1. Introduction

Earth's inhabitants are threatened by several serious or existential crises: environmental, human health, social justice, loss of democratic decision-making, and nuclear war. In terms of environmental threats, human activities have exceeded six of the nine planetary boundaries defined by Earth system science and are approaching the boundary in a seventh (Stockholm Resilience Centre, 2022). In addition to the environmental threats, the gap between the rich and the poor has been increasing, both within and between countries (Chancel et al., Reference Chancel, Piketty, Saez and Zucman2022; Piketty, Reference Piketty2014; World Economic Forum, 2022). At the time of writing, June 2024, the COVID-19 pandemic has killed over seven million people (WHO, n.d.) and the poorest countries are still experiencing shortages of medical personnel and vaccines (Padma, Reference Padma2021). The inadequately regulated arms trade is increasing the risk of war. Based mainly on the risks of nuclear war and climate change, the Bulletin of the Atomic Scientists has set the Doomsday Clock to 90 seconds before midnight, ‘because humanity continues to face an unprecedented level of danger’ (Science & Security Board, 2024).

These global threats must be mitigated urgently to avoid dangerous irreversible changes to climate, public health, peace, and social structure (Armstrong McKay et al., Reference Armstrong McKay, Staal, Abrams, Winkelmann, Sakschewski, Loriani, Fetzer, Cornell, Rockström and Lenton2022; Bardi & Alvarez Pereira, Reference Bardi and Alvarez Pereira2022; Brand-Correa et al., Reference Brand-Correa, Brook, Büchs, Meier, Naik and O'Neill2022; Guterres, Reference Guterres2022; Lenton et al., Reference Lenton, Rockström, Gaffney, Rahmstorf, Richardson, Steffen and Schellnhuber2019). But if humanity focuses only on specific threats, it will fail to come to grips with the underlying driving forces, namely the political power of vested interests (e.g. mining, property, financial services, tobacco, and armaments industries) that have dominated government policies in many nation-states and some international organizations in a process known as ‘state capture’ (Chipkin et al., Reference Chipkin, Swilling, Bhorat, Buthelezi, Duma, Friedenstein, Mondi, Peter, Prins and Qobo2018; Dávid-Barrett, Reference Dávid-Barrett2023; Diesendorf & Taylor, Reference Diesendorf and Taylor2023; Klein, Reference Klein2014; Lucas, Reference Lucas2021). One of the tools used by vested interests in state capture comprises the intellectual framework and ideology that justify and support their power, that is, the dominant model of the real economic system. This model is neoclassical economics (NCE) theory together with neoliberalism practice, both defined in the box. This system is substantially based on exploiting the natural environment and most of the world's human population (Fremstad & Paul, Reference Fremstad and Paul2022; Hickel, Reference Hickel2020; Klein, Reference Klein2014; Sanders, Reference Sanders2016).

These and other critiques of the assumptions, hypotheses, and claims of NCE in books and ‘alternative’ economics journals (e.g. Ackerman, Reference Ackerman2018; Daly & Cobb, Reference Daly and Cobb1990; Davies, Reference Davies2019; Denniss, Reference Denniss2016; Keen, Reference Keen2011; Martins, Reference Martins2016; Quiggin, Reference Quiggin2010; Self, Reference Self1993; Syll, Reference Syll2015; Waring, Reference Waring1988) have had little impact on the teaching of economics in universities, textbooks, publications in leading economics journals, or the public and political discussion of economic issues. Neither have critiques of theoretical, methodological, and policy aspects of NCE by established ‘conventional’ economists, for example, critiques of: Dynamic Stochastic General Equilibrium models (Stiglitz, Reference Stiglitz2018); NCE treatments of inflation and unemployment (Galbraith, Reference Galbraith2001); the instrumentalist approach to NCE (Lawson, Reference Lawson2001); and the misuse of GDP (Stiglitz et al., Reference Stiglitz, Sen and Fitoussi2010). However, it is unclear whether these authors consider themselves as neoclassical (NC) economists.

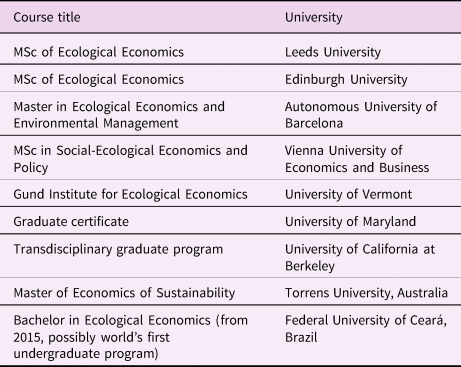

Although the transdisciplinary field of ecological economics focuses directly on achieving planetary and public health and social justice and has grown rapidly since the 1970s, resistance by influential NC economists has ensured that ecological economics, political economy and other ‘heterodox’ approaches to economics have been accepted by only a few Western universities worldwide (see Table 1), have been excluded from prestigious economics journals and have had little public or political impact (Butler et al., Reference Butler, Jones and Stilwell2009; Galbraith, Reference Galbraith2001; Lee, Reference Lee2004; Saith, Reference Saith2022). ‘Leading active members of today's economics profession, the generation presently in their 40s and 50s, have joined together into a kind of politburo for correct economic thinking’ (Galbraith, Reference Galbraith2001). Scientist critics of NCE are rare – we are aware of three: Blatt (Reference Blatt1983), Philip Smith in Smith and Max-Neef (Reference Smith and Max-Neef2011) and Davies (Reference Davies2019).

Table 1. Majora university courses in ecological economics worldwide, 2024

a In addition, some degrees in sustainability, environmental management, environmental studies, environmental policy, and environmental economics contain courses or parts thereof on ecological economics, but it's difficult to verify how substantial they are.

Source: Authors’ Web search, including https://www.isecoeco.org/category/graduate-programs/ and https://ecolecon.eu/ecological-economics-courses-and-programmes/.

In view of the critical situation outlined above, the aim of this paper is to offer a critique, from a scientific standpoint, of NCE and the myths it fosters through the ideology of neoliberalism. The principal audience envisaged comprises scientists and researchers other than NC economists working on sustainability problems, however the paper has been written to be accessible to the general public as well. While critiques of single issues in NCE have been published previously as research papers in peer-reviewed journals by economists, both neoclassical and heterodox, these do not provide an overview of many issues that, taken together, challenge systematically the rational scientific basis of NCE.

