1. Introduction

Large cities in Western countries have seen a return of the housing question, as rents and house price surges have made urban housing more and more unaffordable (Le Galès and Pierson, Reference Le Galès and Pierson2019). With many demand-side subsidies for homeowners only increasing mortgage debt and house prices and with the many undesirable side-effects of rent regulation, national and local governments have been reconsidering the old supply-side policy option of social housing, i.e. a publicly subsidized below-market-rent form of tenancy provided by non-profit associations, local authorities, and even private actors. Long thought a relic of the past, the ongoing housing affordability problems have put social housing back on the political agenda, as the era of homeownership-only policies subsided after the Global Financial Crisis 2008–2009. Yet, while social housing has been the subject of many individual-country studies, country-comparative research, let alone of longer historical time horizons, has largely been missing since the global assessments of the 1980s/1990s. In comparison to the sophisticated comparative OECD studies of the social-insurance-based welfare state, the comparative study of the housing welfare state is still as wobbly a pillar as its object of study is in modern welfare state research (Torgersen, Reference Torgersen1987).

This omission is similar in the varieties of capitalism (VoC) approach, even in its extension into the “varieties of residential capitalism”, where mortgage debt and homeownership appear more important than social housing in defining housing regimes (Schwartz and Seabrooke, Reference Schwartz and Seabrooke2008), not least because they have been more easily measurable. What VoC, but also the more recent growth-model literature tend to overlook – due to their focus on manufacturing, exports and finance – is the construction sector in the economy, where social housing was an important element in Keynesian macro-economic demand management (Kohl and Spielau, Reference Kohl and Spielau2022). The important role of housing as a “macroeconomic resource” has also recently been emphasized in the context of assetized homeownership (Stirling et al., Reference Stirling, Gallent and Purves2022).

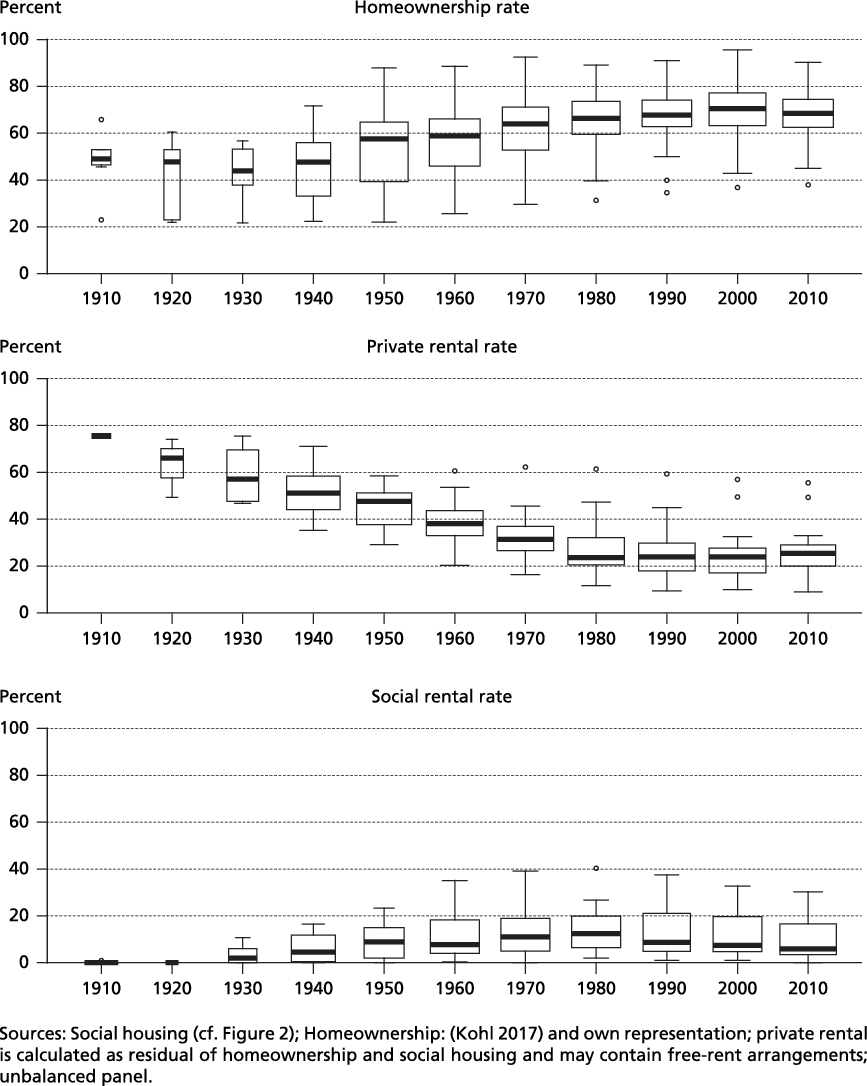

The comparative history of housing tenures over the last century has variously been described as one of almost uninterrupted homeownership expansion (Atterhög, Reference Atterhög, Doling and Elsinga2006; Doling, Reference Doling1997; Kohl, Reference Kohl2017), at the expense of private rental markets (Harloe, Reference Harloe1985), interrupted by the rise and fall of social housing (Harloe, Reference Harloe1995). While benchmark time series data have allowed for at least a historical reconstruction of the homeownership trajectory, few comparative data have been available to describe the long-run development of the private and public rental housing stock, even though the majority of the population of the countries under study lived in rental arrangements until the 1970s (cf. Figure 1). Existing works usually refer to snapshots or describe singular country trajectories. Building on many of these prior contributions, this study sets out to fill this gap by presenting detailed historical data for national social housing stock shares since 1945 in forty-eight countries, social housing construction data mostly since the 1920s, and social housing in major cities of selected countries since the 1920s.

Figure 1. Evolution of the major housing tenures worldwide, 1910–2010.

