Introduction

Prevented planting is a provision within the United States (US) federal crop insurance program that compensates producers for losses from delayed planting or not being able to plant a covered crop within the crop and region-specific planting period. The provision is utilized when an adverse event such as excess moisture or drought inhibits an insured crop from being planted by a defined final planting date or within the defined late planting period.Footnote 1 Indemnity payments for prevented planting losses can account for a large share of annual US crop insurance payments. Kim and Kim (Reference Kim and Kim2018) estimated that prevented planting indemnity payments accounted for 9% of all crop insurance payments from 1998 to 2008 and increased to 17% of all crop insurance indemnity payments from 2009 to 2013. Prevented planting indemnity payments have exceeded over 20% of all US crop insurance indemnity payments in recent years (Kim and Kim Reference Kim and Kim2018; Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020). Record-prevented planting acres (19 million) were claimed, and payments ($4.3 billion) were made in 2019 (Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020).

The increasing trend in prevented planting payments has not gone unnoticed and has been the focus of several policy analyses. The purpose of the prevented planting provision is to provide financial protection for general expenses incurred to the point of planting the insured crop, which might include machinery, land rent, fertilizer, pesticide, labor, and repairs (US Department of Agriculture [USDA] Risk Management Agency [RMA] 2021a). The USDA Office of Inspector General (OIG) (2013) reported, however, that prevented planting indemnities can be greater than the producers’ actual financial losses. This issue has been recognized as potentially making prevented planting claims vulnerable to fraud (Rejesus et al. Reference Rejesus, Lovell, Little and Cross2003, Reference Rejesus, Escalante and Lovell2005) and moral hazard issues (Adkins et al. Reference Adkins, Boyer, Smith, Griffith and Muhammad2020; Boyer and Smith Reference Boyer and Smith2019; Kim and Kim Reference Kim and Kim2018; Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020).

Moral hazard occurs when the insured producer becomes less prone to guard against indemnified outcomes because of the insurance protection. Moral hazard in crop insurance typically occurs prior to the loss (i.e., ex ante moral hazard), such as under-applying chemicals and fertilizer during the production year because losses are covered with insurance (Horowitz and Lichtenberg Reference Horowitz and Lichtenberg1993; Smith and Goodwin Reference Smith and Goodwin1996; Sheriff Reference Sheriff2005). Moral hazard in prevented planting differs from ex ante moral hazard because a producer’s choice to not grow a crop or plant late occurs after the loss (i.e., an insurable reason keeps producers from planting). This is often referred to as ex post moral hazard (Rees and Wambach Reference Rees and Wambach2008; Zweifel and Eisen Reference Zweifel and Eisen2012).

Kim and Kim (Reference Kim and Kim2018) defined ex post moral hazard in prevented planting as selecting the full prevented planting indemnity payment over planting late in the year or planting an alternative crop (the following section describes in detail the prevented planting options for producers). They showed that producers with higher crop insurance coverage levels were less likely to plant late than taking the prevented planting payment. Thus, higher coverage levels resulted in the higher likelihood of ex post moral hazard. Boyer and Smith (Reference Boyer and Smith2019) determined the effect of the prevented planting at various crop insurance coverage levels on prevented planting claims and ex post moral hazard, as defined by Kim and Kim (Reference Kim and Kim2018). They found ex post moral hazard in the prevented planting was more likely for corn than soybeans and that reducing the prevented planting coverage factor for corn could reduce ex post moral hazard. Wu, Goodwin, and Coble (Reference Wu, Goodwin and Coble2020) also found evidence of moral hazard in prevented planting, but they discovered the degree of moral hazard varies by region.

The USDA OIG (2013) report made several recommendations to change the prevented planting provision to the noted shortcomings such as aligning costs with payments. The first of these was to decrease the coverage factor (the prevented planting coverage factor is discussed in detail in the proceeding section), which is a set percentage of the insurance coverage plan’s revenue guarantee. From 2017 to 2019, USDA RMA decreased the full prevented planting payment coverage factor for corn and several other commodities to be aligned with pre-planting costs. Lowering the prevented planting coverage factor has been suggested to reduce the likelihood of moral hazard issues (Adkins et al. Reference Adkins, Boyer, Smith, Griffith and Muhammad2020; Boyer and Smith Reference Boyer and Smith2019; Kim and Kim Reference Kim and Kim2018).