Our method is to review critically ten key hypotheses and four claims of NCE, on the grounds that they are either (a) contradicted by observation, (b) lead to different results from those reported by NCE, (c) are ill-defined, or (d) are internally inconsistent. Hence, we argue that NCE is fundamentally flawed and must no longer be used as the basis for government socioeconomic policies. We note that the distinction between a poorly justified hypothesis and a claim is not sharp.

The authors of the present paper are four interdisciplinary sustainability researchers trained in scientific disciplines, including one with also a PhD in economics, and an ecological economist. Before outlining our critique, we provide a list of definitions in the box.

Glossary of selected neoclassical economics terms

These definitions are drawn from NCE textbooks and re-interpreted using a critical, scientific perspective. Much of the NCE terminology takes words from the physical sciences – for example, force, equilibrium, efficiency – and gives them new meanings that can be subjective and misleading.

Neoclassical economics (NCE) is a broad theoretical structure that focuses on market supply and demand as the driving ‘forces’ behind the production, pricing, and consumption of goods and services. It assumes that people have ‘rational' preferences, that they compete to maximize a concept called ‘utility’, and that decisions are made at the margin (i.e. valuing an addition of something and ignoring sunk costs). It ignores the roles of social interactions, culture and institutions in the economy and plays down the role of money, private debt and profits. It treats the environment as, in effect, an infinite resource and an infinite reservoir for waste. For a more precise, more concise definition, see Section 3.1.

Neoliberalism is economic practice that is based mainly on the theoretical hypotheses of NCE to argue for leaving most major socioeconomic decisions to the market and hence for free trade, low taxes, low regulation, and low government spending, except on defence. In neoliberalism, government exists to maintain property rights, support capitalists, and maintain price stability. Critiques for non-specialist readers are Mirowski (Reference Mirowski2014) and Hutchison and Monbiot (Reference Hutchison and Monbiot2024).

Homo economicus is a notional human being that is entirely self-interested and ‘rational’ in the sense of economics and can process all available information. Their preferences are exogenous, i.e. beyond the scope of economics.

Rational behavior is a decision-making process that is based on making choices that result in the maximum level of ‘utility’ for an individual.

Utility was originally introduced as a subjective measure of total satisfaction and individual gains from consuming a good or service. Nowadays, a utility function is a numerical representation of a preference ordering with no psychological connotation (Hands, Reference Hands2010).

Efficiency in NCE is understood in different ways – here are the two most prominent versions:

1. A state of the market is called Pareto efficient (or Pareto optimal) if there is no alternative state where improvements can be made to at least one participant's ‘well-being’ or ‘welfare’ without reducing any other participant's. In this state, resources are allegedly allocated in the most economically efficient way.

2. An economic transaction that produces or purchases or allocates goods or services for low cost or low physical inputs per item.

Market forces are not physical forces but simply factors that influence the price and availability of goods and services. NCE identifies these factors as supply and demand, but underlying them are many other factors such as government policies, advertising, fashion, personal preference, weather, speculation, population number, international transactions, energy availability, infrastructure, and the levels of public and private debt.

General equilibrium is an idealized state of the economy where demand and supply are equal for all markets in the economy. Many NC economists assume that market ‘forces’ tend to drive economies towards ‘general equilibrium’ and, contrary to clear evidence, that the equilibrium is unique and stable. In NCE ‘equilibrium’ includes ‘dynamic equilibrium’ or ‘balanced growth’, where demand and supply are still equal as the economy grows.

A free (or perfect) market is an idealized economic system, free from government interventions and other external constraints, and controlled by privately owned businesses. It does not exist in real industrial societies because the market is shaped by laws on powers of a corporation, banking and investment, government budgets, trade and consumer protection, and taxation.

Constant returns to scale is an economic condition where an increase in a business's inputs, like capital and labor, increases its outputs at the same rate as the inputs.

An externality is a cost or benefit caused by a producer that is not financially incurred or received by that producer: e.g. carbon emissions by a steelworks in the absence of a carbon price.

Methodological individualism assumes that socioeconomic phenomena can be described in terms of subjective personal motivations by individual actors not influenced by other actors or the society to which they belong.

Methodological instrumentalism: theories are interpreted merely as practical tools or instruments for some purpose other than causal explanation.

2. Critique

2.1 Summary

The ten fundamental hypotheses (labeled H1–H10) and four other claims (labeled C1–C4) of NCE are set out in Table 2, together with concise refutations. More detailed refutations of most are given in Sections 2.2–2.13. Within NCE there is a variety of schools, not all of which accept all these hypotheses and claims. Nevertheless, those discussed here continue to have a strong influence on government policies and must be re-examined critically. Section 3.1 identifies three basic hypotheses that appear to be common to all variants of NCE––they comprise the subset of the ten hypotheses – H2, H7, and H10 – critiqued in Section 2.

Table 2. Key hypotheses and claims of NCE with concise refutations

The implementation into government policies of NCE hypotheses H2, H4, H6, H8, H9, H10, C2, C4 are damaging the environment, while H2, H6, H8, H9, H10, C1–C4 are damaging social justice/equality. Together, the hypotheses form a poor basis for an economic system that should serve all the people and protect our life support system, the biosphere. Hypotheses and claims H1 and H6 have received ample critical discussion in the literature and so do not receive further attention in the rest of Section 2.

2.2 H2 discussion: methodological individualism

Many complex systems have ‘emergent’ properties that cannot be explained simply in terms of the sum of the properties of their individual elements. For instance, the heart is more than the sum of its cells. The freezing of water turns the random motion of its molecules in a liquid into a solid crystal lattice. An electric current ‘in’ a wire travels at the speed of light, although the basic elements, the electrons in the wire, move relatively slowly. In economics, a profit-making corporation composed entirely of environmentalists can still engage in environmentally destructive activities. And macroeconomics, which studies the structure and performance of an economy as a whole, cannot be derived from microeconomics, which studies the economic decision-making of individuals and firms (see Section 2.5).

