DISCUSSION POINTS

• Rare earths are key to modern society.

• Low grades, complex processing, and environmental impacts mean that rare earth production is concentrated in a few countries only.

• Since the rare earth market is small and concentrated, it is susceptible to disruptions.

• Recycling and substitution are extremely difficult and thus, are not near-term solutions.

Introduction

Rare-earth elements (REEs) have become important over the last century as their electrochemical, magnetic, alloy strengthening, and luminescent characteristics are at the core of manufactured modern electric vehicles, green energy generation, electronics, and high performance airframes. This is reflected in the compounded annual growth rate of 13.7% that is expected between 2017 and 2021 for the global rare-earth metal market.Reference Daily1 The global rare earth market is, however, modest at $9 billion and an annual consumption of about 150,000 tons of rare-earth oxide (REO) worldwide. Despite the small direct economic footprint, the reason rare earths are so important is because they are critical inputs to goods worth $7 trillion,Reference Kennedy, De Lima and Leal2 in a global economy worth $75 trillion.3 Therefore, they have exceptional potential for wealth creation and green energy technological advancement. However, these benefits come with a serious social and environmental downsideReference Okabe4 such as illegal mining and subsequent environmental damage. In some cases, as described later in the paper, the potential for environmental damages has led to international controversies.

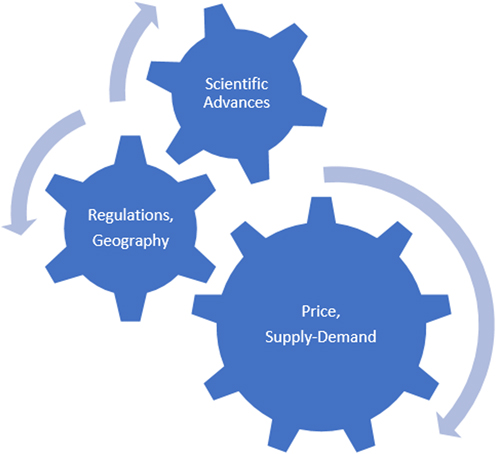

Table 1 lists some common applications of REEs. The importance of some applications is not always obvious from the table. For example:

(i) REEs are critical for exceptionally strong permanent magnets and high temperature superconducting (HTS) magnets, wires, and cables.Reference Bromberg, Hashizume, Ito, Minervini and Yanagi5 Magnets, including the common neodymium–iron–boron (NdFeB) magnets are important for electrical motors, generators, and speakers. An average car uses 40–100 motors.Reference Goodenough, Wall and Merriman6 Windmills, providing wind energy, rely on generators that require REEs. Speakers are a key component of basic entertainment systems.

(ii) REE applications in glass impact the electronics sector for their screens. Cerium (Ce) has unique physical and chemical properties that make it an important polishing agent.9 From precision lenses to mirrors, glass polishing requires Ce.

(iii) There are some critical niche uses of REEs.Reference Haxel, Hedrick and Orris7 Only erbium (Er) possesses the optical properties that are necessary to make laser repeaters work. Laser repeaters are essential to fiber optic communication. Liquid crystal displays used in television monitors and computers use europium (Eu) for red phosphor. There is no known substitute, though substitutes are being developed for fluorescent lighting.Reference King8

Table 1. The many uses of REEs.Reference Guyonnet, Planchon, Rollat, Escalon, Tuduri, Charles, Vaxelaire, Dubois and Fargie112–114

a Promethium is a radioactive metal and does not occur naturally on earth. It is artificially created for applications.

In many of the critical uses, it is not about the quantity of REEs that is needed. REE is often used in small quantities, as in most cases when they are used, they improve the effectiveness of the product. In the others, they are simply essential as they play a required role. Table 2 shows the quantity of REE in some products.

Table 2. Quantity of REEs in some products.Reference Okabe4,Reference Wise101,Reference Haschke, Märten, Kalka and Nikolai115

The definition of REEs has changed over time. The fifteen elements, lanthanum to lutetium (atomic numbers 57 to 71), used to be referred together as REEs (Henderson, 1984). These elements, also known as lanthanoids, are typically discussed together because they have a few common chemical and physical properties. Yttrium (Y) and scandium (Sc), though not lanthanoids, have some properties common to lanthanoids. Therefore, Y and Sc, combined with lanthanoids, are now called REEs.9

A look at the electronic structure provides some explanation for the similarities between REEs. A brief and simplified primer on the general electronic structure of atoms is provided to help with the discussion. Electrons occur at specific quantum level inside of atoms with levels being numbered sequentially from 1. An electron will spin in an orbital of a specific shape (such as s, p, d, and f) around the nucleus of the atom, while maintaining its energy level. Each orbital accommodates up to two electrons spinning in opposite directions. The energy level of an electron is a function of both the quantum level and orbital. Generally, the higher the energy level of an electron, the farther it is from the nucleus of the atom. The electronic structure of lanthanum (atomic number 57) is [Xe]5d 16s 2, which means that it has 3 electrons beyond the closest stable form, that of element xenon. These 3 outer electrons are as follows: 1 electron in energy level 5d and 2 electrons in energy level 6s. Outer electrons are important as they can be dislodged for chemical bonding. The valence electrons (those available for bonding) for an element can change based on conditions.

Cerium is next in the periodic element, with atomic number 58. Its electronic structure is [Xe]4f 26s 2. The electrons in the 4f orbital then steadily increase, and almost sequentially, to 14 as one moves along the periodic tableReference Laboratory10 all the way to lutetium (atomic number 71). These electrons happen to be placed in a part of 4f orbital that is well protected from neighboring orbitals.Reference Spelding11 Thus, these electrons are difficult to dislodge to make bonds with other elements. Additionally, despite the increase in electrons, the ionic radii do not increase, as is common for non-REEs.Reference Gupta and Krishnamurthy12 The REEs are therefore interchangeable in mineral structures and difficult to separate during mineral processing.

The electronic structure also explains some of the other properties. Pairing of electrons is initiated once the 4f orbital is half-filled at gadolinium.Reference Pecharsky and Gschneidner13 Up to that point, all electrons spin in the same direction and add to the magnetic moment. As pairing occurs more and more, magnetic moment reduces all the way to lutetium, which has no magnetic moment.

REEs are often subdivided into two groups, light rare-earth elements (LREEs) and heavy rare-earth elements (HREEs), based on increasing atomic numbers. Elements lanthanum (atomic number 57) through gadolinium (atomic number 64) are considered LREEs and have unpaired electrons ranging from 0 to 7, respectively. The remaining lanthanoids (atomic numbers 65 through 71) all have paired electrons (unlike LREE) and are considered HREEs. Yttrium is included in the HREE due to similarities in some properties. Scandium is in neither category. An alternate classification14 of the REE splits them into light (lanthanum, cerium, praseodymium, neodymium, and promethium), medium (samarium, europium, and gadolinium), and heavy REEs (terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, scandium, and yttrium).

As with other metals, the supply chain of rare earths involves four basic stages. The first stage is exploration, i.e., it involves locating the resources in economic quantities. The second stage is the act of mining (including obtaining permits). These two stages are very similar for all mineral sources. The third stage (processing) can be very simple or very complicated based on the minerals being targeted. For rare earths, this stage is very complicated and consists of two phases: concentration and separation. In the concentration phase, rare earths are concentrated from about <15% original grade to a highly concentrated mixture of various REEs. At the end of this concentration phase, the total rare earth content may be 70% for bastnaesite and upwards of 90% for ores derived from Chinese ion-adsorbed clays.Reference Eggert, Wadia, Anderson, Bauer, Fields, Meinert and Taylor15 In the separation phase, REEs are separated individually as compounds such as nitrates, carbonates, or oxides. The metal is produced from the compounds in the fourth stage of rare earth production, though it may also be alloyed with other elements depending on intended use.

Use and sourcing of REEs

Production and use

The United States Geological Survey produces annual statistics on various aspects of rare earths in its Minerals Yearbook.16 The yearbook is the source of information in this section, unless otherwise stated.

