This discussion relates to five papers by the Institute and Faculty of Actuaries (IFoA) Biodiversity & Natural Capital Working Party presented at the IFoA sessional events held on Monday 26 April 2021 and repeated on Tuesday 27 April 2021. This discussion is from the latter sessional.

The Moderator (Mr N. S. Spencer, F.I.A.): I would like to welcome everyone to today’s IFoA sessional meeting on “Biodiversity” which was one of my themes to champion as chair of the Sustainability Board. The session will cover five separate papers on this topic.

We will start with “The Importance of Biodiversity Risks” by Aled Jones. Aled (Jones) is the Biodiversity Working Party chair. He is the inaugural director of the Global Sustainability Institute at the Anglia Ruskin University. He works on climate change and biodiversity, and how they relate to opportunities and risks within finance. In 2017, he was made an Honorary Fellow of the IFoA.

Georgi Bedenham will talk about zoonotic diseases. She is an actuary in the Insurance and Investment Team within the Government Actuary’s Department. She covers a number of different areas, including disaster risk financing in developing countries, insurance arrangements within the public sector and contingent liabilities across governments.

Alex Darsley will talk about “Natural Capital: An Actuarial Perspective.” Alex (Darsley) is a pensions actuary with 15 years of experience in the industry. He currently works for the Pensions Regulator following previous spells in consultancy for Hymans Robertson and Willis Towers Watson.

We will then turn to “Introduction to Biodiversity Valuation Tools” by Ryan Allison. Ryan (Allison) is EY’s UK sustainable finance actuarial lead and is a member of the IFoA Biodiversity Working Party. He has supported a number of UK’s insurers with their climate risk strategy, climate modelling and wider economic scenario generator (ESG) implementation.

Then we will finish the session with “Biodiversity and Justice” by Bhavin Bharadwa. Bhavin (Bharadwa) is a qualified life insurance actuary and currently works for the Prudential Regulation Authority (PRA) in its life insurance division. Bhavin (Bharadwa) has previously worked in consultancies and with various insurers.

I will now pass over to Aled (Jones) to talk about the “Importance of Biodiversity Risks.”

Dr A. Jones, Hon. F.I.A.: The first paper is an introduction to the issues that the actuarial profession will need to consider on biodiversity.

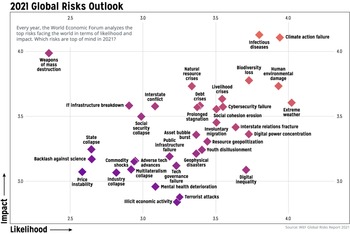

Figure 1 shows the Global Risks Outlook from the World Economic Forum. The top four risks shown in the top right-hand quadrant, in terms of impact and likelihood, are climate action failure, infectious diseases, biodiversity loss and human environmental damage.

Figure 1. 2021 Global Risks Outlook.

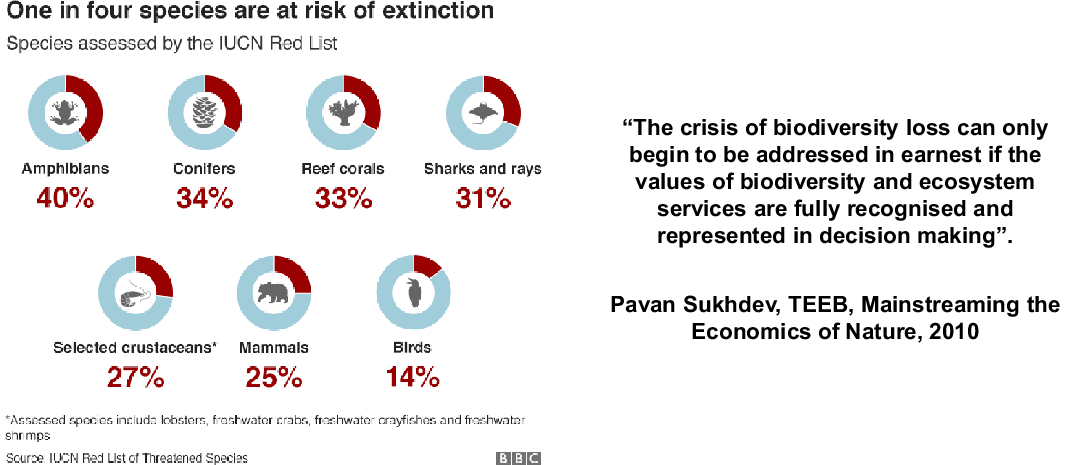

Figure 2 shows that one-in-four species are at risk of extinction, and this is what I would call “biodiversity loss.” Exactly what this means for society and the economy is less clear. A Global Futures report by the World Wildlife Fund (WWF) showed that this “biodiversity loss” could result in a loss of between ½% and 1½% of global GDP over the next 30 or so years. However, we clearly need to carry out more detailed research on the economic and financial impacts and that is where we are assisting the IFoA and its members who have both the long-term, short-term and various different stakeholders to consider.

Figure 2. One in four species are at risk of being lost.

We have started to break this down and what it could mean for different business practices within the actuary profession. The main areas that we have been considering are insurance, pensions, mortality and investment. Everything from the increased severity of natural disasters, through to mortality risks and morbidity risks and how these can be affected by access to natural capital, air pollution and zoonotic diseases.

The Working Party was formed, and we created these five papers. The first one is “The Importance of Biodiversity Risks,” which summarises the key risks and how they might translate into economic and/or financial impacts. There are then four papers that go into more detail. Firstly, there is a paper on zoonotic disease and then we consider the concept of natural capital, which is followed by a paper on how to value natural capital. The final paper is on biodiversity and justice.

I will now hand over to Georgi (Bedenham) who will talk about zoonotic diseases.

Miss G. M. F. Bedenham, F.I.A.: I am an actuary at the Government Actuary’s Department, and I have worked alongside Amy Shields, Umeeta Luhano and Andrew Kirk to produce the paper on the link between zoonotic disease and biodiversity loss.

To start with I thought it would be helpful to talk about what we mean by a zoonotic disease. Zoonotic diseases, or zoonoses, are diseases that have been transmitted from an animal source to humans. Well-known modern zoonotic diseases include diseases such as HIV, influenza, coronavirus, ebola and rabies. The emergence of a zoonotic disease is, by nature, unpredictable. This is demonstrated by the emergence of zoonotic diseases from a wide variety of animal sources and different geographical locations. It is hard to predict where the next disease could come from and the emergence of infectious diseases in humans is increasing with over 70% of these estimated to be zoonotic. The risk of pandemics is increasing rapidly, with more than five new diseases emerging in people every year. Any one of these has the potential to spread and become the next pandemic. As we have seen with COVID-19, once a new zoonotic disease emerges, the impact can be devastating. One example is the Nipah virus that was created in pig farming, where a variant emerged that pushed the mortality rate upwards by more than 75%. But there are also wider effects on society, such as disruption to the economy and health services. As we have seen, the impact of COVID-19 has been felt across the globe with approximately 11.5 trillion dollars of monetary and fiscal support being provided to aid the recovery.