Emergent properties result from interactions between the elements of the system, leading to organization of the elements, and from external conditions. The existence of emergent properties in economics invalidates the hypothesis of methodological individualism (MI) as defined in the box. In response, economists have introduced more sophisticated definitions of MI and casuistic arguments to defend it. (An unsophisticated, invalid attempt to bypass the problems of going from micro to macroeconomics is the creation of a ‘representative agent’.) However, fundamental gaps remain in attempting use MI as a basis for NCE. Favereau (Reference Favereau, Bulle and Di Iorio2023) describes them as ‘a double phenomenon of incompleteness, the first in the modeling of individual rationality…, the second in that of inter-individual/market coordination’. He argues that, since the 1970s, the responses of NC economists have been either to treat one incompleteness but not the other, or to deny both – but to treat both would be to deny NCE.

2.3 H3 discussion: utility

NCE's approach to utility is based on the idea that individuals could order or rank the usefulness of various bundles of goods now and in the future, in order to maximize their utility.

Initially, utility was an ill-defined subjective and unobservable concept. Samuelson (Reference Samuelson1938) attempted to correct this with the concept of an ‘indifference map’, which showed unquantified utility as a function of consumption of a set of commodities. In response to the criticism that this concept also could not be observed, Samuelson developed the ‘axioms of revealed preference’ (Samuelson, Reference Samuelson1938; Reference Samuelson1948), which asserted that a consumer's indifference map could be derived from observations of their actual consumption patterns.

This proposition was put to the test by Sippel (Reference Sippel1997), using consumption decisions in a carefully controlled experiment in which subjects chose combinations of eight commodities, given ten sets of relative price and income combinations which were designed to test these axioms. The experimental subjects violated the axioms so comprehensively that Sippel (Reference Sippel1997, p. 1,443) concluded that the theory was disproven:

In a scientific discipline, this falsification of a fundamental tenet would have provoked great tumult. But in economics, while there have been a small number of subsequent studies, this fundamental challenge to NCE theory has been ignored in the development of neoclassical micro- and macroeconomics ever since. (The Web of Science reported 69 citations of Sippel (Reference Sippel1997) as of June 2023.)

In NCE theory, maximizing utility leads to a demand function, the quantity of an item demanded as a function of price – the lower the price, the higher the demand – see Section 2.5. However, NCE's assumption that a consumer performs the complicated assessment of preferences among many items when going shopping is not credible. Any human behavior, economic or non-economic, is influenced by many factors in addition to the concept of utility (Gowdy & Mayumi, Reference Gowdy and Mayumi2001; Karacuka & Zaman, Reference Karacuka and Zaman2012; Sen, Reference Sen1987; Simon, Reference Simon1955; Weber, Reference Weber2019).

NCE then claims that the aggregation of demand functions for every individual gives a valid market demand function for each item. The intersection of the aggregate demand and supply curves would then determine the item's market price (see Section 2.5). However, Section 2.5 shows that aggregate demand (and aggregate supply) functions can have almost any shape and so do not necessarily intersect at all. Even two NC economists conclude that ‘The utility hypothesis tells us nothing about market demand unless it is augmented by additional requirements’ (Shafer & Sonnenschein, Reference Shafer, Sonnenschein, Arrow and Intriligator1982).

2.4 H4 discussion: natural environment

The standard approach of NCE is via one of its subfields, environmental economics, which sees the environment as a form of natural capital that provides resources and amenities, and acts as a waste repository. It recognizes market failure and it attempts by various techniques to put a monetary value on environmental degradation and on mitigation actions. While this is helpful to some extent, there are several fundamental problems:

• The definition of nature as a capital stock leaves out all those parts of nature that have not (yet) been addressed by human demand.

• When the destruction of our life support system, the biosphere, is at risk, the monetary value would be infinite, making monetary valuation nonsensical.

• For lesser environmental impacts, pricing policies are clearly insufficient. For example, applying a carbon price cannot stop people from commuting by car from the urban fringe where public transport is inadequate (although it would assist the transition to electric cars) and in many countries it cannot incentivise housing renters to improve the energy efficiency of their building envelopes. The former example requires government planning and investment in infrastructure; the latter example requires government regulations and standards for buildings.

• Economic instruments are often regressive, hitting the poor harder than the rich. Those who are rich enough can afford to continue unsustainable lifestyles which are denied to the rest of the population. Yet it is the rich who have the greatest environmental impacts (Wiedmann et al., Reference Wiedmann, Lenzen, Keyßer and Steinberger2020). Specifically, the richest 10% of humanity account for approximately half of the global CO2 emissions (Chancel & Piketty, Reference Chancel and Piketty2015; Kartha et al., Reference Kartha, Kemp-Benedict, Ghosh, Nazareth and Gore2020).

• Monetary valuation is always based on current values and current preferences, which might undergo drastic changes in case of crises. For instance, fertile soil is not valued very highly today, but when food shortage looms, the change would probably be significant (also toppling the utility preference orders).

In formal treatments, NCE typically expresses production/output as a function of capital K and labor L, using the Cobb–Douglas Production Function (Cobb & Douglas, Reference Cobb and Douglas1928):

where A represents technology. A critical aspect of this model is the value of the exponent α, which is set, following the neoclassical theory of income distribution, to the relative income share of workers and capitalists – a typically used value for α is 0.3. Critics have noted that it has no role for non-produced means of production, including energy, nor any acknowledgment of the inevitability of generating waste in production (Keen et al., Reference Keen, Ayres and Standish2019). This ignorance of the need for non-produced inputs into production is, we suggest, a reason why economists have been incapable of appreciating the implications of resource depletion and waste from production as constraints upon the scale of human economic activity.

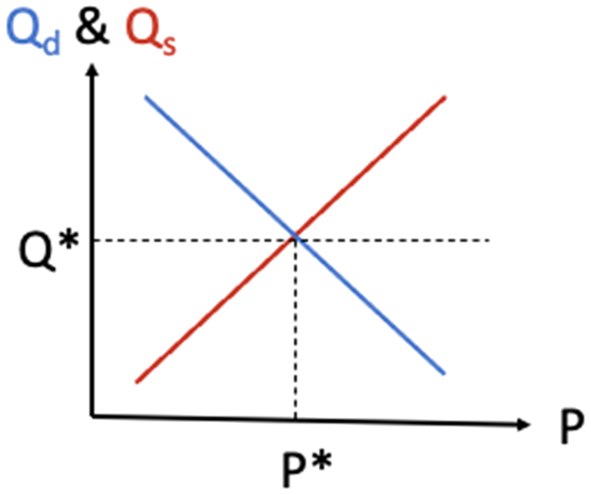

2.5 H5 discussion: supply-demand curves

One of the foundations of NCE is the belief that the quantity Q* of a product sold and its selling price P* are determined by the intersection of two curves, usually presented as straight lines, the quantity demanded Qd(P) and the quantity supplied Qs(P), each expressed as a function of price P (see Figure 1).