This unique historical-comparative data collection summarized in Figure 1 shows that the global trend is best described by a rise of social housing in the early 20th century, with strong advances in the two postwar periods, a peak around the 1970s, and decline ever since. All countries participated in this trend to various extents. Yet, while the Anglophone and Southern European countries never developed substantial social housing, the decline was steepest in socialist countries, with Northwestern European countries in between. Among these, social housing retrenchment is still very heterogeneous, ranging from strong resilience to almost complete disappearance. The construction history and urban-level social housing rates confirm this general national picture. In comparison to social insurances, retrenchment and recommodification was generally more pronounced in social housing. Figure 1 also reveals that social housing rose for a long time in parallel with homeownership at the joint cost of private rentals but did not benefit from the post-2008 homeownership decline, which rather produced a comeback of private rather than social rentals.

Social housing itself, however, is only one component of the broader housing welfare state, which consists of budget-neutral tenancy and mortgage regulation and of budget-heavier rent allowances, fiscal exemptions, and homeownership subsidies. By combining the social housing database with the most comprehensive existing data describing these other housing welfare dimensions, we show that social housing correlates positively with rental regulation and housing allowances, but negatively with homeownership subsidies and liberal mortgage regulation. Housing regimes are divided over whether they support tenancy or mortgaged homeownership and have shifted towards the latter over time.

Our dynamic multivariate analysis seeks to understand the determinants of social housing. Contrary to conventional welfare state literature, we do not find clear effects of economic development or governments’ left-right orientation, but rather see social housing driven by housing shortages and demographics as well as by complementarities with private-rent regulation and the general welfare state: countries regulating private rentals compensate the loss of private production through social housing and generous welfare states also afford larger social housing shares.

The article first contributes to recent attempts to map the housing welfare state, whose quantitative assessment has been lagging behind the more traditional welfare state with its focus on the decommodification of labor. One simple reason for this is the absence of a comparable data view on the phenomenon. Although comparative analyses have produced extensive statistical data (in particular Balchin, Reference Balchin2013; Ball et al., Reference Ball, Harloe and Martens1988; Crook and Kemp, Reference Crook and Kemp2014; Donner, Reference Donner2000; Haffner et al., Reference Haffner, Hoekstra, Oxley and van der Heijden2009; Scanlon et al., Reference Scanlon, Whitehead and Arrigoitia2014), a systematic collection and analysis of historical data has been lacking to date. The OECD housing affordability data have only recently provided a first comparative snapshot picture, while historical time series are still missing. We document the country-specific evolution of social housing and all sources used in a separate long Appendix. The data themselves are visualized and shared through a website.Footnote 1

Second, we challenge simple accounts that see housing working much as other welfare domains: social housing is much more associated with basic housing provision needs, a trade-off with the homeownership segment and complementarity with stricter private rental regulation than with explanatory factors from welfare state research. Finally, in the realm of housing policy, the paper also contributes to a recent rise in interest in this social form of housing tenure, which during the recent trade-off between declines of homeownership and the rise of “generation rent” had been slightly forgotten (Lund, Reference Lund2013). Comparative housing research started with making social housing the central feature for the so-called comprehensive housing regimes (Donnison, Reference Donnison1967), where large parts of the population were in principle eligible for social housing. Among the first researchers to develop a systematic approach to the comparative analysis of housing provision were Ball et al. (Reference Ball, Harloe and Martens1988), who elaborated a typology of different housing provisions (Ball and Harloe, Reference Ball and Harloe1992). Witnessing the attack on the postwar model, they developed a periodization in distinguishing two periods of mass social housing provision that occurred in many European countries after both world wars and which were conceptualized as temporarily interrupting the dominant residual model (Ball, Reference Ball1986; Harloe and Martens, Reference Harloe and Martens1984; Harloe, Reference Harloe1985, Reference Harloe1995). Kemeny and Lowe (Reference Kemeny and Lowe2005) have famously challenged their underlying assumption of universal trends. In his well-known critique of both particularistic and convergence approaches, Kemeny proposed his own divergence thesis consisting of typologies of housing systems. However, social housing provision was equally central to Kemeny’s seminal typology: countries with dualist rental markets tended to residualize and stigmatize social housing contrary to integrated rental markets (Kemeny, Reference Kemeny1995).

Harloe’s and Kemeny’s distinctions between mass (resp. unitary) and residual (resp. dualist) social housing remain strongly influential and research continues to oscillate around the questions of whether to emphasize differences or similarities, convergence or divergence (Malpass, Reference Malpass2014). However, the notion of social housing and its relation to the welfare state has undergone several rounds of reconceptualization in the last decades (Ball, Reference Ball2020; Poggio and Whitehead, Reference Poggio and Whitehead2017; Priemus and Dieleman, Reference Priemus and Dieleman2002; Stephens, Reference Stephens2016, Reference Stephens2020; Van Der Heijden, Reference Van Der Heijden2013). The predominant narrative has until very recently been one of an increasing erosion of social housing (in terms of tenure, funding, provision, etc.) and one in favor of owner occupation. Researchers have described the withdrawal of the state, financialization, and more market-oriented solutions since the 1970s and pointed to residualization and the emergence of new, more diverse forms of social housing, including forms of social homeownership and more hybrid patterns of financing, construction, and management (Czischke, Reference Czischke2009; Harloe, Reference Harloe1995; Mullins et al., Reference Mullins, Czischke and van Bortel2012; Ronald, Reference Ronald2013; Tunstall, Reference Tunstall2021; Wainwright and Manville, Reference Wainwright and Manville2017). In this vein, Haffner et al. (Reference Haffner, Hoekstra, Oxley and van der Heijden2009) have argued that the boundaries between social and private housing have become increasingly blurred, as commercially oriented investors are more and more involved in social housing and policy purposes aimed at wider objectives.