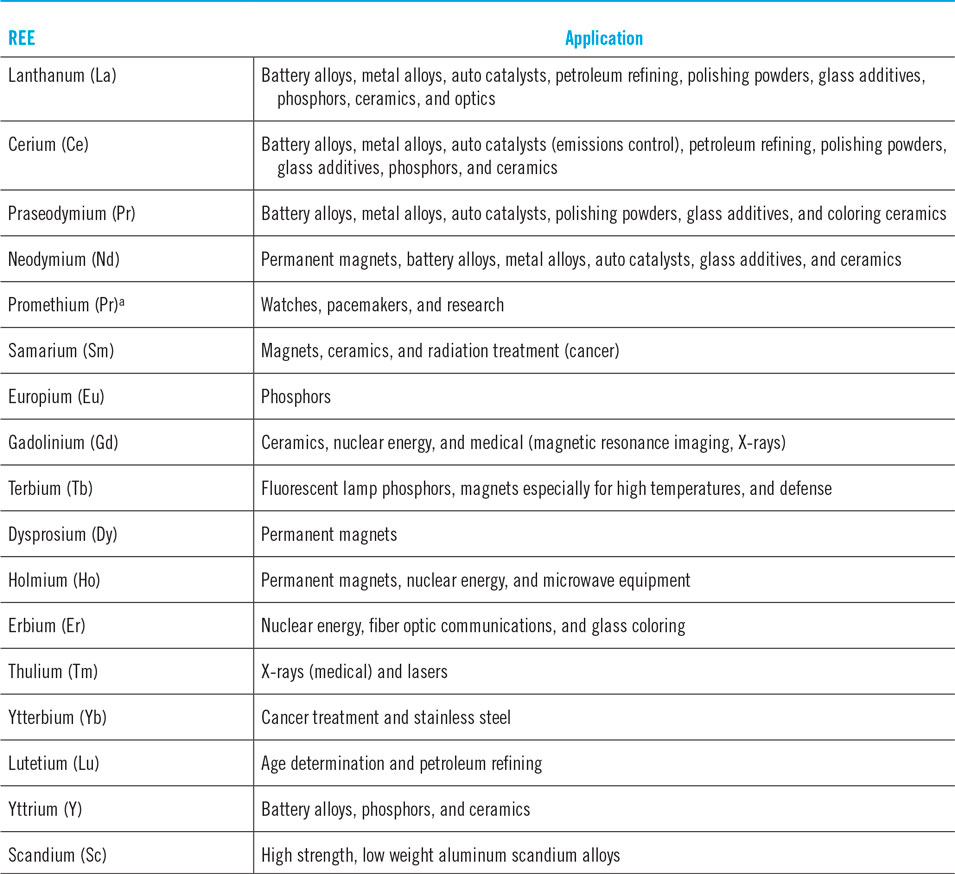

The global production of rare earths have increased dramatically since the 1950s (Fig. 1Reference Van Gosen, Verplanck, Seal, Long and Gambogi17). The United States was the primary producer of rare earths until the 1980s, when China first started producing rare earths. China has since then become the world’s largest producer of rare earths, producing 130,000 mt in 2015. As recently as 2015, when it produced 5900 mt, the United States was the leading producer of rare earths outside of China. However, low prices resulted in shutting down of production in 2015 at Mountain Pass mine, the US’s lone rare earth mine. Mountain Pass is the largest known rare earth deposit in the United States.Reference Long, Van Gosen, Foley and Cordier18 No longer a producer, the United States is now 100% reliant on imports for rare earths, as against being 65% import reliant in 2015.

Figure 1. Historical production of rare earths.Reference Van Gosen, Verplanck, Seal, Long and Gambogi17

In the four year period 2012–2015, 72% of rare earth compounds were imported from China. Estonia, France, and Japan represented between 5 and 7% of the imports each during that time period. The United States consumed 16,000 mt of rare earths in 2016. The details on REE use are given in Table 3.

Table 3. Pattern for rare earths use in the United States in 2016.16

China produced about 80% of the world production in 2015 and 2016 (105,000 mt in each year). Obtaining reliable REE-related (reserve or production) data from China is difficultReference Wang, Huang, Yu, Zhao, Wang, Feng, Cui and Long19 and, therefore, it is not clear if the official figures of China include rare earths that are illegally produced. The world production went down to 126,000 mt in 2016 from 130,000 mt in 2015.

The illegal market is quite substantial in China—almost 60% of the heavy rare-earth oxide produced in China is illegal.Reference Nguyen and Imholte20 Approximately 25,000–50,000 tons of REO was illegally produced annually in China from 2010 to 2015.Reference Eggert, Wadia, Anderson, Bauer, Fields, Meinert and Taylor15 The official Chinese rare earth industry considers the illegal producers a threat because of their unmanaged and negative impact on prices.Reference Xinhua21 The illegal market, sometimes routed through Vietnam and Hong Kong, impacts prices around the world.Reference Jamasmie22 To curb the illegal market, the Chinese government and the Australian REE producer Lynas have proposed setting up a product traceability system.Reference Paul and Stanway23 Some in China are also concerned about the sharp decline in REE resources available in China due to its large REE production.Reference Yang, Lin, Li, Wu, Zhou and Chen24

The countries that produced rare earths in 2016 besides China are Australia (14,000 mt), Russia (3000 tons), India (1700 mt), Brazil (1100), and others (less than 2000 mt total). China, Brazil, and Russia have the most declared rare earth reserves at 44, 22, and 18 million metric tons (Mmt), respectively, while the US reserve stands at 1.4 Mmt. The word “reserve” is used very restrictively in this context. A mineral deposit does not generally become a “reserve” unless it has been drilled extensively, a reliable extraction plan developed for it, and an estimate is made for the amount of mineral resource that can be economically produced from it. Thus, a lack of reserve does not mean a lack of minerals. It simply means that there has not been sufficient due diligence, or that a deposit is not feasible economically at a given price.

China is also a major user of rare earths, though the use is primarily for the products it manufactures for the export market. In 2011, almost 70% of China’s rare earth production was used in China.Reference Wübbeke25 Overall, China uses 60% of world’s rare earth production.26 Among the other major consumers is Japan, which consumed 20,175 mt of rare earths in 2016.27 11,141 mt or 55% of the total use was sourced from China, 4237 mt from France, and 2623 mt from Vietnam.

Demand for rare earth is expected to grow at 6% annually by 2020.28 However, not all rare earths are equal with respect to future demand. The demand for neodymium and dysprosium is expected to rise 700 and 2500% between 2012 and 2027.Reference Alonso, Sherman, Wallington, Everson, Field, Roth and Kirchain29