Figure 1. The supply-demand diagram.

Note: We have exchanged the Q and P axes of the NCE version to conform to the convention of mathematics and science that the independent variable P is on the x-axis and the dependent variables Q d and Q s are on the y-axis.

The diagram contains the following implicit assumptions, only some of which are acknowledged in NCE textbooks:

a. For a given income, Q d and Q s are functions of price alone. If income increases/decreases, the demand line shifts up/down (in the scientific version, Figure 1).

b. Qd and Qs are independent of each other.

c. In perfect competition models, neither the producer nor the consumer can influence the price.

d. The diagram is static and so assumes that a price rise results in an immediate increase in production and reduction in demand.

e. Demand does not saturate (e.g. when a household has a TV in every room).

f. When the product is sold, the market clears, that is, all of the output will be used without wastage, Qd = Qs = Q* and P = P*. This is equivalent to assuming stable equilibrium between supply and demand (an assumption that's refuted in Section 2.6).

For a single individual buying a single product, it is reasonable to accept assumptions b and c and that the quantity demanded Qd(P) generally decreases with increasing price. But when the diagram is applied to a real market, comprising many consumers with different tastes and incomes and many producers, most of the assumptions are incorrect and an aggregated demand curve can have almost any shape (Keen, Reference Keen2011, pp. 51–52). The proof is based on the Sonnenschein–Mantel–Debreu (SMD) Theorem, discussed in Section 2.6.

Neither is the assumption of an upward sloping supply curve Qs(P) generally true, even for a single firm. Alan Blinder, ex vice-chair of the United States Federal Reserve and ex vice-president of the American Economic Association, surveyed 200 firms which accounted for ‘about $319 billion of the United States’ GDP, or 7.6% of the total value added in the nonfarm, for-profit, unregulated sector’. One of the many questions asked was, what was the shape of the firm's marginal cost curve. The result was that only 11% of output was produced under conditions of rising marginal cost, half under constant marginal cost, and 40% under declining marginal cost (Blinder, Reference Blinder1998).

This discovery by Blinder confirmed almost a century of similar findings in previous empirical studies (Eiteman & Guthrie, Reference Eiteman and Guthrie1952; Hall, Reference Hall1988; Hall & Hitch, Reference Hall and Hitch1939), where the standard empirical discovery was that 95% of firms reported constant or falling marginal cost. This fundamentally contradicts neoclassical theory, in which the market supply curve is the sum of the segments of marginal cost curves of competitive firms above the point where marginal cost exceeds average cost. If, for the vast majority of firms, marginal cost is constant or falling, then the marginal cost curve lies well below the average cost curve at all scales of output. A market supply curve therefore cannot be defined. This is why Blinder stated that:

The overwhelmingly bad news here (for economic theory) is that, apparently, only 11 percent of GDP is produced under conditions of rising marginal cost. Almost half is produced under constant MC … But that leaves a stunning 40 percent of GDP in firms that report declining MC functions. (Blinder, Reference Blinder1998, p. 102)

As with Sippel's experiment, this empirical result should have resulted in paradigm-challenging thought within economics. Instead, while there have been more citations of Blinder's work than Sippel's (The Web of Science reported 383 citations of Asking About Prices as of June 2023), it has generally been ignored. Ironically, one of the people who has ignored, and in fact contradicted, Blinder's findings is Blinder himself, in the textbook he has co-written (Baumol & Blinder, Reference Baumol and Blinder2015). Not only does he not cite his own empirical work on this topic, he claims that ‘diminishing marginal productivity’, which is a concept from which ‘rising marginal cost’ is derived, was an empirical discovery, when the opposite is the case, and the example he gives of ‘diminishing marginal productivity’ violates one of the assumptions behind the concept, that the stock of capital is fixed.

Thus, neither the aggregated supply curve nor the aggregated demand curve is assured of having the form shown in Figure 1. This means the behavior of the aggregated economy, the subject of macroeconomics, cannot be deduced from the behaviors of individual actors, the subject of microeconomics. Thus macroeconomics has no micro-level foundation and another nail is added to the coffin of methodological individualism (Section 2.2).

2.6 H7 discussion: methodological equilibration

To obtain equilibrium between supply and demand, NCE theory assumes that all participants behave as Homo economicus and have instant free access to all relevant information including future prices, that they assess that information ‘rationally’, that their choices are not influenced by others' choices (implying no social interactions or advertising or marketing or fashion), are aimed at utility maximization, and that, for firms producing goods and services, there are no economies of scale (see Section 2.5). These conditions are so stringent they are impossible to achieve in the real world. If any of them fails, there is no assurance of equilibrium or optimality. Hence H7 cannot be validly described as a conclusion of a theoretical argument. As far as real economies are concerned, it is a refuted hypothesis.

This conclusion is supported by the empirical finding that nominal GDP growth is highly and positively correlated with short and long-term interest rates in all four high-income countries studied, contrary to NCE belief. This suggests inter alia that markets are not generally in equilibrium (Lee & Werner, Reference Lee and Werner2018).

In the 1970s, NC economists showed that economies satisfying the stringent assumptions of general equilibrium can be constructed with multiple equilibria; furthermore, in general, general equilibrium cannot be unique or stable (Ackerman, Reference Ackerman2002; Stiglitz, Reference Stiglitz2018). A real economic system would be in stable equilibrium if, in response to a small perturbation that pushes it out of equilibrium, it returns to equilibrium. Stability would also imply that a large perturbation behaves just like a small perturbation scaled up, but this is not observed in real economic systems. Perturbations can result from sudden changes in the physical world or consumer demand, market imperfections, and the collapse of excessive private debt. The SMD Theorem states that, for a market populated with utility-maximizing rational agents, the excess demand as a function of price Qd(P) can take the shape of almost any continuous function that has homogeneity of degree zero (i.e. a function whose value does not change when all its variables are multiplied by the same number), an important result of general equilibrium economics within NCE (Debreu, Reference Debreu1974; Mantel, Reference Mantel1974; Sonnenschein, Reference Sonnenschein1972). This implies that market processes will not necessarily reach a unique and stable equilibrium point.

