No CrossRef data available.

Article contents

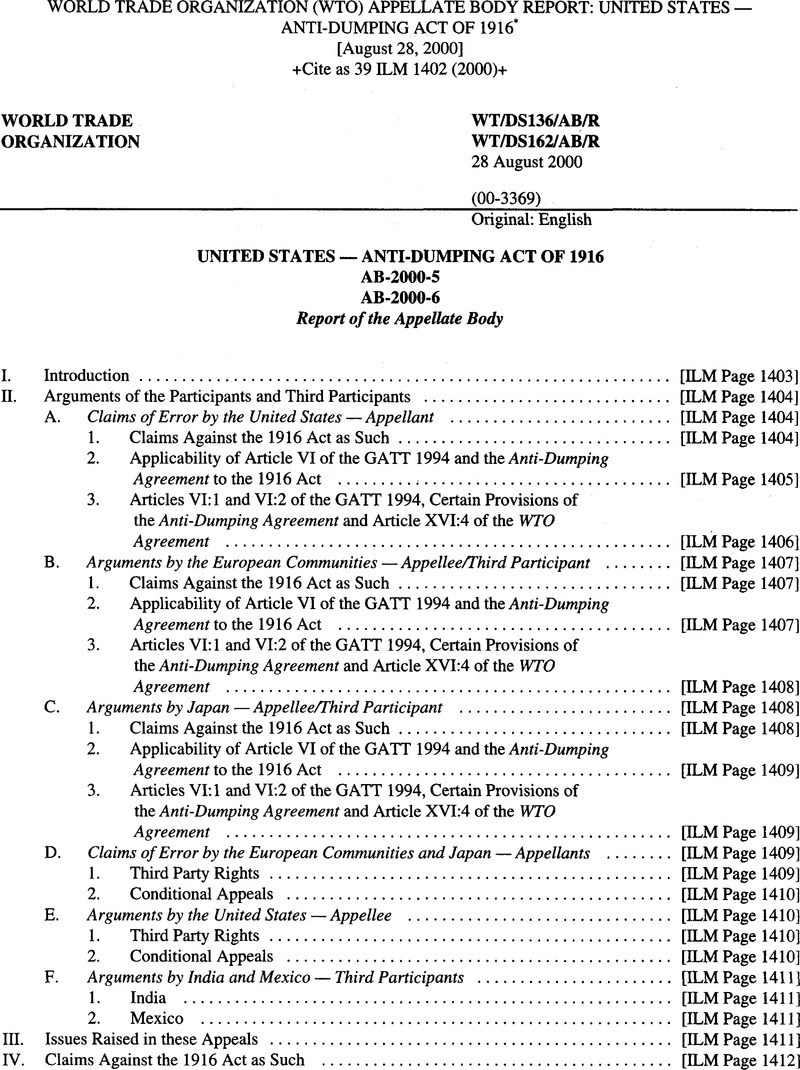

World Trade Organization (WTO) Appellate Body Report: United States —Anti-Dumping Act of 1916

Published online by Cambridge University Press: 27 February 2017

Abstract

- Type

- Judicial and Similar Proceedings

- Information

- Copyright

- Copyright © 2000

References

1 WT/DS136/R, 31 March 2000.

2 WT/DS162/R,29May2000.

3 As the composition of both Panels was identical, we will refer to the Panels as “the Panel”.

4 Act of 8 September 1916, 39 Stat. 756 (1916); 15 U.S.C. § 72.

5 Relevant factual aspects of the 1916 Act are set out at paras. 2.1 - 2.5 and 2.13 - 2.16 of the EC Panel Report, and at paras. 2.1 - 2.5 and 2.14 - 2.16 of the Japan Panel Report. Relevant portions of the 1916 Act are also reproduced in this Report, infra, para. 129.

6 EC Panel Report, para. 7.1.

7 Japan Panel Report, para. 7.1.

8 EC Panel Report, para. 7.2; Japan Panel Report, para. 7.2.

9 Pursuant to Rule 21 of the Working Procedures.

10 Pursuant to Rule 23(1) of the Working Procedures.

11 Pursuant to Rules 22 and 24 of the Working Procedures. The European Communities is an appellee in dispute WT/DS136 and a third participant in dispute WT/DS 162. Japan is an appellee in dispute WT/DS 162 and a third participant in dispute WT/DS 136.

