Over the last few decades, the emergence and growth of global value chains (GVCs) has transformed international trade. Value chains are defined as “the full range of activities that firms and workers perform to bring a product from its conception to end use and beyond.”Footnote 1 This includes various activities like research and development, design, marketing, production, transportation and distribution, as well as customer services for the end consumer. If a value chain crosses borders, i.e., value is added to a product in more than one country, it is called “global.” Put simply: “Global value chains (GVCs) can be thought of as factories that cross international borders.”Footnote 2 In a “GVC World,” value chains connect countries on a regional or even on a worldwide scale.

A key aspect of GVCs is the vertical integration of production across borders within the same multinational corporation (MNCs). Vertical integration means that different steps along a value chain are carried out within the same company. This integration takes place via mergers and acquisitions (M&As), or greenfield investments. It allows multinational companies to gain control over a bigger part of their respective GVCs. The vertical integration of production within GVCs inevitably influences trade preferences and, as a result, trade policy decisions. But what does this impact exactly look like?

Traditionally, much of the literature on trade preferences focused on two key trade policy constituencies: exporters that support trade liberalization and import competitors that oppose it.Footnote 3 The first set of actors can benefit from liberalization, mainly due to improved foreign market access, while import-competing actors are likely to lose from it because of foreign competition in domestic markets. In this view, a country's trade policy is a function of the relative importance of these two constituencies: the stronger exporters are relative to import competitors, the more liberal trade policy will be.

Multiple recent studies,Footnote 4 however, emphasize one crucial point: trade policy is not just about the old “exporters vs. import-competing industries” story anymore. Exporters are increasingly import-dependent (they import intermediate goods to produce their exports) as their participation in GVCs increases. This implies that trade policy preferences are not based on international trade relations alone but also on international production processes.Footnote 5 The internationalization of production, hence, is changing the political economy of trade policymaking: “In a world economy increasingly characterized by the emergence of these transnational chains of production, the preferences, patterns of political mobilization, and influence of firms and sectors that rely on income generated from the import of intermediate products for their production process need to be added to the equation.”Footnote 6 Osgood (Reference Osgood2018, 1) concurs: “A complete account of industrial preferences over trade policy in the current era must place the globalization of supply chain networks at its center.” Yet, “GVCs are largely absent in existing (…) analyses of trade policy.”Footnote 7

We contribute to this new strand of literature conceptually and empirically. The conceptual innovation is that in our argument we specifically concentrate on the role of MNCs and vertical integration in GVCs. The argument that we develop leads to the expectation that trade liberalization should be most ambitious for intermediate goods affected by cross-border M&A deals. Moreover, we anticipate ambitious liberalization for goods with large MNC imports. Our focus on MNCs complements the existing literature's concern with intermediate imports, independent of whether these imports take place within a specific company or at arm's length.

Empirically, just as some earlier studies,Footnote 8 our analysis focuses on preferential trade agreements (PTAs). With the deadlock of multilateral trade negotiations at the WTO level, countries have turned to PTAs as an alternative means to organize international trade relations. As a consequence, since the 1990s, the number as well as the scope of PTAs has grown substantively. Although many agreements signed in the last thirty years have been increasingly broad in scope, dealing with a diverse set of provisions, one of the key reasons to sign a PTA still remains trade liberalization through tariff cuts.Footnote 9 Our original empirical contribution is the combination of a highly disaggregated dataset on tariff cuts between PTA partner countries with data on M&As and on directed dyadic MNC imports at the sectoral level. This allows us to directly test our argument about MNCs, vertical integration, and trade liberalization.

Our paper also makes a contribution to the broader literature on MNCs in the global political economy.Footnote 10 Our findings clearly show that MNCs play a key role in contemporary global trade governance. Their investment decisions shape the structure and nature of global production networks, which in turn affect the trade preferences of MNCs. Because of MNCs’ clout and influence, the trade policies chosen by countries reflect these preferences. Going even further, although we do not show this in this paper, these trade policy choices are likely to reinforce MNCs’ investment decisions, leading to a further strengthening of GVCs. MNCs, thus, actively shape the complex interdependencies that characterize the contemporary global political economy.

MNCs and trade policy

Our argument starts with the assumption that trade policy is always made with important economic actors’ preferences in mind. Governments want to maximize support and minimize opposition from these actors, and therefore design their trade policy accordingly. We assume that MNCs have the means and connections to lobby for their preferred policies—either as individual firms or as part of trade associations, where they often cover decisive shares of all contributions.Footnote 11 In this view, trade policy can be a direct response to lobbying efforts.Footnote 12 Alternatively, governments may pre-empt lobbying by implementing a trade policy that they know will receive backing from key economic actors. They may do so for fear of losing electoral support, for example, when a specific trade policy leads to higher levels of unemployment. In either case, we expect the political clout of actors to be positively related to their economic power (e.g., their economic size). Economically powerful actors will have the necessary resources to lobby government. Moreover, the investment decisions of economically powerful actors are of particular relevance to politicians that want to stay in power.Footnote 13

But what are the preferences of economic actors with respect to trade policy in the presence of GVCs? The globalization of production leads to a diversification and fragmentation of groups in favor of and in opposition to trade liberalization. The two clear-cut groups of exporters and import-competing industries, facing each other in the process of trade preference formation and lobbying, are disintegrating and new alliances are formed.

One group of economic actors particularly linked to the globalization of production are import-dependent producers. Many companies are increasingly dependent on the import of intermediate goods for their production processes. Reducing the variable costs of these intermediates (e.g., through trade liberalization) has an impact on their productivity and competitiveness.Footnote 14 The globalization of production, thus, has not only “super-charged”Footnote 15 the support for trade in net-exporting industries but has also undermined opposition to trade in net-importing and import-competing industries.