A neat demonstration of instability was given by applied mathematician John Blatt, who showed that, even with a simple, linear model economy in balanced growth ‘equilibrium’ that excludes all the above sources of perturbations, the system is unstable and collapses (Blatt, Reference Blatt1983, chap. 7). The assumptions of this model, the Leontief system, include constant returns to scale, and perfect market clearing (i.e. all of the output will be used without wastage). To these, Blatt added perfect thrift: that is, the entire output of the preceding year is available for productive inputs (including necessary consumption but excluding discretionary consumption) in the present year. Making the system more realistic by including the excluded sources of perturbations will make the system even more unstable. (Blatt, Reference Blatt1983, chap. 7; Keen, Reference Keen2011, pp. 183–184). The instability of linear models of an economy implies that any equilibrium of the price system is unstable – since a linear production function determines the stability of an equilibrium – so that prices are in general a non-equilibrium rather than equilibrium phenomenon.

The instability of balanced growth equilibrium in a Leontief system was confirmed in the well-known book by NC economists Dorfman, Samuelson and Solow (Reference Dorfman, Samuelson and Solow1958). However, the authors called it ‘indeterminacy’ instead of ‘instability’ and then attempted to rule it out by arbitrarily requiring that the system return to balanced growth. Attempts to show that instability is an artifact of the particular model of the economy or by the assumed market mechanisms have failed (Ackerman, Reference Ackerman2002).

The failure of NCE to predict the Global Financial Crisis (GFC) and its failure in the economic recovery from the GFC and the COVID pandemic – where governments had to intervene in violation of NCE ‘principles’ – are empirical demonstrations of the falsity of NCE and hence the need to discard the equilibrium hypothesis and linear models.

Blatt (Reference Blatt1983, chap. 8) argues that all economic systems are non-linear and dynamic––furthermore, that ‘if a system shows local instability around the equilibrium path, then this system cannot be described adequately by any linear approximation to the system equations.’

This makes it impossible to deduce, from the behavior of a near-equilibrium system, what it will do far from equilibrium. For example, it can grow until it runs out of natural resources and collapses, or it can follow a cyclic path over time like the observed business/trade cycles, booming and then crashing. (Blatt, Reference Blatt1983, chap. 8).

Instabilities are readily observable in modern economies, such as a financial crash, a property price bubble, the growth to dominance of some firms and inexorable growth of the whole system. A corollary of the invalidity of general equilibrium and of linearity is that economic systems are genuinely dynamic, i.e., they evolve with time in a way that differs fundamentally from balanced growth of a moving equilibrium between supply and demand.

2.7 H8: pareto efficiency

The hypothetical Pareto efficient economy, defined in the Glossary, is characterized as follows:

• a set of markets, each in economic equilibrium

• all participants have complete information

• no externalities

• no participant has the power to influence the price at which it sells a product or service

• no increasing returns to scale.

All these characteristics are unrealistic in the 21st century. To make matters worse, a Pareto-efficient economy can be socially unjust with a vast gap between rich and poor. Nevertheless, NC economists and proponents of neoliberalism use Pareto efficiency to argue against government intervention in the market on the fallacious grounds that it takes the economic system further away from the ideal (as social equity is ignored) Pareto-efficient state.

This notion was refuted in 1956 by economists Lipsey and Lancaster (Reference Lipsey and Lancaster1956) with their general theory of the second best. The ‘second best’ applies to a system in which one or more of the Pareto optimal characteristics is invalid. Lipsey and Lancaster showed that, in such an imperfect market, introducing an additional market ‘distortion’ (e.g. a carbon tax or consumer protection regulation) may partially counteract the existing imperfections and lead to a more efficient outcome. Supporters of neoliberalism ignore this research, performed within the framework of NCE, and continue to claim incorrectly that governments must not intervene in the market, or they will make it less ‘efficient’.

NCE textbooks specify Pareto efficiency as one of the conditions for general equilibrium discussed in H5. Since Pareto efficiency does not exist in the real word, this is either an additional argument for the non-existence of general equilibrium in an industrial economy or an exposure of circular logic in NCE theory.

2.8 H9 discussion: budget deficits

One of the assumptions disseminated by some NC economists is that all government budgets are like household budgets and therefore must be ‘balanced’, that is, with annual expenditure equal to revenue. Aside from the fact that most households and businesses routinely carry significant debts or savings, the analogy is incorrect for governments that are monetary sovereign, that is, issue their own currency, collect taxes in that currency, maintain a floating exchange rate, avoid borrowing in foreign currencies, and are not heavily dependent on imports priced in foreign currencies. They include the USA, the UK, Japan, China, and Australia, but not the member countries of the European Union or state/provincial governments. As explained in Modern Monetary Theory (Hail, Reference Hail, Williams and Taylor2022; Kelton, Reference Kelton2020; Mitchell et al., Reference Mitchell, Wray and Watts2019), monetary sovereign governments face no purely financial constraints on their expenditure and investments. They are in principle able to purchase any good or service which is offered for sale in exchange for domestic currency. Governments already create money when they create and buy bonds. Since they must pay interest on bonds, direct money creation may be preferable. The principal constraint on money creation is the need to avoid inflation by keeping total expenditure within the productive capacity of the economy. This is determined by the available labor, skills, capital equipment, technology, and natural resources within the economy. The risk of inflation can be reduced by assessment of present and possible future economic capacity (Keynes, Reference Keynes1940); taxation, especially of the rich; compulsory national saving (which already exists in many countries in the form of compulsory retirement saving); and government incentives and disincentives to encourage spending that increases national economic capacity while enhancing environmental protection and social equality, for example by funding education, training, research, social security, and infrastructure (Olk et al., Reference Olk, Schneider and Hickel2023).