Other changes that could address ex post moral hazard with prevented planting is making the prevented planting coverage factors specific to regions and crop insurance coverage levels. This change could address the potential for ex post moral hazard across coverage levels (Boyer and Smith Reference Boyer and Smith2019; Kim and Kim Reference Kim and Kim2018) and regions (Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020). The prevented planting coverage factors are uniform across the US, but it is well known that land rents, pre-planting production costs, and yields vary across regions. Thus, a uniform prevented planting coverage factor could cause prevented planting indemnity payments disparities across regions. Some regions and policies result in higher payments than losses, which incentivize forgoing planting and creating moral hazard concerns (Agralytica Consulting 2013; USDA OIG 2013). A prevented planting coverage factor providing equitable payments to cover pre-planting costs could vary by region and policy, potentially reducing the prevented planting moral hazard concerns.

The objective of this paper is to explore the degree to which prevented planting coverage factors would vary by coverage level and region to recover the losses from prevented planting. Specifically, we calculate a prevented planting coverage factors for corn and soybeans in Arkansas, Kentucky, Illinois, Indiana, Iowa, Louisiana, Mississippi, Missouri, Ohio, and Tennessee that would equally recoup pre-plant costs across various insurance coverage levels, regions, and for both no-tillage and conventional tillage planting systems. These are not optimal prevented planting coverage factors but estimates to demonstrate the possible variation to equability compensate producers for losses without overpaying, potentially reducing moral hazard by coverage level and region. The findings are useful for discussion around future prevented planting provision revisions and provide insight into areas of future research for prevented planting.

Prevented planting payments

The prevented planting provision became a standard component of US crop insurance in 1994 with the purpose of decreasing the need for ad hoc disaster assistance for producers. Producers with policies eligible for prevented planting indemnities, which include Revenue Protection (RP), RP with the Harvest Price Exclusion (RPHPE), and Yield Protection (YP) insurance plans, have several options if they are unable to plant within their designated window. However, the producer has 72 hours after the final planting date to provide a notice of loss to their insurance agent and decide which prevented planting option to pursue. These options include planting the originally insured crop during a late planting period, but the producer’s guaranteed coverage reduces 1% each day during the late planting period. The producer could also choose to plant a different insured crop after the late planting period. For instance, planting corn could be switched to growing soybeans since the soybean planting window is later than corn. This could also be an uninsured alternative crop like an annual grass for haying and/or grazing, which also provides a partially prevented planting indemnity payment.

However, the most selected option is to take full prevented planting indemnity (USDA OIG 2013). The USDA OIG (2013) report found more than 99% of all prevented planting claims selected this option. This option pays a percentage of the insurance coverage guaranteed amount and restricts the producer from planting a harvestable crop. The prevented planted field would either need to be left fallow or could be planted to an unharvested cover crop. A producer selecting this option over planting late in the year or planting an alternative crop is what Kim and Kim (Reference Kim and Kim2018) defined as ex post moral hazard.

Mathematically, the net returns from the full prevented plant payment option is defined as

where

![]() $NR_{ik}^{FP}$

is the net returns to the full prevented planting indemnity payment ($/acre) ith crop (i = corn or soybeans) with kth crop insurance coverage level;

$NR_{ik}^{FP}$

is the net returns to the full prevented planting indemnity payment ($/acre) ith crop (i = corn or soybeans) with kth crop insurance coverage level;

![]() $p_i^G$

is the guaranteed price for the insurance policy;

$p_i^G$

is the guaranteed price for the insurance policy;

![]() $\;y_i^G$

is the guaranteed yield or actual production history (APH);

$\;y_i^G$

is the guaranteed yield or actual production history (APH);

![]() $\;{\delta _k}$

is the insurance coverage level and is equal to the value of k (k = 50%, 55%, 60%, 65%, 70%, 75%, 80%, or 85%);

$\;{\delta _k}$

is the insurance coverage level and is equal to the value of k (k = 50%, 55%, 60%, 65%, 70%, 75%, 80%, or 85%);

![]() ${\theta _i}$

is the prevented planting coverage factor, which for corn is 55%, and soybeans is 60%;

${\theta _i}$

is the prevented planting coverage factor, which for corn is 55%, and soybeans is 60%;

