16.1 Introduction

Small island states tend to frame global climate change action in terms of climate justice and environmental stewardship. In fossil fuel–producing developing states, debates about fossil fuel subsidies also include redistributive justice frames, for instance, that the population has a normative right to cheap energy. The question is, how are these contradictory frames reflected in countries that are simultaneously small island developing states and fossil fuel producers, and do other frames also feature in their debate on fossil fuel subsidy reform?

This chapter examines how fossil fuel subsidies and their reform have been addressed in Trinidad and Tobago, a petroleum producer and small island developing state. It puts forward an analytical framework of actors, frames and contexts that have been central to the global and local subsidy reform debate. The chapter uses this framework to understand the particular context of a small island state that is heavily dependent on hydrocarbon exports for its socio-economic development and that has had entrenched producer and consumer subsidies (in the electricity and transport sectors) since the 1970s. The chapter illustrates how different actors use different frames (e.g. environmental stewardship, economic prudence, climate and energy justice) in the subsidy reform debate and how historical and economic contexts are relevant to the reform process.

16.2 The Nature of Fossil Fuel Subsidies in Trinidad and Tobago

Caribbean small island developing states share a history of colonial exploitation (Baptiste and Rhiney Reference Baptiste and Rhiney2016), with a peripheral economic development model that kept an entrenched dependence on colonial powers even after independence. Caribbean island states have many of the vulnerabilities of small island developing states that make their survival a remarkable challenge (Fry Reference Fry2005; Mertz et al. Reference Mertz, Halsnæs and Olesen2009): small size and populations, limited resources, economies that are vulnerable to external economic shocks and dependent on tourism and primary production, especially agriculture, limited resilience to climate change, high levels of migration and limited commercial prospects due to their small scale and geographical position. Having suffered marginalisation and exploitation at the hands of industrial powers during colonialism, the region now suffers the deleterious effects of industrialisation through climate change impacts (Baptiste and Rhiney Reference Baptiste and Rhiney2016; Popke et al. Reference Popke, Curtis and Gamble2016). This includes extreme climatic events, such as floods, hurricanes and drought (Palanisamy et al. Reference Palanisamy, Becker and Meyssignac2012; Trotz and Lindo, Reference Trotz and Lindo2013), that come with adaptation and mitigation burdens (Rhiney Reference Rhiney2015).

Trinidad and Tobago has since 1857 used its petroleum industry as a pathway to social and economic development. Its undiversified economy is heavily dependent on hydrocarbon exports (i.e. petroleum, petroleum products and natural gas; IMF 2016). Since 1990, the hydrocarbons sector changed from being based on oil to mainly natural gas recovery, processing, downstream industries and export; it also has one of the largest liquefied natural gas processing plants in the world (GORTT 2017b). It has a population of about 1.3 million and a human development index of 0.772, which in 2014 placed it as sixty-fourth in the world and seventh in the Americas and the Caribbean (UNDP 2016). The country ranked sixteenth in the world in natural gas exports in 2014, with approximately 17.4 billion cubic meters of gas exported (CIA 2017). It has one of the highest per capita emissions in the world largely because of the size of its hydrocarbons industry compared to its small population. Together with all small island developing states, Trinidad and Tobago contributes to less than 1 per cent of global carbon emissions. However, the country is faced with the climate justice dilemmas of all small island developing states: delivering cheap fuel to its low-income groups and globally uncompetitive small business sector while also considering the environmental responsibilities of reducing emissions. The country’s petroleum output fell progressively after 2015, and fiscal accounts have been negatively affected by falling energy prices (IMF 2016). The national debate on the need to reduce or remove the fuel subsidy began in the 1990s, driven by falling global petroleum prices; the subsequent falling revenues made it difficult for the government to finance this social transfer.

Trinidad and Tobago has producer and consumer fuel subsidies for the hydrocarbon industry. Producer subsidies include fiscal investment incentives to exploit hydrocarbons and produce petrochemical products, written into production-sharing contracts between the government and large foreign (mainly multinational) companies. Far from removing these incentives, the industry’s argument is that the government’s incentives should continue or increase because the sector is now facing diminishing returns – i.e. reserves have fallen, and exploration for unexploited wells in deeper territorial waters is costlier and riskier than the near-shore wells drilled thus far. The incentives include preferential loans, royalty exemptions, depreciation allowances, tax credits, infrastructure allowances and support, research funding and exemptions from import duties on plant and machinery (Iwaro and Mwasha Reference Iwaro and Mwasha2010). Consumer subsidies include pre-tax vehicle fuel subsidies for public, commercial and industrial transportation; prices at the pump are fixed by the state and include the refinery price, excise duty, wholesale margin, retail margin, value-added tax, road improvement tax and the subsidy. The country also provides pre-tax electricity subsidies to domestic, commercial and industrial users. Negligible electricity production comes from renewables despite the government’s policy to provide incentives for the use of wind and solar power.

