No CrossRef data available.

Article contents

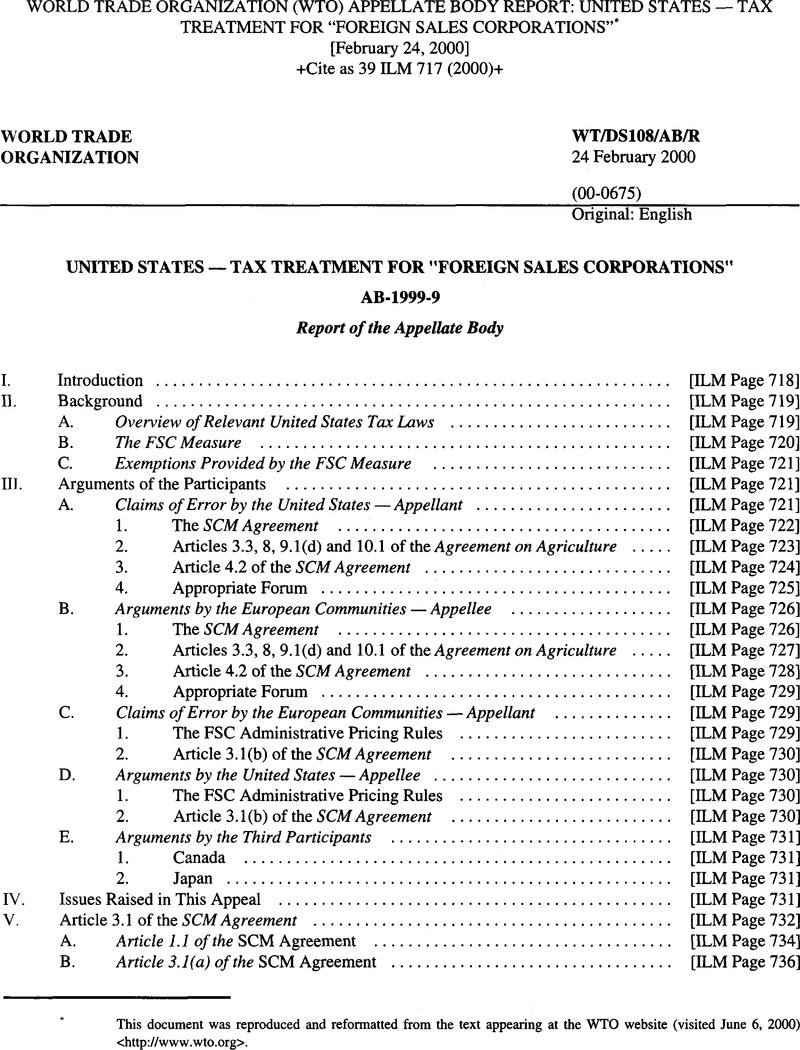

World Trade Organization (WTO) Appellate Body Report: United States— Tax Treatment for “Foreign Sales Corporations”

Published online by Cambridge University Press: 27 February 2017

Abstract

- Type

- Judicial and Similar Proceedings

- Information

- Copyright

- Copyright © 2000

Footnotes

This document was reproduced and reformatted from the text appearing at the WTO website (visited June 6, 2000) http://www.wto.org

References

* This document was reproduced and reformatted from the text appearing at the WTO website (visited June 6, 2000) http://www.wto.org

1 WT/DS108/R, 8 October 1999.

2 The Panel's terms of reference, WT/DS 108/3, 11 November 1998, refer to the European Communities’ request for consultations, WT/DS108/1, 28 November 1997.

3 In paragraph 7.34 and footnote 602 thereto of the Panel Report, the Panel identified sections 245(c), 921 through 927, and 951(e) of the United States Internal Revenue Code as the “primary” legal provisions constituting the FSC measure. This finding has not been appealed.