Governments can and often do run budget deficits without driving inflation. Japan is one of many examples (Mitchell, Reference Mitchell2020). Empirical data (e.g. from the International Monetary Fund) confirm that it is normal for high-income-economy governments to deficit spend (Diesendorf & Hail, Reference Diesendorf and Hail2022). A common response by NC economists is to mention the hyperinflation in Zimbabwe in 2007–2008, which was actually caused by several factors additional to ‘printing’ money: notably the confiscation of farms owned by white colonialists, their subsequent management by local people without experience of large-scale agriculture and the resulting constraint on supply (Mitchell, Reference Mitchell2009; Mitchell et al., Reference Mitchell, Wray and Watts2019, chap. 21).

The fact that monetary sovereign governments can create money without causing inflation has long been known to some leading financiers and economists. In 1946, the then chairman of the New York Federal Reserve, J. Beardsley Ruml, stated that

a sovereign national government is finally free of money worries and need no longer levy taxes for the purpose of providing itself with revenue… It follows that our Federal Government has final freedom from the money market in meeting its financial requirements. (Ruml, Reference Ruml1946)

It is a simple accounting identity that a government budget deficit implies a surplus of money in the private sector, which thus stimulates the private sector. Despite this, the leading NC economist Paul Samuelson said that it is better to maintain the myth that the national budget must be balanced by scaring politicians into behaving responsibly, like ‘old-fashioned religion’ (Samuelson, Reference Samuelsonn.d.). Thus people come to believe incorrectly that their lack of good public health, public education, public housing, and public transportation systems is out of the government's control. ‘The budget deficit is too big’, they are told. In crisis situations (pandemic, monetary crisis), and also when it comes to spend heavily on armaments and to legislate tax cuts for the rich, governments appear to honor the insight that they can run budget deficits without driving inflation; but they do not when dealing with public goods and the environment.

It must be acknowledged that many NC economists recognize that, at least in times of recession, deficit spending has significant benefits, whereas spending cuts by governments aggravate and lengthen recessions (Bourne, Reference Bourne2017; Center on Budget & Policy Priorities, 2011). Nevertheless, the balanced budget myth continues to have a strong grip on the US, Australian and many other governments with monetary sovereignty.

2.9 H10 discussion: methodological instrumentalism

Under H10, theories do not have to describe real economic systems, provided they are not contradicted by observation. Hence, they are unlikely to illuminate our understanding of society and economies, and do not have to have any predictive ability (Lawson, Reference Lawson2001). They are not scientific according to the requirements of natural scientists, who require much more than empirical correlation for an explanation. In NCE, even empirical correlation can be missing (e.g. see Section 2.5).

2.10 C1: Managing inflation

The NCE claim, that the manipulation of policy interest rates is the best approach to managing inflation, rests on two of the three fundamental equations of New Keynesian dynamic, stochastic general equilibrium (DSGE) models – the IS (investment-saving) curve, and the New-Keynesian Phillips curve. A third equation, which is the policy rule the central bank chooses to follow when setting its policy interest rate (often called the Taylor Rule), depends for its relevance on the validity of the relationships described by the other two equations (Clarida et al., Reference Clarida, Gali and Gertler1999).

The IS curve specifies a reliable, timely, negative relationship between aggregate demand and real (inflation adjusted) interest rates. The Phillips curve suggests the inflation rate is determined by aggregate demand relative to potential output and that, if aggregate demand is below potential output, the inflation rate will fall. These two relationships imply that any central bank which raises (cuts) nominal interest rates enough to increase (decrease) the real interest rate will be able to drive inflation down (up) to its target level reliably and quickly (Woodford, Reference Woodford2001).

The first problem with the model is the link between interest rates and demand. The relationship depends on a variety of factors, including the state of private and public balance sheets. The relationship varies over time, and is not necessarily negative. In economies with high levels of government debt and fixed-interest rate mortgages, the positive impact on demand of a fiscal stimulus relating to a higher flow of interest income to purchasers of new government securities can in principle offset any negative impact from a higher cost of private sector borrowing, so that higher interest rates become expansionary rather than contractionary (Kelton & Ballinger, Reference Kelton, Ballinger, Arestis, Baddeley and McCombie2006). Economists such as Stephanie Kelton and Warren Mosler have suggested this is what happened in the USA in 2022 and 2023 (Masters, Reference Masters2024).

A second issue is the extent to which inflation is driven by demand-side factors, supply-side factors (including increased pricing margins of oligopolistic sellers) or global factors. The irony here is that various major central banks published evidence in 2022 or 2023 that for the most part inflationary pressures were being driven by limited supply, the pandemic, war, and possibly climate change, in a global economy with long, complex, and fragile supply chains, and not by fiscal policy, low interest rates, and other monetary measures (Beckers et al., Reference Beckers, Hambur and Williams2023; Bunn et al., Reference Bunn, Anayi, Bloom, Mizen, Thwaites and Yotzov2022; Shapiro, Reference Shapiro2022).

These issues ought to be enough to make any scholar question the efficacy of central bank interest rate decisions as the principal tool for managing inflation.

2.11 C2: GDP

Gross Domestic Product (GDP) is widely used by NCE as a proxy for wellbeing or welfare of an economy. Although some NC economists have criticized this notion (e.g. Stiglitz et al., Reference Stiglitz, Sen and Fitoussi2010), many NC economists continue to treat GDP as a proxy for wellbeing in their writings. Yet, as many authors have pointed out, GDP is an inappropriate measure because it counts environmentally and socially destructive activities as positives along with beneficial activities, ignores the important role of unpaid work, and takes no account of the distributions of wealth and income. Nowadays, wellbeing of a society is measured more realistically by a group of indicators comprising, for example unemployment rate, housing affordability, education levels, and health indices (Costanza, Reference Costanza2023; Richardson & Schokkaert, Reference Richardson and Schokkaert2017). This has the benefit of measuring all factors in their given units instead of converting them into monetary values and relying on disputed methods based on hypothetical markets (Spangenberg & Settele, Reference Spangenberg and Settele2010). With wellbeing assessed by a wide range of social indicators, NC economists cannot be granted special expertise on it.

