1. Introduction

In this paper, we investigate the impacts of fiscal policy (the dividend, corporate, and bond income taxes) and monetary policy (the nominal interest rate) in an endogenous growth model of R&D. We endogenize the firm’s financial structure (in terms of internal and external funds) and enable the financial market (the equity market and the bond market) to reshuffle loanable funds out of less productive firms toward others with greater productivity. The endogenous financing of R&D provides a potentially important channel to link finance and economic growth. We show that the financial structure-growth relationship is not monotonic and that it depends on the relative productivity between the existing and new firms and the allocation of loanable funds between them. Distinct policies end up with quite different consequences for firms’ financial structures (the demand for loanable funds) and households’ asset investments (the supply of loanable funds), with both jointly determining inflation, growth, and the market structure. High growth can be associated with either an intensive (a large number of firms with a small firm size) or extensive margin (a small number of firms with a large firm size) in terms of market structure.

It is crucial to highlight R&D firms’ financial sources as we examine firms’ innovation activities and their influences on the economy’s performance. It is well documented that innovation activities require a lot of funding, but it is difficult for firms to raise sufficient R&D funds (Schumpeter (Reference Schumpeter1942), ch.VIII), leading to an underinvestment in R&D (Arrow (Reference Arrow1962)). There are two main reasons for this phenomenon: the knowledge nonrivalry and the return divergence between the supply of and demand for funding. Knowledge is nonrivalrous, and this externality gives rise to a disincentive effect, discouraging firms from collecting enough funds for the R&D investment, particularly when they need to raise funds externally.Footnote 1 This calls for the government’s intervention via a patent system (e.g. Segerstrom (Reference Segerstrom2000); Futagami and Iwaisako (Reference Futagami and Iwaisako2007); Iwaisako and Futagami (Reference Iwaisako and Futagami2013); Yang (Reference Yang2018); Chu et al. (Reference Chu, Lai and Liao2019)) or tax incentives (Chu and Cozzi (Reference Chu and Cozzi2018)) to remedy the underinvestment in R&D. Tax incentives may be more attractive to policymakers; for example, corporate taxes have been lowered in many industrial countries. From 1980 to 2018, the average worldwide statutory corporate income tax rate declined from 38.84% to 23.03%, representing a 41% reduction over the past 38 years. Corporate income tax rates declined the most in Europe, decreasing by 55% from 40.5% in 1980 to 18.38% in 2018.

These interventions, however, still have difficulty increasing the availability of external finance. The problem of return divergence, as stressed by Arrow (Reference Arrow1962) and other financial economists, manifests itself when R&D firms do not have enough internal funding (retained earnings) to finance their innovation activities, while external funding is costly. Corporate investment decisions may be distorted because the loanable funds suppliers (households) and demanders (R&D firms) have different objectives and different expectations regarding their returns on R&D.Footnote 2 Conventional R&D growth models ignore the importance of financial structures by simply assuming that firms have enough internal funds (retained earnings) to finance R&D expenditures without the need for external funds. Instead, this study endogenizes firms’ financial structures by considering the return divergence between the supply of and demand for R&D funding. Due to the costly nature of state verification, the agency cost between the supply of and demand for funding exists, giving rise to the return divergence (Jensen and Meckling (Reference Jensen and Meckling1976); Bernanke and Gertler (Reference Bernanke and Gertler1989)). The existence of return divergence vividly portrays the transformation from firms’ external finance to their productivity, which provides a microfoundation of macroeconomics (Carlstrom and Fuerst (Reference Carlstrom and Fuerst1997)). Our analysis accounts for the agency cost and, accordingly, endogenizes R&D firms’ financial structures (specifically, the financial leverage (measured by the debt-equity ratio) and the user cost of capital (measured by the weighted average cost of capital, WACC)). The financial structure of R&D firms will affect the demand for and supply of loanable funds, which in turn governs the effects of fiscal and monetary policy. Thus, we offer quite different policy implications from the conventional wisdom gleaned from growth models without endogenously determined financial structures.Footnote 3

In this paper, we develop a growth monetary model in which (1) incumbents engage in R&D aimed at quality improvement (vertical R&D), while entrants engage in R&D aimed at variety expansion (horizontal R&D); (2) both the existing and new firms can access the financial market (the equity market and the bond market) for external funding; and (3) agency costs exist between the supply of and demand for funding. The first feature endogenizes the market structure (the firm size and the number of firms) whereby the competition between incumbents and entrants jointly determines the growth and the proliferation of product varieties to eliminate the scale effect on growth (see Peretto (Reference Peretto2003)).Footnote 4 The second and third features endogenize the firm’s financial structure and enable the financial market to reshuffle loanable funds away from less productive firms toward others with greater productivity, as stressed by Chetty and Saez (Reference Chetty and Saez2006). The empirical literature on finance has shown that external finance (in terms of both equity and debt finance) is non-negligible, particularly for R&D-intensive firms. Compared to mature firms, younger firms rely more on equity finance due to the lack of retained earnings and the problem of financing frictions (see Brown and Petersen (Reference Brown and Petersen2011)). Based on the three novel features, we show that the endogenously determined debt-equity ratio and WACC will affect not only the market amount of loanable funds but also the allocation of loanable funds between incumbents and entrants, with both governing inflation, growth, and the market structure.

Analytically, we show that there exists a unique balanced-growth path (BGP) equilibrium with an endogenous financial structure which is locally determinate. In the BGP equilibrium, the balanced-growth rate can be either positively or negatively correlated with the WACC. A higher WACC leads firms to set a higher price for passing through the increased user cost of capital, pushing up inflation. Higher inflation lowers the real returns on financial assets, decreasing the households’ supply of loanable funds. A scarcity of loanable funds, however, does not necessarily imply a lower growth rate. If entrants are more productive than incumbents, growth decreases with the WACC as loanable funds go to more productive entrants, which reduces the effectiveness of incumbents’ R&D aimed at product quality improvement. By contrast, if incumbents are more productive than entrants, growth increases with the WACC because the financial market can reshuffle funds toward more productive incumbents, which increases the effectiveness of quality-improving R&D, resulting in an increase in growth.

This result implies that instead of the market amount of loanable funds, the allocation of loanable funds plays a more important role in determining economic growth. The importance of intersectoral capital allocation has been pointed out in McKinsey’s study report (by Lewis et al. (Reference Lewis, Agrawal, Buttgenbach, Findley, Jeddy, Petry, Kondo, Subramanian, Bőrsch-Supan, Huang and Greene1996)) which shows that although Japan and Germany had much higher investment rates, US investment was able to be allocated to more profitable (i.e. higher productivity) sectors so that national income was considerably greater in the United States. We also show that higher financial leverage (a higher debt-equity ratio) is not necessarily favorable to economic growth. By bringing the allocation of loanable funds between incumbent R&D firms and new entrants into the picture, our result stands in contrast to the financial accelerator effect proposed by Bernanke and Gertler (Reference Bernanke and Gertler1995) and Bernanke et al. (Reference Bernanke, Gertler and Gilchrist1996), in which higher financial leverage stimulates investment and boosts growth. The ambiguous growth effect in our analytical study explains why empirical findings not only are mixed but also vary greatly. For example, instead of positive growth effects, OECD (2017) and Shah et al. (Reference Shah, Abdul-Majid and Karim2019) find that corporate debt has negative effects on growth in OECD countries (see Section 3.1 for more details).

Numerically, we show that while the dividend tax (levied on the households’ supply of loanable funds) and the corporate tax (levied on the firm’s demand for loanable funds) increase the equilibrium debt-equity ratio, both have quite different impacts on the balanced growth and market structure, given that the dividend tax raises the firm’s WACC but the corporate tax lowers it due to the “tax shield effect.” In spite of a lower WACC, the corporate tax unambiguously decreases growth since it substantially lowers firms’ after-tax profits, which forces incumbents to reduce their demand for loanable funds and impedes their R&D activities. The market structure, nevertheless, has an uncertain response to a higher corporate tax; specifically, the firm size (the number of firms) has an inverted U-shaped (U-shaped) relationship with the corporate tax.

By contrast, the dividend tax has an ambiguous impact on growth but an unambiguous impact on the market structure. The dividend tax decreases (increases) growth if incumbents are less (more) productive than entrants. A higher dividend tax raises the firm’s WACC and hence the economy’s inflation, giving rise to an unfavorable effect on the households’ supply of loanable funds. If entrants are more productive, scarce loanable funds will be allocated to entrants, which reduces the effectiveness of incumbents’ R&D aimed at quality improvement and hence decreases growth. Otherwise, the financial market will allocate scarce loanable funds toward more productive incumbents, and, therefore, the balanced-growth rate rises. The calibration results show that the market structure exhibits an intensive margin (a small number of firms with a large firm size) in response to the dividend tax, regardless of whether incumbents are less or more productive. By focusing on the bond income tax, we also find uncertain responses in terms of the balanced growth and market structure. Again, these responses depend on the relative productivity between incumbents and entrants and the allocation of loanable funds between them. In the sensitivity analysis, we further find that in the presence of higher agency costs the market structure exhibits an intensive margin response to the corporate tax, while it exhibits an extensive margin response to the bond income tax.

