INTRODUCTION

With governments mandating firms to disclose CSR information, CSR disclosure has become a common means for firms to pursue legitimacy in emerging economies. A series of research indicates that legitimacy seeking has become the most likely motivation for firms to disclose CSR information (Aragón-Correa, Marcus, & Hurtadotorres, Reference Aragón-Correa, Marcus and Hurtadotorres2016; Hooghiemstra, Reference Hooghiemstra2000; Woodward, Edwards, & Birkin, Reference Woodward, Edwards and Birkin1996). Despite a consensus among practitioners and academics on the purpose of CSR disclosure to gain legitimacy, the strategies of firms to disclose CSR information to gain legitimacy may vary. Specifically, CSR is a complex and multidimensional concept that involves interactions with multiple stakeholder groups (Wang, Gibson, & Zander, Reference Wang, Gibson and Zander2020; Zhang, Wang, & Zhou, Reference Zhang, Wang and Zhou2020c), such as customers, employees, suppliers, communities, and so on. The multidimensional nature of CSR enables firms to purposefully select prioritized CSR portfolio from multiple CSR fields and gain legitimacy with an optimal CSR disclosure strategy. How do firms then decide the optimal CSR disclosure strategy when faced with mandatory CSR disclosure? What situational factors may affect firms’ disclosure strategies?

Although research on CSR disclosure examines organizations’ CSR disclosure strategy in the face of government CSR regulations (Luo, Wang, & Zhang, Reference Luo, Wang and Zhang2017; Marquis & Qian, Reference Marquis and Qian2014), little is understood about how firms determine the optimal CSR disclosure portfolio from multiple CSR fields when faced with mandatory CSR disclosure. For example, Marquis and Qian (Reference Marquis and Qian2014) indicate that firms with lower legitimacy are more likely to symbolically issue CSR reports to obtain legitimacy when faced with government legitimacy signals and firms subjected to stricter government monitoring are more likely to release substantive CSR reports. Luo et al. (Reference Luo, Wang and Zhang2017) find that in response to conflicting CSR demands from central and provincial governments, firms adopt a disclosure strategy of issuing CSR reports with rapid speed but poor quality. These studies point out several disclosure strategies that firms adopt to gain legitimacy, but they assume CSR as a holistic concept and focus on the overall CSR disclosure strategy, such as the disclosure quality and speed. Given that CSR is a multidimensional concept that covers various stakeholder groups (Zhang et al., Reference Zhang, Wang and Zhou2020c), the CSR disclosure strategy must be examined from a microscopic perspective. However, to the best of our knowledge, few studies focus on how firms identify the optimal disclosure strategy from multiple CSR fields to gain legitimacy.

To answer the research questions and fill in the research gap mentioned above, this study draws on the literature on the cost of legitimacy management and examines how mandatory CSR disclosure affects the scope and emphasis of CSR disclosure. Specifically, scope dimension refers to the number of different CSR fields that a target firm has disclosed, whereas emphasis dimension refers to how much effort the target firm pays to each CSR field to address stakeholder concerns (Ding, Hu, Yang, & Zhou, Reference Ding, Hu, Yang and Zhou2021; Zhang et al., Reference Zhang, Wang and Zhou2020c). Institutional theory indicates that conforming to government regulations grants firm legitimacy and failing to conform threatens firms’ legitimacy and may lead to penalties (Greenwood, Raynard, Kodeih, Micelotta, & Lounsbury, Reference Greenwood, Raynard, Kodeih, Micelotta and Lounsbury2011; Hannan, Reference Hannan2010; Meyer & Rowan, Reference Meyer and Rowan1977). The theory also points out that conforming to government regulations incurs constraints and costs to firms (Luo & Wang, Reference Luo and Wang2021; Meyer & Rowan, Reference Meyer and Rowan1977). That is, legitimacy comes at a cost (Jeong & Kim, Reference Jeong and Kim2019). Based on the perspective of legitimacy management cost, we propose that when faced with mandatory CSR disclosure, firms are likely to disclose more on CSR scope and less on CSR emphasis to gain legitimacy at the lowest cost.

To explore when the relationship between mandatory CSR disclosure and CSR disclosure strategy may be strengthened or weakened, we introduce firm visibility and market competition as two situational factors. When firms are mandated to disclose CSR initiatives in multiple fields, they can make a portfolio of the scope and emphasis dimensions of CSR to gain legitimacy at a minimal cost. Considering that CSR is a multidimensional construct and that mandatory CSR disclosure requires firms to disclose their responsibilities to stakeholders, such as shareholders, creditors, employees, customers, consumers, suppliers, and communities, how firms decide the CSR disclosure strategy may depend on how they evaluate the cost of gaining legitimacy from multiple stakeholder groups. On this basis, this study considers firm visibility and market competition as situational factors that may influence a firm's evaluation of the cost of gaining legitimacy from multiple stakeholders. Firm visibility increases public attention to CSR activities and hence represents legitimacy pressure from a majority of stakeholders. Market competition increases the dependence of firms on a critical minority of stakeholders and hence represents legitimacy pressure from a critical minority of stakeholders.

This study employs data on CSR disclosure of Chinese listed firms from 2008 to 2018. The Chinese context provides a suitable setting for investigating our theoretical framework of mandatory CSR disclosure and firms’ CSR disclosure strategy. Specifically, the Chinese government has issued CSR regulations and guidelines and mandated certain listed firms to disclose CSR information since 2008. Although government guidelines signify appropriate CSR behavior by specifying multiple CSR fields to disclose, they do not require any changes in firms’ CSR behavior or mandate the standards for CSR disclosure (Chen, Hung, & Wang, Reference Chen, Hung and Wang2018; Luo et al., Reference Luo, Wang and Zhang2017). That is, when faced with mandatory CSR disclosure, firms have considerable discretion to decide which CSR field and to what extent they should disclose (Zhang et al., Reference Zhang, Wang and Zhou2020c). Therefore, the Chinese CSR context provides an appropriate opportunity to test our theoretical framework.

This study makes contributions to the literature on CSR disclosure and studies on organization response to the government mandate. First, this study contributes to research on CSR disclosure by shifting the research focus from a holistic CSR perspective to a microscopic one. That is, we focus on specific areas of CSR disclosure. Prior studies on CSR disclosure predominantly focus on the overall CSR disclosure strategy. To the contrary, this study underscores the microscopic perspective of CSR and examines the CSR disclosure strategy from the multi-field of CSR. Second, this study contributes to the CSR disclosure literature by uncovering the underlying mechanisms between mandatory CSR disclosure and CSR disclosure strategy. By utilizing the legitimacy management cost as theoretical perspective, our study contributes to a more nuanced understanding of how mandatory CSR disclosure affects firms’ CSR disclosure strategy. Moreover, prior research proposes that the combination of scope and emphasis allows firms to attain competitive advantage in the competitive market context (Zhang et al., Reference Zhang, Wang and Zhou2020c), but this study argues that the tradeoff between scope and emphasis enables firms to gain legitimacy at minimal cost in the context of mandatory CSR disclosure. Third, this study enriches literature on the variation in organization response to government CSR mandate. Specifically, our identification of firm visibility and market competition as situational factors contributes to understanding how and when firms adjust disclosure strategies in response to mandatory CSR disclosure.

THEORETICAL BACKGROUND

Institutional Theory and Legitimacy Management Cost

Institution theory indicates that organizations that comply with institutionalized rules can gain legitimacy, resources, and survival prospects (DiMaggio & Powell, Reference DiMaggio and Powell1983; Meyer & Rowan, Reference Meyer and Rowan1977). By contrast, organizations that fail to fulfill institutionalized expectations are usually categorized as illegitimate and are subject to market penalties as a result (Zuckerman, Reference Zuckerman1999). Meanwhile, institution theory also indicates that conformity with institutionalized rules usually creates conflict with the existing organizational structure and ultimately undermines the organization economic efficiency (Meyer & Rowan, Reference Meyer and Rowan1977). On this basis, Oliver (Reference Oliver1991) integrates the institutional perspective and resource dependence perspectives and states that legitimacy and efficiency plays a critical role in determining the organizations’ response to institutional pressures. Recently, Jeong and Kim (Reference Jeong and Kim2019) deepened the understanding of the institutional process by examining the costs of gaining legitimacy for organizations.

