1. Introduction

The concept of mutual aid funds can be traced back to hundreds of years ago. A typical example is the collegium tenuiorum of the Roman Empire which was mentioned in Ginsburg [Reference Ginsburg17] and Perry [Reference Perry21] and its main function is to assist its members in paying for funeral expenses. Members pay the membership entrance fee and monthly membership fee into the fund, which is managed by the association. When a member dies, collegium tenuiorum uses its mutual fund to assist the family members of the deceased to pay for funeral expenses and may provide bequests on behalf of the deceased. Historically, there have been many similar mutual aid organizations that shared resources and risks through self-funding within a group of people who has common interests, but most of them were limited to a certain size of the population.

With the development of society, individuals begin to transfer risks through insurance. Nowadays, most of the commercial insurance are relatively mature, but due to operating costs, brand premium, corporate profits, and other factors, the insurance premiums are normally higher than the actual average payout cost. The premium could be unaffordable for the population with low income but high risk. Carlin [Reference Carlin7] discussed the price complexity in retail financial markets. The company divides the price into direct fees and indirect involuntary surcharges, and designs a new technical language for price disclosure. This behavior of increasing industry profits by reducing industry pricing clarity is common in markets such as term life insurance, life annuities, and credit cards. Therefore, Donnelly et al. [Reference Donnelly, Guillén and Nielsen15] proposed a decomposed annuity structure, which can disclose costs and improve the transparency of financial and insurance products.

In response to these shortcomings of insurance products, the market produces new products to transfer risks. The advent of the Internet era has brought a new round of economic reforms. The development of technologies such as big data, blockchain, and artificial intelligence have subtly changed people's lifestyles and thinking patterns. With the development of Internet economy, the insurance industry is also seeking breakthroughs and development amidst reforms. The rise of the sharing economy points out a new direction for insurance. New forms of risk-sharing such as P2P insurance and network mutual aid are based on the principle of sharing economy, which cuts down the cost of the intermediaries by eliminating or reducing the role of traditional insurance companies. We specially review the literature of network mutual aid and P2P insurance in the next two subsections.

1.1. Network mutual aid

Since the establishment of the first mutual aid platform named Kang Ai Gong She in 2011 in China, network mutual aid platforms grew rapidly. By 2015, there were 50 mutual aid platforms in China, and network mutual aid once became a hot topic in the Internet field. However, with the return of capital to rationality and regulatory pressure, a large scaled collapse of mutual aid platforms occurred in 2017, and only a few mutual aid platforms survived. Until the second half of 2018, Ant Financial, JD.com, Suning, and other capital giants successively carried out network mutual aid business. The regulatory rectification of Xianghubao has once again aroused widespread attention on the risk and supervision of network mutual aid platforms. As of May 2020, there were more than 150 million people who have joined network mutual aid platforms in China and the amount of mutual aid has exceeded 5 billion yuan. Zhao and Zeng [Reference Zhao and Zeng30] introduced the historical background and development of mutual aid platform.

However, network mutual aid platforms need to be supervised by regulator because they do not follow actuarial principles and lack of risk assessment. Besides, compared with insurance institutions, they also lack rigid guarantee commitment. The mutual aid platform places eligible participants in the same pool, and at the end of the coverage period, participants bear the cost of losses from other members in the same risk pool. Most of the payment allocation methods in existing mutual aid platforms in China are equal payments, which means that members in the same pool with different risks share the same payout amount, which causes the problem of adverse selection.

Initially, consumers thought that network mutual aid was a kind of crowdfunding, because it was similar to the traditional mutual insurance in risk sharing, but the behavior of raising a large number of donations with small amount through Internet was similar to crowdfunding. Some mutual aid platforms also compare themselves with insurance products, which confuse customers with the differences between insurance products and mutual aid plans. But in practice, regulators deny the possibility that the network mutual aid plan belongs to mutual insurance on the ground of business qualification, and guide it to the direction of public welfare.

Su et al. [Reference Su, Xiong and Tang23] introduced various risks and problems faced by the network mutual aid platform, including adverse selection risk and operation risk. Hence, there is need for network mutual aid platforms to seek for reasonable pricing methods and payment allocation rules to reduce the risk faced by platforms and increase platform revenue.

1.2. P2P insurance and risk sharing

Friendsurance is a German company that launched P2P insurance in 2010, and since then it has been extended to many countries in the world. Compared with many network mutual aid platforms in China, P2P insurance mainly shares risks among a small group of people with social relations (such as friends and relatives). Part of the premium paid by the owner forms a mutual fund, and the other part is paid to a third-party insurance company. The loss of the claimant is first paid by the mutual fund, and the excess claim amount is compensated by the insurer. At the end of the coverage period, the surplus of the mutual fund is returned to participants or donated to a nonprofit organization designated by participants. Through technological innovation and unique product positioning, P2P insurance is more transparent. As the cost of acquiring customers is greatly reduced, the premium charged by P2P insurance is much lower than traditional insurance. Moenninghoff and Wieandt [Reference Moenninghoff and Wieandt20], World Bank Group [27] introduced the characteristics and development status of P2P insurance.

P2P is essentially a form of risk sharing, and its research can be traced back to Borch [Reference Borch6]. Denuit and Dhaene [Reference Denuit and Dhaene14] proposed a conditional average risk-sharing mechanism, which is based on the risk reduction characteristics of convex order to achieve Pareto optimality. Denuit [Reference Denuit12] obtained the expression of each participant's contribution to the pool under the known loss function by the size-biased transform under the conditional mean risk allocation rule. Asimit et al. [Reference Asimit, Boonen, Chi and Chong4] studied the optimal reinsurance contract design under different compensation environments. Based on Pareto optimality, it is concluded that the premium can be selected in a given interval and the buyer and seller should equally distribute the income of risk sharing. Abdikerimova and Feng [Reference Abdikerimova and Feng1] proposed a variety of P2P models for peers with different needs, so that they can exchange a variety of risks in a fair and transparent actuarial way. In addition, Abdikerimova et al. [Reference Abdikerimova, Boonen and Feng2] considered the P2P risk sharing in both the dynamic and the static settings. Domestic network mutual aid and foreign P2P insurance have strong reference significance in terms of sharing methods, pricing rules, and relative fairness.

1.3. Our contributions

The first contribution of this article is to analyze the participants’ behavioral decisions from multiple aspects. Based on the risk aversion degree of the participants, then decision-making model of the participants is constructed by applying utility function. By considering whether to join a mutual aid platform or to buy same type of insurance or not, it has been found that the choice not only affects the decision-making of the participants, but also has important impact on platform's pricing rules.

The other contribution is that the mutual aid platforms with different business concepts have been studies. The optimization problem is constructed from two aspects which are maximizing platform revenue and minimizing business risks. Under the condition of individual fairness and relative fairness between heterogeneous risks, a different loss sharing method is designed. Different from the conditional mean risk-sharing rule of Denuit [Reference Denuit13] and the risk exchange between different participants in Abdikerimova and Feng [Reference Abdikerimova and Feng1], these payment allocation methods are relatively complex, which may reduce the transparency of the mutual aid platform. Besides, the existing business model aggregates all losses and then distributes them equally to members. In this paper, we propose an alternative risk-sharing method which comes from the equal division scheme in Abdikerimova and Feng [Reference Abdikerimova and Feng1] but adopts equal allocation of the same type and proportional allocation for different types of members. The proposed method is relatively simple, reasonable, and can reduce adverse selection.

The rest of the paper is organized as follows. Section 2 introduces the decision-making methods of the participants in the mutual aid plan, the optimization goals of the platform and the payment allocation mode under fair conditions. Section 3 puts forward the sharing method based on fair conditions and the network mutual aid structure model under different choices. Section 4 gives the optimal solution to various problems and analyzes the sensitivity. Section 5 gives a numerical example and compares the difference between network mutual aid and medical insurance with a million-level coverage. Finally, conclusions are given in Section 6.

2. Mutual aid plans

Xueqiu [28] introduced some mutual aid products and sharing cases of the network mutual aid platform in China. The domestic network mutual aid platforms are mainly engaged in serious illness mutual aid and some of them are equipped with comprehensive accident mutual aid. There are two main business models. One is that a certain amount of funds are required to be paid in advance which are used to maintain the qualification of their membership and then to share mutual aid costs at the end of the coverage period. The other model has no need to pay the amount in advance, but both the mutual aid expenses and the management expenses are shared at the end of the coverage period. In order to ensure the transparency of mutual funds, the funds paid by members are managed by a third party. At the end of the publicity period, mutual aid amount and recipients are announced on the platform page, and mutual funds are distributed to the recipients. Most of the mutual aid coverage period is set to be half a month, at the end of the period, the participants need to pay the sharing fee within a specified time. In order to prevent moral hazard, the platform sets a waiting period ranging from 90 to 180 days. Members within the waiting period cannot apply for mutual aid even an accident occurs, but they still have to perform their sharing obligations. For simplicity, the study objects in this paper are mutual aid platforms and members who have finished waiting period.

2.1. Mutual aid platforms

In the mutual aid plan, the main function of the mutual aid platform is to provide certain management services when participants share risks. Sohu [22] introduced some revenue sources of network mutual aid platform. For the platform, the ways to generate profit are mainly from advertisement fees and by providing some additional services, such as medical value-added services and Internet financial services. Part of the mutual aid platform also set up an insurance mall, which makes profits by providing insurance products for members who are more risk-conscious. The management fee is only to meet the costs incurred in normal operations. There are two main ways for the platform to charge management fees.

• Setting a fixed fee

$\beta$. Mutual aid platform charges fixed management fees to participants every month. For example, E-mutual aid, quarkers.com, and some other platforms charge a fixed management fee of 1 yuan per month. The fee charged in this way is only related to the number of people in the mutual aid plan, but it is different from the insurance premium and is not used for claim reserve.

$\beta$. Mutual aid platform charges fixed management fees to participants every month. For example, E-mutual aid, quarkers.com, and some other platforms charge a fixed management fee of 1 yuan per month. The fee charged in this way is only related to the number of people in the mutual aid plan, but it is different from the insurance premium and is not used for claim reserve.• Setting the management rate

$\alpha$. Mutual aid platform is free to join, and the management fee is charged according to the percentage of actual loss in each period of cost-sharing, such as Xianghubao and Waterdrop mutual aid.

$\alpha$. Mutual aid platform is free to join, and the management fee is charged according to the percentage of actual loss in each period of cost-sharing, such as Xianghubao and Waterdrop mutual aid.

Different from insurance products, the pricing of network mutual aid is mainly reflected in the setting of the management fee. Zhao and Zeng [Reference Zhao and Zeng30] mainly analyzes the pricing strategy of mutual aid platform under the goal of maximum revenue. But the government has not given a clear definition of network mutual aid at the present. The profitability of each network mutual aid platform is unknown, and the business strategies of each platform vary at different stages of development. Therefore, for different stages and different decision-making groups, the platform should select the different optimization objectives, respectively.