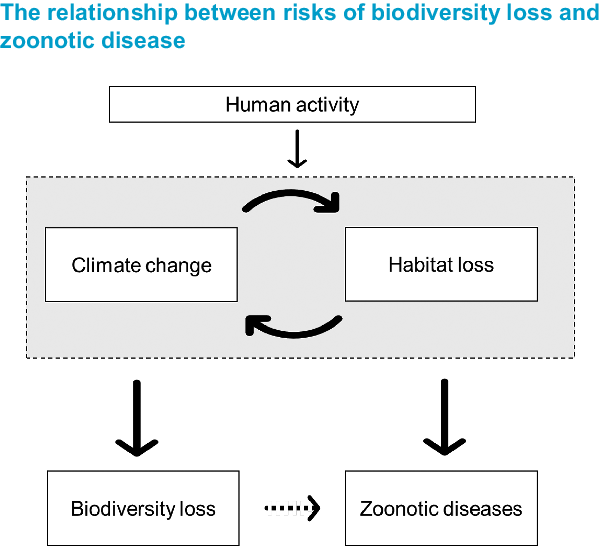

The spread of zoonotic diseases can be attributed to a variety of different causes, such as climate change, habitat loss, animal agriculture and exploitation of natural resources. For all of these, human activity emerges as one of the key underlying drivers. Almost half of the zoonotic diseases that have emerged since 1940 have resulted from change in land use, change in agricultural or reproduction practices, or from wildlife hunting. The drivers of zoonotic diseases are the same drivers that are causing accelerating biodiversity loss as can be summarised in the diagram Figure 3.

Figure 3. The relationship between risks of biodiversity loss and zoonotic disease.

These drivers are inextricably linked, for example, climate change and habitat loss can facilitate migration of animal populations which in turn leads to biodiversity loss and the spread of foreign diseases.

In terms of threat to human health, there is evidence that a greater biodiversity of species can potentially reduce the transmission of disease as there are several species which the disease has to pass through before it reaches humans.

Our current understanding is that it is a case of when, not if, the next pandemic is coming. This, coupled by increased human activity, for example, the rising demand for meat, leads to an unsustainable global system of intensive production, which in turn threatens biodiversity. In terms of reversing the trend there are various groups emerging such as “Wildlife Conservation 20” and “Preventing Pandemics at Source” They aim to prevent future pandemics through building a sustainable relationship between human consumption and wildlife conservation. In addition, the COVID-19 pandemic has highlighted the effects of zoonotic diseases on the global economy. The Dasgupta Review highlighted that the associated cost of monitoring and preventing zoonotic disease over a 10 year-period represents 2% of the estimated cost of COVID-19. Therefore, the hope is that new metrics will be created to measure economic growth that factor in the value of natural assets which would subsequently help to reverse the trend of biodiversity loss and decrease the prevalence of zoonotic diseases.

I will now hand over to Alex (Darsley) who is going to talk about natural capital.

Mr A. J. Darsley, F.I.A.: We have just heard about the problem of biodiversity loss. One possible solution is to focus more on the services that nature provides us and think of nature more like an asset. That is the essence of natural capital. This is a topic that I have looked at together with Matthew Ahern, Alex Martin, Travis Elsum and Rebecca Craddock-Taylor.

To start off with the definition, natural capital is “the stock of renewable and non-renewable natural resources that combine to yield a flow of benefits to people.” Natural capital would include soil, air, water and all living things and biodiversity. The first step of a natural capital approach is understanding the breadth of different services that nature provides. They are called ecosystem services which are split into four groups. Firstly, “Provisioning,” which are the material goods we get from nature, such as timber. Secondly, “Regulating” are the services that keep things in balance, such as the carbon cycle and trees sequestering carbon. Thirdly, “Supporting services” are those processes that are essential to support all the other services, such as pollination. Finally, “Cultural services” are the non-material benefits that people get from nature, such as enjoyment and recreation.

A natural capital approach is any form of analysis where the value of nature is accounted for in those services. There is a range of uses for this and different natural capital models. For example, if you are running a project, you can amend your cost–benefit analysis to allow for the impacts and dependencies on nature. Another metric is to estimate the stock of natural capital in a particular area at a given time. That is what is known as a natural capital accounting approach. One example is a study that estimated the value of the earth’s natural capital at £125 trillion. That kind of figure can seem a bit meaningless, but this exercise becomes more valuable when it is repeated on a consistent basis year on year.

One specific example is an initiative in Australia centred around the Great Barrier Reef. Companies are able to purchase reef credits to offset their environmental footprint and the money must be used by local farmers to improve the quality of water flowing into the sea, which in turn, benefits the reef. That is an example of an investible asset where the intrinsic benefits to the reef can also be represented in economic terms.

This leads to a limitation of the natural capital approach in that the intrinsic value of nature cannot be valued in economic terms.

I think this topic is one where actuaries can add value. These are complex models with a lot of assumptions, whilst the uncertainty in results and model limitations require careful communication. I will now pass over to Ryan (Allison).

Mr R. M. Allison, F.I.A.: I am an actuary at EY and I worked with Pallavi Konwar, Samiksha Sindhu, Lisa Yu and Larissa Naidoo to develop a paper titled “Introduction to Biodiversity Valuation Tools.”

I will start with three quotes which I think set the scene quite nicely for this particular paper. The first is from Professor Dasgupta, who is the author of “The Economics of Biodiversity” (Dasgupta, Reference Dasgupta2021) for the UK government, “We must understand and accept that we are embedded within Nature, not external to it.” This is saying that everything we do in financial services, has a real world impact.

The second quote is from Mark Carney. “Climate considerations must be embedded in every financial decision for a truly green recovery.” This is saying that climate considerations, such as biodiversity risk, need to be taken into account in every financial decision that we make, for us to be able to have an effective and positive real-world impact. Finally, my favourite quote from Lord Kelvin, who was a famous Scottish mathematician, “I often say that when you can measure what you are speaking about and express it in numbers, you know something about it, but when you cannot express it in numbers, your knowledge is of a meagre and unsatisfactory kind.” I think this is the essence of “what gets measured, gets managed.”

In producing this paper, we began with the Department for Environment, Food & Rural Affairs (DEFRA) in the UK government to look into a shortlist of tools that they had already compiled. There are a total of 15 tools in the “Enabling a Natural Capital Approach: Guidance” document that have been prepared and are currently used by local councils, forestry management agencies and other quasi-government bodies. We asked ourselves whether we could adapt such tools so they could be applied in an actuarial context. We found that five of them could be adapted and used by investment teams of insurers and pension funds, for example, when making direct investment decisions in infrastructure assets.

One tool which was developed by the University of Exeter as part of the South West Partnership for Environment and Economic Prosperity pulls together a map-based and web-based view of various ecosystem services. It then attributes a value to each of those services. A user can then identify at postcode level what value has been attributed to different land areas and can therefore develop a view of the impact on this value of land use changes such as infrastructure investments. A limitation of this particular tool, the Natural Environment Valuation Online (NEVO) tool, is that it is limited to England and Wales, and it does not capture the intrinsic value of biodiversity, instead focusing on determining the economic value of the land.