4 The Panel describes the FSC measure in paragraphs 2.1 to 2.8 of the Panel Report.

5 Panel Report, para. 8.1.

6 Ibid., para. 8.3.

7 Ibid., para. 8.4.

8 Pursuant to Rule 21 (1) of the Working Procedures.

9 Pursuant to Rule 23(1) of the Working Procedures.

10 Pursuant to Rule 23(3) of the Working Procedures.

11 Pursuant to Rule 22 of the Working Procedures.

12 Pursuant to Rule 24 of the Working Procedures.

13 United States’ appellant's submission, para. 21.

14 Section 7701(a)(4) IRC; United States’ appellant's submission, para. 21.

15 Section 7701(a)(5) and (9) IRC; United States’ appellant's submission, para. 22.

16 United States’ appellant's submission, para. 22. Panel Report, paras. 4.1127 and 4.1128.

17 Section 882(a) IRC. However, the foreign corporation may be eligible for a foreign tax credit with respect to foreign income taxes that it has paid on such income.

18 However, the United States parent may be eligible for an indirect foreign tax credit on some foreign income taxes paid by the foreign subsidiary. See United States’ appellant's submission, para. 23.

19 United States’ appellant's submission, para. 23.

20 Section 951 IRC; United States’ appellant's submission, para. 24.

21 With respect to such deferred income, the United States parent may be eligible for an indirect foreign tax credit on some foreign income taxes paid by the foreign subsidiary. See United States’ appellant's submission, para. 24.

22 This characterization of the FSC measure is not disputed by the participants. See Panel Report, para. 7.112.

23 During the oral hearing, the United States accepted, in response to a question from the Division hearing this appeal, that paragraphs 7.95-7.97 of the Panel Report accurately describe the FSC exemptions.

24 The description set forth here is intended to outline the main elements of the FSC measure which relate to this appeal. A comprehensive explanation of all the rules applicable to FSCs should be obtained from the text of the statutory provisions themselves or from specialized tax treatises, e.g., J. Isenbergh, International Taxation, 2nd ed. (Aspen Publishers Inc., 1999). We note here that special rules apply inter alia in the case of agricultural cooperatives, small FSCs, shared FSCs, FSCs owned by individual rather than corporate shareholders, and transactions involving military property.

25 Sections 922(a)( 1) and 927(d)(3) IRC. Typically an FSC is organized in a non-United States jurisdiction that does not tax, or applies a low tax rate to, corporate income.

26 Section 922(a)(l) IRC.

27 Section 922(a)(2) IRC.

28 Section 923(b) IRC.

29 Section 923(a) IRC.

30 Section 924 IRC.

31 Section 927(a) IRC; Panel Report, para. 2.1.

32 Section 924(b)(l)(B) IRC.

33 Sections 924(b)(l)(A) and 927(d)(3) IRC.

34 Under the first transfer pricing rule, the “arm's length” rule, the allocation of income is based on the actual price paid by the FSC to its related United States supplier, subject to adjustment under Section 482 IRC. This rule may be used by any FSC. Provided that it meets certain additional requirements to perform distribution activities in respect of qualifying transactions; and that it is related to its United States supplier, an FSC may instead elect to use one of two other transfer pricing rules, known as the “administrative pricing” rules. Each administrative pricing rule allows an FSC to determine its foreign trade income by applying a formula which divides the combined total income derived from qualifying transactions between the FSC and its related United States supplier. See Section 925 IRC and paras. 2.5-2.8 of the Panel Report.

35 See Panel Report, para. 7.95.

36 Section 882(a) IRC.

37 Section 864 IRC sets out the rules for determining whether the income of a foreign corporation is “effectively connected with the conduct of a trade or business within the United States”. Under United States tax law, the “effectively connected” concept is distinct from the “source-of-income” concept. The income of a foreign corporation may be “foreign-source” income under the rules for determining source of income (Sections 861-865 IRC), but may nevertheless be “effectively connected” with a trade or business within the United States and, on this basis, subject to taxation (see J. Isenbergh, supra, footnote 24, Vol. I, chapters 5 and 21).