![]() $C_i^{bp}$

is the expected pre-planting production cost ($/acre); and

$C_i^{bp}$

is the expected pre-planting production cost ($/acre); and

![]() ${I_{ik}}$

is the producer portion of the crop insurance premium ($/acre). For example, a corn producer with an RP policy, with 75% coverage level, an APH of 150 bu/acre, and projected price of $3.86/bu would have a guaranteed revenue minimum of $434.25/acre ($434.25 = $3.86 × 150 × 0.75). Prior to planting, assume the producer has spent $100/acre on the insurance premium, land, machinery, and chemical. The full prevented planting payment would pay 55% of the guaranteed coverage amount, which is $238.84/acre ($238.84 = $434.25 × 0.55) resulting in a profit of $138.84/acre ($238.84 − $100). Building from this example, if the coverage level was 85%, the guaranteed revenue minimum is $492.15/acre ($3.86 × 150 × 0.85) with a prevented planting payment of $270.68/acre and net profit of $170.68/acre. Producers’ full prevented planting payment increases as the guaranteed coverage level of the policy increases (Boyer and Smith Reference Boyer and Smith2019; Kim and Kim Reference Kim and Kim2018).

${I_{ik}}$

is the producer portion of the crop insurance premium ($/acre). For example, a corn producer with an RP policy, with 75% coverage level, an APH of 150 bu/acre, and projected price of $3.86/bu would have a guaranteed revenue minimum of $434.25/acre ($434.25 = $3.86 × 150 × 0.75). Prior to planting, assume the producer has spent $100/acre on the insurance premium, land, machinery, and chemical. The full prevented planting payment would pay 55% of the guaranteed coverage amount, which is $238.84/acre ($238.84 = $434.25 × 0.55) resulting in a profit of $138.84/acre ($238.84 − $100). Building from this example, if the coverage level was 85%, the guaranteed revenue minimum is $492.15/acre ($3.86 × 150 × 0.85) with a prevented planting payment of $270.68/acre and net profit of $170.68/acre. Producers’ full prevented planting payment increases as the guaranteed coverage level of the policy increases (Boyer and Smith Reference Boyer and Smith2019; Kim and Kim Reference Kim and Kim2018).

Net returns from the full prevented planting payment are a function of the insured unit’s state-specific guaranteed price and farm-specific insurance premiums, APH yield, and pre-plant costs. Thus, it is plausible that prevented planting indemnities will vary geographically. A substantial portion of these pre-plant costs will be land rents. Land rents vary widely across US soybean and corn acres and are a function of cost structures, yield potential, government payments, and land use and amenities (Allen and Borchers Reference Allen and Borchers2016; Kirwan Reference Kirwan2009). Regions with higher yields will have potential for higher prevented planting indemnities but will likely have higher land rents (Kirwan Reference Kirwan2009; Paulson and Schnitkey Reference Paulson and Schnitkey2013). This variation in cost structure across regions could also influence payment disparities.

To solve for a prevented planting coverage factors that would provide an equal payment to pre-plant costs across insurance coverage levels and regions, we set equation equal to zero and solve equation (1) for the prevented planting coverage factor. The net returns to full prevented planting payment could also be set to some minimum payment

![]() $\left( M \right)$

, which might be projected returns to a secondary crop. Mathematically, this can be expressed as

$\left( M \right)$

, which might be projected returns to a secondary crop. Mathematically, this can be expressed as

$$\theta _{ikcm}^* = {{C_{ic}^{bp} + M} \over {p_{icm}^Gy_{ic}^G{\delta _k}}}$$

$$\theta _{ikcm}^* = {{C_{ic}^{bp} + M} \over {p_{icm}^Gy_{ic}^G{\delta _k}}}$$

where

![]() $\theta _{ikcm}^*$

coverage factor for the coverage plan m (RP, RPHPE, YP) with kth coverage level that is specific to county c, and

$\theta _{ikcm}^*$

coverage factor for the coverage plan m (RP, RPHPE, YP) with kth coverage level that is specific to county c, and

![]() $M$

is a selected minimum payment provided to the producers. This calculation would capture regional and policy variation in the prevented planting coverage factor that would accomplish the original purpose of this provision to protect producers from failed planting by compensating them for their pre-plant costs or some established revenue minimum. The premium cost was removed from the prevented planting coverage factor since insurance does not reimburse the premium but the losses.