Specifically, Jeong and Kim (Reference Jeong and Kim2019) proposed that legitimacy comes at a cost and that organizations can strategically manage such costs to balance tension between legitimacy pressure and economic efficiency. Defined as ‘how much an organization spends to manage external legitimacy’ (Jeong & Kim, Reference Jeong and Kim2019: 1584), legitimacy management cost provides an important theoretical perspective for understanding the various responses of organizations to institutional pressures. For example, Xiang, Jia, and Zhang (Reference Xiang, Jia and Zhang2021) determined that firms adopted a modest imitation of peers’ social inputs to strategically minimize the costs of gaining political legitimacy and efficiency concerns when they are faced with firm-dependent government claims.

In the context of mandatory CSR disclosure, firms are inevitably faced with the tradeoff between legitimacy pressure and economic efficiency. On the one hand, when firms are mandated to disclose CSR activities, they are subject to normative pressure from governments (Chen et al., Reference Chen, Hung and Wang2018). Therefore, firms are likely to increase their CSR investments and issue CSR reports to align with institutional regulations and gain legitimacy. On the other hand, when firms are mandated to disclose CSR activities, increased CSR investments may impose costs on firms. Some research papers indicate that mandatory CSR disclosure negatively affects corporate financial performance (Chen et al., Reference Chen, Hung and Wang2018; Grewal, Riedl, & Serafeim, Reference Grewal, Riedl and Serafeim2019; Ni & Zhang, Reference Ni and Zhang2019). This study attempts to use the legitimacy management cost as theoretical perspective to explore how mandatory CSR disclosure may affect the firm's CSR disclosure strategy.

Mandatory CSR Disclosure and CSR Disclosure Strategy

Research on CSR disclosure reveals that mandatory CSR disclosure imposes costs on firms and negatively affects their financial performance. For example, Chen et al. (Reference Chen, Hung and Wang2018) point out that the profitability of firms that are required to disclose CSR information declines subsequent to the CSR mandate. Grewal et al. (Reference Grewal, Riedl and Serafeim2019) also conclude that mandatory non-financial disclosure leads to costs on firms with weak non-financial performance. Ren, Wei, Sun, Xu, Hu, and Chen (Reference Ren, Wei, Sun, Xu, Hu and Chen2020) discovered that mandatory environmental information disclosure increases the cost of environment management activities and thus negatively affects firms’ financial performance. Ni and Zhang (Reference Ni and Zhang2019) found that mandatory CSR disclosure significantly decreases the dividend payouts, and they conclude that mandatory CSR disclosure benefits stakeholders’ interests by exploiting the interests of shareholders.

Although mandatory CSR disclosure imposes costs on firms, firms still have to respond to this mandate to gain legitimacy from the government and public. Defined as ‘a generalized perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs, and definitions’ (Suchman, Reference Suchman1995: 574), legitimacy is critical to the survival and growth of firms. When firms are mandated to disclose CSR information, being consistent with government CSR mandates is considered appropriate, thus bringing legitimacy to firms. By contrast, violating government regulations is considered illegitimate and leads to penalties.

Considering the legitimacy benefits and economic costs of mandatory CSR disclosure, this study explores corporate disclosure strategy from the scope and emphasis dimensions of CSR. These two dimensions describe CSR disclosure from different aspects. First, from the perspective of definition, scope dimension horizontally describes the number of CSR fields that target firm disclosures in multiple CSR fields, and it represents the source of the firm's legitimacy (Ding et al., Reference Ding, Hu, Yang and Zhou2021; Zhang et al., Reference Zhang, Wang and Zhou2020c). By contrast, emphasis dimension vertically evaluates the overall effort the target firm pays to each CSR field to address stakeholders' concern and show goodwill to stakeholders (Ding et al., Reference Ding, Hu, Yang and Zhou2021; Zhang et al., Reference Zhang, Wang and Zhou2020c). Emphasis dimension also refers to the number of CSR projects that a target firm has carried out in each CSR field, and it captures whether the firm adopts a differentiated CSR strategy (Ding et al., Reference Ding, Hu, Yang and Zhou2021; Zhang et al., Reference Zhang, Wang and Zhou2020c). Second, from the perspective of feature, scope dimension of CSR represents a prototype that enables stakeholders to easily recognize and evaluate the legitimacy of the practice (Zhang et al., Reference Zhang, Wang and Zhou2020c). Specifically, this dimension is consistent with the CSR fields specified in government regulations, and thus stakeholders can easily use CSR scope as a checklist to judge the legitimacy of corporate CSR disclosure. Although scope dimension can evaluate the legitimacy of CSR disclosure, it cannot capture efforts made by the firms in each dimension of CSR. In comparison, emphasis dimension of CSR captures efforts that firms invest to each CSR field to show goodwill toward multiple stakeholders (Zhang et al., Reference Zhang, Wang and Zhou2020c). Disclosing CSR emphasis enables firms to distinguish themselves from peers and gains competitive advantage in the competitive context (Zhang et al., Reference Zhang, Wang and Zhou2020c). It also means that firms have to put more effort and financial resources in CSR than their peers (Flammer, Reference Flammer2018). That is, disclosing CSR emphasis increases the cost to firms from the viewpoint of efficiency because it implies investing substantial financial resources to the CSR activities. To sum up, scope and emphasis dimensions of CSR disclosure enable us to understand how firms address the legitimacy pressure and cost concerns when they are required to disclose CSR information. Table 1 distinguishes the definitions and features of scope and emphasis dimensions of CSR.

Table 1. The difference between CSR scope and CSR emphasis

HYPOTHESES DEVELOPMENT

Mandatory CSR Disclosure and CSR Disclosure Strategy

Mandatory CSR disclosure mainly imposes normative pressure to affect firms’ CSR disclosure strategy rather than coercive pressure. Specifically, although mandatory CSR disclosure requires subset listed firms to disclose CSR information, it does not require any changes in firms’ CSR behavior (Chen et al., Reference Chen, Hung and Wang2018). It is ideally feasible for firms to report that no effort is made in certain CSR fields. Prior research indicates that the main purpose of mandatory CSR disclosure is to reduce CSR information asymmetry between firms and the government, and increased CSR information transparency allows the government to effectively supervise firms’ CSR practice (Ioannou & Serafeim, Reference Ioannou and Serafeim2017; Jackson, Bartosch, Avetisyan, Kinderman, & Knudsen, Reference Jackson, Bartosch, Avetisyan, Kinderman and Knudsen2020; Liew & Schillebeeckx, Reference Liew and Schillebeeckx2020). We propose that mandatory CSR disclosure will positively affect the scope dimension and negatively affect the emphasis dimension of CSR disclosure. The reasons are as follows.

On the one hand, firms gain legitimacy from the government if the CSR information disclosed is consistent with the specified CSR scope. Institution theory indicates that organizations comply with government regulations and incorporate legitimated elements into their formal structure to maximize organizational legitimacy and increase the survival chance of organizations (Meyer & Rowan, Reference Meyer and Rowan1977; Oliver & Holzinger, Reference Oliver and Holzinger2008). By contrast, organizations that do not comply with regulations lose legitimacy and may even face punishment (Zuckerman, Reference Zuckerman1999). Specifically, mandatory CSR disclosure regulations specify the CSR field that firms should disclose, which provide a checklist for the audience to evaluate the legitimacy of firms’ CSR disclosure (Zhang et al., Reference Zhang, Wang and Zhou2020c). Therefore, firms are likely to conform to CSR scope in the guidelines and disclose CSR information in fields as many as possible to derive legitimacy when they are faced with mandatory CSR disclosure.