The next steps are to try to identify more specific actuarial use cases for each of these tools and try to develop the tools further in this respect. As part of this, we will widen the analysis beyond investment and beyond the UK. I will now pass over to Bhavin (Bharadwa).

Mr B. Bharadwa, F.I.A.: As well as considering whether and how we should value nature, we also need to consider from whose perspective we are valuing it. In particular, biodiversity risks and justice are highly interconnected. I worked with Jessica Fifield, Simon Sutcliffe and Aled Jones in producing a paper on biodiversity and justice.

Justice must be brought into consideration regarding the use of natural resources and biodiversity loss to recognise the views of the different stakeholders. There are three things to consider. Firstly, there may be varying views from different stakeholders of the same ecosystem. We give the example in the paper of the value of a specific tree, which is likely to be higher for someone who sits under it every weekend to read a book than for someone who has never visited the site. Secondly, different types of value may be placed on the same ecosystem, for example, physical value or cultural value. Thirdly, it can be difficult to identify the stakeholders in the first place. There can be additional issues to consider, such as ownership of land.

It is important to define what we mean by justice. In our paper, we propose four concepts that need to be considered to achieve fair outcomes. Firstly, “recognition of inequality and discrimination,” secondly, “participation in the decision-making process of all those who are affected,” thirdly, “distribution of resources” and finally “nature must be considered as a participant.” Along with these definitions, we also need to consider that achieving the UN’s sustainable development goals is a widely accepted standard as a minimum level of global justice.

Our paper presents four case studies covering four different ecosystems: forests, fishing, farming and water. For each ecosystem, we drew out some examples of biodiversity loss and the actions taken to try to recover or reduce the impact of that loss. For all the case studies, there were a variety of intra- and intergenerational justice issues, which we link back to our definitions of justice. For example, in the farming case study, we investigated a payment for ecosystem services, which incentivised the conversion of cropland on highland slopes into forest and grassland by providing farmers with cash and grain subsidies to better manage flood risk further downstream. However, the subsidies were not distributed fairly across all groups of farmers.

The case studies demonstrate examples of how biodiversity loss and justice can have implications for traditional actuarial work. For example, the farming case study shows that agricultural practices could have a direct impact on natural catastrophes, such as floods further downstream, which may impact insurance companies. Also, the intensification of agriculture has led to increased use of chemicals, such as pesticides, which can impact human health over longer time frames. Furthermore, certain groups of people may be more exposed to these health risks than others, which could lead to further unjust outcomes.

In addition to the implications for actuarial work, the paper identifies that the actuarial skillset itself can be hugely useful in developing financial solutions to biodiversity loss and considering justice. In traditional financial settings such as with-profits and pensions valuations, actuaries perform data analysis, long-term modelling and consider the equitable allocation of resources for a range of stakeholders of different generations. Actuaries already work with frameworks that bring fairness into decision-making, such as treating customers fairly and the principles and practices of financial management. As a profession, we have a unique skillset. The paper proposes that not only do we need to consider biodiversity and justice risks in our actuarial work, but that the actuarial skillset can open up opportunities for actuaries to contribute further to the field of biodiversity and justice risks. I will now hand back over to Nick (Spencer).

The Moderator (Mr N. S. Spencer, F.I.A.): Thank you very much to all the panellists. In closing, I think that is very useful introduction to the key topics that society is facing and where actuaries could become involved.

This discussion relates to five papers by the Institute and Faculty of Actuaries (IFoA) Biodiversity & Natural Capital Working Party presented at the IFoA sessional events held on Monday 26 April 2021 and repeated on Tuesday 27 April 2021. This discussion is from the latter sessional.

The Moderator (Mr N. S. Spencer, F.I.A.): I would like to welcome everyone to today’s IFoA sessional meeting on “Biodiversity” which was one of my themes to champion as chair of the Sustainability Board. The session will cover five separate papers on this topic.

We will start with “The Importance of Biodiversity Risks” by Aled Jones. Aled (Jones) is the Biodiversity Working Party chair. He is the inaugural director of the Global Sustainability Institute at the Anglia Ruskin University. He works on climate change and biodiversity, and how they relate to opportunities and risks within finance. In 2017, he was made an Honorary Fellow of the IFoA.

Georgi Bedenham will talk about zoonotic diseases. She is an actuary in the Insurance and Investment Team within the Government Actuary’s Department. She covers a number of different areas, including disaster risk financing in developing countries, insurance arrangements within the public sector and contingent liabilities across governments.

Alex Darsley will talk about “Natural Capital: An Actuarial Perspective.” Alex (Darsley) is a pensions actuary with 15 years of experience in the industry. He currently works for the Pensions Regulator following previous spells in consultancy for Hymans Robertson and Willis Towers Watson.

We will then turn to “Introduction to Biodiversity Valuation Tools” by Ryan Allison. Ryan (Allison) is EY’s UK sustainable finance actuarial lead and is a member of the IFoA Biodiversity Working Party. He has supported a number of UK’s insurers with their climate risk strategy, climate modelling and wider economic scenario generator (ESG) implementation.

Then we will finish the session with “Biodiversity and Justice” by Bhavin Bharadwa. Bhavin (Bharadwa) is a qualified life insurance actuary and currently works for the Prudential Regulation Authority (PRA) in its life insurance division. Bhavin (Bharadwa) has previously worked in consultancies and with various insurers.

I will now pass over to Aled (Jones) to talk about the “Importance of Biodiversity Risks.”

Dr A. Jones, Hon. F.I.A.: The first paper is an introduction to the issues that the actuarial profession will need to consider on biodiversity.

Figure 1 shows the Global Risks Outlook from the World Economic Forum. The top four risks shown in the top right-hand quadrant, in terms of impact and likelihood, are climate action failure, infectious diseases, biodiversity loss and human environmental damage.

Figure 1. 2021 Global Risks Outlook.

Figure 2 shows that one-in-four species are at risk of extinction, and this is what I would call “biodiversity loss.” Exactly what this means for society and the economy is less clear. A Global Futures report by the World Wildlife Fund (WWF) showed that this “biodiversity loss” could result in a loss of between ½% and 1½% of global GDP over the next 30 or so years. However, we clearly need to carry out more detailed research on the economic and financial impacts and that is where we are assisting the IFoA and its members who have both the long-term, short-term and various different stakeholders to consider.

Figure 2. One in four species are at risk of being lost.

We have started to break this down and what it could mean for different business practices within the actuary profession. The main areas that we have been considering are insurance, pensions, mortality and investment. Everything from the increased severity of natural disasters, through to mortality risks and morbidity risks and how these can be affected by access to natural capital, air pollution and zoonotic diseases.

