Introduction

A number of studies in comparative political economy argue that integrating national economies into the world market will lead to a convergence in policy choices. High competition for capital investment under globalization leads states to uniformly adopt market-friendly policies. Unlike during the pre-globalization era, countries can no longer maintain a broad range of domestic fiscal and monetary policies. This ‘limited room to maneuver’ in policy autonomy reduces policy-makers’ level of control over the direction of their national economy (Hellwig and Samuels, Reference Hellwig and Samuels2007). Moreover, globalization synchronizes the national business cycle with the world economy, leading to smaller deviations from it, known as the ‘co-movement’ hypothesis (Kayser and Peress, Reference Kayser and Peress2016).

One dominant expectation of the ‘limited room to maneuver’ and ‘co-movement’ hypotheses is that globalization leads to a weaker economic vote, thereby diminishing elections’ ability to function as mechanisms of democratic accountability. That said, if globalization undermines incumbents’ influence over the economy and leads to convergence in their performance, there is less reason for voters to hold their politicians accountable for economic performance.

Although our understanding of the link between globalization and the economic vote is predominantly based on retrospective economic evaluation, recent studies have shown that there is another way citizens form their economic evaluations based on spatial comparisons (Kayser and Peress, Reference Kayser and Peress2012; Aytaç, Reference Aytaç2018; Hansen et al., Reference Hansen, Olsen and Bech2015; Olsen, Reference Olsen2017; Park, Reference Park2019; Powell and Whitten, Reference Powell and Whitten1993). Put simply, citizens tend to engage in comparison much like we do in our daily lives; they evaluate their own country’s economic performance by comparing it with the economies of similar nations. Given that the relative economy significantly shapes voting behavior, it is essential to extend our analysis to examine how economic globalization impacts the role of national economies based on spatial comparisons on citizens’ vote choices.

In this article, I argue that globalization, which is marked by greater economic openness, enables voters to more actively engage in a benchmarking comparison. With increased flows of goods, services, capital, and labor, as well as ideas, news, and experiences, globalization increases the amount of information available to voters. International comparisons are spurred by the media, which tends to deliver domestic economic news in comparison with other countries. Thus, voters will react more strongly to over (or under)-performance compared to their benchmark as their country becomes more integrated into the world market. Moreover, both the ‘limited room to maneuver’ and ‘co-movement’ hypotheses are somehow overdrawn. Indeed, a number of studies have demonstrated that globalization has resulted in the largest governments with substantial policy tools without strong convergence in economic performance between national and international economies. In particular, when the convergence is measured with the gap in national and closely-related country(ies) growth rates rather than the average world economy, no consistent evidence of ‘co-movement’ is found. Instead, deviations, the over- or under-performing economy, appear to exist regardless of the levels of globalization.

Looking at 156 elections in 29 countries since the 1980s, I find that globalization makes the effect of the relative economic growth on incumbents’ vote share salient. As countries increasingly integrate into the world economy, relative economic growth is likely to bring bigger impacts on incumbents’ electoral support. In contrast, the effect weakens and eventually vanishes in countries that trade less with other nations.

This research contributes to the literature on economic voting by advancing our understanding of why and how globalization can influence voters’ ability to monitor and sanction their government’s relative performance. Specifically, I explore how individuals’ vote choices hinge on comparisons of economic performance across countries, highlighting the need to consider the relative measure of the economy in economic voting models.

This study also implies that politicians, who tend to shift blame for the poor economy to the limited policy options or converging business cycles, will not be completely free of responsibility if their economy’s performance is worse than those of other countries. Voters’ ability to capture competence signals from their incumbent government does not diminish under openness. Instead, this capacity increases as voters juxtapose two or more comparing governments during globalization and consequently helps them to reward/punish their government accordingly. Thus, in the case of a relative economy, globalization ensures electoral accountability.

Globalization and economic voting

Selection models of economic voting suggest that rational voters desire to select the most competent candidates by using information about economic shocks to assess prospective candidates’ future competencies. Regarding voters’ ability to select the most competent candidates, Duch and Stevenson (Reference Duch and Stevenson2008) highlight ‘competence signals’ that capture the extent to which shocks to the economy result from incumbent competency rather than exogenous factors. In other words, they must be able to extract competence signals by distinguishing competence shocks from exogenous shocks to make informed decisions on election days. As such, economic voting depends on the relative size between the two components; for instance, voters weigh economic outcomes more when the competence component is large relative to the exogenous one (Duch and Stevenson, Reference Duch and Stevenson2008; Scheve, Reference Scheve2004).

One dominant explanation suggests that economic globalization will reduce economic voting by shrinking and increasing the competent and exogenous components, respectively (Hellwig and Samuels, Reference Hellwig and Samuels2007; Duch and Stevenson, Reference Duch and Stevenson2008). Due to high competition for capital investment in the open environment, states ‘uniformly’ adopt market-friendly policies such as tax cuts, deregulation, budget-balancing, spending cuts, and flexible labor markets (Rudra, Reference Rudra2002; Wibbels and Arce, Reference Wibbels and Arce2003). Such convergence in policy instruments means that the space countries have to maneuver domestic economic conditions becomes limited, reducing the variance in the competence component. In contrast, openness increases the extent to which national domestic economies are subject to random shocks beyond the control of elected officers, increasing the variance in the exogenous component (Duch and Stevenson, Reference Duch and Stevenson2008).

Relatedly, other scholars focus on voters’ ability to extract competence signals under globalization. It is well known that economic voting will occur when voters can identify who is responsible for the economy (Lewis-Beck, Reference Lewis-Beck1986; Powell and Whitten, Reference Powell and Whitten1993). Economic openness blurs the clarity of the nexus between the economy and the incumbents’ skills (coined as ‘Clarity of Responsibility’ by Powell and Whitten, Reference Powell and Whitten1993) because higher integration into the world market would invite more external forces (e.g., the International Monetary Fund (IMF), the World Trade Organization, and the European Union (EU), and foreign capital) to direct the national economy (Hobolt and Tilley, Reference Hobolt and Tilley2014; Costa Lobo and Lewis-Beck, Reference Costa Lobo and Lewis-Beck2012). More to the point, openness is likely to induce synchronization or co-movement to business cycles because countries in open environments should contend with the economic oscillations of their trading partners through local and regional trade agreements (Hirata et al., Reference Hirata, Kose and Otrok2013; Kose et al., Reference Kose, Otrok and Prasad2012). That said, being embedded in external pressures would conceal incumbents’ responsibility, thus limiting economic voting.

However, other studies suggest conflicting results. Using survey data from 40 countries, Vowles (Reference Vowles2008) shows that voters do not change their perceptions about whether those in power can ‘make a difference’ across different degrees of globalization. If voters believe that the leader’s ability to ‘make a difference’ is unaffected by globalization, their capacity to hold him/her accountable according to the economy should be unaffected. Similarly, Kosmidis (Reference Kosmidis2018) proves through his survey experiment that ‘limited room to maneuver’ does not attenuate the role of the economy during elections. Using both micro- and macro-level data from seven European countries since 1950, Dassonneville and Lewis-Beck (Reference Dassonneville and Lewis-Beck2019) demonstrate that globalization does not weaken the economic vote but observe that the coefficients of gross domestic product (GDP) growth stay stable longitudinally regardless of the levels of trade openness. Giuliani (Reference Giuliani2019), contrary to prevailing wisdom, shows that the more a country was integrated, the more its unemployment rate negatively impacted government electoral outcomes by comparing the economy’s effect on voting before and after the Great Recession.