On the other hand, disclosure of CSR emphasis means disclosing the resources and efforts a firm has already invested in CSR activities, which can be costly to the firm, provided that it may no longer bring any additional legitimacy. Institutional theory points out that conforming to government regulations brings legitimacy for firms, but it also indicates that conforming to government regulations incurs cost for firms (Meyer & Rowan, Reference Meyer and Rowan1977). Evidence shows that mandatory CSR disclosure can impose costs on business operations (Chen et al., Reference Chen, Hung and Wang2018; Ren et al., Reference Ren, Wei, Sun, Xu, Hu and Chen2020). That is, when firms are required to disclose information, they are faced with the dilemma of how much resources to invest in CSR to gain legitimacy without exerting excessive costs on the firm. Research on institutional theory suggests that organizations strategically minimize the cost of legitimacy when they are faced with conflicts between legitimacy pressure and economic efficiency (Jeong & Kim, Reference Jeong and Kim2019; Xiang et al., Reference Xiang, Jia and Zhang2021). Therefore, firms are likely to adopt a disclosure strategy that can gain legitimacy at minimal cost when they are faced with mandatory CSR disclosure. Nonetheless, disclosing CSR emphasis means investing substantial efforts and financial resources to CSR activities (Jeong & Kim, Reference Jeong and Kim2019; Zhang et al., Reference Zhang, Wang and Zhou2020c), which can incur a high cost to business operations. Given that conforming to CSR scope already gains legitimacy, firms are less likely to pay high costs to invest in CSR activities and disclose CSR emphasis when they are faced with mandatory CSR disclosure.

Based on these arguments, when firms are mandated to disclose CSR information, they are likely to disclose more CSR scope and avoid disclosing CSR emphasis to gain legitimacy at the minimal cost. We then propose the following hypotheses:

Hypothesis 1a: Mandatory CSR disclosure is positively related to the CSR scope dimension.

Hypothesis 1b: Mandatory CSR disclosure is negatively related to CSR emphasis dimension

Moderating Role of Situational Factors

When faced with mandatory CSR disclosure, firms disclose more CSR scope and less CSR emphasis to minimize the cost of gaining legitimacy. This is the mechanism of the main relationship in this study. Given that mandatory CSR disclosure requires firms to disclose CSR initiatives that involves multiple stakeholders, how firms decide the CSR disclosure strategy may be contingent on their evaluation of the legitimacy management cost for multiple stakeholder groups. When the legitimacy pressure comes from multiple stakeholders, firms are likely to pay more attention to CSR scope dimension and less attention to emphasis dimension to minimize the cost of legitimacy. When firms are facing legitimacy pressure from stakeholders and survival threats from a critical minority of stakeholders, they are likely to focus on the scope and emphasis dimension of CSR simultaneously. On this basis, this study introduces firm visibility and market competition as two boundary conditions.

Moderating Role of Firm Visibility

Firm visibility is defined as the media attention firms typically receive because of their size, age, reputation, or other factors (Ahmadjian & Robinson, Reference Ahmadjian and Robinson2001). Research indicates that firms’ visibility is generally associated with stakeholders’ expectations and legitimacy pressure (Goodstein, Reference Goodstein1994; Kostova & Zaheer, Reference Kostova and Zaheer1999; Zhang, Xu, Chen, & Jing, Reference Zhang, Xu, Chen and Jing2020b). We argue that the relationship between mandatory CSR disclosure and CSR disclosure strategy will be strengthened when firms are visible. The reasons are as follows.

On the one hand, when firms are more visible to the public, they are subject to greater legitimacy pressure from the government and stakeholders, and thus they are likely to conform to more CSR scope to gain more legitimacy. Stakeholders typically hold higher moral expectations for firms with high visibility because stakeholders are more familiar with them (Kostova & Zaheer, Reference Kostova and Zaheer1999; Marquis, Toffel, & Zhou, Reference Marquis, Toffel and Zhou2016). That is, firms with high visibility are faced with higher legitimacy pressure from stakeholders. When these firms are required to disclose CSR information, they not only face the legitimacy pressure from the government but also are subject to the legitimacy pressure from stakeholders. Given that CSR scope is the basis for stakeholders to evaluate the legitimacy of firms’ CSR disclosure (Zhang et al., Reference Zhang, Wang and Zhou2020c), firms with high visibility are likely to conform to more CSR scope to gain more legitimacy than their low visible peers when facing mandatory disclosure.

On the other hand, when firms are more visible to the external stakeholders, disclosing CSR emphasis means investing more financial resources and thus incurring a higher cost for firms. Specifically, corporate activities of firms with high visible firms are usually noticed and monitored by a larger group of stakeholders than those of low visible firms (Goodstein, Reference Goodstein1994; Kostova & Zaheer, Reference Kostova and Zaheer1999; Zhang et al., Reference Zhang, Xu, Chen and Jing2020b). Similarly, CSR reports issued by firms with high visibility attract the attention of a larger group of stakeholders compared with CSR reports issued by firms with low visibility. In this vein, when firms with high visibility are required to disclose CSR information, they are inclined to consider the demands of a larger group of stakeholders than firms with low visibility. However, disclosing CSR emphasis to a large group of stakeholders means investing more financial resource and thus incurring a high cost to firms with high visibility. As mentioned earlier, when firms are required to disclose CSR information, they strategically minimize the cost of legitimacy. Given that conforming to CSR scope gains legitimacy, firms with high visibility are less likely to spend more financial resources to disclose CSR emphasis when facing mandatory CSR disclosure. Therefore, we propose the following hypotheses:

Hypothesis 2a: Firm visibility strengthens the positive relationship between mandatory CSR disclosure and CSR scope dimension

Hypothesis 2b: Firm visibility strengthens the negative relationship between mandatory CSR disclosure and CSR emphasis dimension

Moderating Role of Market Competition

Market competition is the degree to which a company affects the survival of other companies in the same industry (Barnett, Reference Barnett1997; Zhang, Ren, Chen, Li, & Yin, Reference Zhang, Ren, Chen, Li and Yin2020a). Market competition increases market uncertainty and makes firms more dependent on a critical minority of stakeholders for resources (Tang, Qian, Chen, & Shen, Reference Tang, Qian, Chen and Shen2015; Zhang et al., Reference Zhang, Ren, Chen, Li and Yin2020a). In this vein, these critical stakeholders have more power to influence corporate behavior when the market competition is intense. We propose that market competition can strengthen the positive relationship between mandatory CSR disclosure and CSR scope and weaken the relationship between mandatory CSR disclosure and CSR emphasis. The reasons are as follows.

On the one hand, market competition intensifies the legitimacy pressure for firms. Therefore, firms are likely to disclose more CSR scope to gain legitimacy when the market is more competitive. The competition literature suggests that firms operating in homogeneous markets are more apt to face legitimacy challenges and experience decline in performance because of their nonconformity to industry norms (Miller & Chen, Reference Miller and Chen1995). That is, firms in highly competitive markets are more sensitive to legitimacy challenges and thus are more willing to conform to industry norms than firms in low competitive markets. As previously mentioned, when firms are required to disclose CSR information, CSR scope dimension provides the basis for stakeholders to evaluate the legitimacy of firm's CSR disclosure. By this logic, when facing mandatory CSR disclosure, firms in a more competitive market are likely to disclose more CSR scope to gain legitimacy than firms in a less competitive market.

On the other hand, market competition increases firms’ dependence on a critical minority of stakeholders. Therefore, firms are likely to disclose more CSR emphasis to show goodwill to these critical stakeholders when facing mandatory CSR disclosure. Specifically, market competition increases market uncertainty and exacerbates the scarcity of resources, making firms more dependent on specific stakeholders for resources (Tang et al., Reference Tang, Qian, Chen and Shen2015; Zhang et al., Reference Zhang, Ren, Chen, Li and Yin2020a). For example, firms with customer loyalty can maintain their market share in a highly competitive environment, but those without customer loyalty may lose their market share to competitors (Tang et al., Reference Tang, Qian, Chen and Shen2015). Previous research also suggests that competent, skilled, and knowledgeable human resources represent a sustained competitive advantage for firms operating in a competitive market (Lado & Wilson, Reference Lado and Wilson1994). In addition, evidence from the automotive industry suggests that specialized supplier networks present an important competitive advantage for firms in a competitive market (Dyer, Reference Dyer1996). Given that CSR is essentially stakeholder-oriented (Hambrick & Wowak, Reference Hambrick and Wowak2021), firms with mandatory CSR disclosure are likely to show goodwill to critical stakeholders (e.g., such as customers, employees, and suppliers) and win their support by disclosing more CSR emphasis when the market is more competitive. Disclosing CSR emphasis may incur a cost to the firms, but it also determines the survival of the firms in a highly competitive market. The benefits of disclosing CSR emphasis (wining the competition) outweigh the costs of disclosing CSR emphasis in a competitive market. By this logic, when they are required to disclose CSR information, firms in a more competitive market are likely to disclose more CSR emphasis than firms in a less competitive market. We thus propose the hypotheses 3a and 3b. Figure 1 illustrates the theoretical framework we propose.