However, as the authors themselves reveal in their comparative analysis, a persistent gap between social and market rental housing seems nevertheless to remain. With regard to target groups, providers, policy instruments, and competition within and between the two sectors, a large divide has persisted – albeit with important country-specific variations (Haffner et al., Reference Haffner, Hoekstra, Oxley and van der Heijden2009). This is equally echoed in recent research: the Global Financial Crisis with its decline in homeownership and a remarkable comeback of the private rental market accompanied by the emergence of a “generation rent” (Arundel and Doling, Reference Arundel and Doling2017; Byrne, Reference Byrne2020; Ronald and Kadi, Reference Ronald and Kadi2018) shed new light on housing issues and recent years have witnessed a growing interest in comparative analysis of both the private rental sector (Crook and Kemp, Reference Crook and Kemp2014; Monk et al., Reference Monk, Markkanen, Scanlon and Whitehead2012; Oxley et al., Reference Oxley, Lishman, Brown, Haffner and Hoekstra2010) and social housing (Hegedus et al., Reference Hegedus, Lux and Teller2013; Whitehead and Scanlon, Reference Whitehead and Scanlon2007; Whitehead, Reference Whitehead2017). Although the share of social housing has declined in almost all Western countries, it has proven “to be both flexible and robust” (Scanlon et al., Reference Scanlon, Whitehead and Arrigoitia2014, p. 443) and “surprisingly resilient” (Blackwell and Bengtsson, Reference Blackwell and Bengtsson2021, p. 1) in several countries over the years.

The paper is organized as follows. In the next section, we present how we constructed our historical-comparative database of social housing. This requires a country- and time-consistent definition of what housing is and brief narratives of social housing development in every country. Together with detailed country reports in the Appendix, this section should also caution against demanding too much of the available data: the harmonization allows for broad cross-country and over-time comparisons through interpolated time series but not for point comparisons of decimal digits. Due to data availability we are also restricted to countries of the Global North, even though the descriptive inclusion of all former Soviet Republics, Eastern Europe, and Japan makes it less centered on Western countries than OECD studies of social expenditure. We then present our main descriptive over-time and cross-country results for social housing stocks and construction flows and correlate social housing with other housing variables. In a multivariate section, we develop an empirical model to locate the explanatory determinants of social housing. In the discussion section, we situate social housing in the broader housing welfare state. The conclusion highlights the difficulty of typologizing housing regimes and makes a case for extending research on decommodified housing as part of general welfare state research.

2 Social housing: What it is and how to measure it?

Every comparative study of shares of social housing has to begin with a proper definition of the object of investigation. Social housing is usually understood as being distinct from privately rented housing, on the one hand, and home ownership, on the other. Yet, while the term is well understood as a matter of common sense, a broadly accepted positive definition of social housing is lacking. Scholars rely generally on working definitions.

For our purposes, an applicable definition of social housing in comparative perspective has to meet three criteria. It needs to be: 1) sufficiently narrow to adequately describe the individual social housing systems in each country; 2) broad enough to allow for international comparison; and 3) quantifiable by statistical data with consistency over time. Although the description of the welfare systems of housing is fairly manageable for individual countries, data constraints make comparisons challenging. As Scanlon et al. (Reference Scanlon, Whitehead and Arrigoitia2014, p. 3) have noted, it is “impossible to provide entirely consistent comparative figures for the stock of social housing, both because different countries define the tenure in different ways and because of the limitations of the data.” This applies even more to historical series, in which both differences between countries and intranational developments of individual countries/cities over time have to be considered.

Scholars tend to apply pragmatic definitions in order to take into account the very diverse forms of social housing provision. According to Blackwell and Bengtsson (Reference Blackwell and Bengtsson2021, p. 2), social housing is often referred to as “rental housing that is operated on the basis of meeting housing need and not primarily in order to make profit for the landlord.” However, as we show in the following, such definitions already contain restrictive qualifications that require explanation. Following Granath Hansson and Lundgren (Reference Granath Hansson and Lundgren2019), at least five criteria can be identified to characterize social housing systems: the target group, type of tenure, type of provider, subsidies, and public intervention. To begin with, rather than offering a narrow positive definition, we define social housing ex negativo by what it does not include.

Target groups

Target groups are mostly defined as households that are in some kind of “need,” i.e. having problems accessing an appropriate dwelling (Blackwell and Bengtsson, Reference Blackwell and Bengtsson2021; Haffner et al., Reference Haffner, Hoekstra, Oxley and van der Heijden2009). Existing literature identifies low-income households in particular as belonging to this group. However, in many countries social housing was – especially in the postwar period – and still is aimed at the broad middle class in European countries. By understanding the population “in need” as a fluid group, defined in political processes, we do not find this narrow definition too helpful.

Type of tenure

Historically, the majority of public housing was occupied by renters. However countries such as Ireland or Iceland have known forms of socialized homeownership in which access to housing for large portions of the population has been heavily subsidized (Norris, Reference Norris2016a; Sveinsson, Reference Sveinsson, Bengtsson, Annaniassen, Jensen, Ruonavaara and Sveinsson2006). These units sometimes figure in overall construction statistics, but are very difficult to survey in the stock, let alone after decades have passed. Therefore, we exclude socialized homeownership from our narrower definition of social rentals, but refer to some of these programs in the discussion section.

Type of provider

Most social housing was and is owned by public authorities or by providers who voluntarily commit to legally or institutionally bounded rents permanently or temporarily to limited or non-profit levels (sometimes referred as non-profit principles). These include not only organizations such as housing associations or cooperatives, but also private providers, as exemplified by the case of Germany (see Appendix). We do, however, identify three other forms of affordable housing that we want to exclude from our data set. First, there exists a relatively broad rental sector of for-profit providers who offer housing below market rates for various reasons, e.g. by not adjusting rents to inflation or by demanding lower rents out of goodwill (voluntariness). We further consider market housing under a regime of rent control (coercion) as well as those eligible for rent allowances as being outside the social housing sector. We look at these instruments in more depth in the discussion.