As such, the empirical evidence on economic voting under openness is somewhat less certain. More importantly, the existing literature offers limited accounts for the link between the economy and voting under globalization. This is because the previous literature considered only the retrospective dimension of the economy while overlooking another important dimension: the relative economy. The burgeoning literature highlights the significance of relative economic performance by arguing that voters extract competence signals not only from the retrospective economy but also, and more importantly, from the relative one (Powell and Whitten, Reference Powell and Whitten1993; Kayser and Peress, Reference Kayser and Peress2012; Olsen, Reference Olsen2017; Hansen et al., Reference Hansen, Olsen and Bech2015; Aytaç, Reference Aytaç2018, Reference Aytaç2020; Park, Reference Park2019, Reference Park2021). Some studies strengthen this claim by demonstrating the larger impact of the relative economy on electoral behavior than that of the retrospective one (Kayser and Peress, Reference Kayser and Peress2012; Park, Reference Park2019).

Despite growing attention to the impacts of the relative economy on voting behavior, to the best of this author’s knowledge, no research has investigated how it is conditioned by economic globalization. This paper attempts to fill the gap in the extant literature by testing globalization accounts to establish the potential link between the relative economy and vote choice. The following section briefly reviews the central role of relative macroeconomic performance on public support and then theorizes the moderating influence of economic openness on relative economic voting.

Relative economic voting and economic openness

The idea of relative economy is theoretically rooted in social comparison theory, which suggests that people are more likely to base their assessments on comparisons between their personal performance and other reference points (Festinger, Reference Festinger1954; Hansen et al., Reference Hansen, Olsen and Bech2015). If voters reward or punish incumbents based on economic conditions, evaluating the economy before they cast a ballot would be imperative. Defining what constitutes a good or bad economy, however, can be extremely difficult. Although voters are provided with a substantial amount of economic performance indicators (e.g., GDP, gross national product (GNP), unemployment rate, inflation rates, etc.), compiling this information is cognitively demanding. Additionally, the data do not often speak for themselves. No economic indicator is innately strong or weak, and what passes for strong growth in one period or place might be regarded as weak in another time and location (Hansen et al., Reference Hansen, Olsen and Bech2015; Olsen, Reference Olsen2017).

In this demanding cognitive task, information concerning the relative economy serves as a simple heuristic shortcut helping voters extract incumbents’ competence signals. For instance, Duch and Stevenson (Reference Duch and Stevenson2008) highlight that voters can better capture competence signals by placing domestic economies into a comparative setting with other countries. More specifically, they argue that voters who perceive distinct deviations in the fluctuations of their domestic economies, compared to the average European economy, are more likely to vote based on the economy because they recognize distinct deviations as higher overall competency signals (Duch and Stevenson, Reference Duch and Stevenson2008: 166).

Scholars have repeatedly empirically demonstrated the impact of relative economy on voting behavior. Using the global average values of growth, inflation, and unemployment, Powell and Whitten (Reference Powell and Whitten1993) find that good domestic growth compared to global average growth rewards the government with more votes. Kayser and Peress (Reference Kayser and Peress2012) also present evidence indicating that voters benchmark national economic conditions against the state of economies abroad by employing both the relative growth (the gap between domestic and international growth) and benchmark growth in a vote choice model. Using economic information from media-guided reference countries rather than global average economic indicators, Park (Reference Park2019) also shows that as the relative economy improves (declines), support for the incumbent increases (declines).

Similar findings have been observed in micro-level studies. Danish voters pay particular attention to how their economy evolves relative to the Swedish economy (Hansen et al., Reference Hansen, Olsen and Bech2015), and German and French voters compare one another’s economic conditions before arriving at a voting decision (Jérôme et al., Reference Jérôme, Jérôme-Speziari and Lewis-Beck2001). Using individual survey data in the USA, Fortunato et al. (Reference Fortunato, Swift and Williams2018) also find that voters’ perceptions of national economic performance depend on comparative assessments against other states identified by the media as sharing economic similarities. Aytaç (Reference Aytaç2020) employs population-based surveys from the UK and Turkey and shows that voters from both countries react to a comparative assessment of the economy, retrospectively and relatively, when determining their level of political support. Similarly, Huang (Reference Huang2015) demonstrates that perceptions of other countries’ socioeconomic conditions impact how Chinese people evaluate their country and government. Since voters’ assessments of the economy tends to be guided by relative performance, it is imperative to extend our analysis to observe the varying effects of economic openness on the role of the relative economy in vote choice models.

How openness affects relative economic voting

Given that cross-national comparisons can provide voters the information needed to infer the competence of an incumbent government, economic voting will also depend on the relative size of variance in cross-national ‘competence shock’ compared to variance in ‘exogenous shock’. For a conceptual demonstration, consider the following expressions for the total variance denoted by

![]() $\sigma _i^2$

and

$\sigma _i^2$

and

![]() $\sigma _j^2$

for each country i and j (Duch and Stevenson, Reference Duch and Stevenson2008).

$\sigma _j^2$

for each country i and j (Duch and Stevenson, Reference Duch and Stevenson2008).

where

![]() $\sigma _{{\mu} i}^2$

and

$\sigma _{{\mu} i}^2$

and

![]() $\sigma _{{\mu} j}^2$

refer to variance in ‘competence shock’ and

$\sigma _{{\mu} j}^2$

refer to variance in ‘competence shock’ and

![]() $\sigma _{\xi i}^2$

and

$\sigma _{\xi i}^2$

and

![]() $\sigma _{\xi j}^2$

indicate variance in ‘exogenous shock’ for each country i and j.

$\sigma _{\xi j}^2$

indicate variance in ‘exogenous shock’ for each country i and j.

When voters extract their incumbents’ competence signals based on ‘relative’ economic conditions, we should consider the ‘relative’ variance between country i and j, which can be illustrated as the difference between the above expressions:

The economic voting would depend on the relative size of the relative variance in competence shock (

![]() $\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2$

) and the exogenous shock (

$\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2$

) and the exogenous shock (

![]() $\sigma _{\xi i}^2 - \sigma _{\xi j}^2$

). For instance, when the relative variance in competence shock is large compared to the relative variance in exogenous shock (such as

$\sigma _{\xi i}^2 - \sigma _{\xi j}^2$

). For instance, when the relative variance in competence shock is large compared to the relative variance in exogenous shock (such as

![]() $\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2 \gt \sigma _{\xi i}^2 - \sigma _{\xi j}^2$

), voters extract strong relative competence signals and weigh relative economic performance when they make a vote choice.

$\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2 \gt \sigma _{\xi i}^2 - \sigma _{\xi j}^2$

), voters extract strong relative competence signals and weigh relative economic performance when they make a vote choice.

As discussed above, scholars in previous studies speculate that globalization will reduce the size of the relative variance in competence shock

![]() $(\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2)$

by limiting policy autonomy for incumbents (e.g., Hellwig and Samuels, Reference Hellwig and Samuels2007; Hellwig, Reference Hellwig2008; Duch and Stevenson, Reference Duch and Stevenson2010) or synchronizing national business cycles (called ‘co-movement hypothesis’), thus shrinking the deviations in economic outcomes across borders (Kayser and Peress, Reference Kayser and Peress2016).