The Working Party was formed, and we created these five papers. The first one is “The Importance of Biodiversity Risks,” which summarises the key risks and how they might translate into economic and/or financial impacts. There are then four papers that go into more detail. Firstly, there is a paper on zoonotic disease and then we consider the concept of natural capital, which is followed by a paper on how to value natural capital. The final paper is on biodiversity and justice.

I will now hand over to Georgi (Bedenham) who will talk about zoonotic diseases.

Miss G. M. F. Bedenham, F.I.A.: I am an actuary at the Government Actuary’s Department, and I have worked alongside Amy Shields, Umeeta Luhano and Andrew Kirk to produce the paper on the link between zoonotic disease and biodiversity loss.

To start with I thought it would be helpful to talk about what we mean by a zoonotic disease. Zoonotic diseases, or zoonoses, are diseases that have been transmitted from an animal source to humans. Well-known modern zoonotic diseases include diseases such as HIV, influenza, coronavirus, ebola and rabies. The emergence of a zoonotic disease is, by nature, unpredictable. This is demonstrated by the emergence of zoonotic diseases from a wide variety of animal sources and different geographical locations. It is hard to predict where the next disease could come from and the emergence of infectious diseases in humans is increasing with over 70% of these estimated to be zoonotic. The risk of pandemics is increasing rapidly, with more than five new diseases emerging in people every year. Any one of these has the potential to spread and become the next pandemic. As we have seen with COVID-19, once a new zoonotic disease emerges, the impact can be devastating. One example is the Nipah virus that was created in pig farming, where a variant emerged that pushed the mortality rate upwards by more than 75%. But there are also wider effects on society, such as disruption to the economy and health services. As we have seen, the impact of COVID-19 has been felt across the globe with approximately 11.5 trillion dollars of monetary and fiscal support being provided to aid the recovery.

The spread of zoonotic diseases can be attributed to a variety of different causes, such as climate change, habitat loss, animal agriculture and exploitation of natural resources. For all of these, human activity emerges as one of the key underlying drivers. Almost half of the zoonotic diseases that have emerged since 1940 have resulted from change in land use, change in agricultural or reproduction practices, or from wildlife hunting. The drivers of zoonotic diseases are the same drivers that are causing accelerating biodiversity loss as can be summarised in the diagram Figure 3.

Figure 3. The relationship between risks of biodiversity loss and zoonotic disease.

These drivers are inextricably linked, for example, climate change and habitat loss can facilitate migration of animal populations which in turn leads to biodiversity loss and the spread of foreign diseases.

In terms of threat to human health, there is evidence that a greater biodiversity of species can potentially reduce the transmission of disease as there are several species which the disease has to pass through before it reaches humans.

Our current understanding is that it is a case of when, not if, the next pandemic is coming. This, coupled by increased human activity, for example, the rising demand for meat, leads to an unsustainable global system of intensive production, which in turn threatens biodiversity. In terms of reversing the trend there are various groups emerging such as “Wildlife Conservation 20” and “Preventing Pandemics at Source” They aim to prevent future pandemics through building a sustainable relationship between human consumption and wildlife conservation. In addition, the COVID-19 pandemic has highlighted the effects of zoonotic diseases on the global economy. The Dasgupta Review highlighted that the associated cost of monitoring and preventing zoonotic disease over a 10 year-period represents 2% of the estimated cost of COVID-19. Therefore, the hope is that new metrics will be created to measure economic growth that factor in the value of natural assets which would subsequently help to reverse the trend of biodiversity loss and decrease the prevalence of zoonotic diseases.

I will now hand over to Alex (Darsley) who is going to talk about natural capital.

Mr A. J. Darsley, F.I.A.: We have just heard about the problem of biodiversity loss. One possible solution is to focus more on the services that nature provides us and think of nature more like an asset. That is the essence of natural capital. This is a topic that I have looked at together with Matthew Ahern, Alex Martin, Travis Elsum and Rebecca Craddock-Taylor.

To start off with the definition, natural capital is “the stock of renewable and non-renewable natural resources that combine to yield a flow of benefits to people.” Natural capital would include soil, air, water and all living things and biodiversity. The first step of a natural capital approach is understanding the breadth of different services that nature provides. They are called ecosystem services which are split into four groups. Firstly, “Provisioning,” which are the material goods we get from nature, such as timber. Secondly, “Regulating” are the services that keep things in balance, such as the carbon cycle and trees sequestering carbon. Thirdly, “Supporting services” are those processes that are essential to support all the other services, such as pollination. Finally, “Cultural services” are the non-material benefits that people get from nature, such as enjoyment and recreation.

A natural capital approach is any form of analysis where the value of nature is accounted for in those services. There is a range of uses for this and different natural capital models. For example, if you are running a project, you can amend your cost–benefit analysis to allow for the impacts and dependencies on nature. Another metric is to estimate the stock of natural capital in a particular area at a given time. That is what is known as a natural capital accounting approach. One example is a study that estimated the value of the earth’s natural capital at £125 trillion. That kind of figure can seem a bit meaningless, but this exercise becomes more valuable when it is repeated on a consistent basis year on year.

One specific example is an initiative in Australia centred around the Great Barrier Reef. Companies are able to purchase reef credits to offset their environmental footprint and the money must be used by local farmers to improve the quality of water flowing into the sea, which in turn, benefits the reef. That is an example of an investible asset where the intrinsic benefits to the reef can also be represented in economic terms.

This leads to a limitation of the natural capital approach in that the intrinsic value of nature cannot be valued in economic terms.

I think this topic is one where actuaries can add value. These are complex models with a lot of assumptions, whilst the uncertainty in results and model limitations require careful communication. I will now pass over to Ryan (Allison).

Mr R. M. Allison, F.I.A.: I am an actuary at EY and I worked with Pallavi Konwar, Samiksha Sindhu, Lisa Yu and Larissa Naidoo to develop a paper titled “Introduction to Biodiversity Valuation Tools.”

I will start with three quotes which I think set the scene quite nicely for this particular paper. The first is from Professor Dasgupta, who is the author of “The Economics of Biodiversity” (Dasgupta, Reference Dasgupta2021) for the UK government, “We must understand and accept that we are embedded within Nature, not external to it.” This is saying that everything we do in financial services, has a real world impact.

The second quote is from Mark Carney. “Climate considerations must be embedded in every financial decision for a truly green recovery.” This is saying that climate considerations, such as biodiversity risk, need to be taken into account in every financial decision that we make, for us to be able to have an effective and positive real-world impact. Finally, my favourite quote from Lord Kelvin, who was a famous Scottish mathematician, “I often say that when you can measure what you are speaking about and express it in numbers, you know something about it, but when you cannot express it in numbers, your knowledge is of a meagre and unsatisfactory kind.” I think this is the essence of “what gets measured, gets managed.”

In producing this paper, we began with the Department for Environment, Food & Rural Affairs (DEFRA) in the UK government to look into a shortlist of tools that they had already compiled. There are a total of 15 tools in the “Enabling a Natural Capital Approach: Guidance” document that have been prepared and are currently used by local councils, forestry management agencies and other quasi-government bodies. We asked ourselves whether we could adapt such tools so they could be applied in an actuarial context. We found that five of them could be adapted and used by investment teams of insurers and pension funds, for example, when making direct investment decisions in infrastructure assets.