Subsidies and public intervention

Numerous researchers have for very good reasons drawn attention to the close relationship between public intervention and subsidies, on the one hand, and social housing, on the other. We emphasize their great importance as well, but we do not believe that they are a prerequisite. Philanthropic or cooperative housing projects are preceded by government intervention and, as the example of Switzerland shows, non-profit housing cooperatives do sometimes build without public subsidies or through forms of non-governmental self-help.

To allow for a wide variety of public housing systems, we therefore propose a broad definition of social housing that is less dependent on specific target groups or types of providers and comprises housing units characterized by rents that are: 1) determined by social-political objectivesFootnote 2 ; 2) institutionally set; 3) at a level below market-prices; 4) for at least the medium term (and not just short-term housing poverty welfare). Regarding the measurement of the social housing stock, we largely follow previous research and simple data availability. In every country, we start by identifying the first housing law that established a separated market segment for social housing. From then on, we draw on the earliest population and housing censuses of the various countries, cities, and sometimes parastatal organizations as our most important data on the share of social housing. Almost all censuses start mentioning tenure status after World War II, while prior data hardly exist at the national level, at times on the city level only. The censuses often distinguish between rented and owner-occupied housing, but they generally do not present a distinct category of social housing. Following previous research literature, we rely mainly on the status of housing providers to quantify the share of social housing. However, in the countries of the USSR, for instance, the share is calculated in terms of square meters of the total surface area, whereas, in Germany, in terms of the share of subsidized dwellings. The reason lies in the country-specific statistical traditions, which reflect the respective housing welfare systems. Therefore, Table A1 in the Appendix presents the definitions on which the respective country surveys are based.Footnote 3

Overall the data allow describing trends over time and larger differences between countries, but we do not interpret smaller differences due to a potential margin of error. As census data only provide for benchmark data points, we interpolate between them below for graphical visualization which can be justified by the very gradual nature with which new housing construction transforms overall housing stock. For the more recent years, we can additionally draw on household surveys in certain countries, whose tenure variable is often even more fine-grained than the general census. While Table A1 summarizes the country-specific definitions and sources used in every country, our detailed Appendix contains short country narratives providing an overview of the key aspects of the evolution of social housing in each country and the major historiographical works.

3 Descriptive results

Early initiatives in favor of social housing had long been undertaken by employers as well as philanthropic and worker organizations in the context of urbanization, industrialization, and precarious housing conditions. Yet it was not until the late nineteenth century that first national housing laws were passed. These mostly comprised programs in favor of homeowners, while major cities nourished a parallel municipal (or philanthropic) housing stream (Bullock and Read, Reference Bullock and Read1985). Reform ideas and legislation circulated in a transnational exchange and policies in global capitals were often more similar than in cities within the same country (Rodgers, Reference Rodgers1998). Progressive reform associations such as the Verein für Socialpolitik (Germany), Musée social (France), the Fabian Society (Great Britain), or the Instituto de reformas sociales (Spain) lobbied for the first housing laws as part of the general social reform packages meant to address the “social question” during the fin de siècle. Figure 2 shows how OECD countries passed their first national housing legislation more or less in line with the average social security laws, sometimes even before major social insurance legislation. As will be seen below, housing reform has seen an often parallel or complementary history with general welfare state reform.

Figure 2. Introduction of housing laws and of social security.

Where the pre-WWI period knew social housing only as a marginal phenomenon, different country trajectories emerged after WWI as a geographical break-down of the social housing data shows in Figure 3: socialist countries started to expropriate most private (urban) housing stock following the Russian October Revolution in 1917 and reached the highest level of non-private housing overall, up to 60 to 80 percent within the urban stock. Most of this was achieved through conversion of the existing housing stock, whereas new construction still contained a non-marginal stream of private constructions, which the state had to rely on to focus on industrialization and arms production (Andrusz, Reference Andrusz and Sillince1990; Smith, Reference Smith2010).

Figure 3. Dynamics of social housing rates in individual countries.

At the other extreme, there are Anglophone countries (except the UK) whose short-lived war housing moments during WWI did not spill over into more permanent housing policies before the Great Depression. In the USA, for instance, the war housing program of 1918 was deliberately curtailed to prevent a permanent housing program from emerging and the 1937 Wagner Housing Act was implemented with deliberate institutional breaks such as cost ceilings to prevent it from growing (McDonnell, Reference McDonnell1957), with Canada (Harris, Reference Harris2000) and Australia (Hayward, Reference Hayward1996) following similar paths with comparable temporalities. England and Scotland are clear outliers in the Anglophone group, with council housing emerging from very early on as a non-residual form of housing.

On the lower end of either no or low social housing provision, there are also general economic and welfare laggards such as Asian, Southern, and Eastern European countries which did have early social housing laws in place but not the economic and state capacity to make them more than residual programs (cf. Allen et al., Reference Allen, Barlow, Leal, Maltoutas and Padovani2004). Whereas Spain (Correa, Reference Correa and Sambricio2003) and Italy (Piccinato, Reference Piccinato, Rodriguez-Lores and Fehl1988) followed the French-Belgian model of social homeownership, subsidies remained, for instance, almost completely non-existent in Greece (Leontidou, Reference Leontidou and Pooley1992). France (Flamand, Reference Flamand1989), while initially copying the Belgian housing model, is clearly different from the Mediterranean group it is sometimes classified into. Asian countries were similarly late in devising social housing legislation.

