Book contents

- Capital Controls and International Economic Law

- Cambridge International Trade and Economic Law

- Capital Controls and International Economic Law

- Copyright page

- Contents

- Foreword

- Preface

- Acknowledgements

- Abbreviations

- Part I Key Concepts: Capital Flows and Controls

- Part II The IMF, Capital Flows and Controls

- Part III Legal Frameworks, Rules and Conflicts

- Bibliography

- Index

- References

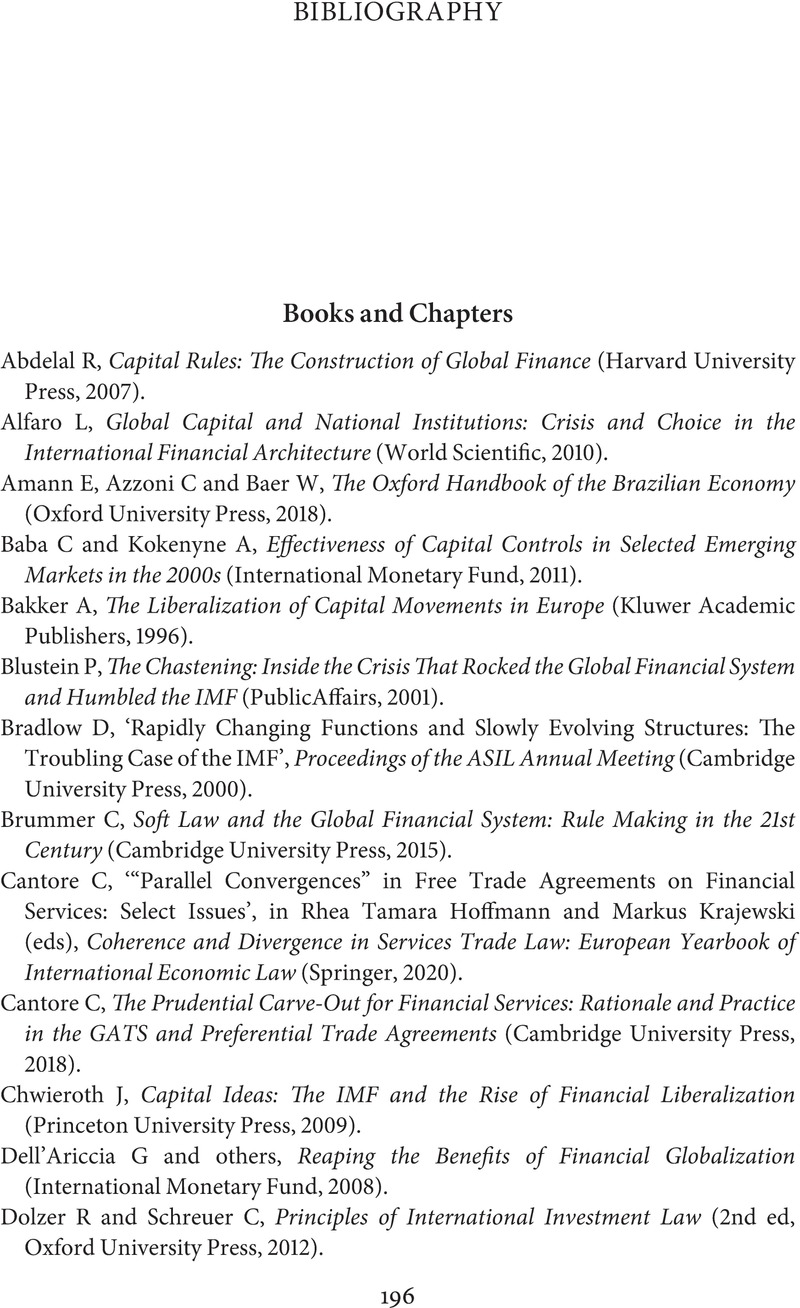

Bibliography

Published online by Cambridge University Press: 18 May 2023

- Capital Controls and International Economic Law

- Cambridge International Trade and Economic Law

- Capital Controls and International Economic Law

- Copyright page

- Contents

- Foreword

- Preface

- Acknowledgements

- Abbreviations

- Part I Key Concepts: Capital Flows and Controls

- Part II The IMF, Capital Flows and Controls

- Part III Legal Frameworks, Rules and Conflicts

- Bibliography

- Index

- References

Summary

- Type

- Chapter

- Information

- Capital Controls and International Economic Law , pp. 196 - 206Publisher: Cambridge University PressPrint publication year: 2023