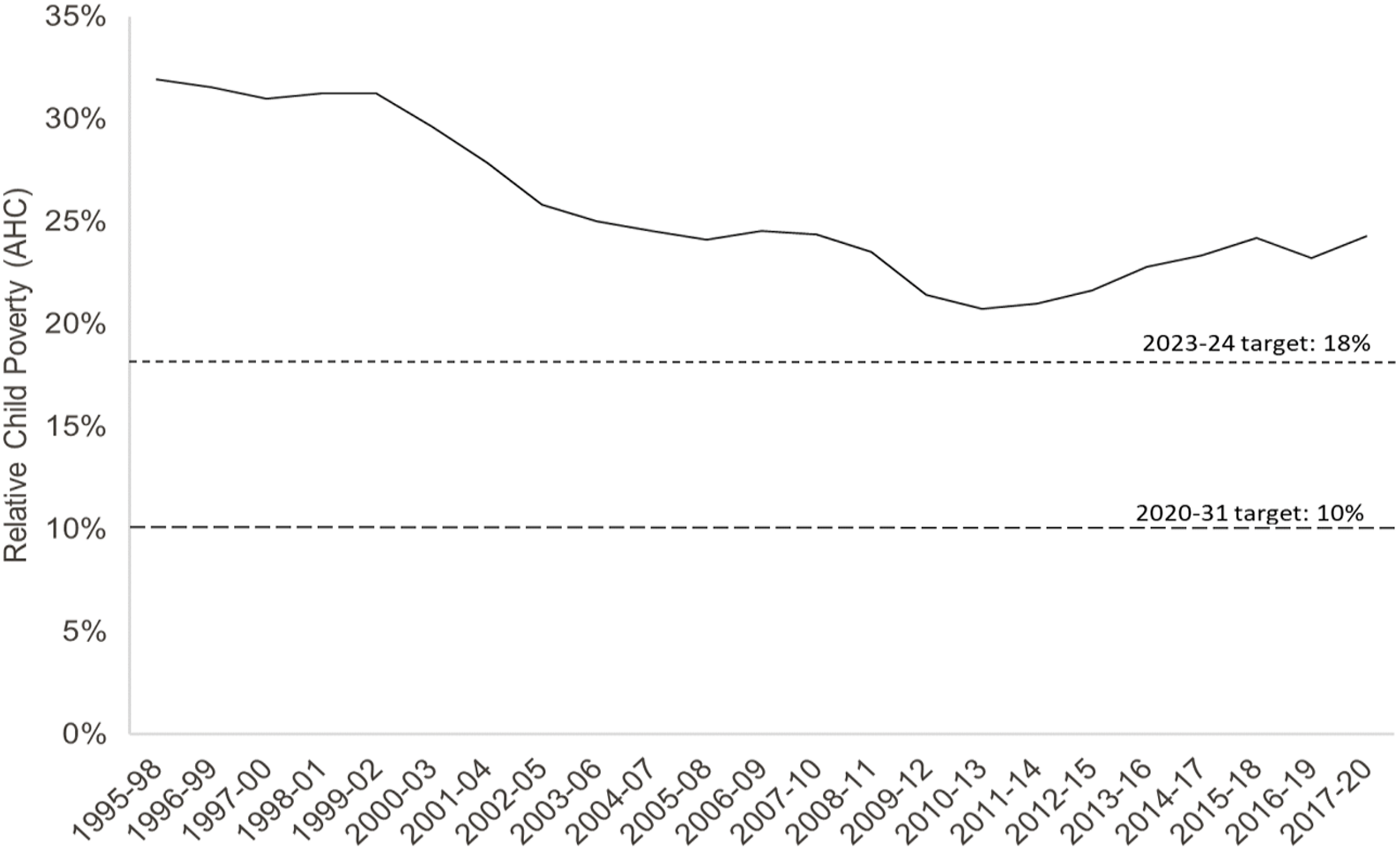

Child poverty has long-term social and economic consequences such as lower educational and health outcomes (Mowat, Reference Mowat2019; Lai et al., Reference Lai, Wickham, Law, Whitehead, Barr and Taylor-Robinson2019). As a result, many European/rich/developed countries have made reducing child poverty a fundamental part of their social and/or economic policy. Currently Scotland, along with the UK, has one of the highest rates of child poverty in Western Europe (OECD, 2021). More than one in four children were living in relative poverty in the three-year period 2017–2020 (Scottish Government, 2021). This represents an increase from the series low of near one in five in 2010 – 2013, a result of a near 9 percentage point reduction in child poverty rates between 1995 (30%) and 2014 (21%) – driven primarily by UK Government increases in social security and support for parents’ labour market participation (Joyce and Sibieta, Reference Joyce and Sibieta2013).

In 2017 the Scottish Parliament passed the Child Poverty (Scotland) Act, which committed the Scottish Government to significantly reduce child poverty under a defined number of targets. One such target is that by 2030/31 there must be fewer than 10% of children in Scotland in relative poverty, defined as having an equivalised household income of less than 60% of the UK median, as measured by the Department for Work and Pensions Family Resources SurveyFootnote 1 (Department for Work and Pensions, Office for National Statistics, NatCen Social Research, 2019). An interim target was also set stipulating that there must be fewer than 18% of children in relative poverty by 2023/24.