$(\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2)$

by limiting policy autonomy for incumbents (e.g., Hellwig and Samuels, Reference Hellwig and Samuels2007; Hellwig, Reference Hellwig2008; Duch and Stevenson, Reference Duch and Stevenson2010) or synchronizing national business cycles (called ‘co-movement hypothesis’), thus shrinking the deviations in economic outcomes across borders (Kayser and Peress, Reference Kayser and Peress2016).

However, albeit intuitive, the ‘limited room to maneuver’ hypothesis is not shared by all economists and is, to some extent, overdrawn. In fact, there is ample empirical evidence demonstrating that globalization does not result in the demise of the ‘nation-state’. For instance, while some states have lost policy autonomy in exchange rate and monetary policies, there is considerable room for incumbents to maneuver for the active promotion of employment and general economic performance in the presence of trade and capital openness (Swank, Reference Swank2002). Rather than being constrained by increasing openness, some scholars have shown that the role of the state moves in the opposite direction under globalization Footnote 1 . For instance, some argue that government expansion has become stronger with greater openness, especially with respect to left-labor power (Garrett, Reference Garrett1998), with ongoing pursuit of activist supply-side policies (Boix, Reference Boix1998). Hay (Reference Hay2007) shows social transfer increasing in line with increasing openness, and Rodrik (Reference Rodrik1998) and Cameron (Reference Cameron1978) argue that the biggest governments and the most generous provisions of social programs have appeared in the most trade-dependent countries. With this evidence, Vowles (Reference Vowles2008: 65) asserts that ‘the usual argument that trade dependence should force policies to convergence on a small government and residual social policy is unconvincing’, and Hay (Reference Hay2007: 326) concludes that ‘this period, the much-vaunted era of globalization, has witnessed the development of the largest states the world had ever seen, and there is little evidence of this trend being reversed.’

All of these findings, which entail substantial government interventions, suggest an important implication regarding the expectation of ‘business-cycle convergence’. The prevailing wisdom strongly suggests that globalization will lead to the convergence of domestic and international business cycles, resulting in smaller deviations in the economic outcomes (Kayser and Peress, Reference Kayser and Peress2016). However, if governments’ room to maneuver is less affected under globalization, there are weak reasons to observe a convergence in policy outcomes.

Figure 1 presents the deviations in GDP growth rates with respect to benchmark economies at different levels of economic openness from 30 countries since the 1980s. The deviation is measured by subtracting the benchmark growth rate from the domestic growth rate, where the benchmark is obtained from media-guided information (Park, Reference Park2019). Footnote 2 Subfigure (a) includes all observations across all ranges of openness, and Subfigure (b) includes cases where the openness is less than 100. In both figures, the slopes are almost flat, suggesting that openness does not necessarily diminish deviations. In contrast to the prevailing assumption of ‘business-cycle convergence’, deviations do exist across all ranges of openness, and there is no systematic relationship between deviations and openness Footnote 3 .

Figure 1. Deviations in growth from the media-based benchmark economy at different levels of economic openness.

If globalization does not diminish governments’ room to maneuver in handling the economy and/or does not induce convergence of national and international business cycles, globalization would not reduce the size of relative variance in competence shock

![]() $(\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2)$

. Instead, because openness creates greater government responsiveness toward various challenges during openness (e.g., income redistribution, economic dislocation, unemployment, industry protections), voters are likely to perceive that who controls the government matters more, not less, particularly from the relative economic conditions. Simply put, rather than attenuating, globalization might increase the size of relative variance in competence shocks from the over-or under-performing economy.

$(\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2)$

. Instead, because openness creates greater government responsiveness toward various challenges during openness (e.g., income redistribution, economic dislocation, unemployment, industry protections), voters are likely to perceive that who controls the government matters more, not less, particularly from the relative economic conditions. Simply put, rather than attenuating, globalization might increase the size of relative variance in competence shocks from the over-or under-performing economy.

With respect to the relative variance in exogenous shocks,

![]() $\sigma _{\xi i}^2 - \sigma _{\xi j}^2$

in Equation (3), Duch and Stevenson (Reference Duch and Stevenson2008) demonstrate that the size of the variance in exogenous shocks in an open economy differs from that of a closed economy (183). Unlike those of closed economies, there are more exogenous factors in open economies affecting the macroeconomy. For instance, in Denmark, an open economy, globalization creates more exogenous factors affecting macroeconomic conditions than it does in Venezuela, a closed economy. Then, the relative variance in exogenous shocks between Denmark and Venezuela would increase under globalization.

$\sigma _{\xi i}^2 - \sigma _{\xi j}^2$

in Equation (3), Duch and Stevenson (Reference Duch and Stevenson2008) demonstrate that the size of the variance in exogenous shocks in an open economy differs from that of a closed economy (183). Unlike those of closed economies, there are more exogenous factors in open economies affecting the macroeconomy. For instance, in Denmark, an open economy, globalization creates more exogenous factors affecting macroeconomic conditions than it does in Venezuela, a closed economy. Then, the relative variance in exogenous shocks between Denmark and Venezuela would increase under globalization.

However, comparing an open and a closed economy, albeit theoretically convincing, is somewhat less practical because, as discussed above, voters in country

![]() $i$

are more likely to benchmark countries

$i$

are more likely to benchmark countries

![]() $x$

,

$x$

,

![]() $y$

, and

$y$

, and

![]() $z$

when these countries are connected, familiar, and similar to them. In other words, voters compare the economic conditions of countries that share a great deal of common grounds in terms of economic structure, history, politics, geography, etc. Indeed, Danish voters tend to benchmark Swedish (Hansen et al., Reference Hansen, Olsen and Bech2015) or Finnish economic conditions reflecting equally open economies rather than closed ones such as Venezuela or North Korea.

$z$

when these countries are connected, familiar, and similar to them. In other words, voters compare the economic conditions of countries that share a great deal of common grounds in terms of economic structure, history, politics, geography, etc. Indeed, Danish voters tend to benchmark Swedish (Hansen et al., Reference Hansen, Olsen and Bech2015) or Finnish economic conditions reflecting equally open economies rather than closed ones such as Venezuela or North Korea.

If comparisons occur between two similar countries, i and j, there is a higher propensity that a common external shock would similarly affect both nations. The consequences of globalization (e.g., rising unemployment, structure adjustment, crises, recession) are not country-specific, but instead, openness is likely to produce similar inputs on exogenous shocks in both i and j, which eventually reduces their relative variance in exogenous shocks,

![]() $\sigma _{\xi i}^2 - \sigma _{\xi j}^2$

Footnote 4

.

$\sigma _{\xi i}^2 - \sigma _{\xi j}^2$

Footnote 4

.

All in all, the above discussion suggests that globalization will strengthen relative competence signals by increasing and decreasing the relative variance in competence

![]() $(\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2)$

and exogenous

$(\sigma _{{\mu} i}^2 - \sigma _{{\mu} j}^2)$

and exogenous

![]() $(\sigma _{\xi i}^2 - \sigma _{\xi j}^2)$

shocks, respectively. With a strong signal in relative competence, voters infer that the relative economy, either through over- or under-performance, is the result of incumbent competence in handling the economy, based on which he/she will reward or punish the government. Simply put, globalization strengthens the link between relative economy and vote choice.