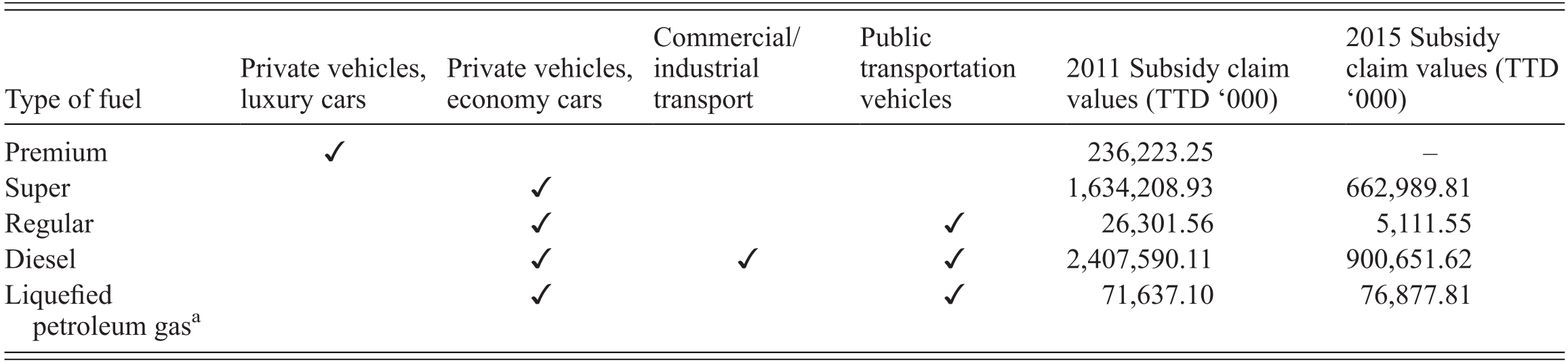

Most of the national fuel subsidy reform debate centres on the removal of transport fuel subsidies, for which disaggregated data are available (Imbert Reference Imbert2016c; Imbert and Khan Reference Imbert and Khan2016; Imbert and Raffoul Reference Imbert and Raffoul2017). Table 16.1 shows the main uses for transport fuels and how the subsidy has changed between 2011 and 2015.

| Type of fuel | Private vehicles, luxury cars | Private vehicles, economy cars | Commercial/industrial transport | Public transportation vehicles | 2011 Subsidy claim values (TTD ‘000) | 2015 Subsidy claim values (TTD ‘000) |

|---|---|---|---|---|---|---|

| Premium | ✓ | 236,223.25 | – | |||

| Super | ✓ | 1,634,208.93 | 662,989.81 | |||

| Regular | ✓ | ✓ | 26,301.56 | 5,111.55 | ||

| Diesel | ✓ | ✓ | ✓ | 2,407,590.11 | 900,651.62 | |

| Liquefied petroleum gasa | ✓ | ✓ | 71,637.10 | 76,877.81 |

a High incidence of use for domestic and commercial cooking.

Pre-tax fuel subsidies for 2006–15 were on average 2 per cent of gross domestic product annually (TTD 31 billion, or about USD 4.6 billion) and strongly correlated to global crude prices (IMF 2016). Lower petroleum prices reduce the subsidy, but this also means that the government has less revenue to finance the subsidy and other social transfers. The transport subsidy disproportionately benefits higher-income groups; in 2014, the average monthly subsidy for the wealthiest households was 95 per cent higher than for low-income households (IMF 2016). In 2016, the drastic fall in national income gave impetus to reform arguments and paved the way for the removal of fuels subsidies for private transport vehicles and a reduction of fuel subsidies for public transportation and cargo vehicles. The country has almost universal electricity coverage; in 2012, 99.8 per cent of the population had access to electricity (World Bank 2016). The state-owned Trinidad and Tobago Electricity Company sells 27 per cent of the electricity it produces to residential clients, 57 per cent to industrial clients and 8 per cent to commercial customers. The subsidised electricity prices are the lowest among Caribbean small island developing states and globally competitive compared to electricity rates of about USD 0.10 per kilowatt hour (kWh) for the United States and USD 0.21 per kWh for Italy (which has one of the highest electricity rates in the world; Marzolf et al. Reference Marzolf, Fernando Casado and Johanna2015). Electricity subsidies disproportionately benefit higher-income groups and local industries that consume more energy and pay lower rates. Residential users pay a maximum of USD 0.06 (TTD 0.37) per kWh, commercial users pay between USD 0.06 and 0.09 (TTD 0.41 and 0.61) per kWh based on a minimum monthly use of 5,000 kWh, and industrial users pay between USD 0.02 and 0.03 (TTD 0.1450 and 0.1990) per kWh (TTEC 2001). In 2017, the government proposed a further 25 per cent rebate on domestic users (about 120,000 households) whose bill is below USD 50 (Imbert Reference Imbert2016b).