For platforms with a small number of members, the limited number of members makes the platform unable to operate sustainably. In Wen and Siqin [Reference Wen and Siqin26], risk-averse platform decision-makers choose to minimize operational risk as their optimization goal, rather than maximize revenue. This paper uses the mean-variance (MV) theory to simulate the risk aversion behavior of decision-makers. The MV theory was initially built for portfolio optimization, which is a standard method to explore the risk hedging problem. Wen and Siqin [Reference Wen and Siqin26] discussed the pricing of risk-averse airlines under the framework of the MV theory. Chiu et al. [Reference Chiu, Choi, Dai, Shen and Zheng9] analyzed the optimal allocation decision of advertising budget by the MV theory. Zhang et al. [Reference Zhang, Meng and Zeng29] analyzed the optimal investment and reinsurance strategies of insurance companies based on the MV premium principle. In order to ensure the platform's revenue and to reduce the operational risk, this paper develops a plan to achieve high revenue and low risk, so as to maximize the expected revenue and minimize the risk at the same time. Besides, in order to reduce the adverse selection problem and the overall loss risk of the mutual aid plan, we divide mutual aid members into different risk levels, and different types of members share different payout amounts. Let ![]() $v$ represents the revenue of the platform, then the optimization goal of minimizing platform risk is

$v$ represents the revenue of the platform, then the optimization goal of minimizing platform risk is

The parameter ![]() $r\ge 0$ indicates the degree of risk aversion of the platform, which increases with the increase of

$r\ge 0$ indicates the degree of risk aversion of the platform, which increases with the increase of ![]() $r$. When

$r$. When ![]() $r=0$, it means that the platform is risk-seeking and only interested in maximizing the expected return. When choosing a finite

$r=0$, it means that the platform is risk-seeking and only interested in maximizing the expected return. When choosing a finite ![]() $r$, it corresponds to a moderate risk aversion which has a balance between minimum variance and maximum expected return. Compared with

$r$, it corresponds to a moderate risk aversion which has a balance between minimum variance and maximum expected return. Compared with ![]() $\max (E(v)-r\,{\rm Var}(v))$ which was selected in Wen and Siqin [Reference Wen and Siqin26] as the objective function, the optimization objective of this paper is more appropriate to the characteristics of mutual aid platform with unclear profitability and aimed at minimizing business risk.

$\max (E(v)-r\,{\rm Var}(v))$ which was selected in Wen and Siqin [Reference Wen and Siqin26] as the objective function, the optimization objective of this paper is more appropriate to the characteristics of mutual aid platform with unclear profitability and aimed at minimizing business risk.

For the mutual aid platform with relatively stable participants, due to its sufficient member size and stable sharing amount, the goal of the platform gradually turns to maximize revenue, that is, ![]() $\max E(v)$.

$\max E(v)$.

By comparing various data of existing mutual aid platforms, we found that as the number of platform members gradually stabilized, the monthly share of cost for members is also gradually increasing. And the same type of insurance products, which are the main competitors of network mutual aid, naturally become the participants’ alternatives. Therefore, for mutual aid platforms with maximize revenue as its goal, this paper considers the impact of insurance products on platform pricing rules additionally.

2.2. Participant

This paper uses the utility function to measure people's satisfaction from a given portfolio, and an individual's behavior depends on his or her attitude to risk. It is assumed that all individuals who consider whether to join the mutual aid plan are risk-averse, that is, the risk aversion coefficient of participants ![]() $\xi$ is set to be great than zero

$\xi$ is set to be great than zero ![]() $\xi > 0$. Suppose that an individual has a utility function

$\xi > 0$. Suppose that an individual has a utility function ![]() $u(y)$, the initial wealth is

$u(y)$, the initial wealth is ![]() $w$, the probability of loss is

$w$, the probability of loss is ![]() $p$, and the amount of loss is

$p$, and the amount of loss is ![]() $B$. The utility function

$B$. The utility function ![]() $u(y)$ of risk aversion is an increasing concave function, that is,

$u(y)$ of risk aversion is an increasing concave function, that is, ![]() $u^{\prime }(y)>0$,

$u^{\prime }(y)>0$, ![]() $u^{\prime \prime }(y)<0$.

$u^{\prime \prime }(y)<0$.

Then, we consider the situation where individuals choose to join a mutual aid plan. In order to distinguish, we refer to individuals who may be joining the network mutual aid plan as participants and those who have joined the mutual aid plan as members. Assuming that there are ![]() $N$ types of members in a mutual aid plan, the probability of loss for

$N$ types of members in a mutual aid plan, the probability of loss for ![]() $i^{\rm th}$ type members is

$i^{\rm th}$ type members is ![]() $p_i$, and the amount of loss which is also the amount of compensation denotes as

$p_i$, and the amount of loss which is also the amount of compensation denotes as ![]() $B_i$ (assuming that all losses incurred are compensated), where

$B_i$ (assuming that all losses incurred are compensated), where ![]() $i\in \mathcal {N}=\{1,2,\ldots,N\}$. The platform can charge members with additional management fees to maintain operation. Assuming that the management fees for all members within the same type are the same, and the management fees for different types of members are different, then the fixed fee for the

$i\in \mathcal {N}=\{1,2,\ldots,N\}$. The platform can charge members with additional management fees to maintain operation. Assuming that the management fees for all members within the same type are the same, and the management fees for different types of members are different, then the fixed fee for the ![]() $i^{\rm th}$ type members is

$i^{\rm th}$ type members is ![]() $\beta _i$, and the management fee rate is

$\beta _i$, and the management fee rate is ![]() $\alpha _i$. We name members who have losses in the coverage period as recipients, and members who have no losses as helpers. Then, at the end of each coverage period, helpers share the mutual aid fund of recipients and pay a certain management fee, recipients collect the mutual aid fund without paying other fees.

$\alpha _i$. We name members who have losses in the coverage period as recipients, and members who have no losses as helpers. Then, at the end of each coverage period, helpers share the mutual aid fund of recipients and pay a certain management fee, recipients collect the mutual aid fund without paying other fees.

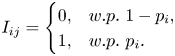

Let ![]() $I_{ij}$ represents the indicator function of loss for

$I_{ij}$ represents the indicator function of loss for ![]() $j^{\rm th}$ participants in

$j^{\rm th}$ participants in ![]() $i^{\rm th}$ type member, such that

$i^{\rm th}$ type member, such that

$${I}_{ij}=\begin{cases} 0, & w.p. \ 1-p_i,\\ 1, & w.p. \ p_i. \end{cases}$$

$${I}_{ij}=\begin{cases} 0, & w.p. \ 1-p_i,\\ 1, & w.p. \ p_i. \end{cases}$$It is assumed that all members of the same type are independent and identically distributed (i.i.d.). Based on this, we assume that the initial wealth of ![]() $j^{\rm th}$ member from

$j^{\rm th}$ member from ![]() $i^{\rm th}$ type is

$i^{\rm th}$ type is ![]() $w^{0}_{i,j}$, the wealth of member

$w^{0}_{i,j}$, the wealth of member ![]() $j$ in

$j$ in ![]() $i^{\rm th}$ type at the end of the coverage period is

$i^{\rm th}$ type at the end of the coverage period is ![]() $w^{1}_{i,j}$ , hence

$w^{1}_{i,j}$ , hence

where ![]() $s_{ij}$ is the expected payout cost of

$s_{ij}$ is the expected payout cost of ![]() $j^{\rm th}$ member in

$j^{\rm th}$ member in ![]() $i^{\rm th}$ type, which is the average of actual payout. For

$i^{\rm th}$ type, which is the average of actual payout. For ![]() $\forall i\in \mathcal {N}$, we consider the utility of

$\forall i\in \mathcal {N}$, we consider the utility of ![]() $i^{\rm th}$ type member in three cases,

$i^{\rm th}$ type member in three cases,

1. The expected utility of choosing not to purchase any guarantee product is

(2.1) \begin{equation} Eu_{i,1}=E[u(w^{1}_{i,j})] = (1-p_i)u(w^{0}_{i,j})+p_iu(w^{0}_{i,j}-B_i). \end{equation}

\begin{equation} Eu_{i,1}=E[u(w^{1}_{i,j})] = (1-p_i)u(w^{0}_{i,j})+p_iu(w^{0}_{i,j}-B_i). \end{equation}2. The expected utility of choosing to join the mutual aid plan is

(2.2) \begin{equation} Eu_{i,2}= (1-p_i)u(w^{0}_{i,j}-\beta_i-s_{ij}(1+\alpha_i))+p_iu(w^{0}_{i,j}). \end{equation}

\begin{equation} Eu_{i,2}= (1-p_i)u(w^{0}_{i,j}-\beta_i-s_{ij}(1+\alpha_i))+p_iu(w^{0}_{i,j}). \end{equation}3. The expected utility of choosing to buy insurance is

(2.3) \begin{equation} Eu_{i,3}= u(w^{0}_{i,j}-\pi_i), \end{equation}

\begin{equation} Eu_{i,3}= u(w^{0}_{i,j}-\pi_i), \end{equation}

where ![]() $\pi _i$ is the premium of term full insurance, and the insured amount is equal to the mutual aid fund. According to the principle of maximum expected utility, individuals make decisions by maximizing expected utility.

$\pi _i$ is the premium of term full insurance, and the insured amount is equal to the mutual aid fund. According to the principle of maximum expected utility, individuals make decisions by maximizing expected utility.

where ![]() $\psi _i\in \{1,2,3\}$ denotes above three different decisions for

$\psi _i\in \{1,2,3\}$ denotes above three different decisions for ![]() $i^{\rm th}$ type members. In other words, based on the management fee and the expected payout amount, the member's expected utility of joining the mutual aid plan is greater than not joining and buying insurance.

$i^{\rm th}$ type members. In other words, based on the management fee and the expected payout amount, the member's expected utility of joining the mutual aid plan is greater than not joining and buying insurance.

2.3. Fair exchange of heterogeneous risks

The premium of traditional insurance is based on the theory of law of large numbers. For a large enough pool of policyholders with independent and identically distributed losses, based on the equivalence principle, the net premium is set to be equal to the expected claim amount. However, most of the insurance products are set up for homogeneous risk. For example, accident insurance compensates for the loss caused by accidents, term life insurance compensates for the death pension when the insured dies. These kinds of insurance go through risk assessment, rate making, and other processes, so that the benefits and expected losses brought by homogeneous risks offset each other.

Network mutual aid platforms in China lack rigid guarantee commitment. Members have the benefit of mutual aid guarantee but also bear the responsibility similar to traditional insurance insurers (share the amount of mutual aid of other “Insured”). However, most mutual aid platforms put members with different risks in the same risk pool. Although platforms divide members into different types by age, members with different ages only have the difference of mutual aid fund, and the actual amount of payment allocation is usually the same. For example, the standard version of mutual aid for Xianghubao divides members into two age groups: 0–39 years old and 40–59 years old, and the mutual aid amount is 300,000 and 100,000 RMB, respectively. At the end of the coverage period, each person's share is calculated as

where ![]() $8\%$ is the existing management fee for Xianghubao platform. This kind of sharing method leads participants with high risk to gain more than the participants with low risk. In other words, it is subsidizing high-risk members through low-risk members. This risk heterogeneity will lead to serious adverse selection problems. High-risk participants are more willing to join the mutual aid plan, the overall risk of the mutual aid pool increases, and the actual allocation payment amount increases. Low-risk members are more likely to quit the mutual aid plan. In the end, only high-risk members remain in the mutual aid plan.

$8\%$ is the existing management fee for Xianghubao platform. This kind of sharing method leads participants with high risk to gain more than the participants with low risk. In other words, it is subsidizing high-risk members through low-risk members. This risk heterogeneity will lead to serious adverse selection problems. High-risk participants are more willing to join the mutual aid plan, the overall risk of the mutual aid pool increases, and the actual allocation payment amount increases. Low-risk members are more likely to quit the mutual aid plan. In the end, only high-risk members remain in the mutual aid plan.

Recently, Shapley value method, ![]() $\tau$ value method, conditional mean risk sharing, and so on are the common ways of cost allocation. These cost allocation methods meet the actuarial conditions but are relatively complex. This paper chooses a simple and fair allocation method, which is more likely to be accepted by consumers for mutual aid platforms.

$\tau$ value method, conditional mean risk sharing, and so on are the common ways of cost allocation. These cost allocation methods meet the actuarial conditions but are relatively complex. This paper chooses a simple and fair allocation method, which is more likely to be accepted by consumers for mutual aid platforms.