In between these groups at the extremes, there are North-Western European countries which all had strong government moments in the new provision of state-financed rental housing. New construction in countries like Denmark, Germany, the Netherlands, and Sweden was predominantly state-financed or supervised in some form, mainly because private capital markets had broken down (particularly in hyperinflation countries) and the war had created a large gap between interrupted supply and pent-up demand. While in some countries interventions were aimed predominantly at the rental sector, countries such as Belgium (Mougenot, Reference Mougenot1988) or Ireland (Norris, Reference Norris2016b) developed socialized homeownership systems. Some countries also saw this intervention as a means to pacify the home front – “homes for heroes” (Swenarton, Reference Swenarton1981) and “Kriegerheimstätten” (Harlander, Reference Harlander, Fehl, Rodriguez-Lores and Roscher1995) – facing revolutionary threats. This more conservative approach in public housing provision was also prolonged under some of the emerging European dictatorships, whose armament programs and war economy, however, prevented larger housing construction programs and even contradicted them (Bodenschatz et al., Reference Bodenschatz, Sassi and Guerra2015).

This broad distinction into different country groups also holds for the post-WWII period, when social housing provision had its historical moment, reaching provision peaks almost everywhere, with socialist countries leading, North-Western Europe following, and Southern and Anglophone countries lagging. Eastern European countries were rather following their Western-European counterparts than carrying out strong Soviet-style nationalizations. England and Scotland were again more leaders of the continental tradition than part of the Anglophone group. In the postwar periods, state provision made up large shares of housing finance, reaching more than 50 percent in post-WWII France or post-WWI New Zealand (Davidson, Reference Davidson1994), up to 40 percent in Germany’s two postwar eras (Blumenroth, Reference Blumenroth1975), and up to 20 percent in Australia and Italy (Minelli, Reference Minelli and Mulino2004) after the wars. This is also visible in the available new construction statistics, which reached their all-century peaks per capita in the 1970s. With hardly any conversion of existing stock into public housing units, the social housing stock was predominantly built up over the years through new construction. Figure 3 shows the strong inroads public housing made into the share of private housing production since 1920.

After WWII, the United Nations and its special commission on housing in Europe collected unique comparative data on housing, including splitting up new construction by constructing entity, starting after WWII and discontinued in the 1970s (UN, 1958-2001). Due to the panoply of non-private institutions of housing provision, the share of purely private construction in the total new construction of housing units can serve again as a common denominator: while the Soviet Union, Southern and Eastern European, as well as non-European Anglophone countries follow a fairly well-identifiable downward trend, North-Western European countries reveal considerable variation (Figure 4). Although housing policy instruments were comparable and characterized by a transnational exchange and diffusion, they were implemented and adapted unequally across countries. In Belgium, home ownership promotion remained dominant (Goossens, Reference Goossens1982), while countries such as Austria, Denmark, the Netherlands, and Sweden strongly promoted public authorities or housing associations (Kemeny, Reference Kemeny1995). In the UK, both social housing and homeownership grew at the expense of the market rented sector. Germany subsidized not only local authorities and cooperatives but also private providers of rental housing, while Switzerland remained the major exception, where the private, unsubsidized rental market continued to dominate (Müller, Reference Müller2021).

Figure 4. New residential construction in OECD countries.

Since the 1980s (and the end of the Iron Curtain), the general social housing trend is one of decline, in line with Harloe’s grand narrative on the rise and fall or residualization of social housing (Harloe, Reference Harloe1995). This is evident in both housing stock and construction flow data. The steepest declines can be found in post-socialist countries, where large-scale conversion processes took place, this time in the opposite direction from revolutionary times (Clapham, Reference Clapham1996; Lux and Sunega, Reference Lux and Sunega2014). Among Western European countries, however, retrenchment was not the dominant trend across all countries: the residual housing welfare states had little to retrench in the first place. Relative to the social housing peak years of the 1970s, the troughs were 21 percent lower in the US, 10 percent in Belgium, and 37 percent in Canada. But among North-Western European countries, quite a few have retained relatively high levels of ongoing social housing provision, with declines of 14 percent in Denmark, 28 percent in the Netherlands, and 28 percent in Sweden. Others, Germany above all, truly retrenched into the residual provision group: its decline of 76 percent leads the Western countries, followed by Ireland (63 percent), Scotland (58 percent), and England (45 percent). One main difference between these different trajectories is whether large-scale conversions from public to private took place or not and whether specialized social housing providers maintained a role in new construction. Large social housing sectors were able to survive where dedicated social housing institutions had been in place, even though they could also change their nature from within (Aalbers et al., Reference Aalbers, Van Loon and Fernandez2017).

Social housing has disproportionately been an urban phenomenon. This is not only because cities were the site of the greatest housing problems and needs due to the urbanization process. Municipal housing was also the precursor of many state programs and municipal companies were among the main institutional carriers of national programs. In pre-WWI cities, social housing amounted to less than 10 percent of the stock, e.g. two percent in Vienna in 1910. German cities averaged about six to seven percent social shares in new housing construction. In the interwar period, however, social housing grew to double-digit numbers, e.g. Zurich cooperatives made up 16 percent in 1936 and Copenhagen’s state (1 percent), municipal (4 percent), foundation (5 percent) and cooperative housing (5 percent) totaled 15 percent in 1921. Many cities reached new highs during the golden era of subsidized public housing after World War II. Whereas in Switzerland, the city of Zurich reached a share of about one-quarter of the total stock during a short period of strong subsidies until 1950, London reached its all-time high of one-third of all dwellings by 1981. London also exemplifies the decline of social housing in many cities since the 1980s with the share decreasing to 24 percent by 2011. German cities saw their social housing peaks of more than 30 percent in the 1980s and have witnessed a decline to less than 10 percent in recent years, as social rentals were converted to private rentals after amortization of subsidized mortgages (Baldenius et al., Reference Baldenius, Kohl and Schularick2020). In Zurich, the proportion was maintained at higher levels. In 2011, the population decided in a ballot that the share would have to increase to one-third by 2050. However, until today, due to the strength of private construction, the percentage has stagnated slightly above one-quarter, despite the large number of new social housing units built in recent years.