$(\sigma _{\xi i}^2 - \sigma _{\xi j}^2)$

shocks, respectively. With a strong signal in relative competence, voters infer that the relative economy, either through over- or under-performance, is the result of incumbent competence in handling the economy, based on which he/she will reward or punish the government. Simply put, globalization strengthens the link between relative economy and vote choice.

In addition to affecting the variance in competence and exogenous shocks, globalization can strengthen the effect of the relative economy on incumbent electoral success by enriching the information available to the public. In the pre-globalization era, it was not easy for ordinary citizens to assess domestic economic conditions in a global or comparative setting, partially because they were less exposed to information on other countries’ economic performance. Although making comparisons is a natural and common human behavior, ignorance about the objects of comparison leads to difficulty in making accurate assessments.

Globalization has generated structural changes to many aspects of life, especially with respect to the availability of information. In particular, economic globalization, marked by increased flows of goods, services, capital, and labor, leads to stronger interconnection and interdependence between countries. When these factors of production cross borders, they are accompanied by related news, ideas, and information. A necessary consequence of this integration process is that ‘local happenings are shaped by events occurring many miles away and vice versa’ (Giddens, Reference Giddens1990: 21). That said, globalization does not simply foster interconnection but rather induces active engagement among participants that, in turn, increases information in the countries where they originated.

Indeed, the increase in trade volume appears to have enriched information about foreign economies by increasing the volume of media coverage (Wu, Reference Wu2000; Ahern, Reference Ahern1984; Kariel and Rosenvall, Reference Kariel and Rosenvall1984). For instance, Ahern (Reference Ahern1984) pointed out trade and GNP as key determinants of foreign coverage in major USA newspapers. Likewise, based on a sample of 38 countries, Wu (Reference Wu2000) demonstrates that trade is not only one of the leading predictors of media coverage but also the most influential determinant. Given this evidence, a more recent study by Aytaç (Reference Aytaç2018) also suggests trade proxies for the availability of information about one’s reference country assuming that ‘there could be relatively more news about the international economy (i.e., reference country) in the media of countries with higher trade intensity’(26).

That said, in the pre-globalization period, the effect of benchmarking across borders was believed to have been weaker because ordinary citizens were less informed about and less affected by other countries’ situations. Thus, voters were less likely to benchmark their own economy against other countries. However, globalization, particularly economic integration, has provided people with a great number of sources for comparison through direct engagements and media coverage. Eventually, this will render voters able to evaluate their national economy relative to other countries’ economic performance. Indeed, such comparisons are inevitable because the environment (e.g., media) provides information on the economic performance of other countries regardless of whether individuals explicitly search for it (Olsen, Reference Olsen2017). Thus, people simply cannot disregard the economic performance of other countries in the modern age.

In sum, openness would not necessarily decrease the competence component of incumbents in directing the economy. Instead, there remain considerable policy tools that the incumbents can utilize to troubleshoot the economic problems. And also, challenges of globalization are ubiquitous to all countries except closed economies. This implies, contrary to the conventional wisdom, that economic globalization results in a reduction in relative variance in exogenous rather than competence shocks. On top of that, globalization provides voters with voluminous information for cross-national comparisons through media coverage, and consequently enabling them to benchmark other countries’ economies in evaluating their own government performance and in making their vote choice accordingly. Following the above discussion, I expect that as countries’ economic globalization increases, the effect of relative economy on incumbents’ vote share will increase.

Model specification and variables

Arel-Bundock et al. (Reference Arel-Bundock, Blais and Dassonneville2021) suggest a simple and direct way to test the effect of the relative economy on incumbent vote share using the following equation:

where Vote is the incumbent’s vote share,

![]() ${G_d}$

is the domestic economic growth rate,

${G_d}$

is the domestic economic growth rate,

![]() ${G_b}$

is the benchmark’s growth rate,

${G_b}$

is the benchmark’s growth rate,

![]() $\omega $

is the vector of control variables, and

$\omega $

is the vector of control variables, and

![]() $\varepsilon $

is a disturbance term. The two coefficients,

$\varepsilon $

is a disturbance term. The two coefficients,

![]() ${\theta _d}$

and

${\theta _d}$

and

![]() ${\theta _b}$

, are the marginal effect of domestic and benchmark growth on vote share. When voters react to the relative economy,

${\theta _b}$

, are the marginal effect of domestic and benchmark growth on vote share. When voters react to the relative economy,

![]() ${\theta _d}$

should be positive because it captures how an increase in domestic growth affects the incumbent vote share when benchmark growth is held constant. In other words, it represents the situation that domestic growth overperforms benchmark growth (a good relative economy). In contrast, the sign of

${\theta _d}$

should be positive because it captures how an increase in domestic growth affects the incumbent vote share when benchmark growth is held constant. In other words, it represents the situation that domestic growth overperforms benchmark growth (a good relative economy). In contrast, the sign of

![]() ${\theta _b}$

should be negative because it shows how an increase in benchmark growth affects vote share when domestic growth is held constant, which creates a situation where domestic growth underperforms in relation to the benchmark growth (a poor relative economy).

${\theta _b}$

should be negative because it shows how an increase in benchmark growth affects vote share when domestic growth is held constant, which creates a situation where domestic growth underperforms in relation to the benchmark growth (a poor relative economy).

Based on Equation (4), Arel-Bundock et al. (Reference Arel-Bundock, Blais and Dassonneville2021) further suggest a regression model capable of testing a conditional theory of relative economy hypothesis in the following form:

where M represents a variable that moderates the electoral salience of relative economy Footnote 5 . If the moderating variable M increases the salience of the benchmark growth, the marginal effect of domestic and benchmark growth should be more positive and negative, respectively, when M is high.

Using the Globalization as the moderating variable, I expect that a positive marginal effect of domestic growth (

![]() ${\theta _d} + {\theta _{dm}}M \gt 0$

) would be consistent with both conventional economic voting and benchmarking because globalization will make the effect of over-performing growth more positive to the incumbent vote. A negative marginal effect of benchmark growth (

${\theta _d} + {\theta _{dm}}M \gt 0$

) would be consistent with both conventional economic voting and benchmarking because globalization will make the effect of over-performing growth more positive to the incumbent vote. A negative marginal effect of benchmark growth (

![]() ${\theta _b} + {\theta _{bm}}M \lt 0$

) would be consistent with benchmarking since globalization will make the effect of under-performing growth more negative to the incumbent vote share

Footnote 6

.

${\theta _b} + {\theta _{bm}}M \lt 0$

) would be consistent with benchmarking since globalization will make the effect of under-performing growth more negative to the incumbent vote share

Footnote 6

.

Data and variables

For empirical analyses of the above-stated claim, I assembled information on the electoral outcome of incumbents in 29 countries since the 1980s, most of which are members of the Organization for Economic Co-operation and Development (OECD). The scope of the data restricts itself to the countries and times for which electoral results and media information are available in the ParlGov dataset (Döring and Manow, Reference Döring and Manow2012) and in the Lexis-Nexis database Footnote 7 .

I use the percentage of votes earned by the executive party (the prime minister’s party) as the dependent variable because citizens do not hold all parties in a government in the same way but rather tend to reward/punish the executive party (Lewis-Beck, Reference Lewis-Beck1997; Duch and Stevenson, Reference Duch and Stevenson2008). For robustness, however, I also include the government parties’ vote share by summing the vote share of all parties that were part of the government coalition before the election.