Assa and Boonen [Reference Assa and Boonen5] study different risk management settings and effective insurance plans under macroeconomic risks. In the risk-sharing platform, assuming that insurance treats all policyholders equally, so that their ultimate wealth is equally distributed, and the risks among policyholders are independent and identically distributed, then it is the best way for everyone to equally share all risks in the market excellent. For members of same type, the method of sharing equally among members of same type is adopted because they facing same risk. ![]() $s_i$ is used to indicate the expected apportionment amount borne by helper in the

$s_i$ is used to indicate the expected apportionment amount borne by helper in the ![]() $i^{\rm th}$ type members, so that

$i^{\rm th}$ type members, so that

Then, income and expenses for each member is considered. Suppose that the number of ![]() $i^{\rm th}$ type members is

$i^{\rm th}$ type members is ![]() $n_i$. For

$n_i$. For ![]() $\forall i\in \mathcal {N}$,

$\forall i\in \mathcal {N}$,![]() $j\in n_i$, we use

$j\in n_i$, we use ![]() $R_{ij}^{\ast }$ to denote the net income of member

$R_{ij}^{\ast }$ to denote the net income of member ![]() $j$ in the

$j$ in the ![]() $i^{\rm th}$ type and without taking the management fee into consideration, hence

$i^{\rm th}$ type and without taking the management fee into consideration, hence

In order to meet the condition of individual fairness, that is, the expected value of member's income should be equal to the expected value of cost, and the expected net income should be 0, that is

Then, the expected payout amount ![]() $s_i$ of helper in

$s_i$ of helper in ![]() $i^{\rm th}$ type members is

$i^{\rm th}$ type members is

In this way, the expected total allocation of all mutual aid persons on the platform is ![]() $\sum _{i=1}^{N}{n_is_i(1-p_i)}$, the total risk of platform members is

$\sum _{i=1}^{N}{n_is_i(1-p_i)}$, the total risk of platform members is ![]() $\sum _{i=1}^{N}{n_iI_iB_i}$, which can be seen from the following equation:

$\sum _{i=1}^{N}{n_iI_iB_i}$, which can be seen from the following equation:

$$E\left(\sum_{i=1}^{N}{n_iI_iB_i}\right)=\sum_{i=1}^{N}{n_is_i(1-p_i)},\quad \forall i\in\mathcal{N}.$$

$$E\left(\sum_{i=1}^{N}{n_iI_iB_i}\right)=\sum_{i=1}^{N}{n_is_i(1-p_i)},\quad \forall i\in\mathcal{N}.$$This way of sharing enables the helpers to share the risks of all members.

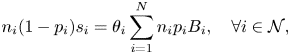

For different types of members, because of different risks they facing, their apportioned amounts should also be different. This paper adopts the method that all kinds of helpers sharing the total loss according to a certain weight. Then, the loss to be shared by all ![]() $i^{\rm th}$ type helpers is

$i^{\rm th}$ type helpers is

\begin{equation} n_i(1-p_i)s_i=\theta_i\sum_{i=1}^{N}{n_ip_iB_i},\quad \forall i\in\mathcal{N}, \end{equation}

\begin{equation} n_i(1-p_i)s_i=\theta_i\sum_{i=1}^{N}{n_ip_iB_i},\quad \forall i\in\mathcal{N}, \end{equation}where ![]() $\sum _{i=1}^{N}{n_ip_iB_i}$ represents the expected total loss of the mutual aid plan, and

$\sum _{i=1}^{N}{n_ip_iB_i}$ represents the expected total loss of the mutual aid plan, and ![]() $\theta _i$ is the proportion of the total loss shared by

$\theta _i$ is the proportion of the total loss shared by ![]() $i^{\rm th}$ type helpers. The two sides of Eq. (2.4) represent the amount expected to be allocated by the

$i^{\rm th}$ type helpers. The two sides of Eq. (2.4) represent the amount expected to be allocated by the ![]() $i^{\rm th}$ type helpers. From (2.4), we can get

$i^{\rm th}$ type helpers. From (2.4), we can get

This kind of apportionment method can allocate all losses, that is, ![]() $\sum _{i=1}^{N}\theta _i=1$.

$\sum _{i=1}^{N}\theta _i=1$.

Regarding the fairness between different types of members, this paper adapts the relative fairness conditions as proposed in Chen et al. [Reference Chen, Feng, Wei and Zhao8]. Let ![]() $R_{ij}$ represents the net cash flow of member

$R_{ij}$ represents the net cash flow of member ![]() $j$ in the

$j$ in the ![]() $i^{\rm th}$ type, so that

$i^{\rm th}$ type, so that

The first term on the right side of the above equation represents the income of member ![]() $j$ in the

$j$ in the ![]() $i^{\rm th}$ type and the second term is its expenditure. It can be seen that

$i^{\rm th}$ type and the second term is its expenditure. It can be seen that ![]() $R_{ij}$ is an additional platform management fee based on

$R_{ij}$ is an additional platform management fee based on ![]() $R_{ij}^{\ast }$. Chen et al. [Reference Chen, Feng, Wei and Zhao8] mentioned that when

$R_{ij}^{\ast }$. Chen et al. [Reference Chen, Feng, Wei and Zhao8] mentioned that when ![]() $E(R_{ij})=E(R_{kl})$, it is fair to different types of members, that is,

$E(R_{ij})=E(R_{kl})$, it is fair to different types of members, that is,

where ![]() $R_{kl}$ represents the net cash flow of member

$R_{kl}$ represents the net cash flow of member ![]() $l$ in the

$l$ in the ![]() $k^{\rm th}$ type,

$k^{\rm th}$ type, ![]() $\forall l\in n_k$. From above equation, we can see that the expected income that platform obtains from each member are the same.

$\forall l\in n_k$. From above equation, we can see that the expected income that platform obtains from each member are the same.

3. Modeling framework

3.1. Decisions excluding insurance

Two types of mutual aid platforms with different optimization goals are considered in this paper. Suppose the target number of ![]() $i^{\rm th}$ type members is

$i^{\rm th}$ type members is ![]() $m_i$, where

$m_i$, where ![]() $i\in \mathcal {N}$. For a member of type

$i\in \mathcal {N}$. For a member of type ![]() $i$, define the cumulative distribution of the risk aversion coefficient

$i$, define the cumulative distribution of the risk aversion coefficient ![]() $\xi _i$ as

$\xi _i$ as ![]() $F_i$. Assuming that for

$F_i$. Assuming that for ![]() $\forall i\in \mathcal {N}$,

$\forall i\in \mathcal {N}$, ![]() $F_i(\xi _i)$ is continuously differentiable, and

$F_i(\xi _i)$ is continuously differentiable, and ![]() $\xi _i\in [0,{\bar {\xi }}_i]$ strictly increases with respect to

$\xi _i\in [0,{\bar {\xi }}_i]$ strictly increases with respect to ![]() $F_i(\xi _i)$.

$F_i(\xi _i)$. ![]() ${\bar {\xi }}_i$ is the upper limit of the

${\bar {\xi }}_i$ is the upper limit of the ![]() $i^{\rm th}$ type member's risk aversion coefficient. Under this assumption, the distribution function

$i^{\rm th}$ type member's risk aversion coefficient. Under this assumption, the distribution function ![]() $F_i$ is reversible. Let

$F_i$ is reversible. Let ![]() $F_i^{-1}$ be the corresponding inverse function, then for

$F_i^{-1}$ be the corresponding inverse function, then for ![]() $\xi _i\in [0,{\bar {\xi }}_i]$, we have

$\xi _i\in [0,{\bar {\xi }}_i]$, we have ![]() $F_i^{-1}(F_i(\xi _i))=\xi _i$. In Cohen and Einav [Reference Cohen and Einav10] and Halek and Eisenhauer [Reference Halek and Eisenhauer18], they used survey data to estimate people's risk aversion. This paper studies a more general form of

$F_i^{-1}(F_i(\xi _i))=\xi _i$. In Cohen and Einav [Reference Cohen and Einav10] and Halek and Eisenhauer [Reference Halek and Eisenhauer18], they used survey data to estimate people's risk aversion. This paper studies a more general form of ![]() $F_i$ and specific distribution functions are used in numerical examples.

$F_i$ and specific distribution functions are used in numerical examples.

For mutual aid platform, the initial number of platform members have not yet stabilized. Due to the effect of waiting period, the actual payment allocation amount paid by members are smaller than that of traditional insurance, and the utility obtained exceeds the utility given by traditional insurance. So here we assume that members only consider whether to join the mutual aid platform and not consider purchasing insurance. Then, the condition for individuals to choose to join the mutual aid plan is

We then adapt Taylor series’ expansion on utility function of personal initial wealth to estimate personal risk aversion. This method is also used in Thomas [Reference Thomas24], Hassett et al. [Reference Hassett, Sears and Trennepohl19], Eeckhoudt and Laeven [Reference Eeckhoudt and Laeven16], Corner [Reference Corner11], and Viscusi and Evans [Reference Viscusi and Evans25]. Its advantage is that it does not need to formulate the form of the utility function, but there may be a certain error in approximating the original utility function as a quadratic expression.