Sourcing: deposits, mineral structures, and mines

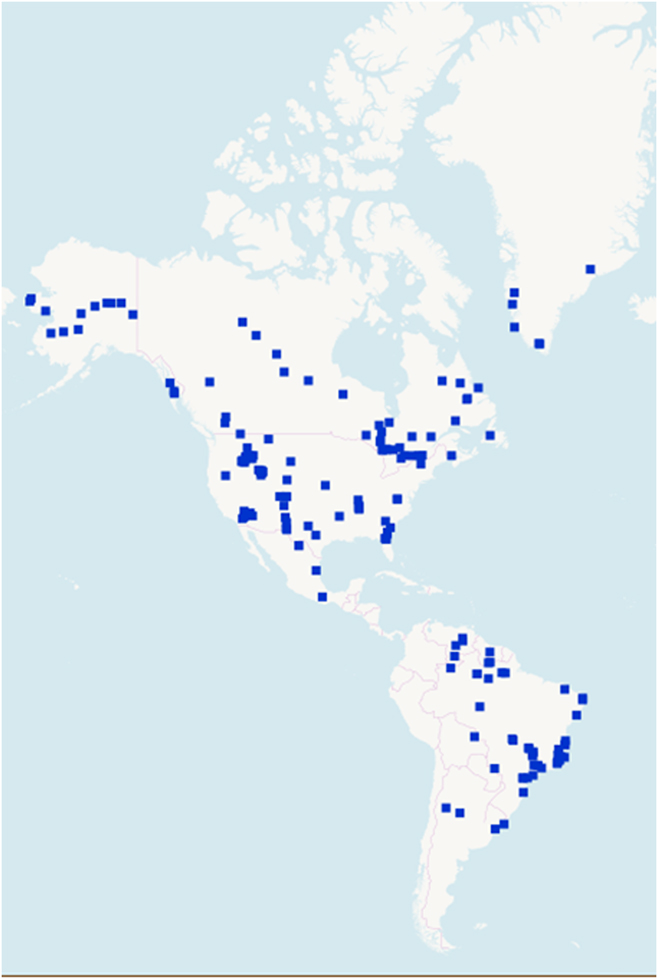

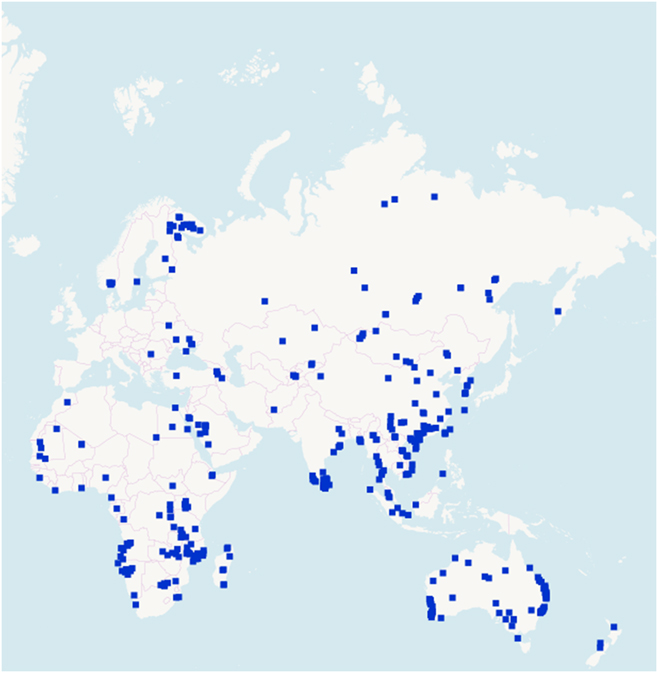

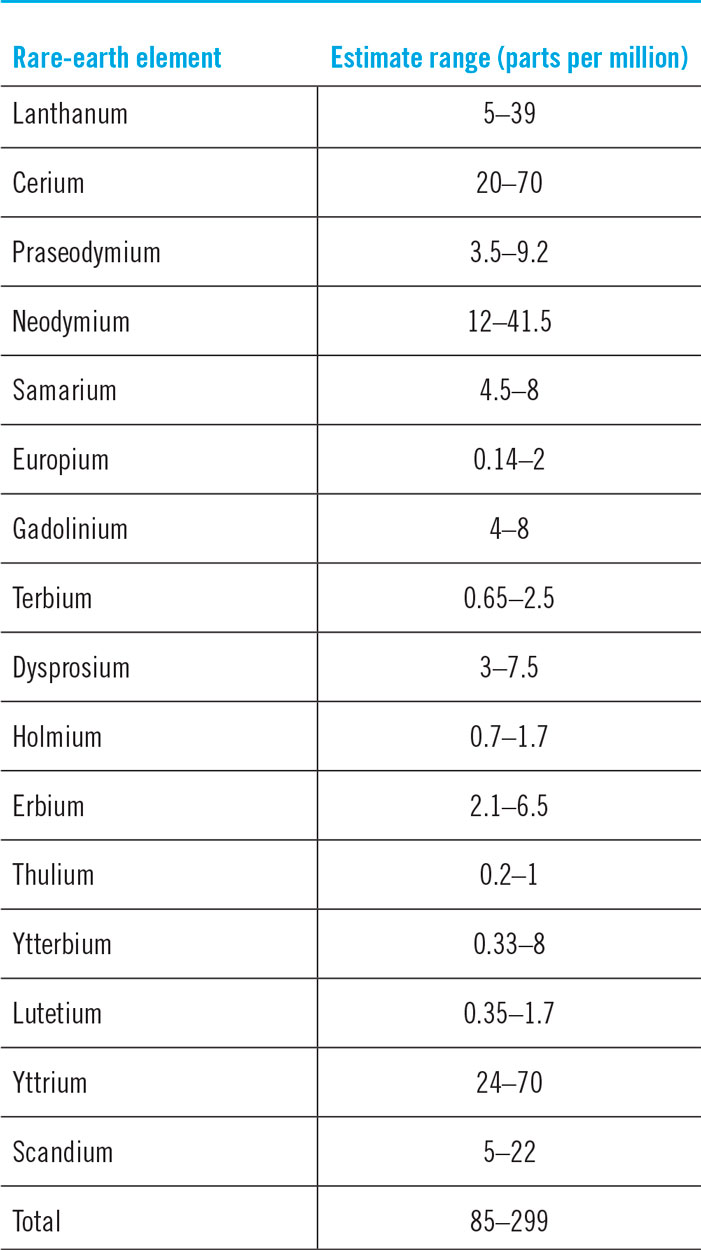

REEs are not rare (Figs. 2 and 3).30 Thulium (Tm) and Lutetium (Lu) are two of the rarest REEs on the planet Earth. Yet, they are 200 times more abundant than gold.Reference Haxel, Hedrick and Orris7 Table 4 shows the crustal abundance estimates for REEs. It is worthwhile to compare the crustal abundance concentration of the REE (85–299 parts per million) with that of zinc (70 parts per million) and copper (55 parts per million). While not rare relative to many other commonly mined elements, deposits of REEs that are large enough and concentrated enough to mine economically are very rare. The REE is a group of 17 elements and, therefore, the individual concentrations are much lower. The few locations where REE concentrations are high are those that have become mine sites.

Figure 2. REE deposits in the Americas and Greenland.30 © OpenStreetMap contributors.

Figure 3. REE deposits in the rest of the world.30 © OpenStreetMap contributors.

Table 4. Estimated crustal abundance of REEs.Reference Long, Van Gosen, Foley and Cordier18

The mineralogies of REE deposits help explain the challenges of mining REE. In a typical mine, the commodity of interest is often locked in a specific mineral. Minerals are chemical compositions with relatively fixed chemistries. For example, the zinc in a zinc mine may almost entirely come from the mineral sphalerite (ZnS) though there are numerous minerals that contain zinc. In such cases, separating the pay commodity from within the mineral structure can be easy. REEs, on the other hand, typically occur in multiple mineralogies in a site. For example, the REE in a deposit may be equally distributed between silicate, carbonate, and phosphate minerals. Additionally, a given mineralogy may contain different REE combinations as REEs are sometimes interchangeable with each other due to their similar ionic radii. Bastnasite is a carbonate mineralReference Long, Van Gosen, Foley and Cordier18 with the structure [Ce, La, Y]CO3F, where [Ce, La, Y] indicates that the mineral may contain one or more of cerium, lanthanum, or yttrium. Similarly, monazite is a phosphate mineral of the structure [Ce, La, Nd, Y, Th]PO4, where [Ce, La, Nd, Y, Th] indicates that the mineral may contain one or more of cerium, lanthanum, neodymium, yttrium, or thorium.Reference Long, Van Gosen, Foley and Cordier18

Bastnaesite, monazite, and xenotime (YPO4) are the most commonly mined rare-earth minerals worldwide, not including ion-adsorbed clays.Reference Wübbeke25,Reference Jordens, Cheng and Waters31 The major minerals that contain REEs in the United StatesReference Nguyen and Imholte20 are euxenite ([(Y, Er, Ce, U, Pb, Ca)(Nb, Ta, Ti)2(O, OH)6]), bastnaesite, xenotime, monazite, and allanite ([Ca(Ce, La, Y, Ca)Al2(Fe2+, Fe3+)(SiO4)(Si2O7)O(OH)]). The presence of uranium (U) and thorium (Th) as part of the possible mineral structure in euxenite and monazite should be noted.