Broadly, governments can aim to reduce child poverty directly, through income transfers, or indirectly, through investments that aim to improve, for example, the functioning of the labour market, childcare, or education and training opportunities for parents. In a direct response to the targets set by the passing of the Child Poverty (Scotland) Act the Scottish Government used relatively newly devolved social security powers to establish a new social security instrument, titled the Scottish Child Payment (SCP). It provides a fixed rate per eligible child and when fully rolled out will operate as a top-up to existing UK-wide benefits with eligibility therefore based on eligibility for Universal Credit and legacy benefits. It is similar to the child element in Universal Credit with two important differences: there are no additional premiums for the first child, and there is no limit on the number of children who can receive the payment, particularly important as children in larger families have increased likelihood of being in poverty. The SCP therefore represents a direct transfer from the government to eligible households, the aim of which is to aid in meeting a pre-defined target for the rate of child poverty.

As such, in this paper we analyse how, and the extent to which, this type of transfer might be used to reduce child poverty, and how doing so might affect the macro-economy. To this end, we take a novel approach in which we use both micro- and macro-simulation methods to shed light on two important aspects of income transfers aimed at reducing poverty among children: their effectiveness and their potential wider economic effects.

From a microsimulation model, we first consider the value of SCP needed to reach current poverty targets and identify the associated costs of the programme. These costs are then combined with a macrosimulation model of the Scottish economy to determine the economy-wide impacts of funding the required level of SCP. The focus of the paper is on the impacts of reaching the 2030/31 final child poverty targets of 10%.

Review of policy leavers to combat poverty

Broadly speaking there are two main income-based transfers that government can use in tackling child poverty – cash transfers and in-kind transfers (such as childcare provision). There is debate among academics and research on the most effective approach with a large existing literature arguing the pros and cons of both approaches. While the focus of this paper is on the economic impacts of using cash-transfers, we review literature related to both cash and in-kind transfers.

Many studies employ regression techniques to measure the effectiveness of government transfers on child poverty in different countries. For example, using a linear regression, Bäckman and Ferrarini (Reference Bäckman and Ferrarini2010) analyses the relationship between policy cash transfers and child poverty rates in Europe, finding a clear negative relationship between the two. A similar study is also carried out for child poverty in Europe using the Eurostat and OECD SOCX databases by Nygård et al. (Reference Nygård, Lindberg, Nyqvist and Härtull2019). Again, the authors find a clear negative relationship between in-cash transfers and child poverty rates, but the authors also note that in some case the effectiveness of in-kind transfers is greater than cash transfers.

Bezze et al. (Reference Bezze, Canali, Geron and Vecchiato2020) analyse the social protection benefit system in Italy, finding that the country has a much higher proportion of in-cash benefits than in-kind when compared with the EU average, but is less effective in combating child poverty in disadvantaged families. Using a 120-family survey and discussions with social care workers, the authors find that, while cash-transfers do help to a point, families in mid to extreme poverty experience difficulties other than income that benefit greatly from professional service provision. Coppola and di Laurea (Reference Coppola and di Laurea2016) also argue that the Italian high level in-cash transfers system is ineffective in protecting the worse-off households.

There are several papers that investigate the impacts of both cash and in-kind transfers on child poverty in other countries. Using a microsimulation model and the national social survey 2013-2018 Sinisaar (Reference Sinisaar2021) evaluates the impact of an increase in family benefits in Estonia, finding that this resulted in reductions in absolute, relative and persistent poverty rates. But the author does note that the impact of benefits varies depending on the family type. Pac et al. (Reference Pac, Nam, Waldfogel and Wimer2017) compares the impact of different measures on child poverty rates in the US.

A key component of the literature has been on policy design and how this needs to be adapted for the specific country’s demographics. Using multilevel model analysis, Bárcena-Martín et al. (2018) analyses the different ways of social transfer targeting across 30 EU counties, finding targeting lower income households has larger impacts. Guio et al. (Reference Guio, Marlier, Vandenbroucke and Verbunt2022) also use a multilevel analysis for child poverty in 31 European countries using a range of micro and macro level determinants. They determine that a policy combination of both income support and social benefits is needed to combat child poverty effectively.

A number of studies compare individual countries’ current social transfer system with other similar neighbouring nations. For example, using the EUROMOD microsimulation model, Avram and Militaru (Reference Avram and Militaru2016) compare Romania and the Czech Republic to examine the extent to which child poverty reductions are driven by the policy design and size of benefit or interaction between policies and population characteristics. Salanauskaite and Verbist (Reference Salanauskaite and Verbist2013) carry out a similar study to compare Lithuanian design with Estonia, Hungary, Slovenia and the Czech Republic in reducing child poverty in single parent and large families.