Growth in GDP is generally correlated with growth in the consumption of energy (Stern, Reference Stern, Vernengo, Caldentey and Ghosh2018) and materials (Wiedmann et al., Reference Wiedmann, Schandl, Lenzen, Moran, Suh, West and Kanemoto2015), which result in growing environmental impacts (Haberl et al., Reference Haberl, Wiedenhofer, Virág, Kalt, Plank, Brockway, Fishman, Hausknost, Krausmann, Leon-Gruchalski, Mayer, Pichler, Schaffartzik, Sousa, Streeck and Creutzig2020). Even when all energy is eventually supplied by renewables, increasing energy consumption will increase the environmental impacts of the associated increases in raw material use, industrial activities, and transportation. Furthermore, during the transition to 100% renewables, the continuing increase in energy consumption is slowing the rate of substitution of renewable energy for fossil fuels, thus increasing the risk of crossing a climate tipping point (Diesendorf, Reference Diesendorf2022; Diesendorf & Hail, Reference Diesendorf and Hail2022)., Growth in GDP has not helped the poor in the world's richest country, the United States, where the problem of poverty is one of distribution (Center for American Progress, 2022).

2.12 C3: trickle-down hypothesis

To supplement the concise critique in Table 2, which relates to inequalities within countries, it should be noted that a growing literature finds that the global North relies on a large net appropriation of resources and labor from the global South, extracted through price differentials in international trade (Giljum & Eisenmenger, Reference Giljum and Eisenmenger2004; Hickel et al., Reference Hickel, Dorninger, Wieland and Suwandi2022a; Nkrumah, Reference Nkrumah1965; Pérez-Sánchez et al., Reference Pérez-Sánchez, Velasco-Fernández and Giampietro2021).

2.13 C4: impacts of global heating

NC economists Nordhaus (Reference Nordhaus1991, Reference Nordhaus2018) and Tol (Reference Tol2009) claim that the economic impacts of substantial global heating (3–6 °C) would be trivial. In reaching their results that are refuted by climate science (Keen et al., Reference Keen, Lenton, Garrett, Rae, Hanley and Grasselli2022; Lenton et al., Reference Lenton, Rockström, Gaffney, Rahmstorf, Richardson, Steffen and Schellnhuber2019), their assumptions include the following:

• Almost 90% of GDP will be unaffected by climate change, because it happens indoors or underground, or in agriculture.

• Temporal variation is the same as geographic variation.

• The relationship between temperature and GDP today, a fairly smooth function of temperature, is a proxy for the impact of future global warming.

• Surveys that dilute severe warnings from scientists with optimistic expectations from economists are valid.

Although these assumptions have been refuted by leading climate scientists and two ‘heterodox’ economists (Keen, Reference Keen2021; Keen et al., Reference Keen, Lenton, Garrett, Rae, Hanley and Grasselli2022; Lenton et al., Reference Lenton, Rockström, Gaffney, Rahmstorf, Richardson, Steffen and Schellnhuber2019; Spash, Reference Spash2002), both Nordhaus and Tol are cited on this topic in the IPCC ARC WGIII report (IPCC, 2022). Recent research even suggests that, within the next 26 years, global income might be reduced by 19% through climate change that is already locked into the system, that is, independent of future emission choices (Kotz et al., Reference Kotz, Levermann and Wenz2024).

3. Discussion

We next address two standard arguments used by NC economists to accuse critics of ignorance and hence to decline debate about the foundations of NCE. Then we comment on the use of mathematical models in NCE.

3.1 ‘Neoclassical economics has advanced and no longer depends on all the assumptions you have critiqued.’

It is true that some variant NCE models do not depend on such assumptions as selfish individualism, Pareto efficiency or market clearing. However, Arnsperger and Varoufakis (Reference Arnsperger and Varoufakis2006) argue that all variants of NCE depend on three unproven assumptions that, taken together, define NCE: methodological individualism (critiqued as H2 in Table 2 and Section 2.2); methodological equilibration (critiqued as H7 in Table 2 and Section 2.6) and methodological instrumentalism (critiqued as H10 in Table 2 and Section 2.9).

Many of the alleged advances in NCE (e.g. behavioral economics; experimental economics, game theory) are not parts of NCE as defined in this section, but instead have been developed to address failings of NCE.

3.2 ‘As in physics, we teach simple models to undergraduates; more sophisticated understanding is taught to postgraduate students.’

It's true that, for example, Newton's laws of motion are taught in elementary physics and their modifications by special and general relativity are taught at more advanced levels. This is an honest and reasonable approach because Newton's laws are valid to a very high degree of accuracy for almost all circumstances in daily living. NCE's situation is very different, where students are taught invalid concepts at elementary level and more complicated but still invalid concepts, cloaked in difficult mathematics, at advanced levels.

For example, elementary NCE teaches that the intersection of supply and demand curves gives the quantity Q* and price P* as in Figure 1. As explained in Section 2.5, this approach depends on several assumptions that are not generally valid, including the notion that economic systems are generally in, or tend to, stable equilibrium. More advanced economics frequently makes use of computable general equilibrium modeling, which still makes the invalid assumption of equilibrium, because it greatly simplifies the calculations.

3.3 Mathematical models

NC economists often construct mathematical models, creating the impression of sophistication. NCE's use of sophisticated mathematics and the questionable use of terminology from physics discourage critiques of its basis and methods (Drakopoulos, Reference Drakopoulos2016). Mathematical models are a simplified version of reality and can be a valid tool of science provided they retain some essential features of the system of interest and provided the exclusion of other factors is noted. Their assumptions can be validated or otherwise by comparison with observation and sensitivity analysis, that is, how ‘sensitive’ the model is to variations in the parameters and data on which it is built (Iooss & Fratelli, Reference Iooss, Fratelli, Ghanem, Higdon and Owhadi2017). On rare occasions when NCE studies perform sensitivity analysis, they obtain results contradicting fundamental theory. For example, if we relax the assumption, that all market participants have perfect information about all commodities, employment, investment opportunities, etc., then the unregulated market equilibrium may be far from optimal (Stiglitz, Reference Stiglitz2018).

Most mathematical models in economics are linear models because these can be easily solved computationally. However, as discussed in Section 2.5, real economies are dynamic, non-linear systems, pervaded by instabilities and generally far from equilibrium in both the economic sense (supply and demand unequal) and the scientific sense (evolving in time). The behavior of such complex systems is radically different from static (or balanced growth) linear, near-equilibrium systems, as different as a wild horse from a wooden rocking horse. Spangenberg (Reference Spangenberg, Enders and Remig2015) argues that ‘The complexity of real economies by far exceeds that of the neoclassical ontology and the computer models based upon it’. In the words of Wassily Leontief, winner of the Nobel Memorial Prize in Economic Science,

Year after year economic theorists continue to produce scores of mathematical models and to explore in great detail their formal properties; and the econometricians fit algebraic functions of all possible shapes to essentially the same sets of data without being able to advance, in any perceptible way, a systematic understanding of the structure and the operations of a real economic system (Leontief, Reference Leontief1982, p. 104).