16.3 Understanding the Dynamics of Fossil Fuel Subsidy Reform: Actors, Frames and Contexts

This section explains the framework that will be used to illustrate the dynamics behind fossil fuel subsidy reform in Trinidad and Tobago: the role of actors with different interests in shaping policy, the ways in which the debates for and against the subsidy have been framed and the prevailing contexts (macroeconomic and local) that can determine the reform trajectory (see also Chapter 1).

16.3.1 Actors

Multiple actors influence subsidy reform agendas. The group advocating for subsidy reform usually includes international development agencies (Lockwood Reference Lockwood2015), multilateral financial institutions and environmental groups. Traditionally, the group of actors that have championed its maintenance has included labour and elite interest groups and energy-intensive industries (de Moor Reference de Moor2001; van Beers and de Moor Reference de Moor2001; Lockwood Reference Lockwood2015). Politicians, especially in developing states, tend to shape policy based on which group of actors has a greater sway on public opinion (Lockwood Reference Lockwood2015), except – as we will see later – when it is financially impossible to maintain the subsidy. In developing states, especially where information on the real cost and economic inefficiency of the subsidy is not readily available, politicians are able to use subsidies to gain or keep political patronage with the poor population. In spite of the inefficiency of subsidies, powerful groups were mobilised to strike and stage social disturbances during recent attempts in Nigeria in 2012, Indonesia in 2013 (see Chapter 11) and Yemen in 2014 to reduce fuel subsidies and use the savings for improved social services (Lockwood Reference Lockwood2015).

16.3.2 Frames

Arguments for and against fuel subsidy reform have been framed in different ways, with actors employing frames related to (1) climate as well as energy redistributive justice, (2) environmental stewardship and (3) economic prudence. Subsidies may be a (contested) way to redistribute national wealth in energy-producing states (climate and energy redistributive justice) or a fillip to environmental pollution (environmental stewardship). They can also contribute to fiscal imbalances and economic inefficiency and irresponsibility in the case of consumer subsidies (economic prudence); in the case of producer subsidies for the hydrocarbons industry, subsidies may help buttress falling government revenues (economic prudence).

‘Climate justice’ refers to the burden-sharing arrangement for climate change impacts and mitigation actions among states, non-state actors and individuals within both wealthy and poor states (Okereke Reference Okereke2010; Barrett Reference Barrett2013; Baptiste and Rhiney Reference Baptiste and Rhiney2016). It draws from political philosophy on fairness (Rawls Reference Rawls2005) in the distribution of resources and responsibilities, rights and obligations for mitigation and adaptation (Caney Reference Caney2010). ‘Energy redistributive justice’ concerns energy access and affordability and applies ethical and justice arguments to the fields of energy policy (McCauley et al. Reference McCauley, Heffron, Stephan and Jenkins2013), energy use and energy production (Sovacool and Dworkin Reference Sovacool and Dworkin2015). Rising energy prices have a larger impact on the poor, who have less disposable income (Boardman Reference Boardman2010) and are less able to challenge energy policy related to mitigation measures (such as measures that make fossil fuels more expensive to reduce the demand for them). Poorer countries need low-cost energy resources for economic development. Energy justice may be qualified by climate justice duties that are everyone’s responsibility: negative duties correspond to polluters, and positive duties apply to all capable of contributing to reducing emissions (Duus-Otterström and Jagers Reference Duus-Otterström and Jagers2012). The greenhouse development rights model, for example, may be interpreted as warranting the poor to adopt a part, albeit proportionately minimal, of the burden of higher energy costs that come with the removal of fuel subsidies. In that model, in 2030, least developed countries would have a 1.2 per cent ‘responsibility capacity’ (the measure used for burden sharing) to reduce emissions compared to 25 per cent for the United States (Baer et al. Reference Baer, Athanasiou, Kartha and Kemp-Benedict2008). Thus, energy and climate justice frames can be used to argue both for and against fossil fuel subsidy reform.

Those in favour of keeping fossil fuel subsidies have also used energy redistributive justice frames. Most members of the Organization of the Petroleum Exporting Countries (Hochman and Zilberman Reference Hochman and Zilberman2015) appeal to justice. This is particularly powerful when there is little public confidence in the government’s ability to transfer savings from subsidy removal to other social programmes. Lower energy prices contribute to lower transport and food prices (Soile et al. Reference Soile, Tsaku and Yar’Adua2014). Energy subsidies, according to this frame, allow citizens to their entitlement – i.e. citizens (including the poor) own the resource (Whitley Reference Whitley2013). Fuel and electricity subsidies, according to this argument, may also help boost export competitiveness by contributing to lower production costs for small manufacturers (who are disadvantaged by a lack of economies of scale and distance from global markets). Removing subsidies is unappealing to the poor because the short- to medium-term distributional effects of the removal are harder on low-income groups, at least when remedial measures are not adopted (Mathur and Morris Reference Mathur and Morris2014; Siddig et al. Reference Siddig, Aguiar and Grethe2014; Jiang et al. Reference Jiang, Ouyang and Huang2015).