Also explored in the literature is the effectiveness of transfers on reducing child poverty in certain family types and different economic regions. Payments to single parent households are evaluated in Van Lancker et al. (Reference Van Lancker, Ghysels and Cantillon2014) and Chzhen and in Bradshaw (Reference Chzhen and Bradshaw2012), finding the possibility of significant reductions in child poverty rates and that targets focussed specifically on single parents produce the most efficient results. Barrientos and DeJong (Reference Barrientos and DeJong2006) investigate cash transfers as an option in developing countries (South Africa & Latin America), with results similar to the European studies in that they prove to be an effective means of combating child poverty. Kumara and Pfau (Reference Kumara and Pfau2011) find some additional benefits in developing countries of cash transfers, such as an increase in school attendance.

The focus to date in the literature has been on the impact of cash transfers on individual households. While this is part of our investigation, we extend the analysis by considering the macroeconomic impacts of funding the cash transfers policy.

The remainder of this paper is structured as follows: the next section provides background on child poverty in Scotland and the SCP, followed by an outline of the data we use and our simulation methodology. We then present and discuss our results; and draw our conclusions in the final section.

Policy context

The statutory child poverty targets that this analysis focusses on are based on after-housing cost measures of household income, which are net of families’ cost of housing. They measure relative poverty – defined as the proportion of children living in households with income below 60% of the population median. Having an income below this level represents having a standard of living well below the average family in the UK. This is likely to translate into being unable to afford basic goods and services and being unable to participate in extracurricular or social activities, such as sports clubs or birthday parties, without cutting back on already constrained spending on essentials.

Although not the only measure of child poverty referred to in the Child Poverty (Scotland) Act, relative poverty is the most often used measure of poverty in analyses of household incomes. In the rest of this report, relative child poverty (using the after-housing cost measure) is referred to simply as child poverty.

The rate of child poverty has not changed significantly since the passing of the Act in 2017. Figure 1 shows relative poverty between 1995 and 2018 in Scotland based on three-year averages. The child poverty target levels are also shown in the chart by the dashed lines.

Figure 1. Child Poverty in Scotland (Relative poverty, after housing costs).

Source: Family Resources Survey, DWP

The figure shows that whilst child poverty still remains above the targets, it has not always been this high. There were a number of contributing factors to the decline in the early 2000s, including increases in social security for families with children and policies to incentivise and support labour market participation for parents. Many of these factors have been analysed in the existing literature on poverty (see Joyce and Sibieta, Reference Joyce and Sibieta2013).

The Scottish Child Payment was designed by the Scottish Government to help low-income parents with the costs of supporting their family. It originated as a weekly payment of £20 per child below the age of 16 (on full roll out) with a recent rise to £25 in November 2022. Although receiving the Scottish Child Payment may affect the need for some local council grants (for example, the Scottish Welfare Fund), it does not interact with any other UK or Scottish Government benefits that parents or household members might receive. It is similar to the child element in Universal Credit, but it does not have a limit on the number of children who can receive the payment. This makes it particularly effective for tackling child poverty, which is higher for larger families.Footnote 2

The Scottish Child Payment represents a direct transfer between the Scottish Government and households. It is also a policy instrument over which the Scottish Government has direct control. We therefore explicitly simulate scenarios in which the final child poverty targets are met through this channel and highlight the magnitude of the government investment required. With the change in the Scottish Child Payment, we then use the microsimulation model to solve for the changes to income tax bands that are sufficient to generate the tax revenue required to fully meet the net cost of this investment.

Where we model a Scottish Child Payment of £40 per week, for example, this amount is set in 2020/21 (the current financial year at the time of the analysis) and is then uprated in line with the Consumer Price Index to each of our chosen policy years, 2023/24 and 2030/31.

We model an increase in Income Tax rates to pay for the higher Scottish Child Payment, which reduces net incomes slightly. This in turn creates a small increase in Universal Credit entitlement, and thereby a small increase in entitlement to the Scottish Child Payment. Where we report results for the ‘fiscally neutral’ case, these interactions are taken into account.

Data & Methodology

Data

The underlying data are taken from the Family Resources Survey (FRS), a continuous UK-wide survey of individuals living in a representative sample of private households. The data are owned and managed by the Department for Work and Pensions (DWP). They provide detailed information on income and on household characteristics including the number of children.

Relative to administrative datasets, FRS is known to underreport caseload and receipt of social security benefits (Department for Work and Pensions, 2013). A modified dataset is used to correct for this underreporting. Caseload for means tested benefits, including the Scottish Child Payment, are calculated based on comparing earnings and characteristics of the household to the respective eligibility criteria. A downwards adjustment is made to account for take-up, informed by administrative data where available. For those remaining in the caseload, receipt is estimated based on amounts available under eligibility rules.

A three-year pooled FRS dataset is used to maximise the available sample including the years 2016-17, 2017-18 and 2018-19. This baseline household income dataset includes 2,800 records for Scotland.

Simulation methods

Our modelling approach employs two forms of simulations: one which changes individuals’ net income through alterations to the tax and benefit system – a microsimulation; and another which estimates the wider economic effects of these changes (for example, on GDP and employment) – a macrosimulation.