$M$

is a selected minimum payment provided to the producers. This calculation would capture regional and policy variation in the prevented planting coverage factor that would accomplish the original purpose of this provision to protect producers from failed planting by compensating them for their pre-plant costs or some established revenue minimum. The premium cost was removed from the prevented planting coverage factor since insurance does not reimburse the premium but the losses.

Data

Data were collected from USDA RMA Summary of Business database from 2011 to 2020 for corn and soybeans in Arkansas, Kentucky, Illinois, Indiana, Iowa, Louisiana, Mississippi, Missouri, Ohio, and Tennessee (USDA RMA 2021c). The corn and soybean acres in regions near major river basins commonly make the majority of prevented planting acres and are the most frequently designated as prevented planting acres due to excessive moisture (USDA OIG 2013; USDA Farm Service Agency [FSA] 2021; USDA RMA 2021b; Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020; Boyer, Park, and Yun Reference Boyer, Park and Yun2023). Therefore, we focused on the Mississippi River Basin states given this region is primarily corn and soybean acres to explore if regional variation exists.

These county-level data include the number of insurance policies sold, policies indemnified, acres coverage, total premiums, subsidies, and indemnity payment by county, state, year, coverage plan, and coverage level. For example, in a specific county there could be five observations in a year for RP policies with 50%, 55%, 65%, 75%, and 80% coverage level. There could also be a similar five observations within that same county for other coverage plans like YP. Thus, each county could have multiple observations within a year. The projected price data were gathered from the USDA RMA Price Discovery database for 2011 to 2020 (USDA RMA 2021d). These are state-level prices set by USDA RMA. APH yield data are not publicly available, which is a challenge for researchers who analyze crop insurance policies; thus, studies typically use USDA National Agricultural Statistical Service (NASS) yields (Kim and Kim Reference Kim and Kim2018; Seo et al. Reference Seo, Kim, Kim and McCarl2017).

County-level cost of production data is difficult to obtain and hard to estimate. We first collect county-level cropland rent from USDA NASS by year. Pre-plant costs typically include land rent along with chemical and machinery costs for burndown and pre-emerge herbicides (Boyer and Smith Reference Boyer and Smith2019).Footnote 2 Data on county-level chemical and machinery costs do not exist; thus, we use POLYSYS budgeting system to generate county-level pre-plant costs for chemical and machinery. POLYSYS is a partial equilibrium socioeconomic simulation modeling system of the US agricultural sector in which production decisions are made. POLYSYS is a system of interdependent modules simulating crop production, national crop demand and prices, and livestock supplies and demand. POLYSYS also generates cost of production information for various crops using the 13 USDA Economic Research Service regional budgets for each crop and tillage combination. Budgets are estimated for all counties in our study using “inverse distance weighting” interpolation for costs and input quantities (Hellwinckel Reference Hellwinckel2019). We use POLYSYS budgeting system to generate pre-planting production costs for corn and soybeans at the county level within the region of study. POLYSYS generates pre-plant costs for 2020, and these costs are adjusted using producer price indices used in USDA baseline projections to estimate pre-plant costs in prior years. These POLYSYS pre-plant data had minor variation at the county level, but the land rent costs accounted for most of the total pre-plant costs and pre-plant cost county-level variation. Table 1 shows the summary statistics of yields and pre-plant costs.

Table 1. Summary statistics of the estimated yields and POLYSYS generated pre-plant costs from 2011 to 2020 for corn (n = 63,989) and soybeans (n = 72,353)

1 United States Department of Agriculture National Agricultural Statistic Service.

Data collected were substituted into equation (2) to estimate the prevented planting coverage factor by crop, tillage system, county, coverage level, and coverage plan. We chose to set the minimum payment to be zero for this study, which means the indemnity payment would cover the pre-plant costs and not exceed this amount. Changing this value would result in same relative changes between regions and policies but would change the absolute value. Table 2 shows the summary statistics of the prevented planting coverage factor for corn and soybeans by tillage at various coverage levels. The table demonstrates how the coverage factor varies across coverage levels with coverage factors being higher at lower coverage levels and declining as the coverage increases. This is because the prevented planting payment increases as the coverage level increases.

Table 2. Summary statistics of the estimated coverage factor from 2011 to 2020 for corn and soybeans planted with no-tillage and conventional tillage

Note: Coverage factors were calculated using Equation (2).