In regard to monetary policy, in response to a higher nominal interest rate, inflation can be positively related to growth, resembling the so-called Mundell−Tobin effect. Our channel, however, is different from their asset substitution effect. In effect, our model predicts that a higher nominal interest rate tends to decrease, rather than increase, the supply of loanable funds. Even though loanable funds become scarce, a higher nominal interest rate can enhance growth, provided that incumbents are more productive and that the financial market can effectively reshuffle loanable funds to them. In this case, inflation is positively related to growth. While the conventional macroeconomic model predicts a negative relationship (see, e.g. Cooley and Hansen (Reference Cooley and Hansen1989); Wang and Yip (Reference Wang and Yip1992)), the empirical evidence gives rise to the possibility of a positive inflation-growth relationship (e.g. Bullard and Keating (Reference Bullard and Keating1995)).Footnote 5

While the seminal works of Peretto (Reference Peretto2007, Reference Peretto2011) contribute to the literature, the growth effects of the dividend tax and the corporate tax in our analysis are in contradiction to those of his works. In his models, incumbents are assumed to have enough retained earnings (internal funds) to invest without the need for external funds, whereas entrants have to amass funds by issuing equities (external funds). The asymmetric financial structure eliminates the problem of the return divergence between the supply of and demand for funding for firms, and growth thereby unambiguously increases in response to the dividend income tax (Peretto (Reference Peretto2007, Reference Peretto2011)) and the corporate tax (Peretto (Reference Peretto2007)). In our model, both incumbents and entrants can access the equity and bond markets and optimally decide their financial structures so that the financial market can effectively reshuffle funds out of less productive firms toward more productive ones, as stressed by Chetty and Saez (Reference Chetty and Saez2006). The effects of taxation on growth crucially depend on the relative productivity and the allocation of loanable funds between the existing and new firms. Empirically, there is no consensus on the growth effect of either dividend (see Carroll (Reference Carroll2010) for a summary) or corporate taxation (see Auerbach (Reference Auerbach2013) for a summary).Footnote 6 To complement Peretto’s study, our results provide convincing explanations for the mixed empirical findings.

2. The model

The economy consists of households, firms, and a government. Households derive utility from consumption and leisure and make portfolio choices among various assets: money, equities, corporate bonds, and government bonds.Footnote

7

There are two sectors: the final-good sector is perfectly competitive while the intermediate-good sector is characterized by monopolistic competition. Like Peretto (Reference Peretto2007, Reference Peretto2011), the intermediate-good firms engage in two distinct types of R&D investment: vertical (in-house quality) R&D and entry investment (horizontal variety R&D). Unlike their setup, in addition to retained earnings, the intermediate-good firms can collect funding for their R&D investment by issuing not only equities but also corporate bonds. Accordingly, the debt-equity ratio is determined endogenously. The government (the monetary authority) runs a balanced budget and implements a nominal interest rate peg by purchasing/selling government bonds in the open market. Money is introduced into this model through a cash-in-advance (CIA) constraint. In line with Lucas (Reference Lucas1980), real money balances are required prior to purchasing the consumption good. Focusing the CIA constraint only on consumption will make our point (the balance sheet channel) more striking.Footnote

8

Time

![]() $t$

is continuous. For compact notation, the time index is suppressed throughout the paper.

$t$

is continuous. For compact notation, the time index is suppressed throughout the paper.

2.1. Households

The economy is populated by a unit measure of identical infinitely lived households. For simplicity, there is no population growth. Each household, in facing the budget and CIA constraints, maximizes the discounted sum of future instantaneous utilities. To be specific, it optimally chooses consumption

![]() $c$

and working time

$c$

and working time

![]() $L$

(

$L$

(

![]() $(1-L)$

is leisure) and also makes an asset portfolio allocation among nominal money balances

$(1-L)$

is leisure) and also makes an asset portfolio allocation among nominal money balances

![]() $M$

, government bonds

$M$

, government bonds

![]() $B^{G}$

, outstanding equities

$B^{G}$

, outstanding equities

![]() $E_{j}$

, and corporate bonds

$E_{j}$

, and corporate bonds

![]() $B_{j}^{F}$

issued by firm

$B_{j}^{F}$

issued by firm

![]() $j$

, taking the general price (the consumer price index)

$j$

, taking the general price (the consumer price index)

![]() $P$

, wage offers

$P$

, wage offers

![]() $W$

, the market price for firm

$W$

, the market price for firm

![]() $j$

’s share

$j$

’s share

![]() $V_{j}$

, the yield rates of equities

$V_{j}$

, the yield rates of equities

![]() $i_{j}^{E}$

, corporate bonds

$i_{j}^{E}$

, corporate bonds

![]() $i_{j}^{B}$

, government bonds

$i_{j}^{B}$

, government bonds

![]() $\overline{i}$

, and the government’s tax (lump-sum)

$\overline{i}$

, and the government’s tax (lump-sum)

![]() $T$

as given. Thus, given a set of initial endowment assets

$T$

as given. Thus, given a set of initial endowment assets

![]() $\{M(0),E_{j}(0),B_{j}^{F}(0),B^{G}(0)\}$

, the representative household’s optimization problem can be expressed as:

$\{M(0),E_{j}(0),B_{j}^{F}(0),B^{G}(0)\}$

, the representative household’s optimization problem can be expressed as:

subject to the (real) budget constraint,

and the CIA constraint,

where

![]() $\rho$

is the time preference rate,

$\rho$

is the time preference rate,

![]() $\delta$

measures the relative preference weight of leisure to consumption,

$\delta$

measures the relative preference weight of leisure to consumption,

![]() $N$

is the mass of intermediate goods (the number of intermediate-good firms),

$N$

is the mass of intermediate goods (the number of intermediate-good firms),

![]() $\tau _{L}$

is the tax rate imposed on labor income,

$\tau _{L}$

is the tax rate imposed on labor income,

![]() $\tau _{c}$

is the tax rate imposed on consumption,

$\tau _{c}$

is the tax rate imposed on consumption,

![]() $\tau _{D}$

is the tax rate imposed on the dividend incomes from outstanding equities,

$\tau _{D}$

is the tax rate imposed on the dividend incomes from outstanding equities,

![]() $\tau _{B}$

is the tax rate imposed on the yield incomes from government and corporate bonds,

$\tau _{B}$

is the tax rate imposed on the yield incomes from government and corporate bonds,

![]() $\tau _{V}$

is the tax rate imposed on the capital gains of outstanding equities (i.e.

$\tau _{V}$

is the tax rate imposed on the capital gains of outstanding equities (i.e.

![]() $\dot{V}_{j}E_{j}$

), and

$\dot{V}_{j}E_{j}$

), and

![]() $\sigma _{j}$

is the agency cost of debt.

$\sigma _{j}$

is the agency cost of debt.

In line with Osterberg (Reference Osterberg1989), households, as indicated in (2), incur an extra cost due to the risk associated with holding corporate bonds

![]() $\sigma _{j}$

, compared with holding equities. The extra cost

$\sigma _{j}$

, compared with holding equities. The extra cost

![]() $\sigma _{j}$

may stem from the default risk of private firms or the potential monitoring cost of debt issued by private firms. These potential costs of debt are attributable to the so-called agency cost, as stressed by Jensen and Meckling (Reference Jensen and Meckling1976) and Leland (Reference Leland1994). There is a costly financial contractual relationship—the difference in interests and the existence of information asymmetry—between debt holders (households) and debtors (corporations). Because corporate managers in general have more information about the prospects of the business compared to debt holders, they have incentives to misreport the true cash flow, and the debt holders (households) attempt to take various preventive measures to monitor the actions of the debtors (corporations). As a result, it is plausible that any additional resources devoted to increasing the intensity of monitoring of debtors or decreasing the conflicting interests between debtors and debt holders can be treated as the agency cost of debt

$\sigma _{j}$

may stem from the default risk of private firms or the potential monitoring cost of debt issued by private firms. These potential costs of debt are attributable to the so-called agency cost, as stressed by Jensen and Meckling (Reference Jensen and Meckling1976) and Leland (Reference Leland1994). There is a costly financial contractual relationship—the difference in interests and the existence of information asymmetry—between debt holders (households) and debtors (corporations). Because corporate managers in general have more information about the prospects of the business compared to debt holders, they have incentives to misreport the true cash flow, and the debt holders (households) attempt to take various preventive measures to monitor the actions of the debtors (corporations). As a result, it is plausible that any additional resources devoted to increasing the intensity of monitoring of debtors or decreasing the conflicting interests between debtors and debt holders can be treated as the agency cost of debt

![]() $\sigma _{j}$

.

$\sigma _{j}$

.

Equities may also give rise to a similar agency cost between shareholders and corporations, but equity is better informed about the firm’s financial structure (Habib and Johnsen (Reference Habib and Johnsen2000)). In (2), the agency cost is specified as an extra risk cost of holding corporate bonds, compared with holding equities. This “relative agency cost” implies that debt holders (households) tolerate a higher risk cost if the debtors’ (corporations’) leverage (capital structure) relies more on debt financing, rather than equity financing. Our results, however, are robust even though the agency costs of both debt and equity holdings are separately included.