12 Pursuant to Rule 23(3) of the Working Procedures.

13 Pursuant to Rule 24 of the Working Procedures. India is a third participant in both disputes. Mexico is a third participant in dispute WT/DS 136, but not in dispute WT/DS 162.

14 Appellate Body Report, WT/DS60/AB/R, adopted 25 November 1998.

15 Appellate Body Report, WT/DS22/AB/R, adopted 20 March 1997.

16 Panel Report, adopted 4 October 1994, BISD 41S/131.

17 Panel Report (unadopted), ADP/136, circulated 28 April 1995.

18 Panel Report, adopted 28 April 1992, BISD 39S/436.

19 Panel Report, adopted 4 May 1988, BISD 35S/116.

20 Panel Report, adopted 16 May 1990, BISD 37S/132.

21 Appellate Body Report, WT/DS98/AB/R, adopted 12 January 2000.

22 Appellate Body Report, WT/DS 108/AB/R, adopted 20 March 2000.

23 Panel Report, WT/DS 152/R, adopted 27 January 2000.

24 Appellate Body Report, WT/DS26/AB/R, WT/DS48/AB/R, adopted 13 February 1998.

25 Appellate Body Report, WT/DS50/AB/R, adopted 16 January 1998, paras. 65-66.

26 EC Panel Report, para. 5.27. See also Japan Panel Report, para. 6.91.

27 EC Panel Report, para. 5.19.

28 Appellate Body Report, supra, footnote 21, paras. 127 - 131.

29 Appellate Body Report, supra, footnote 22, para. 166.

30 EC Panel Report, para. 5.17. We note that it is a widely accepted rule that an international tribunal is entitled to consider the issue of its own jurisdiction on its own initiative, and to satisfy itself that it has jurisdiction in any case that comes before it. See, for example, Case Concerning the Administration of the Prince von Pless (Preliminary Objection) (1933) P.C.I.J. Ser. A/B, No. 52, p. 15; Individual Opinion of President Sir McNair, A., Anglo-Iranian Oil Co. Case (Preliminary Objection) (1952) I.C.J. Rep., p. 116;Google Scholar Separate Opinion of Judge Sir Lauterpacht, H. in Case of Certain Norwegian Loans (1957) I.C.J. Rep., p. 43;Google Scholar and Dissenting Opinion of Judge Sir Lauterpacht, H. in the nterhandel Case (Preliminary Objections) (1959) I.C.J. Rep., p. 104.Google Scholar See also Hudson, M.O., The Permanent Court of International Justice 1920-1942 (MacMillan, 1943), pp. 418–419;Google Scholar Fitzmaurice, G., The Law and Procedure of the International Court of Justice, Vol. 2(Grotius Publications, 1986), pp. 530, 755-758;Google Scholar Rosenne, S., The Law and Practice of the International Court (Martinus Nijhoff, 1985), pp. 467–468;Google Scholar Podesta Costa, L.A. and Ruda, J.M., Derecho International Público, Vol. 2 (Tipografica, 1985), p. 438;Google Scholar de Velasco Vallejo, M. Diez, nstituciones de Derecho International Público (Tecnos, 1997), p. 759.Google Scholar See also the award of the Iran-United States Claims Tribunal in Marks & Umman v. Iran, 8 Iran-United States C.T.R., pp. 296-97 (1985) (Award No. 53-458-3); van Hof, J.J., Commentary on the UNCITRAL Arbitration Rules: The Application by the Iran-US. Claims Tribunal (Kluwer, 1991), pp. 149–150;Google Scholar and Rule 41(2) of the rules applicable to ICSID Arbitration Tribunals: International Centre for Settlement of Investment Disputes, Rules of Procedure for Arbitration Proceedings (Arbitration Rules).