Small island developing states contribute minimally to carbon emissions (World Bank 2017), but from the perspective of climate justice, and acknowledging the principle of common but differentiated mitigation responsibilities under the United Nations Framework Convention on Climate Change, they should also be environmental stewards and avoid fuel subsidies where possible. From the environmental stewardship perspective, fuel subsidies are environmentally harmful: they contribute to global warming, local pollution, traffic congestion and road accidents and damage (see Chapters 3 and 8).

From an economic prudence perspective, fuel subsidies are suboptimal: they reduce economic growth by artificially supporting inefficient national production and have a negative impact on national welfare and the economy (Arzaghi and Squalli Reference Arzaghi and Squalli2015). Specifically, fuel subsidies are inefficient wealth-transfer mechanisms (Saboohi Reference Saboohi2001; Dube Reference Dube2003) because the wealthy use more high-energy-consuming goods and benefit most from direct fuel subsidies (Gangopadhyaya et al. Reference Gangopadhyaya, Ramaswamia and Wadhwaa2005; Arze del Granado and Coady Reference Arze del Granado and Coady2012; Rao Reference Rao2012). Savings from removing subsidies – redirected, for example, to health and education programmes – and direct transfers to targeted groups are more efficient ways to distribute national energy wealth (Commander Reference Commander2012).

International development agencies that provide financial and technical assistance to developing states commonly exert pressure and use narratives for reform within frames of economic prudence and environmental stewardship: subsidies are inefficient social transfer mechanisms, and energy subsidies encourage overuse and increase emissions.

16.3.3 Contexts

The third part of the framework addresses contexts. For many energy-producing developing states, energy subsidies have been simple – with visible administrative mechanisms to transfer the state’s resources to the poor (Victor Reference Victor2009) – and easily justifiable to voters (Cheon et al. Reference Cheon, Lackner and Urpelainen2015). However, they tend to be non-transparent (Koplow and Dernbach Reference Koplow and Dernbach2001). Reform advocates recommend several measures, including

Public and stakeholder consultations for hydrocarbon or energy sector reform (Commander Reference Commander2012);

Clear communication of the nature and benefits of the subsidy removal (Jakob et al. Reference Jakob, Chen and Fuss2015);

Substituting targeted support to the poor, including direct and indirect transfers (AlShehabi Reference AlShehabi2012; Yates Reference Yates2014);

Steps to transparently channel savings into improved infrastructure, health and education (Plante Reference Plante2014; Siddig et al. Reference Siddig, Aguiar and Grethe2014; Jiang et al. Reference Jiang, Ouyang and Huang2015); and

Institutional reforms in the hydrocarbons sector to remove political influence over energy pricing (Gangopadhyaya et al. Reference Gangopadhyaya, Ramaswamia and Wadhwaa2005).

Successful reform, however, often depends on national contexts, including the administrative capacity to channel savings towards targeted social assistance, the availability of timely and accurate economic data on the cost of the subsidy and potential savings (IMF 2013), the power of an antireform lobby to block or hinder reform, the availability or attractiveness of substitutes for the subsidy, the level of trust and buy-in that the government has from the population to transfer savings to more efficient social programmes (Vagliasindi Reference Vagliasindi2013), the force of external macroeconomic pressures to reduce government disposable income and the health of the economy and its ability to sustain subsidies. In developing states, contexts are often less favourable, and reform may pose administrative burdens for poorer governments.

16.4 Actors, Frames and Contexts in Fuel Subsidy Reform in Trinidad and Tobago

16.4.1 Actors

Following the framework just outlined, this section identifies the main actors involved in the subsidy reform debate in Trinidad and Tobago and their positions on the issue. These actors include the International Monetary Fund (IMF) (IMF 2016), the Energy Chamber – the energy and hydrocarbon industry’s trade association, which is particularly vocal on consumer subsidies (Long Reference Long2013), the environmental lobby, including academics and economists that comment on government policy, government agencies more directly involved in climate policymaking, such as the Ministry of Planning and Development and the Ministry of the Environment and Water Resources (Solaun et al. Reference Solaun, Gómez and Larrea2015; GORTT 2017a) and companies from the other member states of the Caribbean Community Common Market (Khelawan Reference Khelawan2013; Collister Reference Collister2016).