4 Bivariate findings: Social housing and the broader housing welfare state

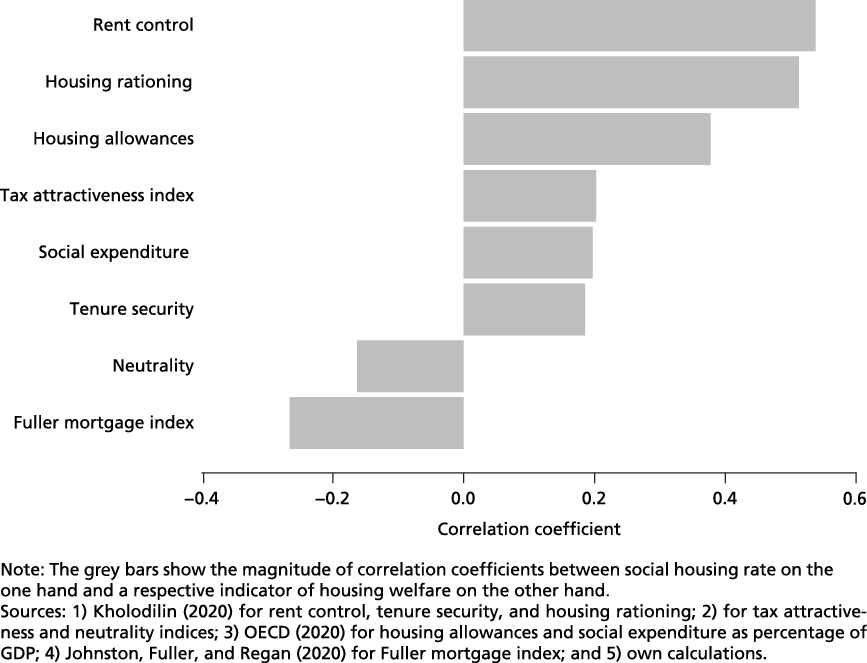

How do social housing institutions correlate with other housing policies? Governments have various means and institutions at their disposal to reduce market rents or house prices for housing market participants. The provision of publicly supply-side subsidized rentals which underlies our comparative data work and had become a dominant understanding of social housing in the 20th century is obviously only one such institution. Other prominent institutions include rental allowances, fiscal exemptions (imputed rent, VAT on the new housing, capital gains tax, mortgage tax exemptions, and property taxes), and socialized homeownership subsidies (credit and savings incentives). While all these institutions figure directly or indirectly in governments’ budgets, either as direct expenditure or foregone tax income (Pollard, Reference Pollard, Bezes and Siné2011), housing welfare in a broader sense also includes a more budget-neutral regulatory dimension of rental markets (Kholodilin, Reference Kholodilin2020). Many more regulatory dimensions play into housing welfare – e.g. building codes, urban planning, zoning, environmental policy, etc. – which are often very local in nature. In the following, we focus on those with a national regulatory dimension for which internationally comparative data are available.

A central regulatory housing policy comes in the form of rental market regulation that can use combinations of rent controls, tenancy security, and housing rationing measures to potentially create de facto social housing arrangements through legal means. Another one is mortgage lending regulation, which can make mortgage loans more broadly and easily available through more permissive lending regulation and government absorption of risks. At least superficially many of these regulatory measures are budget-neutral, even though they can obviously imply indirect and future costs. This list is not exhaustive but probably describes the largest and the comparatively measurable part of a more general housing welfare state. In the following, we describe how social housing has historically evolved within this larger housing welfare state, drawing on other existing statistical attempts at mapping housing welfare.

The longest-run comparison of social housing can be undertaken with rental regulation and the fiscal incentives regulation for homeowners (Kholodilin et al., Reference Kholodilin, Kohl, Korzhenevych and Pfeiffer2022). Both dimensions have been standardized in historic-comparative regulation indices for a wide range of countries since the date of their introduction in about 1914 (Kholodilin, Reference Kholodilin2020; Kholodilin et al., Reference Kholodilin, Kohl, Korzhenevych and Pfeiffer2022), where a value of 100 is equivalent to the strongest possible intervention into private rental markets for the rental regulation index. It is highest for the fiscal homeowner attractiveness index, when imputed rents are not taxed and interest payments for homeowners are tax deductible. Over time, the regulation of private rentals broadly correlates with the rise and decline of social housing, as Figure 5 shows: both became extremely important in and after the world wars and both started to decline again afterwards, without completely disappearing. Social housing flanked rent regulation in a complementary way, compensating for the loss of private construction incentive (Figure 6).

Figure 5. Share of private construction in total residential construction.

Figure 6. Intensity of housing policy regulations: rent control and tax attractiveness of homeownership.

Some countries never developed a larger social housing stock in the rental sense because they followed the path of socialized homeownership. In fact, the focus of the first housing laws in most countries before WWI was on the state promotion of socialized homeownership and in most countries social housing always included one branch meant for owner-occupiers such as the “accession sociale à la propriété” in France (Frouard, Reference Frouard2012). Even in tenant-dominated German social housing, the so-called first subsidy pillar with substantial government contribution made up 30 percent of owner-occupied housing in 1962–1999, the second pillar with more modest government contribution as much as 70 percent (Sensch, Reference Sensch2010). Socialized homeownership regimes in countries such as Belgium, Finland, Ireland, and, partly, Iceland even made homeownership the primary or even only goal of governments’ housing programs. In Ireland, for instance, more than 50 percent of annual construction was in this form until the 1950s and by 1971 more than 10 percent of the households were living in dwellings purchased from local authorities (Norris, Reference Norris2016a).

