Summary of the dispute

China–Audiovisuals Footnote 1 is a complex and broad-based dispute filed by the United States in April 2007 against a series of Chinese restrictions on the importation and distribution of certain ‘cultural’ or ‘content’ goods and services: (i) reading materials such as books, periodicals, and electronic publications; (ii) audiovisual home-entertainment products such as DVDs; (iii) sound recordings; and (iv) films for theatrical release. More particularly, the dispute concerns problems faced by the US ‘content’ industry trying to obtain the right to import and distribute within China on a nondiscriminatory basis. This dispute is closely related to the one on China–IP Rights Footnote 2 where the issue at stake was the protection and enforcement within China of intellectual property rights, in particular copyrights, linked to cultural goods and services. Indeed, the United States argued that the fact that China was controlling which companies could import audiovisual items and which ones could distribute these items raised prices and opened up the market to piracy and counterfeits.

As a preliminary matter, the Panel found that certain measures and products complained about fell outside its terms of reference. The Chinese measures it did examine, however, were almost all (15 out of 17 measuresFootnote 3) found to violate one or more of the following WTO commitments: (i) China's commitment to grant the right to trade (in particular, import) to all enterprises in China including foreign-invested enterprises and individuals, under China's Protocol of Accession; (ii) GATS market-access and national-treatment obligations towards foreign (US) suppliers of distribution services operating within China; and (iii) GATT national treatment in respect of measures that affect the distribution of imported reading materials.

The Panel Report was circulated in August 2009. Most Panel findings were not appealed. China only appealed three elements. First, it appealed the Panel's finding that China's trading-rights commitments apply to Chinese measures concerning films for theatrical release and unfinished audiovisual products, on the ground that, according to China, these measures regulate ‘services’ and content, not ‘goods’. Second, China appealed the Panel's analysis and conclusion under GATT Article XX(a) (public morals), an exception that China had unsuccessfully invoked to justify violations of its Accession Protocol with reference to China's censorship regime allegedly imposed to protect public morals against sensitive cultural imports.Footnote 4 Third, China appealed the Panel's finding that ‘Sound recording distribution services’ in China's GATS Schedule cover the electronic distribution of sound recordings in nonphysical form, notably over the Internet. The Appellate Body upheld all of the Panel's conclusions and confirmed that China had violated its Protocol of Accession in a way that cannot be justified under GATT Article XX(a). The Appellate Body also confirmed the Panel's findings of GATS violation. The Panel's findings of violation under GATT had not been appealed. Both the Panel and the Appellate Body Reports were adopted by the WTO Dispute Settlement Body on 19 January 2010.

In what follows, we discuss what we believe to be the most interesting legal and economic issues raised by the Appellate Body's ruling on China–Audiovisuals.Footnote 5 The legal analysis is divided in two parts. First, we review the Appellate Body's approach to, and definition of, what is a ‘good’ (is a ‘film’ a good or a service?). Second, we discuss the extent to which GATT Article XX exceptions can justify violations under WTO agreements or instruments other than the GATT itself. In this case, China was allowed to invoke ‘public morals’ under GATT Article XX(a) to justify violations under its Protocol of Accession. In future cases, the issue may well be whether a health or environmental regulation, anti-dumping duty, safeguard, or subsidy that violates the SPS, TBT, AD, SG, or SCM agreement can be justified under GATT Article XX (or XXIV) exceptions.

The economic analysis will also be divided in two parts. First, we review the economic implications of the Appellate Body's ruling in China–Audiovisuals. We argue that trade volumes are unlikely to significantly rise as a result of this ruling as it does not affect China's right to keep out foreign films and publications if China finds them objectionable. However, foreign producers of audiovisuals can now gain potentially large economic rents, by being able to export and distribute their products into the Chinese market. Second, we discuss the issue of the protection of cultural goods. In China–Audiovisuals, China argued that reading materials and finished audiovisual products are so-called ‘cultural goods’ and as such have a potentially serious negative impact on public morals. However, this dispute left open the question of whether the protection of cultural goods can or should actually be justified under GATT/WTO rules. We briefly review the recent literature on trade and culture, which has put forward economic arguments to justify, under some conditions, the protection of cultural goods.

1. Legal analysis

1.1 Is a film a ‘good’ or a ‘service’?

In China–Audiovisuals, the United States invoked market-access and trading rights under the GATT, GATS, and China's Accession Protocol. It complained that China's distribution system discriminates imports as compared to domestic, Chinese goods or service suppliers in violation of national treatment, a cornerstone of both GATT and GATS agreements.Footnote 6

Faced with such choice between GATT and GATS in the context of today's sophisticated ‘content’ industry that often has goods-and-services components (a newspaper is made of paper, but its content is a bundle of services that are by far the most important added value; moreover, newspapers can now also be read and traded online), a question that arises is whether a product is a ‘good’ or a ‘service’ and whether a particular measure is subject to the GATT as a restriction on trade in goods or the GATS as a restriction on trade in services, or both. This classification may be rather academic in a legal system (such as the EU) where free movement of goods and free movement of services are by now subject to more or less the same commitments. In other situations, in contrast, the goods and the services regimes may impose radically different obligations. In such cases, drawing the line between goods and services can make or break a dispute. This is the situation in the WTO, where GATT is over 60 years old with a complete ban on all quantitative restrictions and discriminatory regulations unless justified under limited exceptions (in particular GATT Article XX). The GATS, in contrast, is only 15 years old and composed mainly of country-specific commitments carefully bound (or not bound, depending on the services sector in question) so that national-treatment or market-access obligations only exist if and to the extent that a particular member made a specific commitment for the particular sector in question. These obligations are subject to general exceptions, particularly, in GATS Article XIV, which is similar to GATT Article XX. A similarly divergent regulation of goods as opposed to services can be found in anti-dumping rules. Such rules permit the imposition of anti-dumping duties on imports of goods below fair or normal value. In cases where an import is classified as a ‘service’ (instead of a ‘good’) no anti-dumping duties can be imposed.Footnote 7