The main explanatory variables are Domestic GDP Growth and unemployment rate and those of Benchmark(s) Footnote 8 . I use one-year lagged values of these economic indicators. For benchmark information, I used the media-guided benchmark(s) dataset in an attempt to identify the best possible reference point for each election across countries. Based on the distribution of domestic media coverage of foreign economic conditions from Lexis-Nexis, the dataset identifies the benchmark country that appears most frequently in a domestic news report (Park, Reference Park2019). It is also possible that two or three countries appear most frequently in the media, in which case they are jointly considered as benchmarks. Regarding the joint benchmarks, I use the weighted average of economic indicators from the three countries appearing most frequently in the domestic media and assign weights based on the proportion of media coverage Footnote 9 .

Another important variable is Globalization. Following previous research, I explore the most important and widely employed component of economic globalization: trade volume measured as the sum of a country’s exports and imports as a percentage of its GDP (Scheve, Reference Scheve2004; Alesina et al., Reference Alesina, Grilli and Milesi-Ferrett1993; Hellwig and Samuels, Reference Hellwig and Samuels2007; Kayser and Peress, Reference Kayser and Peress2012; Vowles, Reference Vowles2008; Aytaç, Reference Aytaç2018). The trade variable is also useful to test the informational mechanism discussed in the theory section since it serves as a good proxy for the availability of information about economic outcomes of a reference country (Aytaç, Reference Aytaç2018) and has received consistent empirical support as one of the most important predictors of one’s media coverage from voluminous studies (e.g., Wu, Reference Wu2000; Ahern, Reference Ahern1984; Kariel and Rosenvall, Reference Kariel and Rosenvall1984).

Scholars also include capital flows to test the impact of capital market openness on government accountability (Hellwig and Samuels, Reference Hellwig and Samuels2007). Among the many components that measure capital flows, I employ the two most widely used measures: FDI flows and portfolio flows (Broner et al., Reference Broner, Erce, Martin and Ventura2014). Specifically, I use them separately (FDI only) and jointly (FDI + Portfolio) because FDI flows tend to create more direct citizen engagement between the recipient and sending countries (Broner et al., Reference Broner, Erce, Martin and Ventura2014). I obtain the information on capital flows from Broner et al. (Reference Broner, Erce, Martin and Ventura2014), who scaled the two measures by GDP trends Footnote 10 to account for volatility in capital flows Footnote 11 .

The KOF Economic Globalization is also considered because it is the most often used index for measuring the multifaceted concept of globalization Footnote 12 (Dreher, Reference Dreher2006; Potrafke, Reference Potrafke2015). The index is constructed based on two components: actual flows (e.g., trade, FDI, portfolios, income payments to foreign nationals) and restrictions (e.g., hidden imports barriers, mean tariff rates, taxes on trade, and capital account restrictions).

Finally, I include a set of controls based on the current literature. I control for coalition size and the effective number of parties (ENEP) as larger governing coalitions as well as a larger number of parties are expected to lead to a smaller vote share for the government. I gather information on Coalition Size and Effective Number of Parties from Gallagher (Reference Gallagher2015). Presidential Election, a dummy variable, is included as the data contains both legislative and presidential elections. To allow a time trend, the Year variable is included. I further account for serial dynamics of the vote share function by including the lagged dependent variable (Previous Vote Share). To address the concern of unit specific errors in the composite error term, it also includes fixed effects estimations.

Results and analysis

Before I present the conditional effect of globalization on relative economic voting, it would be useful to see whether the relative economy has direct effects on incumbent vote share. Figure 2 presents the effect of relative economy on incumbent vote share. The coefficient of Domestic GDP and Benchmark GDP are the marginal effects of domestic and benchmark growth on vote share. If voters react to the relative economic performance, the coefficient of Domestic GDP should be positive as it represents relatively positive growth. On the contrary, the sign of Benchmark GDP should be negative because it represents relatively negative growth. The signs for Domestic Unemployment and Benchmark Unemployment are expected to be the opposite.

Figure 2. The effect of relative economy on incumbent vote share.

Note: For a simple visual demonstration, only the economy variables are included in the figure although the results are based on the full models available in Table A3 in the Appendix.

As expected, Domestic GDP is positive and Benchmark GDP is negative, and they are statistically significant for both executive party and incumbent parties

Footnote 13

. Additionally, the importance of the relative over retrospective economic voting could be verified from a comparison of the predictive power of each model. As shown in Figure A5 in the online Appendix, the higher predictive power of the model with relative economy (i.e.,

![]() ${R^2} = 0.5094$

) than that of the model with retrospective economy (i.e.,

${R^2} = 0.5094$

) than that of the model with retrospective economy (i.e.,

![]() ${R^2} = 0.4326$

) suggests greater confidence of employing the relative economy voting models. Voters indeed respond to relative growth rates when they make a vote choice.

${R^2} = 0.4326$

) suggests greater confidence of employing the relative economy voting models. Voters indeed respond to relative growth rates when they make a vote choice.

Turning to the main goal of the research, testing how globalization conditions the strengths of relative economic voting, I include the domestic and benchmark economy variables additively in the regression equation by interacting them with a measure of economic openness. All else being equal, I should observe a positive sign in the interaction term between Domestic GDP and the variable of globalization, implying that openness strengthens the positive effect of over-performing domestic growth on the incumbent vote. I also expect to observe a negative sign in the interaction term between Benchmark GDP and the globalization variable, which suggests that openness makes the negative effect of under-performing domestic growth more salient on the incumbent vote.

Table 1 presents the results of the ordinary least squares (OLS) estimation. In Models 1 and 2, the coefficient of the interaction of Domestic GDP with Trade is positive and statistically significant, indicating that a more integrated economy is a strengthening factor for the electoral importance of relative over-performance. Similarly, the negative interaction coefficient of Benchmark GDP with Trade suggests that trade openness strengthens the negative impact of relative under-performance on incumbent vote share Footnote 14 .

Table 1 The effect of relative economy on incumbent vote share conditional on trade (% of GDP)

Robust standard errors in parentheses.

*

![]() $p \lt 0.10$

, **

$p \lt 0.10$

, **

![]() $p \lt 0.05$

, ***

$p \lt 0.05$

, ***

![]() $p \lt 0.01$

.

$p \lt 0.01$

.

The other two models using multiple benchmarks do not show any supportive evidence since none of the interaction coefficients reaches conventional significance levels. Trade openness does not affect the linkage between the relative economy and the electoral outcome when performance data are based on complex comparisons. This is perhaps that, as stated above, a comparison serves as a heuristic shortcut for voters to extract a competence signal, and thus, a simple comparison between the domestic economy and that of a relevant benchmark would lower ‘calculative’ burden (Hart and Matthews, Reference Hart and Matthews2019).

Regarding unemployment, the interaction coefficient of Domestic and Benchmark with Trade is not distinguishable from zero in all four models, suggesting there is no evidence for the conditional benchmarking hypothesis of globalization. This is perhaps because, regardless of intensity of market integration, voters do not benchmark on unemployment because relatively high or low unemployment rates do not alter the unemployed’s level of discontent (Palmer and Whitten, Reference Palmer and Whitten1999, 667) Footnote 15 . Regarding control variables, as expected, the ENEP shows a negative and statistically significant effect. However, the effects of Coalition Size and Presidential Elections are unstable across different models.