Other actors have, at times, been opposed to the removal of the transport subsidy, including some labour unions such as the National Workers Union and the Federation of Independent Trade Unions and Non-Governmental Organisations (C News 2016; NWU 2016), minibus associations (Phillip Reference Phillip2016) and groups representing low-income communities (Sturge Reference Sturge2016; Taitt Reference Taitt2016). The manufacturing sector comprises about 400 companies and contributes to approximately 8 per cent of the country’s gross domestic product (TTMA 2017). Small retail businesses and manufacturers and sub-national chambers of commerce – which are less able to absorb higher transport costs – argue that removing the subsidy will mean higher prices for consumers and inflationary pressure on the economy (Ali Reference Ali2016). Larger manufacturers have more recently begun to argue for removal of the subsidy, citing its inefficiency, negative environmental consequences and unsustainability (referring to the drop in petroleum prices and consequent drop in government revenue from the hydrocarbons sector; Harrinanan Reference Harrinanan2015). Figure 16.1 presents the main actors in the subsidy removal debate in Trinidad and Tobago.

Figure 16.1 Actors in fuel subsidy reform in Trinidad and Tobago.

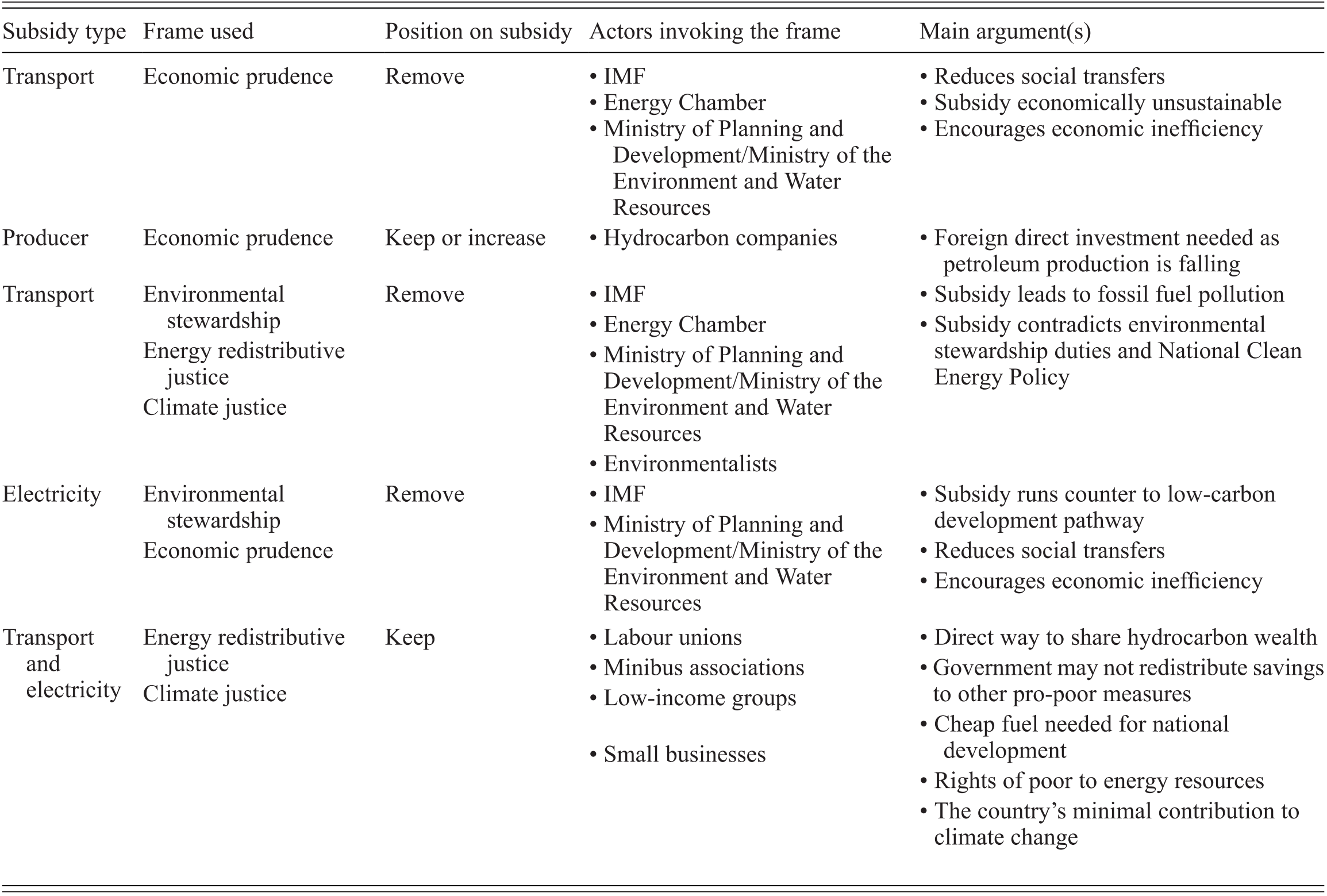

16.4.2 Frames

In Trinidad and Tobago, economic prudence and environmental stewardship frames are used to object to the transport and electricity subsidies. Actors in favour of those subsidies use climate and energy redistributive justice frames. Those in favour of the producer subsidy (the hydrocarbons sector) also use economic prudence frames. However, there is very little evidence of public debate on producer subsidies. Low-income groups focused more on the maintenance of social transfers related to health, education and employment, which are also being contested as inefficient and in need of reduction by the IMF, the larger manufacturers and the government.

