No CrossRef data available.

Article contents

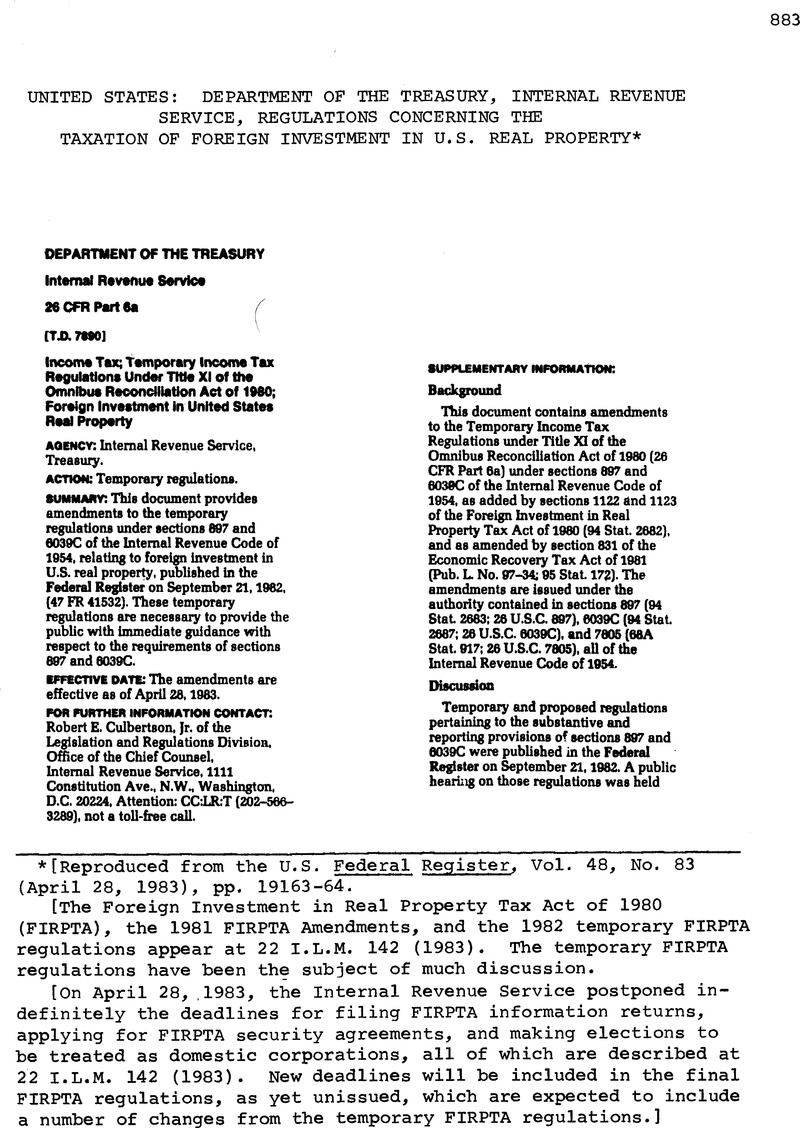

United States: Department of the Treasury, Internal Revenue Service, Regulations Concerning the Taxation of Foreign Investment in U.S. Real property*

Published online by Cambridge University Press: 04 April 2017

Abstract

- Type

- Legislation and Regulations

- Information

- Copyright

- Copyright © American Society of International Law 1983

Footnotes

[Reproduced from the U.S. Federal Register, Vol. 48, No. 83 (April 28, 1983), pp. 19163-64.

[The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), the 1981 FIRPTA Amendments, and the 1982 temporary FIRPTA regulations appear at 22 I.L.M. 142 (1983). The temporary FIRPTA regulations have been the subject of much discussion.

[On April 28, ,1983, the Internal Revenue Service postponed indefinitely the deadlines for filing FIRPTA information returns, applying for FIRPTA security agreements, and making elections to be treated as domestic corporations, all of which are described at 22 I.L.M. 142 (1983). New deadlines will be included in the final FIRPTA regulations, as yet unissued, which are expected to include a number of changes from the temporary FIRPTA regulations.]

References

* [Reproduced from the U.S. Federal Register, Vol. 48, No. 83 (April 28, 1983), pp. 19163-64.

[The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), the 1981 FIRPTA Amendments, and the 1982 temporary FIRPTA regulations appear at 22 I.L.M. 142 (1983). The temporary FIRPTA regulations have been the subject of much discussion.

[On April 28, ,1983, the Internal Revenue Service postponed indefinitely the deadlines for filing FIRPTA information returns, applying for FIRPTA security agreements, and making elections to be treated as domestic corporations, all of which are described at 22 I.L.M. 142 (1983). New deadlines will be included in the final FIRPTA regulations, as yet unissued, which are expected to include a number of changes from the temporary FIRPTA regulations.]