Microsimulation

The microsimulation model (based on the Institute for Public Policy Research’s Tax and Benefit model) was developed to forecast short-term changes in the UK income distribution and model the fiscal and distributional effects of tax and benefit policy. Initially the model establishes a baseline net household income distribution using the baseline household income dataset described in the previous section. As the poverty targets are set for the years 2030/31 the base year financial values are uprated – achieved using a combination of forecasts from the Office of Budget Responsibility (OBR), economic indicators and known policy changes. This analysis includes all policies announced up to March 2021.

To implement a policy change a counterfactual tax and benefit system or economic scenario is created. For this paper the counterfactual is increased income from the SCP which then impacts the assumptions of the model creating a new outcome. By comparing the counterfactual household outcomes to its baseline counterpart we can estimate the impact of the simulated change on incomes, rates of poverty, and government expenditure.

Macrosimulation

The macrosimulation proceeds in a similar manner to the microsimulation by setting up a baseline economy. We use a Computable General Equilibrium (CGE) model based on the AMOS (Harrigan et al., Reference Harrigan, McGregor, Dourmashkin, Perman, Swales and Ping Yin1991) family of models. The version of the model used here is based on the 2013 Scottish Input-Output (IO) table with 18 economic sectors. In addition to the 18 sectors/commodities within the model there are three internal institutions – households, firms and governments – and two external, the rest of the UK (RUK) and the rest of the world (ROW). Transactors are taken to be myopic. Scotland is treated as a small open economy so that RUK and ROW variables are treated as exogenous (1). Commodity markets are assumed to be competitive. Financial flows are not explicitly modelled, and the interest rate is assumed to be exogenous.

This AMOS framework has been used in a number of applications (e.g. Allan et al., Reference Allan, Lecca, McGregor and Swales2014; Figus et al., Reference Figus, Lisenkova, McGregor, Roy and Swales2018; Connolly et al., Reference Connolly, Eiser, Kumar, McGregor and Roy2021) and allows for a degree of flexibility in choice of model closures and parameters. Fundamentally, the model assumes that producers minimise cost using a nested multilevel production function. The combination of intermediate inputs with RUK and ROW inputs is based on Armington (Reference Armington1969). Output is produced from a combination of intermediates and value added, where labour and capital combine in a constant elasticity of substitution (CES) function to produce value added, allowing for substitution between these factors in response to relative price changes, i.e.

Where Yj,t is the value added of sector j at time t and K and L are the stocks of labour and capital respectively. σ is the elasticity of substitution between labour and capital with share parameters α and β (β = 1 − α). [EK] and [EL] are the efficiency parameters for capital and labour, which initially are kept constant in our simulations.

There are four components of final demand in the model – namely, household consumption, investment, government expenditure and exports. Household consumption is assumed to be a linear function of real disposable income. Real government expenditure in the model is held constant, while exports are determined by an Armington function (Armington, Reference Armington1969) and accordingly are dependent on relative prices.

While the model can be run in dynamic mode, with periods interpreted as years, as both the SAM and behavioural relationships are benchmarked using annual data, here we focus primarily on long-run equilibria in which both capital stocks and population are optimally adjusted. The model is initially assumed to be in steady-state equilibrium, implying that with no exogenous disturbances, the model simply replicates the initial values over all subsequent time periods.

Capital stocks are fixed in the short run, but subsequently each sector’s capital stock is updated through investment, set as a fraction of the gap between the desired and actual (adjusted for depreciation) level of capital stock – in line with the Jorgenson (1963) neoclassical investment formulation. In the long-run, equilibrium investment is equal to depreciation and capital stocks are constant.

There is a single, imperfectly competitive labour market with perfect sectoral mobility. Workers bargain over their real consumption wage where their bargaining power is inversely related to the unemployment rate:

where w S is the net of tax nominal wage in Scotland, cpi s the Consumer Price Index, u S the Scottish unemployment rate, and c is a calibration parameter (Layard et al., Reference Layard, Layard, Nickell, Nickell and Jackman2005). Wage and employment changes are governed by the interaction of the wage curve given by (2) and the (general equilibrium) demand curve for labour (which is obtained by aggregating over all sectors’ labour demands).

While there is substantial support for this wage curve specification, there is evidence that wage rises have been very limited since the Great Recession of 2008, so we also allow for a simple fixed nominal wage case, which captures the limiting case of zero wage flexibility. At a regional level this is traditionally motivated in terms of a national bargaining system in which the region acts as a wage taker. It also corresponds to a traditional Keynesian view of the way that regional labour markets operate.

Labour force changes in the model are due entirely to migration as there is no assumed change in natural population. Migration in the model is determined by the real wage and unemployment rate differential between Scotland and the rest of the UK (RUK). We assume zero net migration in the base year (2013) and net migration flows re-establish this equilibrium.

The net migration function is given by:

In Equation 3, m is net migration from Scotland to RUK; ν is a calibration parameter to generate net zero migration in the base year and u the unemployment rate with the S and R superscripts representing Scotland and the RUK, respectively.