The iconic Bayan Obo mine in China’s Inner Mongolia, which supplied 45% of the world’s REE production in 2005, mines bastnaesite and monazite, although REE is present in 15 different minerals.Reference Zhi and Yang32 This mine operated as an iron ore mine for decades, before producing rare earths. A big part of the REE in the mine is extracted from the tailings of the iron ore.Reference Zhang and Edwards33 The recently shut down Mountain Pass mine in California also mined bastnaesite. REOs are approximately 70% of bastnaesite, primarily consisting of cerium, lanthanum, praseodymium, and neodymium.Reference Jordens, Cheng and Waters31

The Bayan Obo mine also contains monazite. REOs are approximately 70% of monazite and like bastnaesite primarily consisting of cerium, lanthanum, praseodymium, and neodymium.Reference Jordens, Cheng and Waters31 A major mineral in the REE producing mine at Mt. Weld, Australia, is monazite.Reference Hedrick34

Monazite is also in most placer deposits around the world as many igneous, sedimentary, and metamorphic rocks contain small amounts of monazite.Reference Long, Van Gosen, Foley and Cordier18 An issue with monazite is that it can contain 0–12% thorium by weight,Reference Long, Van Gosen, Foley and Cordier18,Reference Jordens, Cheng and Waters31 making its tailings potentially radioactive. For example, the monazite beach sands in the state of Odisha in India have an REE content of 56.75% by weight, with ThO2 and UO2 content of 10.18 wt% and 0.26%, respectively.Reference Mohanty, Das, Vijayan, Sengupta and Saha35 India reports 11.93 million tons of monazite reserves.36

Both bastnaesite and monazite are important sources of LREEs. Xenotime, on the other hand, is a source of HREE even though it is often a by-product of processing monazite.Reference Jordens, Cheng and Waters31 Aluminosilicate minerals (such as kaolinite and illite) present in ion-adsorbed clay deposits are also an important source of HREEs. As REEs are adsorbed to the surface of the clays, it is easier to extract them. The simplicity of extracting REEs from these deposits means that though ion-adsorbed clays account for only 2.9% of China’s REE reserves, they contributed 26% to the total REE production in China from 1988 to 2007.Reference Su37

Loparite [(Ce, Na, Ca)(Ti, Nb)O3] is another REE mineral that is mined, in Russia’s only REE mine in the Lovozero agpaitic nepheline syenite complex in Murmansk Oblast.Reference Goodenough, Wall and Merriman6,Reference Vereschagin, Kudrevatykh, Malygin and Emelina38 It has been mined since 1951 for Ce and Nb.Reference Wall and Gunn39 The Nora Karr deposits in Sweden and Ilimaussaq and Motzfeldt deposits in Greenland are some large agpaitic nepheline syenite complexes that are currently of interest for REEs.Reference King8

Mineral processing

The mineral processing for extraction of REEs from broken rock often starts with comminution (crushing and grinding). Comminution is needed to expose the REE in rocks to downstream chemical processes for their extraction. Comminution is always a major component of total cost in any mine where it is needed. The mined rock is incrementally enriched through beneficiation processes such as X-ray sorting, magnetic, or gravity separation, followed by flotation. A review of flotation for rare earths was recently published.Reference Anderson, Taylor and Anderson40

Beneficiation is followed by leaching, baking, or cracking.Reference Verbaan, Bradley, Brown, Mackie, Simandl and Neetz41 Ionic clays may not need any of the preceding processing steps, including the very expensive comminution step. Impurities may be removed next in the process, using alkaline reagents. This step can be problematic if calcium-based reagents are used in a sulfate environment as REEs may precipitate along with gypsum, leading to losses in REEs. Solvent extraction (SX) and ion exchange (IX) may also be used. The goal at this step is usually to remove thorium, iron, phosphorus, and aluminum. The first stage of recovering REE happens next, followed by a second stage of impurity removal. Impurities such as base metals, uranium, radium, and thorium (whatever remains) are removed. REOs are individually recovered next. Acids (nitric, hydrochloric, or sulfuric), alkaline [sodium hydroxide, or ((NH4)2SO4)] reagents are usually recovered to minimize reagent cost, though that results in additional complication.

Ion-adsorbed clays are processed easily, by leaching them with aqueous sodium chloride or ammonium sulfate, though sodium chloride has replaced ammonium sulfate due to cost concerns. REE extraction occurs through IX.Reference Zhi and Yang32 REEs are then precipitated as “oxalic acid-rare earths” using oxalic acid. The precipitate is burned to get the final REO.

Producing rare earths requires a lot of energy and water. A studyReference Koltun and Tharumarajah42 that used the Bayan Obo operation as a model estimated energy and water consumption for REE production. According to the study, production of 1 kg of REO consumes 4.64 MJ of electricity, 10.11 MJ of heat, and 3.24 kL of water by the time it is mined and beneficiated.Reference Koltun and Tharumarajah42 It consumes almost ten times as much electricity in the next stage of REO extraction from monazite (5.6 MJ of electricity for bastnaesite and 55.6 MJ of electricity for monazite). The final stage can be an additional 15.5 MJ of electricity. The heat energy consumption is 90 and 11.9 MJ for the second stage of REO extraction from bastnaesite and monazite, respectively. Water consumption in the second and third stage of REO extraction is an additional 20–30 kL. Note that since a group of REEs is extracted together in most deposits, the processing costs are all the same, even if their prices are dramatically different.Reference Golev, Scott, Erskine, Ali and Ballantyne43 This is also reflected in the similar energy (∼180 MJ) and water (∼38 kL) consumption for light and heavy REOs.Reference Koltun and Tharumarajah42

Given the challenges, researchers have focused on methods capable of maximizing or optimizing recovery of REEs. The use of salicylhydroxamic acid in flotation of rare-earth minerals was recently explored.Reference LaDouceur, Young and Amelunxen44 A low temperature leaching method was patented for the Bear Lodge project in the USA that lowered the leaching kinetics of gangue while selectively leaching rare earths at low acid concentrations.Reference Kasaini, Bourricaudy and Larochelle45 An additional process patented for the deposit precipitates REEs from the base metal containing highly acidic chloride leach solution. A new process for the Bayan Obo deposit recovers upwards of 92% of REEs, while reducing the environmental issues.Reference Zou, Chen and Li46 A new flotation, agglomeration, and magnetic separation process has been successfully tried at the Dalucao rare earth deposit in China.Reference Deng, Chen and Xiong47 Flotation and magnetic separation was also reported for the Montveil deposit in Canada.Reference Negeri and Boisclair48 Some are developing the right leaching technology for ion-adsorbed clays from Africa, Asia, and South Africa.Reference Papangelakis and Moldoveanu49 If successful, it would create new REE resources outside China.

Sourcing: recycling, nontraditional sources

The waste from electronics equipment, or e-waste, is often recycled in the developed countries by exporting it to third world countries.Reference Ladou and Lovegrove50 Exported scrap includes printed circuit boards, scrap automobile magnets, and hard drives. The handling and recycling of these in the third world nations is considered a threat to both the health of the individual attempting to recover the metals as well as to the environment.Reference Veronese51 Additionally, rare earths are often used in small quantities, making their recycling challenging. For example, when hard disk drives (which contain between 10 and 20 g of neodymium–iron–boron alloy) are shredded to destroy data, the magnets break into pieces and attach to ferrous wastes.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52 Metallic wastes eventually end up in smelters that are designed to extract large quantities of base metals and not REE, making REE extraction impossible. Additionally, their pricing has been volatile, making investment in recycling risky. Therefore, less than 1% of REEs are recycled, even though recycling has been an area of interest in the laboratory.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52 Selective recycling can help increase prices. For example, lanthanum and cerium are often co-produced when the desired REE is neodymium. This results in unintended production of lanthanum and cerium. If neodymium was to be recycled, less lanthanum and cerium would be produced, increasing their prices.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52

Recycling of REE magnets

The highest potential for recycling is with REE magnets in hard disk drives and specific automobile applications.53 Industrial investments on REE recycling have currently focused on magnets. This includes the Hitachi facility that is focused on recycling REE from magnets in hard disk drives, compressors, and air conditioners.54 Since magnets are alloys containing REEs, there is no benefit for grinding or physical separation of the product components. Hitachi created custom machinery to address the challenges of recycling.