So how does the WTO proceed in its application of the GATT and/or the GATS in situations of doubt? Firstly, and most importantly, nowhere does GATT define what a ‘good’ or ‘product’ is. GATS, in turn, does not define the concept of a ‘service’ either. Instead, the GATT Secretariat issued an indicative list of service activities or sectors that most WTO members have used as a template when making GATS commitments.Footnote 8 GATS Article I:1 does, however, state broadly that it applies to any measure by any WTO member ‘affecting’ trade in services. Secondly, and largely as a consequence, in EC–Bananas the Appellate Body found that the GATT and the GATS are not mutually exclusive so that one and the same measure can be subject to both GATT and GATS.Footnote 9 In Canada–Periodicals, for example, the Appellate Body found that ‘a periodical is a good comprised of two components: editorial content and advertising content. Both components can be viewed as having services attributes, but they combine to form a physical product – the periodical itself’.Footnote 10 In US–Lumber CVDs Final, the Appellate Body found that standing timber, even before it is harvested (that is, trees attached to the land but severable from it), is a ‘good’ even if it is not tradable as such.Footnote 11 The Appellate Body rejected Canada's argument that the term ‘goods’ must be read as limited to ‘tradable items with an actual or potential tariff classification’Footnote 12 but added that important caveat that ‘“[g]oods” in … the SCM Agreement and “products” in … the GATT 1994 are different words that need not necessarily bear the same meanings in the different contexts in which they are used’.Footnote 13

That set the stage for a jurisprudence that focuses on the measure in question and whether it has an effect or impact on trade in goods and/or services, with physical or material nature being a decisive criterion for something to be a good.

China–Audiovisuals follows this line. In China, only certain state-approved entities may engage in the business of importing films into China. These entities enter into a licensing or distribution agreement with a foreign-film producer or licensor and, after content review, import certain delivery materials including hard-copy cinematographic films. In paragraph 5.1 of its Accession Protocol, however, China committed to phase out state trading three years after its accession (with limited exceptions) and that, after three years, ‘all enterprises in China shall have the right to trade in all goods throughout the customs territory of China’. The Protocol defines the right to trade as ‘the right to import and export goods’. According to China, this right to trade in goods does not apply to measures pertaining to films for theatrical release since such measures ‘do not regulate the importation of goods, but, rather, regulate the content of films and the services associated with the importation of such content’.Footnote 14 For China, ‘films for theatrical release are not goods because they are exploited through a series of services; because the commercial value of films for theatrical release lies in the revenue generated by these services; and because the delivery materials containing the content of films are mere accessories of such services and have no commercial value of their own’.Footnote 15

In response, the United States argued that ‘the vast majority of goods are commercially exploited through a series of associated services and that China's argument would transform virtually all goods into services’.Footnote 16 The United States added that ‘Articles III:10 and IV of the GATT 1994, which deal with cinematographic films, confirm that films for theatrical release are goods’.Footnote 17 The United States also referred to the international classification of products under the Harmonized Commodity Description and Coding System of the World Customs Organization and China's WTO Schedule of Concession for goods, both of which contain a heading for ‘cinematographic film’ with embedded content.

In line with the abovementioned focus on measures (and their effect) rather than products as such (is a film a good or a service?), the Appellate Body focused on the Chinese regulation setting out the restriction, including a detailed analysis of the term ‘Dian Ying’ used in that regulation and its English translation (‘motion picture’). The Appellate Body concluded that ‘where the content of a film is carried by physical delivery materials, [the Chinese restriction] will inevitably regulate who may import goods for the plain reason that the content of a film is expressed through, and embedded in, a physical good’.Footnote 18 For the Appellate Body, this effect on goods (i.e. the physical film reel that crosses the border) is ‘inevitable, rather than “incidental”’ and ‘the mere fact that the import transaction involving hard-copy cinematographic films may not be the “essential feature” of the exploitation of the relevant film does not preclude the application of China's trading-rights commitments to the Film Regulation’.Footnote 19 The Appellate Body reached the same conclusion in respect of restrictions on unfinished audiovisual products or master copies to be used to publish and manufacture copies for sale in China.Footnote 20

Several lessons can be drawn from this ruling. First, the Appellate Body confirms that a given product can have both a goods and a services component and that a given measure can be subject to both GATT and GATS where it ‘affects’ both goods and services. The two universes are not mutually exclusive. Crucially, the Appellate Body did not find that a film ‘is’ a good, but rather that it has a good's ‘component’ or ‘includes’ a good, to the extent the film is carried on a film reel or other physical material and that, as a result, a regulation which affects such film ‘inevitably’ affects a good. This means that regulators, when enacting a rule, must be aware that the new rule may have to comply with both GATT and GATS. This approach cumulates WTO obligations and may not make it easier to figure out which GATT or GATS discipline applies. The safest move may then be to comply with the strictest discipline be it under GATT or GATS. For complainants, including countries that want to challenge China's censorship regime, this approach is positive news: they do not have to limit themselves to GATT or GATS claims; they can submit and prevail under both. For regulating countries, such as China, the cumulative application of GATT and GATS is, obviously, less appealing.