The economic prudence frame dominates the fuel subsidy debate. Estimates in parliamentary debates put subsidies for fuel, unemployment relief, electricity and water at 50 per cent of national expenditure (Imbert Reference Imbert2016c). The fuel subsidy may have continued as long as the government was able to finance it, but the global financial crisis of 2007–8 gave greater prominence to economic prudence frames. In a 2016 budget debate, the Minister of Finance noted that the government is taking steps to reduce expenditure on other social programmes, including spending on tertiary education (the Government Assistance for Tuition Expenses Programme) and on job creation (the Community-Based Environmental Protection and Enhancement Programme and the Unemployment Relief Programme; Imbert, Reference Imbert2016b, 16). Past IMF Article IV consultations – in which the IMF’s staff study the country’s economic and fiscal policy and trajectory – repeatedly called for the removal of the transport subsidy to improve the fiscal climate and to increase savings to the country’s sovereign wealth fund, which was created to encourage state savings from petroleum revenues (IMF 2016). The political response has changed over the years from being wary of the IMF’s intrusion into domestic policy (Trinidad Guardian 2013) to a commitment to a phased removal of the transport subsidy. Subsidy removal will be coupled with a new pricing mechanism for transport fuels to reduce transport costs for low-income groups (Imbert Reference Imbert2016b).

National debates have very recently begun to introduce data on the subsidy’s cost that confirm its inefficient design (GORTT 2012a) and the opportunity costs to taxpayers (Scobie Reference Scobie2017). However, the lack of data on the inefficiencies gave the climate and energy redistributive justice frames greater appeal over the years. The country has a small carbon footprint and relies on its petrochemical sector; thus, some argue that fuel, electricity and transport prices should be very affordable to the poor, to local businesses and manufacturers (Trinidad Guardian 2011; Newsday 2016) and to the population in general (Thomas Reference Thomas2003; NWU 2016). Successive governments have deferred subsidy reform in part because of the prominence given to these redistributive justice frames in public opinion.

Actors who support keeping the transport subsidy have used energy redistributive justice and environmental stewardship frames. Private minibus associations – the main source of public transport – objected to early attempts to remove the fuel transport subsidy because removal would reduce their small profit margins. They argued that such a move would force them to increase fares, which would hurt the low-income groups that depend upon this public transport. In 2003, for example, in response to proposals to reduce the transport subsidy, two minibus associations covering important parts of the minibus network threatened to increase transit fares or refuse to offer their services (Thomas Reference Thomas2003). Labour unions representing low-wage earners have traditionally been hostile to the government’s reform policy, which in their view includes austerity measures that take national wealth away from the poor. The National Workers Union, for example, argued that ‘the government in an effort to keep us away from an IMF standby programme is implementing all the measures the IMF would have imposed. An IMF programme is being implemented even though no loans have been made by the IMF’ (NWU 2016). It also issued a statement in 2016 objecting to fuel subsidy reform, which it views as part of a larger move by the government to reduce pro-poor programmes, such as the ‘extending of [a value-added tax] on thousands of items, the increases in fuel prices, the job losses in the public sector, the reduction of social welfare programmes and the speeding up of divestment/privatisation of state enterprises’ (NWU 2016). Small businesses (mainly retailers) benefit from savings in transport and electricity costs.

On the other side of the debate, companies from other Caribbean states – as well as the regional airline Leeward Islands Air Transport (LIAT, which is not based in Trinidad and Tobago) – have been critical of the unfair advantage that the transport and electricity subsidies have given to companies from Trinidad and Tobago and to the Trinidad and Tobago airline (Caribbean Airways) on the regional common market (Collister Reference Collister2016). Opposition to subsidies from the regional business community has had little resonance in parliamentary debates and on reform policy (Scobie Reference Scobie2017).

The economic prudence frame that holds that the electricity subsidy creates an artificial sense of security and inefficiencies in production has traditionally had less resonance. Unlike transport fuels, electricity prices have not been adjusted since 2009, and the electricity subsidy received less attention in public debates. Environmental stewardship and economic prudence, however, are used in the literature around subsidy reform for transport fuels and electricity. The government’s carbon emissions reduction strategy proposed introducing renewables to reduce dependence on natural gas for electricity generation, but uptake has been slow because the fuel subsidy makes traditional electricity sources more economical (Humpert and Espinosa Reference Humpert and Espinosa2016: 11). Small businesses and manufacturers used climate and energy redistributive justice frames to argue that the electricity subsidy supports the local small business sector, given electricity generation’s small carbon footprint and the economic challenges and lack of economies of scale faced by small island developing state exporters. Local small businesses need government assistance to be competitive in an increasingly globalised world, to provide local jobs, to help the country’s diversification away from the dwindling hydrocarbons sector and to contribute to social and economic development.

