No CrossRef data available.

Article contents

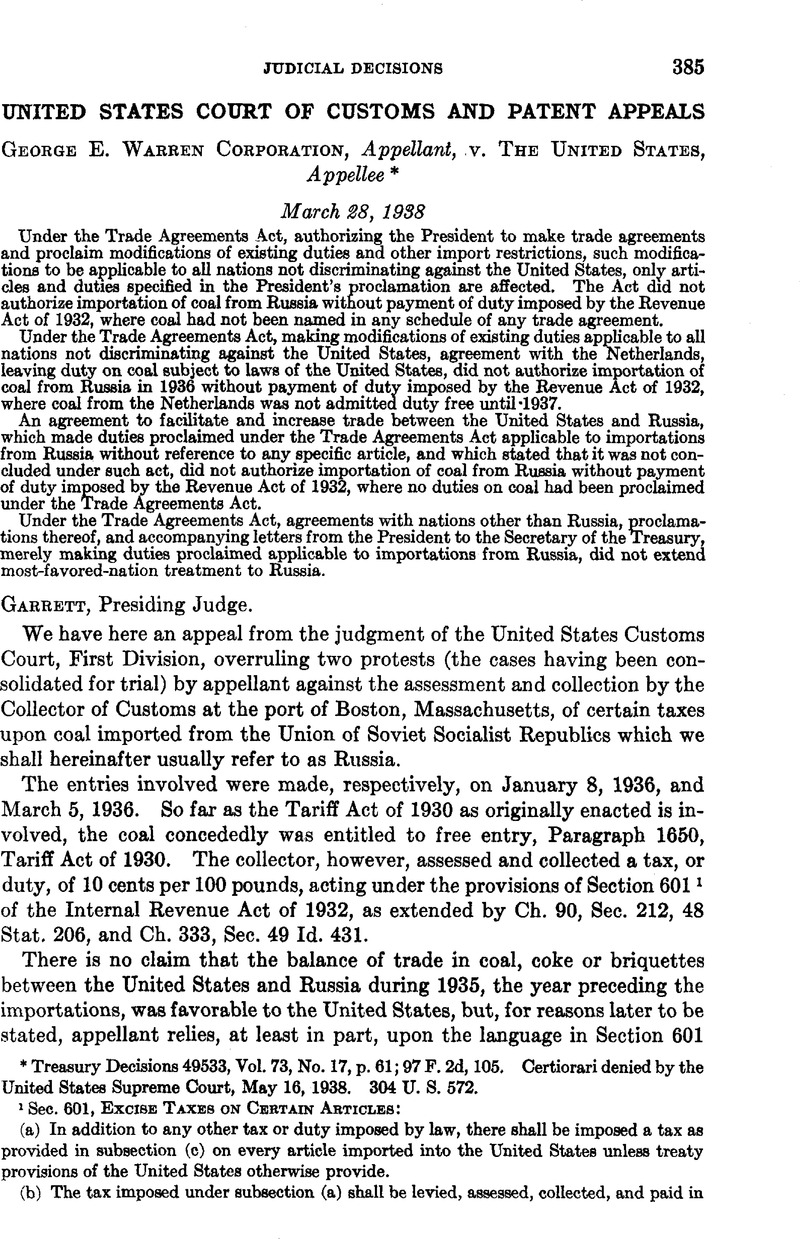

George E. Warren Corporation, Appellant, v. The United States, Appelle*

Published online by Cambridge University Press: 12 April 2017

Abstract

- Type

- Judicial Decisions

- Information

- Copyright

- Copyright © The American Society of International Law 1939

Footnotes

Treasury Decisions 49533, Vol. 73, No. 17, p. 61; 97 F. 2d, 105. Certiorari denied by the United States Supreme Court, May 16, 1938. 304 U. S. 572.

References

1 Sec. 601, Excise Taxes on Certain Articles:

(a) In addition to any other tax or duty imposed by law, there shall be imposed a tax as provided in subsection (e) on every article imported into the United States unless treaty provisions of the United States otherwise provide.

(b) The tax imposed under subsection (a) shall be levied, assessed, collected, and paid in the same manner as a duty imposed by the Tariff Act of 1930, and shall be treated for the purposes of all provisions of law relating to the customs revenue as a duty imposed by such Act, except that—

. . . . .

(c) There is hereby imposed upon the following articles . . . imported into the United States, a tax at the rates hereinafter set forth . . .

(5) Coal of all sizes, grades, and classifications (except culm and duff), coke manufactured therefrom; and coal or coke briquettes, 10 cents per 100 pounds. The tax on the articles described in this paragraph shall apply only with respect to the importation of such articles, and shall not be imposed upon any such article if during the preceding calendar year the exports of the articles described in this paragraph from the United States to the country from which such article is imported have been greater in quantity than the imports into the United States from such country of the articles described in this paragraph.

2 The here pertinent portions of the Act of June 12, 1934, read:

Part III—Promotion of Foreign Trade

Sec. 350. (a) For the purpose of expanding foreign markets for the products of the United States (as a means of assisting in the present emergency in restoring the American standard of living, in overcoming domestic unemployment and the present economic depression, in increasing the purchasing power of the American public, and in establishing and maintaining a better relationship among various branches of American agriculture, industry, mining, and commerce) by regulating the admission of foreign goods into the United States in accordance with the characteristics and needs of various branches of American production so that foreign markets will be made available to those branches of American production which require and are capable of developing such outlets by affording corresponding market opportunities for foreign products in the United States, the President, whenever he finds as a fact that any existing duties or other import restrictions of the United States or any foreign country are unduly burdening and restricting the foreign trade of the United States and that the purpose above declared will be promoted by the means hereinafter specified, is authorized from time to time—

(1) To enter into foreign trade agreements with foreign governments or instrumentalities thereof; and

(2) To proclaim such modifications of existing duties and other import restrictions, or such additional import restrictions, or such continuance, and for such minimum periods, of existing customs or excise treatment of any article covered by foreign trade agreements, as are required or appropriate to carry out any foreign trade agreement that the President has entered into hereunder. No proclamation shall be made increasing or decreasing by more than 50 per centum-any existing rate of duty or transferring any article between the dutiable and free lists. The proclaimed duties and other import restrictions shall apply to articles the growth, produce, or manufacture of all foreign countries, whether imported directly or indirectly: Provided, That the President may suspend the application to articles the growth, produce, or manufacture of any country because of its discriminatory treatment of American commerce or because of other acts or policies which in his opinion tend to defeat the purposes set forth in this section; and the proclaimed duties and other import restrictions shall be in effect from and after such time as is specified in the proclamation. The President may at any time terminate any such proclamation in whole or in part.

(b) Nothing in this section shall be construed to prevent the application, with respect to rates of duty established under this section pursuant to agreements with countries other than Cuba, of the provisions of the treaty of commercial reciprocity concluded between the United States and the Republic of Cuba on December 11, 1902, or to preclude giving effect to an exclusive agreement with Cuba concluded under this section, modifying the existing preferential customs treatment of any article the growth, produce, or manufacture of Cuba: Provided, That the duties payable on such an article shall in no case be increased or decreased by more than 50 per centum of the duties now payable thereon.

(c) As used in this section, the term “duties and other import restrictions” includes (1) rate and form of import duties and classification of articles, and (2) limitations, prohibitions, charges, and exactions other than duties, imposed on importation or imposed for the regulation of imports.

* This Journal, Vol. 30 (1936), p. 142.

† Ibid., p. 730.