The relationship between social housing and socialized homeownership, similar to fiscal ownership incentives above, is mostly negative: countries have either followed one path or the other and, within countries, programs for owner-occupiers compete with public rentals for resources (cf. the UK). The fiscal attractiveness of housing investment is generally positively associated with social housing. Both can be seen as following a government investment logic, where social housing requires more direct public subsidies, while tax incentives through exemptions stimulate private investment. The association with how biased the fiscal support is towards homeowners (neutrality index) is hence negative. Such a negative association also holds with how liberal countries regulate mortgage lending. This has been proxied with a combination of different measures and summarized in an index of mortgage encouragement that scores highest, if countries use secondary mortgage markets, subsidize mortgages, have high loan-to-value (LTV) ratio, and low capital gains taxes, as well as anti-usury laws in place (Fuller, Reference Fuller2015). Where mortgage encouraging countries tend to financialize their housing sectors, i.e. encouraging mortgage indebtedness through liberal legislation, this correlates negatively with the extent of decommodifying social housing (Figure 7).

Figure 7. Correlations between the intensities of various housing policy tools.

Finally, the OECD social expenditure database, which extensively reports on the traditional social-security welfare state, also includes one item with “housing expenditure,” which – far from covering all housing-related budget items – is mainly referring to rental allowances, i.e. a demand-side subsidy in favor of private tenants (OECD, 2020). This is in line with the general observation that policies favoring private tenants go along with policies favoring public tenants. The total OECD social expenditure, by contrast, is without any clear association with social housing. While housing and general welfare have been built up at the same time and rather in countries with more generous welfare states, this positive correlation of the earlier years was counteracted by the social housing retrenchment in the more recent period. Overall, social housing is part of housing regimes directed towards investments and tenants and less pronounced where (financialized) homeownership welfare prevails.

5 Multivariate: The determinants of social housing provision

To understand the determinants of social housing provision beyond these bivariate findings, we turn to a panel data regression model methodologically and to more general welfare approaches theoretically. Even the “wobbly pillar” metaphor cited above suggests that social housing provision could be understood in welfare theory terms. A first such approach, the logic of industrialism, then, would see social housing as determined by GDP development: richer countries can afford more social housing (Donnison and Ungerson, Reference Donnison and Ungerson1982). A second approach is partisan: as a social policy, social housing could more likely be associated with (center-)left governments (Schmidt, Reference Schmidt1989). Third, small states with stronger redistributive tradition could be more inclined to have large social housing stocks (Obinger et al., Reference Obinger, Starke, Moser, Bogedan, Gindulis and Leibfried2010). Fourth, social housing has an obvious legacy of (post-)war welfare such that countries that experienced greater war and postwar housing shortages-would develop more social housing (Obinger et al., Reference Obinger, Petersen and Starke2018). Fifth, social housing can be seen as a functional complementarity of rent regulation: known to impact new constructions negatively, rent control may require government to step up the production of social housing to fill the gap left by the private sector. Sixth, social housing may be seen as one tool of Keynesian macro-economic demand management that depends on governments capacity to engage in deficit spending. Finally, ever since the work of Jim Kemeny (Kemeny, Reference Kemeny1992), social housing as an integral part of unitary rental markets has been seen as one element of a broader welfare state arrangement, with more universal welfare states also providing more than residual social housing (Stephens, Reference Stephens2020).

In order to determine the factors of the social housing rates we use panel data models. Due to multiple missing observations, the social housing rates are interpolated using the stinterp function of the stinepack library of the statistical programming language R, which is based on piecewise rational functions using Stineman’s algorithm (Stineman, Reference Stineman1980). Given the strong persistence of social rental housing rates and in order to remove serial correlation and potential non-stationarity, we compute the dependent variable as the first difference of the social housing rate. The model can be formulated as:

where

![]() ${y_{it}}$

is the first difference of the social housing rates in country i in year t;

${y_{it}}$

is the first difference of the social housing rates in country i in year t;

![]() ${x_{it}}$

is the vector of explanatory variables;

${x_{it}}$

is the vector of explanatory variables;

![]() ${z_{it}}$

is the vector of rental market regulation indices;

${z_{it}}$

is the vector of rental market regulation indices;

![]() ${\eta _i}$

are country fixed effects;

${\eta _i}$

are country fixed effects;

![]() ${\theta _t}$

year fixed effects;

${\theta _t}$

year fixed effects;

![]() ${v_{it}}$

the random disturbance; and β and γ are the vectors of coefficients to estimate. To use time-invariant independent variables and for robustness we also estimate random-effect models.

${v_{it}}$

the random disturbance; and β and γ are the vectors of coefficients to estimate. To use time-invariant independent variables and for robustness we also estimate random-effect models.

To operationalize the different explanatory approaches mainly derived from the general welfare state literature, we use: growth rates of the real GDP per capita and of the general population; completed dwellings-to-population ratio, and the population-to-housing stock ratio to proxy periods of housing shortages; left-right government to test the partisan dimension; rental market regulations; social expenditure-to-GDP to test the complementarity hypotheses; as well as government debt to GDP and interest rates to approximate Keynesian deficit spending (cf. Table A1 in the Appendix for data sources and descriptive statistics).