One tool which was developed by the University of Exeter as part of the South West Partnership for Environment and Economic Prosperity pulls together a map-based and web-based view of various ecosystem services. It then attributes a value to each of those services. A user can then identify at postcode level what value has been attributed to different land areas and can therefore develop a view of the impact on this value of land use changes such as infrastructure investments. A limitation of this particular tool, the Natural Environment Valuation Online (NEVO) tool, is that it is limited to England and Wales, and it does not capture the intrinsic value of biodiversity, instead focusing on determining the economic value of the land.

The next steps are to try to identify more specific actuarial use cases for each of these tools and try to develop the tools further in this respect. As part of this, we will widen the analysis beyond investment and beyond the UK. I will now pass over to Bhavin (Bharadwa).

Mr B. Bharadwa, F.I.A.: As well as considering whether and how we should value nature, we also need to consider from whose perspective we are valuing it. In particular, biodiversity risks and justice are highly interconnected. I worked with Jessica Fifield, Simon Sutcliffe and Aled Jones in producing a paper on biodiversity and justice.

Justice must be brought into consideration regarding the use of natural resources and biodiversity loss to recognise the views of the different stakeholders. There are three things to consider. Firstly, there may be varying views from different stakeholders of the same ecosystem. We give the example in the paper of the value of a specific tree, which is likely to be higher for someone who sits under it every weekend to read a book than for someone who has never visited the site. Secondly, different types of value may be placed on the same ecosystem, for example, physical value or cultural value. Thirdly, it can be difficult to identify the stakeholders in the first place. There can be additional issues to consider, such as ownership of land.

It is important to define what we mean by justice. In our paper, we propose four concepts that need to be considered to achieve fair outcomes. Firstly, “recognition of inequality and discrimination,” secondly, “participation in the decision-making process of all those who are affected,” thirdly, “distribution of resources” and finally “nature must be considered as a participant.” Along with these definitions, we also need to consider that achieving the UN’s sustainable development goals is a widely accepted standard as a minimum level of global justice.

Our paper presents four case studies covering four different ecosystems: forests, fishing, farming and water. For each ecosystem, we drew out some examples of biodiversity loss and the actions taken to try to recover or reduce the impact of that loss. For all the case studies, there were a variety of intra- and intergenerational justice issues, which we link back to our definitions of justice. For example, in the farming case study, we investigated a payment for ecosystem services, which incentivised the conversion of cropland on highland slopes into forest and grassland by providing farmers with cash and grain subsidies to better manage flood risk further downstream. However, the subsidies were not distributed fairly across all groups of farmers.

The case studies demonstrate examples of how biodiversity loss and justice can have implications for traditional actuarial work. For example, the farming case study shows that agricultural practices could have a direct impact on natural catastrophes, such as floods further downstream, which may impact insurance companies. Also, the intensification of agriculture has led to increased use of chemicals, such as pesticides, which can impact human health over longer time frames. Furthermore, certain groups of people may be more exposed to these health risks than others, which could lead to further unjust outcomes.

In addition to the implications for actuarial work, the paper identifies that the actuarial skillset itself can be hugely useful in developing financial solutions to biodiversity loss and considering justice. In traditional financial settings such as with-profits and pensions valuations, actuaries perform data analysis, long-term modelling and consider the equitable allocation of resources for a range of stakeholders of different generations. Actuaries already work with frameworks that bring fairness into decision-making, such as treating customers fairly and the principles and practices of financial management. As a profession, we have a unique skillset. The paper proposes that not only do we need to consider biodiversity and justice risks in our actuarial work, but that the actuarial skillset can open up opportunities for actuaries to contribute further to the field of biodiversity and justice risks. I will now hand back over to Nick (Spencer).

The Moderator (Mr N. S. Spencer, F.I.A.): Thank you very much to all the panellists. In closing, I think that is very useful introduction to the key topics that society is facing and where actuaries could become involved.

Sessional Meeting: Monday 26 and Tuesday 27 April 2021 Biodiversity-Related Risks: Zoonotic Diseases, Natural Capital, Biodiversity Tools and Justice

Summary of Roundtable Discussions

Following presentation of five papers, there was 40 minutes of discussion among delegates, across seven groups. There was a group for four of the papers (zoonotic diseases, natural capital, biodiversity tool and justice), as well as ones considering the impact of biodiversity implications for pensions, insurance and risk management. Each group was assigned three main questions, although in practice the tables had varied and wide-ranging discussions. Each table included one facilitator and one note-taker from the IFoA’s sustainability community. The following summary has been prepared from the notes taken.

There was an expectation that requirements to manage biodiversity loss and nature-related risks will progress more quickly than the previous timeline for climate change-related risks. Learnings from climate change including frameworks such as TFND (Task Force on Nature-Related Financial Disclosures) which follow on from the TCFD (Task Force on Climate-Related Financial Disclosures) will help facilitate this. It is also likely that there will be increasing public demand to preserve and restore nature as part of the increasing public engagement on climate change, especially as there is growing acknowledgement of the need to preserve biodiversity as part of the required actions on climate change.

A challenge for biodiversity is that defined goals and targets are less established, making it more difficult for institutions to identify actions which help address these issues. Regulations are needed in the real economy for such issues to be incorporated into markets including prices. However, since many of these risks cannot be quantified it may remain a challenge for markets to appropriately incorporate such factors, and actuaries will need to be comfortable working with qualitative measures as well as facing into data challenges. The COVID-19 pandemic has brought the topic of biodiversity loss and climate change into focus and made the risks more tangible, which was deemed likely to accelerate policymaker and public awareness of these issues.

This roundtable report covers the core questions on work being undertaken, the actuarial articulation of potential financial risk, and any tools or metrics being developed. It then considers implications for each of the actuarial domains (insurance, pensions and risk management) and finally suggested next steps.

Are you aware of any work on natural capital/biodiversity justice or zoonotic diseases (excluding COVID-19 response) going on within the finance sector?

Thought pieces and articles on pandemics, disease emergence, natural capital and justice were acknowledged, but there was widespread recognition that tangible actions and detailed plans to address these challenges were lacking. However, it was felt that recognition of such topics and their relevance to the financial sector had accelerated over the last year. In particular, consideration of climate justice is evident, and parallels here with biodiversity should be explored.

Within investment circles, biodiversity was a more widely recognised term than “Natural Capital”; however, both concepts were new to some attendees. Consistent with the Natural Capital paper, there was the recognition that natural capital valuation may help accelerate action but has limitations, not least because valuations are subjective, may differ between different groups and necessarily involve moral and ethical judgements. The implications are significant. If the true costs of nature were appropriately internalised into company valuations, this would result in some companies being revealed as less profitable than they currently appear.