Households are disaggregated by quintile. The model takes the cost of the policy change from the microsimulation model, along with funding assumptions, to generate shocks to the macrosimulation model that take the form of changes in government transfers. In one scenario we explore the case where the policy change is unfunded with the region: there is external funding – perhaps by a central government committed to “levelling up” a “left behind” region. At least in the Scottish case, however, a more realistic scenario assumes that the increase in transfers to households has to be funded by an increase in income tax.Footnote 3 This fiscally neutral case produces estimates of the impact of the policy change on the wider economy, registering changes in, for example, Gross Domestic Product (GDP), employment, unemployment, capital stock, population, real wages, and CPI.

Results

Household incomes

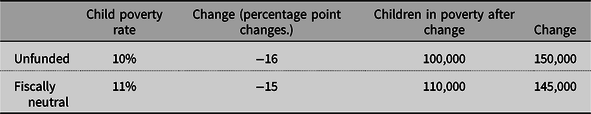

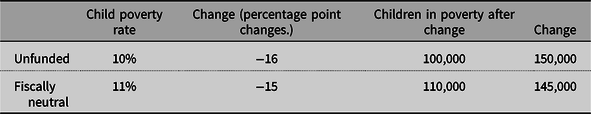

Our simulations show that the government target of a maximum child poverty rate of 10% can be met with a Scottish Child Payment of £165 per week (Table 1) – representing an increase of £140 from its current value of £25. Overall, the cost of doing so is £3 billion per year. The fiscally neutral outcome was obtained by raising all income tax rates by 4 percentage pointsFootnote 4 .

Table 1. Changes to child poverty rates in 2030/31 with a £165 per week Scottish Child Payment

Note: Rates and numbers are rounded to whole percentage points and the nearest 10,000 respectively. As a result, rows do not add up to an identical total.

In the unfunded/ externally funded case, meeting the 10% target generates a 16 percentage point reduction in the child poverty rate, equivalent to moving roughly 150,000 children out of poverty. However, in the fiscally neutral case – in which all income tax rates are raised by four percentage points – 6,000 fewer children were moved out of poverty. This is a result of the increase in income tax pushing some households below the poverty line.