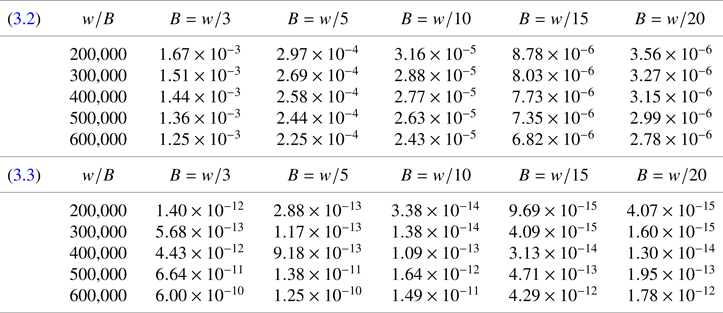

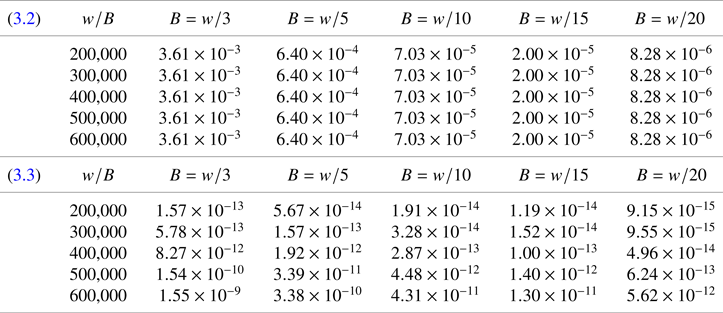

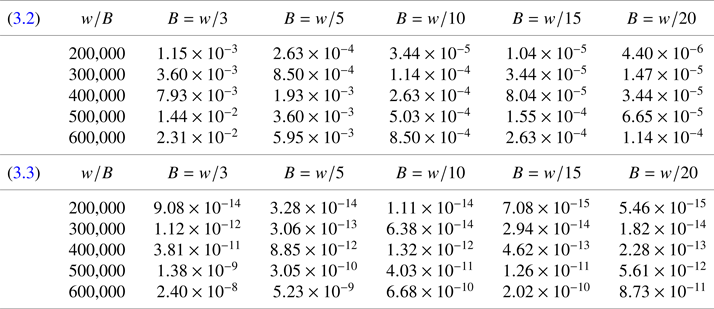

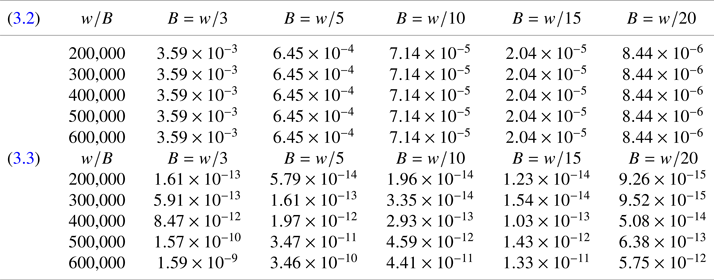

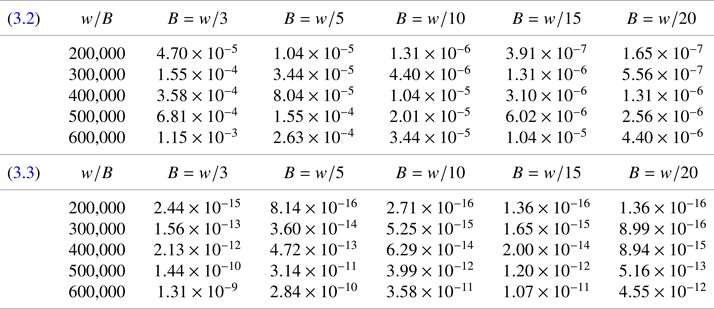

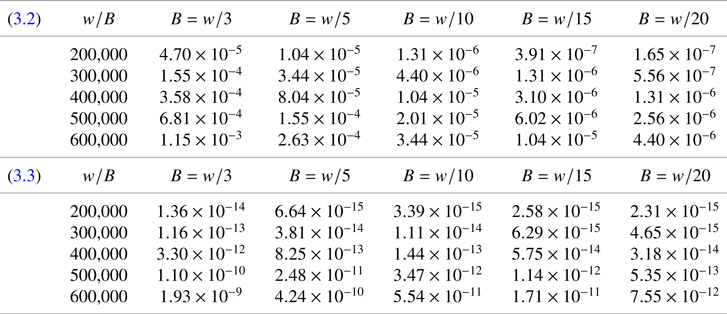

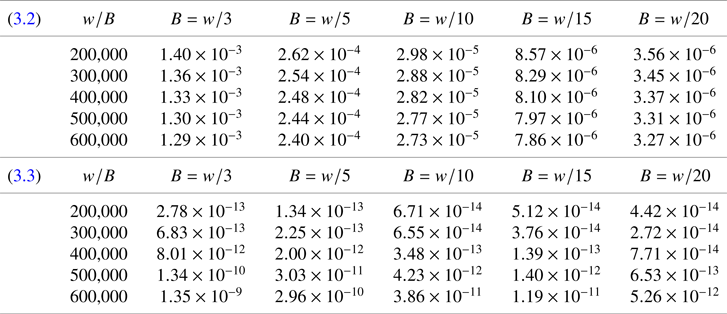

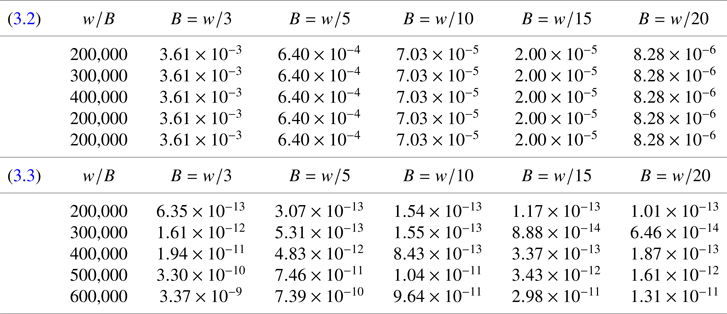

This paper intends to compare the expected utility functions for decision-making, rather than approximating the expected utility of various situations based on the Taylor expansion method. We adopt this Taylor series approximation constrains from Thomas [Reference Thomas24] that are both ![]() $w^{0}_{i,j}\gg B_i$ and

$w^{0}_{i,j}\gg B_i$ and ![]() $w^{0}_{i,j}\gg \beta _i+s_{ij}(1+\alpha _i)$ to make sure second-order Taylor expansion is good approximation. The assumptions represent that the initial wealth is much greater than potential loss. Because of these conditions,

$w^{0}_{i,j}\gg \beta _i+s_{ij}(1+\alpha _i)$ to make sure second-order Taylor expansion is good approximation. The assumptions represent that the initial wealth is much greater than potential loss. Because of these conditions, ![]() $(w^{0}_{i,j})-B_i$ and

$(w^{0}_{i,j})-B_i$ and ![]() $(w^{0}_{i,j})-\beta _i+s_ij (1+\alpha _i)$ are in a sufficiently small neighborhood of

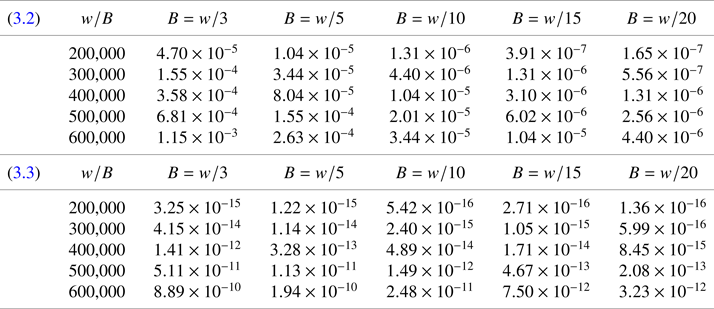

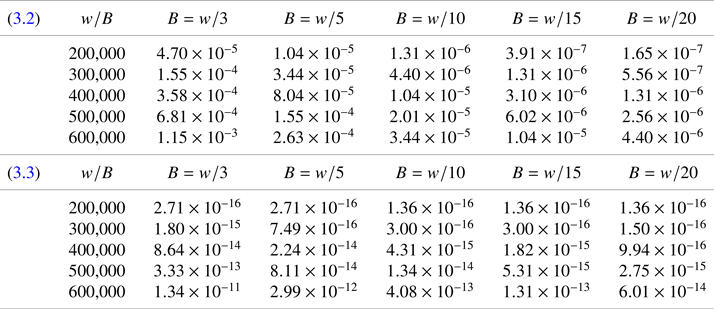

$(w^{0}_{i,j})-\beta _i+s_ij (1+\alpha _i)$ are in a sufficiently small neighborhood of ![]() $(w^{0}_{i,j})$. Some numerical examples are given in Appendix to show that the second-order Taylor expansion is a good approximation for decision making under an individual's expected utility function in this study.

$(w^{0}_{i,j})$. Some numerical examples are given in Appendix to show that the second-order Taylor expansion is a good approximation for decision making under an individual's expected utility function in this study.

Assuming that both ![]() $w^{0}_{i,j}\gg B_i$ and

$w^{0}_{i,j}\gg B_i$ and ![]() $w^{0}_{i,j}\gg \beta _i+s_{ij}(1+\alpha _i)$, the utility terms on the right-hand side of Eqs. (2.1) and (2.2) may be expanded using the first three terms of a Taylor series,

$w^{0}_{i,j}\gg \beta _i+s_{ij}(1+\alpha _i)$, the utility terms on the right-hand side of Eqs. (2.1) and (2.2) may be expanded using the first three terms of a Taylor series,

\begin{align} & u(w^{0}_{i,j}-B_i)\approx u(w^{0}_{i,j})-B_iu^{\prime}(w^{0}_{i,j})+\frac{1}{2}B_i^{2}u^{\prime\prime}(w^{0}_{i,j}).\\ & u(w^{0}_{i,j}-\beta_i-s_{ij}(1+\alpha_i))=u\left(w^{0}_{i,j}-\frac{x+p_iB_i}{1-p_i}\right)\nonumber\\ \end{align}

\begin{align} & u(w^{0}_{i,j}-B_i)\approx u(w^{0}_{i,j})-B_iu^{\prime}(w^{0}_{i,j})+\frac{1}{2}B_i^{2}u^{\prime\prime}(w^{0}_{i,j}).\\ & u(w^{0}_{i,j}-\beta_i-s_{ij}(1+\alpha_i))=u\left(w^{0}_{i,j}-\frac{x+p_iB_i}{1-p_i}\right)\nonumber\\ \end{align}where ![]() $x=(1-p_i)\beta _i+p_i B_i \alpha _i$ to simplify expressions. Then,

$x=(1-p_i)\beta _i+p_i B_i \alpha _i$ to simplify expressions. Then,

From the decision condition (3.1), we get

According to the definition of absolute risk aversion coefficient,

$$\xi_i={-}\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})}.$$

$$\xi_i={-}\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})}.$$Therefore, when the risk aversion coefficient of participants meets the following two conditions, they will choose to join the mutual aid plan:

1. when

$0< x< B_i[\sqrt {p_i(1-p_i)}-p_i]$,

(3.6)

$0< x< B_i[\sqrt {p_i(1-p_i)}-p_i]$,

(3.6) \begin{equation} -\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} >\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}=\xi_i^{{\ast}}. \end{equation}

\begin{equation} -\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} >\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}=\xi_i^{{\ast}}. \end{equation}2. when

$x>B_i[\sqrt {p_i(1-p_i)}-p_i],$

$x>B_i[\sqrt {p_i(1-p_i)}-p_i],$

$$-\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} <\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}<0.$$

$$-\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} <\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}<0.$$

![]() $\xi _i^{\ast }$ is the minimum value of the risk aversion coefficient of participants who choose to join the platform. Only those participants whose risk aversion coefficient exceeds

$\xi _i^{\ast }$ is the minimum value of the risk aversion coefficient of participants who choose to join the platform. Only those participants whose risk aversion coefficient exceeds ![]() $\xi _i^{\ast }$ join the mutual aid program, and the target groups in this paper are risk-averse, so the second case is not considered. As a result, the probability of a participant joining the mutual aid platform is

$\xi _i^{\ast }$ join the mutual aid program, and the target groups in this paper are risk-averse, so the second case is not considered. As a result, the probability of a participant joining the mutual aid platform is ![]() $P(\xi _i>\xi _i^{\ast })$. The final number of

$P(\xi _i>\xi _i^{\ast })$. The final number of ![]() $i^{\rm th}$ type participants who choose to join the mutual aid plan

$i^{\rm th}$ type participants who choose to join the mutual aid plan ![]() $n_i$ is

$n_i$ is

\begin{align} n_i& =m_i\times P(\xi_i>\xi_i^{{\ast}})\nonumber\\ & = m_i\left(1-F_i \left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right),\quad \forall i\in\mathcal{N}. \end{align}

\begin{align} n_i& =m_i\times P(\xi_i>\xi_i^{{\ast}})\nonumber\\ & = m_i\left(1-F_i \left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right),\quad \forall i\in\mathcal{N}. \end{align} Denote ![]() $v_i$ as the platform's income from

$v_i$ as the platform's income from ![]() $i^{\rm th}$ type members,

$i^{\rm th}$ type members, ![]() $\forall i\in \mathcal {N}$. The platform's revenue comes from management fees paid by helpers. Therefore,

$\forall i\in \mathcal {N}$. The platform's revenue comes from management fees paid by helpers. Therefore,

$$v_i=\sum_{j=1}^{n_i}{(1-I_{ij})(s_i\alpha_i+\beta_i)}.$$

$$v_i=\sum_{j=1}^{n_i}{(1-I_{ij})(s_i\alpha_i+\beta_i)}.$$ Then, the expectation and variance of the platform's income from ![]() $i^{\rm th}$ type members are

$i^{\rm th}$ type members are

and

Setting ![]() $(\alpha,\beta )$ to be the vector of management fee and fixed cost of the platform, where

$(\alpha,\beta )$ to be the vector of management fee and fixed cost of the platform, where ![]() $\alpha =(\alpha _1,\ldots,\alpha _N)\in \mathbb {R}^{|N|}$,

$\alpha =(\alpha _1,\ldots,\alpha _N)\in \mathbb {R}^{|N|}$, ![]() $\beta =(\beta _1,\ldots,\beta _N)\in \mathbb {R}^{|N|}$. Total revenue of the platform

$\beta =(\beta _1,\ldots,\beta _N)\in \mathbb {R}^{|N|}$. Total revenue of the platform ![]() $v={\sum _{i=1}^{N}{v_i}}$. When participants do not consider purchasing insurance, the risk minimization model of the platform (Model 1) is

$v={\sum _{i=1}^{N}{v_i}}$. When participants do not consider purchasing insurance, the risk minimization model of the platform (Model 1) is

\begin{align} {\rm s.t.}\quad & n_i=m_i\left[1-F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right], \quad \forall i\in\mathcal{N}, \end{align}

\begin{align} {\rm s.t.}\quad & n_i=m_i\left[1-F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right], \quad \forall i\in\mathcal{N}, \end{align} In Model 1, constraint (3.11) comes from the condition of relative fairness. Constraint (3.12) guarantees ![]() $n_i$ is a feasible solution, constraint (3.13), (3.14) to ensure that

$n_i$ is a feasible solution, constraint (3.13), (3.14) to ensure that ![]() $(\alpha,\beta )$ is a feasible management rate and fixed cost. The platform influences the number of people who join the mutual aid plan by selecting appropriate management fees and fixed fees, so as to minimize operating risks.