From a broader justice perspective, work on treating customers fairly has largely resulted from action by regulators rather than the industry itself. Actuaries do have experience of considering justice and fairness as part of their wider work, in particular balancing the needs of different stakeholders. Examples include

Collective defined contribution pension schemes: these differ across the world, with different types of fairness used in designing those schemes. It is important to remember here that the concept of fairness (i.e. what is and is not fair) did not arise by itself, it was created by actuaries and other professionals as well as employers, which then influenced regulation. It is often guided by (reasonable) expectations of the participants.

With-profit fund management necessarily involves judgements between different cohorts of policyholders, between policyholders and shareholders, and considering policyholders reasonable expectations.

Portfolio transfers of investment funds must consider all perspectives, including the impacts on those remaining in the fund.

Factors influencing individual views and values were discussed, and it was recognised that past knowledge and lived experience shape future expectations. In the context of natural capital and justice, the United Nations sustainable development goals could be seen as defining reasonable expectations for society. Others may hold the expectation that things will stay roughly the same and may therefore reject such changes. For some financial products, reasonable expectations can be well defined, especially where there is long-standing practice, but the concept as it relates to biodiversity cannot.

There are wider initiatives such as the Finance for Biodiversity Pledge, the Prince of Wales’ Terra Carta and the Task Force on Nature-Related Financial Disclosures, although these are in early stages and do not have detailed action plans.

How well are the potential financial impacts of natural capital/biodiversity justice/zoonotic diseases/biodiversity risks being articulated by actuaries?

There is not widespread consideration of the financial impacts of natural capital, biodiversity justice and zoonotic, diseases and the pace of change across the industry needs to increase. It is believed that financial service regulators will respond more quickly to these than they did with climate-related risks, and it was felt that future regulatory action in this area was almost certain. The pace of change across the finance industry should increase, and current understanding across business is low.

Compared to climate change, biodiversity impacts are more widespread, and hence it is more difficult to identify risks and opportunities. This problem is made worse by a lack of standardised metrics for measurement. Like the climate crisis, collective action is required. It was felt that due to the interactions between climate change and biodiversity loss, these risks could not be separated, and should rank equally, but a common perception among the wider industry and society is that biodiversity ranks lower. Currently, nature crises are not enjoying the same high profile as climate change. It was felt that actuaries are not doing enough to communicate that climate change and biodiversity loss should be considered together. However, there was hope that this would shift going forward.

Actuaries should consider how we might encourage the right kind of behaviour, in terms of biodiversity loss and climate change, and think about the types of incentive that could encourage action. Applying financial values is difficult however, for example, how do you quantify the loss of a bee population?

Within General Insurance, it had been generally considered “when” not “if” a pandemic would happen, but most of the scenarios did not consider the lockdown response. There is now work underway to compare previous hypothetical scenarios with what actually happened. The importance of a holistic view and considering multiple risks acting together was highlighted (e.g. there have been more cyber-attacks during the pandemic).

Are you aware of any tools or metrics being developed by actuaries to quantify biodiversity risk?

The groups did not identify any tools or metrics being used, or developed, by actuaries to quantify biodiversity risks.

Implications for Insurance

Are you aware of (or involved in) any work currently going on within the insurance industry on biodiversity-related risks? If not, where do you see that they may emerge?

The insurance industry (as both an insurer and asset owner) is still at very early stages of assessing the impacts of biodiversity loss, with most insurers not yet actively working on this. Detailed plans and understanding are currently limited. Efforts are especially primitive when compared to the efforts currently applied to understanding climate-related risks. Ironically, progress on this topic has been held up by the pandemic despite pandemics being a manifestation of biodiversity risks.

It was felt that further work was needed by insurers, and that this should be a priority in the coming years with the opportunity to leverage experience from climate risks (e.g. reusing risk management frameworks) to accelerate action. It was suggested that the CRO forum would be well positioned to prepare a paper on what we have learnt from climate change and how to apply these lessons to biodiversity risks. This includes work on how to bring biodiversity loss into a risk management framework. Additionally, insurance consultancies should look to keep pace with developments and help bring the conversation to clients. It was thought that applying a similar classification of risks as that used for climate-related risks – Physical, Transition and Liability would be useful.

An example of regulatory intervention was given. The regulator in South Africa ordered a pension fund to set up a financial provision for the costs of retiring a mine (held as one of its assets) and the rehabilitation of the surrounding environment (e.g. to address water contamination).

The insurance industry should consider the impact that government intervention might have on the performance of their assets and liabilities, in sectors vulnerable to government intervention (e.g. mining industries). The materialisation of biodiversity-related risks could impact insurance claims on products such as business interruption, as well as impact operational supply chains. In terms of litigation risks, direct action against insurers who underwrite activities that accelerate biodiversity loss was not widely recognised among delegates (consideration of litigation risk was largely limited to exposures on directors and officers liabilities products), so is an area that warrants future investigation.

What are the challenges to recognising these risks? How could the insurance industry (as an asset owner/financer and underwriter) address activity that contributes to biodiversity risks?

A key challenge is the lack of clearly defined goals – such as the Paris Climate Agreement, but for biodiversity. Awareness of the Aichi biodiversity targets for 2020 among delegates was absent. These targets were not met, but there has not been a collective response to this. There appears to be a lack of a common “forward-looking goals” from either government or industry. Additionally, knowledge about how to translate such goals into actions that address them is absent. Actions needed to limit climate impacts were felt to be more tangible. The lack of common goals and detailed implementation plans mean that it is very difficult to apply market-based solutions such as disclosures and valuations. Without disclosure and valuations, markets are unlikely to be incorporating such risks into asset prices.

Capacity was also an issue. Regulatory and government focus has placed climate change front and centre. Creating space for biodiversity is a challenge and there is currently little perceived financial incentive for actuaries/insurers to dedicate time and money to address this problem.

A lack of metrics to measure biodiversity impacts on insurance and investments was identified as a key challenge. Metrics, and a common language, are required for communication of these risks to board members and other stakeholders. Metrics require standardisation to avoid problems of “green washing” and to assist decision-making. Improving reporting and disclosures from companies is critical to allow assessment for investment purposes.

The current actuarial approach to extreme event scenarios is focused on looking at an extreme event happening within the next year. This is a very short-term approach in the context of climate change and biodiversity loss, which are chronic trends that materialise over a longer time horizon. A long-horizon reverse stress scenario approach was felt to be useful to identify key drivers of system collapse and allow a wider understanding of how to monitor, manage and mitigate these risks.

There is an apparent dichotomy between life insurance and pension’s business which is long term, and hence exposed to the impacts of climate change and biodiversity loss compared to short-term General Insurers. General Insurers can reprice annually, but their underwriting activities have significant implications for the intensity of risks faced by these longer-term businesses. General Insurers also face these in the long term. In the long term, repricing could become unaffordable for many customers, and threaten their long-term business models. In the nearer term, General Insurers could also be exposed to reputational risks.

It was recognised among delegates that a world without biodiversity is as uninsurable as a 4-degree climate scenario, so we might want to consider introducing a “bio-wise” to complement the existing “climatewise” initiative. As with climatewise, involving all functions of the business to embed such considerations will be key.