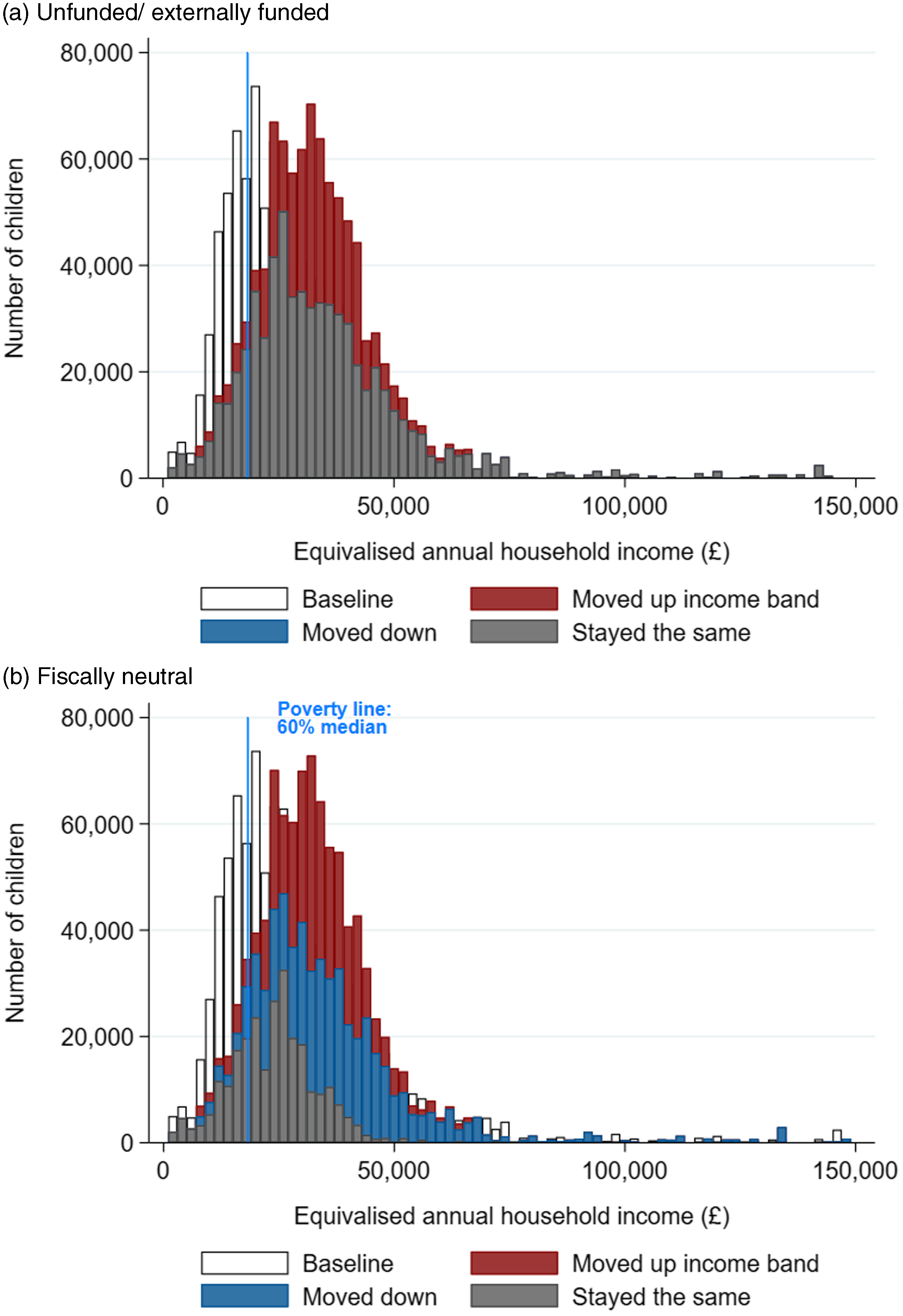

Figure 2 then shows the effect on children’s position in the household income distribution after increasing the SCP. The bars represent the number of children in £2,000 bands of equivalised disposable household income. The portion of each bar that is grey represents the proportion of children in each band whose position in the income distribution was unaffected by the policy, whereas the blue and red bars show the proportion who were in families that moved up or down the distribution respectively. The black and white bars show the height of the baseline distribution, so where these are not visible the number of people in an income band has increased.

Figure 2. The effect on children’s position in the household income distribution after increasing the Scottish Child Payment (SCP) to meet the 2030/31 target.

Panel (a) firstly shows the overall effect on the income distribution, with a significant number of children moving upward. By construction, there are no downward moves since the simulated policy was not funded through increases in income tax.

In Panel (b), however, there are some children whose position is adversely affected by the 4 percentage point increase in income tax that is required for fiscal neutrality. This is more marked for those on relatively higher annual incomes, and highlights the trade-off when funding large-scale cash transfers through increases in income tax; although many people are moved up the income distribution – and large numbers still moved above the poverty line – there are also many who are made worse off.

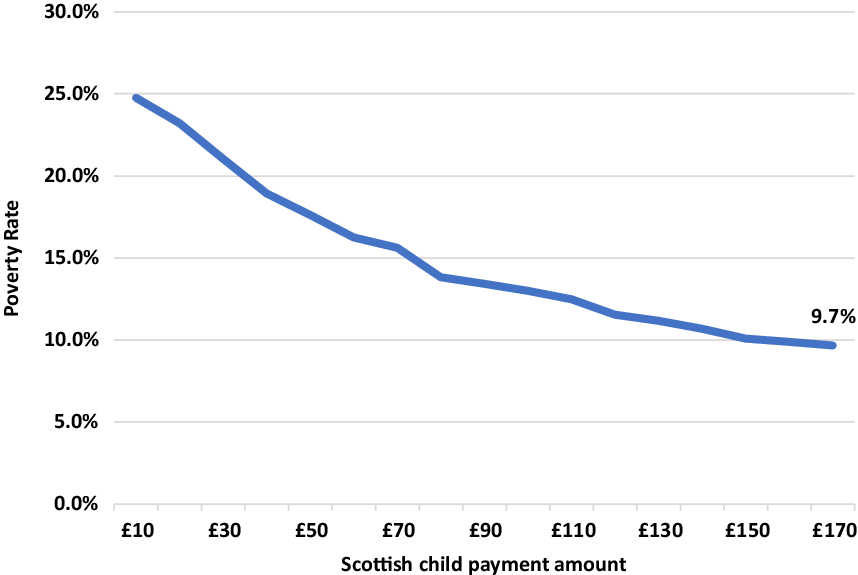

A key issue with only using the income transfer of the Scottish Child Payment is the diminishing returns to additional SCP payments apparent from Figure 3. From a payment of £10 per week to around £80 we find a near linear relationship between the SCP value and the reduction in child poverty rate. However, after £80 the marginal gain in child poverty rate from an increase in the SCP reduces significantly. With a payment of £80 per week the poverty rate decreases by 11.2 percentage points (to 13.8%) compared with the baseline. However, to reach the 10% target (a further 3.8 percentage points) the payment needs to rise to £165 per week. On average between £10-£80 per week, each £10 increase in SCP results in a 1.6 percentage point reduction in the poverty rate, which decreases to 0.5 percentage points between payments of £80 and £165 per week.

Figure 3. Effect of increases in the SCP on child poverty rates.

This non-linearity in response to payments is driven by the distribution of incomes across the households in poverty. In the baseline there is a significant proportion of households with incomes near the poverty line with relatively small increases in the SCP moving these households out of poverty. However, as we move further from the poverty line the income distribution of households becomes much more dispersed, resulting in a reduction in the marginal gain of increasing the SCP. The households at the lower end of the distribution are also those that are more likely to find employment difficult (due to disability, caring, etc.) and as such the SCP alone may not be enough to reduce the poverty rate to the targeted level. Other payments of targeted income support may be needed for these households.