Figure 3 presents the degree to which exposure to the world market conditions the effect of Domestic GDP and Benchmark GDP on incumbent vote share Footnote 16 . The upper figures (Subfigure (a)) show the marginal effect plot of Domestic GDP, which demonstrates how an increase in domestic growth affects the vote when the benchmark’s growth is held constant across the entire range of Trade. In other words, it suggests a marginal effect of over-performing domestic growth at varying levels of globalization. The other two figures at the bottom (Subfigure (b)) present the opposite outcome; that is, the impact of under-performing domestic growth at the full range of Trade in that benchmark’s growth increases while the domestic growth is held constant.

Figure 3. The Effect of Growth on Incumbent Vote Share conditional on Trade (95% CI).

It is generally obvious that the slope of the marginal effect of Domestic GDP rises in Subfigure (a), suggesting that trade openness strengthens the positive association between domestic GDP and vote share for the incumbent. For instance, similar to Hellwig and Samuels’ (Reference Hellwig and Samuels2007) example, consider a

![]() $3\% $

increase in domestic growth when the benchmark’s growth remains the same (a relative

$3\% $

increase in domestic growth when the benchmark’s growth remains the same (a relative

![]() $3\% $

increase). The over-performing economy of

$3\% $

increase). The over-performing economy of

![]() $3\% $

will increase the executive party’s vote share by

$3\% $

will increase the executive party’s vote share by

![]() $3.67\% $

(3 ×

$3.67\% $

(3 ×

![]() $1.232$

) when trade openness is at

$1.232$

) when trade openness is at

![]() $150\% $

of GDP and will increase the government party votes by

$150\% $

of GDP and will increase the government party votes by

![]() $4.18\% $

(

$4.18\% $

(

![]() $3$

×

$3$

×

![]() $1.394$

). The same size increase in relative growth will yield an increase in the executive party and the government parties’ vote shares by

$1.394$

). The same size increase in relative growth will yield an increase in the executive party and the government parties’ vote shares by

![]() $2.20\% $

(

$2.20\% $

(

![]() $3$

×

$3$

×

![]() $0.732$

) and

$0.732$

) and

![]() $2.12\% $

(

$2.12\% $

(

![]() $3$

×

$3$

×

![]() $0.708$

), respectively, when Trade is at

$0.708$

), respectively, when Trade is at

![]() $100\% $

of GDP. When exposure to the world market goes below about

$100\% $

of GDP. When exposure to the world market goes below about

![]() $50\% - 60\% $

of GDP, the positive effects of an over-performing economy on the incumbent vote are no longer statistically significant, as shown by the

$50\% - 60\% $

of GDP, the positive effects of an over-performing economy on the incumbent vote are no longer statistically significant, as shown by the

![]() $95\% $

CIs that include

$95\% $

CIs that include

![]() $zero$

. Even if a politician’s country has better economic growth than other countries, the outperforming growth would not help his or her vote when the economy is less connected to the global market.

$zero$

. Even if a politician’s country has better economic growth than other countries, the outperforming growth would not help his or her vote when the economy is less connected to the global market.

Subfigure (b) shows the opposite patterns. The declining slopes are consistent with the expectation, implying that globalization measured by trade magnifies the negative association between the benchmark’s GDP and the incumbent vote. The 3% increase in the benchmark’s growth while domestic growth remains unchanged (a relative

![]() $3\% $

decrease) will invite negative consequences on the incumbent by dropping his/her vote share by

$3\% $

decrease) will invite negative consequences on the incumbent by dropping his/her vote share by

![]() $3.88\% $

(3 × –1.293) in the executive party and by

$3.88\% $

(3 × –1.293) in the executive party and by

![]() $4.41\% $

(

$4.41\% $

(

![]() $3$

×

$3$

×

![]() $ - 1.471$

) in all governing parties when trade openness is at 150% of GDP. When trade openness is at 100% of GDP, the relatively poor economy of 3% will cause the executive party and all governing parties’ vote shares to fall by 2.65% (3 × –0.882) and 2.67% (3 ×

$ - 1.471$

) in all governing parties when trade openness is at 150% of GDP. When trade openness is at 100% of GDP, the relatively poor economy of 3% will cause the executive party and all governing parties’ vote shares to fall by 2.65% (3 × –0.882) and 2.67% (3 ×

![]() $ - 0.896$

), respectively. However, the negative impact of under-performing growth on the incumbent vote becomes statistically insignificant when exposure to the global market is below about

$ - 0.896$

), respectively. However, the negative impact of under-performing growth on the incumbent vote becomes statistically insignificant when exposure to the global market is below about

![]() $45\% - 55\% $

of GDP, as the 95% CIs contain zero.

Footnote 17

$45\% - 55\% $

of GDP, as the 95% CIs contain zero.

Footnote 17

The study findings can be further illustrated by real-world elections. For example, the Czech Republic experienced a negative growth rate of

![]() $4.51\% $

in 2009. Considering that the average GDP growth rate in 28 European countries in the same year was

$4.51\% $

in 2009. Considering that the average GDP growth rate in 28 European countries in the same year was

![]() $ - 4.3\% $

, the Czech Republic’s poor growth was not a significant deviation from the average. However, its deviation becomes apparent when compared to the Polish economy (marked with a

$ - 4.3\% $

, the Czech Republic’s poor growth was not a significant deviation from the average. However, its deviation becomes apparent when compared to the Polish economy (marked with a

![]() $2.8\% $

growth in GDP), which appeared the most frequently in Czech domestic news media. This comparison made the Czech growth record look abysmal. In the run up to the 2010 general election, the executive party, the Civic Democrat Party (ODS), heavily focused on addressing the troubled economy, namely reducing unemployment and public debt and restoring growth. However, the ODS failed to garner the most popular votes and experienced a significant drop in its vote share from

$2.8\% $

growth in GDP), which appeared the most frequently in Czech domestic news media. This comparison made the Czech growth record look abysmal. In the run up to the 2010 general election, the executive party, the Civic Democrat Party (ODS), heavily focused on addressing the troubled economy, namely reducing unemployment and public debt and restoring growth. However, the ODS failed to garner the most popular votes and experienced a significant drop in its vote share from

![]() $35.3\% $

in the 2006 election to

$35.3\% $

in the 2006 election to

![]() $20.2\% $

in the 2010 election (a

$20.2\% $

in the 2010 election (a

![]() $ - 15.2\% $

point change in vote share), marking the largest reduction in vote share in the Czech general election records.

$ - 15.2\% $

point change in vote share), marking the largest reduction in vote share in the Czech general election records.

This election outcome becomes more surprising when juxtaposed with the 1998 general election result. In 1997, the country was under-performing substantially in its growth compared to its benchmark (a relatively poor growth of approximately

![]() $ - 3.15\% $

). However, the ODS was not heavily punished by voters, losing only about

$ - 3.15\% $

). However, the ODS was not heavily punished by voters, losing only about

![]() $0.11\% $

points in the vote share, and retained its incumbency. Although numerous factors might be involved in the election outcomes

Footnote 18

, one noticeable change occurred in the level of integration into the global market. Indeed, the Czech Republic had adopted market-friendly economic policies since the liberal-conservative ODS party came to power in the 1992 election, which eventually led to substantive changes in trade volume (as a percentage of GDP), an approximately

$0.11\% $

points in the vote share, and retained its incumbency. Although numerous factors might be involved in the election outcomes

Footnote 18

, one noticeable change occurred in the level of integration into the global market. Indeed, the Czech Republic had adopted market-friendly economic policies since the liberal-conservative ODS party came to power in the 1992 election, which eventually led to substantive changes in trade volume (as a percentage of GDP), an approximately

![]() $55\% $

point increase from 1998 to 2010. Although it is hard to conclude that trade openness generates the discrepancy in these election outcomes, this anecdote offers a useful illustration of the possible impacts of globalization on the link between the relative economy and the incumbent vote.