Estimation

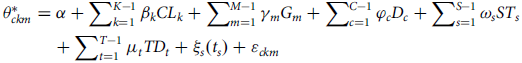

The estimated prevented planting coverage factor becomes the dependent variable of our estimation to measure the marginal impacts of insurance products’ features, such as coverage level and type of plan, on the estimated prevented planting coverage factor. We estimate four pooled ordinary least squares regression models with estimated prevented planting coverage factors for corn no-tillage planting, corn tillage planting, soybean no-tillage planting, and soybean no-tillage planting as dependent variables. The independent variables included coverage level, coverage plan, state, county, year, and state-specific time trend dummies. We estimate the models specified as each of the four dependent variables:

$$\eqalign{ & \theta _{ckm}^* = \alpha + \sum\nolimits_{k = 1}^{K - 1} {{\beta _k}} C{L_k} + \sum\nolimits_{m = 1}^{M - 1} {{\gamma _m}} {G_m} + \sum\nolimits_{c = 1}^{C - 1} {{\varphi _c}} {D_c} + \sum\nolimits_{s = 1}^{S - 1} {{\omega _s}} S{T_s} \cr

& \quad \quad \quad + \sum\nolimits_{t = 1}^{T - 1} {{\mu _t}} T{D_t} + {\xi _s}\left( {{t_s}} \right) + {\varepsilon _{ckm}} \cr} $$

$$\eqalign{ & \theta _{ckm}^* = \alpha + \sum\nolimits_{k = 1}^{K - 1} {{\beta _k}} C{L_k} + \sum\nolimits_{m = 1}^{M - 1} {{\gamma _m}} {G_m} + \sum\nolimits_{c = 1}^{C - 1} {{\varphi _c}} {D_c} + \sum\nolimits_{s = 1}^{S - 1} {{\omega _s}} S{T_s} \cr

& \quad \quad \quad + \sum\nolimits_{t = 1}^{T - 1} {{\mu _t}} T{D_t} + {\xi _s}\left( {{t_s}} \right) + {\varepsilon _{ckm}} \cr} $$

where

![]() $\theta _{ckm}^*$

is the prevented planting coverage factor;

$\theta _{ckm}^*$

is the prevented planting coverage factor;

![]() $C{L_k}$

is a dummy variable for the kth insurance policy coverage level;

$C{L_k}$

is a dummy variable for the kth insurance policy coverage level;

![]() ${G_m}$

is policy type dummy variable;

${G_m}$

is policy type dummy variable;

![]() ${D_c}$

is a county dummy variable for county

${D_c}$

is a county dummy variable for county

![]() $c$

;

$c$

;

![]() $S{T_s}$

is a state dummy variable for state

$S{T_s}$

is a state dummy variable for state

![]() $s$

(s = 1,…,S);

$s$

(s = 1,…,S);

![]() $T{D_t}$

is a year dummy variable at year

$T{D_t}$

is a year dummy variable at year

![]() $t$

(t = 1,…,T);

$t$

(t = 1,…,T);

![]() ${\xi _s}\left( {{t_s}} \right)$

is the state-specific time trend;

${\xi _s}\left( {{t_s}} \right)$

is the state-specific time trend;

![]() ${\varepsilon _{ckm}}$

is the error term; and

${\varepsilon _{ckm}}$

is the error term; and

![]() $\alpha, \beta, \gamma, \;\varphi, \;\omega, \mu \;$

and

$\alpha, \beta, \gamma, \;\varphi, \;\omega, \mu \;$

and

![]() $\xi $

are parameters to be estimated. The models were estimated with Ordinary Least Squares with Huber-White Sandwich estimator.

$\xi $

are parameters to be estimated. The models were estimated with Ordinary Least Squares with Huber-White Sandwich estimator.

The state dummy variable is expected to capture state-level prices. The state-level time trend variables were included to absorb any long-run technological changes that might impact planting, such as equipment, installation of drainage tiles, or biotechnical advancements across states. The county dummy is expected to capture some other unobserved county-level factors. The year dummy controls for year-to-year variable in variables such corn and soybean prices. While we include these in the model, changing prevented planting coverage by year could cause confusion across producers and insurance agents. The results for year-to-year variability in the prevented planting coverage factor are not discussed.

Results

Regression results

Tables 3 and 4 show the determinants of corn and soybean prevented planting coverage factors by the tillage system along with fit statistics; respectively. The variables dropped from the regression were the 50% coverage level, YP coverage plan, Arkansas county in the state of Arkansas, and year 2011 for both crops. Results are discussed relative to these dropped variables.