4. Conclusion

Our critical examination of ten key hypotheses underlying NCE and four additional claims shows that NCE fails to describe the behavior of the real economies of industrial society. The common claims and political recommendations of NCE are based on invalid assumptions, lack empirical support and, in some cases, have even been refuted by some NC economists.

While a common defense of NCE is that ‘it has advanced and no longer depends on all the assumptions you have critiqued’, it still depends on at least three hypotheses that are not generally true: methodological individualism (H2), methodological equilibration (H7) and methodological instrumentalism (H10). Furthermore, few NC economists publicly contradict policies arising from other invalid hypotheses and claims of NCE, such as support for endless growth on a finite planet, tax deductions for the rich, and balanced national budgets in monetary sovereign countries.

Financial crashes are not possible in NCE theory, yet even the GFC of 2008 did not cause NC economists to significantly revise their concepts. Time and again, NCE has failed to demonstrate predictive capacity. While NC microeconomics performs a useful role in collecting and analyzing economic data on households and firms, its theory is based on unrealistic assumptions and so its policy recommendations cannot be relied upon. There is no valid theoretical basis for NC macroeconomics. We conclude that NC microeconomics should be reformed and NC macroeconomics should be abandoned.

At present, neoliberal recommendations arising from the idealized, that is, reality-free, economic system of NCE are still dominating government policies in many countries (Chawla, Reference Chawla2024). They are the conventional ‘wisdom’ articulated daily by politicians, journalists, and academics. The result is environmental destruction, the impoverishment of billions of people, and inadequate management of threats to human health and wellbeing.

Many of the issues discussed in this paper have been raised previously by a minority of economists and, on rare occasions, by scientists, for example Blatt (Reference Blatt1983), Philip Smith in Smith and Max-Neef, (Reference Smith and Max-Neef2011), and Davies (Reference Davies2019). The general response of the NCE establishment has been to ignore the criticisms or to marginalize their authors by denying them academic appointments, promotions and publications in mainstream economics journals (Butler et al., Reference Butler, Jones and Stilwell2009; Galbraith, Reference Galbraith2001; Lee, Reference Lee2004; Saith, Reference Saith2022).

NCE is socially constructed and therefore can be replaced. Because of its damaging influence, it must be replaced, at least at the macro level. The operation of an economy is complex and subtle. It is inextricably linked with the society of which it is a part, and with the natural world of which humanity is a part. Knowledge from many fields must be brought to bear to help to understand it, and to render it compatible with and supportive of its society and the natural world. Recent publications propose strategies and in some cases government policies to drive the transition (Davies, Reference Davies2019, Reference Davies2023; Diesendorf & Taylor, Reference Diesendorf and Taylor2023; Dixson-Declève et al., Reference Dixson-Declève, Gaffney, Ghosh, Randers, Rockström and Stoknes2022; Hickel et al., Reference Hickel, Kallis, Jackson, O'Neill, Schor, Steinberger, Victor and Ürge-Vorsatz2022b; Spash, Reference Spash2024). A broad socioeconomic framework is provided by the transdisciplinary field of ecological economics, which integrates knowledge about nature into economic reasoning and gives ecological sustainability and social justice higher priority than economic efficiency (Costanza, Reference Costanza2014; Daly & Farley, Reference Daly and Farley2011; Diesendorf & Taylor, Reference Diesendorf and Taylor2023; Williams & Taylor, Reference Williams and Taylor2022). However, within the broad church of ecological economics, a variety of denominations exists, including ones that ignore such core foundations as the need for a steady state economy that's compatible with ecological sustainability and social justice, and the need to discard many of the hypotheses of NCE such as price theory (Spash, Reference Spash2020). A more radical approach than ecological economics, namely social ecological economics, is proposed by Spash (Reference Spash2024). Political economy, which recognizes the roles of power structures (Stilwell, Reference Stilwell2011) and traditional institutional economics (Voigt, Reference Voigt2019) can make valuable contributions to the new economics that is needed urgently. It may still be possible to choose a transition path to an ecologically sustainable, socially just civilization, although time is of the essence, especially in the face of accelerating climate change and transgression of other planetary boundaries.

To achieve ecological sustainability, it is necessary, but not sufficient, to limit the scale of human activity. Therefore the rich countries must reduce their physical consumption (land, energy, other natural resources) and stabilize their populations, which could be done while still improving the quality of life for all (D'Alessandro et al., Reference D'Alessandro, Cieplinski, Distefano and Dittmer2020; Hickel et al., Reference Hickel, Kallis, Jackson, O'Neill, Schor, Steinberger, Victor and Ürge-Vorsatz2022b; Jackson, Reference Jackson2021; Victor, Reference Victor2012, Reference Victor2019). The fate of GDP is unimportant. Social justice can be improved, while reducing the pressure for continuing growth. Furthermore, Modern Monetary Theory (Kelton, Reference Kelton2020; Mitchell et al., Reference Mitchell, Wray and Watts2019) offers insights into how the transition to an ecologically sustainable, socially just society could be funded by monetary sovereign countries without driving inflation (Diesendorf & Hail, Reference Diesendorf and Hail2022; Olk et al., Reference Olk, Schneider and Hickel2023). Policies could include universal basic services in which a social wage replaces part of a monetary wage (Coote et al., Reference Coote, Kasliwal and Percy2019; Social Prosperity Network, 2017) and a job guarantee (Tcherneva, Reference Tcherneva2020) . Thus governments, guided by the people via democratic decision-making, can play an important role in strategic planning and implementation. There would still be a role for markets, provided they are shaped to protect the environment, social justice and human health.

Acknowledgement

We thank Brian Martin and the anonymous reviewers for valuable comments.

Author contributions

MD conceived the study. All authors contributed to the design and writing.

Funding statement

This research received no specific grant from any funding agency, commercial or not-for-profit sectors.

Competing interests

All authors declare no conflicts of interest.