A crucial part of GVC-integration is the emergence and growth of multinational corporations (MNCs)—meaning firms with subsidiaries or assets in at least one other than their home country. Multinational production, i.e., production that is carried out by firms outside of their country of origin,Footnote 16 is often the most efficient way for companies to organize their business. The history of MNCs goes back a long time, with the British East India Trading Company, established in 1600, being widely considered the very first multinational company. Modern MNCs started to emerge only in the late nineteenth century, but it was not until after the Second World War that international investments really took off. US firms were the key drivers, later joined by Japanese and European corporations.Footnote 17

MNCs today are the biggest, most competitive and productive firms inside increasingly fragmented GVCs. These “superstar exporters”Footnote 18 rely heavily on intermediate imports for their production processes, and are therefore an integral part of the alliance supporting trade liberalization. Although trade growth slowed down significantly after the Global Crisis 2008, Lakatos and Ohnsorge (Reference Lakatos and Ohnsorge2017) show that this development can mostly be attributed to a sharp decrease in arm's-length trade. Intra-firm trade growth (between firms linked by control or ownership), on the other hand, has been relatively stable in the recent decade. This means that MNC activities like international investments and intra-firm trade are still crucial elements of our global economy, which should influence trade policy in a substantive way.

What kind of trade liberalization is relevant for multinationals? Advantageous trade policy for MNCs can include various dimensions. PTA provisions concerning foreign direct investments, services, intellectual property rights, but also environmental or labor standards, can be significant issues for large international companies. Although all these aspects might be relevant and could be included in future research, we decided to focus on the most straightforward means of trade liberalization in this paper, namely, tariff cuts.

Tariff liberalization, in the form of tariff cuts, does not apply equally to all goods. Although countries agree to liberalize trade between each other in a PTA, they have a certain amount of leeway concerning the speed and final level of tariff cuts. Hence, we see considerable variation in different tariff schedules included in PTAs.Footnote 19 Countries are able to set priorities in their trade liberalization in order to support important economic actors. Explaining these different priorities and finding out more about which actors might be influencing countries’ decisions are the core objectives of this paper.

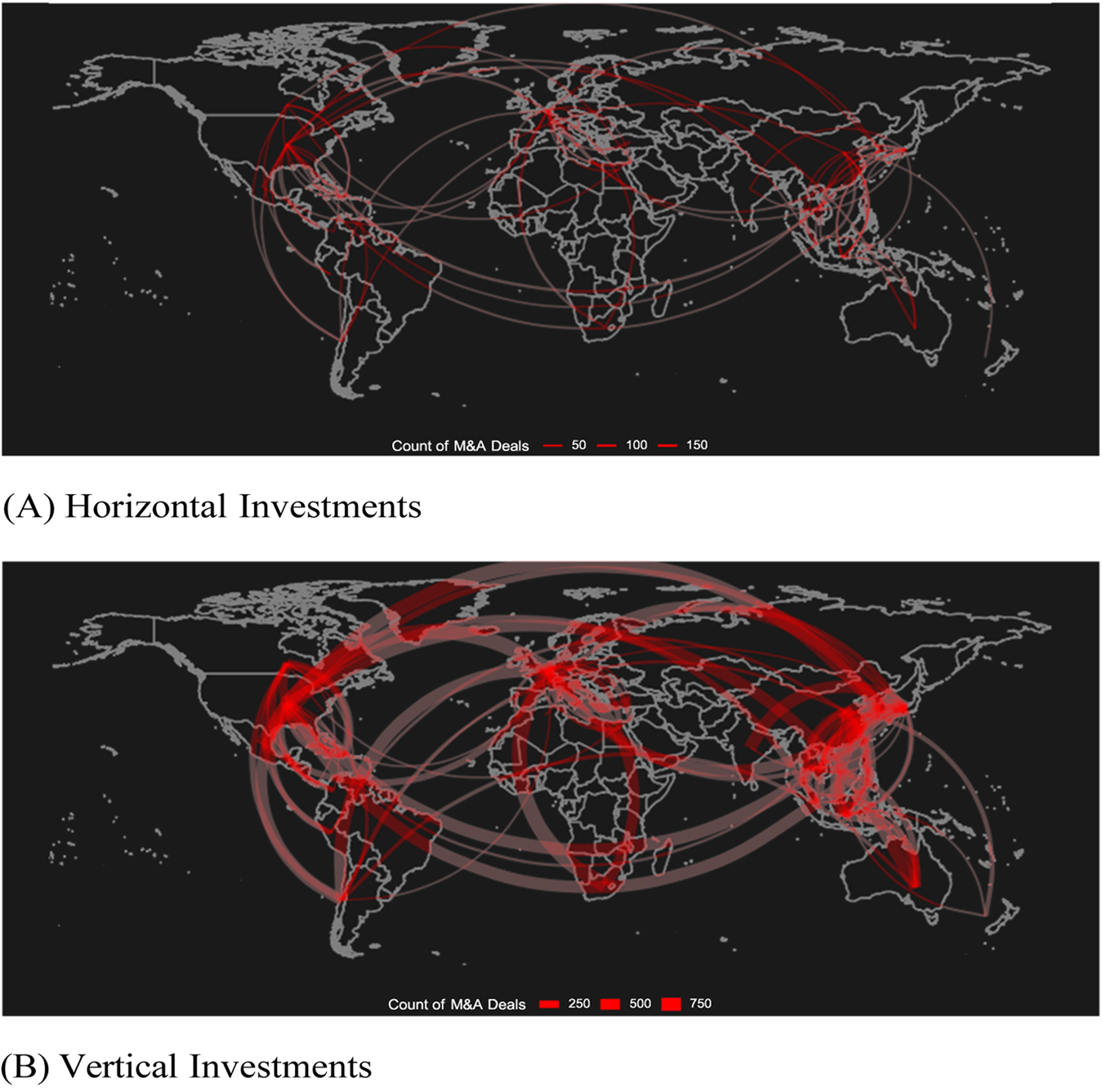

Overall, we expect that deeper GVC integration should lead to faster trade liberalization. This is an obvious and almost trivial argument. Yet, the difficulty to retrieve disaggregated MNC-level data has represented a major challenge in studying and testing the effect of MNCs on trade-policy decisions. We access two novel data sources and examine the question of the relationship between GVCs and trade policy. For one, we use detailed information on M&As for over one million transactions worldwide since the 1970s provided by Thomson Reuters (2019). To better understand the motives of the firms, we combine the M&As data with information on whether sectors trade intermediate or solely consumer goods. This allows us to distinguish between vertical (M&As for the production of intermediate goods) and horizontal investment (M&As for the production of consumer goods). Second, we rely on a measure of MNC imports of intermediates, which is offered by Cadestin et al. (Reference Cadestin, De Backer, Desnoyers-James, Miroudot, Rigo and Ye2018a). By dint of this variable, we measure the degree of vertical integration in a less disaggregated manner than with the M&As data, but more directly.