Whilst international biodiversity issues are often recognised (such as Amazonian deforestation), we should consider that natural capital preservation starts locally (e.g. soil health and planting trees to help with flood defences). It is important to recognise, and address, the damage to biodiversity that has occurred locally, such as the UK, as well as efforts on the smaller remaining amounts of global wilderness.

Implications for Pensions (and Investment)

What work are you aware of to identify, measure, monitor and manage biodiversity risks? What are the concepts that actuaries need to focus on (e.g. asset modelling, investment diligence, covenant risk, stewardship, regulations)?

In terms of forward-looking projections, the financial modelling company Ortec Finance was identified, who have a focus on climate modelling including GDP effects. The IFoA’s Economics Member Interest Group covers sustainability topics including zero-growth and population demographics. The Dasgupta report has raised the profile of a need for alternative measures to GDP.

What do you see as the challenges around assessing the financial impacts of biodiversity risks (given their nature; complexity, uncertainty, non-linearity, optionality/tipping points):

a. Within individual investments (including supply chain issues)

b. In asset modelling

c. Interconnectedness with other systemic risks (e.g. zoonotic diseases)

Biodiversity is currently less well understood compared to climate change, especially in terms of target setting. For example, within climate change there is widespread recognition of net zero and temperature rise targets. From an actuarial perspective, it is therefore easier to understand what is needed and the end goal. The challenge with biodiversity is how to articulate targets, so it can be better used in the public arena. “Net zero” is clear and is about avoiding harm. Furthermore, there is a lack of uniformity in biodiversity targets as well as the inherent uniqueness of biodiversity itself. “Net zero” is global, but biodiversity goals can be very different at local and global levels and biodiversity destroyed in one area cannot easily be offset by improving it somewhere else. Any biodiversity target should also consider regeneration. “Biodiversity” may be a difficult concept to communicate and perhaps we should look at alternative terminology such as “nature” with biodiversity being a subset of that. We also need to consider the implications for the economy as a whole, not just the financial sector.

As actuaries, one thing we need to make an assumption about is investment returns. Currently, there is a lot of looking backwards to create inputs to ESGs. A large part of investment returns come from economic growth. There is a lack of forward-looking factors which is an issue that needs further research, particularly considering the potential for limits to growth which is recognised in the Dasgupta report but not in most investment projection work.

For pension funds, there is also the question of covenant risk which could arise from biodiversity loss – both in terms of private and public sectors – for companies, economies and regions that are highly dependent on biodiversity.

It was recognised that there is a limit to valuing nature – some parts are not possible to value. This should not dissuade the efforts on valuing – but its limitations, and undervaluation bias, should be recognised.

With respect to assessing biodiversity issues in investments, it was felt that change would need to come from developed nations, primarily through demanding supply chain transparency. The idea that pension members should care about the social impact of the companies they invest in is potentially powerful.

The concept of social discounting was discussed with the 3.5% rate, recommended currently in the UK government’s Green Book identified. It was raised that perhaps pension scheme members (especially those who are parents) wouldn’t support a positive social discount rate. They might even support a negative one with the recognition that older generations often care about future generations and legacy. However, it was noted that there is a potential disconnect between pensions members (who may care a lot about these issues) and pension trustees. Pension trustees may have a narrow view of long-term value and the framing of the conversation in terms of the impact on future generations needs to carry a bigger weight in the discussion.

It was also recognised that intergenerational transfer and systemic risks are not linked to political time horizons, so action may not come from government. Some group members believed that the social time preference (discount) rate of 3.5% in the government’s Green Book was too high.

Implications for Risk Management

What work are you aware of to identify, measure, monitor and manage biodiversity risks?

There was a joint study by The Dutch Central Bank & Netherlands environmental assessment agency on financial sector exposure to risk because of biodiversity loss. This identified that Dutch financial institutions had EUR 510 billion in exposure to companies highly or very highly dependent on biodiversity. This was c.36% of the portfolio examined. This highlights that industry is embedded in nature and that there are large risks but the big challenge in measuring this.

What do you see as the challenges around quantifying the financial impacts of biodiversity risks (given their nature; complexity, uncertainty, non-linearity, optionality/tipping points) and how might they be addressed in a practical way that addresses the needs of:

a. Pension schemes and insurance companies?

b. Their regulators?

c. Pension scheme members and insurance customers?

It was noted that EIOPA is intending to require climate change scenarios to be included within the ORSA. A natural extension would be to include biodiversity scenarios in the ORSA too (which are interrelated with climate change scenarios).

At present, ORSAs are an annual report required for insurers only (in many countries, but not all). It is not published, and only goes to the regulator, which limits its value in some respects, although regulators could insist on evidence of biodiversity considerations. Pension funds, like listed companies, are being pushed to consider TCFD (Task Force on Climate-Related Financial Disclosures) scenarios, but this is not as coherent a format as the ORSA. In concept, there’s no reason why the ORSA could not be extended to other types of business, certainly banks and potentially pension funds. A publicly disclosable form of the ORSA could also be considered, particularly regarding these areas of high public interest.

Credits schemes (e.g. Australian Reef) often boil down to people buying credits to improve ocean water quality if they feel bad about what they’re doing (“conscience offsetting”).

There is a risk around monetisation of natural capital, in that converting nature into monetary value leads us to make incorrect development decisions. In the near term, transparency was felt a quicker route to change, than needing to measure things, but it is possible to develop both. For example, on climate change, there is discussion on carbon trading and credit, but it could be said that TCFD has had more of an effect than the distant financial “threat” of a carbon tax.

There is also difficulty on understanding whether certain actions currently have a net positive or negative on biodiversity (e.g. planting monocultural forest when impacting water and especially peatland, resources). There is a need for more sophisticated system-wide understanding of biodiversity interventions and their long-term impact (to avoid greenwashing).

We need to be mindful that our risk going forward is different from the past (something that is a 1 in 100 risk today may be a 1 in 50 risk in the future as we suffer the ever greater impacts of biodiversity loss).

What should the IFoA and individual actuaries (or regulators) do next?

Biodiversity was discussed throughout the sessional in the context of climate change and COVID-19. A recurring theme was that work already underway in these areas should be leveraged to accelerate action on biodiversity loss and that action should be possible on a shorter timescale than happened for climate change as we build on lessons learned. This may also be accelerated further through increased public awareness of nature-related issues.

More specifically the following actions were identified from the notes of the discussion. They have been passed to the IFoA’s Sustainability Board and the working parties that participated in the event for consideration.

Identification, Measurement and Targets

There is an immediate need to identify biodiversity loss issues and set targets in order to manage them. That is the aim for Taskforce for Nature-Related Financial Disclosures. The Net Zero Asset Owner Alliance and the IIGCC Net Zero Investment Framework are good structures for setting targets – clear and comparable – and thus lead to action. The same is required for biodiversity loss.

An action plan is needed to address how we meet these agreed targets. Disclosure of this plan by companies and governments is needed.