Following Osterberg (Reference Osterberg1989) specification, we establish the following assumption:

Assumption 1.

The relative agency cost of debt to equity

![]() $\sigma _{j}$

is increasing and convex in the corporation’s debt-equity ratio, denoted by

$\sigma _{j}$

is increasing and convex in the corporation’s debt-equity ratio, denoted by

![]() $\lambda _{j}(\!=B_{j}^{F}/V_{j}E_{j})$

, that is,

$\lambda _{j}(\!=B_{j}^{F}/V_{j}E_{j})$

, that is,

![]() $\sigma _{j}^{\prime }(\!=\partial \sigma _{j}/\partial \lambda _{j})\gt 0$

and

$\sigma _{j}^{\prime }(\!=\partial \sigma _{j}/\partial \lambda _{j})\gt 0$

and

![]() $\sigma _{j}^{\prime \prime }(\!=\partial (\sigma _{j})^{2}/\partial ^{2}\lambda _{j})\gt 0$

.

$\sigma _{j}^{\prime \prime }(\!=\partial (\sigma _{j})^{2}/\partial ^{2}\lambda _{j})\gt 0$

.

Assumption 1 is consistent with the “costly contracting hypothesis” of Smith and Warner (Reference Smith and Warner1979) in the sense that the presence of bond covenants can be viewed as a method of controlling the conflict between debt holders and debtors, and bond covenants are negotiated to restrict the level of debt for a given value of equity. Thus, the higher the debt-equity ratio

![]() $\lambda _{j}$

, the more likely it is that the covenant will be violated, resulting in restrictions for investors (debt holders) on their investment activities in relation to corporate bonds. In the handbook of the economics of finance, Stein (Reference Stein2003) claims that such a reduced-form specification can capture the costly external finance, although it may appear ad hoc. The specification of agency cost shares the merit with a variant of the Townsend (Reference Townsend1979) and Gale and Hellwig (Reference Gale and Hellwig1985) costly state verification models, as shown by Froot et al. (Reference Froot, Scharfstein and Stein1993), and an appropriately parameterized version of the Myers and Majluf (Reference Myers and Majluf1984) adverse-selection model, as shown by Stein (Reference Stein1998).

$\lambda _{j}$

, the more likely it is that the covenant will be violated, resulting in restrictions for investors (debt holders) on their investment activities in relation to corporate bonds. In the handbook of the economics of finance, Stein (Reference Stein2003) claims that such a reduced-form specification can capture the costly external finance, although it may appear ad hoc. The specification of agency cost shares the merit with a variant of the Townsend (Reference Townsend1979) and Gale and Hellwig (Reference Gale and Hellwig1985) costly state verification models, as shown by Froot et al. (Reference Froot, Scharfstein and Stein1993), and an appropriately parameterized version of the Myers and Majluf (Reference Myers and Majluf1984) adverse-selection model, as shown by Stein (Reference Stein1998).

In the analysis, we focus on the symmetric equilibrium. Thus, we can impose symmetry across firms to keep the notation simple. Let

![]() $\eta$

be the shadow price associated with the real budget constraint and

$\eta$

be the shadow price associated with the real budget constraint and

![]() $\zeta$

be the Lagrangian multiplier of the CIA constraint. The necessary conditions, in real terms, for this optimization problem are summarized as follows:

$\zeta$

be the Lagrangian multiplier of the CIA constraint. The necessary conditions, in real terms, for this optimization problem are summarized as follows:

and the transversality conditions are as follows:

where

![]() $w(\!=\frac{W}{P})$

is the real wage,

$w(\!=\frac{W}{P})$

is the real wage,

![]() $\pi (\!=\frac{\dot{P}}{P})$

is the inflation rate,

$\pi (\!=\frac{\dot{P}}{P})$

is the inflation rate,

![]() $m(\!=\frac{M}{P})$

are real money balances,

$m(\!=\frac{M}{P})$

are real money balances,

![]() $b^{G}(\!=\frac{B^{G}}{P})$

are real government bonds,

$b^{G}(\!=\frac{B^{G}}{P})$

are real government bonds,

![]() $v(\!=\frac{V}{P})$

is the relative price of equities to final goods, and

$v(\!=\frac{V}{P})$

is the relative price of equities to final goods, and

![]() $b^{F}(\!=\frac{B^{F}}{P})$

are real corporate bonds. Equation (4) describes how the household trades off consumption and leisure at the real tax-adjusted wage

$b^{F}(\!=\frac{B^{F}}{P})$

are real corporate bonds. Equation (4) describes how the household trades off consumption and leisure at the real tax-adjusted wage

![]() $\frac{1-\tau _{L}}{\left ( 1+\tau _{c}\right ) +\left ( 1-\tau _{B}\right ) \overline{i}}w$

. Equation (5) refers to the optimal condition for real money holdings, which equates the shadow price of real money balances to its opportunity cost, that is, the after-tax nominal yield on government bonds

$\frac{1-\tau _{L}}{\left ( 1+\tau _{c}\right ) +\left ( 1-\tau _{B}\right ) \overline{i}}w$

. Equation (5) refers to the optimal condition for real money holdings, which equates the shadow price of real money balances to its opportunity cost, that is, the after-tax nominal yield on government bonds

![]() $ ( 1-\tau _{B} ) \overline{i}$

. While (6) is the CIA constraint, (7) refers to the consumption Euler equation. Equation (8) is a no-arbitrage condition, indicating that all the rates of after-tax yields on government bonds

$ ( 1-\tau _{B} ) \overline{i}$

. While (6) is the CIA constraint, (7) refers to the consumption Euler equation. Equation (8) is a no-arbitrage condition, indicating that all the rates of after-tax yields on government bonds

![]() $ ( 1-\tau _{B} ) \overline{i}$

, on corporate bonds

$ ( 1-\tau _{B} ) \overline{i}$

, on corporate bonds

![]() $(1-\tau _{B})i^{B}-\sigma$

, and on equities

$(1-\tau _{B})i^{B}-\sigma$

, and on equities

![]() $(1-\tau _{D})i^{E}+\left ( 1-\tau _{V}\right ) \frac{\overset{\centerdot }{V}}{V}$

must be equal.

$(1-\tau _{D})i^{E}+\left ( 1-\tau _{V}\right ) \frac{\overset{\centerdot }{V}}{V}$

must be equal.

In our paper, government bonds are treated as a risk-free asset (such as Blanchard (Reference Blanchard1993)), and their return rate

![]() $\overline{i}$

can thus be viewed as the benchmark return for which households are willing to supply loanable funds (i.e. hold risk assets including equities and corporate bonds). Thus, from the no-arbitrage condition (8), we can further obtain the nominal rate of returns on corporate bonds,

$\overline{i}$

can thus be viewed as the benchmark return for which households are willing to supply loanable funds (i.e. hold risk assets including equities and corporate bonds). Thus, from the no-arbitrage condition (8), we can further obtain the nominal rate of returns on corporate bonds,

![]() $i^{B}$

, and the capital gain or loss stemming from a change in the equity price,

$i^{B}$

, and the capital gain or loss stemming from a change in the equity price,

![]() $\frac{\overset{\centerdot }{V}}{V}$

:

$\frac{\overset{\centerdot }{V}}{V}$

:

Equation (9) indicates that the nominal rate of return no corporate bonds equals the sum of the nominal yield on riskless government bonds

![]() $\overline{i}$

and its risk premium adjusted by the corporate bond tax

$\overline{i}$

and its risk premium adjusted by the corporate bond tax

![]() $\frac{\sigma }{1-\tau _{B}}$

. Equation (10) then indicates that the capital gain (loss) from the equity price appreciation (depreciation) is the wedge between the after-tax yield rate on government bonds

$\frac{\sigma }{1-\tau _{B}}$

. Equation (10) then indicates that the capital gain (loss) from the equity price appreciation (depreciation) is the wedge between the after-tax yield rate on government bonds

![]() $\frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}$

and that on corporate equities

$\frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}$

and that on corporate equities

![]() $\frac{1-\tau _{D}}{1-\tau _{V}}i^{E}$

.

$\frac{1-\tau _{D}}{1-\tau _{V}}i^{E}$

.

2.2. Firms

The final-good and intermediate-good sectors make up the production side. To focus on R&D activities, physical capital is abstracted from the production of final and intermediate goods, for simplicity.