Second, as in Canada–Periodicals, the Appellate Body's definition of a good focuses on the tangible or material nature of the product, i.e. the film reel or hard-copy films, and this irrespective of whether this tangible component represents only a minor fraction of the value or economic reality of the product. This, in turn, raises two questions. First, will the Appellate Body automatically find a good whenever it sees tangible material? Is, for example, a paper lottery ticket automatically a good – so that cross-border restrictions on lottery activities affect trade in goods? – or merely an element in the supply of (lottery) services, making the entire activity subject only to GATS? What about coins or paper money in the context, for example, of allegations of currency undervaluation or subsidization?Footnote 21 Would the Appellate Body consider paper money to be a ‘good’ provided by the government (‘financial contribution’) or rather as falling under the free movement of capital and, therefore, neither subject to GATT/SCM nor GATS rules on free movement of goods or services? What about paper carbon-emission allowances or permits which, under EU law, companies can trade and must submit when emitting CO2? Are these goods or services, or neither?Footnote 22

A second question that arises from the Appellate Body's focus on tangible material is this: does it suffice for a traded product to be intangible for that product to be regarded only as a service?Footnote 23 For example, if US film producers would stop physically shipping film reels or master copies to China for reproduction within China, and rather send the material electronically over the Internet, would that automatically imply that we can no longer talk of trade in goods and trading rights, and must examine the transaction exclusively under GATS (say, as a cross-border supply of ‘entertainment services’)? If so, China would then no longer violate its Accession Protocol (trading rights only apply in respect of goods) and the United States would have to rely exclusively on, for example, Chinese GATS commitments in entertainment or distribution services (which may well be below China's commitments in GATT). Should the mere method of delivery (tangible or over the Internet) bring about this drastic change in legal regime? If so, the GATT could be said to be technologically biased (unlike the GATS which, as discussed below, is technologically neutral). Should the law follow economic reality (in business terms little changes when sending the film on a reel or over the Internet, assuming the quality is the same), or should the law stick to physics (tangible is GATT, intangible is GATS)? Making tangibility a necessary condition for something to be a good may also mean that, for example, in the trade-in-energy context electricity cannot be classified as a good. Similarly, is a carbon-emissions allowance a good as long as it is traded in paper form or sufficiently linked to a ‘tangible, but fungible, input material’Footnote 24 (e.g., carbon emitted during production), but does it become a service, or otherwise stop being a good, when traded and registered electronically? The same conclusion could then be drawn in respect of intellectual property rights – which are intangible and arguably, on that basis, not a good – and this even though they are now commonly protected as ‘assets’ or ‘investments’ under bilateral investment treaties and the IP value (e.g., copyright) of a film is by far the most valuable component of the film. In contrast, if IP rights as such were to be seen as ‘goods’, major questions of GATT-TRIPS overlap would arise.

Interestingly, when interpreting the phrase ‘[s]ound recording distribution services’ in China's GATS Schedule, the Appellate Body found that this includes not only distribution of tangible products (such as CDs) as China had argued, but also distribution of intangibles over the Internet, as submitted by the United States.Footnote 25 It did so based on a textual and contextual interpretation of the words in this phrase, rather than with reference to broader criteria of ‘services’ or ‘goods’ definitions. Crucially, the Appellate Body confirmed its evolutionary approach to treaty interpretation, finding that the terms in China's GATS Schedule ‘are sufficiently generic that what they apply to may change over time’,Footnote 26 and that limiting their meaning to ‘the time the Schedule was concluded’ would mean that ‘very similar or identically worded commitments could be given different meanings … depending on the date of their adoption’, which would ‘undermine the predictability, security, and clarity of GATS’.Footnote 27

As a result, it is interesting to point out that the Appellate Body interpreted services commitments in a technologically neutral way (distribution covers both old-style physical delivery and new-style delivery over the Internet, unless otherwise specified), but limited goods commitments and the right to import goods to restrictions affecting material or tangible products (thereby, as noted earlier, apparently excluding films traded intangibly over the Internet). In other words, method of delivery (tangible or over the Internet) matters for goods, but not for services. In this sense, GATS is technologically neutral, GATT technologically biased.

From an economic perspective, it should be pointed out that the fine legal distinctions made in the WTO between goods and services, and the often crucial regulatory consequences that come with it, find little or no support in the economic literature. In general, there should be no reason why basic trade effects and welfare calculations should apply differently to, for example, tangible versus intangible products or to distribution by mail or over the Internet.

1.2 Can GATT exceptions justify breach under all WTO agreements?

Important issues are raised by the finding of the Appellate Body that a GATT exception can, in principle, justify a violation of China's Accession Protocol. Interestingly enough, in China–Audiovisuals, China did not invoke any GATS or GATT exception to justify the abovementioned GATS and GATT violations found by the Panel (but not appealed). In particular, although it could have done so, China did not invoke ‘public morals’ so as to justify some of these violations with reference to its censorship regime. In contrast, China did invoke GATT art. XX(a) (‘public morals’) to justify certain (but not all) restrictions on trading rights found to be in violation of China's Accession Protocol.Footnote 28

GATT Article XX is entitled ‘General Exceptions’ and states that ‘nothing in this Agreement shall be construed to prevent the adoption or enforcement’ of certain measures, including those ‘necessary to protect public morals’. Paragraph 5.1 of China's Accession Protocol, in turn, explicitly states that the right to trade that China committed to is ‘[w]ithout prejudice to China's right to regulate trade in a manner consistent with the WTO Agreement’. For GATT Article XX to justify a Protocol breach raises two hurdles. First, given that Article XX explicitly refers back to ‘nothing in this Agreement’, i.e. GATT, how can Article XX justify breaches outside the GATT? Second, and related, given that the Appellate Body had not made any prior finding of violation under GATT (say, a national-treatment violation under GATT Article III) how could China even rely on, or the Panel turn to, GATT Article XX exceptions?