Table 3. Determinants of corn prevented planting coverage factor

Note: Single and double asterisks (*, **) represent significance at the 5% and 1% levels.

1 Standard errors are White-Arellano heteroscedasticity-consistent standard error.

Table 4. Determinants of soybean prevented planting coverage factor

Note: Single and double asterisks (*, **) represent significance at the 5% and 1% levels.

1 Standard errors are White-Arellano heteroscedasticity-consistent standard error.

Derived prevented planting coverage factors for corn that would provide a uniform payment across policies were statistically different across coverage levels, states, and years. Relative to the coverage level of 50%, the prevented planting coverage factor declined as the coverage level increased. This is expected since the guaranteed revenue minimum increased as the coverage level increased as demonstrated in the example. Additionally, this aligns with what Kim and Kim (Reference Kim and Kim2018) and Boyer and Smith (Reference Boyer and Smith2019) observed that higher coverage levels could increase the likelihood of ex post moral hazard. The prevented planting payment was not statistically different across coverage plan for corn. This is not surprising since the payment is based on the same projected price. State-level effects were significantly different for the corn prevented planting coverage factors, meaning the other states’ prevented planting coverage factors are different from Arkansas. Again, this is likely associated with variation in land rent prices and APH yields across the region of study. These coverage factors also varied across the years.

Regression results for corn were used to predict prevented planting coverage factors across coverage levels (Figure 1). These results are assumed to be the year 2020 for Illinois. The coverage factor varied from 0.88 to 0.54 for corn with no-tillage or conventional tillage planting systems. The coverage factor is higher for no-tillage planted corn than conventional tillage planted corn. Figure 2 shows the predicted prevented planting coverage factor assuming RP policy at 75% coverage level in 2020 for no-tillage planting and conventional tillage planting by county. The figure shows the regional variation of the coverage factors and the variation in coverage factors for no-tillage and conventional tillage. The prevented planting coverage factor is lower in the southern states where land rents are less than the northern states and counties in the study area. The northern counties in the study area would likely have higher pre-plant costs due to land rent. The figure demonstrates how geographic factors such as costs, land rent, and yields can impact prevented planting indemnity payments disparities across regions and provides an explanation for studies showing ex post moral hazard in prevented planting across regions (Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020).

Figure 1. Predicted prevented planting coverage factor for corn by tillage system and coverage level. Note: Predicted values from estimated coefficients and the assumption is these are for the year 2020 and in Illinois; NT = no-tillage, CT = conventional tillage.

Figure 2. Predicted prevented planting coverage factor for corn by tillage system by county. Note: Predicted values from estimated coefficients and the assumption is these are for the year 2020, coverage level is 75% coverage Revenue Protection policy.

Table 4 shows the estimated parameters for the soybean regression results. The prevented planting coverage factor was found to also decline as the coverage level increased. This matches what we observed for the corn results as well as what was hypothesized from the literature. Unlike corn, the coverage plan was significantly different, but the magnitude of the estimated parameter is small. State-level effects were also significantly different for soybeans. Like corn, state-level variation, which is likely driven by land rent and yields, can impact the prevented planting coverage factors.

The predicted prevented planting coverage factor for soybeans ranged from 0.90 to 0.49 for Illinois in 2020 between the two planting tillage systems (Figure 3). The prevented planting coverage factor was higher for conventional tillage than no-tillage planting, which is the opposite of the corn results. This is likely due to conventional tillage costs for soybeans being higher than no-tillage. However, a similar pattern to corn was found. The coverage factor declines as coverage level increases. Figure 4 shows the predicted prevented planting coverage factor assuming RP policy at 75% coverage level in 2020 for no-tillage planting and conventional tillage planting by state. Like corn, the prevented planting coverage factor varied across these states and counties likely associated with variability in rent and yields.

Figure 3. Predicted prevented planting coverage factor for soybean by tillage system and coverage level. Note: Predicted values from estimated coefficients and the assumption is these are for the year 2020 and in Illinois; NT = no-tillage, CT = conventional tillage.

Figure 4. Predicted prevented planting coverage factor for soybeans by tillage system by county. Note: Predicted values from estimated coefficients and the assumption is these are for the year 2020, coverage level is 75% coverage Revenue Protection policy.