2.2.1. Final-good firms

In line with Romer (Reference Romer1990) and Aghion and Howitt (Reference Aghion and Howitt2005), we assume that in the final-good sector competitive firms produce a homogeneous final good

![]() $y$

. The final good, as in Peretto (Reference Peretto2007), can be consumed, used to produce intermediate goods, invested in R&D that raises the quality of existing intermediate goods, or invested in the creation of new intermediate goods. Final goods are produced by using labor

$y$

. The final good, as in Peretto (Reference Peretto2007), can be consumed, used to produce intermediate goods, invested in R&D that raises the quality of existing intermediate goods, or invested in the creation of new intermediate goods. Final goods are produced by using labor

![]() $l_{j}$

(with the production share/elasticity

$l_{j}$

(with the production share/elasticity

![]() $1-\theta$

) and a continuum of intermediate goods

$1-\theta$

) and a continuum of intermediate goods

![]() $x_{j}$

,

$x_{j}$

,

![]() $j\in (0,N)$

(with the production share/elasticity

$j\in (0,N)$

(with the production share/elasticity

![]() $\theta$

), according to the following Cobb−Douglas production technology:

$\theta$

), according to the following Cobb−Douglas production technology:

where

![]() $A_{j}$

is the productivity parameter of workers

$A_{j}$

is the productivity parameter of workers

![]() $l_{j}$

(which are associated with the use of intermediate goods

$l_{j}$

(which are associated with the use of intermediate goods

![]() $x_{j}$

). Specifically,

$x_{j}$

). Specifically,

![]() $A_{j}$

depends on good

$A_{j}$

depends on good

![]() $j$

’s quality

$j$

’s quality

![]() $z_{j}$

and on average quality

$z_{j}$

and on average quality

![]() $Z=\frac{1}{N}\int _{0}^{N}z_{j}dj$

(which captures the positive externality of R&D) according to:

$Z=\frac{1}{N}\int _{0}^{N}z_{j}dj$

(which captures the positive externality of R&D) according to:

By defining

![]() $P_{x_{j}}$

as the price of intermediate goods, the final-good firms’ profit maximization problem is given by:

$P_{x_{j}}$

as the price of intermediate goods, the final-good firms’ profit maximization problem is given by:

Thus, the first-order conditions for the final-good firms are as follows:

Equation (12) is the demand function of the final-good firm for intermediate goods

![]() $x_{j}$

showing that the value of the marginal product of intermediate good

$x_{j}$

showing that the value of the marginal product of intermediate good

![]() $j$

equals its price,

$j$

equals its price,

![]() $P_{x_{j}}$

. Equation (13) is the demand function of the final-good firm for labor

$P_{x_{j}}$

. Equation (13) is the demand function of the final-good firm for labor

![]() $l_{j}$

showing that the value of the marginal product of labor equals the wage rate,

$l_{j}$

showing that the value of the marginal product of labor equals the wage rate,

![]() $W$

.

$W$

.

2.2.2. Intermediate-good firms

There are two dimensions of technology change in the intermediate-good (or corporate) sector. In the vertical dimension, incumbents engage in in-house R&D to raise the quality of their products and earn higher profits. In the horizontal dimension, entrepreneurs make entry decisions and compete with incumbents for market share. The introduction of new firms (firm entry) expands the variety of intermediate goods (the number of firms)

![]() $N$

.

$N$

.

Incumbents

Following Peretto (Reference Peretto2011), intermediate-good firm

![]() $j$

produces its differentiated good with a technology that requires one unit of final output per unit of intermediate good and a fixed operating cost

$j$

produces its differentiated good with a technology that requires one unit of final output per unit of intermediate good and a fixed operating cost

![]() $\phi Z$

. Moreover, the intermediate firm increases its product quality according to the technology:

$\phi Z$

. Moreover, the intermediate firm increases its product quality according to the technology:

where

![]() $I_{j}$

is the R&D investment in terms of final goods. The R&D investment can be financed by either internal funds (retained earnings

$I_{j}$

is the R&D investment in terms of final goods. The R&D investment can be financed by either internal funds (retained earnings

![]() $R_{j}$

) or external funds (issuing new corporate bonds

$R_{j}$

) or external funds (issuing new corporate bonds

![]() $\dot{B}_{j}^{F}$

and new equities

$\dot{B}_{j}^{F}$

and new equities

![]() $V_{j}\dot{E}_{j}$

). Thus, the financing constraint facing an intermediate firm is as follows:

$V_{j}\dot{E}_{j}$

). Thus, the financing constraint facing an intermediate firm is as follows:

Notice that Peretto (Reference Peretto2007, Reference Peretto2011) studies abstract from the possibility of external funds. The consideration of the external funds enables firms to collect funds by issuing equities and corporate bonds to households, and the debt-equity ratio

![]() $\lambda _{j}(\!=B_{j}^{F}/V_{j}E_{j})$

can be thereby determined optimally (see below).

$\lambda _{j}(\!=B_{j}^{F}/V_{j}E_{j})$

can be thereby determined optimally (see below).

Define

![]() $Q$

as the average price of product quality

$Q$

as the average price of product quality

![]() $Z$

, that is,

$Z$

, that is,

![]() $Q=\frac{1}{N}\int _{0}^{N}Q_{j}dj$

, where

$Q=\frac{1}{N}\int _{0}^{N}Q_{j}dj$

, where

![]() $Q_{j}$

is the price of quality

$Q_{j}$

is the price of quality

![]() $z_{j}$

. Accordingly, intermediate-good firm

$z_{j}$

. Accordingly, intermediate-good firm

![]() $j$

’s pretax gross profits are given by:

$j$

’s pretax gross profits are given by:

The firm’s pretax profits equal total revenues

![]() $P_{x_{j}}x_{j}$

minus total production costs

$P_{x_{j}}x_{j}$

minus total production costs

![]() $Px_{j}+Q\phi Z$

and the interest payment for corporate bonds

$Px_{j}+Q\phi Z$

and the interest payment for corporate bonds

![]() $i_{j}^{B}B_{j}^{F}$

. Let

$i_{j}^{B}B_{j}^{F}$

. Let

![]() $\tau _{\Pi }$

be the corporate tax rate. Thus, the post-tax gross profits are either transferred to stockholders as dividends

$\tau _{\Pi }$

be the corporate tax rate. Thus, the post-tax gross profits are either transferred to stockholders as dividends

![]() $D_{j}$

or become the firm’s internal funds as retained earnings

$D_{j}$

or become the firm’s internal funds as retained earnings

![]() $R_{j}$

. That is,

$R_{j}$

. That is,

In line with Turnovsky (Reference Turnovsky2000, chs. 9 and 10), we assume that the intermediate-good firms offer a fixed dividend yield to stockholders, that is,

![]() $i^{E}=\frac{D_{j}}{V_{j}E_{j}}$

. This assumption enables us to isolate the dividend policy from the firm’s investment decisions (see, e.g. Myers and Majluf (Reference Myers and Majluf1984)), which allows us to easily construct the firm’s objective function and to attach more attention to the investment effect of an endogenous debt-equity ratio.

$i^{E}=\frac{D_{j}}{V_{j}E_{j}}$

. This assumption enables us to isolate the dividend policy from the firm’s investment decisions (see, e.g. Myers and Majluf (Reference Myers and Majluf1984)), which allows us to easily construct the firm’s objective function and to attach more attention to the investment effect of an endogenous debt-equity ratio.

The intermediate firm’s market value of total assets

![]() $\Omega _{j}$

is the sum of the market value of its equities

$\Omega _{j}$

is the sum of the market value of its equities

![]() $V_{j}E_{j}$

and debts

$V_{j}E_{j}$

and debts

![]() $B_{j}^{F}$

, that is,

$B_{j}^{F}$

, that is,

![]() $\Omega _{j}=V_{j}E_{j}+B_{j}^{F}$

. Differentiating

$\Omega _{j}=V_{j}E_{j}+B_{j}^{F}$

. Differentiating

![]() $\Omega _{j}$

with respect to time, and utilizing (15), (17), and (8) yield:

$\Omega _{j}$

with respect to time, and utilizing (15), (17), and (8) yield:

In (18), as in Osterberg (Reference Osterberg1989),

![]() $\omega _{j}$

is defined as the firm’s post-tax cash flow and

$\omega _{j}$

is defined as the firm’s post-tax cash flow and

![]() $\Gamma _{j}$

is the (nominal) WACC. Specifically,

$\Gamma _{j}$

is the (nominal) WACC. Specifically,

where

![]() $C^{E}=\left ( \frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}+\frac{\tau _{D}-\tau _{V}}{1-\tau _{V}}i^{E}\right )$

and

$C^{E}=\left ( \frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}+\frac{\tau _{D}-\tau _{V}}{1-\tau _{V}}i^{E}\right )$

and

![]() $C^{B}=\left ( 1-\tau _{\Pi }\right ) \left ( \overline{i}+\frac{\sigma _{j}}{1-\tau _{B}}\right )$

represent the cost of equity capital and the cost of debt capital, respectively. While the net cash flow (19) is related to the firm’s production, the nominal WACC is related to the firm’s financial structure.Footnote

9

It is well documented in the finance literature (e.g. Arditti (Reference Arditti1973)) that the WACC plays a crucial role in determining a firm’s financial (capital) structure: it measures the user cost of capital for perpetuity companies, which is a decisive criterion in investment decision-making. In our model, the nominal WACC is a weighted average cost of issuing equity (equity capital)

$C^{B}=\left ( 1-\tau _{\Pi }\right ) \left ( \overline{i}+\frac{\sigma _{j}}{1-\tau _{B}}\right )$

represent the cost of equity capital and the cost of debt capital, respectively. While the net cash flow (19) is related to the firm’s production, the nominal WACC is related to the firm’s financial structure.Footnote