The Appellate Body skillfully jumped over both hurdles. It found that China's obligation to grant the ‘right to trade’ under the Protocol may not impair China's ‘right to regulate trade’ in the sense of both (i) measures that other WTO agreements ‘affirmatively recognize’ provided they ‘satisfy prescribed disciplines and meet specified conditions’ (think of WTO-consistent import licensing, TBT, or SPS measures), and (ii) regulatory action that derogates from WTO obligations but ‘may be justified under an applicable exception’.Footnote 29 For the Appellate Body, the fact that the United States had not made a claim of violation under GATT to begin with (it only claimed a violation of the Protocol) should not ‘deny China access to a defence’. What matters, according to the Appellate Body, is the existence of a ‘clearly discernable, objective link’ or relationship between (i) the restriction on who may trade (breach of the right to trade) and (ii) China's regulation of what may be traded (China's right to regulate trade).Footnote 30 Since the regulation of trade or what can be traded (here, content review) may restrict or require regulation of who may import or trade (here, only selected state enterprises), the Appellate Body found that China's breach of the right to trade under the Protocol could possibly be justified by China's right to regulate trade pursuant to GATT Article XX(a).

This approach raises a fundamental question of WTO law. Must the ‘right to regulate trade’ as a possible defense be explicitly provided for in the violated provision that needs justification? Put differently, would China have been able to rely on GATT Article XX(a) even if paragraph 5.1 of China's Accession Protocol had not stated that the right to trade is ‘[w]ithout prejudice to China's right to regulate trade in a manner consistent with the WTO Agreement’? The Appellate Body's close textual analysis of this phrase and its context in China's Protocol may lead some to conclude that without this savings clause, GATT Article XX(a) would not have been available. On the other hand, one could argue that adding this savings clause was not strictly necessary in the first place and that all WTO obligations must be interpreted in the context of a WTO member's background or default ‘right to regulate trade consistent with the WTO Agreement’. In this direction, the Appellate Body saw ‘the “right to regulate”, in the abstract, as an inherent power enjoyed by a Member's government, rather than a right bestowed by international treaties such as the WTO Agreement’.Footnote 31 On this view, even without the savings clause in the Protocol, China could have relied on its ‘inherent power’ to regulate trade and, as a result, have justified its breach with reference to GATT Article XX(a). If so, what matters is not an explicit savings clause or reference back to GATT Article XX – nor the fact that the text of GATT Article XX itself is limited to ‘this Agreement’ (i.e., GATT) – but that the trade restriction or WTO violation in question may, as a regulatory or factual matter, result from, and be justified by, a GATT Article XX type regulation to protect public morals, health, or the environment. This relates to what the Appellate Body referred to as the ‘clearly discernable, objective link’ between, on the one hand, the breach and, on the other hand, a legitimate regulation of trade (consistent with specific WTO rules or exceptions).

That this question is of the utmost importance for WTO law is illustrated by the following examples. Can an environmental subsidy inconsistent with the SCM Agreement (be it a prohibited or actionable subsidy) on this ground be justified under GATT Article XX(g) as a measure ‘relating to the conservation of exhaustible natural resources’? Similarly, can a health or safety restriction inconsistent with the SPS or TBT Agreement on this ground be excused as a ‘public morals’ measure in line with GATT Article XX(a)?Footnote 32 Can an anti-dumping duty inconsistent with the AD Agreement be justified under GATT Article XX(d) as a measure ‘necessary to ensure compliance with laws or regulations which are not inconsistent with’ GATT?Footnote 33 Can a safeguard that carves out regional partners in violation of the Safeguards Agreement be justified under GATT Article XXIV allowing for preferential agreements?Footnote 34 Finally, can a measure in violation of TRIPS be excused as the exercise of the right to regulate so as to protect health in line with GATT Article XX(b)?

The above reasoning in China–Audiovisuals may support such general, fall-back right to regulate. Although these other WTO agreements do not include a general ‘without prejudice clause’ as set out in China's Protocol, there is a clear, legal relationship between these other agreements and GATT provisions (e.g., between GATT Articles VI and XVI and the SCM and AD agreements; GATT Article XIX and the Safeguards Agreement; GATT Article XX(b)/(g) and the SPS and TBT agreements; and GATT Article XX(d) and TRIPS). Moreover, as a regulatory or factual matter, there may also be a ‘discernable, objective link’ between the trade restriction or breach and the exception invoked, in that the breach sufficiently relates to, or results from, a legitimate exercise of the right to regulate consistent with other WTO rules or exceptions (the way Chinese censorship on what can be traded may require restrictions on who can trade).

Such approach would certainly harness the regulatory autonomy of WTO members. At the same time, it risks a considerable reduction of WTO obligations. It would also create tension with the Appellate Body's approach of applying WTO agreements and obligations cumulatively,Footnote 35 as well as with the principle that, in the event of conflict, GATT (including presumably GATT Article XX) must give way to more specialized WTO agreements on trade in goods such as obligations in the SCM, AD, SPS, or TBT agreements.Footnote 36 Finally, allowing GATT Article XX to be invoked to justify any WTO violation could well mean that any WTO dispute will ultimately be decided on whether the measure is ‘necessary’ to pursue an Article XX objective and nondiscriminatory under the chapeau of Article XX. This would both confer considerable power and discretion to the Appellate Body in its ‘weighing and balancing exercise’ under Article XX as well as highlight the limited list of objectives that can be pursued under Article XX (should, indeed, the fall-back ‘right to regulate’ not extend beyond the exhaustive list of objectives mentioned in GATT Article XX, a provision written in 1947 essentially with quantitative border restrictions in mind?).