$(\alpha,\beta )$ is a feasible management rate and fixed cost. The platform influences the number of people who join the mutual aid plan by selecting appropriate management fees and fixed fees, so as to minimize operating risks.

In the same way, the platform with maximize its revenue as optimization object (Model 2) can be expressed as

\begin{align} {\rm s.t.}\quad & n_i=m_i\left[1-F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right],\quad \forall i\in\mathcal{N}, \end{align}

\begin{align} {\rm s.t.}\quad & n_i=m_i\left[1-F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right],\quad \forall i\in\mathcal{N}, \end{align}3.2. Decisions including insurance

In Section 3.1, participants’ decisions of whether join the mutual aid plan are based on the principle of maximum expected utility. As the actual cost-sharing is relatively small, participants only need to consider whether to join a mutual aid plan. However, this assumption is not comprehensive enough. In recent years, some low-priced, competitive insurance products have also appeared, such as medical insurance with a million-level coverage and city universal commercial health insurance. Based on Section 3.1, this section assumes that participants also consider whether to purchase insurance with the same sum insured amount as mutual aid and without a deductible.

For the ![]() $i^{\rm th}$ type participant,

$i^{\rm th}$ type participant, ![]() $\forall i\in \mathcal {N}$, the condition for an individual to choose to join a mutual aid plan instead of buying insurance is

$\forall i\in \mathcal {N}$, the condition for an individual to choose to join a mutual aid plan instead of buying insurance is

that is, the utility of joining a mutual aid plan exceeds the utility of buying insurance. Under different premiums, the minimum value of the member's risk aversion coefficient ![]() ${\widetilde {\xi }}_i^{\ast }$ is

${\widetilde {\xi }}_i^{\ast }$ is

1. when

$0< x<\pi _i\sqrt {1-p_i}-p_iB_i$,

(3.22)

$0< x<\pi _i\sqrt {1-p_i}-p_iB_i$,

(3.22) \begin{equation} -\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} >\frac{2(x+p_iB_i-\pi_i)}{{\pi_i}^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}={\widetilde{\xi}}_i^{{\ast}}. \end{equation}

\begin{equation} -\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} >\frac{2(x+p_iB_i-\pi_i)}{{\pi_i}^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}={\widetilde{\xi}}_i^{{\ast}}. \end{equation}2. when

$\pi _i\sqrt {1-p_i}-p_iB_i< x,$

(3.23)

$\pi _i\sqrt {1-p_i}-p_iB_i< x,$

(3.23) \begin{equation} -\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} <\frac{2(x+p_iB_i-\pi_i)}{{\pi_i}^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}={\widetilde{\xi}}_i^{{\ast}}. \end{equation}

\begin{equation} -\frac{u^{\prime\prime}(w^{0}_{i,j})}{u^{\prime}(w^{0}_{i,j})} <\frac{2(x+p_iB_i-\pi_i)}{{\pi_i}^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}={\widetilde{\xi}}_i^{{\ast}}. \end{equation}3. when

$x=\pi _i\sqrt {1-p_i}-p_iB_i$,

$x=\pi _i\sqrt {1-p_i}-p_iB_i$,  $Eu_{i,2}>Eu_{i,3}$ established.

$Eu_{i,2}>Eu_{i,3}$ established.

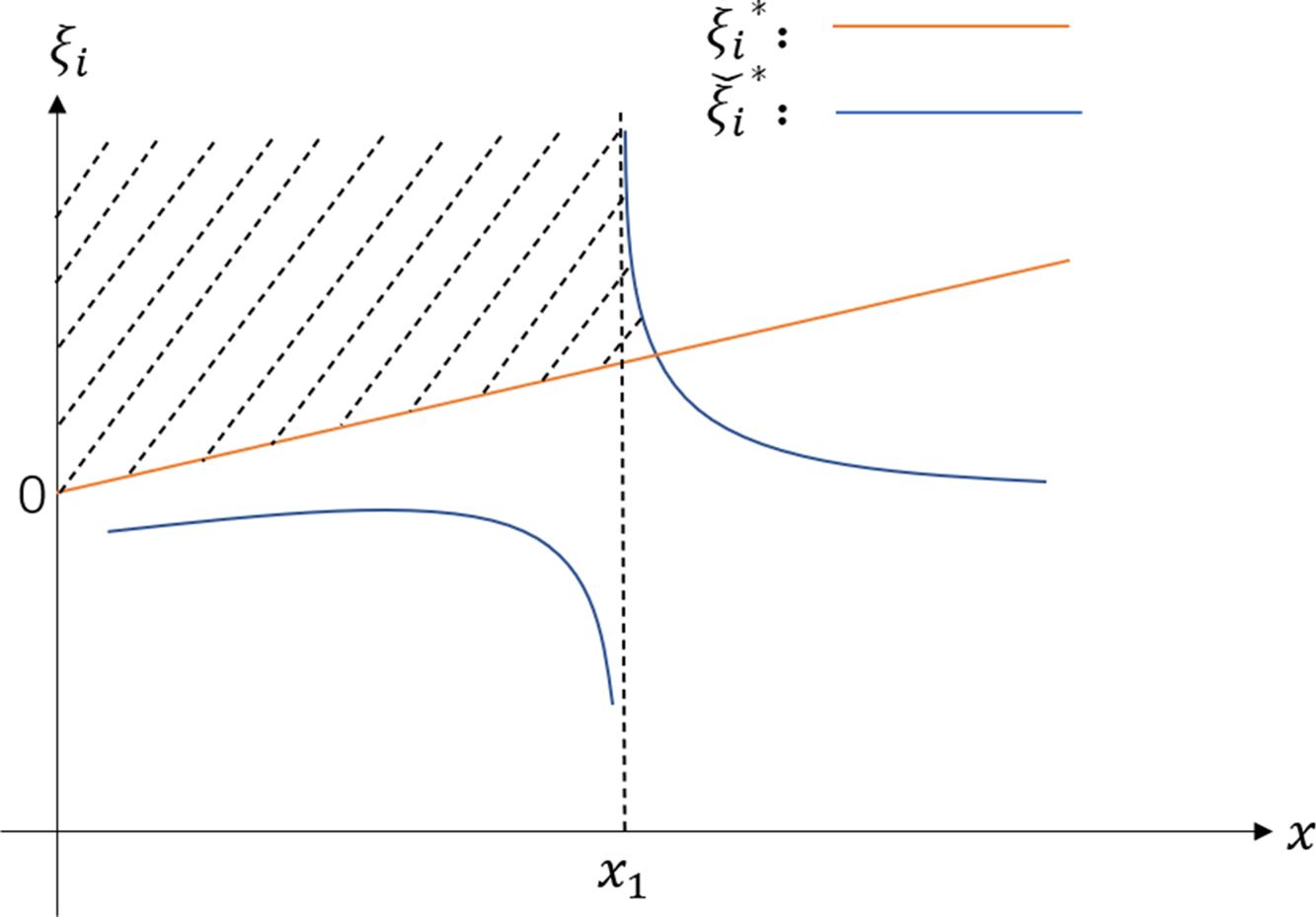

When the platform's expected return ![]() $x$ is relatively small, only the participants’ risk aversion level needs to be considered. Excessive fees cause participants to switch to insurance. Figure 1 shows the value range of the risk aversion coefficient of

$x$ is relatively small, only the participants’ risk aversion level needs to be considered. Excessive fees cause participants to switch to insurance. Figure 1 shows the value range of the risk aversion coefficient of ![]() $i^{\rm th}$ type members under different decision-making conditions. When considering whether to join a mutual aid program, the participant's risk aversion coefficient must be above the orange solid line. When considering whether to join a mutual aid plan or purchase insurance, the expected return

$i^{\rm th}$ type members under different decision-making conditions. When considering whether to join a mutual aid program, the participant's risk aversion coefficient must be above the orange solid line. When considering whether to join a mutual aid plan or purchase insurance, the expected return ![]() $x$ affects the threshold of the member's risk aversion coefficient. When

$x$ affects the threshold of the member's risk aversion coefficient. When ![]() $x< x_1$, the member's risk aversion coefficient should be below the blue solid line; when

$x< x_1$, the member's risk aversion coefficient should be below the blue solid line; when ![]() $x>x_1$, the member's risk aversion coefficient should be above the blue realization, where

$x>x_1$, the member's risk aversion coefficient should be above the blue realization, where ![]() $x_1=\pi _i\sqrt {1-p_i}-p_iB_i$. Combining the two types of decision-making, only participants whose risk aversion coefficient is in the shadow zone choose to join the mutual aid platform.

$x_1=\pi _i\sqrt {1-p_i}-p_iB_i$. Combining the two types of decision-making, only participants whose risk aversion coefficient is in the shadow zone choose to join the mutual aid platform.

Figure 1. Risk aversion coefficient ![]() $\xi _i$ and platform expected return

$\xi _i$ and platform expected return ![]() $x$.

$x$.

According to Figure 1 and combining equations (3.6), (3.17), and (3.18), it can be seen that in different situations, for ![]() $\forall i\in \mathcal {N}$,the final numbers of

$\forall i\in \mathcal {N}$,the final numbers of ![]() $i^{\rm th}$ type participants who choose to join the mutual aid plan are

$i^{\rm th}$ type participants who choose to join the mutual aid plan are

1. when

$0< x\le \pi _i\sqrt {1-p_i}-p_iB_i$,

$0< x\le \pi _i\sqrt {1-p_i}-p_iB_i$,

$$n_i=m_i\left[1-F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right].$$

$$n_i=m_i\left[1-F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right].$$2. when

$\pi _i\sqrt {1-p_i}-p_iB_i< x\le (p_iB_i^{2}(1-2p_i)+z_i^{2})^{\frac{1}{2}}-z_i$,

where

$\pi _i\sqrt {1-p_i}-p_iB_i< x\le (p_iB_i^{2}(1-2p_i)+z_i^{2})^{\frac{1}{2}}-z_i$,

where $$n_i=m_i\left[F_i\left(\frac{2(x+p_iB_i-\pi_i)}{{\pi_i}^{2}-\frac{{(x+p_iB_i)}^{2}}{1-p_i}}\right) -F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right].$$

$$n_i=m_i\left[F_i\left(\frac{2(x+p_iB_i-\pi_i)}{{\pi_i}^{2}-\frac{{(x+p_iB_i)}^{2}}{1-p_i}}\right) -F_i\left(\frac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right].$$ $z_i=p_iB_i+{((p_iB_i^{2}-{\pi _i}^{2})(1-p_i))}/{2(\pi _i-p_iB_i)}$.