In another effort, the sintered NdFeB magnets were decrepitated from hard drives using hydrogen to obtain demagnetized hydrogenated powder.Reference Walton, Yi, Rowson, Speight, Mann, Sheridan, Bradshaw, Harris and Williams55 Researchers claimed to recover upwards of 90% of the magnetic properties of the starting material on reprocessing of the powder. It is not clear if the method has matured to an industrial application.

Pyrometallurgy, involving melting of metals, has often been used to treat production wastes in manufacturing. The various pyrometallurgical methods include electroslag refining, liquid metal extraction, glass slag method, and direct melting.Reference Ellis, Schmidt, Jones, Liddell, Bautista and Orth56,Reference Saito, Sato, Ozawa, Yu and Motegi57

The presence of adhesives, plastics, corrosion, and metals such as nickel, zinc, and cobalt prevents the use of pyrometallurgical routes for recycling end of life magnets.Reference Lorenz and Martin58 Therefore, hydrometallurgy-based REE recycling has also been proposed by some for recycling magnets.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52 These are the methods commonly used to extract REEs from ores and require a variety of chemicals. Solvay is using hydrometallurgy methods to recycle samarium and cobalt.Reference Bounds, Liddell, Bautista and Orth59 Solid-state chlorination has also been offered as an alternative to recycling magnets.Reference Lorenz and Martin58

Recycling of other REE products

Solvay, along with Umicore, is recycling REEs from nickel metal hydride rechargeable batteries, though the process is unknown.60 At the end of their life, lamp phosphors are a good source of HREEs. Recycling these (fluorescent lamps and compact fluorescent lamps) is easier than magnets. They can either be reused in new lamps or hydrometallurgical processes can be used to extract REEs from them.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52 Presence of mercury in the lamps can be an issue, both as an impurity and also as a toxic element. Solid-state chlorination can be a potential alternative to wet processes for recycling REEs from fluorescent lamps.Reference Lorenz and Martin58

Recycling of cerium from polishing powders is extremely difficult partly because it is heavily contaminated with the material from the surface being polished.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52 Fluid cracking catalysts and automobile exhaust catalysts have not been the focus of any industrial recycling efforts. Similarly, recycling of REEs from optical glass has not been of significant interest to the industrial sector.

Regardless of the low level of activity on recycling, it is estimated that 5000–10,000 tons would be produced by recycling in 2020.Reference Binnemans, Jones, Blanpain, Van Gerven, Yang, Walton and Buchert52

REE from nontraditional sources

There has been a significant interest in recent years in nontraditional sources of rare earths. Rare metal complexes with varying mineral structures were discovered in the South Gobi region of Mongolia.Reference Vladykin61 REE associated with the lanthanide elements was detected at a concentration of 1100 ppm in the tailings solvent unit of Canadian oil sands.Reference Roth, Bank, Howard and Granite62 The sands itself did not have much REEs. Many have recently focused on recovering REEs from coal and coal by-products such as ash.Reference Seredin and Dai63,Reference Granite, Roth and Alvin64 Some have claimed to produce 98% pure rare earth concentrate from a coal source.65 Their achievements include efficiently separating scandium from other REEs.

On a worldwide basis, coal and coal ash contain approximately 68 and 404 ppm of rare earths, respectively,Reference Seredin and Dai63 with US averages at 62 and 517 ppm, respectively, for coal and coal ash. The REE content of coal ash is close to the REE content of the ion-adsorbed clays that are currently mined in China. Several researchers understandably studied the enrichment of REE content in coal and coal ash.Reference Lin, Howard, Roth, Bank, Granite and Soong66,Reference Gupta, Ghosh, Akdogan and Srivastava67

Coal is unlikely to be mined for the sake of its REE. However, the presence of REEs in coal and coal ash could turn coal and coal-ash–based environmental liabilities into assets. Tailings dams containing coal wash plant rejects from mine sites or coal ash from power plants could be seen as repositories of REEs, albeit at low concentrations. In both cases, particles would be fine, i.e., comminution needs would be minimal. Waste from REE extraction could go back into the same tailings dams, minimizing permit requirements. The complex processes (and cost) of extracting REE would, however, still remain. The Jungar coal field in China could supply as much as 12,000 tons of REO based on the 0.14% REO content of its ash.Reference Seredin and Dai63 It is estimated that acid mine drainage sludge from Pennsylvania and West Virginia in the United States alone could provide 45,000 tons of REE per year.68

Avoiding or minimizing REE: substitutes

REE consumers have also focused from time to time on reducing or eliminating REEs from their products. Hitachi and others have used technologies to reduce REE use in their magnet production.Reference Smith and Eggert69 Diffusion technology can reduce REE use by up to 50% by allowing dysprosium or terbium to be placed around the grain rather than through the crystal structure. The element for element substitution, however, is only somewhat possible for NdFeB magnets.Reference Smith and Eggert69

The automotive industry has been a leader in finding alternatives to rare earth-based magnets.Reference Widmer, Martin and Kimiabeigi70 The electric induction motor developed by Tesla and wound motor by Renault do not require rare earths. BMW uses less rare earths in its hybrid motors by limiting its use in just the right parts of the motor.

Substitution has not been promising in the wind sector for NdFeB magnets.Reference Pavel, Lacal-Arántegui, Marmier, Schüler, Tzimas, Buchert, Jenseit and Blagoeva71 However, the dysprosium use in the sector has fallen due to an increase in material efficiencies. The permanent magnets in some newer models use only 1% dysprosium rather than the typical 3–6%. As demand for wind energy grows, however, wind turbines will have to become larger. This will increase costs as traditional turbines cannot be scaled up easily. Lightweight turbines, possibly with experimental HTS-based generators, would necessarily be required if turbines are to be scaled up. If HTS generators indeed become feasible, REE use will go down. HTS generators only require 2 kg/MW of REE compared to 30–200 kg/MW for permanent magnet-based synchronous generators.Reference Buchert72 Other efforts to reduce REE use in the wind sector include developing completely new materials with desirable magnetic propertiesReference King8 and increasing density of magnetic energy in magnets. Some assert that the wind sector is well prepared for short-term and midterm potential challenges to REE supply.Reference Pavel, Lacal-Arántegui, Marmier, Schüler, Tzimas, Buchert, Jenseit and Blagoeva71 The long-term outlook may be optimistic given developments such as HTS generators.

In the area of lighting, organic light emitting devices may emerge as substitutes for rare earth-based lighting.Reference Carbonaro, Chiriu and Ricci73 Finding substitutes for europium in color television sets, neodymium in lasers, terbium in fiber optics, and lanthanum, yttrium and gadolinium, and cerium in glass polishing are considered less promising.Reference Lograsso74 A substitute for red phosphor for fluorescent lighting is, however, being tested.Reference King8

Substitution, though welcome, is not seen as a major solution to rare earth supply chain constraints by Europeans.53

Challenges with rare earth mining

There are two significant factors that impact the economic viability of an REE prospect (besides the ones listed in previous sections). One is the relative distribution of light and heavy REEs within a deposit. Second is the environmental impact associated with mining and processing.