While the child poverty target can, in principle, be met solely by SCP, the fact that it can only do so at very considerable cost to the Scottish Government creates problems for the macroeconomy, which we explore in the next section

Wider macroeconomic effects

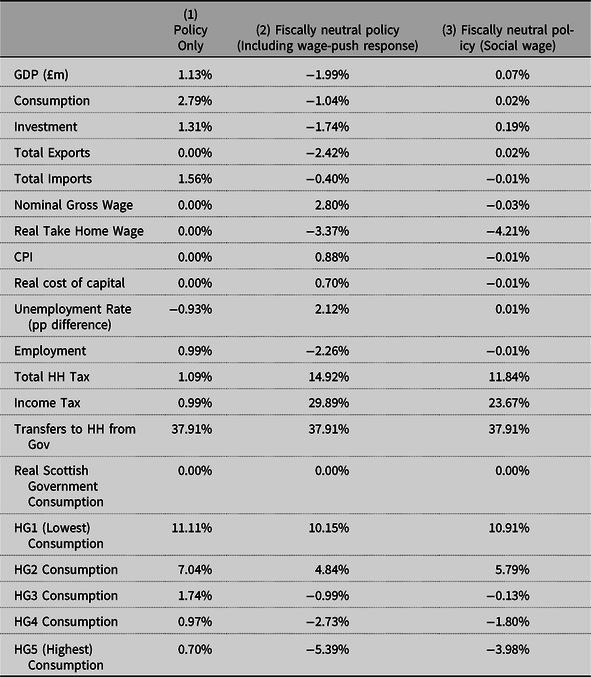

Table 2 below shows the long-term macroeconomic effects of meeting the 2030/31 child poverty targets through increasing the Scottish Child Payment for three separate cases. The first column shows the impacts of the externally funded policy given the assumption of a fixed nominal wage. This Keynesian perspective abstracts from any supply-side responses and implies that only demand matters in the determination of regional output and employment. The second column shows the effects of the fiscally neutral policy change when we assume that wages are determined in accordance with the wage curve of equation (2) above. Here the funding of the increase to the Scottish Child Payment through income tax revenues induces a wage-push effect as labour seeks to restore its real take home wage. The final column again shows the results for the fiscally neutral case although here workers are assumed not to attempt to restore their real net-of-tax wages as they value the social benefit of the fiscal transfers – the reduction in poverty. This is the ‘social wage’ case.

Table 2. Macroeconomic results from increase in SCP to £165 per week

All results represent percentage changes relative to the baseline, so that an impact of x% corresponds to an x% change in the relevant economic variable in comparison to its baseline value. (The exception is the unemployment rate, where percentage point changes are reported.)

The externally funded case

Focussing on column (1) shows that, unsurprisingly, the increase in household income leads to increases in consumption across the income distribution (reflected in quintiles within the macrosimulation model). The magnitude of the increase is larger among the bottom two quintiles (the bottom 40%), given that the impact of the benefit is concentrated among low-income households. The percentage change in consumption is between five and six times higher for these lower-income households in 30/31. This is because the microsimulation results imply an increase of £165 per child per week – a large increase in monthly income that amounts to, in the non-fiscally neutral case, a cash injection of £3.03 billion.

As a result of this transfer of income from the government to households, GDP increases by 1.13% and employment by 0.99%. The unemployment rate falls by 0.93 percentage points with both investment and consumption increasing by 1.31% and 2.79% respectively. Overall, this transfer results in an unambiguously positive effect on economic activity. Of course, the simulation captures only the demand-side effects of a policy that is not funded by the Scottish Government. This reflects the type of effects that would be expected if the UK government chose to fund these regional-specific child payments as part of a “levelling up” strategy.

Fiscal neutrality and supply-side responses through wage bargaining

Practically, however, the fiscally neutral case seems more relevant. Columns (2) and (3) of Table 2 focus on the impact of the policy once we require that it is fully funded through increases in income tax, which: significantly adversely impact the consumption of higher income groups that virtually offsets the overall stimulus to demand; and, furthermore, in the case of column (2) induce an adverse supply-side response through the wage-bargaining process as workers attempt to restore their real take home wage – which is, of course, adversely impacted by the rise in income tax rates.

Raising revenue through income tax in fact results in a reduction in consumption in all but the bottom two quintiles of the income distribution (and, ultimately, in total consumption). This is because funding the increases to the child payment that meet the 2030/31 targets requires an increase of roughly £3 billion in income tax, much of which is raised among higher-earning households. In both cases there is also a reduction in the real take-home wage in both years, driven by the changes to income taxes and increases in prices.

For the fiscally-neutral simulation (column 2) workers’ attempts to restore their real wage are frustrated by the induced increase in the unemployment rate, which inhibits their bargaining power. Firms, in part, pass increases in wage costs realised through bargaining to the prices of their goods and services, reducing competitiveness and adversely impacting net trade flows. They also hire less staff – employment falls as a result of meeting both targets and the unemployment rate increases by 2.12 percentage points. Altogether, the result is a significant decline in GDP of almost 2.0%, driven primarily by the induced wage push process.

In the social wage case (column 3) there is no attempt by workers to restore their take home pay because they are assumed to value the improvement in child poverty as much as their own reduction in real take home pay. There is thus no need for firms to pass on price increases for goods and services – there is actually a small increase in exports. As lower quintile households have a smaller propensity to save there is actually a modest increase (0.02%) in aggregate consumption, driving an increase in GDP, but employment falls – albeit negligibly – reflecting the greater capital intensity of low-income households’ consumption expenditure.