9

It is well documented in the finance literature (e.g. Arditti (Reference Arditti1973)) that the WACC plays a crucial role in determining a firm’s financial (capital) structure: it measures the user cost of capital for perpetuity companies, which is a decisive criterion in investment decision-making. In our model, the nominal WACC is a weighted average cost of issuing equity (equity capital)

![]() $C^{E}$

and issuing corporate bonds (debt capital)

$C^{E}$

and issuing corporate bonds (debt capital)

![]() $C^{B}$

, with the weights being given by their relative structures

$C^{B}$

, with the weights being given by their relative structures

![]() $\frac{1}{1+\lambda _{j}}$

and

$\frac{1}{1+\lambda _{j}}$

and

![]() $\frac{\lambda _{j}}{1+\lambda _{j}}$

, respectively. The cost of equity capital consists of the tax-adjusted opportunity cost of issuing equity

$\frac{\lambda _{j}}{1+\lambda _{j}}$

, respectively. The cost of equity capital consists of the tax-adjusted opportunity cost of issuing equity

![]() $\frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}$

and the net tax burden on dividends

$\frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}$

and the net tax burden on dividends

![]() $\frac{\tau _{D}-\tau _{V}}{1-\tau _{V}}i^{E}$

. The cost of debt capital is made up of the tax-adjusted opportunity cost of issuing corporate bonds

$\frac{\tau _{D}-\tau _{V}}{1-\tau _{V}}i^{E}$

. The cost of debt capital is made up of the tax-adjusted opportunity cost of issuing corporate bonds

![]() $(1-\tau _{\Pi })\overline{i}$

and the tax-adjusted agency cost of holding corporate bonds

$(1-\tau _{\Pi })\overline{i}$

and the tax-adjusted agency cost of holding corporate bonds

![]() $\frac{1-\tau _{\Pi }}{1-\tau _{B}}\sigma _{j}$

. With the interest rate on risk-free government bonds as the benchmark return for which households are willing to supply loanable funds (i.e. hold risk assets including equities and corporate bonds), the nominal WACC can be alternatively expressed as:

$\frac{1-\tau _{\Pi }}{1-\tau _{B}}\sigma _{j}$

. With the interest rate on risk-free government bonds as the benchmark return for which households are willing to supply loanable funds (i.e. hold risk assets including equities and corporate bonds), the nominal WACC can be alternatively expressed as:

![]() $\Gamma =\overline{i}+\frac{1}{1+\lambda _{j}}(C^{E}-\overline{i})+\frac{\lambda _{j}}{1+\lambda _{j}}(C^{B}-\overline{i})$

, which conveys the viewpoint of Bernanke and Gertler (Reference Bernanke and Gertler1995) in the sense that the firm’s cost of capital consists of the riskless interest rate

$\Gamma =\overline{i}+\frac{1}{1+\lambda _{j}}(C^{E}-\overline{i})+\frac{\lambda _{j}}{1+\lambda _{j}}(C^{B}-\overline{i})$

, which conveys the viewpoint of Bernanke and Gertler (Reference Bernanke and Gertler1995) in the sense that the firm’s cost of capital consists of the riskless interest rate

![]() $\overline{i}$

and the weighted wedges between the cost of equity capital

$\overline{i}$

and the weighted wedges between the cost of equity capital

![]() $(C^{E}-\overline{i})$

and that of debt capital

$(C^{E}-\overline{i})$

and that of debt capital

![]() $(C^{B}-\overline{i})$

. Most notably, in our model firms collect funds via issuing equities and corporate bonds, and, accordingly, their capital structure (the debt-equity ratio) is endogenously determined. Through the financial channel (or the balance sheet channel), any fiscal (

$(C^{B}-\overline{i})$

. Most notably, in our model firms collect funds via issuing equities and corporate bonds, and, accordingly, their capital structure (the debt-equity ratio) is endogenously determined. Through the financial channel (or the balance sheet channel), any fiscal (

![]() $\tau _{D},\tau _{B},\tau _{\Pi },\tau _{V}$

) or monetary policy (

$\tau _{D},\tau _{B},\tau _{\Pi },\tau _{V}$

) or monetary policy (

![]() $\overline{i}$

) which affects the firm’s WACC will influence economic growth.

$\overline{i}$

) which affects the firm’s WACC will influence economic growth.

To construct the firm’s objective function, we solve (18) for

![]() $\Omega _{j}(t)$

. Accordingly, the intermediate-good firm’s objective is assumed to be its initial market value of total assets

$\Omega _{j}(t)$

. Accordingly, the intermediate-good firm’s objective is assumed to be its initial market value of total assets

![]() $\Omega _{j}(0)$

, as in Osterberg (Reference Osterberg1989) and Turnovsky (Reference Turnovsky1990), as follows:Footnote

10

$\Omega _{j}(0)$

, as in Osterberg (Reference Osterberg1989) and Turnovsky (Reference Turnovsky1990), as follows:Footnote

10

Equation (21) indicates that the market value of total assets

![]() $\Omega _{j}(0)$

reflects the discounted value of the firm’s lifetime post-tax cash flow. It should be noted that

$\Omega _{j}(0)$

reflects the discounted value of the firm’s lifetime post-tax cash flow. It should be noted that

![]() $\Gamma _{j}$

is a function of variables related to financial structure, whereas

$\Gamma _{j}$

is a function of variables related to financial structure, whereas

![]() $\omega _{j}$

is a function of variables related to production. Thus, the intermediate-good firm can make its optimal choice based on the following sequential procedure. As in Osterberg (Reference Osterberg1989), subject to the evolution of quality (14) and (15) and given the initial values of

$\omega _{j}$

is a function of variables related to production. Thus, the intermediate-good firm can make its optimal choice based on the following sequential procedure. As in Osterberg (Reference Osterberg1989), subject to the evolution of quality (14) and (15) and given the initial values of

![]() $z_{j}(0)$

,

$z_{j}(0)$

,

![]() $B_{j}^{F}(0)$

, and

$B_{j}^{F}(0)$

, and

![]() $E_{j}(0)$

, the intermediate-good firm first chooses

$E_{j}(0)$

, the intermediate-good firm first chooses

![]() $x_{j}$

,

$x_{j}$

,

![]() $P_{x_{j}}$

,

$P_{x_{j}}$

,

![]() $I_{j}$

, and

$I_{j}$

, and

![]() $z_{j}$

to maximize (21) and then chooses

$z_{j}$

to maximize (21) and then chooses

![]() $\lambda _{j}$

to minimize the nominal WACC of (20).

$\lambda _{j}$

to minimize the nominal WACC of (20).

Under the symmetric equilibrium, the optimality conditions for a typical intermediate-good firm’s optimization problem are given by:

(14), (15), and the transversality conditions

where

![]() $0\lt \tilde{\tau }=1-\frac{\left ( 1-\tau _{\Pi }\right ) \left ( 1-\tau _{V}\right ) }{1-\tau _{B}}\lt 1$

is defined as the effective tax advantage of issuing debt and

$0\lt \tilde{\tau }=1-\frac{\left ( 1-\tau _{\Pi }\right ) \left ( 1-\tau _{V}\right ) }{1-\tau _{B}}\lt 1$

is defined as the effective tax advantage of issuing debt and

![]() $\Psi ^{In}=(1-\tau _{\Pi })\alpha \frac{1-\theta }{\theta }\frac{x}{z}$

is denoted as the incumbent’s tax-adjusted marginal product of raising product quality. Equation (22) describes how the intermediate-good firm decides its optimal output

$\Psi ^{In}=(1-\tau _{\Pi })\alpha \frac{1-\theta }{\theta }\frac{x}{z}$

is denoted as the incumbent’s tax-adjusted marginal product of raising product quality. Equation (22) describes how the intermediate-good firm decides its optimal output

![]() $x$

. The intermediate-good firm’s pricing rule (23) indicates that the price of the intermediate goods

$x$

. The intermediate-good firm’s pricing rule (23) indicates that the price of the intermediate goods

![]() $P_{x}$

decreases with the final-good production elasticity with respect to intermediate goods

$P_{x}$

decreases with the final-good production elasticity with respect to intermediate goods

![]() $\theta$

. Equation (24) equates the price of final goods to the average price of product quality, which reflects the fact that final goods can be either consumed or invested in R&D that raises the quality of intermediate goods. Equation (25) refers to the equality between the marginal product of quality and the user cost of capital; that is, the tax-adjusted marginal product of quality

$\theta$

. Equation (24) equates the price of final goods to the average price of product quality, which reflects the fact that final goods can be either consumed or invested in R&D that raises the quality of intermediate goods. Equation (25) refers to the equality between the marginal product of quality and the user cost of capital; that is, the tax-adjusted marginal product of quality

![]() $\Psi ^{In}$

equals the real WACC (net of the inflation rate)

$\Psi ^{In}$

equals the real WACC (net of the inflation rate)

![]() $\Gamma -\pi$

. Equation (26) pins down the optimal debt-equity ratio, indicating that the relative advantages of debt (corporate bonds) to equity financing should be balanced by the disadvantage of debt stemming from its agency costs.