Mergers and acquisitions

One way of measuring corporate connections is to use international M&As data. M&As are a popular form of foreign direct investment (FDI): almost 50 percent of FDI inflows come in the form of M&As, which amounted to 694 USD billion in 2017.Footnote 20

MNCs’ investment choices are typically described as either horizontal or vertical. Horizontal investments are primarily motivated by market-seeking reasons. MNCs want to place production close to customers in order to avoid trade costs (e.g., tariffs) and make use of other locational advantages.Footnote 21 Multinationals produce similar products in home and host countries, which means that foreign affiliates are usually not linked to their headquarters by any international production processes. Vertical investments, on the other hand, are mostly based on efficiency-seeking motives. MNCs spread different stages of production across international borders, with foreign affiliates being tightly linked to other production facilities inside the same GVC. In the words of Cadestin et al. (Reference Cadestin, De Backer, Desnoyers-James, Miroudot, Ye and Rigo2018b, 5), “The production in one country serves as input for production activities in other countries and the location of different stages depend on where the factors of production they use intensively are relatively less costly.”

It has to be noted, however, that modern MNCs are far more complex than this dichotomy would suggest. Most multinational companies are engaged in both horizontal and vertical investments,Footnote 22 and most foreign affiliates fulfill market-seeking as well as efficiency-seeking purposes.Footnote 23 To characterize either a multinational company or a foreign affiliate as purely horizontal or vertical, is surely oversimplifying the complex reality of global MNC activity. However, distinguishing dominant investment-motives, rather than assuming that MNCs fit into one of these ideal types, can nevertheless prove valuable for our analysis. The main reason for specific investments should have an impact on MNCs’ trade policy preferences.

If a company merges with or acquires another company in a different country, their trade policy preferences toward this partner country are likely to change. The vertical integration of certain steps of a production process should shift the trade policy preferences of the companies involved toward (fast) trade liberalization. Both countries have an interest to facilitate trade along the production chain, which can be achieved by reducing tariffs on intermediate inputs crossing borders. If a specific M&A-deal is predominately driven by market-seeking motives (horizontal investments), the impact on trade preferences is less clear. MNCs investing for market-seeking reasons might even prefer trade barriers, since their subsidiaries put them at a comparative advantage relative to firms exporting to the same market.Footnote 24

In this vein, we hypothesize that M&As are especially prone to increase the pressure on decision-makers to liberalize trade if the deals go beyond purely market-seeking purposes. To incorporate the distinction between horizontal and vertical investment in our analysis, we include an interaction effect, using the type of product as a proxy for investment motives. We assume that investments in industries dealing mainly with finished goods are predominantly driven by market-seeking motives and should therefore not have a substantive impact on MNCs’ trade preferences. Hence, our first hypothesis reads as follows:

H1: Tariff cuts in PTAs are more ambitious in the presence of vertical cross-border investments than in the presence of horizontal cross-border investments.

MNC imports of intermediates

The number of cross-border M&A deals are by far not the only indicator for international corporate connections. M&A deals (especially when the target industry produces intermediate goods) are made to internalize parts of the international production process under the same corporate umbrella. This brings several advantages, compared to other forms of connections between production sites (e.g., arm's-length trade), like more control over the production process, reducing costs, and maximizing profits. In the argument above, we implicitly assumed that MNCs invest abroad in order to import intermediates, which they use for further production. We had to make this assumption, since we do not have trade data for the companies involved in these M&A deals, so we are not able to trace their activities at the firm level. For the second hypothesis, we want to zero in on this specific part of our causal claim: What happens between company headquarters and their foreign affiliates? What effect does intra-firm trade have on trade policy outcomes?

FDI flows (of which M&As are a part) have often been used to study cross-border MNC activities. In many cases, multinational production flows “are a more appropriate empirical object than FDI. This is because the importance of a subsidiary depends on the magnitude of its production activity (…) rather than the way in which it is financed.”Footnote 25 Using the data described above, under the subsection “mergers and acquisitions,” we were able to capture the first part of a headquarter–subsidiary connection. This allows us to know who set up a specific relationship, but we do not know anything about the subsequent connection between the MNC and the foreign affiliate. This can result in biased measures of foreign affiliate activity.Footnote 26

Therefore, the second part of the analysis builds on data capturing the MNC imports of intermediates from foreign affiliates. Along the lines of Ramondo et al. (Reference Ramondo, Rodr´ıguez-Clare and Tintelnot2015), we expect that high exports of the affiliate company to the headquarter country create pressure for faster tariff liberalization. If a US-owned company with foreign affiliates in Vietnam imports intermediate textile products from these affiliates, we expect the US tariffs toward Vietnam in the US-Vietnam PTA to be cut faster (if the tariff was greater than zero before the PTA). The causal relationship we propose here is similar to our first hypothesis (MNC connections lead to stronger preferences toward the liberalization of specific tariff lines, which triggers lobbying efforts and results in faster tariff cuts), what has changed is the type of MNC connection we focus our analysis on. Therefore, our second hypothesis is the following:

H2: Tariff cuts in PTAs are more ambitious for industries with stronger cross- border MNC activity than those with weaker cross-border MNC activity.

