No CrossRef data available.

Article contents

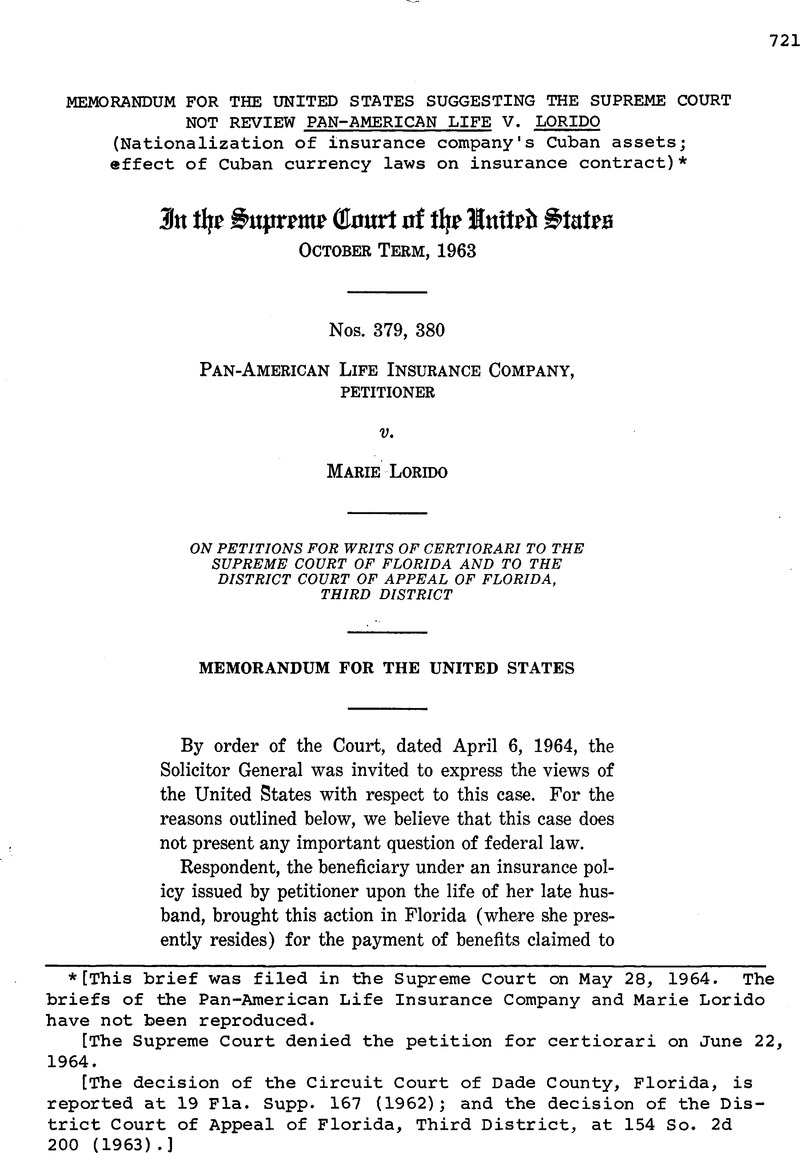

Memorandum for the United States Suggesting the Supreme Court not Review Pan-American Life v. Lorido (Nationalization of insurance company's Cuban assets; effect of Cuban currency laws on insurance contract)*

Published online by Cambridge University Press: 18 May 2017

Abstract

- Type

- Judicial and Similar Proceedings

- Information

- Copyright

- Copyright © American Society of International Law 1964

Footnotes

[This brief was filed in the Supreme Court on May 28, 1964. The briefs of the Pan-American Life Insurance Company and Marie Lorido have not been reproduced.

[The Supreme Court denied the petition for certiorari on June 22, 1964.

[The decision of the Circuit Court of Dade County, Florida, is reported at 19 Fla. Supp. 167 (1962); and the decision of the District Court of Appeal of Florida, Third District, at 154 So. 2d 200 (1963).]

References

1 Because the insured had made and received payments in pesos instead of dollars as a result of a 1951 Cuban monetary decree, the court held that the parties had, by their conduct, agreed to payment in pesos instead of dollars (Pet. App. 16, 17). The court did not find that a similar novation occurred with respect to the place of payment. This remained New Orleans, pursuant to the written contract.

2 The only possible exception to this limitation is where there is a significant policy of our national government requiring that extra-territorial effect be accorded a foreign governmental act in a particular case. See United States v. Belmont, 301 U.S. 324; United States v. Pink, 315 U.S. 203. No similar federal policy exists in the present case.