$\Gamma -\pi$

. Equation (26) pins down the optimal debt-equity ratio, indicating that the relative advantages of debt (corporate bonds) to equity financing should be balanced by the disadvantage of debt stemming from its agency costs.

In particular, the relative advantages of debt to equity financing (the LHS of (26)) consist of two components. One is the tax shield effect (captured by

![]() $\tilde{\tau } ( 1-\tau _{B} ) \overline{i}$

) which is raised by Modigliani and Miller (Reference Modigliani and Miller1963). Intuitively, a higher corporate tax

$\tilde{\tau } ( 1-\tau _{B} ) \overline{i}$

) which is raised by Modigliani and Miller (Reference Modigliani and Miller1963). Intuitively, a higher corporate tax

![]() $\tau _{\Pi }$

induces the intermediate-good firm to raise its debt-equity ratio

$\tau _{\Pi }$

induces the intermediate-good firm to raise its debt-equity ratio

![]() $\lambda$

because the interest payment for corporate bonds, as shown in (16) and (17), reduces the firm’s profits but escapes from the corporate tax. Therefore, issuing corporate bonds provides a tax shield that results in a reduction of taxable corporate taxes. The tax shield effect is crucial for our analysis. For example, the tax shield effect plays an important role in affecting the growth effect of monetary policy via implementing a nominal interest rate peg

$\lambda$

because the interest payment for corporate bonds, as shown in (16) and (17), reduces the firm’s profits but escapes from the corporate tax. Therefore, issuing corporate bonds provides a tax shield that results in a reduction of taxable corporate taxes. The tax shield effect is crucial for our analysis. For example, the tax shield effect plays an important role in affecting the growth effect of monetary policy via implementing a nominal interest rate peg

![]() $\overline{i}$

. The other one reflects the cost efficiency effect of issuing corporate bonds (captured by

$\overline{i}$

. The other one reflects the cost efficiency effect of issuing corporate bonds (captured by

![]() $ ( \tau _{D}-\tau _{V} ) i^{E}$

). In the presence of a higher dividend income tax (net of the tax rate imposed on the capital gains of outstanding equities), households are inclined to hold more corporate bonds and fewer equities due to a lower return on equities. This implies, as shown in (20), the user cost of equity capital

$ ( \tau _{D}-\tau _{V} ) i^{E}$

). In the presence of a higher dividend income tax (net of the tax rate imposed on the capital gains of outstanding equities), households are inclined to hold more corporate bonds and fewer equities due to a lower return on equities. This implies, as shown in (20), the user cost of equity capital

![]() $C^{E}=\left ( \frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}+\frac{\tau _{D}-\tau _{V}}{1-\tau _{V}}i^{E}\right )$

becomes higher as

$C^{E}=\left ( \frac{1-\tau _{B}}{1-\tau _{V}}\overline{i}+\frac{\tau _{D}-\tau _{V}}{1-\tau _{V}}i^{E}\right )$

becomes higher as

![]() $ ( \tau _{D}-\tau _{V} )$

rises. As a result, firms can collect external funds more efficiently by issuing corporate bonds.

$ ( \tau _{D}-\tau _{V} )$

rises. As a result, firms can collect external funds more efficiently by issuing corporate bonds.

In practice, the tax shield effect must be substantially large so that firms are willing to use relatively costly debt (

![]() $\lambda \gt 0$

) as their external funds to engage in investment (see Strulik (Reference Strulik2003, Reference Strulik2008) for a more detailed illustration). The importance of the tax shield is supported by empirical studies, such as Bradley et al. (Reference Bradley, Jarrell and Kim1984) and Booth et al. (Reference Booth, Aivazian, Demirguc-Kunt and Maksimovic2001). In our model, we assume a substantially large tax shield effect (a sufficient but not necessary condition) in order to ensure a non-negative ratio of debt to equity. Accordingly, we have:

$\lambda \gt 0$

) as their external funds to engage in investment (see Strulik (Reference Strulik2003, Reference Strulik2008) for a more detailed illustration). The importance of the tax shield is supported by empirical studies, such as Bradley et al. (Reference Bradley, Jarrell and Kim1984) and Booth et al. (Reference Booth, Aivazian, Demirguc-Kunt and Maksimovic2001). In our model, we assume a substantially large tax shield effect (a sufficient but not necessary condition) in order to ensure a non-negative ratio of debt to equity. Accordingly, we have:

Assumption 2. (Interior solution for the optimal debt-equity ratio)

By the implicit-function theorem, we can use (26) with Assumption 2 to obtain the optimal debt-equity ratio, denoted by

![]() $\tilde{\lambda }$

:Footnote

11

$\tilde{\lambda }$

:Footnote

11

It easily follows from (20) that the user cost of issuing equity

![]() $C^{E}$

increases with the dividend income tax

$C^{E}$

increases with the dividend income tax

![]() $\tau _{D}$

and decreases with the corporate bond income tax

$\tau _{D}$

and decreases with the corporate bond income tax

![]() $\tau _{B}$

, while the user cost of issuing corporate bonds

$\tau _{B}$

, while the user cost of issuing corporate bonds

![]() $C^{B}$

decreases with the corporate tax

$C^{B}$

decreases with the corporate tax

![]() $\tau _{\Pi }$

and increases with the corporate bond income tax

$\tau _{\Pi }$

and increases with the corporate bond income tax

![]() $\tau _{B}$

. Thus, to minimize the WACC, the debt-equity ratio

$\tau _{B}$

. Thus, to minimize the WACC, the debt-equity ratio

![]() $\tilde{\lambda }$

is positively related to

$\tilde{\lambda }$

is positively related to

![]() $\tau _{D}$

and

$\tau _{D}$

and

![]() $\tau _{\Pi }$

but negatively related to

$\tau _{\Pi }$

but negatively related to

![]() $\tau _{B}$

. Since the tax on the capital gains of outstanding equities

$\tau _{B}$

. Since the tax on the capital gains of outstanding equities

![]() $\tau _{V}$

may increase (via the tax-adjusted opportunity cost of issuing equity) or decrease (via the net tax burden on dividends) the user cost of issuing equity

$\tau _{V}$

may increase (via the tax-adjusted opportunity cost of issuing equity) or decrease (via the net tax burden on dividends) the user cost of issuing equity

![]() $C^{E}$

, the relationship between

$C^{E}$

, the relationship between

![]() $\tilde{\lambda }$

and

$\tilde{\lambda }$

and

![]() $\tau _{V}$

is ambiguous. In addition, a higher nominal interest rate

$\tau _{V}$

is ambiguous. In addition, a higher nominal interest rate

![]() $\overline{i}$

induces firms to rely more on debt financing, rather than on equity financing, in the presence of the tax shield effect (

$\overline{i}$

induces firms to rely more on debt financing, rather than on equity financing, in the presence of the tax shield effect (

![]() $0\lt \tilde{\tau }\lt 1$

). Finally, substituting (26) and (27) into (20) allows us to further obtain the optimal nominal WACC, denoted by

$0\lt \tilde{\tau }\lt 1$

). Finally, substituting (26) and (27) into (20) allows us to further obtain the optimal nominal WACC, denoted by

![]() $\tilde{\Gamma }$

, as follows:

$\tilde{\Gamma }$

, as follows:

Entrants

By following Peretto (Reference Peretto2007, Reference Peretto2011), setting up a firm is assumed to require

![]() $\beta z$

units of final output, where

$\beta z$

units of final output, where

![]() $\beta \gt 1$

, capturing the fact that entrants have to pay additional setup costs (

$\beta \gt 1$

, capturing the fact that entrants have to pay additional setup costs (

![]() $P\beta z$

) that incumbents have already paid. Due to the additional setup cost, new firms introduce a new good to engage in a Bertrand competition with the incumbent monopolist. The entry of new firms thus expands product variety.

$P\beta z$

) that incumbents have already paid. Due to the additional setup cost, new firms introduce a new good to engage in a Bertrand competition with the incumbent monopolist. The entry of new firms thus expands product variety.

Similar to incumbents, new entrants can issue equity and debt to finance their entry. While this specification is realistic, it is different from a common treatment in the literature; for example, Peretto (Reference Peretto2007, Reference Peretto2011) assumes that, for simplicity, new firms finance their entry by issuing equity only. In the spirit of Modigliani and Miller (Reference Modigliani and Miller1958, p. 268), the funds raised for the entrants equal the sum of the expected market value of the firm (i.e.