Hypothesis 3a: Market competition strengthens the positive relationship between mandatory CSR disclosure and CSR scope dimension

Hypothesis 3b: Market competition weakens the negative relationship between mandatory CSR disclosure and CSR emphasis dimension

Figure 1. A theoretical framework of how and when mandatory CSR disclosure affects firms’ CSR disclosure strategy

METHODS

Empirical Context

The Chinese government believes that the idea of CSR is consistent with the political vision of constructing a harmonious society; thus, it has taken a series of CSR initiatives (Chen et al., Reference Chen, Hung and Wang2018; Zhang et al., Reference Zhang, Wang and Zhou2020c). Particularly, the Chinese government plays an important role in promoting the disclosure of CSR information (Chen et al., Reference Chen, Hung and Wang2018; Hung, Shi, & Wang, Reference Hung, Shi and Wang2013). For example, on September 25, 2006, the Shenzhen Stock Exchange (SZSE) issued CSR guidelines for companies listed on the SZSE. The guidelines encourage listed firms to actively undertake social responsibility and voluntarily disclose CSR information from the following aspects: shareholder and creditor protection, staff protection, supplier and customer protection, environment protection and sustainable development, public relations and social services, and CSR system construction.

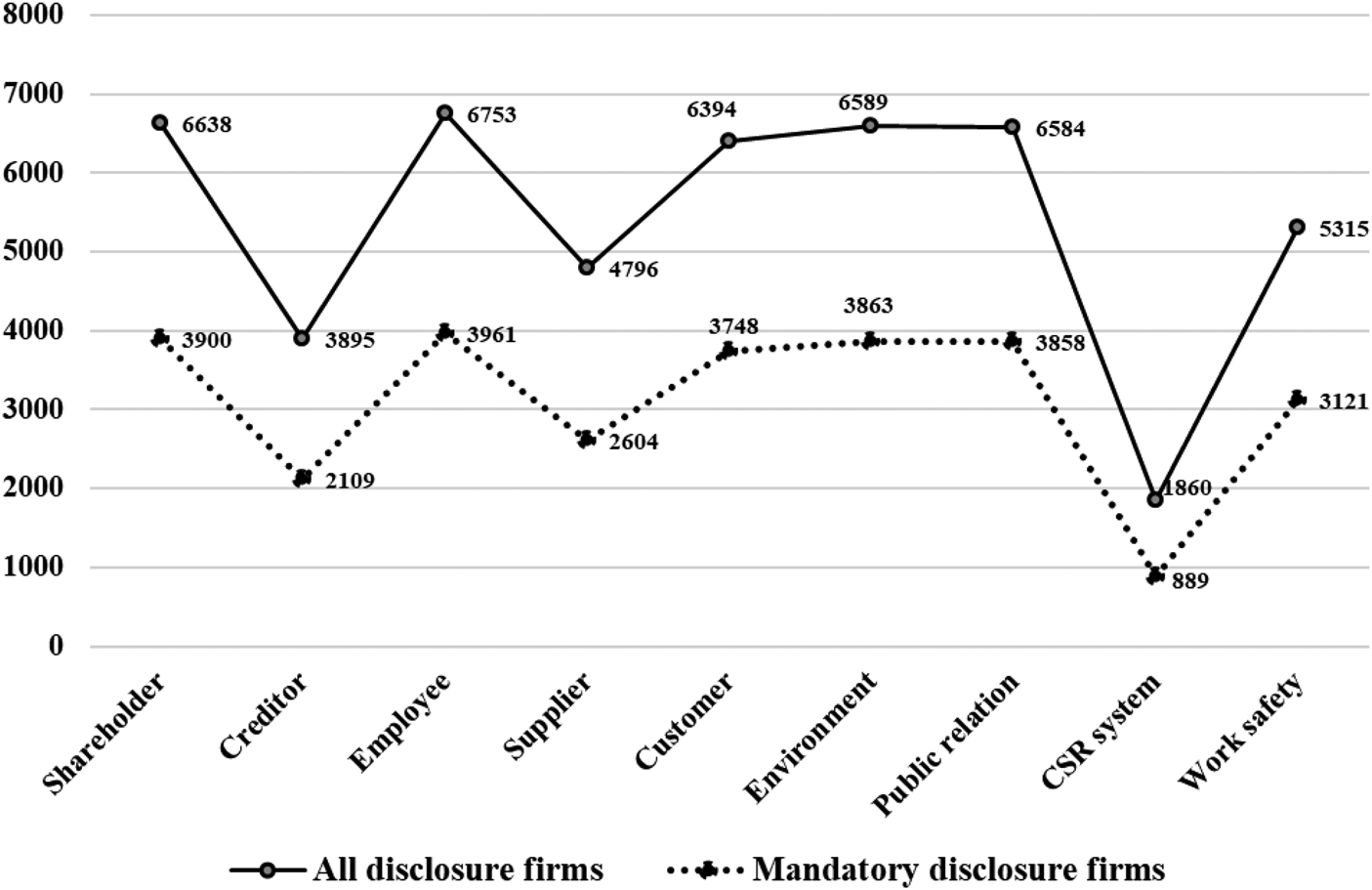

To ensure the transparency of listed firms’ CSR information, the Chinese government further required that certain listed firms should compulsorily disclose CSR information. Specifically, on December 30, 2008, the Shanghai Stock Exchange (SSE) issued an announcement requiring three types of listed firms to disclose CSR reports. That is, firms in the SSE Corporate Governance Sector, firms that issued foreign shares, and firms in financial industries should issue CSR reports. On December 31, 2008, the SZSE required that listed firms included in the Shenzhen 100 Index should issue CSR reports in accordance with the CSR guidelines for companies listed on the SZSE. Moreover, firms may face the risk of delisting if they fail to provide their CSR report (Chen et al., Reference Chen, Hung and Wang2018). Although the government guidelines specify multiple CSR fields to disclose, they do not mandate the standards for CSR disclosure (Luo et al., Reference Luo, Wang and Zhang2017). That is, a firm has considerable discretion to determine whether or not to disclose its behavior in multiple CSR fields. For example, among the firms that are mandated to disclose CSR, the majority of these firms disclose employee protection, shareholder protection, environment protection, and public relation, while only a small percentage of them disclose their CSR system. Meanwhile, within the scope of CSR disclosure designated by the government, the number of disclosures made by mandatory firms is higher than that of non-mandatory firms in any CSR field, except in the area of CSR system. Figure 2 illustrates the differences in corporate disclosure in multiple areas of CSR.