Research design

Dependent variable

For our dependent variable, Tariff Cut, we rely on data from Baccini et al. (Reference Baccini, Dür and Elsig2018). This dataset covers tariff concessions included in sixty-one preferential trade agreements (PTAs) signed by the seven largest trading entities (i.e., Australia, Canada, China, the EU, Japan, South Korea, and the United States) between 1995 and 2014.Footnote 27 Tariff lines for the respective partner countries are also included, which results in a total of fifty trading entities covered in the dataset. These countries vary in terms of levels of development, geographical regions, and political institutions. Each PTA contains at least two tariff schedules: one for country A toward country B, and one vice versa. Plurilateral PTAs often contain even more, which leaves us with a total number of 156 schedules. Each of these tariff schedules includes roughly five thousand tariff lines at a highly disaggregated level, namely, the Harmonized Commodity Description and Coding System (HS) six-digit level.

As far as modern PTAs are concerned, most tariffs between PTA partner countries are cut to zero eventually. This is in line with the WTO obligation that within a PTA, “substantially all trade” should be liberalized. What varies, is the time frame in which the elimination of tariffs takes place. Whether for a tariff line the cut happens sooner or later is decided in negotiations among the future signatories of the PTA. We especially see considerable variation in the extent of the first-year tariff cut. Many tariffs are cut to zero immediately upon entry into force of a PTA; but other tariff lines are not or just minimally cut in this first year. For economic actors, the extent of the first-year tariff cut should be important, as it makes a difference whether an import-competing company has some time to adjust to a tariff cut.

Hence, following Baccini and Dür (Reference Baccini and Dür2018), we chose the first-year tariff cut as our measure of the ambition of tariff cuts in PTAs. The variable Tariff Cut, which is calculated as the difference between the tariff rate at time t0 and the tariff rate at time t1, divided by the tariff rate at time t0, can take on values between zero (no tariff cut in the first year) and one (tariffs are cut completely in the first year). A large first-year cut from country A vis-à-vis country B is beneficial for acquirers in country A and their suppliers in country B, since it facilitates trade in intermediates. This helps exporters in country B as well as importers in country A. The dataset we use is directed dyadic, meaning that our dependent variable can take on different values for the dyad country A–country B than for the dyad country B–country A. This also makes sense from a theoretical standpoint: Trade relations between countries are usually asymmetric, which means that tariff cuts in specific industries can have beneficial effects for one partner country, but not for the other. This leads to considerable variation between the different directed dyads.

Explanatory variables

M&As and trade in intermediates

Our first test covers the interaction effect of M&As and intermediate goods trade. M&As prior to a PTA is based on the Thomson Reuters Eikon Mergers and Acquisitions Database.Footnote 28 We downloaded data for roughly fourteen thousand deals between all country-pairs in our tariff dataset. Over thirteen thousand different target companies in sixty-five countries have been acquired by (or merged with) around ninety-four hundred companies in fifty-five countries. After dropping all deals in the service sector (which was necessary given that our dependent variable only captures tariffs on goods), we still have nearly sixty-five hundred deals in our dataset. Table A1 in the Appendix provides a list of all countries in our dataset and the respective number of deals for each one as a target and as an acquirer.

The only industry classification Thomson Reuters provides for all their deals are Thomson Reuters Business Classification (TRBC) codes. This classification scheme is similar to, but not fully compatible with, other well-known industry classifications. We therefore had to manually match TRBC codes to the North American Industry Classification System (NAICS), and then use the NAICS-HS crosswalk provided in R's concordance packageFootnote 29 in order to merge our deals data with the tariff lines described above.

One deal can have an impact on several different HS codes. Consider the following example: If a company in country A, specializing in fertilizers, is investing in country B, we assume that this investment is relevant for tariff lines like “Nitric acid,” “Ammonium sulphate,” and several other chemicals used in the production of fertilizers. As a result, most deals in our M&A-dataset have been matched with more than one tariff line. Our deals can be connected to over forty-six hundred different product codes (six-digit HS codes), which allows us to capture the impact of M&A-deals on tariffs at a very disaggregated level.

Our theoretical expectation outlined above is that deals between acquirer companies in country A and targets in country B lead to more lobbying pressure from the acquirer companies for tariff cuts in the concerned sectors in country A. These companies benefit from policies facilitating trade in intermediates with their affiliates in country B—tariff cuts in country A are one very direct way to achieve this goal. We, thus, calculate a variable that takes the value 1 for the directed dyad “country A-country B” if an HS product has been affected by one or several deals (where country A is the acquirer and country B is the target) prior to a PTA.

It would have been possible to work with the cumulative sum of deals as value for our variable, but we decided to use a dichotomous variable instead: either there has been at least one deal prior to the PTA (then the variable takes on the value 1) or there has not (then the value equals 0). This makes theoretical sense, since although the second deal in a specific industry might increase the pressure to cut tariffs for the products potentially involved, the additional impact each deal can have is likely smaller than the first one. We do not assume that five deals in a specific industry really have five times the impact on trade policy that one deal in the same industry can have. Hence, our explanatory variable tells us if there has been at least one deal between country A (acquirer) and country B (target), with the potential of influencing a specific tariff line in country A toward country B.

Determining the best time frame for our variable is not a straightforward task. For how long are deals supposed to influence trade policy? Is a deal made in 1995 still relevant for tariff cuts in 2005? To deal with this uncertainty, we calculated several different indicators: one capturing all years prior to a PTA (Mergers & acquisitions), one restricted to the last ten years before the agreement (Mergers & acquisitions (10)), one including the last five years (Mergers & acquisitions (5)), and one for the last three years (Mergers & acquisitions (3)). We use the five-year-restricted variable in the baseline model.

We expect the effect of the M&A variables to be conditional on the variable Intermediates. As mentioned above, M&As should only influence the ambition of tariff cuts for intermediate products. If a deal is made for market-seeking reasons (horizontal investments, which means that country A simply wants market access in country B), as opposed to a deal to integrate a step in a cross-country production process (vertical integration), we do not expect the deal to have an impact on first-year tariff cuts. We, therefore, use intermediates as a proxy for vertical integration.