From an economic perspective, if there are reasons to justify the use of protectionist measures on the ground of environmental externalities (under the GATT and Article XX), then similar arguments could in principle be used to justify exceptions when it comes to, for example, the use of subsidies (under the SCM Agreement, where no environmental exception is available). Indeed, if traditionally more harmful distortions such as a full ban on imports can be justified on environmental grounds under GATT, why not the normally less harmful distortion of a production subsidy under the SCM Agreement?

2. Economic analysis

In China–Audiovisuals, the United States has obtained certain rights to import and distribute within China on a nondiscriminatory basis. In what follows, we briefly review the main economic implications of the Appellate Body's ruling on this dispute and discuss the economic arguments that could be used for the protection of audiovisual products and other cultural goods.

2.1 Economic implications of the Appellate Body's ruling

Audiovisuals have for the most part been excluded from the progress in trade liberalization that has occurred in other sectors. Indeed, they are the object of an explicit exception concerning internal film quotas in Article IV of GATT 1994.Footnote 37 Countries such as Korea, Brazil, Venezuela, Italy, and Spain, have taken advantage of this exception to institute screening quotas for domestic (or EU) film exhibition (Bernier, Reference Bernier2003). Within China, there is a similar screening quota, pursuant to which two-thirds of films projected must be made in China.

In the case of China, foreign films must, in addition, be deemed suitable for all audiences. Under an elaborate censorship mechanism, China prohibits all content that, in its view, would have a negative impact on ‘public morals’. The list of materials banned includes, for example, material that ‘injures the national glory’, ‘undermines the solidarity of the nationalities’, ‘propagates evil cults or superstition’, ‘destroys social stability’, or ‘jeopardizes social morality or fine cultural traditions of the nationalities’.Footnote 38 For foreign-made films, this sometimes means controversial footage must be cut before such films can play in Chinese cinemas.Footnote 39

Regardless of the screening quota and the censorship, China permits only 20 foreign films per year for theatrical release on a revenue-sharing basis (of which 14–16 are usually Hollywood releases).Footnote 40 This means that only 20 foreign films per year get a (small) percentage of what they earn in the country instead of selling distribution rights for a flat fee.Footnote 41

China's internal screening quota, censorship policy, and quota on foreign movies that can be imported on a revenue-sharing basis were not at issue in China–Audiovisuals. The dispute was instead over the fact that imported audiovisual products could only be distributed by Chinese state-owned enterprises.Footnote 42

China–Audiovisuals has been hailed as a big victory for US movie producers. On the day when the Appellate Body Report was circulated, the US Trade Representative Ron Kirk announced: ‘Today America got a big win … The Appellate Body's findings are key to ensuring full market access in China for legitimate, high-quality entertainment products and the exporters and distributors of those products.’Footnote 43

Yet, the WTO ruling did not affect China's right to keep out foreign films and publications if it finds them objectionable. It also left in place the existing screening and import quotas. Therefore, sales of US audiovisuals in China are unlikely to increase as a result of this dispute. The WTO basically said that foreign audiovisuals can no longer be distributed only by Chinese state-owned enterprises. This implies that, even if market access is unaffected, foreign companies will be able to earn potentially very large economic rents when now allowed to import and distribute their entertainment products into the Chinese market.Footnote 44 Distribution by US companies (instead of Chinese state-owned companies) could also mean that more Chinese consumers watch the (still limited amount of) US movies allowed for screening in China. In other words, more transparent or efficient distribution may lead to more sales of particular imports that do pass China's quotas and censorship.

The Chinese government restricts the volume of cultural goods imported through strict censorship and explicit import quotas. Both kinds of policies are equivalent to quantitative restrictions of imports. In what follows, we examine the economic implications of such restrictions, distinguishing between two scenarios: (a) if China is a small country, i.e., takes the world price of cultural goods as given; (b) if China is a large country, which can affect the price of cultural goods in the world market. In both scenarios, we examine the welfare effects of a quantitative restriction (compared to free trade) and discuss the implications of the Appellate Body's ruling in China–Audiovisuals.

Small-country case

Assume that China is a small country importing cultural goods and facing a world price equal to p FT. At this price, domestic demand in China is given by D FT, domestic supply by S FT, and imports by the difference D FT – S FT.

Now suppose that the Chinese government desires to reduce the volume of cultural goods imported to an amount Q, which is below the free-trade level. It can do so by censoring some foreign goods or by explicitly introducing an import quota. The welfare effects of a quantitative restriction on imports can be described with the use of Figure 1. A reduction in imports will lower the supply in the domestic market and raise the domestic price.Footnote 45 In the new equilibrium, the domestic price will rise to the level p Q, where import demand equals the value of the quota, i.e. Q=D Q – S Q. Since the country is ‘small’, there will be no effect on the world price, which will remain at p FT.

Figure 1.