31 United States’ response to questioning at the oral hearing.

32 WT/DS/136/2, 12 November 1998; WT/DS162/3,4 June 1999; and WT/DS162/3/Corr.l, 10 February 2000.

33 We note, however, that, as discussed in our Report in Guatemala — Cement, the Anti-Dumping Agreement does not incorporate by reference Articles XXII and XXIII of the GATT 1994: Appellate Body Report, supra, footnote 14, para. 64 and footnote 43.

34 See, for example, Panel Report, United States — Taxes on Petroleum and Certain Imported Substances (” United States — Superfund“), adopted 17 June 1987, BISD 34S/136; Panel Report, United States — Section 337 of the Tariff Act of 1930, adopted 7 November 1989, BISD 36S/345; Panel Report, Thailand — Restrictions on Importation of and Internal Taxes on Cigarettes (“Thailand— Cigarettes“), adopted 7 November 1990, BISD 37S/2OO; Panel Report, United States — Measures Affecting Alcoholic and Malt Beverages (” United States — Malt Beverages“), adopted 19 June 1992, BISD 39S/206; and Panel Report, United States — Tobacco, supra, footnote 16. See also Panel Report, United States — Wine and Grape Products, supra, footnote 18, examining this issue in the context of a claim brought under the Tokyo Round Agreement on Interpretation and Application of Articles VI, XVI and XXIII of the General Agreement on Tariffs and Trade.

35 See, for example, Panel Report, Japan — Taxes on Alcoholic Beverages, WT/DS8/R, WT/DS10/R, WT/DS11/R, adopted 1 November 1996, as modified by the Appellate Body Report, WT/DS8/AB/R, WT/DS 10/AB/R, WT/DS 11/AB/R; Panel Report, Canada — Certain Measures Concerning Periodicals, WT/DS31/R, adopted 30 July 1997, as modified by the Appellate Body Report, WT/DS31/AB/R; Panel Report, European Communities — Hormones, WT/DS26/R, WT/DS48/R, adopted 13 February 1998, as modified by the Appellate Body Report, supra, footnote 24; Panel Report, Korea — Taxes on Alcoholic Beverages, WT/DS75/R, WT/DS84/R, adopted 17 February 1999, as modified by the Appellate Body Report, WT/DS75/AB/R, WT/DS84/AB/R; Panel Report, Chile — Taxes on Alcoholic Beverages, WT/DS87/R, WT/DS110/R, adopted 12 January 2000, as modified by the Appellate Body Report, WT/DS87/AB/R, WT/DS 110/AB/R; Panel Report, United States — FSC, WT/DS108/R, adopted 20 March 2000, as modified by the Appellate Body Report, supra, footnote 22; and Panel Report, United States — Section 110(5) of the US Copyright Act, WT/DS160/R, adopted 27 July 2000.

36 Appellate Body Report, supra, footnote 14, para. 64.

37 Appellate Body Report, supra, footnote 14, paras. 79 - 80.

38 An unrestricted right to have recourse to dispute settlement during an anti-dumping investigation would allow a multiplicity of dispute settlement proceedings arising out of the same investigation, leading to repeated disruption of that investigation.

39 Once one of the three types of measure listed in Article 17.4 is identified in the request for establishment of a panel, a Member may challenge the consistency of any preceding action taken by an investigating authority in the course of an anti-dumping investigation.

40 See infra, paras. 122 -126.

41 While the Panel used the phrase “non-mandatory legislation” to describe legislation that does not mandate a violation of a relevant obligation, we prefer the phrase “discretionary legislation”.

42 EC Panel Report, para. 6.82. See also Japan Panel Report, para. 6.95.

43 EC Panel Report, para. 6.84. See also Japan Panel Report, para. 6.97.

44 EC Panel Report, para. 6.169. See also Japan Panel Report, para. 6.191.

45 The reason it must be possible to find legislation as such to be inconsistent with a Contracting Party's GATT 1947 obligations was explained as follows: [the provisions of the GATT 1947] are not only to protect current trade but also to create the predictability needed to plan future trade. That objective could not be attained if contracting parties could not challenge existing legislation mandating actions at variance with the General Agreement until the administrative acts implementing it had actually been applied to their trade. Panel Report, United States — Superfund, supra, footnote 34, para. 5.2.2.