Our operationalization of intermediates is based on Francois and Pindyuk (Reference Francois, Pindyuk and Timmer2012) and Bekkers et al. (Reference Bekkers, Francois and Manchin2012). Their classification distinguishes between goods that are of “intermediate consumption,” of “final consumption,” or of “mixed use.” If a good is either of intermediate or mixed use, we code it as an intermediate (since we only want to exclude final consumption goods). With this operationalization, intermediates account for 77 percent of the products in the dataset. If we look at tariff levels before a PTA enters into force, we see that intermediates are at a considerably lower level than finished goods (means of 5.6 and 11.7, respectively), which implies that countries might already have reacted to preferences of industries dependent on imports for their production processes.

Figure 1 shows the number of M&A deals in both situations: a) M&A deals in sectors that produce final consumption goods and b) M&A deals in sectors that produce intermediates. Overall, we see that vertical investment is the dominant strategy.

Figure 1: M&As and trade in intermediates

MNC imports of intermediates

Several different approaches to measuring multinational production exist. Alfaro and Charlton (Reference Alfaro and Charlton2009), for example, use firm-level foreign affiliate sales to distinguish between horizontal and vertical subsidiaries and measure MNC activity. Albeit useful information on the firm-level, limited data coverage in some countries leads to problems at the aggregated industry- or country-level.Footnote 30

Another important data source, Eurostat's FATS, is employed by numerous scholars,Footnote 31 who assemble bilateral, disaggregated data on multinational production at the sector-level. Alviarez (Reference Alviarez2019) combines FATS data with OECD data on International Direct Investments, Bureau of Economic Analysis public data, and Bureau van Dijk's Orbis dataset. She aggregates all these sources at the source-location-sector level, which results in a comprehensive database covering nine manufacturing and four nontradeable sectors, across thirty-two countries, from 2003–12. Finally, Miroudot and Rigo (Reference Miroudot and Rigo2019) measure foreign affiliate activity using the new OECD analytical Activity of Multinational Enterprises (AMNE) databaseFootnote 32 to estimate the impact of deep preferential trade agreements on multinational production. This novel database covers more countries than FATS and can distinguish between far more industries. Additionally, the data not only allows us to measure foreign affiliate output, but also intra-firm trade, which is a huge advantage in the context of this paper.

Hence, we follow Miroudot and Rigo (Reference Miroudot and Rigo2019) and rely on the OECD's analytical AMNE databaseFootnote 33 for our second explanatory variable. The main aim of this new dataset is to combine data on the activities of MNCs with Inter-Country (Inter-Industry) Input-Output (ICIO) tablesFootnote 34 in order to better understand the role of MNCs in the global economy. National Input-Output tables describe sale and purchase relationships inside an economy. ICIO tables enable us to trace these relationships across borders; and they tables additionally differentiate between industries. Combining these ICIO tables with international trade data, we are able to estimate, for example, how much value of Belgian metal products are used in French transport equipment exports.Footnote 35

The crucial advantage of AMNE, compared to ICIO tables on their own, is its distinction between three types of firms: foreign affiliates (firms with at least 50 percent foreign ownership), domestic MNCs (domestic firms with foreign affiliates), and domestic firms (without any international investments). The analytical AMNE database includes matrices (on a bilateral home country–host country basis) of the output, value added, exports and imports of these companies, for forty-three industries, ranging from 2005 to 2016.Footnote 36 Using these matrices, we are able to add an ownership-dimension to international input-output analyses.Footnote 37 AMNE-data, therefore, enable us to measure the connections between countries and industries on the level of MNCs and their foreign affiliates. Not only do we get an idea about the activities of MNCs in their respective host countries but we are also able to trace their respective outputs. The data tells us, for example, how much intermediates (value in USD) produced by Japanese-owned foreign affiliates in India are imported into Japan, at the industry level. This allows us to estimate the importance of specific industries for MNCs in their cross-border production chains. The more intermediates are imported from India to Japan, the bigger Japan's incentive will be to reduce tariffs toward India at a faster rate. We call this variable, which captures the imports of intermediates from foreign affiliates in USD, MNC imports.