The producer subsidy is firmly entrenched, and there is little national debate on its reform – its maintenance is part of the economic prudence frame employed by the hydrocarbon companies. This demonstrates that frames are used differently by different actors in different contexts. Economic prudence frames employed in the context of producer subsidies suggest that the country should provide incentives to industry to boost output and government revenue (IMF 2016: 7). The Energy Chamber supported the removal of the transport subsidy but was silent on production subsidy reform or removal. Generally, these transfers to the industry are not framed as subsidies but rather as incentives needed to keep the hydrocarbons sector and exports as near to current levels as possible. The hydrocarbon companies argue for a fiscal regime that would reduce exploration risk and encourage foreign direct investment; producer subsidies thus should remain, in their view, especially in the context of a hydrocarbon-dependent economy in an epoch of economic downturn. Trinidad and Tobago has over 40 active production-sharing contracts and joint-venture partnerships with several energy companies, including Petro-Canada, BHP Petroleum, BG and many others (Petrotrin 2015; Ministry of Energy and Energy Affairs 2017). Large multinational and local energy actors are now negotiating production-sharing contracts with attractive investment terms for riskier investments in new oil fields (Energy Chamber 2017). When the state-owned oil company – the Petroleum Company of Trinidad and Tobago Limited (Petrotrin) – released a call for expressions of interest in March 2017 to assist with enhanced oil and gas recovery, it received responses from 29 firms in China, Canada, the United Kingdom, the United States and Trinidad and Tobago (Energy Chamber 2017).

Voices against the petroleum subsidy have been negligible in comparison, with one Member of Parliament going on record to complain that the subsidy was unfair to the state. The energy industry, he argued, generated as much as TTD 150 billion but ‘the State was only receiving [TTD] 18 to [TTD] 19 billion in revenue, something was wrong with the system because somebody else (not the State) was getting [TTD] 132 billion’ (Small Reference Small2016: 30; Taitt Reference Taitt2016).

Climate justice and environmental stewardship frames have been used by the government and are embedded in the country’s low-carbon development policy. The environmental stewardship–related goal is to move towards a low-carbon development pathway by removing dependence on the hydrocarbons sector. Restructuring fuel subsidies (Solaun et al. Reference Solaun, Gómez and Larrea2015) is part of the government’s 2011 National Climate Change Policy, Low Carbon Development Plan and Carbon Reduction Strategy (GORTT 2012b). Resource and capacity constraints hinder the implementation of several climate policy initiatives in small island developing states (Scobie Reference Scobie2016). This is true for Trinidad and Tobago, which is struggling with the national Carbon Reduction Strategy target to reduce emissions from the power, industrial and transport sectors by 15 per cent by 2040 compared to 2000 levels – targets also included in the country’s nationally determined contribution submitted under the Paris Agreement (GORTT 2015). A recent report on renewables in Trinidad and Tobago noted that to achieve the stewardship goal, it needed to better incentivise the use of wind, solar and wave energy (Solaun et al. Reference Solaun, Gómez and Larrea2015). Table 16.2 summarises how the frames just discussed have been used by groups of actors to support positions on the reform/removal debate in Trinidad and Tobago.

Table 16.2 Actors and frames in fuel subsidy reform debates in Trinidad and Tobago

| Subsidy type | Frame used | Position on subsidy | Actors invoking the frame | Main argument(s) |

|---|---|---|---|---|

| Transport | Economic prudence | Remove |

|

|

| Producer | Economic prudence | Keep or increase |

|

|

| Transport | Environmental stewardship | Remove |

|

|

| Energy redistributive justice | ||||

| Climate justice | ||||

| Electricity | Environmental stewardship | Remove |

|

|

| Economic prudence | ||||

| Transport and electricity | Energy redistributive justice | Keep |

|

|

| Climate justice |

|

16.4.3 Contexts

While some actors have become more vocal in the use of economic prudence and environmental stewardship frames to advocate for subsidy removal – and although pro-subsidy advocates who appeal to climate and energy justice frames concede that fuel subsidies are not the most efficient form of pro-poor government spending – it does not follow that reform will be the next step (Scobie Reference Scobie2017; see also Chapter 6). Several of the contextual factors identified in the literature have made reforms more challenging and have favoured subsidy lock-in, such as the unavailability of timely and accurate economic data on the cost of the producer and consumer subsidies and potential savings, the power of the antireform lobby to influence government policy, the unavailability of appropriate substitutes for the subsidy and the low level of trust and buy-in that the government has had from the population to transfer savings to more efficient social programmes (Scobie Reference Scobie2017). However, other contextual factors have favoured the removal of the transport subsidy. Notably, external macroeconomic pressures (the global financial crisis of 2007 and the subsequent fall in petroleum prices) increased pressure to reduce inefficient government spending. Moreover, the dependence on the hydrocarbon sector for national income and the resulting falling government revenue reduced the state’s ability to sustain subsidies (IMF 2016).

