No CrossRef data available.

Article contents

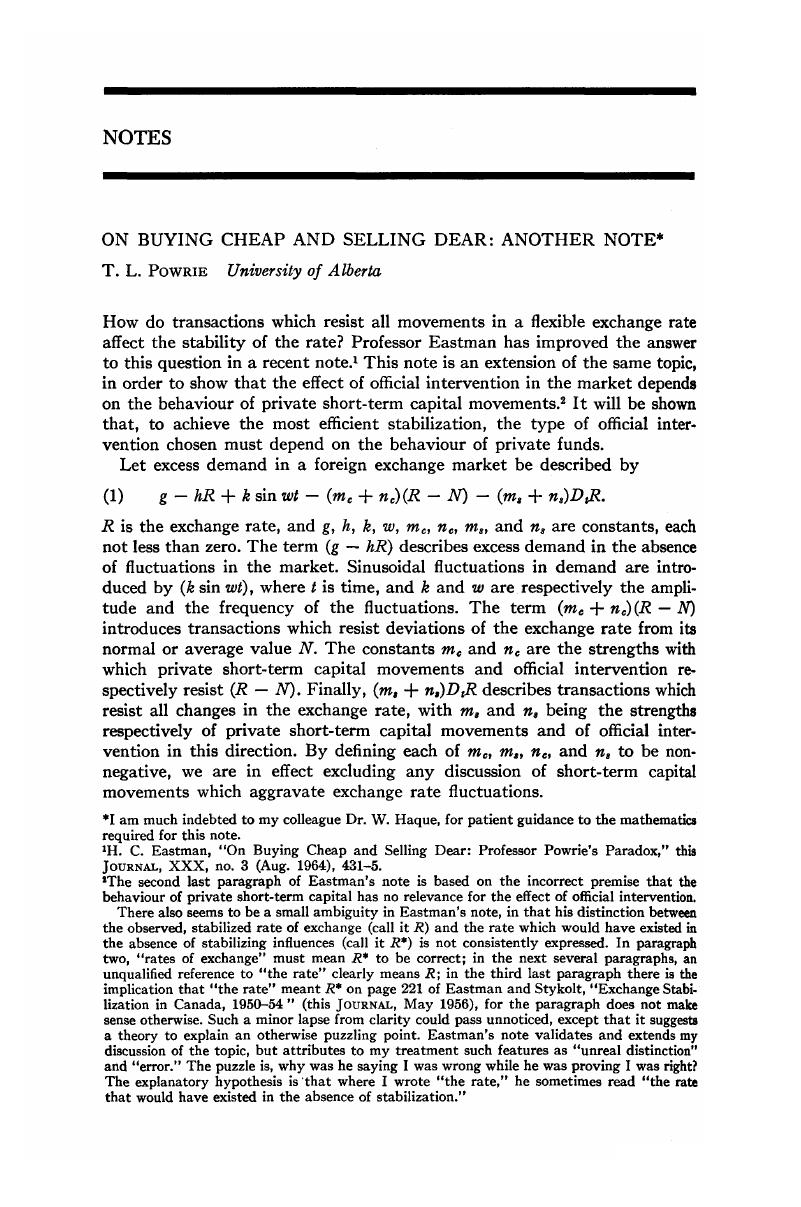

On Buying Cheap and Selling Dear: Another Note*

Published online by Cambridge University Press: 07 November 2014

Abstract

- Type

- Notes

- Information

- Canadian Journal of Economics and Political Science/Revue canadienne de economiques et science politique , Volume 31 , Issue 4 , November 1965 , pp. 566 - 570

- Copyright

- Copyright © Canadian Political Science Association 1965

Footnotes

I am much indebted to my colleague Dr. W. Haque, for patient guidance to the mathematics required for this note.

References

1 Eastman, H. C., “On Buying Cheap and Selling Dear: Professor Powrie's Paradox,” this Journal, XXX, no. 3 (08 1964), 431–5.Google Scholar

2 The second last paragraph of Eastman's note is based on the incorrect premise that the behaviour of private short-term capital has no relevance for the effect of official intervention.

There also seems to be a small ambiguity in Eastman's note, in that his distinction between the observed, stabilized rate of exchange (call it R) and the rate which would have existed in the absence of stabilizing influences (call it R*) is not consistently expressed. In paragraph two, “rates of exchange” must mean R* to be correct; in the next several paragraphs, an unqualified reference to “the rate” clearly means R; in the third last paragraph there is the implication that “the rate” meant R* on page 221 of Eastman, and Stykolt, , “Exchange Stabilization in Canada, 1950–54 “ (this Journal, 05 1956)Google Scholar, for the paragraph does not make sense otherwise. Such a minor lapse from clarity could pass unnoticed, except that it suggests a theory to explain an otherwise puzzling point. Eastman's note validates and extends my discussion of the topic, but attributes to my treatment such features as “unreal distinction” and “error.” The puzzle is, why was he saying I was wrong while he was proving I was right? The explanatory hypothesis is that where I wrote “the rate,” he sometimes read “the rate that would have existed in the absence of stabilization.”

3 “On Buying Cheap and Selling Dear,” 434.