A majority of REE production (and demand) is for LREEs.Reference Binnemans, Jones, Van Acker, Blanpain, Mishra and Apelian75 LREEs are produced in large quantities partly because production of one LREE (such as neodymium, which has a high demand) necessitates production of all associated LREEs, such as cerium or lanthanum.Reference Binnemans, Jones, Van Acker, Blanpain, Mishra and Apelian75

HREEs are scarcer than LREEs but are also produced less and have lower demands. The Oddo–Harkins rule states that elements with odd numbered atomic numbers are much rarer than elements with even numbered atomic numbers.Reference Jordens, Cheng and Waters31 Also, elements higher up in the periodic table are rarer in occurrence than those below them. These explain some of the natural scarcity of HREE deposits. HREEs are produced in less volume partly because they occur in much lower concentrations. A shortage of HREEs, especially dysprosium and yttrium, was predicted by experts given their natural scarcity and low production.Reference Prentice76 The Bokan Mountain deposit in Alaska, therefore, generated significant interest in the United States because approximately 40% of the total rare earths in the deposit are HREEs.Reference Robinson, Power and Barker77

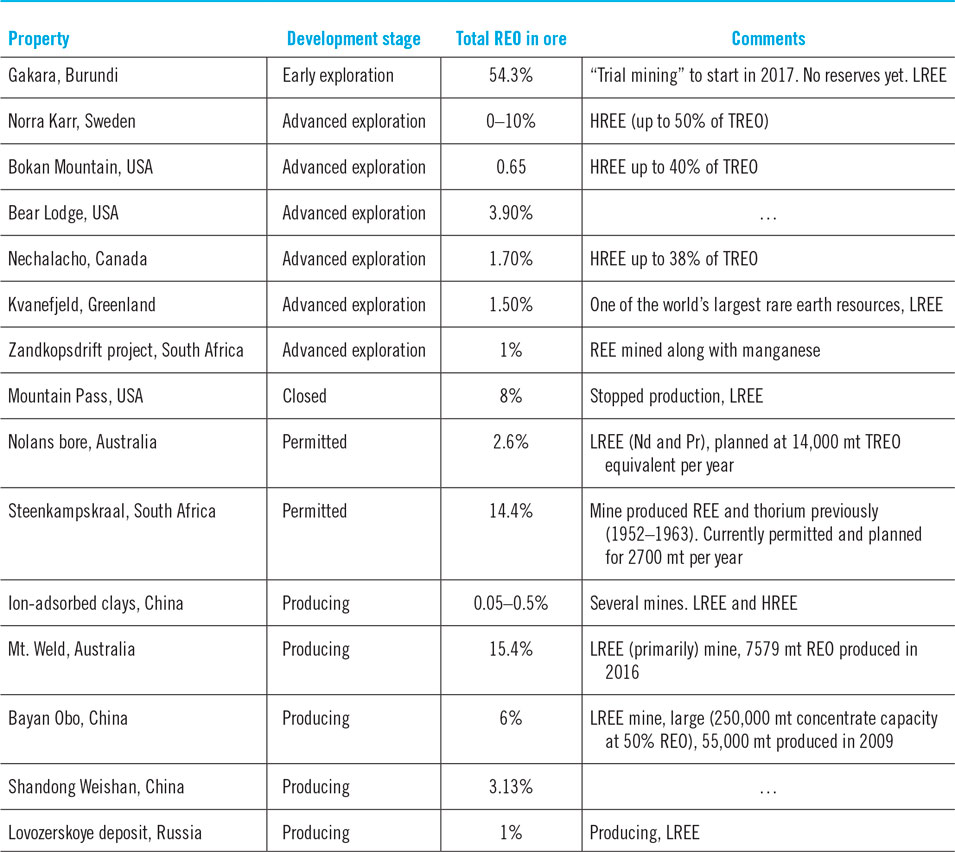

The total rare-earth oxide (TREO) content within a deposit is a strong indicator of its economic value. However, projects cannot be compared based on the proportion of TREO in the ore because HREEs command a much higher price than LREEs. Therefore, the proportion of HREEs within the rare earth mix is often cited by developers whose deposits are skewed toward HREEs. Table 5 shows the TREO of some currently operating mines and proposed projects. Proposed projects have been classified as “early” or “advanced exploration”. In the early stage, projects do not have sufficient investment in drilling to define the orebody well. Additionally, metallurgical studies are not definitive. Therefore, they do not have a reserve. Promising early stage projects attract investments for detailed drilling and metallurgical studies. These projects are able to quantify economical reserves at a set price point. These are termed advanced exploration projects. These projects usually focus on fine tuning their technical plans to improve project economics and ability to permit. These projects are close to being developed, though a project could remain in this phase (and/or permit phase) for decades depending on local laws and economics. Thus, while “early stage” and “advanced exploration” are phrases that help distinguish how close a project is to being a mine, these terms are useful only for comparing the timeline for projects when both are in similar regions. The purpose of the table is to show that REE projects exist around the world, each of which has a different pathway to fruition. In other words, while a good project may be stuck in one location, a mediocre project may speed to completion in another part of the world.

Table 5. Total rare earths in ore in selected deposits.Reference Long, Van Gosen, Foley and Cordier18,Reference Zhi and Yang32,Reference Vereschagin, Kudrevatykh, Malygin and Emelina38,Reference Verbaan, Bradley, Brown, Mackie, Simandl and Neetz41,82,Reference Schreiber, Marx, Zapp, Hake, Voßenkaul and Friedrich88,Reference Riesgo García, Krzemień, Manzanedo del Campo, Menéndez Álvarez and Gent108,Reference Ciuculescu, Foo, Gowans, Hawton, Jacobs and Spooner116–120

Table 5 shows that operating LREE mines typically have a much higher TREO as without the high TREO content they would not be economical. Only two low TREO deposits in the table have operating mines in them: ion-adsorbed clays in China and the LREE Lovozerskoye deposit in Russia. The ion-adsorbed deposits in China contain dysprosium, an HREE that commands a good price. Mines on those deposits also benefit from easy mineral processing (due to their chemistry), cheap labor, and lax environmental standards. The last two benefits may apply to the Lovozerskoye deposit as well.

The technical–economic challenges facing rare earth mines are primarily caused by the complication (and associated economics) of processing, i.e., extraction of rare earths from the rocks. Additionally, a lot of waste is produced from REE processing that is highly hazardous. The waste contains the acids and organic solvents used in the processing. Fluorine can be released with exhaust gases when molten salts are handled in open air in the molten salt electrolysis (MS-EW) process.Reference Okabe4 Hydrogen fluoride can also be generated in that process.

The extraction of REEs has been a source of environmental concerns in many areas, especially China. The ion-adsorbed clays occur in seven provinces of southern China (Jiangxi, Guangdong, Fujian, Zhejiang, Hunan, Guangxi, and Yunnan) at shallow depths.Reference Yang, Lin, Li, Wu, Zhou and Chen24 It is estimated that 300 m2 of vegetation and topsoil is removed for every ton of REO.Reference Su37 Additionally, 2000 mt of tailings are dumped into valleys and streams, and 1000 mt of wastewater is produced (with high concentrations of ammonium sulfate and heavy metals). Therefore, the sites where ion-adsorbed deposits have been mined have become environmentally degraded. 191 million mt of tailings, 302 abandoned mines, and 153 km2 of destroyed forests were left behind by rare earth mining in the Ganzhou region.Reference Guo78 As a result, surface mining and tank/heap leaching was banned for ion-adsorbed rare earths by China in 2011, in favor of in situ leaching. However, in situ leaching also has environmental problems.

In in situ leaching, holes of 0.8 m diameter, spaced 2–3 m apart, are drilled to a depth of up to 3 m.Reference Yang, Lin, Li, Wu, Zhou and Chen24 Most of the topsoil and vegetation do not have to be removed. The leach solution, ammonium sulfate at a concentration of 3–5%, is poured into the holes, and leaching takes 150–400 days. As can be expected given the method, in situ leaching causes groundwater contamination and potential landslides, while lowering recovery. High concentrations of ammonium sulfate (3500–4000 mg/L), ammonium (80–160 mg/L), sulfate and rare earths (20 mg/L) in the water, and elevated pH are reported.Reference Liu79 Streams are polluted and surface vegetation destroyed (due to capillary action that draws the leach solution back into the topsoil).

The presence of thorium and uranium in the REE mineral structure has led to concerns of radioactive waste, including some stemming from incidences of the past. Radioactive materials leaked from Mitsubishi’s Bukit Merah mine in Malaysia, leading to a $100 million radiation cleanup cost at the site.Reference Bradsher80 Therefore, there was significant opposition when Lynas Corp proposed placing a rare earth processing site in Malaysia.Reference Ali81 The Lynas concentrate, from their Mount Weld deposit in Australia, is considered low-level radioactive. Lynas publishes data from radioactive and environmental monitoring programs at their Malaysian facility to allay concerns. The tailings at their mine site in Australia contain low levels of radiation.82 Lynas plans to cover the tailings with a capping layer, topsoil, and vegetation, when the mine is closed.