The information deficit on subsidy costs can be seen as another contextual factor influencing the public debate. It reduced the persuasive power of economic prudence frames to lower-income groups and made energy redistributive justice arguments more appealing. Two recent developments may pave the way for a greater understanding of the true costs of the subsidy and may improve transparency. The first is a National Tripartite Advisory Council, created in March 2016 to improve transparency and promote regular consultation between the private sector, labour groups and the government. The second is the creation of an autonomous National Statistical Institute to reduce the backlogs in the state-owned Central Statistical Office. Both bodies have not yet addressed the fuel subsidy, but they have the potential to contribute to improved data availability for policymaking.

One of the elements of subsidy reform suggested in the literature is the substitution of inefficient fuel subsidies with targeted pro-poor transfers (AlShehabi Reference AlShehabi2012). In the Trinidad and Tobago context, this raises two problems. First, there is already a generous and comprehensive set of social programmes (Imbert Reference Imbert2016b: 32); the social safety net includes conditional cash-transfer programmes, housing-assistance programmes, infrastructure projects in needy communities and a suite of social services in the areas of health, alimentation, education, employment and sanitation (Imbert Reference Imbert2016b). Second, the system of transfers has been heavily criticised for being inefficient, with the employment programmes distorting and undermining the local labour market (IMF 2016) and programmes being subject to fraud and corruption (Imbert Reference Imbert2016c: 14). While it is true that subsidy removal savings may be redirected to improve the quality and delivery of existing social relief programmes, this is more difficult to measure, justify and support given the existing inefficiencies in public administration and the lack of public trust in the way public funds are administered in social programmes.

16.5 Conclusion

Fuel subsidies have been part of the economic policy of Trinidad and Tobago for decades. The hydrocarbons sector has always benefited from investment incentives, many of which amount to producer subsidies. Since the 1970s, transport fuels have been subsidised as a way to transfer national wealth from the petroleum sector to the population, and electricity has always been generated with autochthonous natural gas priced below market prices. While producer subsidies and electricity subsidies persist, the transport subsidy was substantially reduced over the last decade. This chapter outlined a novel framework to better understand the politics of subsidy reform, focusing on actors, frames and contexts as explanatory variables. Employing this framework, the chapter sought to provide insights into the subsidy reform debates in this small island hydrocarbon-dependent state.

External actors, including companies from other Caribbean countries and the IMF (which advised the government on economic policy) – as well as internal actors such as the Energy Chamber, the government ministries charged with climate policy and environmentalists – have for different reasons opposed the subsidy. The labour unions representing low-wage earners, minibus associations that service a large part of the public transport network, small businesses and the hydrocarbons sector have been more or less vocal advocates for the maintenance of the status quo for the transport, electricity or producer subsidies.

The frames developed in this chapter helped to coalesce the perspectives or motivations of actors or groups of actors on subsidy reform, removal or maintenance. To some extent, the frames used in the Trinidad and Tobago debate mirrored the (sometimes conflicting) frames found in the fossil fuel subsidy reform literature. Subsidies run counter to good economic policy, or subsidies are needed for economic development. Subsidies allow for redistributive energy justice, or subsidies are an ineffectual tool of redistributive energy justice. Subsidies run counter to climate justice – or climate justice explains their persistence in countries with minimal emissions, and subsidies thus detract from environmental stewardship.

This chapter explained that even with the same actors and the existence of similar frames, policy changed in the last decade. The removal of transport subsides was needed because of a changed international economic context (Imbert Reference Imbert2016a) – which is in keeping with the small states literature that recognises the relevance of global trends for domestic policymaking (Keohane Reference Keohane1969; Payne Reference Payne2004). In this case, the financial crisis of 2007 was accompanied by a fall in petroleum prices and thus a fall in government revenues, which opened up space to discuss the frames that promoted subsidy reform. The government no longer had levels of income that would allow for the subsidy’s continuance. Transport subsidies were largely removed, and reform of the electricity subsidy is being discussed, but the government has kept producer subsidies to promote investments that maintain or increase hydrocarbon output. Context was also relevant for the reform trajectory in other ways. While the literature recommends substituting the fossil fuel subsidy for other forms of wealth transfer, this was inappropriate in this case for two reasons: first, there was already a comprehensive social net, and second, social transfers were already badly managed, and there was little appetite to add another mechanism. Finally, the availability of data (transparency) was another relevant contextual factor. The transport subsidy – for which most information on government expenditure was available – was gradually removed. But the producer and electricity subsidies – for which information is not easily available – have not yet been removed or reduced. The case is a sobering example of how global frames are applied at local scales and of how local contexts, economic and historical realities and actors articulate these frames to shape domestic fuel subsidy policy.