Table 1 provides a summary of the welfare effects of the quota on cultural goods on the Chinese economy compared to free trade. The left panel and right panel of the table consider, respectively, the welfare implications of quantitative restrictions before and after the Appellate Body's ruling on China–Audiovisuals. Notice that, since quantitative restrictions on foreign cultural goods (through de facto censorship quotas or import quotas) are still in place after the ruling, equilibrium quantities and prices are unaffected and so are Chinese consumers and producers: compared to free trade, consumers continue to experience a loss equivalent to the area A+B+C+D, while producers continue to gain A. However, the WTO ruling has a crucial impact on who receives the quota rents. These are given by area C, which is equivalent to the domestic price of the imported good, minus the world price, times the quantity of imports. Before the ruling, the permit to import and distribute foreign cultural goods was given by the Chinese government to state-owned companies; after the ruling, such right will be given to foreign producers.

Table 1. Welfare effects of a quota on cultural goods compared to free trade

Compared to free trade, a quota on cultural goods unambiguously hurts the Chinese economy. Compared to the previous policy regime, the Appellate Body's ruling on China–Audiovisuals leads to a net welfare loss for China, equivalent to area C, and to a corresponding gain for the United States.

The above analysis of the economic implications of China–Audiovisuals could have a potentially crucial impact on the calculation of US-authorized retaliation in the event China does not implement the Appellate Body ruling within the prescribed period. Traditionally, annual retaliation rights are set by the WTO at the annual value of trade that is kept out by the WTO-inconsistent measure. In the present case, China's restriction on who may import is unlikely to impact the amount of audiovisual products that can be imported, since this is limited by government censorship (and, in the case of films, by the quota of 20 foreign movies on a revenue-sharing basis per year). Hence, there may be no trade value linked to the violation. Yet, if welfare effects were used to calculate retaliation rights, the shift in quota rents could be used to fix the ‘nullification or impairment’ linked to the violation and with it the authorized level of US retaliation.Footnote 46

Large-country case

In our analysis above, we have examined the welfare implications of China's quantitative restrictions on cultural goods assuming that such restrictions have no impact on world prices. However, with just over 1.3 billion people, China is the world's largest and most populous country, representing a full 20% of the world's population, and has thus the potential to affect world prices in many sectors. As shown below, this can change some of the welfare implications of its policies on imported cultural goods.

To illustrate the large-country case, consider two trading countries, one importing (China) and one exporting (United States) cultural goods. At the free-trade equilibrium price, denoted by p FT, the excess demand by the importing country equals excess supply by the exporter

Suppose now that China introduces a quantitative import restriction, allowing only an amount Q of cultural goods to be imported from the United States. As a result, the supply of cultural goods in the Chinese market will fall and, if the price remained at p FT, there would be excess demand for these goods in the market. The excess demand will induce an increase in the price; in turn, this will reduce demand and increase domestic supply causing a reduction in China's import demand.

Since China is a ‘large’ importer, the fall in its demand for cultural goods will cause excess supply in the US market at the original price, leading to a reduction in the US price. The lower price will, in turn, reduce US supply and raise US demand, causing a reduction in US export supply. The price in China will rise to the level at which import demand is equal to the quota level; the price in the United States will fall until export supply is equal to the quota level. A new equilibrium will be reached when the following two conditions are satisfied

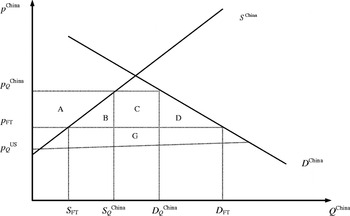

where p QChina is the price in China after the quota, and p QUS is the price in the US after the quota. Figure 2 depicts the welfare effects of the introduction of a quantitative restriction on imports of cultural goods for the Chinese economy, while Table 2 distinguishes between the effects on producers, consumers, and the government (before and after the WTO ruling).

Figure 2.

Notice that, in the large-country case, the quota rents gained by those individuals or firms that are allowed to sell foreign cultural goods in China are larger than in the small-country case (they are equal to C+G rather than C). As discussed below, this implies that, if China is able to affect world prices, the WTO ruling leads to a larger loss in terms of quota rents for the Chinese government (and to a correspondingly larger gain for US content producers).

The Appellate Body's ruling in China–Audiovisuals implies that the quota rents (C+G) are transferred from Chinese state-owned enterprises to foreign-content producers. It is also interesting to compare Table 1 with Table 2 above. Notice that, if China is able to affect its terms of trade, the introduction of a quota on cultural goods can potentially be beneficial compared to free trade. However, for this to be the case, the quota rents must be sufficiently large (i.e. G must exceed B+D) and the right to sell foreign cultural products must be given to Chinese firms. This implies that, following the ruling on China–Audiovisuals, China would unambiguously gain by removing restrictions on the number of foreign movies that can be imported into its market. Of course, this assumes that the Chinese government makes decisions with respect to cultural goods based on national welfare rather than internal politics. That said, the recent literature on trade and culture has shown that, even from an economic perspective, there can be arguments for restricting imports of cultural goods. It is to these arguments that we turn next.

Table 2. Welfare effects of a quota on cultural goods compared to free trade

2.2 Economic arguments for the protection of cultural goods

In China–Audiovisuals, China argued that reading materials and finished audiovisual products are so-called ‘cultural goods’ and as such have a potentially serious negative impact on public morals. Referring to the UNESCO Universal Declaration on Cultural Diversity – which defines cultural goods as ‘vectors of identity, values and meaning’ – China explained that cultural goods play an essential role in the evolution and definition of elements such as societal features, values, ways of living together, ethics, and behaviors. It then argued that restrictions on cultural products are needed to prevent the dissemination of cultural goods with a content that could have a negative impact on public morals in China. The Panel and Appellate Body in China–Audiovisuals ultimately rejected this defense, finding that China could pursue its censorship regime and the ‘public morals’ it is allegedly protecting in a less-trade-restrictive manner, for example, by letting the Chinese government itself do the censorship and then granting the right to import the approved goods to all companies, be they Chinese or foreign, on a nondiscriminatory basis.

