No CrossRef data available.

Article contents

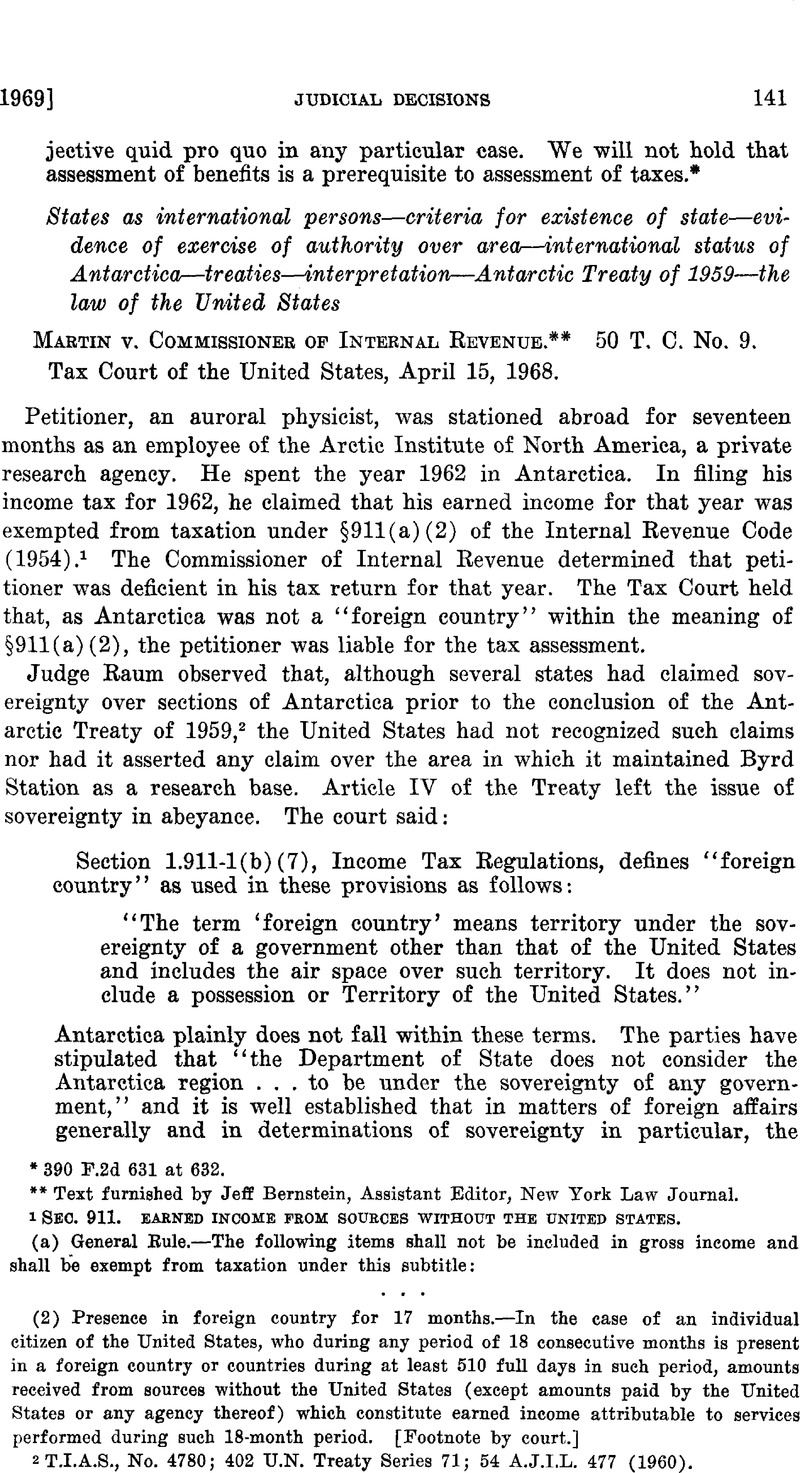

Martin v. Commissioner of Internal Revenue

Published online by Cambridge University Press: 28 March 2017

Abstract

- Type

- Judicial Decisions

- Information

- Copyright

- Copyright © The American Society of International Law 1969

References

1 SEC. 911. Earned Income From Sources Without The United States. (a) General Eule.—The following items shall not be included in gross income and shall be exempt from taxation under this subtitle: (b) Presence in foreign country for 17 months.—In the case of an individual citizen of the United States, who during any period of 18 consecutive months is present in a foreign country or countries during at least 510 full days in such period, amounts received from sources without the United States (except amounts paid by the United States or any agency thereof) which constitute earned income attributable to services performed during such 18-month period. [Footnote by court.]

2 T.I.A.S., No. 4780; 402 U.N. Treaty Series 71; 54 A.J.I.L. 477 (1960).

* 50 T.C. No. 9, pp. 5-6.