38 Section 921(a) IRC.

39 Section 951 (a) IRC.

40 Panel Report, para. 7.96; Section 951(e) IRC. If an FSC uses the administrative pricing rules, then this second exemption applies with respect to both the exempt and the non-exempt portions of the FSC's foreign trade income. However, if an FSC uses the Section 482 arm's length transfer pricing rules, then the United States shareholder must declare a pro rata share of the non-exempt portion of its FSC's foreign trade income and generally is subject to United States tax on that portion of the FSC's foreign trade income.

41 See Panel Report, para. 7.97.

42 Ibid.

43 Section 245(c) IRC. If an FSC uses the administrative pricing rules, then this third exemption applies to dividends derived from both the exempt and non-exempt portions of that FSC's foreign trade income. However, if an FSC uses the Section 482 arm's length transfer pricing rules, then the United States shareholder generally is subject to tax on dividends received from distributions derived from the non-exempt portion of its FSC's foreign trade income, unless such income has already been taxed under the Subpart F rules.

44 Panel Reports, Tax Legislation — United States Tax Legislation (DISC),L002F 4422, adopted 7-8 December 1981, BISD 23S/98; Tax Legislation — Income Tax Practices Maintained By France, L/4423, adopted 7-8 December 1981, BISD 23S/114; Tax Legislation — Income Tax Practices Maintained By Belgium, L/4424, adopted 7-8 December 1981, BISD 23S/127; Tax Legislation — Income Tax Practices Maintained By The Netherlands, L/4425, adopted 7-8 December 1981, BISD 23S/137.

45 The participants in this appeal have generally referred to the 1981 Council action on the basis of which the Council adopted the panel reports in the Tax Legislation Cases as the “1981 Understanding”. Tax Legislation, L/5271, 7-8 December 1981, BISD 28S/114. As explained infra at footnote 76, we prefer the term “1981 Council action”. In order faithfully to summarize the arguments of the participants, however, we use the term 1981 “understanding” within this section of our Report.

46 United States’ appellant's submission, para. 45.

47 United States’ appellant's submission, para. 101.

48 Panel Report, para. 4.348.

49 The United States refers to the statements of the Belgian, French, Dutch and Swiss representatives of 14 January 1981 (C/M/145).

50 Appellate Body Report, Brazil — Measures Affecting Desiccated Coconut (“Brazil — Desiccated Coconut“), WT/DS/22/AB/R, adopted 20 March 1997.

51 United States’ appellant's submission, para. 323.

52 Appellate Body Report, Brazil — Export Financing Programme for Aircraft (“Brazil — Aircraft”), WT/DS46/AB/R, adopted 20 August 1999, para. 148.

53 United States’ appellant's submission, para. 341.

54 Panel Report, Australia — Subsidies Provided to Producers and Exporters of Automotive Leather (' 'Australia — Leather“), WT/DS126/R, adopted 16 June 1999, para. 9.29.

55 Appellate Body Report, Guatemala — Anti-Dumping Investigation Regarding Portland Cement from Mexico (' 'Guatemala — Cement“), WT/DS60/AB/R, adopted 25 November 1998.

56 United States’ appellant's submission, para. 381.

57 Panel Report, United States — Imposition of Anti-Dumping Duties on Imports of Seamless Stainless Steel Hollow Products from Sweden, ADP/47, issued 20 August 1990 (unadopted), para. 5.20.

58 Appellate Body Reports, Canada — Measures Affecting the Export of Civilian Aircraft (“Canada — Aircraft“), WT/DS70/AB/R, adopted 20 August 1999, para. 187; EC Measures Concerning Meat and Meat Products (Hormones), WT/DS26/AB/R, WT/DS48/AB/R, adopted 13 February 1998, para. 133.

59 European Communities’ appellee's submission, para. 86.

60 European Communities’ appellee's submission, para. 13.

61 European Communities’ appellee's submission, para. 214, referring to the United States’ appellant's submission, para. 295.

62 Panel Report, para. 7.159.

63 Panel report, Canada — Measures Affecting the Importation of Milk and the Exportation of Dairy Products, WT/DS103/R, WT/DS113/R, adopted 27 October 1999, as modified by the Appellate Body Report.