Figure 2. Number of CSR disclosures on specific CSR field by all disclosure firms and mandatory disclosure firms

Although CSR disclosure in emerging countries was mainly driven by governments in the early days, it has gradually become a mechanism for firms to manage stakeholder perceptions, maintain stakeholder relationships, and manage the corporate image (Wang, Tong, Takeuchi, & George, Reference Wang, Tong, Takeuchi and George2016). With the development of digital communication and social media, firms are closer to stakeholders and it has become easier for stakeholders to monitor and exert pressure on corporate behavior (Luo, Zhang, & Marquis, Reference Luo, Zhang and Marquis2016). On the one hand, stakeholder groups, which are led by investors, can punish socially irresponsible behaviors by reducing or selling their stock holdings. For example, on April 30, 2019, a Chinese company, Kangmei Pharmaceutical, stated that the firm made errors in financial data in its 2017 annual report. On that day, the firm's share price fell to a maximum daily drop of 10%. On May 29, 2019, Kangmei Pharmaceutical admitted its false transaction records and financial misreporting. The stock value has shrunk by more than 60% since the accounting irregularities were disclosed in late April.[Footnote 1] On the other hand, stakeholder groups, which are led by consumers, can reward socially responsible behavior by increasing product purchases. For example, on July 21, 2021, Chinese sportswear brand Erke donated 3 million yuan in cash and 47 million yuan worth of materials to Henan Province to help flood victims, making the little-known brand an overnight internet sensation. The donation led to a 52-times increase in Erke's total sales on July 23, compared with the same period last year.[Footnote 2] Taken together, stakeholders in emerging economies, such as China, are gradually increasing their influence on CSR activities by rewarding socially responsible firms and punishing socially irresponsible firms. By this trend, firms in emerging economies are bound to invest more resources to CSR activities and pay more attention to CSR disclosure.

Data and Sample

This study covers Chinese A-share listed firms that issued CSR reports from 2008 to 2018. We start in 2008 because China began to enact mandatory CSR disclosure in this year. The CSR data come from the China Listed Firm Corporate Social Responsibility Research Database in the CSMAR database. The CSR database describes CSR activities from 10 fields: shareholder protection, creditor protection, staff protection, delivery protection, customer protection, environment protection, public relations, CSR system construction, work safety, and deficiencies of the firm. Following prior research, this study excludes the deficiencies of firms because this field is not directly related to firms’ CSR activities (Zhang et al., Reference Zhang, Wang and Zhou2020c). We used two tables from the CSR database to measure CSR scope and emphasis. The first table contains information on whether a firm engages in the nine CSR fields mentioned above. The second table contains information on the resources and efforts that firms devote to these nine CSR fields, including the names and values of these fields. For example, China Eastern Airlines Co., Ltd. engaged in 10 staff protection activities in 2014, including employee vocational training, healthcare, and welfare promotion. China Shenhua Energy Co., Ltd. engaged in 20 environmental protection activities in 2013, including water resources protection, development of low-carbon energy, green mining, and construction of energy-saving and environmental protection projects. Shanghai Fosun Pharmaceutical Co., Ltd. engaged in 25 work safety activities in 2016, including safety training, fire prevention, employee medical checkups, and improvement of occupational health facilities. A majority of control variables also comes from the CSMAR database. We manually collect firm data for mandatory CSR disclosure from the official website of the SHSE (www.sse.com.cn) and the SZSE Index Agency (www.cnindex.com.cn). Data on firm visibility are obtained from the Chinese Research Data Services platform (www.cnrds.com). This database contains news on Chinese listed companies from over 600 major newspaper outlets and several mainstream financial newspapers. Data on market competition are also obtained from the CSMAR database. The final sample contains 1,096 firms and 6,800 firm-year observations from 2008 to 2018.

Measures

Dependent variables

The dependent variables of this study are the scope and emphasis dimensions of CSR. For the measurement of these two variables, we adopt the approach of Zhang et al. (Reference Zhang, Wang and Zhou2020c). First, considering the variance in the importance of each CSR field, we calculate the weights for each CSR field. (1) By creating a two-mode affiliation matrix for each year, we specify CSR field as the column and sample firms as the rows of the matrix. (2) We convert the two-mode affiliation matrix (firms and CSR fields) to one-mode concept networks (CSR field). (3) We calculate the eigenvector centrality values of the conceptual network as the weight of each CSR field.

Second, following Zhang et al. (Reference Zhang, Wang and Zhou2020c) and Fiss, Kennedy, and Davis (Reference Fiss, Kennedy and Davis2012), we measure the CSR scope dimension as the sum of the product of each CSR field of the firm (dummy variable) and the weight of each field in the previous period. The formula is as follows:

where CSRit captures whether CSR field i is included in the firm's CSR report at time t, and CENit is the eigenvector centrality values of CSR field i at time t.

Third, given that the theoretical argument of CSR emphasis in our study is slightly different from that in Zhang et al. (Reference Zhang, Wang and Zhou2020c), we adjust the measurement of CSR emphasis based on that of Zhang et al. (Reference Zhang, Wang and Zhou2020c). Specifically, our study does not focus on the comparison of CSR emphasis between a specific firm and its industry peers, so we remove the industry-adjusted section from the measurement of CSR emphasis. Following Zhang et al. (Reference Zhang, Wang and Zhou2020c), we measure CSR emphasis by quantifying the percentage of effort that firms allocate to each CSR field. The adjusted measurement for CSR emphasis is as follows: (1) Calculate the percentage of the firm's CSR emphasis in each CSR field. (2) Multiply the firm's CSR emphasis in the first step by the weight in the previous period. (3) Sum up the weighted differences for all CSR fields. The formula is as follows:

where FEit denotes the firm's average emphasis of CSR field i at time t, and it is measured as the percentage of the firm's efforts allocated to each CSR field. CENit represents the eigenvector centrality values of CSR field i at time t. Both dependent variables are standardized in the subsequent analysis.

Independent variables

Following prior research, mandatory CSR disclosure is coded as 1 if a firm should issue a CSR report, and 0 otherwise (Chen et al., Reference Chen, Hung and Wang2018; Marquis & Qian, Reference Marquis and Qian2014; Wang, Cao, & Ye, Reference Wang, Cao and Ye2018). Firms that are mandated to issue CSR reports are those included in the Shenzhen 100 Index and the SSE Corporate Governance Sector, those that issued foreign shares, and those in financial industries.

Moderating variables

Firm visibility

Firm visibility is measured as the media attention received by the firms (Chang, Milkman, Chugh, & Akinola, Reference Chang, Milkman, Chugh and Akinola2019; Chiu & Sharfman, Reference Chiu and Sharfman2011; Kim & Davis, Reference Kim and Davis2016). We select news reports from the CNRDS database that mentioned the sample firms and were published over the past 12 months in mainstream publications, such as China Daily, 21st Century Business Herald, China Business News, Economic Observer, Securities Times, and China Economic Weekly. Given that media volume is highly skew for firms with good reputation, we then measure media attention with the natural logarithm of the number of news articles (Kim & Davis, Reference Kim and Davis2016).

Market competition

Market competition is measured as the Herfindahl index (Guo, Yu, & Gimeno, Reference Guo, Yu and Gimeno2017; Li, Poppo, & Zhou, Reference Li, Poppo and Zhou2008). We calculate the Herfindahl index by summing the square of the market shares for each firm in an industry (Guo et al., Reference Guo, Yu and Gimeno2017; Li et al., Reference Li, Poppo and Zhou2008). Market share refers to the proportion of a firm's sales revenue in the whole industry (Banbury & Mitchell, Reference Banbury and Mitchell1995). Fierce market competition means a greater number of firms in the industry but smaller market shares for each single firm. The more intense the market competition, the smaller the value of the Herfindahl index. To make the results more intuitive, we follow prior research by using a negative Herfindahl index in the analysis (Li et al., Reference Li, Poppo and Zhou2008). A larger value of the negative Herfindahl index thus represents a fiercer market competition.

Control variables

We control for a series of variables that may affect the scope dimension and emphasis dimension of CSR. First, a set of firm-level variables has been included based on previous research. Larger firms may face greater pressure to conform in CSR; thus, we control for the size of the firm (Petrenko, Aime, Ridge, & Hill, Reference Petrenko, Aime, Ridge and Hill2016). Firm size is measured as the natural log of total assets. Aged firms may be more concerned about firm reputation and thus implement more CSR activities (Zhang et al., Reference Zhang, Ren, Chen, Li and Yin2020a). Firm age is measured as the years since the firm is founded. Specifically, firms with better financial performance tend to invest more resources in CSR emphasis (Tang et al., Reference Tang, Qian, Chen and Shen2015). Thus, firms’ return on assets (ROA) and slack resources (the ratio of current assets to current liabilities) are included in the control variable. Firm risk is measured by the ratio of earnings before interest and taxes to earnings before taxes (Tang, Mack, & Chen, Reference Tang, Mack and Chen2018). Firm ownership is measured as a dummy variable that is coded as 1 if the firm is state-owned, and 0 otherwise.