There is clearly a considerable range of potential macroeconomic outcomes, depending on our assumptions about funding and the nature of wage determination. Most would accept that the externally funded results are unlikely to be realised in the Scottish context given the current fiscal framework; Scotland has no sovereign wealth fund and it seems inconceivable that the UK government would be prepared to fund a Scottish-specific increase in child benefit. Accordingly, the results of our analysis so far vary between a negligible macroeconomic outcome in the absence of wage push to a significant contraction in economic activity (of nearly 2% of GDP) to meet the final target. However, the latter case assumes that workers’ attempt to fully restore their post-tax real wage. If workers respond only partially to the tax changes (for example, because of generally weak bargaining power or a willingness to at least partially absorb the cost of the policy change because workers value the reduction in child poverty), the scale of the adverse changes is much reduced. Indeed there is a negligible economic impact in the limiting social wage case. Analysing whether policy might influence these reactions is beyond the scope of the present analysis, as it would require analysis of workers’ willingness to accept a reduction in take home pay to combat child poverty.

Discussion/Conclusion

As part of the Child Poverty Act 2017, the Scottish Government has committed to reducing the child poverty rate to 10% by 2030/31. The purpose of this paper is to explore the extent to which the Scottish Government would have to adjust the policy instrument that is most directly linked to its policy target of child poverty (and over which it has direct control, requiring no input from the Westminster Government) – namely, the Scottish Child Payment (SCP) – to meet these targets.

Many previous studies (e.g. Bäckman and Ferrarini, Reference Bäckman and Ferrarini2010; Nygård et al., Reference Nygård, Lindberg, Nyqvist and Härtull2019) take a microsimulation approach to analyse the effects of cash transfers on child poverty. In this paper we use a combination of micro and macro simulation models to analyse the effectiveness of the Scottish Child Payment in reaching the final target. This novel combination allows us to analyse the detailed distributional effects of the significant policy change, while also capturing its likely macroeconomic impacts. The microsimulation model is based on the Institute for Public Policy Research’s Tax and Benefit model, with outputs feeding into the AMOS modelling framework for macroeconomic analysis.

Acting as a direct cash transfer to households, we find that the 2030/31 Scottish child poverty can be met with a very large SCP payment of £165 per week – a very significant increase from its current level. It is very clear that, while the Scottish Government can in principle achieve its target through this mechanism, the scale of the required policy adjustment is dramatic. This increase in payment would require an additional £3 billion tax revenue to be raised in the realistic case of it having to be funded internally by the Scottish Government. In our modelling we assume the additional tax is raised through a 4 percentage point increase in income tax rates across all income bands.

From the macrosimulations we estimate the potential economy-wide impact of the policy, using the results of the microsimulation to identify the scale of the fiscal change. If the policy is funded externally, it has unambiguously positive effects on the economy. However, once we impose the restriction that the policies are funded through across the board increases in income tax rates – the mode of raising revenue to offset their costs most easily available to the Scottish Government – we find that, with inflexible wages, the consequences for economic activity are negligible in size, but positive. However, if wages are very sensitive to changes in income taxes we find that fiscally neutral Scottish Child Payment policy changes tend to have negative consequences for economic activity: the induced wage-push effect dominates any stimulus to demand. The macroeconomic outcomes of the policy are inversely related to the responsiveness of wage bargaining to the income tax changes required to fund the SCP.

While we demonstrate that the ambitious Scottish 2030/31 child poverty targets can be achieved in principle with sole use of the SCP policy instrument, this can only be done by incurring a very high fiscal cost. One key result of our analysis suggests that combining the SCP with other policies may provide a more promising route to achieving child poverty targets. Specifically, we find a non-linear response between the SCP and child poverty rates. Above payments of £80 per week there is a significant reduction in the marginal gain in child poverty rates for each additional £10 spend on the SCP. Accordingly, it becomes an increasingly expensive method of lifting children out of poverty, echoing the finding in Bezze et al. (Reference Bezze, Canali, Geron and Vecchiato2020) that high levels of cash transfers can be an ineffective way of combating child poverty. It may well be that other policy instruments such as those impacting rentals become a more efficient way of reducing child poverty than ever higher levels of SCP.

It is well known that there are certain circumstances, such as lone parent household or disability in the family, that increase the chances of a child living in poverty. One approach, for which the existing literature provides some support (Bárcena-Martín et al., Reference Bárcena-Martín, Blanco-Arana and Pérez-Moreno2018), is to reduce the costs of meeting child poverty targets by adopting a more targeted approach to direct transfers. So instead of a universal increase in SCP, other payments could be introduced directly to households with characteristics that are known to have a higher probability of being in poverty. Targeting these households should reduce the cost per child out of poverty.

In addition to direct transfers, there are other policy levers that may be used in conjunction with the SCP to meet the targets similar to the argument made by Zagel and Van Lancker (Reference Zagel and Van Lancker2022). The significant expense of childcare is a key barrier to work with many parents not able to work or working reduced hours, increasing the possibility of children being in poverty. Increased childcare provision would allow parents to either enter the workforce or increase the number of hours they can work. The effectiveness of such policy levers, and combinations of them, for Scotland should be explored in future work.