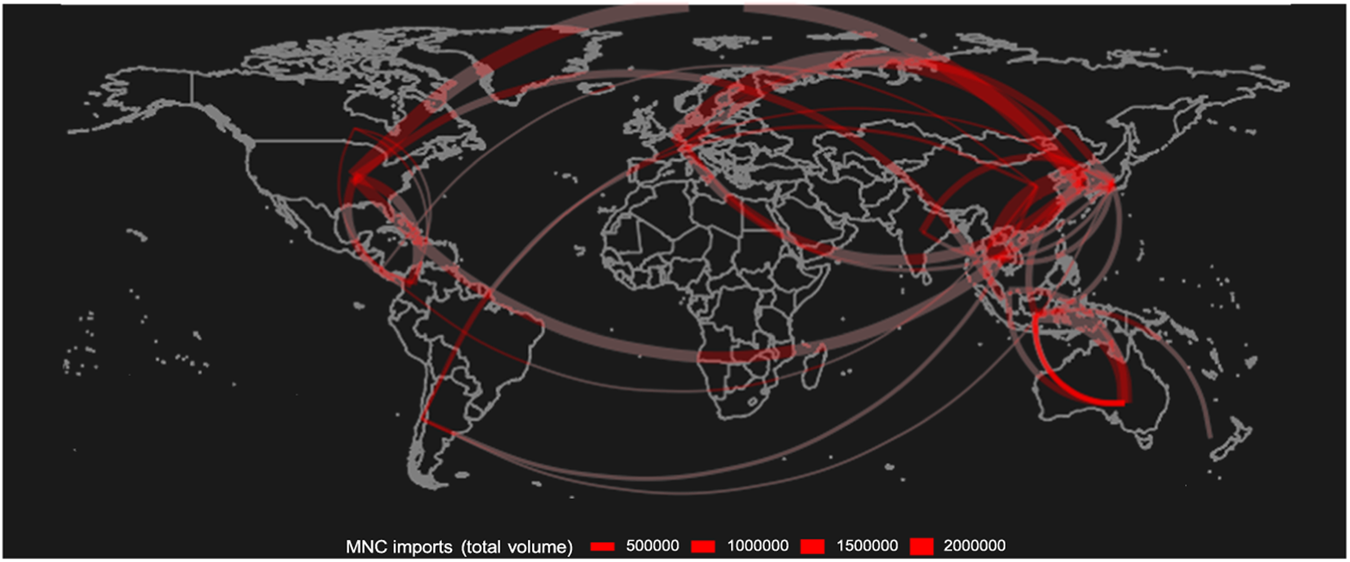

AMNE data includes industries in agriculture, forestry & fishing, mining & quarrying, several manufacturing industries, and numerous service industries. Excluding services leaves us with a total of seventeen different industries on the International Standard Industrial Classification (ISIC, Revision 4) two-digit-level. Although this data is far more aggregated than our tariff data, we still capture MNC activity on a much more fine-grained level than most previous studies, mentioned above. Tables A2 and A3 in the appendix provide an overview of all industries and PTA-country pairs used in our analysis. Since the variable's distribution is rather skewed (with a couple of very high values), we use the log of MNC imports in our estimation. Figure 2 shows for which directed dyads we see large values on the MNC imports variable. The highest value is for the Japan–Thailand dyad, which reflects the strong GVC ties between the two countries.

Figure 2: MNC imports of intermediates

As can be expected, MNC imports is positively associated with Mergers & acquisitions. The value on MNC imports is around four times higher when: Mergers & acquisitions takes the value of 1 than when it takes the value of 0. However, the two variables are not perfect substitutes. Regressing MNC imports on Mergers & acquisitions only gives an R2 of 0.08. The strength of the Mergers & acquisitions variable is that the data are highly disaggregated. At the same time, while M&As in sectors producing intermediate goods likely lead to imports of intermediates into the home country of the acquirer, the variable does not directly capture these imports. The MNC imports data are less disaggregated, but directly measure the concept that we are interested in.

Control variables

We include several control variables in our models. The first one is a measure for intra-industry trade (IIT), defined as the extent country A exports and imports the same goods and services to and from country B. Several studies have analyzed the consequences of IIT on the political economy of trade. Some suggest that IIT might lessen the threat of import competition since companies in the same industry can coexist more easily when products are differentiated, which leads to greater net support for trade liberalization.Footnote 38 Others argue that IIT may disempower narrow protectionist groups (import-competing companies) from being able to overcome collective action problems and lobby for protection more effectively.Footnote 39 Baccini et al. (Reference Baccini, Dür and Elsig2018) find mixed results, with no clear indication either way. To include intra-industry trade as a control variable, we use the same operationalization as Baccini et al. (Reference Baccini, Dür and Elsig2018), who calculate the Grubel Lloyd IndexFootnote 40 for imports and exports. The index, labeled IIT, ranges from 0 (countries only import from or only export to the other country) to 1 (two countries that simultaneously import and export the same amount of a good). Since some trade data is missing (and it cannot be assumed that this is at random), we also include a dummy variable, assigned a score of 1 in the case of zero trade flows (IIT missing).

We account for market size (GDP) and level of development (GDP per capita) for both countries in a dyad using data from the World Development Indicators database.Footnote 41 The level of imports (value over the four years prior to the signature of a PTA) is also included (Imports). This variable controls for the effect of import flows on tariff cuts and distinguishes it from our main explanatory variable, M&As. Data comes from CEPII (2014). Building on the literature suggesting that democracies are more open to trade than autocracies,Footnote 42 Barari et al. (Reference Barari, Kim and Wong2019) show that the regime types of trading partners can have nuanced and complex effects on unilateral and bilateral tariff liberalization. We follow this notion and include the variable Regime Footnote 43 in our model. Moreover, we include a dummy for WTO membership, scoring 1 if both countries are WTO members (WTO). Finally, the model captures the tariff rate between countries before signing the respective PTA (Tariff pre-PTA).

A summary of univariate statistics for all variables mentioned above is provided in table 1.

Table 1: Descriptive Statistics

Model specification

The main empirical challenge is that a substantial part of tariffs were set to zero (either unilaterally or within WTO negotiations) even before the implementation of a PTA. To meet this challenge, we estimate a two-stage Heckman selection model with bootstrapped errors.Footnote 44 The first stage represents a probit model, which explains the pre-PTA zero tariffs. Beyond all predictors in the second stage, we follow the suggestion of Baccini et al. (Reference Baccini, Dür and Elsig2018, 334) and include a “measure of country competitiveness at the six-digit level as an instrument for the selection equation.” This variable contributes to explaining the zero-tariff rate prior to the PTA. The more competitive a country is, the more likely it should be to have a zero tariff on a good. Yet general competitiveness is less likely to matter in the bilateral or plurilateral context of a PTA. Therefore, the specification very likely fulfills the exclusion restriction. In line with Heckman (Reference Heckman1977), we derive the Inverse Mills Ratio from the probit estimation. The Inverse Mills Ratio is then included as a covariate in the second stage estimation, where we run an ordinary least squares (OLS) regression with bootstrapped errors and fixed country and year effects on the sub-sample of products that have a tariff higher than zero before the PTA implementation. Whereas the Inverse Mills Ratio accounts for the correlation between error terms of the first and the second stage, the bootstrapped errors allow for an estimation of consistent standard errors.Footnote 45 We apply this strategy for all models of both our main explanatory variables: Mergers & acquisitions as well as MNC imports.