64 Ibid.

65 Panel Report, para. 7.163.

66 European Communities’ appellee's submission, para. 273, citing the Panel Report in Canada — Milk, supra, footnote 63, para. 7.27.

67 Panel Report, para. 7.170 (all emphasis added by the European Communities).

68 The European Communities refers to the Panel reports, Australia — Leather, supra, footnote 54, paras. 9.38 and 9.41; and Canada-—Aircraft, WT/DS70/R, adopted 20 August 1999, as modified by the Appellate Body Report, supra, footnote 58.

69 The European Communities refers to the Appellate Body Reports, Brazil — Aircraft, supra, footnote 52, para. 158; and Argentina — Measures Affecting Imports of Footwear, Textiles, Apparel and Other Items, WT/DS56/AB/R, adopted 22 April 1998, para.55.

70 The European Communities cites the Appellate Body Reports, India — Patent Protection for Pharmaceutical and Agricultural Chemical Products, WT/DS50/AB/R, adopted 16 January 1998; Brazil — Aircraft, supra, footnote 52; and Korea — Taxes on Alcoholic Beverages, WT/DS75/AB/R, WT/DS84/AB/R, adopted 17 February 1999.

71 Appellate Body Report, WT/DS90/AB/R, adopted 22 September 1999.

72 Panel Report, para. 4.274.

73 Appellate Body Report, Australia — Measures Affecting Importation of Salmon (“ 'Australia — Salmon”), WT/DS18/AB/R, adopted 6 November 1998, para. 118; see also Appellate Body Report, Korea — Definitive Safeguard Measure on Imports of Certain Dairy Products (“Korea — Dairy”), WT/DS98/AB/R, adopted 12 January 2000, para. 92.

74 Appellate Body Report, Australia — Salmon, supra, footnote 73, para. 118.

75 Panel Report, para. 7.45.

76 Throughout our findings, we use the term “1981 Council action” to refer to the action taken by the GATT 1947 Council when adopting the panel reports in the Tax Legislation Cases, supra, footnotes 44 and 45.

77 Panel Report, para. 7.74.

78 Ibid., para. 7.85.

79 Ibid., paras. 7.79 and 7.85.

80 Panel Report, para. 7.92.

81 Ibid., para. 7.100.

82 Ibid., para. 7.102.

83 Ibid., para. 7.103.

84 Panel Report, para. 7.104.

85 Section 924 IRC.

86 Section 927(a) IRC.

87 Panel Report, para. 7.119.

88 Ibid., para. 8.1.

89 United States’ appellant's submission, para. 64.

90 Ibid.

91 Ibid., para.283.

92 Ibid., para. 133 and the heading on page 48.

93 United States’ appellant's submission, para. 65.

94 Ibid., paras. 74 and 83.

95 Ibid., para. 133 and the heading on page 48.

96 Panel Report, para. 7.39.

97 We note that, in Brazil — Aircraft, we stated that in a dispute involving claims under Article 3.1(a) brought against a developing country Member, it is incumbent on the complaining Member to demonstrate, first, that the developing country Member in question is not in compliance with Article 27.4 of the SCM Agreement. The reason for this is that, in the circumstances described in Article 27, Article 3.1(a) does not apply to developing country Members. It is, therefore, necessary to establish, first, that Article 3.1(a) actually applies to the dispute (supra, footnote 52, para. 141). However, Article 27 does not apply to this dispute, which does not involve a complaint against a developing country Member, and the applicability of Article 3.1(a) is not, therefore, in issue.

98 The United States agreed with this view in reply to questioning during the oral hearing.

99 We note that the relationship between Article 1.1 and footnote 59 of the SCM Agreement is, therefore, different in this way from the relationship between the chapeau of Article XX of the GATT 1994 and the particular exceptions listed in sub-paragraphs (a) to (j) of that Article. In our Report in United States — Import Prohibitions of Certain Shrimp and Shrimp Products (“United States — Shrimp“), we observed that the application of the general standards of the chapeau of Article XX of the GATT 1994 is rendered very difficult, if not impossible, if the treaty interpreter does not, first, identify and examine the specific exception at issue (WT/DS58/AB/R, adopted 6 November 1998, para. 120).