$z_i=p_iB_i+{((p_iB_i^{2}-{\pi _i}^{2})(1-p_i))}/{2(\pi _i-p_iB_i)}$.3. when

$x>p_iB_i^{2}(1-2p_i)+z_i^{2})^{1/2}-z_i$,

$x>p_iB_i^{2}(1-2p_i)+z_i^{2})^{1/2}-z_i$,

$$n_i=0.$$

$$n_i=0.$$

It can be found that the number of participants in the second case is the ones in the former case minus the number of people who buys insurance due to excessive cost-sharing. Then, when participants consider purchasing insurance, the number of participants in the platform's risk minimization model (Model 3) is

\begin{equation} n_i=\begin{cases} m_i\left[1-F_i\left(\dfrac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right], \quad 0< x\le \pi_i\sqrt{1-p_i}-p_iB_i,\\ 0, \quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad x>(p_iB_i^{2}(1-2p_i)+z_i^{2})^{1/2}-z_i,\\ m_i\left[F_i\left(\dfrac{2\left(x+p_iB_i-\pi_i\right)}{{\pi_i}^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right) -F_i\left(\dfrac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right], \quad \text{otherwise}, \end{cases}\quad \forall i\in\mathcal{N}. \end{equation}

\begin{equation} n_i=\begin{cases} m_i\left[1-F_i\left(\dfrac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right], \quad 0< x\le \pi_i\sqrt{1-p_i}-p_iB_i,\\ 0, \quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad x>(p_iB_i^{2}(1-2p_i)+z_i^{2})^{1/2}-z_i,\\ m_i\left[F_i\left(\dfrac{2\left(x+p_iB_i-\pi_i\right)}{{\pi_i}^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right) -F_i\left(\dfrac{2x}{p_iB_i^{2}-\frac{(x+p_iB_i)^{2}}{1-p_i}}\right)\right], \quad \text{otherwise}, \end{cases}\quad \forall i\in\mathcal{N}. \end{equation}The rest of constraints are the same as Model 1.

Based on relatively fair conditions, the expected revenue ![]() $x$ of the platform is the same for different types of members. However, since premiums and loss probabilities for different types of members are different, when a certain type of member's platform expected revenue

$x$ of the platform is the same for different types of members. However, since premiums and loss probabilities for different types of members are different, when a certain type of member's platform expected revenue ![]() $x$ is in the range

$x$ is in the range ![]() $(\pi _i\sqrt {1-p_i}-p_iB_i,(p_iB_i^{2}(1-2p_i)+z_i^{2})^{1/2}-z_i]$,

$(\pi _i\sqrt {1-p_i}-p_iB_i,(p_iB_i^{2}(1-2p_i)+z_i^{2})^{1/2}-z_i]$, ![]() $x$ of the remaining members are in other ranges. When the expected return

$x$ of the remaining members are in other ranges. When the expected return ![]() $x$ of the platform is within the premium range of high-risk groups

$x$ of the platform is within the premium range of high-risk groups ![]() $(\pi _i\sqrt {1-p_i}-p_iB_i,+\infty )$, the utility of the mutual aid plan for low-risk groups is lower than the insurance utility. In other words, an excessively high platform expected return leads to withdrawal of low-risk groups.

$(\pi _i\sqrt {1-p_i}-p_iB_i,+\infty )$, the utility of the mutual aid plan for low-risk groups is lower than the insurance utility. In other words, an excessively high platform expected return leads to withdrawal of low-risk groups.

Similarly, the platform revenue maximization model considering that participants may purchase insurance (Model 4) is to adjust the number of participants to formula (3.19) based on Model 2, and other constraints remain unchange.

4. Finding the optimal solutions

In this section, we first find the optimal solutions of Model 1 and Model 2. Then, the numerical method is applied to find optimal solutions for Model 3 and Model 4. Finally, the network structure of the mutual aid plan is analyzed by studying the relationship between variables.

4.1. The analytic solutions of Model 1 and Model 2

In this section, the optimal solutions of Model 1 and Model 2 are found by implementing the KKT condition, that is, the optimal fixed cost and management rate of the mutual aid platform are obtained. In order to facilitate the calculation, ![]() $n_i$ is considered as a decision variable and bring (3.8) and (3.9) into (3.10) to get the optimization objective as

$n_i$ is considered as a decision variable and bring (3.8) and (3.9) into (3.10) to get the optimization objective as

$$\min_x{\displaystyle\sum_{i=1}^{N}{\left(\frac{rn_ip_ix^{2}}{1-p_i}-n_ix\right),}}$$

$$\min_x{\displaystyle\sum_{i=1}^{N}{\left(\frac{rn_ip_ix^{2}}{1-p_i}-n_ix\right),}}$$with the corresponding Lagrange function ![]() $\mathcal {L}$ as

$\mathcal {L}$ as

\begin{align} \mathcal{L}(x,n,\lambda,\mu)& =\sum_{i=1}^{N}\lambda_i\left[F_i^{{-}1}\left(1-\frac{n_i}{m_i}\right) \left(\frac{(x+p_iB_i)^{2}}{1-p_i}-p_iB_i^{2}\right)+2x\right] \nonumber\\ & \quad +\sum_{i=1}^{N}{\left(\frac{rn_ix^{2}p_i}{1-p_i}-n_ix\right)+}\sum_{i=1}^{N}{\mu_{1i}(m_i-n_i)}+\sum_{i=1}^{N}{\mu_{2i}n_i}+\mu_3x, \end{align}

\begin{align} \mathcal{L}(x,n,\lambda,\mu)& =\sum_{i=1}^{N}\lambda_i\left[F_i^{{-}1}\left(1-\frac{n_i}{m_i}\right) \left(\frac{(x+p_iB_i)^{2}}{1-p_i}-p_iB_i^{2}\right)+2x\right] \nonumber\\ & \quad +\sum_{i=1}^{N}{\left(\frac{rn_ix^{2}p_i}{1-p_i}-n_ix\right)+}\sum_{i=1}^{N}{\mu_{1i}(m_i-n_i)}+\sum_{i=1}^{N}{\mu_{2i}n_i}+\mu_3x, \end{align}where ![]() $\mu$ and

$\mu$ and ![]() $\lambda$ are Lagrange multipliers with

$\lambda$ are Lagrange multipliers with ![]() $\mu =(\mu _{11},\ldots,\mu _{1N},\mu _{21},\ldots,\mu _{2N},\mu _3)$ and

$\mu =(\mu _{11},\ldots,\mu _{1N},\mu _{21},\ldots,\mu _{2N},\mu _3)$ and ![]() $\lambda =(\lambda _1,\ldots,\lambda _N)$. According to the stationary condition, we take the derivatives of

$\lambda =(\lambda _1,\ldots,\lambda _N)$. According to the stationary condition, we take the derivatives of ![]() $\mathcal {L}$ with respect to

$\mathcal {L}$ with respect to ![]() $x$ and

$x$ and ![]() $n_i$, respectively. Then, we have

$n_i$, respectively. Then, we have

\begin{equation} \frac{\partial\mathcal{L}}{\partial x}=\sum_{i=1}^{N}\left[\frac{2rxn_ip_i}{1-p_i}-n_i +2\lambda_i\left(1+F_i^{{-}1}\left(1-\frac{n_i}{m_i}\right)\left(\frac{x+p_iB_i}{1-p_i}\right)\right)\right]+ \mu_3=0, \end{equation}

\begin{equation} \frac{\partial\mathcal{L}}{\partial x}=\sum_{i=1}^{N}\left[\frac{2rxn_ip_i}{1-p_i}-n_i +2\lambda_i\left(1+F_i^{{-}1}\left(1-\frac{n_i}{m_i}\right)\left(\frac{x+p_iB_i}{1-p_i}\right)\right)\right]+ \mu_3=0, \end{equation}and

\begin{align} \frac{\partial\mathcal{L}}{\partial n_i}& =\frac{rx^{2}p_i}{1-p_i}-x+\lambda_i\left[F_i^{{-}1}\left(1-\frac{n_i}{m_i}\right)\right]^{\prime} \left(\frac{(x+p_iB_i)^{2}}{1-p_i}-p_iB_i^{2}\right)\nonumber\\ & \quad - \mu_{1i}+\mu_{2i}=0,\quad \forall i\in\mathcal{N}. \end{align}

\begin{align} \frac{\partial\mathcal{L}}{\partial n_i}& =\frac{rx^{2}p_i}{1-p_i}-x+\lambda_i\left[F_i^{{-}1}\left(1-\frac{n_i}{m_i}\right)\right]^{\prime} \left(\frac{(x+p_iB_i)^{2}}{1-p_i}-p_iB_i^{2}\right)\nonumber\\ & \quad - \mu_{1i}+\mu_{2i}=0,\quad \forall i\in\mathcal{N}. \end{align}According to equality constraints, taking the derivative of ![]() $\mathcal {L}$ with respect to

$\mathcal {L}$ with respect to ![]() $\lambda _i$ gives

$\lambda _i$ gives

From the complimentary slackness conditions, it gives

and

Suppose ![]() $0< n_i< m_i$ and

$0< n_i< m_i$ and ![]() $x\neq 0$, that

$x\neq 0$, that ![]() $\mu _{1i}=\mu _{2i}=\mu _3=0$. From Eq. (4.4), it can be concluded that:

$\mu _{1i}=\mu _{2i}=\mu _3=0$. From Eq. (4.4), it can be concluded that:

\begin{align} x& ={\left[(1-p_i)(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})} +\frac{1-p_i}{{(F_i^{{-}1}(1-\frac{n_i}{m_i}))}^{2}})\right]}^{1/2}\nonumber\\ & \quad -\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})}-p_iB_i, \end{align}

\begin{align} x& ={\left[(1-p_i)(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})} +\frac{1-p_i}{{(F_i^{{-}1}(1-\frac{n_i}{m_i}))}^{2}})\right]}^{1/2}\nonumber\\ & \quad -\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})}-p_iB_i, \end{align}By taking Eq. (4.7) into Eqs. (4.2) and (4.3), we obtain

\begin{align} & \sum_{i=1}^{N}{\left(\frac{rp_i(g_i-p_iB_i)}{1-p_i} -\frac{rp_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})}-1\right) \frac{g_i\left[F_i^{{-}1}(1-\frac{n_i}{m_i})\right]^{2}}{(1-p_i)[F_i^{{-}1}(1-\frac{n_i}{m_i})]^{\prime}}}\nonumber\\ & \quad +\sum_{i=1}^{N}\left(\frac{2rn_ip_i(g_i-p_iB_i)}{1-p_i} -\frac{2rp_in_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})}-n_i\right)=0, \end{align}

\begin{align} & \sum_{i=1}^{N}{\left(\frac{rp_i(g_i-p_iB_i)}{1-p_i} -\frac{rp_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})}-1\right) \frac{g_i\left[F_i^{{-}1}(1-\frac{n_i}{m_i})\right]^{2}}{(1-p_i)[F_i^{{-}1}(1-\frac{n_i}{m_i})]^{\prime}}}\nonumber\\ & \quad +\sum_{i=1}^{N}\left(\frac{2rn_ip_i(g_i-p_iB_i)}{1-p_i} -\frac{2rp_in_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})}-n_i\right)=0, \end{align}where

$$g_i=\left[(1-p_i)\left(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})} +\frac{1-p_i}{[F_i^{{-}1}(1-\frac{n_i}{m_i})]^{2}}\right)\right]^{1/2}.$$

$$g_i=\left[(1-p_i)\left(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i}{m_i})} +\frac{1-p_i}{[F_i^{{-}1}(1-\frac{n_i}{m_i})]^{2}}\right)\right]^{1/2}.$$Note that, ![]() $n_i=0$ or

$n_i=0$ or ![]() $n_i=m_i$ are not solutions to Model 1. Thus, the assumption

$n_i=m_i$ are not solutions to Model 1. Thus, the assumption ![]() $0< n_i< m_i$ holds. This can also be seen from practice as it is impossible for everyone to be willing to join the mutual aid plan nor if no one joins the mutual aid plan, the platform cannot operate.

$0< n_i< m_i$ holds. This can also be seen from practice as it is impossible for everyone to be willing to join the mutual aid plan nor if no one joins the mutual aid plan, the platform cannot operate.

Using the same method, the optimal solution of Model 2 can be obtained, and Theorems 4.1 and 4.2 then can be obtained.