$55\% $

point increase from 1998 to 2010. Although it is hard to conclude that trade openness generates the discrepancy in these election outcomes, this anecdote offers a useful illustration of the possible impacts of globalization on the link between the relative economy and the incumbent vote.

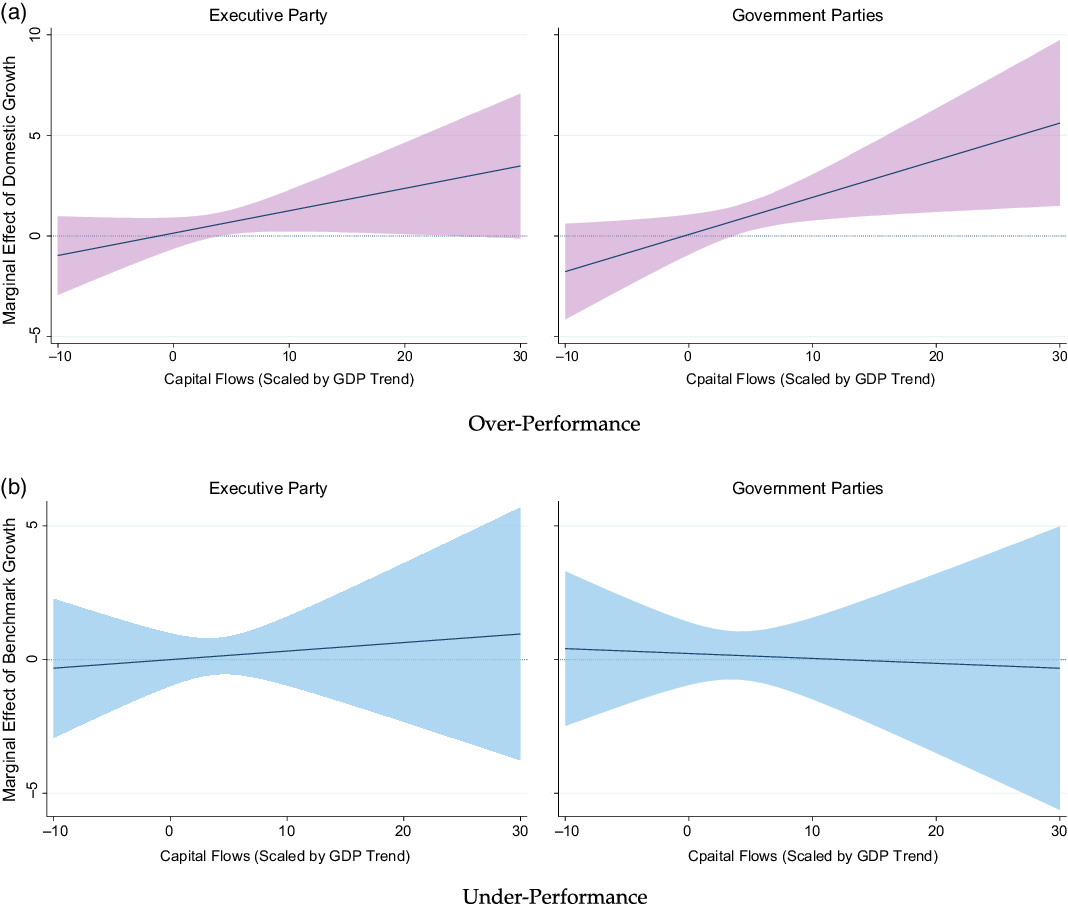

Figure 4 illustrates the degree to which exposure to the world financial market conditions the effect of relative economy on election outcomes

Footnote 19

. The marginal effect of domestic growth (Subfigure (a)) is positive and statistically significant on the coalition government’s vote share, but its effect on the executive party’s vote share is statistically indistinguishable from

![]() $zero$

. In Subfigure (b), none of the marginal effect is clearly negative, and most lines are nearly flat. The results offer no evidence that financial market integration marked by FDI flows increases the salience of the comparative economic assessment. This is similar to Hellwig and Samuels’ (Reference Hellwig and Samuels2007) finding that capital flows appear to have a less substantial effect than that of trade

Footnote 20

. A plausible explanation might be the role of media coverage. As previously noted, media attention on the domestic economy is considerably affected by trade volume more than any other indicators of economic globalization. Similarly, McGrew (2008) explains that ‘trade now reaches deeper than ever before into more sectors of many national economies as an expanded array of goods have become tradable’(283). Thus, as the national economy becomes more integrated with global markets, the consequences of imports/exports or trade volume volatility abroad are magnified and diffused rapidly at home through media coverage.

$zero$

. In Subfigure (b), none of the marginal effect is clearly negative, and most lines are nearly flat. The results offer no evidence that financial market integration marked by FDI flows increases the salience of the comparative economic assessment. This is similar to Hellwig and Samuels’ (Reference Hellwig and Samuels2007) finding that capital flows appear to have a less substantial effect than that of trade

Footnote 20

. A plausible explanation might be the role of media coverage. As previously noted, media attention on the domestic economy is considerably affected by trade volume more than any other indicators of economic globalization. Similarly, McGrew (2008) explains that ‘trade now reaches deeper than ever before into more sectors of many national economies as an expanded array of goods have become tradable’(283). Thus, as the national economy becomes more integrated with global markets, the consequences of imports/exports or trade volume volatility abroad are magnified and diffused rapidly at home through media coverage.

Figure 4. The Effect of Growth on Incumbent Vote Share conditional on Capital Flows (95% CI).

For robustness, I estimated several additional models to verify whether the main findings are stable and consistent across different estimation models and measurement sets. First, I employ the empirical strategy that Kayser and Peress (Reference Kayser and Peress2012) originally suggested, which includes the gap between domestic and benchmark growth (relative growth) and benchmark growth in the same model. They then treat the coefficient of the gap as the effect of relative economic performance on incumbent votes. The main results, shown in Figure A1 and Table A1 in the Robustness section in the Appendix, remain robust and consistent in that trade increases the salience of comparative economic assessment on incumbent vote share but financial market integration does not.

Because economic globalization is the central variable of this research, I also explored whether the results are stable using an alternative operationalization of economic globalization: the KOF’s Economic Globalization. The signs of the marginal effect of relative growth seem consistent, as shown in Figure A2 in the Robustness section in the Appendix. The marginal effect of a good relative growth steadily increases and that of a poor relative growth steadily declines as the Economic Globalization values of the KOF increase. However, while the marginal effect of under-performing growth is statistically significant when the KOF index value is high, that of over-performing growth is statistically indistinguishable from zero across the entire range of KOF’s Economic Globalization. One plausible explanation is that the KOF index is an aggregate measure combining trade and financial openness, whereas the main results are based on models using each variable separately. As the main results indicate that the effect of relative economic performance becomes salient with trade openness but not with financial integration, the effect might be canceled out with the aggregate measure. Two alternative models are also investigated: one excluding the unemployment variable and the other including the economy variables and the LDV only. The findings, available in the Robustness section, remain robust, suggesting that the study’s main findings do not ebb and flow across different models and measures.