100 Sec Japan —Taxes on Alcoholic Beverages (“Japan —Alcoholic Beverages“), WT/DS8/AB/R, WT/DS10/AB/R, WT/DS11/AB/R, adopted 1 November 1996, p. 16, and Chile — Taxes on Alcoholic Beverages, WT/DS87/AB/R, WT/DS110/AB/R, adopted 12 January 2000, paras.59 and 60.

101 Panel Report, para.7.45.

102 In the Panel proceedings, the European Communities advanced an interpretation of the term “otherwise due” that differed from that retained by the Panel. The European Communities considered the Panel's interpretation to be “formalistic”. See Panel Report, paras. 4.591 and 7.46.

103 United States’ appellant's submission, para. 279.

104 Ibid., para. 64.

105 Ibid., para. 111.

106 In paragraphs 7.95, 7.96 and 7.97 of the Panel Report, the Panel described, in detail, the manner in which the three tax exemptions provided under the FSC measure constitute a departure from the rules of taxation that would “otherwise” apply. At the oral hearing, the United States confirmed the correctness of the description given of the rules of taxation that would “otherwise” apply and of the three FSC exemptions in paragraphs 7.95, 7.96 and 7.97 of the Panel Report. The FSC measure is also described, supra, in paragraphs 11 to 18.

107 United States’ appellant's submission, para. 83.

108 United States’ appellant's submission, para. 268.

109 United States’ first submission to the Panel, para. 54, reproduced at para. 4.348 of the Panel Report.

110 Panel Report, para. 7.118.

111 Supra, footnote 58, para. 211.

112 Ibid.

113 Panel Report, para. 7.85.

114 United States’ appellant's submission, para. 133 and the heading on page 48.

115 Panel Report, para. 7.79.

116 Supra, footnote 44; Panel Report, paras. 7.52-7.54.

117 Supra, footnote 45.

118 Supra, footnote 45.

119 Supra, footnote 100, p. 14.

120 Ibid. In that Report, we noted that Article 59 of the Statute of the International Court of Justice makes explicit provision to the same effect (p. 14).

121 Ibid., p. 13.

122 European Communities’ appellee's submission, para. 154.

123 Ibid., para. 158.

124 We note, in that respect, that we do not share the Panel's misgivings regarding the use of the word “should” in a “legal instrument“ (Panel Report, para. 7.65). In our view, many binding legal texts employ the word “should” and, depending on the context, the word may imply either an exhortation or express an obligation (see, further, Canada — Aircraft, supra, footnote 58, para. 187).

125 Panel Report, para. 7.65.

126 This view is borne out by the statements made by a number of delegations, speaking either before or after the adoption of the panel reports in the Tax Legislation Cases. These delegations also expressed the view that the 1981 Council action did not affect or diminish their rights and obligations under the GATT 1947 (Panel Report, paras. 7.70-7.72).

127 The distinction between an authoritative interpretation and an interpretation made in dispute settlement proceedings is made clear in the WTO Agreement. Under the WTO Agreement, an authoritative interpretation by the Members of the WTO, under Article IX:2 of that Agreement, is to be distinguished from the rulings and recommendations of the DSB, made on the basis of panel and Appellate Body reports. In terms of Article 3.2 of the DSU, the rulings and recommendations of the DSB serve only “to clarify the existing provisions of those agreements” and “cannot add to or diminish the rights and obligations provided in the covered agreements.“