Theorem 4.1. Suppose ![]() $(\alpha ^{a},\beta ^{a})$ is the optimal solution of minimizing platform risk Model 1,

$(\alpha ^{a},\beta ^{a})$ is the optimal solution of minimizing platform risk Model 1, ![]() $n_i^{a}$ is the stable number given

$n_i^{a}$ is the stable number given ![]() $(\alpha ^{a},\beta ^{a})$. In the case of heterogeneous risk fair exchange,

$(\alpha ^{a},\beta ^{a})$. In the case of heterogeneous risk fair exchange, ![]() $n_i^{a}$ is determined by solving the following equation:

$n_i^{a}$ is determined by solving the following equation:

\begin{align} & \sum_{i=1}^{N}{\left(\frac{rp_i(g_i^{a}-p_iB_i)}{1-p_i}-\frac{rp_i}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})}-1\right) \frac{g_i^{a}[F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})]^{2}}{(1-p_i)[F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})]^{\prime}}}\nonumber\\ & \quad +\sum_{i=1}^{N}\left(\frac{2rn_i^{a}p_i(g_i^{a}-p_iB_i)}{1-p_i} -\frac{2rp_in_i^{a}}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})}-n_i^{a}\right)=0. \end{align}

\begin{align} & \sum_{i=1}^{N}{\left(\frac{rp_i(g_i^{a}-p_iB_i)}{1-p_i}-\frac{rp_i}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})}-1\right) \frac{g_i^{a}[F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})]^{2}}{(1-p_i)[F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})]^{\prime}}}\nonumber\\ & \quad +\sum_{i=1}^{N}\left(\frac{2rn_i^{a}p_i(g_i^{a}-p_iB_i)}{1-p_i} -\frac{2rp_in_i^{a}}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})}-n_i^{a}\right)=0. \end{align}The optimal fixed cost and management rate of Model 1 are not unique, and the relationship is as follows:

\begin{equation} (1-p_i)\beta_i^{a}+p_iB_i\alpha_i^{a}=g_i^{a}-\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})}-p_iB_i,\quad \forall i\in\mathcal{N}, \end{equation}

\begin{equation} (1-p_i)\beta_i^{a}+p_iB_i\alpha_i^{a}=g_i^{a}-\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})}-p_iB_i,\quad \forall i\in\mathcal{N}, \end{equation}with

$$g_i^{a}=\left[(1-p_i)\left(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})} +\frac{1-p_i}{(F_i^{{-}1}(1-\frac{n_i^{a}}{m_i}))^{2}}\right)\right]^{1/2}.$$

$$g_i^{a}=\left[(1-p_i)\left(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i^{a}}{m_i})} +\frac{1-p_i}{(F_i^{{-}1}(1-\frac{n_i^{a}}{m_i}))^{2}}\right)\right]^{1/2}.$$Theorem 4.2. Suppose ![]() $(\alpha ^{b},\beta ^{b})$ is the optimal solution of maximizing platform revenue Model 2,

$(\alpha ^{b},\beta ^{b})$ is the optimal solution of maximizing platform revenue Model 2, ![]() $n_i^{b}$ is the stable number given

$n_i^{b}$ is the stable number given ![]() $(\alpha ^{b},\beta ^{b})$. In the case of heterogeneous risk fair exchange,

$(\alpha ^{b},\beta ^{b})$. In the case of heterogeneous risk fair exchange, ![]() $n_i^{b}$ is determined by solving the following equation:

$n_i^{b}$ is determined by solving the following equation:

\begin{equation} \sum_{i=1}^{N}\left(n_i^{b}+\frac{g_i^{b}{[F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})]}^{2}} {(1-p_i){[F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})]}^{\prime}}\right)=0. \end{equation}

\begin{equation} \sum_{i=1}^{N}\left(n_i^{b}+\frac{g_i^{b}{[F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})]}^{2}} {(1-p_i){[F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})]}^{\prime}}\right)=0. \end{equation}The optimal fixed fee and management fee rate of Model 2 are also not unique, the relationship is as follows:

\begin{equation} (1-p_i)\beta_i^{b}+p_iB_i\alpha_i^{b}=g_i^{b}-\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})}-p_iB_i,\quad \forall i\in\mathcal{N}, \end{equation}

\begin{equation} (1-p_i)\beta_i^{b}+p_iB_i\alpha_i^{b}=g_i^{b}-\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})}-p_iB_i,\quad \forall i\in\mathcal{N}, \end{equation}where

$$g_i^{b}=\left[(1-p_i)\left(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})} +\frac{1-p_i}{[F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})]^{2}}\right)\right]^{1/2}.$$

$$g_i^{b}=\left[(1-p_i)\left(p_iB_i^{2}+\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})} +\frac{1-p_i}{[F_i^{{-}1}(1-\frac{n_i^{b}}{m_i})]^{2}}\right)\right]^{1/2}.$$From Theorems 4.1 and 4.2, we find that the relationship between optimal fixed fee and management rate are the same under different optimization objectives. The reason is that the decision objects of the participants are the same, and they only consider whether to join the platform. But the actual apportionment value can be unequal because that the number of participants is different from time to time. This paper determines the optimal fixed fee and management rate by selecting the best participant group under the optimization goal. There are many kinds of optimal fixed fees and management fee rates on the platform, but in reality, most mutual aid platforms only charge a fixed fee or only set a management rate. Participants may prefer an uncomplicated charging method. Hence, we have the following corollary from Theorems 4.1 and 4.2.

Corollary 4.1. A simpler example of the optimal solution of Models 1 and 2 is as follows, ![]() $(\alpha ^{\ast },\beta ^{\ast })$ is the optimal solution under the optimization objective,

$(\alpha ^{\ast },\beta ^{\ast })$ is the optimal solution under the optimization objective, ![]() $n_i^{\ast }$ is given

$n_i^{\ast }$ is given ![]() $(\alpha ^{\ast },\beta ^{\ast })$ stable number of people. For

$(\alpha ^{\ast },\beta ^{\ast })$ stable number of people. For ![]() $\forall i\in \mathcal {N}$,

$\forall i\in \mathcal {N}$,

• Setting

$\alpha _i^{\ast }=0$, then

$\alpha _i^{\ast }=0$, then

$$\beta_i^{{\ast}}=\displaystyle\frac{g_i^{{\ast}}}{1-p_i}-\frac{1}{F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})} -\frac{p_iB_i}{(1-p_i)},\quad \forall i\in\mathcal{N}.$$

$$\beta_i^{{\ast}}=\displaystyle\frac{g_i^{{\ast}}}{1-p_i}-\frac{1}{F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})} -\frac{p_iB_i}{(1-p_i)},\quad \forall i\in\mathcal{N}.$$• Setting

$\beta _i^{\ast }=0$, then

$\beta _i^{\ast }=0$, then

$$\alpha_i^{{\ast}}=\frac{1}{p_iB_i}\left(g_i^{{\ast}}-\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})}\right)-1, \quad \forall i\in\mathcal{N}.$$

$$\alpha_i^{{\ast}}=\frac{1}{p_iB_i}\left(g_i^{{\ast}}-\frac{1-p_i}{F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})}\right)-1, \quad \forall i\in\mathcal{N}.$$

Among them,

$$g_i^{{\ast}}=\left[(1-p_i)\left(p_iB_i^{2}+\displaystyle\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})} +\frac{1-p_i}{[F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})]^{2}}\right)\right]^{1/2}.$$

$$g_i^{{\ast}}=\left[(1-p_i)\left(p_iB_i^{2}+\displaystyle\frac{2p_iB_i}{F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})} +\frac{1-p_i}{[F_i^{{-}1}(1-\frac{n_i^{{\ast}}}{m_i})]^{2}}\right)\right]^{1/2}.$$ In Cohen and Einav et al. [Reference Cohen and Einav10], the risk aversion coefficient is estimated to be a logarithmic normal distribution. The simulation experiment of Andersen et al. [Reference Andersen, Harrison, Lau and Rutström3] obtained a skewed distribution with a thick right tail. Based on this, this paper selects the lognormal distribution function and the Pareto distribution function as the distribution function of the risk aversion coefficient. Then, in the case of determining the number of ![]() $i^{\rm th}$ type participants

$i^{\rm th}$ type participants ![]() $n_i^{\ast }$, the optimal solution expressions under different distribution functions are given.

$n_i^{\ast }$, the optimal solution expressions under different distribution functions are given.

When ![]() $\xi _i$ follows the lognormal distribution with parameters

$\xi _i$ follows the lognormal distribution with parameters ![]() $(u_i,\sigma _i)$, the relationship between the optimal fixed cost and the management rate is

$(u_i,\sigma _i)$, the relationship between the optimal fixed cost and the management rate is

\begin{align} (1-p_i)\beta_i^{{\ast}}+p_iB_i\alpha_i^{{\ast}} & =\left[(1-p_i)\left(p_i{B_i}^{2}+\frac{2p_iB_i}{y_i^{{\ast}}}+\frac{1-p_i}{{y_i^{{\ast}}}^{2}}\right)\right]^{1/2}\nonumber\\ & \quad - \frac{1-p_i}{y_i^{{\ast}}}-p_iB_i,\quad \forall i\in\mathcal{N}, \end{align}

\begin{align} (1-p_i)\beta_i^{{\ast}}+p_iB_i\alpha_i^{{\ast}} & =\left[(1-p_i)\left(p_i{B_i}^{2}+\frac{2p_iB_i}{y_i^{{\ast}}}+\frac{1-p_i}{{y_i^{{\ast}}}^{2}}\right)\right]^{1/2}\nonumber\\ & \quad - \frac{1-p_i}{y_i^{{\ast}}}-p_iB_i,\quad \forall i\in\mathcal{N}, \end{align}where ![]() $y_i^{\ast }=\exp [\sigma _i\Phi _i^{-1}(1-{n_i^{\ast }}/{m_i})+u_i]$ and

$y_i^{\ast }=\exp [\sigma _i\Phi _i^{-1}(1-{n_i^{\ast }}/{m_i})+u_i]$ and ![]() $\Phi _i^{-1}(\cdot )$ is the inverse function of the standard normal distribution function.

$\Phi _i^{-1}(\cdot )$ is the inverse function of the standard normal distribution function.

When ![]() $F_i=1-{({\vartheta _i}/{(x+\vartheta _i)})}^{a_i}$,

$F_i=1-{({\vartheta _i}/{(x+\vartheta _i)})}^{a_i}$, ![]() $\xi _i$ obeys the Pareto distribution with parameters

$\xi _i$ obeys the Pareto distribution with parameters ![]() $(a_i,\vartheta _i)$, then the relationship between the optimal fixed cost and management rate is

$(a_i,\vartheta _i)$, then the relationship between the optimal fixed cost and management rate is

\begin{align} (1-p_i)\beta_i^{{\ast}}+p_iB_i\alpha_i^{{\ast}}& =\left[(1-p_i)\left(p_i{B_i}^{2}+\frac{2p_iB_i}{h_i^{{\ast}}} +\frac{1-p_i}{{h_i^{{\ast}}}^{2}}\right)\right]^{1/2}\nonumber\\ & \quad - \frac{1-p_i}{h_i^{{\ast}}}-p_iB_i,\quad \forall i\in\mathcal{N}. \end{align}

\begin{align} (1-p_i)\beta_i^{{\ast}}+p_iB_i\alpha_i^{{\ast}}& =\left[(1-p_i)\left(p_i{B_i}^{2}+\frac{2p_iB_i}{h_i^{{\ast}}} +\frac{1-p_i}{{h_i^{{\ast}}}^{2}}\right)\right]^{1/2}\nonumber\\ & \quad - \frac{1-p_i}{h_i^{{\ast}}}-p_iB_i,\quad \forall i\in\mathcal{N}. \end{align}where ![]() $h_i^{\ast }=\vartheta _i({m_i^{1/a_i}}/{n_i^{\ast }}^{{1}/{a_i}}-1)$.