Implications

Currently, the prevented planting coverage factor for corn is 55%, which is within the range of our results. Based on predicted prevented planting coverage factors that would reimburse for the assumed pre-plant costs, we found that 71% of all corn insurance policies in the states in this region studied during this time would receive a prevented planting indemnity payment at or above their pre-plant costs. For conventional tillage planted corn, we found 69% of all crop insurance policies in this region during this time would receive a prevented planting indemnity payment at or above their pre-plant costs.

For soybeans, the current provision coverage factor is 60% of the guaranteed revenue minimum. We found that 59% of crop insurance policies in this region during this time for no-till planted soybean production would receive a prevented planting indemnity payment at or above their pre-plant costs. This percentage declines to 49% of all soybean insurance policies in this region during this time receiving a prevented planting indemnity payment at or above their pre-plant costs with conventional tillage.

Under the current uniform coverage factor for each commodity, disparities in prevented planting indemnity payments exist across regions and coverage levels. This is evident by reports that prevented planting indemnities can exceed producers’ estimated losses and concerns about moral hazard issues (Adkins et al. Reference Adkins, Boyer, Smith, Griffith and Muhammad2020; Boyer and Smith Reference Boyer and Smith2019; Kim and Kim Reference Kim and Kim2018; Wu, Goodwin, and Coble Reference Wu, Goodwin and Coble2020). Agralytica Consulting (2013) stated there is a need for a regional, state, or sub-state prevented planting coverage factor but providing a stable and clearly understood prevented planting coverage factor is important for producers to effectively manage their risk. The cost of determining accurate regional or state coverage factors by coverage level could be high to administer across the US. While benefits might include increasing production and reducing moral hazard in crop insurance, policy makers and federal agencies would need to consider the administration costs associated with making any regional or coverage specific prevented planting coverage factor changes.

Conclusions

This study aims to explore the degree to which coverage level and region could impact the prevented planting coverage factors for corn and soybeans. We estimate prevented planting coverage factors for corn and soybeans in Arkansas, Kentucky, Illinois, Indiana, Iowa, Louisiana, Mississippi, Missouri, Ohio, and Tennessee that recovers pre-plant costs across various crop insurance policies for both no-tillage and conventional tillage planting systems. This is a unique analysis to demonstrate regional and policy coverage variation in prevented planting payments, which might be useful for future policy revisions.

We find that prevented planting coverage factors can be estimated and there is significant variation across crop, coverage level, tillage system, and location. The prevented planting coverage factors decline as the coverage level increases. Soybeans need a higher coverage factor than corn, which is how the current provision is set. While we see this variation, from a policy perspective the administrative cost of modifying the prevented planting coverage factor at a policy or county level might be greater than the changes in payments. The cost of administering a regional and coverage level-specific prevented planting coverage factor might be greater than the cost savings.

There are several extensions of this work. First, we focus on a specific region of the US, but this framework and model could be extended for the entire US, specifically the Great Plains. County-level cost of production data do not exist, which is a limitation of this work. However, exploring new ways to extrapolate county-level costs from USDA economics research service cost of production estimates would be interesting. Then, we would like to explore the prevented planting payments per acre and the pre-plant cost of production data. This would give insight into how actually receiving payments compares to estimated pre-plant costs. Finally, the questions of why these indemnity payments are increasing over time and whether this is related to climate change need to be explored.

Data availability statement

These data are publicly available, and locations are cited in the manuscript.

Acknowledgements

We are grateful for the funding by Agriculture and Food Research Initiative Competitive Grant no. 2021-67023-33819 from the United States Department of Agriculture National Institute of Food and Agriculture to support this research.

Author contribution

Conceptualization, C.N.B, E.P., S.A.S.; Methodology, C.N.B, E.P.; Formal Analysis, C.N.B, E.P., G.P. Data Curation, C.H., S.A.S, W.M, C.N.B; Writing – Original Draft, C.N.B; Writing – Review and Editing, S.A.S, W.M., E.P, G.Q.,; Supervision, C.N.B.; Funding Acquisition, C.N.B, S.A.S, W.M, E.P

Funding statement

This research was supported by Agriculture and Food Research Initiative Competitive Grant no. 2021-67023-33819 from the United States Department of Agriculture National Institute of Food and Agriculture.

Competing interests

No conflict of interest is to be disclosed by the authors