Findings

M&As and trade in intermediates

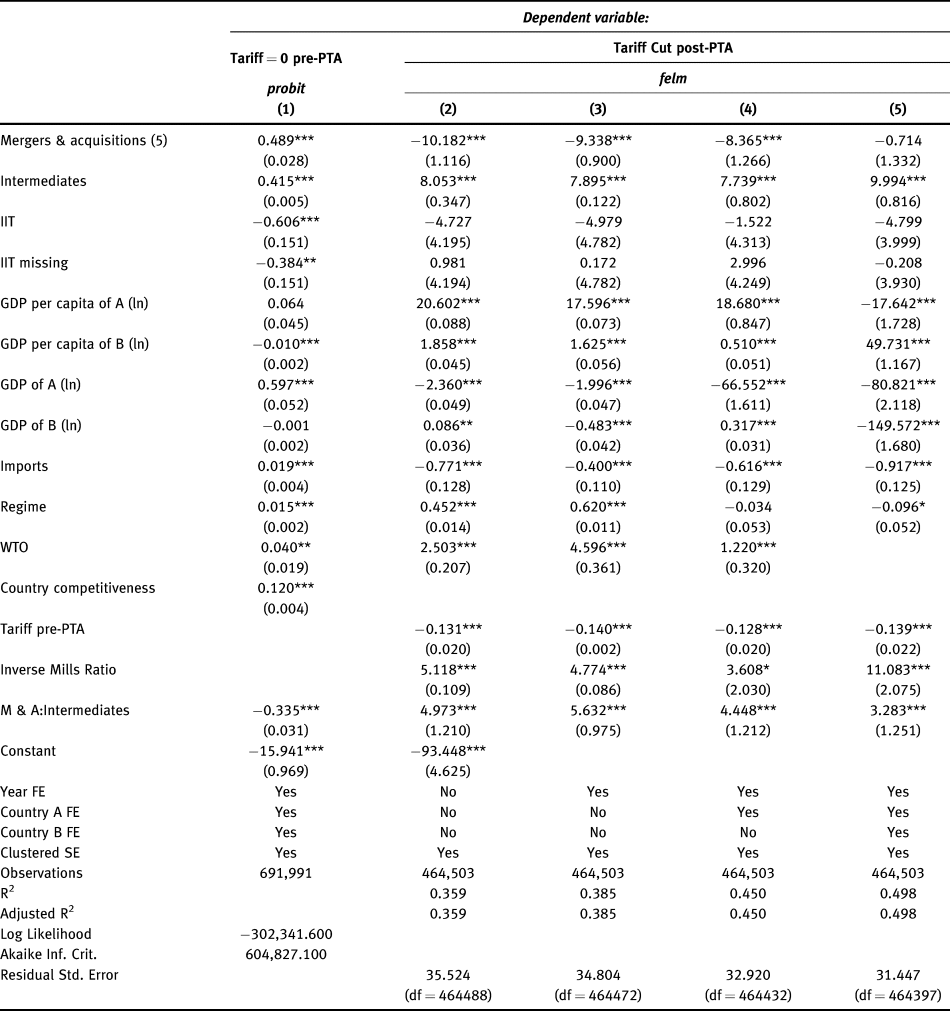

We start with models that include Mergers & acquisitions as key predictor. Model 1 in table 2 reports the results of the selection equation. The instrument, which is the competitiveness of countries, is highly significant. This suggests that the variable works well as instrument. Even before the implementation of PTAs, intermediate trade as well as M&As have a positive and significant effect on tariff cuts. Not surprisingly, more democratic countries and WTO members are more likely to cut the tariff to the zero level.

Table 2: M&As and Trade in Intermediates

Note: *p < 0.1; **p < 0.05; ***p < 0.01

Models 2 to 5 in table 2 show findings of the second stage, where the dependent variable is the level of tariff cuts at the product level. We alter the fixed effects approaches across the different models, where model 2 represents the most shallow one without fixed effects and model 5 is the most comprehensive one with year, country A, and country B fixed effects. H2 is supported across all four models, with the interaction effect of mergers and acquisitions being positive and significant in every column. Yet, the main effect of Mergers & acquisitions is negative and significant. This suggests that vertical investment causes tariff cuts, but horizontal FDI triggers the opposite effect (e.g., higher tariffs). This makes sense as companies that engage in horizontal FDI may want to protect their market share in the foreign market.

Figure 3 shows the interaction effect in the most restrictive model, namely model 5. The effect of Mergers & acquisitions is negative, but not significant, for sectors that merely trade consumer goods, but positive as soon as intermediate goods are involved. Our findings show that sectors with vertical investment, measured as M&A deals in the past five years and trade in intermediates, show on average 3 percent higher tariff cuts than sectors with horizontal investments, measured as M&A deals in the past five years, but no trade in intermediates. This effect is even stronger for the less restrictive models.

Figure 3: Horizontal versus vertical investment (model 5)

Note: The bars indicate 95 percent confidence intervals.

Similar to the selection model, the level of democratization and WTO membership impact tariff cuts positively 0.Footnote 46 Also, a high tariff before a PTA becomes effective decreases the likelihood of ambitious tariff cuts when negotiating a PTA. The significant Inverse Mills Ratio suggests that it was indeed important to estimate a two- rather than a one-stage model.

Beside the baseline models, we ran several robustness checks for which the detailed results are available in the appendix. First and instead of Tariff Cuts, we use a variable called Time To Zero, which measures the number of years it takes to lower a tariff to zero. Table A4 shows that indeed vertical investment is prone to be to a shorter timespan until zero-tariffs. Next, we modify the timespan used to measure M&A deals. In the baseline model, we coded the variable M&A as 1 if at least one M&A deal was completed within the last five years. As a robustness check, we take the last three and ten years as well as all previous years to specify the M&A variable. Tables A6, A7, and A8 show that the results are not sensitive to this empirical choice. Finally, we take a count of M&A deals instead of the M&A dummy variable. Again, the results are in line with the findings from the baseline model (see table A9).

