No CrossRef data available.

Article contents

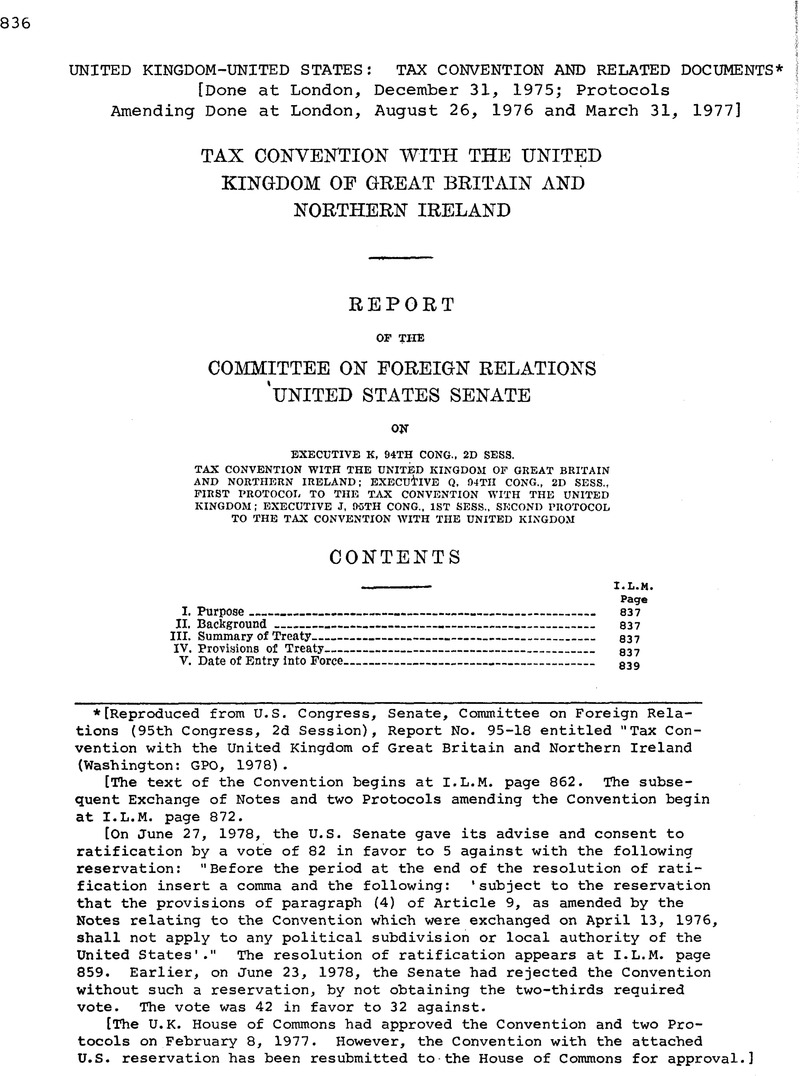

United Kingdom-United States: Tax Convention and Related Documents

Published online by Cambridge University Press: 20 March 2017

Abstract

- Type

- Treaties and Agreements

- Information

- Copyright

- Copyright © American Society of International Law 1978

References

* [Reproduced from U.S. Congress, Senate, Committee on Foreign Relations (95th Congress, 2d Session), Report No. 95-18 entitled “Tax Convention with the United Kingdom of Great Britain and Northern Ireland (Washington: GPO, 1978). [The text of the Convention begins at I.L.M. page 862. The subsequent Exchange of Notes and two Protocols amending the Convention begin at I.L.M. page 872.

[On June 27, 1978, the U.S. Senate gave its advise and consent to ratification by a vote of 82 in favor to 5 against with the following reservation: “Before the period at the end of the resolution of ratification insert a comma and the following: 'subject to the reservation that the provisions of paragraph (4) of Article 9, as amended by the Notes relating to the Convention which were exchanged on April 13, 1976, shall not apply to any political subdivision or local authority of the United States'.” The resolution of ratification appears at I.L.M. page 859. Earlier, on June 23, 1978, the Senate had rejected the Convention without such a reservation, by not obtaining the two-thirds required vote. The vote was 42 in favor to 32 against.

[The U.K. House of Commons had approved the Convention and two Protocols on February 8, 1977. However, the Convention with the attached U.S. reservation has been resubmitted to the House of Commons for approval.]

* The Committee would Hke to thank the staff of the Joint Committee on Taxation for preparing the explanation of the provisions of the proposed treaty.

1 The excise tax is imposed at a rate of 4 percent of the premiums paid on casualty insurance and indemnity bonds, and one percent of the premiums paid on life, sickness, and accident insurance, annuity contracts, and reinsurance

2 The treaty as initially negotiated included a registery test under which the exemption applied only to income of U.S. enterprises from the operation of ships and aircraft registered in the United States and income of British enterprises from the operation of ships and aircraft registered in the United Kingdom.

3 The proposed treaty provides that in the event that the United Kingdom modifies its current system of taxation and ceases to allow a shareholder credit to its residents, then dividends will be treated as they are under the existing treaty, and the withholding taxes of both the United States and the United Kingdom will be limited to 15 percent on dividends paid to residents of the other country

4 As contrasted with the rules applicable to U.K. direct corporate investors in U.S. corporations (discussed below), a U.S. corporation will be considered to be a direct investor where it, together with any related corporations, owns a 10- percent stock interest in the U.K. corporation.

5 Biddle v. Commissioner.302 U.S. 573, 103S-1 TTSTC H9040. If the ACT were a shareholder tax, it would be subject to, and limited by, the dividend provisions of the existing treaty.

6 Rev. Rul. 78-61, Rev. Rul. 78-62, and Rev. Rul. 78-63, 1978 I.R.B. 8.

8 The allowance of the foreign tax credit at a 48.5-percent rate rather than at the average rate of U.K. tax (47.5 percent) Imposed on retained and distributed profits results from the characterization of the $9 net payment by the U.K. to the U.S. shareholder as comprised of (i) a $12 ACT refund to the U.K. subsidiary (one-half of the $24 ACT imposed) reduced by (li) a $3 withholding tax (5 percent of the sum of the $48 dividend and the $12 unrefunded ACT) rather than merely as an ACT refund of the net $9 payment made by the U.K. (or % of the ACT imposed). This treatment yields a slightly higher foreign tax credit than would otherwise be available because the full amount of the withholding tax is available to the U.S, shareholder as a direct credit, while the reduction in its deemed paid foreign taxes attributable to the ACT refund is allocated between

9 Tticw figures ire derived from data contained in the Wood, Mackenzie & Co. Nortli Sea report of October and December 1977.

* [The Resolution of Ratification was amended on June 27, 1978. The text appearsin the footnote at I.L.M. page 836.]

* Secretary Woodworth's statement concerned all three treaties which were the subject of the hearings: the proposed treaties with the United Kingdom, with the Republic of Korea, and with, the Philippines. That portion of the statement which solely deals with the proposed treaties with Korea and the Philippines has been deleted where indicated by an ellpsls ( … ) .