Second, based on previous research, we also control for the characteristics of CEOs that may influence CSR implementation. To control for the effect of corporate governance structure on CSR implementation, we include board independence and CEO duality (Petrenko et al., Reference Petrenko, Aime, Ridge and Hill2016; Tang et al., Reference Tang, Qian, Chen and Shen2015). Board independence is measured as the proportion of independent board directors to all board directors. CEO duality equals 1 if a CEO serves as the chairman in the firm, and 0 otherwise. Previous research has indicated that CSR implementation may vary with age; thus, we control for CEO age (Petrenko et al., Reference Petrenko, Aime, Ridge and Hill2016). CEO gender is coded as 1 if the CEO is male, and 0 if female.

Finally, following Li and Lu (Reference Li and Lu2020), we control for the GDP per capita in a province as firms in economically developed areas may invest more resources to CSR. Previous research indicates that CSR practices of industry peers can also influence the CSR implementation of firms (Cao, Liang, & Zhan, Reference Cao, Liang and Zhan2019), so we also control for the industry peer effects in studying the scope and emphasis dimensions of CSR. Moreover, we include the (two-digit) year and industry dummy variables.

Models

We estimate our hypotheses using firm fixed-effect models to control for the unobserved time-invariant differences across firms (Zhang et al., Reference Zhang, Wang and Zhou2020c). To verify whether the firm fixed-effect is appropriate, we conduct a Hausman test, and the results indicate that the fixed effect is appropriate. In addition, we use the Heckman two-stage model to eliminate the endogenous problems caused by selection bias. Details are in robust regression.

RESULTS

Table 2 displays the descriptive statistics and correlations for all variables included in the dataset. From Table 2, the mean value of mandatory CSR disclosure is 0.59, which indicates that 59% of the firms in the sample are required to issue CSR information. The average age of the firms is 16.51 years, and 59% of firms are state-owned.

Table 2. Descriptive statistics and correlations analysis

Notes: The correlation coefficients marked in bold are significant at p < 0.05.

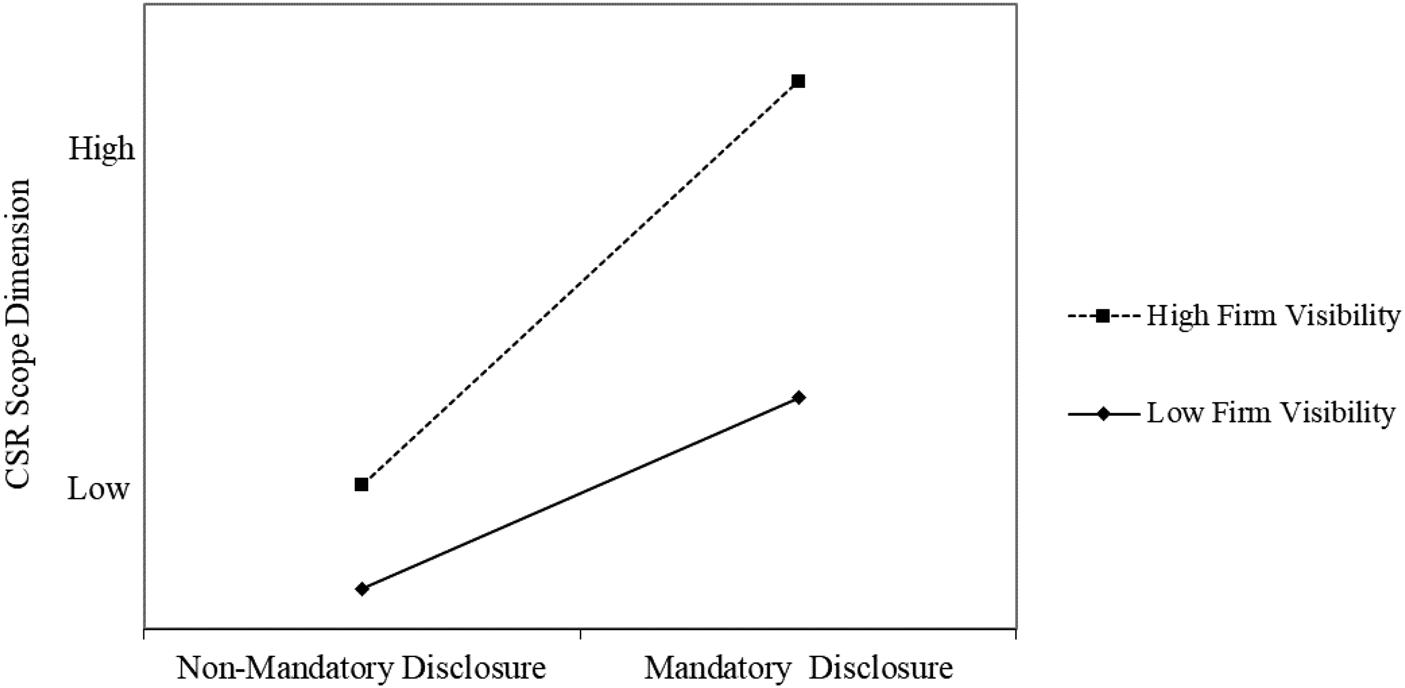

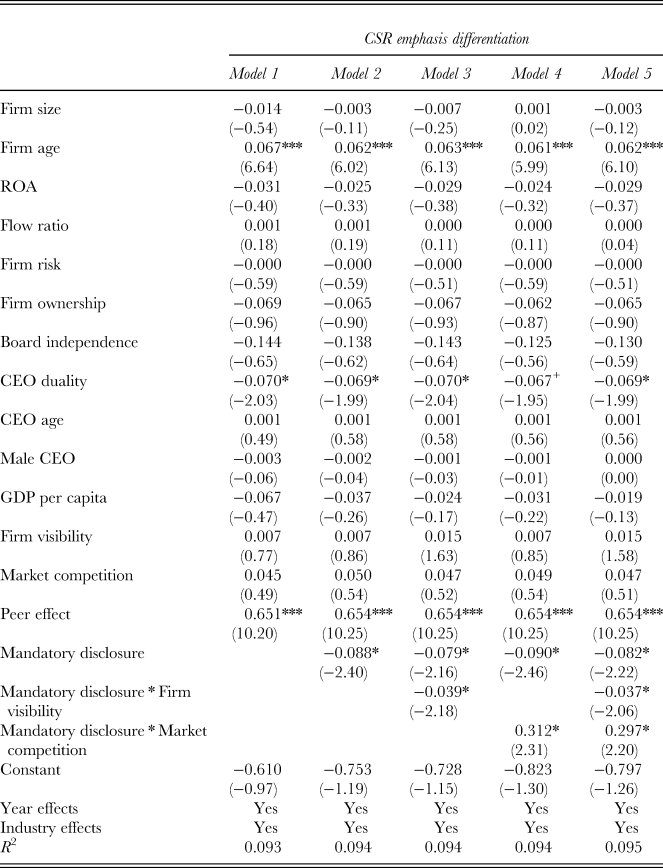

Table 3 reports the regression results for CSR disclosure strategy. The dependent variable in Models 1–5 is CSR scope dimension. Model 1 is the baseline model, and it consists of only control variables. Model 2 introduces the independent variable to test the main effect. Models 3 and 4, respectively, include the interaction items. Model 5 specifies the full model. In Model 2, the coefficient estimate of mandatory CSR disclosure is positive and statistically significant (β = 0.108, p < 0.05). Thus, Hypothesis 1a is supported. We test the moderating effects on CSR scope dimension in Models 3 and 4. All interaction terms in the models are mean-centered to avoid potential multicollinearity concern (Tang et al., Reference Tang, Qian, Chen and Shen2015). Hypothesis 2a predicts that firm visibility strengthens the positive relationship between mandatory CSR disclosure and CSR scope dimension. In Model 3, the interaction between mandatory CSR disclosure and firm visibility is significantly positive (β = 0.053, p < 0.05). Thus, Hypothesis 2a is supported. The moderating effect of firm visibility on the relationship between mandatory CSR disclosure and CSR scope dimension is illustrated in Figure 3. Hypothesis 3a proposes that market competition strengthens the positive relationship between mandatory CSR disclosure and CSR scope dimension. In Model 4, the interaction between mandatory CSR disclosure and market competition is not significant, failing to support Hypothesis 3a.