![]() $\Omega$

, the discounted value of the firm’s lifetime net cash flow, as shown in (21)).Footnote

12

That is, the post-entry profit that accrues to an entrant is given by the expression derived for a typical incumbent, as in Peretto (Reference Peretto2007, Reference Peretto2011). With an endogenous financial structure, if the discounted value of the entrant’s lifetime net cash flow (profit stream)

$\Omega$

, the discounted value of the firm’s lifetime net cash flow, as shown in (21)).Footnote

12

That is, the post-entry profit that accrues to an entrant is given by the expression derived for a typical incumbent, as in Peretto (Reference Peretto2007, Reference Peretto2011). With an endogenous financial structure, if the discounted value of the entrant’s lifetime net cash flow (profit stream)

![]() $\Omega$

is larger (resp. less) than its setup cost, entry is positive (resp. negative). In equilibrium the free-entry (the no-arbitrage) condition holds, that is:

$\Omega$

is larger (resp. less) than its setup cost, entry is positive (resp. negative). In equilibrium the free-entry (the no-arbitrage) condition holds, that is:

Note that

![]() $\frac{1}{\beta }$

, as we will see later, captures the extent of an entrant’s productivity. To derive the equity price evaluated in the financial market, we take logs and time derivatives of (29). Substituting (14), (15), (16), (17), and (24) into the resulting equation, we have:

$\frac{1}{\beta }$

, as we will see later, captures the extent of an entrant’s productivity. To derive the equity price evaluated in the financial market, we take logs and time derivatives of (29). Substituting (14), (15), (16), (17), and (24) into the resulting equation, we have:

Equation (30) illustrates the evolution of the reserved equity price under endogenous entry. If the issue price of the equity is higher (lower) than the reserved equity price, the funds raised will be large (will not be large) enough to cover the setup cost, leading the entrant to enter (stay out of) the market. It essentially describes how entrants (new firms) require loanable funds.

2.3. The government (monetary authority)

A nominal interest rate peg is implemented by targeting the nominal level of the interest rate on government bonds

![]() $\overline{i}$

. By letting the growth rate of money be

$\overline{i}$

. By letting the growth rate of money be

![]() $\mu =\dot{M}/M$

, the evolution of real money balances is

$\mu =\dot{M}/M$

, the evolution of real money balances is

![]() $\frac{\dot{m}}{m}=\mu -\pi$

. Accordingly, the government (monetary authority) endogenously adjusts the money growth rate

$\frac{\dot{m}}{m}=\mu -\pi$

. Accordingly, the government (monetary authority) endogenously adjusts the money growth rate

![]() $\mu$

(by purchasing/selling government bonds in the open market) to whatever level is needed for the targeted interest rate

$\mu$

(by purchasing/selling government bonds in the open market) to whatever level is needed for the targeted interest rate

![]() $\overline{i}$

to prevail.

$\overline{i}$

to prevail.

In addition, the government runs a balanced budget. It spends government consumption

![]() $Pg$

, provides lump-sum transfers

$Pg$

, provides lump-sum transfers

![]() $T$

to households, and also pays interest to government-bond holders

$T$

to households, and also pays interest to government-bond holders

![]() $\overline{i}B^{G}$

. To finance these expenditures, the government taxes the consumption, labor income, government/corporate bonds yields, the dividend income of equities, and the capital gains on households, while it levies the corporate tax on the profits of intermediate-good firms. Besides, the government’s expenditures can be financed by issuing bonds and money. Thus, the government budget constraint is given by:

$\overline{i}B^{G}$

. To finance these expenditures, the government taxes the consumption, labor income, government/corporate bonds yields, the dividend income of equities, and the capital gains on households, while it levies the corporate tax on the profits of intermediate-good firms. Besides, the government’s expenditures can be financed by issuing bonds and money. Thus, the government budget constraint is given by:

In the endogenous growth model, we must assume that the government consumption is proportional to total output of final goods, that is,

![]() $g=\varphi y$

, with

$g=\varphi y$

, with

![]() $0\lt \varphi \lt 1$

, to prevent it from degenerating.

$0\lt \varphi \lt 1$

, to prevent it from degenerating.

3. Competitive equilibrium

The equilibrium, as noted above, is symmetric across firms, implying that the total labor force is

![]() $L=Nl$

and

$L=Nl$

and

![]() $Z=z$

. Thus, the competitive equilibrium is defined as a tuple of paths for prices

$Z=z$

. Thus, the competitive equilibrium is defined as a tuple of paths for prices

![]() $ \{ w,i^{B},\pi \} _{t=0}^{\infty }$

, real allocations

$ \{ w,i^{B},\pi \} _{t=0}^{\infty }$

, real allocations

![]() $ \{ c,L,z,I,\mu \} _{t=0}^{\infty }$

, real assets

$ \{ c,L,z,I,\mu \} _{t=0}^{\infty }$

, real assets

![]() $ \{ b^{G},b^{F},m,E \} _{t=0}^{\infty }$

, the debt-equity ratio

$ \{ b^{G},b^{F},m,E \} _{t=0}^{\infty }$

, the debt-equity ratio

![]() $ \{ \lambda \} _{t=0}^{\infty }$

, and policy variables

$ \{ \lambda \} _{t=0}^{\infty }$

, and policy variables

![]() $ \{ \overline{i},g,\tau _{D},\tau _{\Pi },\tau _{B},\tau _{V},\tau _{c},\tau _{L},i^{E},T \} _{t=0}^{\infty }$

that satisfy:

$ \{ \overline{i},g,\tau _{D},\tau _{\Pi },\tau _{B},\tau _{V},\tau _{c},\tau _{L},i^{E},T \} _{t=0}^{\infty }$

that satisfy:

-

the representative household maximizes its lifetime utility (1), subject to the budget constraint (2), that is, the optimizing conditions (4)−(8) hold;

-

the final-good firm maximizes its profit, that is, the optimizing conditions (12)−(13) hold;

-

the intermediate-good firm maximizes its initial market value (21), that is, the optimizing conditions (14), (15), and (22)−(26) hold;

-

the budget constraints of households (2) and the government (31) as well as the financing constraints of firms (15) with the R&D investment (14) are met.

By putting (2), (11), (15), (16), (17), and (31) together, we have the economy-wide resource constraint:

which is also the clearing condition for the final-good market. Note that the agency cost (captured by

![]() $\sigma b^{F}N$

) is a kind of resource depletion which becomes a component of resource utilization in the economy’s resource constraint reported in (32). From (22) with

$\sigma b^{F}N$

) is a kind of resource depletion which becomes a component of resource utilization in the economy’s resource constraint reported in (32). From (22) with

![]() $L=Nl$

and

$L=Nl$

and

![]() $Z=z$

, the clearing condition for the intermediate-good market satisfies:

$Z=z$

, the clearing condition for the intermediate-good market satisfies:

To extract intuition from (33), we define the average gross profit to a typical incumbent brought by a quality-improving invention as

![]() $\frac{\left ( P_{x}-P\right ) x}{Qz}$

. From (23), (24), and (33), the ratio of the gross profit to quality can be expressed as:

$\frac{\left ( P_{x}-P\right ) x}{Qz}$

. From (23), (24), and (33), the ratio of the gross profit to quality can be expressed as:

This equation indicates that a higher total labor force

![]() $L$

shifts out the conditional demand for the intermediate good and, accordingly, increases the ratio of firm’s gross profit to quality. By contrast, a larger number of firms

$L$

shifts out the conditional demand for the intermediate good and, accordingly, increases the ratio of firm’s gross profit to quality. By contrast, a larger number of firms

![]() $N$

implies a lower market share per firm and thus decreases the gross profit. Note that because the firm’s market share is defined as

$N$

implies a lower market share per firm and thus decreases the gross profit. Note that because the firm’s market share is defined as

![]() $s_{j}=\frac{P_{x_{j}}x_{j}}{\int _{0}^{N}P_{x_{\varsigma }}x_{\varsigma }d\varsigma }$

(a certain firm

$s_{j}=\frac{P_{x_{j}}x_{j}}{\int _{0}^{N}P_{x_{\varsigma }}x_{\varsigma }d\varsigma }$

(a certain firm

![]() $j$

’s output divided by the industry-wide output), under the symmetric equilibrium the firm’s market share is

$j$

’s output divided by the industry-wide output), under the symmetric equilibrium the firm’s market share is

![]() $s=\frac{1}{N}$

. This implies that the growth rate of the quality innovation (

$s=\frac{1}{N}$

. This implies that the growth rate of the quality innovation (

![]() $\frac{\dot{z}}{z}$

), as we will see from (38), depends on the firm size

$\frac{\dot{z}}{z}$

), as we will see from (38), depends on the firm size

![]() $\frac{L}{N}=l$

, rather than the total labor force

$\frac{L}{N}=l$

, rather than the total labor force

![]() $L$

, and the scale effect is thereby eliminated by the endogenous market structure.

$L$

, and the scale effect is thereby eliminated by the endogenous market structure.