$h_i^{\ast }=\vartheta _i({m_i^{1/a_i}}/{n_i^{\ast }}^{{1}/{a_i}}-1)$.

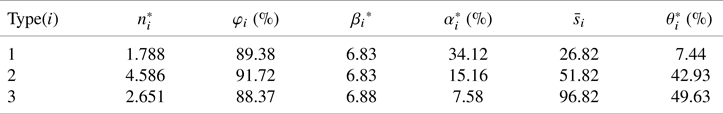

To compare the influence of the distribution function of different risk aversion coefficients on the final result, we consider a simple mutual aid example, in which the mutual aid platform divides the participants into three types. Suppose ![]() $m=(2,5,3)$,

$m=(2,5,3)$, ![]() $p=(0.0004,0.0015,0.009)$,

$p=(0.0004,0.0015,0.009)$, ![]() $r=20$,

$r=20$, ![]() $B=(50{,}000,30{,}000,10{,}000)$. For

$B=(50{,}000,30{,}000,10{,}000)$. For ![]() $\forall i\in \{1,2,3\}$, we use

$\forall i\in \{1,2,3\}$, we use ![]() $\varphi _i=n_i^{\ast }/m_i$ to represent the proportion of the number of people joining the

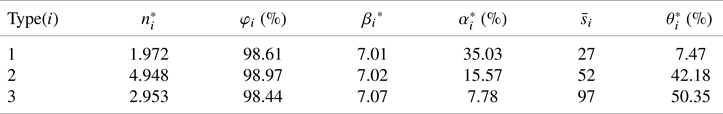

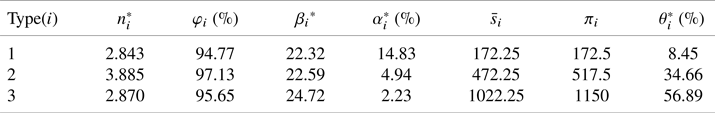

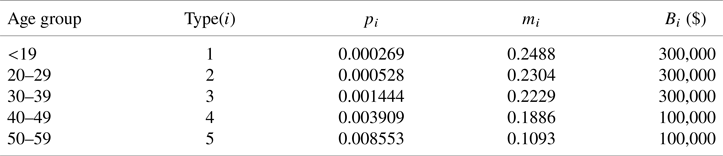

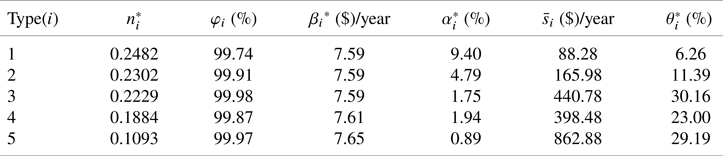

$\varphi _i=n_i^{\ast }/m_i$ to represent the proportion of the number of people joining the ![]() $i$-type member. It is assumed that different types of participants obey the same distribution function with the same parameters, and for the convenience of comparison, the mean and variance of the two distribution functions are the same, with the mean value of 0.002 and the standard deviation of 0.02. Tables 1 and 2 respectively show the optimal solutions for minimizing platform risk under different distribution functions.

$i$-type member. It is assumed that different types of participants obey the same distribution function with the same parameters, and for the convenience of comparison, the mean and variance of the two distribution functions are the same, with the mean value of 0.002 and the standard deviation of 0.02. Tables 1 and 2 respectively show the optimal solutions for minimizing platform risk under different distribution functions.

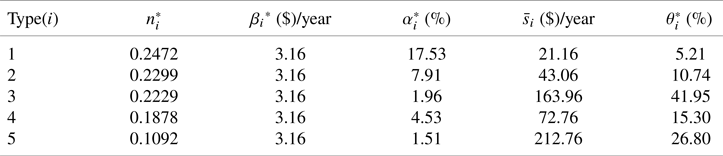

Table 1. The optimal solution of Model 1 under the lognormal distribution function.

Table 2. The optimal solution of Model 1 under the Pareto distribution function.

It can be seen from Tables 1 and 2 that the optimal number of participants ![]() $n_i^{\ast }$, the optimal management rate

$n_i^{\ast }$, the optimal management rate ![]() $\alpha _i^{\ast }$, and the optimal fixed cost

$\alpha _i^{\ast }$, and the optimal fixed cost ![]() ${\beta _i}^{\ast }$ of Model 1 under the Pareto function are greater than the optimal solution under the lognormal distribution function, but the overall difference is not significant. This shows that the selection of different distribution functions has a certain impact on the final results of the model, which is related to the nature of the function itself.

${\beta _i}^{\ast }$ of Model 1 under the Pareto function are greater than the optimal solution under the lognormal distribution function, but the overall difference is not significant. This shows that the selection of different distribution functions has a certain impact on the final results of the model, which is related to the nature of the function itself.

4.2. Numerical solution of Model 3 and Model 4

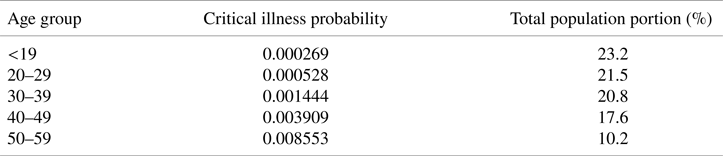

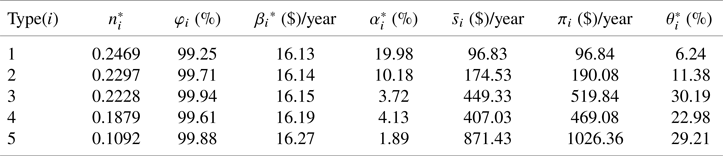

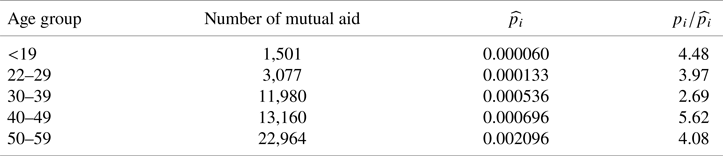

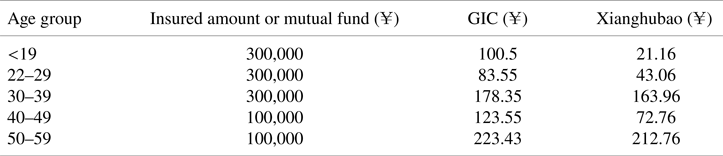

In this section, we give numerical optimization results with minimize the platform risk and maximize the platform revenue when taking insurance product into consideration, respectively. The parameter values used in the numerical calculation are shown in Table 3. The premium is set in the form of pure premium plus additional premium,

where ![]() $\rho$ is the surcharge rate, here we assume that the surcharge rate of all types of insurance is the same.

$\rho$ is the surcharge rate, here we assume that the surcharge rate of all types of insurance is the same.

Table 3. Parameter value.

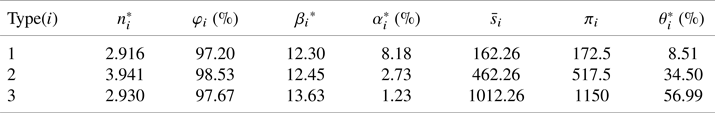

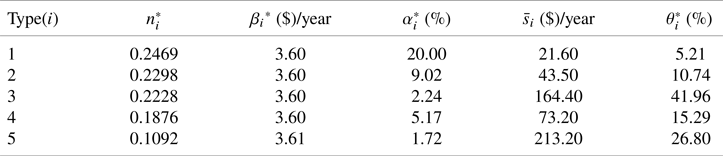

We calculate the number of participants of various agents and the expected revenue of the platform in an iterative manner. Table 4 shows the optimal mutual aid plan under the maximization of the mutual aid platform. We select three types of members based on the probability of loss. The mean value of the risk aversion coefficient is 0.002, the standard deviation is 0.02, and the surcharge rate is 0.15. Among them, the participation rate of the first type member is the lowest, mainly because the difference between the expected contribution amount of participants and insurance is very small. Some members with high degree of risk aversion choose insurance with more security.

Table 4. Maximize platform revenue.

Table 5 gives the optimal plan design of the mutual aid platform under minimizing risks. We select the same parameters as Table 4, and the risk aversion degree of the platform is ![]() $r=1$. It can be found that, compared to Table 4, the fixed fees and management rates under minimized platform risk are much smaller, and the corresponding number of participants is higher than Table 4. In other words, the platform increases the number of users by reducing unit revenue to maintain stable operation of the platform.

$r=1$. It can be found that, compared to Table 4, the fixed fees and management rates under minimized platform risk are much smaller, and the corresponding number of participants is higher than Table 4. In other words, the platform increases the number of users by reducing unit revenue to maintain stable operation of the platform.

Table 5. Minimize platform risk.

4.3. Analysis of relations between variables

In this section, we mainly analyze how various variables affect each other when participants do not consider insurance. First, we study the relationship between the expected revenue of the platform unit and the number of participants of various members. There are following propositions.

Proposition 1. The number of ![]() $i^{\rm th}$ type members participants

$i^{\rm th}$ type members participants ![]() $n_i$ is a decreasing function of the expected revenue of the platform unit

$n_i$ is a decreasing function of the expected revenue of the platform unit ![]() $x$ for

$x$ for ![]() $\forall i\in \mathcal {N}$. That is,

$\forall i\in \mathcal {N}$. That is,

Proof. We consider the following function, for ![]() $\forall i\in \mathcal {N}$,

$\forall i\in \mathcal {N}$,

Taking the derivative of ![]() $G_i$ with respect to

$G_i$ with respect to ![]() $x$ yields

$x$ yields

Taking the derivative of ![]() $G_i$ with respect to

$G_i$ with respect to ![]() $n_i$ yields

$n_i$ yields

Note that ![]() $F_i^{-1}$ is an increasing function and thus

$F_i^{-1}$ is an increasing function and thus ![]() $F_i^{-1}(1-{n_i}/{m_i})$ is a decreasing function of

$F_i^{-1}(1-{n_i}/{m_i})$ is a decreasing function of ![]() $n_i$, so

$n_i$, so ![]() $[F_i^{-1}(1-{n_i}/{m_i})]^{\prime }<0$. Because of the risk aversion coefficient

$[F_i^{-1}(1-{n_i}/{m_i})]^{\prime }<0$. Because of the risk aversion coefficient ![]() $\xi _i>0$, we have

$\xi _i>0$, we have ![]() ${(x+p_iB_i)^{2}}/{(1-p_i)}-p_iB_i^{2}<0$, so

${(x+p_iB_i)^{2}}/{(1-p_i)}-p_iB_i^{2}<0$, so

□

It can be seen from Proposition 1 that the platform can control the number of participants of various members by changing the expected return of the unit. More specifically, the platform can adjust the expected return of the unit by increasing or reducing the management fee of a certain type of member, thereby affecting the final number of participants. Hence, it is necessary to study the relationship between the expected return of the platform unit and various parameters.

Proposition 2. The relationship between the expected revenue ![]() $x$ of the platform unit and the fixed management fee

$x$ of the platform unit and the fixed management fee ![]() $\beta _i$, the management rate

$\beta _i$, the management rate ![]() $\alpha _i$, the probability of loss

$\alpha _i$, the probability of loss ![]() $p_i$, and the mutual aid amount

$p_i$, and the mutual aid amount ![]() $B_i$ are as follows:

$B_i$ are as follows:

1. For

$\forall i\in \mathcal {N}$,

$\forall i\in \mathcal {N}$,  $x$ is the increasing function of

$x$ is the increasing function of  $\beta _i$ and

$\beta _i$ and  $\alpha _i$.Thus,

$\alpha _i$.Thus,

$$\frac{\partial x}{\partial\beta_i}>0,\quad \frac{\partial x}{\partial\alpha_i}>0.$$