Figure 3. The moderating effect of firm visibility in the relationship between mandatory CSR disclosure and CSR scope dimension

Table 3. Estimates from the fixed-effect regression of the CSR disclosure strategy

Notes: Number of observations = 6,800; T-statistics are reported in parentheses.

+ p < 0.10, *p < 0.05, **p < 0.01, ***p < 0.001.

Likewise, Models 6–10 report the regression results of CSR emphasis dimension. The dependent variable is CSR emphasis dimension. Model 6 consists of only control variables. Model 7 adds the independent variable. Models 8 and 9, respectively, test the moderating effects of firm visibility and market competition. Model 10 contains all the variables. In Model 7, the coefficient estimate of mandatory CSR disclosure is significantly negative (β = −0.087, p < 0.05), supporting Hypothesis 1b. In Model 8, the interaction term between mandatory CSR disclosure and firm visibility is significantly negative (β = −0.045, p < 0.01). Therefore, Hypothesis 2b that firm visibility strengthens the negative relationship between mandatory CSR disclosure and CSR emphasis dimension is supported. The moderating effect of firm visibility on the relationship between mandatory CSR disclosure and CSR emphasis dimension is illustrated in Figure 4. Model 9 displays that the interaction item between mandatory CSR disclosure and market competition is significantly positive (β = 0.315, p < 0.05). Hence, Hypothesis 3b is supported. The moderating effect of firm visibility on the relationship between mandatory CSR disclosure and CSR emphasis dimension is illustrated in Figure 5.

Figure 4. The moderating effect of firm visibility in the relationship between mandatory CSR disclosure and CSR emphasis dimension

Figure 5. The moderating effect of market competition in the relationship between mandatory CSR disclosure and CSR emphasis dimension

Robustness Analysis

To test the robustness of the regression results, we perform a series of robustness analyses. First, the sample of firms with mandatory CSR disclosure is not randomly selected, and selection bias may exist for our independent variable. To alleviate the potential concerns that our treatment sample is not a random choice, we use the propensity score matching (PSM) to match the mandatory CSR disclosure firms to non-mandatory CSR disclosure firms (Rosenbaum & Rubin, Reference Rosenbaum and Rubin1983). In stage 1, we estimate the probability of a firm being selected to disclosure CSR information by employing a logit regression. Specifically, we use firm age, firm size, slack resource, CEO duality, CEO age, male CEO, visibility, and market competition to calculate a firm's propensity score. In stage 2, we employ the one-to-four nearest-neighbor matching with propensity scores within 0.01 and less to identify the matching sample (Abadie, Drukker, Herr, & Imbens, Reference Abadie, Drukker, Herr and Imbens2004). We regress our theoretical model based on the matched samples. Table 4 shows the regression results. As shown in Table 4, the regression results after the PSM approach are consistent with the results in Table 3.

Table 4. Results of PSM sample regression for the CSR disclosure strategy

Notes: Number of observations = 4,740; T-statistics are reported in parentheses.

+ p < 0.10, *p < 0.05, **p < 0.01, ***p < 0.001.

Second, the sample of our study is firms that have issued CSR reports; thus, there may exist sample selection bias for the dependent variable. We use the Heckman two-stage approach to correct the endogenous problems caused by sample selection bias (Heckman, Reference Heckman1979). In stage 1, the dependent variable is a dummy variable of whether the firm issues CSR reports. We use the probit regression and then obtain an inverse Mills ratio (Katmon & Al Farooque, Reference Katmon and Al Farooque2017). We also use the stock exchange where firms are listed as an exclusionary restriction. Previous studies have indicated that the stock exchange is a suitable instrumental variable because it has not specified requirements for the quality of CSR reports (Marquis & Qian, Reference Marquis and Qian2014). In stage 2, we put the inverse Mills ratio into all the regression models (Zhang et al., Reference Zhang, Ren, Chen, Li and Yin2020a). Table 5 shows the regression results. From the table, the coefficients of the inverse Mills ratio are insignificant in Models 1–5 and significant in Models 6–10. The coefficients of the regression results indicate that our theoretical model still holds after correcting for the sample selection bias.

Table 5. Results of Heckman two-step regression for the CSR disclosure strategy

Notes: Number of observations = 6,800; T-statistics are reported in parentheses.

+ p < 0.10, *p < 0.05, **p < 0.01, ***p < 0.001.

Third, to show the robustness of our main results, we also present the regression results using the same measure of CSR emphasis as Zhang et al. (Reference Zhang, Wang and Zhou2020c). Table 6 shows the regression results. The regression results of using the same measure of CSR emphasis as Zhang et al. (Reference Zhang, Wang and Zhou2020c) are consistent with the results in Table 3.

Table 6. Results of using the measurement of CSR emphasis differentiation

Notes: Number of observations = 6,800; T-statistics are reported in parentheses.

+ p < 0.10, *p < 0.05, **p < 0.01, ***p < 0.001.

DISCUSSION

This study attempts to understand how mandatory CSR disclosure influences firms’ CSR disclosure strategy. First, using the CSR disclosure of Chinese listed firms as the empirical context, we find that mandatory CSR disclosure is positively associated with firms’ CSR scope dimension and negatively associated with firms’ CSR emphasis dimension. This finding is consistent with our hypothesis that when firms are faced with mandatory CSR disclosure, they choose a disclosure strategy that can gain legitimacy at minimal cost. Given that conforming to CSR scope can gain legitimacy from government at a lower cost, firms are less likely to pay additional effort to disclose CSR emphasis. When facing mandatory CSR disclosure, firms are likely to disclose more CSR scope and less CSR emphasis to gain legitimacy at minimal cost. Second, firm visibility strengthens the positive relationship between mandatory CSR disclosure and CSR scope dimension and the negative relationship between mandatory CSR disclosure and CSR emphasis dimension. The moderating effect supports our argument that firm visibility increases the legitimacy pressure from stakeholders and the cost of CSR disclosure. Third, we find that the negative relationship between mandatory CSR disclosure and CSR emphasis dimension is weakened when firms face fierce market competition. This finding supports our hypothesis. When firms with mandatory CSR disclosure face fierce market competition, they become more dependent on specific stakeholders and thus they are likely to disclose more CSR emphasis to show goodwill to stakeholders and win their support. However, the positive relationship between mandatory CSR disclosure and CSR scope dimension is not influenced by market competition. A possible reason is that firms with mandatory CSR disclosure already disclose full CSR scope to gain legitimacy when the market competition is not fierce. Therefore, when market competition is fierce, firms can no longer exert more efforts in the CSR scope.

Despite these significant relationships identified in our study, it is noteworthy that effect size of our model is quite small (Cohen, Reference Cohen1988). This is understandable because the vast majority of variances in the CSR disclosure strategy are due to different institutional pressures (Luo et al., Reference Luo, Wang and Zhang2017; Marquis & Qian, Reference Marquis and Qian2014; Sun, Wang, Wang, & Yin, Reference Sun, Wang, Wang and Yin2015), stakeholder influence (Thijssens, Bollen, & Hassink, Reference Thijssens, Bollen and Hassink2015), social performance feedback (Wang, Jia, Xiang, & Lan, Reference Wang, Jia, Xiang and Lan2021), and managerial preferences (Ma, Zhang, Zhong, & Zhou, Reference Ma, Zhang, Zhong and Zhou2020), whereas our study examines only one observable institutional pressure. Hence, the effect size of mandatory CSR regulation on the CSR disclosure strategy may be limited. Although our data do not allow for nuanced observations of how firms actually make CSR disclosure decisions, these findings nevertheless help us understand how firms react when faced with mandatory CSR disclosure. Given that the focus of this study is on the CSR disclosure strategy in the context of mandatory CSR disclosure, the model can be regarded as meaningful.