Both the Panel and the Appellate Body simply ‘assumed’ that all of the censorship by the Chinese government is driven by the need to protect ‘public morals’, an assumption that is, given the above examples of censored content, not easy to make. The Panel recalled that in US–Gambling the term ‘public morals’ was found to denote ‘standards of right and wrong conduct maintained by or on behalf of a community or nation’ and that ‘content of these concepts for Members can vary in time and space, depending upon a range of factors, including prevailing social, cultural, ethical and religious values’.Footnote 47 Given the absence of US protest on the matter, the Panel simply ‘assumed that each of the types of prohibited content in China's measures could, if it were brought into China, have a negative impact on “public morals” in China within the meaning of Article XX(a)’.Footnote 48

While accepting the Panel's ‘assumption’ on this question, the Appellate Body had, however, a few pages earlier (in respect of another assumption that it found unacceptable) stressed that assumptions may ‘not always provide a solid foundation upon which to rest legal conclusions’ and ‘detract from a clear enunciation of the relevant WTO law and create difficulties for implementation’.Footnote 49 Indeed, now that the Appellate Body found that China's trading-rights restrictions are not ‘necessary’ to protect public morals because, as explained earlier, there are less-trade-restrictive alternatives (e.g., the government rather than importers could do the censorship), what if China now implements such alternative but still restricts trading rights? Given that the Appellate Body merely ‘assumed’ that public morals are at issue, nothing guarantees China that such less-trade-restrictive alternatives would actually comply with Article XX.

China–Audiovisuals leaves open the question of whether the protection of cultural goods can or should actually be justified under GATT/WTO rules. This is the question that we address in the remainder of this section.Footnote 50

For many years, concerns have been expressed about the possible detrimental effects of globalization on cultural diversity. In some countries, policymakers have taken these concerns very seriously. For example, Canada and France have implemented policies to prevent the possible loss of cultural identity that might result from free trade. France has restrictions on foreign films and television programs from English-speaking countries, while Canada requires minimum levels of Canadian content in radio and television broadcasts.

Does the economic literature support these concerns? In recent years, various papers have attempted to model the effects of trade on culture. In what follows, we briefly review some of the economic arguments developed in this literature to justify the use of protectionist measures in the case of cultural goods.

Many of these theories develop the idea that consumers have heterogeneous preferences and that an individual's decision to consume foreign cultural goods imposes a negative externality on other consumers. Below we will distinguish between two classes of such models: those in which the externality is due to increasing returns in the production of cultural goods, and those in which it is directly built in consumers' preferences.Footnote 51

Economies of scale in the production of cultural goods

One of the first papers to examine the link between trade and culture is by Francois and van Ypersele (2002), who show that losses from trade may occur when cultural goods are characterized by fixed costs and heterogeneous valuations.

To fix ideas, they describe a simple model of trade between two countries, denoted by France and the United States. Both countries can produce their ‘auteur’ (or locally flavored) cinema, which is valued differentially by their own consumers.Footnote 52 In addition, the United States can produce Hollywood movies, a homogeneous good that is valued equally by all consumers in both countries. There are important economies of scale in the movie industry: producers must sell enough units, at relatively low marginal costs, to cover the high fixed costs.

Trade leads to greater production of a ‘culturally homogeneous’ good at the expense of culturally specific goods, since with the homogeneous good fixed costs can be spread out across countries. In their example, the Hollywood blockbuster can drive out independent films in both France and the United States. Depending on parameters, trade restrictions on Hollywood movies may be Pareto improving because it makes local movies viable in both markets.

The intuition for their result is that, if price discrimination is not possible (for example, cinema tickets must, by law, be priced the same irrespective of the movie watched), high consumer valuation cannot be captured in the heterogeneous case. In contrast, the social benefit of a homogeneously valued good can be effectively captured by the producers setting one price. This can lead to inefficiently low production of the heterogeneous good, even when welfare would be higher with it.

The paper by Francois and van Ypersele (2002) demonstrates that restrictions on trade of cultural goods (for instance by a tariff or quota) can be welfare improving. The two main assumptions that are required for their argument to hold are: (1) cultural goods must be produced using increasing-returns-to-scale technologies; (2) for some cultural goods, there is high variation in valuation amongst consumers, while for others valuations are relatively homogeneous.

The authors argue that these conditions seem to be satisfied by the film-industry example, but possibly also by other cultural goods (for example radio and television programming, literature, or print media). However, they also stress that their analysis does not definitively favor protection over free trade in cultural goods. It only suggests that protection may be justified when consumers have heterogeneous tastes and cultural goods are produced under increasing returns to scale.

Network externalities in the consumption of cultural goods

A second stream of the literature on trade and culture provides a rationale for the protection of cultural goods based on the existence of consumption externalities.

Seminal contributions to this literature are by Janeba (Reference Janeba2004, Reference Janeba2007), who formalizes the notion of cultural identity and incorporates it in a Ricardian model of trade. To define culture, he adopts the ‘identity function’ of Akerlof and Kranton (Reference Akerlof and Kranton2000), whereby a person suffers a utility loss if some individuals in his country deviate from social norms, and an individual who deviates from social norms incurs a direct utility loss for the self-inflicted loss of identity.

In Janeba's model, an individual's utility for a cultural good is based in part on how many others are also consuming it. He argues that consumers often face the choice between differentiated products that are characterized by network externalities. One notable example is the choice of a computer operating system. Similarly, in the context of cultural goods people may have an additional benefit from consuming a certain good when others do the same. For example, watching a movie when others see it as well allows consumers to share their experience.