Targets for restoring biodiversity are needed at a global level, for example, there could be deforestation-related targets to help Brazil preserve the Amazon (using some form of payment mechanism as suggested in the Dasgupta report). The delayed Kunming Biodiversity Congress of Parties will hopefully create some momentum to these targets, with an agreement on a successor to the Aichi 2020 biodiversity targets.

Businesses and governments need to start identifying and monitoring biodiversity loss. The first step could involve identifying the key drivers and their inter-relationships and associated risks. This could be done quicker than something which attempts to directly quantify the loss.

Actuaries need to work towards identifying biodiversity risk impacts across the businesses in which we work. In particular, the potential impacts on mortality were felt to warrant further investigation.

There is a need to also identify areas where opportunities may arise through protecting biodiversity, natural capital solutions and where businesses can help deliver this change and where they may benefit.

There is a need for comprehensive and comparable disclosures for wider nature – akin to the TCFD – this is currently being developed in the TFND and was largely welcomed.

Insurers and banks should be encouraged to review their underwriting and lending activities and ensure they understand what impact they have on biodiversity loss. These impacts should form part of public disclosures.

Insurers should be encouraged to review their operations, including claims process, and ensure they understand what impact they have on biodiversity loss. An example was given of schemes in place for more sustainable car replacement schemes for motor insurers that has less of an impact on the environment, by refurbishing or using second-hand replacement parts.

Accountability for implementing these changes is important and performance against targets needs to be monitored. Developing governance and interim milestones that ensures active progress towards these targets is critical and could be linked to remuneration of the senior executive team.

Since some of these issues are difficult to quantify, it is often about governance processes over specific metrics. Actuaries may need to get comfortable with not seeing numbers, understand how to evaluate and give credit to governance processes which take a more qualitative approach to measurement.

Education and communication

Educating wider stakeholders should include

○ Promoting understanding and focus on the link between long-term profits and the natural environment (including biodiversity loss).

○ Promoting a longer-term view of investment returns that consider the impact of sustainable investment.

○ An illustration of how a positive impact today on the world and environment will lead to a less of a negative impact in future – that is, it could be more expensive to take no action.

○ Development of joint policy that tackles climate change and biodiversity loss.

Publish a reading list and include biodiversity in the weekly sustainable finance newsletter

Thought Leadership

In terms of understanding the risks posed by biodiversity loss, an industry-wide conversation is needed to encourage collaboration –whilst data is imperfect, this should not preclude decisions being made and action being taken.

It would be beneficial to develop specific examples and case studies in this area in order to learn and raise awareness of action that may be taken.

Acting in the public interest – is this a professional body duty or an individual actuary duty? Different people think differently about this. How you define the public interest is an important question that should be addressed? At the very least, the IFoA should leverage the perspective of actuarial science to illustrate the long-term financial risks that biodiversity loss could create.

Investigations on the interaction of biodiversity, zoonotic diseases and financial impacts should be undertaken.

Areas of justice and values can be explored through the links with actuarial fairness and actuarial values. Actuaries should highlight the impacts of social and environmental discount rates on justice and intergenerational fairness.

Further work should be undertaken on the impact of tipping points, irreversibility and non-fungibility of biodiversity risks.

Collaboration and Multidisciplinary thinking

COVID-19 has brought to light the value of the actuarial skillset, particularly by supporting with modelling and scenario analysis. It would be useful going forward to have models that help us understand how diseases might spread and where we could get incidences of cross over between animals and humans. We would need to collaborate with other professionals (e.g. scientists, economists and academics) in order to collect the data and understanding needed. Collaborating with others would also help actuaries capture assumptions such as government intervention and national lockdowns, which may not have been captured in our thinking pre-COVID-19. It is not possible to ignore human demographics in considering biodiversity issues and this is an area in which actuaries have expertise.

It would be beneficial to partner with institutions (e.g. Finance for Biodiversity) and professionals globally as this issue is not specific to any one country and there are many areas where we could learn from each other. A multidisciplinary approach, between actuaries and other risk managers, is beneficial in order to consider the limitations of each other’s frameworks.

Biodiversity is not a problem confined to certain jurisdictions – collaboration across industries and national governments is needed. We should call on a collation of at least the G7 countries to create a global commission on the economy and nature. There was such a climate collaboration following the Nicholas Stern review. A nature-focused one is needed to follow the Dasgupta review.

Broader areas for research

What are the investible “natural capital solutions”? What does appropriate regulation for this look like (to avoid green washing)? Is a public−private partnership required to ensure sufficient financing of public goods?

What criteria might be used to determine whether or not a company genuinely qualifies for a “green” tick mark, which decides whether the company is included in a passive fund?

Are markets pricing natural capital and biodiversity properly? Should this be explored by the actuarial profession? – could we move away from the law of one price and accept a plurality of prices and values?

Green products can cost more than standard products, for example, solar panels at home leading to increased home insurance premiums as fire risk goes up. We should investigate solutions to reduce this so that “green” decisions are not penalised.

Develop better and more data on possible future pandemics including different possible scenarios (e.g. a pandemic that had the inverse impact on mortality as compared to COVID-19 – e.g. younger people more impacted). This would involve looking at pathways for the disease, mortality rate and spread rates for different zoonotic diseases, as well as including how governments respond. A set of experts is needed, for example, scientists working with actuaries to better develop responses and understanding.

Question the assumption of endless economic growth and whether growth is a desirable target. What would a zero-growth society mean for actuarial projections and our work?

Where new biodiversity funds are launched, we should explore these in terms of justice issues.

Understanding the current tools and frameworks used to think about fairness and value, from different groups and perspectives. Then thinking about how we can use these in the assessment of biodiversity justice issues.

What do we mean by equity and justice with regard to living standards? Is the West placing their conceptions of fairness onto the rest of the world?

Understanding stakeholder perspectives. For example, in the UK, decisions around impacts for things like HS2 or housing developments often have different valuation approaches for local communities versus those of the developers. Can actuaries develop a multi-valuation framework which reflects different stakeholder valuation perspectives?

Regulation

Requires a systems-thinking approach with regulators developing disclosure requirements, managing permitted behaviours and organising incentives to reduce the market failure of biodiversity losses.

Given the long-term nature of biodiversity risks and that many of the benefits may not be attributable to any one individual, there is a need for regulation to shape action. This ensures that everyone is playing by the same rules. A lack of action leaves everyone bearing the consequences of negative externalities.

A capital-based regime should be developed that helps capital flow to areas of economy that are compliant with biodiversity preservation (e.g. higher capital requirements for assets deemed to be disruptive to biodiversity).

Direct prohibition of financing and underwriting activities may be needed for business activities that hasten biodiversity loss where inadequate transition plans are in place.

Transparency is required and this means a need for disclosures that focus on, not only risks to a business from biodiversity loss, but also the impact the business has on biodiversity loss. A challenge here is scope – we need to develop something akin to scope 1, 2 and 3 carbon emissions but for biodiversity loss.

Regulation should consider which stakeholder voices get heard and should reflect differences in terms of valuation from different points of view.