MNC imports of intermediates

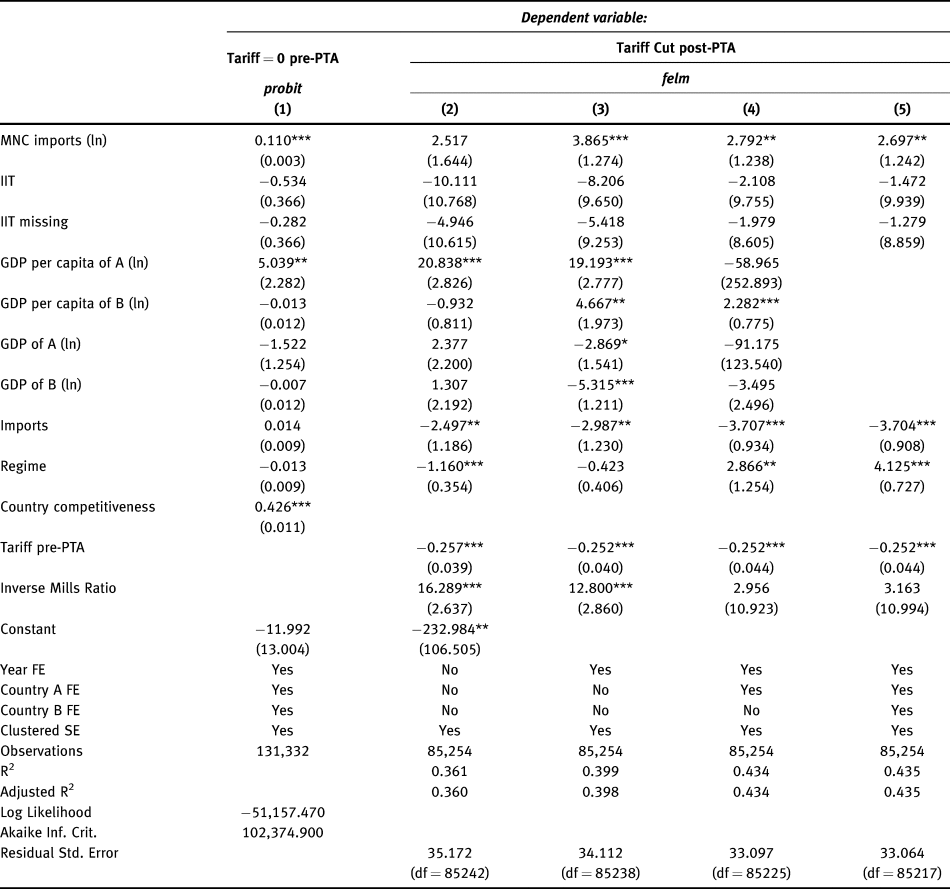

We follow a similar estimation strategy for our second explanatory variable (MNC imports). Model 1 in table 3 again reports the selection equation. As before, the coefficient for the instrument, Country competitiveness, is highly statistically significant. We also see that MNC imports is correlated with zero tariffs prior to the entry into force of a PTA.

Table 3: MNC Imports of Intermediates

Note: *p < 0.1; **p < 0.05; ***p < 0.01

Building on the selection model, models 2 to 5 in table 3 report the coefficients for our second stage estimation. Similar to table 2, we use different fixed effects specifications (year, country A, country B), with the most comprehensive one presented in model 5. The findings support H2: The coefficient for MNC imports is positive in all models and statistically significant in three out of four. Overall, we conclude that MNC imports of intermediates indeed increases the size of tariff cuts. In the most comprehensive model, namely, model 5, we see that a growth in MNC imports by 30 percent leads to a decrease in the tariffs by one percent.

Similar to the findings above, we see that high pre-PTA tariffs decrease the size of tariff cuts. Moreover, greater imports are consistently negatively correlated with the extent of first-year tariff cuts in PTAs. The other control variables do not show consistent effects across models.

Also for the second hypothesis, we change the dependent variable from Tariff Cuts to Time to Zero to check for the robustness of the results. The results of this test add further confidence to our findings. Indeed, an increase in MNC imports leads to a shorter time period until the tariffs hit zero. Again, the magnitude of the effect is not large, yet significant across all fixed-effect specifications (see table A5).

Conclusion

GVCs alter the dynamics of trade policymaking by creating a constituency that favors trade liberalization with the aim of lowering the costs of intermediate imports. MNCs are key players within this constituency. They often rely on intermediate imports in their production processes—a cost reduction (e.g., due to tariff cuts) of these imports hence enhances their productivity. They should, thus, have a preference for ambitious trade liberalization that facilitates cross-border trade in intermediates within their own company. Moreover, these MNCs possess the resources to affect policymaking via lobbying, or they simply have sufficient clout to ensure that policymakers take their interests into account pre-emptively. Our expectation hence has been for MNC involvement in GVCs to lead to more ambitious tariff cuts in PTAs.

So far, a lack of suitable data represented a major challenge to scholars interested in assessing the GVC-trade policy nexus. Our empirical contribution has been to mitigate this problem by relying on two novel data sources. More precisely, we have used a) fine-grained data on M&As, which we combined with trade in intermediates to account for vertical versus horizontal investment and b) data on MNC imports of intermediates to capture the extent to which MNCs are involved in GVCs. The combination of a fine-grained but indirect measure of vertical investment (M&As and trade in intermediates) and a more aggregated but also more direct measure of cross-border activity of MNCs (imports of intermediates from foreign affiliates) have allowed us to comprehensively test the effect of MNCs’ GVC integration on trade liberalization.

The results from a two-stage regression analysis with tariff concessions at the HS6-level in sixty-one PTAs as dependent variable offer support for our theoretical expectations. They show that MNCs that invest to obtain intermediates from affiliates abroad indeed push for faster trade liberalization. Whereas vertical investment is prone to lead to tariff cuts, market-seeking (horizontal) investment does not have the same effect. Moreover, we have found that intermediate MNC imports, which are produced by a foreign affiliate, increase the likelihood of ambitious tariff cuts. We conclude that, as expected, GVCs have the potential to speed up the liberalization of trade in certain products, especially if MNCs are involved.

In making the argument and testing it empirically, we also contribute to the broader literature on MNCs in the global political economy. MNCs do not only participate in transnational production networks, but are also able to lead, cultivate, and sustain the GVCs they are part of. Their sourcing decisions (either investing abroad and engaging in intra-firm trade or buying at arm's length) fundamentally shape the form and strength of international production networks. This formative role in influencing value chains suggests that MNCs do not operate in a purely economic sphere, but are bound to have distinct preferences concerning international trade policy. Our results also indicate that these preferences get reflected in specific policy decisions, which gives us an idea about MNCs’ political power.

In short, although the recent popular backlash against globalization and trade liberalization in many developed countries could have the potential to re-empower protectionist groups, at least in the short term, our findings show that powerful actors like MNCs still have a lot at stake when it comes to trade policy. They have the resources to influence policymakers and are very likely to continue their efforts to facilitate trade in intermediates.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/bap.2020.4.