This interdependence of preferences can be used to study how a country's cultural identity is affected by trade liberalization. In this framework, ‘cultural goods differ from other goods in that they create an interdependence among individual consumption decisions, like a network externality, and thus generate cultural identity … the more consumers buy the same good the lower is the loss in identity for existing consumers and the more attractive becomes the consumption of such good for other consumers’ (Janeba, Reference Janeba2004: 25).

The analysis of Janeba points out that trade can be welfare reducing when a country is culturally homogeneous. In particular, he shows that free trade is not always Pareto superior to autarky because individuals can suffer a negative externality when others have different consumption patterns.

Janeba studies the welfare effects of trade openness on welfare for a given and exogenous population of cultural agents.Footnote 53Olivier et al. (Reference Olivier, Thoenig and Verdier2008), on the other hand, do not derive welfare results but focus on the impact of trade openness on endogenous cultural identity. In particular, they highlight the disutility experienced by the parent generation as their children adopt new cultures. In their model, cultural identity comes as the outcome of a dynamic process of transmission of preferences as micro-founded for instance by Bisin and Verdier (Reference Bisin and Verdier2000), in which preferences of children are acquired through an adaptation and imitation process that depends on their parents' decisions and on the environment in which they live.

A dynamic analysis of culture is also presented in Bala and Van Long (2005). They develop an evolutionary model of preferences in which cultural dynamics are driven by an exogenous process directly imported from the Darwinian literature in biology. They show that a large country may be able to overrun the indigenous preferences of a smaller country through trade.

Where does this leave the WTO and possible exceptions based on culture or cultural diversity? First, it must be noted that apart from GATT Article IV on internal film or screening quotas, there is no explicit cultural exception in the GATT or GATS. Second, in China–Audiovisuals, the cultural exception was channeled into GATT through the backdoor of ‘public morals’. However, nowhere under this exception of GATT Article XX(a) is reference made to any of the criteria referred to in the economics literature. What matters under Article XX(a) is whether the measure does, indeed, protect public morals and, if so, whether the measure is ‘necessary’ to achieve its objective. Third, when it comes to China's censorship it is far from clear whether all of it is related to public morals, let alone culture. Moreover, even to the extent that it is related to culture, further examination would be needed to see whether any of China's measures are welfare enhancing. The only aim of the above survey is to indicate that, in some cases, and under certain assumptions, trade restrictions on cultural goods can be welfare enhancing and can, therefore, be justifiable.

3. Conclusions

No head-on collision occurred in China–Audiovisuals between, on the one hand, free trade in cultural goods and services and, on the other hand, China's censorship regime. The main parties involved went to great pains to avoid such clash: China, by only invoking GATT's public-morals exception for Protocol violations (not for GATT/GATS violations); the United States, by not contesting that all of the content prohibited by China harms ‘public morals’; and, finally, the Panel and Appellate Body by simply assuming that China's censorship does, indeed, promote ‘public morals’, without making a definitive finding on the matter.

In future disputes, governments may be required to justify the use of measures to protect cultural goods. To do so, they may be able to use different economic arguments that have been developed in the recent literature on trade and culture, which we have reviewed in Section 2.2 above. However, it is important to stress that the arguments developed in this literature do not unambiguously favor protection over free trade in cultural goods. They merely suggest that protection may be justified when (a) consumers have heterogeneous preferences over cultural goods and (b) there are economies of scale in the production and/or network effects in the consumption of cultural goods.

The Appellate Body's ruling clarified crucial questions on how to distinguish between goods and services when it comes to today's ‘content’ industry. For the application of WTO rules on trade in ‘goods’ the Appellate Body focused on whether Chinese restrictions have an effect or impact on a material or physical product, even if this tangible product was only a minor element in the economic value of the transaction (e.g., a physical film reel when it comes to movies). This implies a technological bias requiring a physical product before WTO rules on trade in goods can be applied (not, for example, when a film is transferred over the Internet). When it comes to services, in contrast, the Appellate Body approached GATS in a technologically neutral fashion, covering under ‘distribution services’ both the physical transfer of CDs and distribution of music over the Internet. It remains to be seen whether tangibility or material nature is a sufficient condition for something to be a ‘good’ and whether it is, conversely, a necessary condition (can intangible assets, such as IP, electricity, or films over the Internet never be ‘goods’?).

The Appellate Body also confirmed a general ‘right to regulate’ (e.g., pursuant to GATT Article XX) and found that the right to regulate what can be traded can, in principle, excuse violations or restrictions on who can trade or import. The exact scope of this ‘right to regulate’ and whether it must be explicitly referred to in the text of WTO obligations remains unclear. It is sure to animate many WTO disputes ahead.

Finally, the Appellate Body found that, even assuming that China's censorship regime promotes public morals, China's approach of limiting the right to import cultural goods to certain state-owned enterprises is not ‘necessary’ to protect public morals since less-trade-restrictive alternatives are available – for example, letting the Chinese government itself do the censorship and then granting the right to import the approved goods to all companies, including US companies established in China.

The ruling does not restrict censorship by the Chinese government and keeps the existing quota on foreign movies in place. However, it allows producers to import and distribute audiovisual products that pass China's censorship without discrimination. Even if their sales may be unaffected by the ruling, US producers can now obtain potentially large rents in the Chinese market. In addition, more efficient or transparent distribution by US companies (rather than state-owned Chinese) may lead to more sales of particular imports that do pass China's quotas and censorship.