The estimations are based on an unbalanced data set covering nineteen so-called developed countriesFootnote 4 over the time period between 1904 and 2013. The estimation results are reported in Table 1:

Table 1. Fixed effect models (country, both) on social housing rates

***p < 0.001; **p < 0.01; *p < 0.05

A first observation is that some of the typical welfare-state explanatory variables remain insignificant or at low significance levels: neither economic growth nor left-right leaning of parliaments are very instrumental in understanding changes in social housing rates, even though the coefficient signs point in the expected direction: with more economic growth and left-wing parties in parliament, social housing rates are likely to be higher. Classifying countries additionally in three different sizes shows that larger countries have more social housing. Two other groups of variables are particularly important: First, variables measuring housing-shortage periods are all significantly associated with more social housing, e.g. country-years with higher crowding numbers (population per housing unit in columns (4)-(8)), higher construction activity per population in columns (1)-(4), or periods of strong population growth. More housing demand and supply generally increases social housing rates. In this regard, social housing bears some relation with war-related welfare. Second, variables showing some form of policy complementarity are significantly positively associated with social housing. This is the case for rent regulation: when rent controls cap the rent prices and returns on private rental housing, governments need to come in and increase housing supply to make up for the loss of private construction incentives. In the even columns of Table 1 we distinguish moreover between the hard or first-generation price controls which set absolute price caps during and after the wars from the softer or second-generation controls that allow moderate price increases. The total rent control effect is rather driven by the hard controls. The complementarity between rent regulation and social housing is indirectly supported by its trade-off with fiscal homeownership support. The second kind of complementarity is with social expenditure: country-years of growing welfare states are positively associated with increases in social housing stock, making housing an integral part of larger welfare state arrangements. The third complementarity is with indicators approximating Keynesian macro-economics: when interests are low and government debt is increasing relative to GDP, then social housing rates also increase.

To distinguish the results by country groups and for general robustness, we additionally estimate a random-effects model (Table 2) with legal-origins as the time-variant country classifier (La Porta et al., Reference La Porta, Lopez-de-Silanes and Shleifer2008). Legal origins have been shown to have economic effects and moreover correlate with welfare and capitalism typologies while avoiding their classification problems of difficult cases. While the substantive results of the main coefficients are robust, the country-group effects confirm a complementarity of welfare with social housing regimes, where countries of Scandinavian legal origin are most related to social housing when compared to the Anglophone common law countries on the other end, with countries of Germanic and Roman legal origin in-between.

Table 2. Random effect models on social housing rates

***p < 0.001; **p < 0.01; *p < 0.05

6 Conclusion

Social housing has been a latecomer among Western countries’ social policy reforms and never really occupied as permanent a place as countries’ social security systems. Its introduction and expansion phases correlate with those of the general welfare state, with the aftermath of the two world wars being decisive moments of growth. Similar to the welfare state, the 1970s were a watershed: at the peak of the reconstruction boom, private construction started to take over and social housing entered a stagnation or, more frequently, retrenchment phase. Today total housing production, social housing construction, and social housing stock levels have on average reached historically low values both in countries and their major cities. The post-socialist countries joined the club of privatized housing provision after 1990. Contrary to the much-observed inertia of social security, social housing has been a case where significant cut-backs have occurred in various countries.

Social housing, narrowly understood here as state supply-side support for below-market rentals, is only one pillar in the total housing welfare state and its generally declining trend does not necessarily imply that housing welfare in general has decreased. In fact, we found that the declining trend correlates positively with the regulation of private rentals and housing allowances, but might be compensated by more subsidies in favor of homeowners through fiscal exemptions and mortgage regulation. Prima facie, we do not see globally that less social housing is compensated for by more social expenditure elsewhere.

The declining trend in social housing is probably less surprising to scholars familiar with the existing literature we heavily build upon than the perhaps intriguing inertia of the social housing stock which is found in countries as diverse as Denmark, the Netherlands, and the UK (Blackwell and Bengtsson, Reference Blackwell and Bengtsson2021). It is true that, with few exceptions, hardly any country has higher social housing levels than at the peak of its social housing development, but in light of gloomy predictions about a complete collapse of the social housing pillar, it has had resilience close to the one claimed for other spheres of the welfare state. We noted that wherever social housing has morphed into a well identified institutional carrier instead of being just one housing segment, the survival of large social housing stocks was more likely. These organizations might have acted as a reinforcing mechanism and lobby against further retrenchment. The more they were independent of governments, the less they were at the whim of politically motivated cut-backs.

High levels of social housing in these countries may not imply that nothing has changed. For one, recent Dutch research has shown how the financialization of social housing providers can also change organizations from within (Aalbers et al., Reference Aalbers, Van Loon and Fernandez2017) and, while the name and statistical category might have remained unchanged, the institution may no longer be recognizable to a social tenant of the 1970s. The building statistics also reveal that, whatever the share of social housing left in the stock, new construction of social housing is not necessarily showing a rejuvenation trend, but should rather lead one to expect that the aging social housing stock will gradually be replaced in the future.

The new synoptic view should bear some surprises for the many attempts to classify countries into typologies. Our descriptive country grouping by broad geographies mainly serves descriptive purposes and its heterogeneity should make one cautious about taking geography too seriously. Also, the country grouping that Kemeny (Reference Kemeny1992) once subsumed under the large header of integrated housing regimes inspired by an Ordoliberal German approach turns out to be quite heterogeneous. Whereas in Austria, Denmark, the Netherlands, and Sweden, social rented housing shows strong resilience, in Germany, the sector has declined sharply, while in Switzerland it has never developed strongly at all. At the other end of the spectrum of countries, in Southern and non-European Anglophone countries, the decline of social housing was obviously less important. However, none of the countries embarked on a late path of promoting social rented housing. The hypothesis of a simple correlation of social housing with welfare typologies or VoC encounters difficult cases such the UK in the liberal group, Germany in the conservative group or Norway in the universal welfare group.

The paper allows bringing decommodification and housing welfare research closer together and, while it does support Kemeny’s idea of a complementarity between large welfare states in terms of social expenditure of Scandinavian legal origin and more social housing, it also finds that, on the explanatory level, typical welfare state predictors (GDP, left-right, small states) have low power when compared to more housing-related factors such as demography, housing shortages and complementarities with countries’ approaches towards the private-rental and owner-occupier segment: strict rental regulation requires social housing to step in, while the promotion of homeownership and social housing rather stand in a political trade-off relationship. Overall, the paper and its new database should encourage future investigations into the varieties of housing welfare and their intricate relationship with the more classical branches of the social-insurance based welfare state.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/S0047279422000770

Competing interests

The authors declare none