Lack of regulations related to radioactive wastes in Brazil led to radioactive wastes from monazite processing to be dumped without any protective measures.Reference Lauria and Rochedo83 Subsequent remediation of the sites resulted in additional waste that also had to be dealt with. These wastes could not be transported to other locations within Brazil as no one accepted them. Acknowledging the difficulty with public acceptance of radioactive waste potentially generated by the rare earth industry in the United States, some have called for the creation of a thorium cooperative that would accept the liability associated with radioactive waste.Reference Kennedy84 Federal legislation was also proposed for establishing the cooperative,Reference Stockman85 though it had its critics.86,Reference Weslosky87 Thorium is not a real issue in many of the US REE deposits.

Mountain Pass mine, USA, closed in the 1990s, due to leakage of (nonradioactive) wastewater from pipes.Reference Ali81 The wastewater system was changed, prior to its reopening in 2013. The mine is not producing REEs now due to low prices.

Aware of the environmental footprint of mining REE, a lifecycle assessment of the Norra Karr deposit in Sweden, which contains HREEs in the mineral eudialyte, was conducted.Reference Schreiber, Marx, Zapp, Hake, Voßenkaul and Friedrich88 It was estimated that impacts per kilogram of HREEs can be reduced by 80% compared to Bayan Obo mine in China, given the tighter European laws, and the process optimization that comes from being a planned, modern mine. It is unknown if the study included the advances reported on processing for bastnaesite in China.Reference Wang, Yao, Li, Zhang, Zhu and Zheng89

An operating example of good practices may be the rare earth processing facility in La Rochelle, France, that has been operating within a strong tourist economy without any incident or opposition.Reference Ali81 The developers of Bokan Mountain, USA, rare earth deposit that is located in pristine southeast Alaska, have proposed using molecular technology to avoid the environmental issues connected with SX.Reference Izatt, McKenzie, Izatt, Bruening, Krakowiak and Izatt90

Geopolitics

The United States was a primary producer of rare earths from the 1965 to the mid-1980’s.Reference Haxel, Hedrick and Orris7 In 1987, China’s then leader Deng Xiaoping is reported to have said “The Middle East has its oil. China has rare earths… It is of extremely important strategic significance; we must be sure to handle the rare earth issue properly and make fullest use of our country’s advantage in rare earth resources”.Reference Ting98 Perhaps, that is why, there was a steep increase in China’s production of rare earths since 1985 (Fig. 1).

Prices of REOs have been highly volatile in the last decade. Average prices for REO shot up from approximately USD 18 per kg in 2010 to USD 270 per kg in 2011, before falling back to USD 18.5 per kg in 2015, and USD 7.5 per kg in 2017.91,92 Oversupply has been blamed for the falling prices.30 Rare earths are usually traded with prices listed for their oxide forms. Table 6, which lists the prices for some individual REO, demonstrates the price variance between REO.

Table 6. Prices of selected REOs (per kg) in 2010, 2012, and 2017.Reference Gambogi121,Reference Gambogi122

a The data come from two different sources, one for 2010 & 2012 and the other for 2017. Since the term “average rare-earth oxide” does not have a formal definition, they may not be strictly comparable. However, they represent the overall trend very well.

China has modified its export regime for rare earths several times in the last few decades. The changes in China’s policies and its effect on rare earth price, market power in the United States and Japan were studied.Reference Zhang, Guo, Zhang, Huang and Xiong93 China supported the export of rare earths from the 1980 to 2003 (“supportive period”). It changed course from 2004 to 2007, when it started imposing export tariffs and imposed several restrictions (“restrictive period”). Export restrictions were gradually increased from 2008 to 2011 (“prohibitive period”). This resulted in a World Trade Organization (WTO) ruling in 2014 against China’s export quota restrictions.Reference Zuill94 China complied with the ruling and removed restrictions found to be in violation of the WTO order.95

Several effects of China’s policies were notedReference Zhang, Guo, Zhang, Huang and Xiong93:

(i) China’s rare earth policies have impacted prices.

(ii) Between 2001 and 2010, China’s market power of rare earth products grew by 140.2% in the US market. The authors considered China’s pricing power in the international market as a key element of its market power. Therefore, they used the Lerner indexReference Lerner96 to quantify market power. During the same period, China’s market power grew by 244% for the Japanese market.

(iii) Price sensitivity has slowly grown from the supportive period to restrictive period. A drop in Chinese exports can be expected to result in increase in prices.

(iv) China’s hold over prices has not necessarily resulted in large profits for China. Price increases have led other nations to either look for substitutes or start producing rare earths. These actions have had a moderating effect on prices and control.

The impact of China’s policies on rare earth projects around the world has been noted by others as well.Reference Wübbeke25 Some claim that China used this leverage to punish Japan, by restricting rare earth exports to Japan, when a dispute erupted by Senkaku/Diaoyu islands in 2010.Reference Krugman97,Reference Ting98 Some, however, dispute that claim and state that rare earth exports to Japan (from China) held steady or even increased during the dispute.Reference Johnston99,Reference King and Armstrong100

There has been an increased discomfort in the developed world about China’s control over the rare earth supply chain since the Senkaku/Diaoyu incident. Some have called for governmental intervention to assist their domestic REE industries.Reference Eggert, Wadia, Anderson, Bauer, Fields, Meinert and Taylor15,53,Reference Wise101 This feeling of vulnerability has not been helped by China’s investment in rare earth projects outside China. A Chicago-based investment consortium with a Chinese REE mining partner recently won the bid for part of the assets of the closed Mountain Pass mine.Reference Topf102 This type of strategy enables China to own 42% of the global REE mineable deposits,Reference Okabe4 yet control 90–97% of the market. To reduce reliance on China, Japan has been looking to other nations including Kazakhstan and Vietnam.Reference Fuyuno103,Reference Jamasmie104 India is exploring the sea floor for REEs.Reference Fuyuno103 In the United States, a commitment was announced to produce NdFeB magnets that were sourced entirely from materials and technologies from within the country.Reference King8

All of the above is perhaps best summarized by the six problems with the rare earth marketReference Klossek, Kullik and van den Boogaart105: “competing political–economic models, resource nationalism, market opacity, lack of trust, weak cooperation and short- versus long-term approaches, and profit orientation”.

Highlights and discussion

The Chinese announced their intention to phase out the internal combustion engine recently, as part of their clean air policy. This announcement was quickly duplicated by France and the United Kingdom. Unless technologies that bypass/minimize rare earths are developed and adopted at a faster pace, China’s (and other countries’) clean air policies could drive up the demand and price of REEs. The importance of REEs to global economy and its sourcing from a single country, especially one that dictates the strategy for its economy, has resulted in much debate in countries that depend on REEs. It is not known for sure if China actively controls the rare earth market for strategic purposes. It is also not accepted by all that China can control the rare earth market for long periods.Reference Abraham106 Its ability to control its illegal REE sector is also questionable. Its monopoly over rare earths has also been questioned.Reference Lo107 Increased Chinese control has previously led to price spikes, which led to new projects being developed.Reference Riesgo García, Krzemień, Manzanedo del Campo, Menéndez Álvarez and Gent108 Even if most of the promising projects are once again dormant after the price crash, they advanced in development because of investments during price spikes. Price spikes also led to the reopening of large mines like Mountain Pass. REE prices have increased recently in response to actions in China on environmental protection and illegal mining.109 Possible opening of North Korea’s economy could also impact the REE market, as they are known to have significant quantities of REEs.Reference Wise101

This paper has described several technical challenges that REE producers (miners) face: complex mineral processing, environmental impacts, regulations, and pricing. Difficulty in recycling and finding substitutes are challenges faced by REE consumers. Despite these significant challenges, higher prices would ameliorate many of these problems since higher prices have historically led to new production capacity. The quantity of REE needed is not that high and, therefore, new demand could easily be met with new production. The mines that are currently producing under capacity can easily ramp up production as prices increase. Additionally, just a few new mines worldwide would also go a long way to absorb unmet demands. Regardless, mining projects are expensive and take a long time for permitting in countries that have high environmental standards. This exposes projects to an unstable and unpredictable price environment during its long development phase, which reduces their chances of development. Therefore, while price increases can be expected to reduce China’s dominance over the long term, they will have no real impact on China’s hold over the short term.