Moreover, from (4) and (13) with

![]() $L=Nl$

and

$L=Nl$

and

![]() $Z=z$

, the clearing condition for the labor market is:

$Z=z$

, the clearing condition for the labor market is:

where

![]() $\Theta =\frac{\delta }{1-\theta }\frac{\left ( 1+\tau _{c}\right ) +\left ( 1-\tau _{B}\right ) \overline{i}}{1-\tau _{L}}$

. With regard to the bond market, we can obtain the clearing condition for the corporate bond market from (26) and (9):

$\Theta =\frac{\delta }{1-\theta }\frac{\left ( 1+\tau _{c}\right ) +\left ( 1-\tau _{B}\right ) \overline{i}}{1-\tau _{L}}$

. With regard to the bond market, we can obtain the clearing condition for the corporate bond market from (26) and (9):

indicating that the equilibrium return rate on corporate bonds is jointly determined by the demand for and supply of bonds issued by private intermediate firms. On the other hand, the government implements a nominal interest rate peg (at the level of

![]() $\overline{i}$

) by purchasing/selling government bonds in the open market. This implies that the equilibrium condition of the government-bond market is given by (7) with the inflation rate

$\overline{i}$

) by purchasing/selling government bonds in the open market. This implies that the equilibrium condition of the government-bond market is given by (7) with the inflation rate

![]() $\pi =\Gamma -(1-\tau _{\Pi })\alpha \frac{1-\theta }{\theta }\frac{x}{z}$

obtained from (25):

$\pi =\Gamma -(1-\tau _{\Pi })\alpha \frac{1-\theta }{\theta }\frac{x}{z}$

obtained from (25):

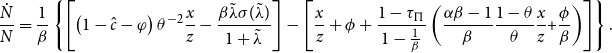

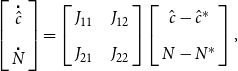

\begin{eqnarray} \frac{\dot{c}}{c} &=&\left \{ \left [ \left ( 1-\tau _{B}\right ) \overline{i}-\pi \right ] -(\widetilde{\Gamma }-\pi )\right \} +\Psi ^{In}-\rho \\[5pt] &=&\left ( 1-\tau _{B}\right ) \overline{i}-\widetilde{\Gamma }+\left ( 1-\tau _{\Pi }\right ) \alpha \frac{1-\theta }{\theta }\frac{x}{z}-\rho, \notag \end{eqnarray}

\begin{eqnarray} \frac{\dot{c}}{c} &=&\left \{ \left [ \left ( 1-\tau _{B}\right ) \overline{i}-\pi \right ] -(\widetilde{\Gamma }-\pi )\right \} +\Psi ^{In}-\rho \\[5pt] &=&\left ( 1-\tau _{B}\right ) \overline{i}-\widetilde{\Gamma }+\left ( 1-\tau _{\Pi }\right ) \alpha \frac{1-\theta }{\theta }\frac{x}{z}-\rho, \notag \end{eqnarray}

where

![]() $\widetilde{\Gamma }$

is the firm’s optimal nominal WACC reported in (28). Equation (37) is the “modified” consumption Euler equation when the financial (loanable funds) market (i.e. the equity and bond (government and corporate bonds) markets) are in existence. Equation (37) atrophies to a standard consumption Euler equation:

$\widetilde{\Gamma }$

is the firm’s optimal nominal WACC reported in (28). Equation (37) is the “modified” consumption Euler equation when the financial (loanable funds) market (i.e. the equity and bond (government and corporate bonds) markets) are in existence. Equation (37) atrophies to a standard consumption Euler equation:

![]() $\frac{\dot{c}}{c}=\Psi ^{In}-\rho$

, recalling that

$\frac{\dot{c}}{c}=\Psi ^{In}-\rho$

, recalling that

![]() $\Psi ^{In}$

is the marginal product of raising product quality if the financial friction caused by agency costs and the endogenously determined financial structure are ignored. Instead, there is an additional force—the return divergence between the supply of and demand for loanable funds,

$\Psi ^{In}$

is the marginal product of raising product quality if the financial friction caused by agency costs and the endogenously determined financial structure are ignored. Instead, there is an additional force—the return divergence between the supply of and demand for loanable funds,

![]() $ \{ [ ( 1-\tau _{B} ) \overline{i}-\pi ] -(\widetilde{\Gamma }-\pi ) \}$

, in the modified consumption Euler equation. Under the no-arbitrage condition (8),

$ \{ [ ( 1-\tau _{B} ) \overline{i}-\pi ] -(\widetilde{\Gamma }-\pi ) \}$

, in the modified consumption Euler equation. Under the no-arbitrage condition (8),

![]() $ [ ( 1-\tau _{B} ) \overline{i}-\pi ]$

captures the household’s real return from supplying loanable funds. As for the intermediate-good firm, the real user cost of capital

$ [ ( 1-\tau _{B} ) \overline{i}-\pi ]$

captures the household’s real return from supplying loanable funds. As for the intermediate-good firm, the real user cost of capital

![]() $(\widetilde{\Gamma }-\pi )$

can be thought of as the required real return for demanding loanable funds. Under Assumption 2, in the presence of financial friction the return divergence (wedge) between the supply of and demand for loanable funds,

$(\widetilde{\Gamma }-\pi )$

can be thought of as the required real return for demanding loanable funds. Under Assumption 2, in the presence of financial friction the return divergence (wedge) between the supply of and demand for loanable funds,

![]() $ ( 1-\tau _{B} ) \overline{i}-\widetilde{\Gamma }$

, will play an important role in affecting the consumption growth (or the balanced growth), as will be clear below.Footnote

13

$ ( 1-\tau _{B} ) \overline{i}-\widetilde{\Gamma }$

, will play an important role in affecting the consumption growth (or the balanced growth), as will be clear below.Footnote

13

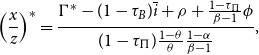

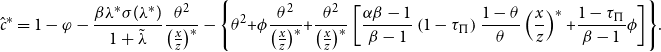

Finally, the equity market equilibrium is obtained by equating the demand for equities (i.e. equation (10)) to the supply of equities (substituting (16), (23), and (25) into (30)):

where

![]() $\Psi ^{In}=(1-\tau _{\Pi })\alpha \frac{1-\theta }{\theta }\frac{x}{z}$

is the incumbent’s tax-adjusted marginal product of R&D (see (25)) and

$\Psi ^{In}=(1-\tau _{\Pi })\alpha \frac{1-\theta }{\theta }\frac{x}{z}$

is the incumbent’s tax-adjusted marginal product of R&D (see (25)) and

![]() $\Psi ^{En}=\frac{1-\tau _{\Pi }}{\beta }(\frac{1-\theta }{\theta }\frac{x}{z}-\phi )$

is the counterpart entrant’s tax-adjusted marginal product of R&D. The quantity-quality ratio of intermediate goods

$\Psi ^{En}=\frac{1-\tau _{\Pi }}{\beta }(\frac{1-\theta }{\theta }\frac{x}{z}-\phi )$

is the counterpart entrant’s tax-adjusted marginal product of R&D. The quantity-quality ratio of intermediate goods

![]() $\frac{x}{z}$

affects not only the gross profit (see (34)) but also the firm size (see (33) with

$\frac{x}{z}$

affects not only the gross profit (see (34)) but also the firm size (see (33) with

![]() $\frac{L}{N}=l$

). Note that, the existence of an extra sunk cost weakens the entrant’s R&D productivity, captured by

$\frac{L}{N}=l$

). Note that, the existence of an extra sunk cost weakens the entrant’s R&D productivity, captured by

![]() $\frac{1}{\beta }$

. In the model, incumbents engage in in-house R&D (the vertical R&D) to raise the product quality for higher profits, which thereby entails an incentive for innovation

$\frac{1}{\beta }$

. In the model, incumbents engage in in-house R&D (the vertical R&D) to raise the product quality for higher profits, which thereby entails an incentive for innovation

![]() $z$

. New firms (entrepreneurs) enter the market by engaging in variety-expanding R&D (the horizontal R&D), and the new products compete with those of the incumbents for market share. If the competition from new products decreases the (endogenously determined) incumbent’s market share, entry gives rise to a disincentive effect on the quality innovation

$z$

. New firms (entrepreneurs) enter the market by engaging in variety-expanding R&D (the horizontal R&D), and the new products compete with those of the incumbents for market share. If the competition from new products decreases the (endogenously determined) incumbent’s market share, entry gives rise to a disincentive effect on the quality innovation

![]() $z$

. Thus, the growth rate of

$z$

. Thus, the growth rate of

![]() $z$

, as shown in (38), increases with

$z$

, as shown in (38), increases with

![]() $\Psi ^{In}$

but decreases with

$\Psi ^{In}$

but decreases with

![]() $\Psi ^{En}$

. As noted above, the competition between incumbents and entrants, on the one hand, endogenizes the market structure (the firm size and the number of firms) and, on the other hand, eliminates the scale effect (i.e. the growth rate

$\Psi ^{En}$

. As noted above, the competition between incumbents and entrants, on the one hand, endogenizes the market structure (the firm size and the number of firms) and, on the other hand, eliminates the scale effect (i.e. the growth rate

![]() $\frac{\dot{z}}{z}$

depends on the firm size

$\frac{\dot{z}}{z}$

depends on the firm size

![]() $\frac{L}{N}=l$

, rather than on the total labor force

$\frac{L}{N}=l$

, rather than on the total labor force

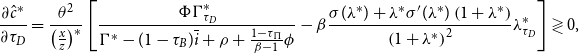

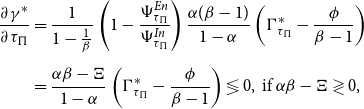

![]() $L$