Theoretical Contribution

This study contributes to the literature on CSR disclosure and studies on organizational responses to the government mandate. First, we contribute to the CSR disclosure literature by exploring CSR disclosure strategy from a microscopic perspective. Prior research investigates CSR disclosure strategy from a holistic perspective (Luo et al., Reference Luo, Wang and Zhang2017; Marquis & Qian, Reference Marquis and Qian2014). However, little research pays attention to the microscopic perspective of CSR and how firms determine the optimal disclosure strategy among multiple fields of CSR when disclosing CSR. We fill this gap by exploring how mandatory CSR disclosure affects firms’ CSR disclosure choices among multiple CSR fields. By describing multiple CSR fields from the scope and emphasis dimensions, our study broadens the limited understanding of the microscopic perspective of CSR. In doing so, we also answer the call for going beyond studying CSR based on the assumption of a unified stakeholder group (Wang et al., Reference Wang, Gibson and Zander2020).

Second, we contribute to the CSR disclosure literature by elaborating the mechanism by which mandatory CSR disclosure affects CSR disclosure strategy. Previous studies on CSR disclosure predominantly agree that issuing CSR reports can help firms gain legitimacy from the government when facing mandatory CSR disclosure (Crane & Glozer, Reference Crane and Glozer2016). This study adds that mandatory CSR disclosure also imposes costs on firms. Drawing on the literature on legitimacy management cost, our research uncovers a corporate response to mandatory CSR disclosure. That is, firms with mandatory CSR disclosure disclose more CSR scope and less CSR emphasis to obtain legitimacy at the minimal cost. In doing so, we also extend the CSR disclosure literature in that a firm's CSR disclosure strategy is somewhat contingent on the specific context in which it operates. Specifically, although prior research finds that firms simultaneously engage in the scope and emphasis dimensions of CSR to attain competitive advantage in the competitive market context (Zhang et al., Reference Zhang, Wang and Zhou2020c), this study finds that firms make a tradeoff between the two dimensions to gain legitimacy at the minimal cost in the context of mandatory CSR disclosure.

Third, this study enriches the literature on the variation in organization response to the government mandate by identifying firm visibility and market competition as situational factors that affect firms’ CSR disclosure strategy. Prior studies argue that variation in organizational responses to government mandates depends on firm characteristics (Westphal & Zajac, Reference Westphal and Zajac2001) and government–firm relationship (Marquis & Qian, Reference Marquis and Qian2014). This study emphasizes that the size of the corporate stakeholders’ groups also influences the variation in organization response to the government mandate. By introducing firm visibility and market competition as situational factors, this study adds to previous studies that a majority of stakeholders and a critical minority of stakeholders have a differentiated influence on the organization's response to government mandates on CSR.

Practical Implications

In addition to theoretical contributions, this study also offers implications for policymakers and corporate executives. First, although government CSR mandates in emerging economies have promoted the breadth of CSR participation, the depth of CSR participation in emerging economies still has a long way to go. Our findings indicate that while mandatory CSR disclosure promotes the scope dimension of CSR disclosure, it underperforms in promoting the emphasis dimension of CSR disclosure. The main reason for this phenomenon is that the economic costs of in-depth participation of CSR outweigh the legitimacy benefit that firms may gain. To address this issue, we propose one possible solution. Specifically, the government can implement financial subsidies or tax breaks and other incentives to reduce the cost of corporate in-depth participation in CSR in the early stages. When firms are able to profit from in-depth CSR, the government can gradually withdraw policy support. A typical example is the development of China's environmental protection industry. In the early stage, the development of environmental protection industry mainly relies on the state's investment in environmental protection. In 1999, for example, the Chinese government invested 82.32 billion yuan in environmental protection, as much as 1% of the GDP.[Footnote 3] In recent years, as the operating revenue of the environmental protection industry has been increasing, the state has been gradually reducing its investment in environmental protection. In 2019, for example, when the revenue of the environmental protection industry reached 1,780 billion yuan, the Chinese government invested 55.68 billion yuan in environmental protection.[Footnote 4]

Second, it is appropriate for corporate executives to use CSR disclosure proactively as a platform to fulfill the government's requirements, manage stakeholder perceptions, and maintain stakeholder relationship. Our results show that disclosing CSR emphasis in specific CSR fields may help firms win the support of a critical minority of stakeholders. As digital communications and social media boom in emerging economies, stakeholders are able to exert instant, direct, and powerful pressure on corporate behavior. Specifically, online technology makes it possible for a large group of dispersed stakeholders to focus on an event, make their voice heard, and force a corporate response. As the example mentioned in the empirical context section, the large sales generated by Erke's contribution to the floods in August 2021 confirm that dispersed stakeholders can exert influence on firms through online technology. Under this trend, corporate executives might as well proactively use CSR disclosure as a weapon to maintain the stakeholders’ relationship and win market competition, rather than passively responding to it.

Limitations and Future Research Directions

This study suffers from limitations that can become avenues for future research. First, the empirical setting of our study may make our findings somewhat limited in understanding the effects of mandatory CSR disclosure in other countries. For one thing, given that mandatory CSR disclosure relies mainly on the coercive power of the government, our findings are unlikely to be suitable for countries that use market mechanisms to regulate CSR, rather than the government forces. Second, although some developing countries and emerging economies have adopted mandatory CSR disclosure, such as India, Indonesia, and so on, the content of mandatory regulations in different countries are somewhat heterogeneous because of the various indigenous conditions (Aragón-Correa, Marcus, & Vogel, Reference Aragón-Correa, Marcus and Vogel2020). Thus, researchers should be cautious to extend our findings to help explain mandatory CSR disclosure in other countries. Meanwhile, with some countries beginning to adopt mandatory CSR disclosure, future studies may focus on the various effects of mandatory CSR disclosure among countries by means of a comparative study.

Second, although the empirical results support that market competition weakens the negative relationship between mandatory CSR disclosure and CSR emphasis dimension, we are unable to identify which CSR field firms may emphasize in a competitive market. Specifically, our measurement of CSR emphasis dimension is a relatively comprehensive indicator rather than a specific indicator of each CSR field. Thus, we cannot identify which stakeholder groups, such as customer, communities, or others, drive the emphasis of CSR in a highly competitive market. We hope future research can find more specific CSR data to further refine our findings.

Third, although our study examines the effect of mandatory CSR disclosure on CSR disclosure strategy, the effect size of the overall model is relatively small. There is still much unexplained variance regarding CSR disclosure strategy. This highlights the notion that corporate disclosure strategy in multiple CSR fields is not only influenced by mandatory disclosure requirements but also by other factors that have not yet been identified. Given that CSR disclosure strategy is an important tool enabling firms to gain legitimacy, future research should examine the impact of other factors, such as corporate ownership, executive preferences, and peer pressure, among others, on CSR disclosure strategy.

CONCLUSION

By examining how mandatory CSR disclosure influences firms’ CSR disclosure strategy, we find that firms that are required to disclose CSR information disclose CSR scope to gain legitimacy from the government and disclose less CSR emphasis to lower the economic cost. Moreover, firm visibility exposes firms to a wide range of stakeholder groups, thus increasing the legitimacy pressure and the economic cost of CSR disclosure for firms. Therefore, when firms are visible to the stakeholders, they disclose more of the CSR scope and less of the CSR emphasis. By contrast, market competition increases the power of a critical minority of stakeholders over the firms and drives firms to pay extra attention to the interests to the critical minority of stakeholders. Thus, firms with mandatory CSR disclosure are likely to disclose more CSR emphasis to show goodwill to a critical minority of stakeholders when faced with fierce market competition.

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are openly available in the Open Science Framework at https://doi.org/10.17605/OSF.IO/7MJ9G