In general, the above findings, particularly those pertaining to trade openness, provide solid reasons to believe that voters in open economies are more likely to evaluate incumbents on the basis of deviations in economic growth from other countries. Globalization leads voters to hold their elected officials accountable for the ‘relative’ economic performance. Do these findings contradict conventional wisdom? Not necessarily. Hellwig and Samuels’ (Reference Hellwig and Samuels2007) argument is based on retrospective economic evaluations using temporal comparisons, whereas this study considers the importance of the relative economy based on spatial comparisons. While globalization may dampen the effect of the domestic economy on incumbent vote share when it comes to retrospective voters, we do not yet know whether voters who use information concerning the relative economy are affected by globalization in a similar manner. As globalization emerged, often simultaneously, it brought similar challenges to political elites in many parts of the world. Although it created a common exogenous shock across many governments, policy responses and performance have varied substantially. Thus, it is imperative to study how voters form their evaluations of governments based on comparative assessments with other governments. Simply put, this paper attempts to complement the existing knowledge by employing the relative economy as a variable that provides a fuller picture for our understanding of the relationship between the economy and electoral accountability under openness.

Conclusion

Conventional wisdom suggests that globalization weakens economic voting by increasing the national economy’s dependence on the global economy, which limits the policy autonomy of the incumbent and leads to convergence of economic performance. However, the extant literature provides an incomplete picture of the impacts of globalization on the linkage between the economy and vote choice. As recent scholarship reveals, voters respond more strongly to the relative economy than to the domestic economy, so the reward/punishment mechanism is more pronounced when the economy is outperforming (or under-performing) their benchmark economy. Given the substantial effect of the relative economy in voting behavior, it is surprising that no existing studies in the fields of globalization and economic voting consider how globalization shapes the role of the relative economy in voters’ minds and helps them arrive at a vote choice. This study attempts to fill the missing gap in the existing literature.

This pager suggests that trade openness leads voters to compare their economy with those of other countries due to the increasing availability of global economic information. Globalization, in particular trade openness, provides citizens great sources for cross-national comparison in the form of media coverage. Such comparisons are inevitable in this globalized era, so they cannot disregard the economic performance of other countries. Moreover, contrary to the conventional wisdom, trade openness does not necessarily diminish the competence component of incumbents with respect to handling the economy. Indeed, there remain considerable policy instruments that elected officers can exercise to address the economic issues. Importantly, openness creates similar externalities to all governments unless they are isolated from the global market. In sum, trade openness results in a reduction in relative variance in exogenous rather than competence shocks. The empirical evidence supports such an expectation: trade openness leads to relative growth having a more pronounced effect on the incumbent vote share. As countries integrate more deeply into the global market economy, relative economic growth is likely to have bigger impacts on incumbents’ electoral performance. However, the magnitude of the effect becomes weaker and eventually vanishes as countries trade less with other nations.

One important implication of this finding is that politicians will not be completely free from blame for their poor performance if they are doing worse than their counterparts. Under globalization, politicians are likely to use openness-induced policy limitations or convergence in business cycles as excuses for poor performance. However, if all neighboring countries have faced similar constraints or challenges due to globalization, can local politicians still rely on the same excuse for the relatively poor performance? If globalization-induced externalities are ubiquitous, citizens will not consider the common factors as excuses for cross-border deviations. If so, the blame-shifting strategy of political elites would fail. Moreover, when voters become more aware of the economy of other countries with increased access to information, they are likely to juxtapose two or more countries in a comparative setting. If this happens, they will extract the ‘relative’ competence signal from the relative economic performance: a strong or weak relative competence from an over-performing or under-performing economy, respectively. That said, as Giuliani (Reference Giuliani2019: 16) refers to Jensen et al. (Reference Jensen, Quinn and Weymouth2017), ‘openness is more a curse than a boon for the incumbent’ in cases of a poor relative economy.

The findings of this research may reassure democratic theorists. Elections offer citizens periodic opportunities to change policy-makers. By shaping voting behavior, the economy greatly appeals to democratic accountability because voters reject policy-makers who lack the competence to properly handle the economy. The power of voters to throw the so-called ‘rascals’ out will ‘not only keep obvious rascals from remaining in office, but also create pressure on all incumbents to worry about the next elections and make policies with voter review in mind’ (Powell, Reference Powell2000: 11). If this mechanism exists, it should reassure democratic theorists. If it does not, it is worrisome. In contrast to conventional wisdom, this research shows that globalization strengthens the role of the economy on vote choice, thereby alleviating skepticism in the electoral accountability mechanism.

Nonetheless, some questions remain unanswered. At the aggregate-level, the relative economic performance and trade openness variables are to be understood as contextual variables. However, some parts of the theoretical mechanism rely more or less on an individual-level understanding in that ‘voters’, not ‘countries’ evaluations of incumbent competence are shaped by relative economic performance. Moreover, the influence of the relative economy on their vote choice is affected by voters’ global economic information. Regarding the former issue, a recent study by Aytaç (Reference Aytaç2020) shows that individuals from the UK and Turkey are likely to react to international economic performance comparisons in government approval calculations. Interestingly, the effect of relative evaluations appears to be stronger among British rather than Turkish voters. Although Aytaç (Reference Aytaç2020) does not direct this finding to the latter issue, it matches well with the expectation of this research that voters from a more globalized nation (i.e., the UK) are likely to utilize the relative economic conditions for political support than voters from a less globalized country (i.e., Turkey). Hence, future studies should test the notions concerning voters’ global economic information by examining responses to appropriate questions in individual-level surveys.

Another extension to this research would directly focus on the role of the media by measuring the coverage of economic news reports. Rather than using trade as a proxy for information availability, it would be useful to directly model the media coverage on foreign economies to understand how economic information received by voters shapes the nexus between the relative economic performance and political support. Furthermore, although this study focuses on economic globalization by focusing on trade and capital flows, globalization tends to be conceived as ‘a multidimensional, rather than a singular, process – evident across the cultural, political, ecological, military, and social domains – in that it is associated with patterns of trans-world integration’ (McGrew, 2008: 280). That said, globalization does not simply foster ‘economic’ information, but rather induces active engagement and interdependence among participants through cultural, political, and social networks. These questions, although beyond the scope of current analysis, would provide fruitful ground for future research.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/S1755773923000127.

Acknowledgment

I am most grateful for the editors and three anonymous reviewers for their constructive comments and suggestions. Previous versions of this paper were presented at the 115th American Political Science Association’s Annual conference and the 76th Annual Midwest Political Science Association conference. I am grateful to the participants of these events including Michael Lewis-Beck, Mary Stegmaier, Timothy Hellwig, and Erdem Aytaç for their helpful comments and feedback. I also thank Laron Williams, Ruth Dassonneville, Dan Bowen, Gang Soo Jun, Christoph Arndt, Daphne Halikiopulou, Martin Binder, Tae-Nyun Kim, Jun Park, Wonho Park as well as Sung Chul Kang for his research assistance.