46 Panel Report, supra, footnote 16.

47 Ibid., para. 118, referring in footnote to: Panel Report, United States — Superfund, supra, footnote 34, p. 160; Panel Report, EEC — Parts and Components, supra, footnote 20, pp. 198-199; Panel Report, Thailand—Cigarettes, supra, footnote 34, pp. 227-228; Panel Report, United States — Malt Beverages, supra, footnote 34, pp. 281 -282 and 289-290; Panel Report, United States — Denial of Most- Favoured Nation Treatment as to Non-Rubber Footwear from Brazil, adopted 19 June 1992, BISD 39S/128, p. 152.

48 The Panel noted that the United States did not allege that any discretion of the executive branch of government in relation to the civil proceedings would make the 1916 Act discretionary. EC Panel Report, footnote 350 to para. 6.82; Japan Panel Report, footnote 482 to para. 6.95.

49 EC Panel Report, para. 6.169; Japan Panel Report, para. 6.191.

50 See, in particular the reasoning in the Panel Report, United States — Malt Beverages, supra, footnote 34, para. 5.60.

51 EC Panel Report, para. 6.89; Japan Panel Report, para. 6.103.

52 EC Panel Report, paras. 6.86 - 6.87; Japan Panel Report, paras. 6.100 - 6.101.

53 Japan Panel Report, para. 6.192. See also EC Panel Report, para. 6.170.

54 Appellate Body Report, WT/DS33/AB/R, adopted 23 May 1997, pp. 14 -17.

55 Appellate Body Report, supra, footnote 24, para. 109.

56 EC Panel Report, paras. 6.37 - 6.38; Japan Panel Report, paras. 6.24 - 6.25.

57 EC Panel Report, paras. 6.86 - 6.90; Japan Panel Report, paras. 6.100 - 6.104.

58 Japan Panel Report, para. 6.189.

59 We note that in a recent case, a panel found that even discretionary legislation may violate certain WTO obligations. See Panel Report, United States — Section 301, supra, footnote 23, paras. 7.53 - 7.54.

60 We note that, in the EC Panel Report, the Panel reached the same results as in the Japan Panel Report without making any finding that the notion of mandatory/discretionary legislation “is no longer relevant”.

61 EC Panel Report, para. 6.84; Japan Panel Report, para. 6.97.

62 EC Panel Report, para. 6.163; Japan Panel Report, para. 6'.182.

63 Japan Panel Report, para. 6.184. See also EC Panel Report, para. 6.165.

64 United States’ appellant's submission, para. 85.

65 We consider that the second sentence of Article 1 merely indicates that the Anti-Dumping Agreement implements only those provisions of Article VI of the GATT 1994 that concern dumping, as distinguished from the provisions of Article VI of the GATT 1994 that concern countervailing duties imposed to offset subsidies.

66 We do not find it necessary, in the present cases, to decide whether the concept of “specific action against dumping” may be broader.

67 United States’ appellant's submission, para. 133.

68 Ibid.

69 Supra, footnote 4.

70 Supra, footnote 4.

71 EC Panel Report, para. 6.165. See also Japan Panel Report, para. 6.184. We note that the Panel frequently referred to the concept of “transnational price discrimination”. It should be stressed that “transnational price discrimination”, i.e., a difference in price between two markets, is a broader concept than “dumping” as defined in Article VI: 1 of the GATT 1994. Unlike transnational discrimination, “dumping” requires importation, and a lower price in the import market than in the export market or relevant third country market. Dumping is always transnational price discrimination, but transnational price discrimination is not always dumping. We are, therefore, of the opinion that the Panel's use of the term “transnational price discrimination” in its findings is problematic, and deserves specific mention.

72 EC Panel Report, para. 6.204; Japan Panel Report, para. 6.230.

73 EC Panel Report, paras. 6.33 - 6.34. See also Japan Panel Report, paras. 6.33 - 6.34.

74 Appellate Body Report, supra, footnote 24, para. 154.

75 Japan Panel Report, para. 6.272. See also EC Panel Report, para. 6.220.

76 Japan Panel Report, para. 6.281.

77 EC Panel Report, para. 6.225.

78 Japan Panel Report, para. 6.288.