The commodity prices necessary for a project to be viable depend on its geographic region, access to infrastructure, complexity of mineral processing, and presence of radioactivity. In this context, it is better to consider the “mining” of REE by looking at its two distinct parts, “extraction of REE out of earth” and “processing of broken rock”.

The extraction can only occur where the REE occurs. However, the processing can be done anywhere. It is common in the base metal industry to mine in one region (with partial processing), followed by final processing in another location that has the technology and/or the laws that allow such processing. Extraction (surface or underground mining) of REEs is no different than that for other metals. Partial processing typically involves gravity methods of mass reduction, potentially followed by flotation that dramatically reduces the mass of the concentrate without toxic chemicals. Such an extraction site would be easier to permit than one that additionally involves toxic chemicals. The Kensington gold mine in Alaska, albeit not a REE mine, took this route. It does not produce gold bars at its site like the other gold mines in Alaska. Instead, it ships the concentrate out to another site. Lynas took this approach with its Mount Weld REE mine site. However, such a strategy has the potential for public outrage if the waste generated from processing is highly hazardous, and it is perceived that a developed nation is sending its waste to a poor country with lax regulations.

Large REE processing facilities that accept concentrates from many producers could deal with the issue of toxic waste (or high costs) through economies of scale. There is negligible mining in Japan. Yet, they have smelters to produce metal. These smelters receive feed from around the world. This appears to be the logic behind a recent announcement from Ucore,110 who wish to build a REE processing facility in Alaska that would be designed to accept concentrates from non-Chinese sources.

Extracting REEs from mine and power plant waste could be a promising solution for REEs for developed nations, as these sites would be much easier to permit since no new mine and disposal site would be needed. Techniques such as bioleachingReference Brisson, Zhuang and Alvarez-Cohen111 may not only bring new deposits into play but also reduce the environmental footprint at the same time.

Recycling and substitution are currently not seen as significant solutions. However, that could change rapidly in the future, especially substitution. Centralized recycling facilities could work with recycling, as the REE is used widely. With a dense population base, it is not surprising that Europe has been recommended to focus on better waste collection with regards to REEs and assist with creation of centralized recycling facilities through variety of means including policy, co-financing, and research.53

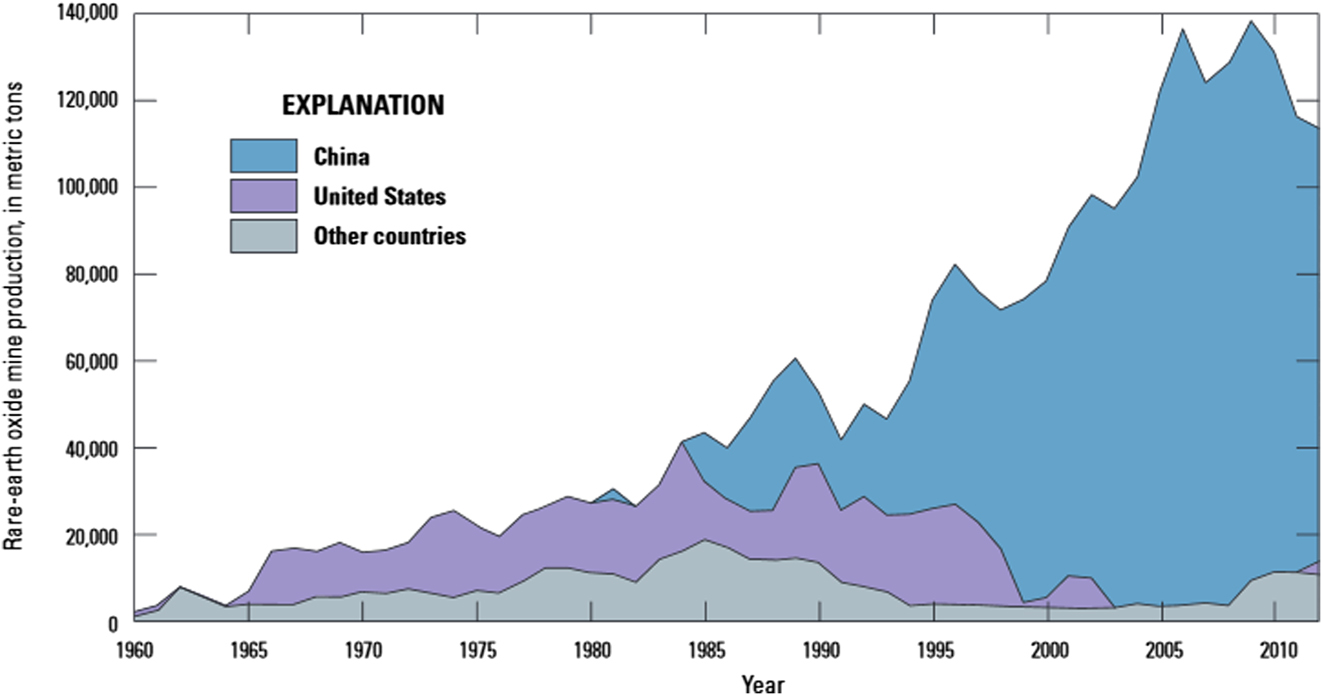

In summary, rapid acceleration in the demand for critical materials derived from select REO may disrupt and stress sustainable REE supply chains. Recent China, France, and United Kingdom policies that mandate a complete shift from fossil fuel driven vehicles to electric vehicles combined with a shift to green energy—wind turbines over the next twenty years will result in demand far exceeding supply. Regulatory and corporate social responsibility requirements for supply chain transparency, socially-ecologically responsible mining, and mineral processing may become a necessary supply chain choke point and, thus, lead to higher REO prices. Figure 4 demonstrates the push–pull interlocking of various factors on the stability of the REE market. Sustainable supply and increasing demand will have a large influence on the stability of the market. Scientific advances in substitution, nontraditional sources, expansion of recycling and discovery, extraction and processing of new large deposits will act as a balancing influence. Regulatory and transnational enforcement (environmental and economic) combined with geography (location of deposits) will add to the complexity of the relationships. The direction of the arrows and the size of the interlocking gear would change from time to time depending on the circumstances. Given the small size of the rare earth market, any of the factors could have an outsize influence on its stability at any given time. Therefore, the biggest conclusion one could draw from Fig. 4 is perhaps that no firm prediction is possible on the stability of the REE market.

Figure 4. The REE inter-lock.

Conclusions

Rare earths are central to the modern lifestyle. Though available everywhere in nature, they are produced in small quantities and in a limited number of countries compared to other metals because of a combination of factors:

(1) REEs occur in low concentrations in most places they occur.

(2) The electronic structure of REEs is such that they often occur together in minerals. Additionally, the REE resource in a deposit may be locked in multiple mineral structures. All of this makes their separation and extraction difficult, requiring complex processing.

(3) Complex processing creates hazardous wastes. This has cost and legal implications.

(4) High environmental standards in many countries make REE extraction more expensive.

There is substantial illegal REE mining in China, which complicates the REE market. Despite and because of that, China has a huge impact on the REE market. Therefore, nations with advanced manufacturing industries feel vulnerable to Chinese intervention. This is made worse by the general opacity of the REE supply chain, lack of traceability of supply chain, difficulty in recycling, and finding substitutes. There have been proposals in some countries for governmental intervention to spur production of REE, whether it is from mining, recycling, or substitution. Despite the appeal, most, if not all, REE production related activities have been market driven. Therefore, most projects that were being pursued when prices spiked briefly have now been shelved given the steep decline in prices. Price spikes in the future—stemming from increased demand or Chinese policies—will likely activate those same projects, if past trends repeat. Even when prices increase, however, significant increase in REE production from outside China will likely take a few years, as permitting new mines and processing facilities is often a long process. Demand for REEs may increase as demand for electric cars and wind energy increase. However, development of technologies that bypass REE could put a dent on demand over the long term. Alternate sources of rare earths, such as from coal by-products, could also change the REE supply chain landscape. The small size of the rare earth market makes it vulnerable to disruptions from any of these factors at any time.

Acknowledgment

The assistance of Eduardo Pimenta with some of the literature review is greatly appreciated.