128 Panel Report, para. 7.67.

129 In particular, the Agreement on Safeguards and Part V of the SCM Agreement.

130 Supra, footnote 50, p. 14.

131 Articles 10 and 32.1 of the SCM Agreement. See Brazil — Desiccated Coconut, supra, footnote 50, p. 16.

132 Supra, footnote 73.

133 Appellate Body Report, WT/DS121/AB/R, adopted 12 January 2000.

134 Ibid., para. 82.

135 We note, however, that under Article 1. l(a)(2) of the SCM Agreement, a “subsidy” may exist if “there is any form of income or price support in the sense of Article XVI of GATT 1994”. This is a reference to Article XVI: 1 and not Article XVI:4 of the GATT 1994. Footnote 1 of the SCM Agreement, which is attached to Article 1.1 (a)(1)(ii) of that Agreement, also makes reference to Article XVI of the GATT 1994 in connection with “the exemption of an exported product from duties or taxes borne by like products destined for domestic consumption … ”. This is a reference to the Interpretative Note Ad Article XVI of the GATT and is not a specific reference to Article XVI:4 of the GATT 1994. This reference to the Interpretative Note also has no relevance to this dispute. These references do not, therefore, provide us with guidance in determining the relationship between the export subsidy provisions of the SCM Agreement and Article XVL4 of the GATT 1994.

136 Brazil — Desiccated Coconut, supra, footnote 50, p. 17.

137 Panel Report, para. 7.85.

138 Panel Report, para. 7.146.

139 Ibid,

140 Ibid.

141 Panel Report, para.7.155.

142 Ibid., para.7.156.

143 Ibid., paras.7.156 and 7.159.

144 Ibid., para. 7.165.

145 Ibid., paras. 7.174-7.176.

146 United States’ appellant's submission, para. 309.

147 Panel Report, para. 7.154, citing Webster's Third International Dictionary, Vol. II.

148 The New Shorter Oxford English Dictionary, Brown, Lesley (ed.) (Clarendon Press, 1993), Vol. I, p. 1700.Google Scholar

149 Canada — Aircraft, supra, footnote 58, para. 153.

150 See Panel Report, para. 7.155.

151 Appellate Body Report, Canada — Measures Affecting the Importation of Milk and the Exportation of Dairy Products (“Canada — Milk“), WT/DS103/AB/R, WT/DS113/AB/R, adopted 27 October 1999, para. 87.

152 Ibid.

153 Canada — Milk, supra, footnote 151, para. 112. In reaching this conclusion, we observed that, under Article l(c) of the Agreement on Agriculture, the terms “budgetary outlays” and “outlays” may include “ revenue foregone”.

154 Panel Report, para. 7.103.

155 See, further, Canada —Aircraft, supra, footnote 58, paras. 162-180.

156 Panel Report, para. 7.108.

157 The New Shorter Oxford English Dictionary, supra, footnote 148, p. 452.

158 The term “reduction commitments” also appears in the chapeau to Article 9.1.

159 Article 9.2(b)(iv) provides that, with respect to scheduled products, the budgetary outlay and quantity commitment levels must, by the end of the implementation period, not exceed certain threshold levels, expressed as a percentage of the 1986-1990 base period levels.

160 The New Shorter Oxford English Dictionary, supra, footnote 148, Vol. I, p. 406.

161 Panel Report, para. 7.1.

162 Ibid., para. 7.6.

163 Ibid., para. 7.7.

164 Ibid., para. 7.10.

165 WT/DS108/1, 28 November 1997.

166 Guatemala — Cement, supra, footnote 55, para. 65.

167 Consultations were held on 17 December 1997,10 February 1998, and 3 April 1998 (Panel Report, para. 1.3).

168 Panel Report, para. 7.10.

169 Ibid.

170 The first request for establishment of a panel was on the agenda of the DSB at the meeting held on 23 July 1998 (WT/DSB/M/47). The panel was established at the DSB meeting held on 22 September 1998 (WT/DSB/M/48).

171 Panel Report, p. 5, footnote 19.

172 United States — Shrimp, supra, footnote 99, para. 158. In that report, we addressed the issue of good faith in the context of the chapeau of Article XX of the GATT 1994.

173 Panel Report, para. 7.18.

174 Ibid., para. 7.22.

175 United States’ appellant's submission, para. 389.

176 Ibid., para. 391.

177 Ibid., para. 400.

178 Ibid., para. 389.

179 Panel Report, para. 7.127.

180 See Section IX of this Report, infra.

181 Panel Report, para. 7.127.

182 European Communities’ other appellant's submission, para.62.

183 Panel Report, para. 7.132.

184 European Communities’ other appellant's submission, para.62.